Current Report Filing (8-k)

October 04 2022 - 6:09AM

Edgar (US Regulatory)

0000887247

false

0000887247

2022-10-03

2022-10-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): October

3, 2022

ADAMIS PHARMACEUTICALS CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

0-26372 |

|

82-0429727 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

11682 El Camino Real, Suite 300

San Diego, CA |

|

92130 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (858) 997-2400

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

ADMP |

|

NASDAQ Capital Market |

On October 3, 2022, Adamis Pharmaceuticals Corporation

(the “Company”) issued a press release announcing that following the recently announced halting of the Company’s Phase

2/3 clinical trial examining the effects of Tempol in high risk subjects with early COVID-19 infection, it has initiated a process to

explore a range of strategic and financing alternatives focused on maximizing stockholder value. Potential alternatives that may be explored

or evaluated include a partnership regarding or sale of one or both of the Company’s commercial products SYMJEPI®

and ZIMHI®, a merger, sale, or reverse merger of the Company, and/or seeking additional financing. As part of this process,

the Company has engaged the investment bank Raymond James & Associates, Inc. to act as strategic advisor to assist the Company in

evaluating certain alternatives. There can be no assurance regarding the schedule for completion of the strategic review process, that

this strategic review process will result in the Company pursuing any transaction or that any transaction, if pursued, will be completed.

The Company is also reviewing and intends to pursue expense reduction alternatives and measures which may include, without limitation,

employee headcount reductions and reduction or discontinuation of certain product development programs.

A copy of the Company’s press release

is filed with this Report as Exhibit 99.1, and is incorporated herein by reference.

Forward Looking Statements

This Current Report on Form 8-K, and the press

release filed as an exhibit with this Report, contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that express plans, anticipation,

intent, contingencies, goals, targets or future development and/or otherwise are not statements of historical fact. These statements

relate to future events or future results of operations, including, but not limited to statements concerning the following matters: the

Company’s review and evaluation of potential strategic alternatives and their impact on stockholder value; the process by which

the Company engages in evaluation of strategic alternatives; the Company’s ability to identify potential buyers or partners for

one or both the Company’s commercial products; the Company’s ability to identify potential merger or acquisition partners;

the Company’s ability to raise capital to continue as a going concern; the possibility that the Company may be required to seek

bankruptcy protection or other alternatives for restructuring and resolving its liabilities; the

terms, timing, structure, benefits and costs of any strategic transaction and whether one will be consummated at all; and the impact

of any strategic transaction on the Company. These statements are only predictions and involve known and unknown risks, uncertainties,

and other factors, which may cause Adamis’ actual results to be materially different from the results anticipated by such forward-looking

statements. Factors that could cause actual results to differ materially from management’s current expectations include those risks

and uncertainties relating to: our ability to raise capital; the results of our strategic review process; our revenues, cash flow, cash

burn, expenses, obligations and liabilities, and ability to pay expenses and satisfy obligations as they become due; the interest of

third parties in entering into a merger, reverse merger, or other strategic transaction with the Company or in purchasing or entering

into a partnership regarding one or more of our commercial products; any impact of this evaluation process on the sale of the Company’s

commercial products; the outcomes of any litigation, regulatory proceedings, inquiries or investigations that we are or may become subject

to; the timing and results of our efforts to sell assets relating to our former compounding pharmacy business; and other important factors

discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”). In addition, forward-looking

statements concerning our anticipated future activities assume that we have sufficient funding to support such activities and continue

our operations and planned activities, which may not be the case. If we are unable to timely complete

a transaction or we do not obtain required additional equity or debt funding or obtain required funding from other sources or transactions,

our cash resources will be depleted and we could be required to materially reduce or suspend operations, which would likely have a material

adverse effect on our business, stock price and our relationships with third parties with whom we have business relationships. If we

do not have sufficient funds to continue operations or satisfy our liabilities, we could be required to seek bankruptcy protection or

other alternatives to attempt to resolve our obligations and liabilities, which could result in our stockholders losing some or all of

their investment in us. You should not place undue reliance on any forward-looking statements. Further, any forward-looking statement

speaks only as of the date on which it is made, and except as may be required by applicable law, we undertake no obligation to update

or release publicly the results of any revisions to these forward-looking statements or to reflect events or circumstances arising after

the date of this press release. Certain of these risks and additional risks, uncertainties, and other factors are described in greater

detail in Adamis’ filings from time to time with the SEC, including its annual report on Form 10-K for the year ended December

31, 2021, and subsequent filings with the SEC, which Adamis strongly urges you to read and consider, all of which are available free

of charge on the SEC’s website at http://www.sec.gov.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| |

99.1 |

Press release dated October 3, 2022. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ADAMIS PHARMACEUTICALS CORPORATION |

| |

|

| |

|

| Dated: October 3, 2022 |

By: |

/s/ David C. Benedicto |

| |

Name: |

David C. Benedicto |

| |

Title: |

Chief Financial Officer |

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

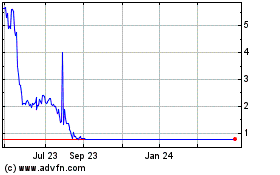

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024