UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

| (Mark One) |

| |

|

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| For the year ended

May 31, 2022 |

| |

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______

Commission File Number: 000-54163

| The Marquie Group, Inc. |

| (Exact name of registrant as specified in its Charter) |

| Florida |

|

26-2091212 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employee Identification No.) |

| |

|

|

|

7901 4th ST N, Suite 4000

St. Petersburg, FL 33702 |

|

33702 |

| (Address of principal executive office) |

|

(Zip Code) |

(800) 351-3021

(Registrant’s telephone number, including area

code)

Not Applicable

(Former Name, former address and former fiscal year,

if changed since last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Yes ☒ No

☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit and post such files). Yes

☒ No

☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act:

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer (Do not check if smaller reporting company) |

☐ |

Smaller reporting company |

☒ |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

Based

on the closing price of our common stock as listed on the OTC Bulletin Board, the aggregate market value of the common stock of The Marquie

Group, Inc. held by non-affiliates as of November 30, 2021 was $1,008,505.

As

of July 26, 2022, there were 16,189,732 shares of common stock issued and outstanding.

EXPLANATORY NOTE

The purpose of this Amendment No. 1 to the

registrant’s Yearly Report on Form 10-K for the year ended May 31, 2022, filed with the Securities and Exchange

Commission on August 30, 2022 (the “Form 10-K”), is to furnish Exhibit 101 to the Form 10-K. No other changes have been

made to the Form 10-K. This Amendment No. 1 to the Form 10-K speaks as of the original filing date of the Form 10-K, does not

reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way disclosures

made in the original Form 10-K.

Gries & Associates, LLC

Certified Public Accountants

501 S. Cherry Street Suite 1100

Denver, Colorado 80246

Report of Independent Registered Public Accounting

Firm

Board of Directors and Shareholders

The Marquie Group, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheet of The Marquie

Group, Inc. (the “Company”) as of May 31, 2022, and the related consolidated statements of operations, statements of stockholders’

deficit, and cash flows for the year then ended, and the related notes and schedules (collectively referred to as the “financial

statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company

as of May 31, 2022, and the results of its operations and its cash flows for each of the years then ended, in conformity with accounting

principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the entity’s

management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting

firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent

with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities

and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB.

Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free

of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit

of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control

over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control

over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material

misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures

included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Going Concern Uncertainty

The accompanying financial statements have been prepared assuming that

the Company will continue as a going concern. As discussed in note 12 to the financial statements, the Company has incurred

losses since inception of $15,878,189 and negative working capital of $5,667,209. These factors create an uncertainty as to the

Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in note

12. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

blaze@griesandassociates.com

501 S. Cherry Street, Suite 1100, Denver, Colorado 80246

(O)720-464-2875 (M)773-255-5631 (F)720-222-5846

Gries & Associates, LLC

Certified Public Accountants

501 S. Cherry Street Suite 1100

Denver, Colorado 80246

Critical Audit Matters

The critical audit matters communicated below are

matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the

audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially

challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the

financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions

on the critical audit matters or on the accounts or disclosures to which they relate.

Loss on conversions of notes payable and accrued

interest to common stock

Critical Audit Matter Description

The Company has had outstanding notes payable to lenders

which are convertible into Company common stock at conversion prices which are based on the future trading price of the Company's common

stock. For the year ended May 31, 2022, the Company issued a total of 11,511,179 shares of its common stock pursuant to conversions of

an aggregate of $285,683 in principal and accrued interest. The $2,941,708 in excess of the $3,227,391 fair value of the 11,511,179 shares

of common stock at the respective dates of issuance over the $285,683 liability reduction was charged to Loss on Conversions of Notes

Payable.

How the Critical Audit Matter was Addressed

in the Audit

Our principal audit procedures related to the Company's

loss on conversions of notes payable and accrued interest to common stock expense included:

| · | We obtained Company prepared quarterly schedules of all conversions of notes payable and accrued interest

to common stock for the year ended May 31, 2022. |

| · | We agreed the prices used to independent third-party sources of closing trading prices of the Company

common stock on the respective issuance dates. We then verified the calculation by multiplying the number of shares issued times the respective

closing trading prices for each conversion. |

| · | We agreed the principal and accrued interest amounts to Notices of Conversions for each conversion. |

Emphasis of Matters-Risks and Uncertainties

The Company is not able to predict the ultimate impact

that COVID -19 will have on its business. However, if the current economic conditions continue, the pandemic could have an adverse impact

on the economies and

financial markets of many countries, including the geographical area in which the Company plans to operate.

/s/ Gries & Associates, LLC

We have served as the Company’s auditor since 2022.

Denver, CO

June 28, 2022

blaze@griesandassociates.com

501 S. Cherry Street, Suite 1100, Denver, Colorado 80246

(O)720-464-2875 (M)773-255-5631 (F)720-222-5846

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of The Marquie Group, Inc.

(formerly Music of Your Life, Inc.)

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of The Marquie

Group, Inc. (the “Company”) as of May 31, 2021 and the related consolidated statements of operations, stockholders’

equity (deficit), and cash flows for the year then ended, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of The Marquie

Group, Inc. as of May 31, 2021 and the results of their operations and cash flows for the year then ended in conformity with accounting

principles generally accepted in the United States.

Explanatory Paragraph – Going Concern

The accompanying financial statements referred to above have been prepared

assuming that the Company will continue as a going concern. As discussed in Note 12 to the financial statements, the Company’s present

financial situation raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to this

matter are also described in Note 12. The financial statements do not include any adjustments that might result from the outcome of this

uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public

accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to

be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations

of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those

standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of

material misstatement, whether due to error or fraud. The Company is not required to have, nor was We engaged to perform, an audit of

its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over

financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over

financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material

misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures

included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below

are matters arising from the audit of the financial statements as of May 31, 2021 and for the year then ended that were communicated

or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial

statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters

does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit

matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Loss

on conversions of notes payable and accrued interest to common stock – Refer to Note 10 to the consolidated financial statements

Critical Audit Matter Description

The

Company has had outstanding notes payable to lenders which are convertible into Company common stock at conversion prices which are based

on the future trading price of the Company's common stock. For the year ended May 31, 2021, the Company issued a total of 4,304,842 shares

of its common stock (as adjusted for the April 21, 2022 1 for 1000 reverse split) pursuant to conversions of an aggregate of $835,050

in principal and accrued interest. The $1,445,042 excess of the $2,218,092 fair value of the 4,304,842 shares of common stock at the respective

dates of issuance over the $835,050 liability reduction was charged to Loss on Conversions of Notes Payable.

How the Critical Audit

Matter was Addressed in the Audit

Our

principal audit procedures related to the Company's loss on conversions of notes payable and accrued interest to common stock expense

included:

(1)

We obtained Company prepared quarterly schedules of all conversions of notes payable and accrued interest to common stock in the year

ended May 31, 2021.

(2)

For the fair value measurements, we agreed the prices used to independent third-party sources of closing trading prices of TMGI common

stock on the respective issuance dates. We then verified the calculation by multiplying the number of shares issued times the respective

closing trading prices for each conversion.

(3)

For the liability reduction amounts, we agreed the principal and accrued interest amounts to Notices of Conversions for each conversion.

/s/ Michael T. Studer CPA P.C.

Michael T. Studer CPA P.C.

Freeport, New York

October 14, 2021

We served as the Company’s auditor from 2015 to 2022.

Item 6. Exhibits.

| Exhibit No. |

|

Description |

| 3.1 |

|

Amended and Restated Articles of Incorporation of Music of Your life, Inc. |

| 3.2 |

|

Amended and Restated Bylaws of Music of Your Life, Inc. |

| 31.1 |

|

Certification of Principal Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1 |

|

Certification of Principal Executive Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101.INS |

|

XBRL Instance Document |

| 101.SCH |

|

XBRL Taxonomy Extension Schema Document |

| 101.CAL |

|

XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF |

|

XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB |

|

XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE |

|

XBRL Taxonomy Extension Presentation Linkbase Document |

| |

|

|

| |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

The Marquie Group, Inc. |

| |

|

| Date:September 30, 2022 |

By: |

/s/ Marc Angell |

| |

|

Marc Angell |

| |

|

Chief Executive Officer |

| |

|

(Duly Authorized Officer and Principal Executive Officer) |

| |

|

|

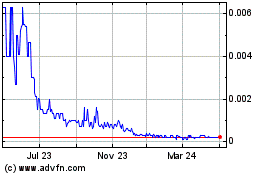

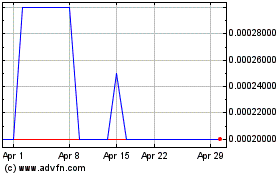

Marquie (PK) (USOTC:TMGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marquie (PK) (USOTC:TMGI)

Historical Stock Chart

From Apr 2023 to Apr 2024