UK Government Tax Cuts Are Credit Negative, Moody's Says

September 28 2022 - 5:44AM

Dow Jones News

By Xavier Fontdegloria

The series of large tax cuts and increased spending outlined by

the U.K. government is fueling a confidence shock which could

weaken debt affordability and the country's credit profile,

according to global ratings agency Moody's.

The tax cuts are credit negative and will lead to structurally

greater deficit, a weaker growth outlook and acute public spending

pressure, the agency said in a report published Tuesday.

"A sustained confidence shock arising from market concerns

around the credibility of the government's fiscal strategy that

resulted in structurally higher funding costs could also more

permanently weaken the U.K.'s debt affordability," Moody's

said.

U.K. Chancellor of the Exchequer Kwasi Kwarteng sparked a

financial markets selloff by announcing the biggest tax cuts in a

generation, at a cost of around 45 billion pounds ($48.3 billion) a

year, in addition to new spending to freeze the rise in energy

bills for households and businesses that is expected to cost GBP60

billion.

Increased borrowing, together with weakening economic growth,

will push already elevated government debt on an upward trajectory

in the coming years, Moody's said.

"The measures... reflect the weakening predictability of fiscal

policymaking that we have highlighted in recent years. Moreover,

uncertainty around the government's continuing compliance with its

often revised fiscal rules weaken our assessment of policymakers'

forward-planning ability and their willingness or ability to

deliver on the targets they set," the agency said.

In the context of a sharp depreciation of the British pound and

the spike in government bond yields, Moody's said maintaining

foreign-investor confidence may become increasingly important.

"A sustained confidence shock, accompanied by concerns around

the government's commitment to fiscal prudence and/or the central

bank's ability to contain inflation, could more permanently weaken

debt affordability and the U.K.'s credit profile," it said.

Write to Xavier Fontdegloria at xavier.fontdegloria@wsj.com

(END) Dow Jones Newswires

September 28, 2022 05:29 ET (09:29 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

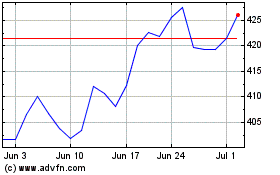

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024