UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 2)

Imperalis Holding Corp.

(Name of Issuer)

Common

Stock, par value $0.001 per share

(Title of Class of Securities)

45257M106

(CUSIP Number)

MILTON C.

AULT, III

c/o BitNile

Holdings, Inc.

11411 Southern Highlands Parkway, Suite 240

Las Vegas, NV 89141

(949)

444-5464

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 6, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed

in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for

other parties to whom copies are to be sent.

The information required on

the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSON

BITNILE HOLDINGS, INC. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

WC |

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A. |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

159,520,163(1) |

| 8 |

SHARED VOTING POWER

140,253,571(2) |

| 9 |

SOLE DISPOSITIVE POWER

159,520,163(1) |

| 10 |

SHARED DISPOSITIVE POWER

140,253,571(2) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

299,773,734 |

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

90.27% |

| 14 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

| (1) | Represents shares of common stock

issuable upon conversion of 25,000 shares of series A preferred stock as of September 8,

2022. Each share of series A preferred stock has a stated value of $1,000 and is convertible

into such number of shares of common stock equal to the stated value divided by eighty percent

(80%) of the volume weighed average price of the Issuer’s common stock over the 10

trading days immediately preceding the date of conversion. Does not include any shares of

the Issuer’s common stock that are issuable, at the Issuer’s option, in lieu

of payment in cash of the dividend that accrues at 8% per annum. Also does not include any

shares of common stock issuable upon exercise of a common stock purchase warrant, as the

warrant will not be exercisable by the reporting person. The warrant will only be exercisable

by the reporting person’s stockholders after distribution. |

| (2) | Represents (i) 129,363,756 shares

of common stock held by BitNile, Inc., (ii) 16,501 shares of common stock held by Digital

Power Lending, LLC and (iii) 10,873,314 shares of Common Stock issuable upon conversion of

an outstanding convertible promissory note in the principal face amount of $101,529, which

is convertible into shares of Common Stock at a conversion price of $0.01 per share. |

| 1 |

NAME OF REPORTING PERSON

BITNILE, INC. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

WC, OO |

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A. |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

129,363,756 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

129,363,756 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

129,363,756 |

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

80.00% |

| 14 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

| 1 |

NAME OF REPORTING PERSON

DIGITAL POWER LENDING, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

WC, OO |

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A. |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

10,889,815(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

10,889,815(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

10,889,815 |

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.31% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

| (1) | Represents (i) 16,501 shares of Common

Stock and (ii) 10,873,314 shares of Common Stock issuable upon conversion of an outstanding

convertible promissory note in the principal face amount of $101,529, which is convertible

into shares of Common Stock at a conversion price of $0.01 per share. |

| 1 |

NAME OF REPORTING PERSON

DAVID J. KATZOFF |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A. |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

- 0 - |

| 8 |

SHARED VOTING POWER

- 0 - |

| 9 |

SOLE DISPOSITIVE POWER

- 0 - |

| 10 |

SHARED DISPOSITIVE POWER

- 0 - |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

- 0 - |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

This Amendment No. 2 (“Amendment

No. 2”) amends and supplements the Schedule 13D filed by the undersigned on December 23, 2021 as amended on January 28, 2022

(the “Schedule 13D”). Except as otherwise specified in this Amendment No. 2, all items in the Schedule 13D are unchanged.

All capitalized terms used in this Amendment No. 2 and not otherwise defined herein have the meanings ascribed to such terms in the Schedule

13D.

| Item 2. | Identity and Background. |

Item 2 of the Schedule 13D is hereby amended and restated in its entirety

as follows:

| (a) | This statement is filed by: |

| (i) | BitNile Holdings, Inc., a Delaware

corporation, with respect to the Shares beneficially owned by it directly and through its

subsidiaries BitNile, Inc. and Digital Power Lending, LLC; |

| (ii) | BitNile, Inc., a Nevada corporation,

with respect to the Shares directly and beneficially owned by it; |

| (iii) | Digital Power Lending, LLC, a California

limited liability company, with respect to the Shares directly and beneficially owned by

it; and |

| (iv) | David J. Katzoff, Chief Financial

Officer, Secretary and Treasurer of the Issuer and Manager of Digital Power Lending, LLC. |

Each of the foregoing is referred to as

a “Reporting Person” and collectively as the “Reporting Persons.” Each of the Reporting Persons

is party to that certain Joint Filing Agreement, attached hereto as Exhibit 99.1. Accordingly, the Reporting Persons are hereby filing

a joint Schedule 13D.

Set forth on Schedule A annexed hereto

(“Schedule A”) is the name and present principal occupation or employment, principal business address and citizenship

of the executive officers and directors of BitNile Holdings, Inc. To the best of the Reporting Persons’ knowledge, except as otherwise

set forth herein, none of the persons listed in Schedule A beneficially owns any securities of the Issuer or is a party to any contract,

agreement or understanding required to be disclosed herein.

Set forth on Schedule B annexed hereto

(“Schedule B”) is the name and present principal occupation or employment, principal business address and citizenship

of the executive officers and directors of BitNile, Inc. To the best of the Reporting Persons’ knowledge, except as otherwise set

forth herein, none of the persons listed in Schedule B beneficially owns any securities of the Issuer or is a party to any contract,

agreement or understanding required to be disclosed herein.

Set forth on Schedule C annexed hereto

(“Schedule C”) is the name and present principal occupation or employment, principal business address and citizenship

of the executive officers and directors of Digital Power Lending, LLC. To the best of the Reporting Persons’ knowledge, except

as otherwise set forth herein, none of the persons listed in Schedule C beneficially owns any securities of the Issuer or is a party

to any contract, agreement or understanding required to be disclosed herein.

(b) The

principal business address of BitNile Holdings, Inc. and BitNile, Inc. is 11411 Southern Highlands Parkway, Suite 240, Las Vegas, Nevada

89141. The principal business address of Digital Power Lending, LLC and Mr. Katzoff is 940 South Coast Drive, Suite 200, Costa Mesa,

CA 92626.

(c) BitNile

Holdings, Inc. is a diversified holding company pursuing growth by acquiring undervalued businesses and disruptive technologies with

a global impact. Through its wholly and majority-owned subsidiaries and strategic investments, BitNile Holdings owns and operates a data

center at which it mines Bitcoin and provides mission-critical products that support a diverse range of industries, including oil exploration,

defense/aerospace, industrial, automotive, medical/biopharma, karaoke audio equipment, hotel operations and textiles. The principal business

of BitNile, Inc. is Bitcoin mining, data center operations and decentralized finance initiatives. The principal business of Digital Power

Lending, LLC is investing in securities. The principal occupation of Mr. Katzoff is serving as the Manager of Digital Power Lending,

LLC.

(d) No

Reporting Person nor any person listed in Schedules A through C has, during the last five years, been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors).

(e) No

Reporting Person nor any person listed in Schedules A through C has, during the last five years, been party to a civil proceeding of

a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or

finding any violation with respect to such laws.

(f) BitNile

Holdings, Inc. is organized under the laws of the State of Delaware. BitNile, Inc. is organized under the laws of the State of Nevada.

Digital Power Lending, LLC is organized under the laws of the State of California. Mr. Katzoff is a citizen of the United States of America. The

citizenship of the persons listed in Schedules A through C is set forth therein.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 of the Schedule 13D is hereby amended and restated

in its entirety as follows:

The securities of the Issuer purchased

by each of BitNile, Inc. and Digital Power Lending, LLC were purchased with working capital. The purchase price of the 129,363,756 Shares

directly owned by BitNile, Inc. is $200,000.00. The aggregate purchase price of the 16,501 Shares directly owned by Digital Power Lending,

LLC is $2,526.77. The aggregate purchase price of the convertible promissory note directly owned by Digital Power Lending, LLC and currently

convertible into 10,873,314 Shares is $100,000. The aggregate purchase price of the 25,000 shares of series A preferred stock directly

owned by BitNile Holdings, Inc. and currently convertible into 159,520,163 Shares and the common stock purchase warrants that will only

be exercisable by the stockholders of BitNile Holdings, Inc. after distribution, is $36,643,580.

| Item 5. | Interest in Securities of the Issuer. |

Item 5 of the Schedule 13D is hereby amended

and restated in its entirety as follows:

The aggregate percentage of Shares reported

owned by each Reporting Person is based upon 161,704,695 Shares outstanding, which is the total number of Shares outstanding as reported

by the Issuer as of September 8, 2022.

| (a) | As of the close of business on September

8, 2022, BitNile Holdings, Inc. may be deemed to beneficially own 299,773,734 Shares, consisting

of (i) 129,363,756 Shares held by BitNile, Inc., (ii) 16,501 Shares held by Digital Power

Lending, LLC, (iii) 10,873,314 Shares issuable upon conversion of an outstanding convertible

promissory note in the principal face amount of $101,529, which is convertible into Shares

at a conversion price of $0.01 per share, and (iv) 159,520,163 shares of common stock issuable

upon conversion of 25,000 shares of series A preferred stock as of September 8, 2022. Each

share of series A preferred stock has a stated value of $1,000 and is convertible into such

number of shares of common stock equal to the stated value divided by eighty percent (80%)

of the volume weighed average price of the Issuer’s common stock over the 10 trading

days immediately preceding the date of conversion. Does not include any shares of the Issuer’s

common stock that are issuable, at the Issuer’s option, in lieu of payment in cash

of the dividend that accrues at 8% per annum. Also does not include any shares of common

stock issuable upon exercise of a common stock purchase warrant, as the warrant will not

be exercisable by the reporting person. The warrant will only be exercisable by the reporting

person’s stockholders after distribution. BitNile Holdings, Inc. may be deemed to beneficially

own the Shares beneficially owned by BitNile, Inc. and Digital Power Lending, LLC by virtue

of its relationship with such entity described in Item 2. |

Percentage: 90.27%

| (b) | 1. Sole power to vote or direct vote: 159,520,163 |

2. Shared power to vote or direct vote: 140,253,571

3. Sole power to dispose or direct the disposition: 159,520,163

4. Shared power to dispose or direct the disposition:

140,253,571

| (c) | BitNile Holdings, Inc. has not entered

into any transactions in the Shares during the past sixty days except for the acquisition

of the 25,000 shares of series A preferred stock currently convertible into 159,520,163 Shares,

and the common stock purchase warrants that will only be exercisable by the stockholders

of BitNile Holdings, Inc. after distribution, which shares of series A preferred stock and

warrants were acquired directly from the Issuer in exchange for all of the issued and outstanding

shares owned by BitNile Holdings, Inc. in TurnOnGreen, Inc. and elimination all of the intercompany

accounts between BitNile Holdings, Inc. and TurnOnGreen, Inc. evidencing historical equity

investments made by BitNile Holdings, Inc. to TurnOnGreen, Inc., in the amount of $36,643,580. |

| (a) | As of the close of business on September

8, 2022, BitNile, Inc beneficially owns 129,363,756 shares of Common Stock held directly

by it. |

Percentage: 80.00%

| (b) | 1. Sole power to vote or direct vote: 0 |

2. Shared power to vote or direct vote:

129,363,756

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 129,363,756

| (c) | BitNile, Inc. has not entered into any transactions

in the Shares during the past sixty days. |

| C. | Digital Power Lending, LLC |

| (a) | As of the close of business on September

8, 2022, Digital Power Lending, LLC may be deemed to beneficially own 10,889,815 Shares,

consisting of (i) 16,501 Shares held directly and (ii) 10,873,314 Shares issuable upon conversion

of an outstanding convertible promissory note in the principal face amount of $101,529, which

is convertible into Shares at a conversion price of $0.01 per share. |

Percentage: 6.31%

| (b) | 1. Sole power to vote or direct vote: 0 |

2. Shared power to vote or direct

vote: 10,889,815

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 10,889,815

| (c) | The only transactions by Digital Power

Lending, LLC in the Shares during the past sixty days was 6,501 Shares purchased in an open

market transaction on September 6, 2022 at $0.2108 per Share. |

| (a) | As of the close of business on September

8, 2022, Mr. Katzoff does not beneficially own any Shares. |

Percentage: 0.0%

| (b) | 1. Sole power to vote or direct vote: 0 |

2. Shared power to vote or direct vote:

0

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 0

| (c) | Mr. Katzoff has not entered into any transactions in the Shares during the past sixty days. |

The filing of this Schedule

13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934,

as amended, the beneficial owners of any securities of the Issuer that he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the securities reported herein that he or it does not directly own.

| (d) | No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends

from, or proceeds from the sale of, the Shares. |

| Item 6. | Contracts, Arrangements, Understandings

or Relationships With Respect to Securities of the Issuer. |

Item 6 of the Schedule 13D is hereby amended and restated

in its entirety as follows:

On September 8, 2022, the Reporting Persons

entered into a Joint Filing Agreement in which the Reporting Persons agreed to the joint filing on behalf of each of them of statements

on Schedule 13D with respect to the securities of the Issuer. A copy of this agreement is attached as an exhibit hereto and is incorporated

herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 of the Schedule 13D is hereby amended and restated

in its entirety as follows:

| 99.1 | Joint Filing Agreement by and among BitNile Holdings, Inc., BitNile,

Inc., Digital Power Lending, LLC and David J. Katzoff, dated September 8, 2022. |

SIGNATURES

After reasonable inquiry and

to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: September 8, 2022

| |

|

BITNILE HOLDINGS, INC. |

|

/s/ David J. Katzoff |

|

|

|

| DAVID J. KATZOFF |

|

By: |

/s/ Milton C. Ault, III |

| |

|

|

Name: |

Milton C. Ault, III |

| |

|

|

Title: |

Executive Chairman |

| |

|

BITNILE, INC. |

|

|

|

|

|

| |

|

By: |

/s/ Henry C.W. Nisser |

| |

|

|

Name: |

Henry C.W. Nisser |

| |

|

|

Title: |

President |

| |

|

DIGITAL POWER LENDING, LLC |

| |

|

|

|

| |

|

By: |

/s/ David J.Katzoff |

| |

|

|

Name: |

David J.Katzoff |

| |

|

|

Title: |

Manager |

SCHEDULE A

Officers and Directors of BitNile Holdings, Inc.

| Name and Position |

Principal

Occupation |

Principal

Business Address |

Citizenship |

Milton C. Ault, III

Executive Chairman |

Executive Chairman of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

William B. Horne

Chief Executive Officer and Director |

Chief Executive Officer of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Henry C.W. Nisser

President, General Counsel and Director |

President and General Counsel of BitNile Holdings, Inc. |

c/o

BitNile Holdings, Inc. 100 Park Avenue, 16th Floor, Suite 1658A, New York, NY 10017 |

Sweden |

Kenneth S. Cragun

Chief Financial Officer |

Chief Financial Officer of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Howard Ash

Independent Director |

Chairman of Claridge Management |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Jeffrey A. Bentz

Independent Director |

President of North Star Terminal & Stevedore Company |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Robert O. Smith

Independent Director |

Independent Executive Consultant |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Moti Rosenberg

Independent Director |

Independent Consultant |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

Israel |

SCHEDULE B

Officers and Directors of BitNile, Inc.

| Name and Position |

Principal

Occupation |

Principal

Business Address |

Citizenship |

Milton C. Ault, III

Executive Chairman |

Executive Chairman of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

William B. Horne

Chief Executive Officer and Director |

Chief Executive Officer of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Henry C.W. Nisser

President, General Counsel and Director |

President and General Counsel of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 100

Park Avenue, 16th Floor, Suite 1658A, New York, NY 10017 |

Sweden |

Kenneth S. Cragun

Chief Financial Officer |

Chief Financial Officer of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411

Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Christopher K. Wu

Executive Vice President and Director |

Executive Vice President of Alternative Investments

of BitNile Holdings, Inc. |

c/o BitNile Holdings, Inc. 11411 Southern Highlands

Parkway, Suite 240, Las Vegas, NV 89141 |

USA |

Darren Magot

Director |

Chief Executive Officer of Ault Alliance, Inc. |

c/o Ault Alliance, Inc. 11411 Southern Highlands Parkway,

Suite 240, Las Vegas, NV 89141 |

USA |

SCHEDULE C

Officers and Directors of Digital Power Lending, LLC

| Name and Position |

Principal

Occupation |

Principal

Business Address |

Citizenship |

David J. Katzoff

Manager |

Manager of Digital Power Lending,

LLC |

c/o Digital Power Lending, LLC,

940 South Coast Drive, Suite 200, Costa Mesa, CA 92626 |

USA |

14

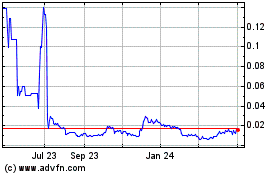

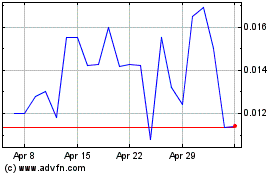

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024