Current Report Filing (8-k)

September 01 2022 - 4:20PM

Edgar (US Regulatory)

0001836981false00018369812022-08-292022-08-290001836981us-gaap:CommonStockMember2022-08-292022-08-290001836981bbai:RedeemableWarrantsMember2022-08-292022-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 29, 2022

________________________________________________________

BigBear.ai Holdings, Inc.

(Exact name of Registrant as Specified in Charter)

________________________________________________________

| | | | | | | | |

Delaware | 001-40031 | 85-4164597 |

| (State or Other Jurisdiction of | (Commission | (IRS Employer |

| Incorporation or Organization) | File Number) | Identification Number) |

| | |

6811 Benjamin Franklin Drive, Suite 200 |

Columbia, MD 21046 |

(Address of principal executive offices, including Zip Code) |

(410) 312-0885 |

(Registrant's telephone number, including area code) |

________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | Trading | | Name of each exchange |

Title of each class | | Symbols | | on which registered |

| Common stock, $0.0001 par value | | BBAI | | New York Stock Exchange |

| Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share | | BBAI.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities

In order to align its strategy with market conditions to support its long-term success, BigBear.ai Holdings, Inc. (NYSE: BBAI) (“BigBear.ai,” the “Company,” “we” or “us”), committed to a reduction in force (the “Reduction”), of approximately 7% of our workforce. We commenced the Reduction on August 29, 2022 upon notification to certain affected employees, and we completed notification of all affected employees on August 31, 2022. The Reduction has now been substantially completed.

As a result of the Reduction, we estimate that we will incur approximately $1.5 million of costs and expenses, primarily comprising severance and termination-related costs, which we expect to recognize in the third quarter of 2022.

The Company expects the Reduction to yield substantial reductions in operating costs and the Reduction is one component of a larger strategy to reduce cash burn through cost savings initiatives, streamline operations and achieve operational efficiencies through continued integration.

Forward-Looking Statements

This Item 2.05 may contain “forward-looking statements” about BigBear.ai's future expectations, plans, outlook, projections and prospects. Such forward-looking statements can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,” “proposes” and similar expressions. Although BigBear.ai believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021. Forward-looking statements speak only as of the date of the document in which they are contained, and BigBear.ai does not undertake any duty to update any forward-looking statements except as may be required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

By: | /s/ Sean Ricker |

Name: | Sean Ricker |

Title: | Chief Accounting Officer |

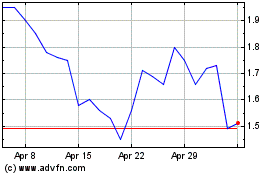

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

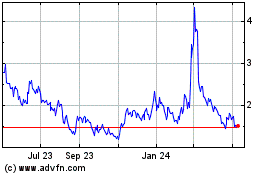

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Apr 2023 to Apr 2024