Current Report Filing (8-k)

August 30 2022 - 8:34AM

Edgar (US Regulatory)

0001539894FALSE00015398942022-08-252022-08-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 25, 2022

Atlas Financial Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Cayman Islands | | 000-54627 | | 27-5466079 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

| | | | | |

953 American Lane, 3rd Floor Schaumburg, IL (Address of principal executive offices) | 60173 (Zip Code) |

Registrant's telephone number, including area code: (847) 472-6700

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 25, 2022, the Board of Directors (the “Board”) of Atlas Financial Holdings Inc. (the “Company”) appointed Mark E. Holliday and Steven D. Scheiwe to the Board, effective immediately, with a term to expire at the Company’s 2023 annual general meeting of shareholders. Mr. Holliday is 54 and Mr. Scheiwe is 61. Mr. Holliday has a background in portfolio management, holds a Bachelor of Arts degree in Economics from Northwestern University, and has served as a director on a number of boards, including chairing multiple committees. Mr. Scheiwe has a legal and mergers and acquisitions background, holds a Bachelor of Arts degree Cum Laude from University of Colorado, as well as a Juris Doctor with Honors from the Washburn University School of Law, and has served as a director on a number of boards, including chairing multiple committees. Pursuant to the terms of the Company’s Convertible Senior Secured Delayed-Draw Credit Agreement agented by Sheridan Road Partners, LLC (in such capacity, the “Agent”), with certain lenders (the “Lenders”), each of Mr. Holliday and Mr. Scheiwe is reasonably acceptable to the Agent and the Lenders who do not have a material relationship with the Company or its affiliates and are neither executives of the Company nor involved in the Company’s day-to-day operations.

The Board concluded that each of Mr. Holliday and Mr. Scheiwe is qualified to serve as an independent director of the Company in accordance with the requirements of The Nasdaq Stock Market, the Securities and Exchange Commission and the Company’s Articles of Association. Neither Mr. Holliday nor Mr. Scheiwe have been appointed to any committees at this time, however, Mr. Holliday and Mr. Scheiwe will likely be added to one or more committees following the next scheduled Board meeting.

Mr. Holliday and Mr. Scheiwe will each be entitled to receive compensation as non-employee directors, which consists of a $4,500 quarterly cash retainer, restricted stock units totaling 100,000 ordinary voting common shares which vest over a two year period, plus an equity incentive that has the potential to provide an additional 100,000 shares of Atlas common stock linked to certain milestones. Mr. Holliday and Mr. Scheiwe will be eligible to receive reimbursements from the Company for their out-of-pocket expenses incurred in connection with attendance at or participation in meetings of the Board.

On August 25, 2022, concurrently with the appointment of Mr. Holliday and Mr. Scheiwe, each of Paul A. Romano and Joseph R. Shugrue informed the Company that they were resigning from the Board effective on that date. Neither Mr. Romano nor Mr. Shugrue served on any committees of the Board. Neither Mr. Romano’s nor Mr. Shugrue’s decision to resign was the result of any disagreement with the Company, and each will remain with the Company in their current officer capacities of Vice President and Chief Financial Officer and Vice President and Chief Operating Officer, respectively.

Following these changes, a majority of the Board is independent.

Item 7.01. Regulation FD Disclosure.

On August 30, 2022, the Company issued a press release announcing the appointment of Mark E. Holliday and Steven D. Scheiwe to the Board, the resignation of Paul A. Romano and Joseph R. Shugrue from the Board and the court approval of a Settlement Agreement (the “Settlement Agreement”) with Dana Popish Severinghaus, Director of the Illinois Department of Insurance, acting solely in her capacity as the statutory and court affirmed liquidator (the “Liquidator”) of American Country Insurance Company, American Service Insurance Company, and Gateway Insurance Company, and Adrienne A. Harris, Superintendent of the New York State Department of Financial Services, solely in her capacity as liquidator of Global Liberty Insurance Company (the “Superintendent” and, together with the Liquidator, the “Insurance Regulators”), with the Insurance Regulators serving as liquidators in connection with the previously announced liquidation of the Company’s former insurance company subsidiaries. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference. The information disclosed under this Item 7.01, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing under the Securities Act.

Item 8.01. Other Information.

On August 25, 2022, the Circuit Court of Cook County, Illinois, County Department, Chancery Division entered an order approving the Settlement Agreement with the Insurance Regulators. The Supreme Court of the State of New York, New York County had previously approved the agreement. Having received both supervising court approvals, the Settlement Agreement became effective as of August 25, 2022, pursuant to its terms.

The Settlement Agreement is filed as Exhibit 10.1 to the Company’s Current Report filed on August 4, 2022 and is incorporated herein by reference. The description of the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the Settlement Agreement filed as Exhibit 10.1 to the Company’s Current Report filed on August 4, 2022.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 10.1 | Settlement Agreement, by and among Dana Popish Severinghaus, Director of the Illinois Department of Insurance, acting solely in her capacity as the statutory and court affirmed liquidator of American County Insurance Company, American Service Insurance Company, and Gateway Insurance Company, American Insurance Acquisition, Inc., and Adrienne A. Harris, Superintendent of the New York State Department of Financial Services, solely in her capacity as liquidator of Global Liberty Insurance Company, dated August 2, 2022. |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | ATLAS FINANCIAL HOLDINGS, INC.

(Registrant) |

| Date: August 30, 2022 | By: | /s/ Paul A. Romano |

| | Name: | Paul A. Romano |

| Title: | Vice President and Chief Financial Officer |

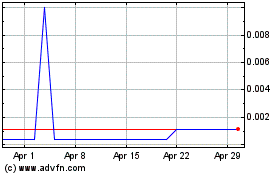

Atlas Financial (CE) (USOTC:AFHIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

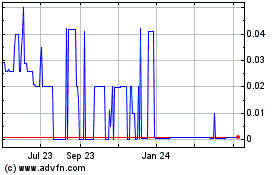

Atlas Financial (CE) (USOTC:AFHIF)

Historical Stock Chart

From Apr 2023 to Apr 2024