UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For August 30, 2022

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

(Harmony and/or the Company)

RESULTS FOR THE YEAR ENDED 30 JUNE 2022 – SHORT-FORM ANNOUNCEMENT

Johannesburg. Tuesday, 30 August 2022. Harmony Gold Mining Company Limited is pleased to announce its financial and operating results for the year ended 30 June 2022 (FY22).

•2% increase in revenue to R42 645m (US$2 804m) from R41 733m

(US$2 710m)

•Production profit of R9 546m (US$628m), down 20% from R11 958m (US$777m)

•Net debt to EBITDA stable at 0.1x

•3% decrease in underground recovered grade to 5.37g/t from 5.51g/t

•3% decrease in gold production to 46 236kg (1 486 517oz) from

47 755kg (1 535 352oz)

•6% decrease in total mineral resources and reserves to 132.6Moz and 39.8Moz respectively

•Operating free cash flow of R2 905m (US$191m) decreased by 55% from R6 528m (US$424m)

•Net loss of R1 012m (US$48m) after net profit decreased by 120% from R5 124m (US$326m)

•Ongoing focus on safety with LTIFR now below 6.00 for 3 consecutive quarters

•Commenced the 30MW Phase 1 renewable energy programme

•HEPS decreased by 49% to 499 SA cents (33 US cents) from a comparative headline earnings per share of 987 SA cents (64 US cents)

•EPS decreased by 120% to a loss of 172 SA cents (8 US cents) from a comparative earnings per share of 842 SA cents (54 US cents)

•Interim dividend declared and paid during FY22 of 40 SA cents (2.7 US cents) per ordinary share (June 2021: 110 SA cents (7.7 US cents))

•Final dividend of 22 SA cents (approximately 1.3 US cents) per ordinary share declared (June 2021: 27 SA cents (1.8 US cents))

OPERATING RESULTS

| | | | | | | | | | | | | | | | | |

| Year ended 30 June 2022 | Year ended 30 June 2021 | % change |

| Gold produced | Kg | 46 236 | 47 755 | (3) | |

| Oz | 1 486 517 | 1 535 352 | (3) | |

| Underground grade | g/t | 5.37 | 5.51 | (3) | |

| Gold price received | R/kg | 894 218 | 851 045 | 5 | |

| US$/oz | 1 829 | 1 719 | 6 | |

| Cash operating costs | R/kg | 701 024 | 600 592 | (17) | |

| US$/oz | 1 434 | 1 213 | (18) | |

| Total costs and capital | R/kg | 834 937 | 707 445 | (18) | |

| US$/oz | 1 707 | 1 429 | (19) | |

| All-in sustaining costs | R/kg | 835 891 | 723 054 | (16) | |

| US$/oz | 1 709 | 1 460 | (17) | |

| Production profit | R million | 9 546 | 11 958 | (20) | |

| US$ million | 628 | 777 | (19) | |

| Average exchange rate | R:US$ | 15.21 | 15.40 | (1) | |

FINANCIAL RESULTS

| | | | | | | | | | | | | | |

| Year ended 30 June 2022 | Year ended 30 June 2021 | % change |

| Basic earnings/(loss) per share | SA cents | (172) | 842 | <(100) |

| US cents | (8) | 54 | <(100) |

| Headline earnings | R million | 3 055 | 5 959 | (49) |

| US$ million million | 199 | 387 | (49) |

| Headline earnings per share | SA cents | 499 | 987 | (49) |

| US cents | 33 | 64 | (49) |

FY23 group production and cost guidance

Production guidance for FY23 is estimated to be between 1.4Moz and 1.5Moz at an all-in sustaining cost of below R900 000/kg. Underground recovered grade is planned to be about 5.45g/t to 5.60g/t.

“The solid platform we have built has placed Harmony in a strong position to deliver operationally. We have a clear strategy to prioritise capital for high-grade and high-margin projects that will generate the best possible returns, ensuring we meet our long-term objectives. Delivering meaningful returns to our shareholders while at the same time effecting positive change and maintaining the trust of all of our stakeholders is what we call 'Mining with Purpose'.”

Notice of Final Gross Cash Dividend

Our dividend declaration for the 12 months ended 30 June 2022 is as follows:

Declaration of final gross cash ordinary dividend no. 92

The Board has approved, and notice is hereby given, that a final gross cash dividend of 22 SA cents (1.3 US cents*) per ordinary share in respect of the 12 months ended 30 June 2022, has been declared payable to the registered shareholders of Harmony on Monday, 17 October 2022.

In accordance with paragraphs 11.17(a)(i) to (x) and 11.17(c) of the JSE Listings Requirements the following additional information is disclosed:

• The dividend has been declared out of income reserves;

• The local Dividend Withholding Tax rate is 20%;

• The gross local dividend amount is 22.00000 SA cents(1.31274 US cents*) per ordinary share for shareholders exempt from the Dividend Withholding Tax;

• The net local dividend amount is 17.60000 SA cents per ordinary

share for shareholders liable to pay the Dividend Withholding Tax;

• Harmony currently has 616 525 702 ordinary shares in issue (which

includes 47 381 treasury shares); and

• Harmony’s income tax reference number is 9240/012/60/0.

A dividend No. 92 of 22.00000 SA cents (1.31274 US cents*) per ordinary share, being the dividend for the 12 months ended 30 June 2022, has been declared payable on Monday, 17 October 2022 to those shareholders recorded in the share register of the company at the close of business on Friday, 14 October 2022. The dividend is declared in the currency of the Republic of South Africa. Any change in address or dividend instruction to apply to this dividend must be received by the company’s transfer secretaries or registrar not later than Friday, 7 October 2022.

Dividends received by non-resident shareholders will be exempt from income tax in terms of section 10(1)(k)(i) of the Income Tax Act. The dividends withholding tax rate is 20%, accordingly, any dividend will be subject to dividend withholding tax levied at a rate of 20%, unless the rate is reduced in terms of any applicable agreement for

the avoidance of double taxation (DTA) between South Africa and the country of residence of the shareholder.

Should dividend withholding tax be withheld at a rate of 20%, the net dividend amount due to non-resident shareholders is 17.60000 SA cents per share. A reduced dividend withholding rate in terms of the applicable DTA may only be relied on if the non-resident shareholder has provided the following forms to their CSDP or broker, as the case may be in respect of uncertificated shares or the company, in respect of certificated shares:

(1)a declaration that the dividend is subject to a reduced rate as a result of the application of a DTA; and

(2)a written undertaking to inform the CSDP or broker, as the case may be, should the circumstances affecting the reduced rate change or the beneficial owner cease to be the beneficial owner,

both in the form prescribed by the Commissioner for the South African Revenue Service. Non-resident shareholders are advised to contact their CSDP or broker, as the case may be, to arrange for the abovementioned documents to be submitted prior to the payment of the distribution if such documents have not already been submitted.

In compliance with the requirements of Strate Proprietary Limited (Strate) and the JSE Listings Requirements, the salient dates for payment of the dividend are as follows:

| | | | | |

| Last date to trade ordinary shares cum-dividend is | Tuesday, 11 October 2022 |

| Ordinary shares trade ex-dividend | Wednesday, 12 October 2022 |

| Record date | Friday, 14 October 2022 |

| Payment date | Monday, 17 October 2022 |

No dematerialisation or rematerialisation of share certificates may occur between Wednesday, 12 October 2022 and Friday, 14 October 2022 both dates inclusive, nor may any transfers between registers take place during this period.

On payment date, dividends due to holders of certificated securities on the SA share register will either be electronically transferred to such shareholders' bank accounts or, in the absence of suitable mandates, dividends will be held in escrow by Harmony until suitable mandates are received to electronically transfer dividends to such shareholders.

Dividends in respect of dematerialised shareholdings will be credited to such shareholders' accounts with the relevant Central Securities Depository Participant (CSDP) or broker.

The holders of American Depositary Receipts (ADRs) should confirm dividend details with the depository bank. Assuming an exchange rate of R16.76/US$1* the dividend payable on an ADR is equivalent to 1.31274 US cents for ADR holders before dividend tax. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

* Based on an exchange rate of R16.76/US$1 at 25 August 2022. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

Short-form announcement

This short-form announcement is the responsibility of the board of directors of the Company.

Shareholders are advised that this short-form announcement represents a summary of the information contained in the full announcement (results booklet) and does not contain full or complete details published on the Stock Exchange News Service, via the JSE link at https://senspdf.jse.co.za/documents/2022/jse/isse/HARE/FY22result.pdf and on Harmony’s website (www.harmony.co.za) on 30 August 2022.

The financial results as contained in the condensed consolidated financial statements for the financial year ended 30 June 2022, from which this short-form announcement has been correctly extracted, have been reviewed by PricewaterhouseCoopers Inc., who expressed an unmodified review conclusion thereon.

Any investment decisions by investors and/or shareholders should be based on a consideration of the results booklets as a whole and shareholders are encouraged to review the results booklet, which is available for viewing on the Company’s website and the JSE link, referred to above.

The results booklet is also available for inspection at the registered office of the Company, Randfontein Office Park, Randfontein, 1760, Corner Main Reef Road/Ward Avenue, Randfontein, by emailing HarmonyIR@harmony.co.za and at the offices of the sponsors, JP Morgan. Inspection of the full announcement is available to investors and/or shareholders at no charge, during

normal business hours from today, 30 August 2022, together with the aforementioned review report by the Company’s external auditors.

Ends.

For more details, contact:

Jared Coetzer

Head: Investor Relations

+27 (0)82 746 4120

Johannesburg, South Africa

30 August 2022

Sponsor:

J.P. Morgan Equities South Africa Proprietary Limited

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Harmony Gold Mining Company Limited |

| |

| Date: August 30, 2022 | By: /s/ Boipelo Lekubo |

| Name: Boipelo Lekubo |

| Title: Financial Director |

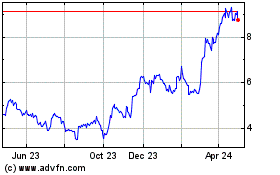

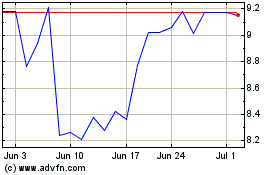

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024