Conn’s, Inc. (NASDAQ: CONN) (“Conn’s” or the

“Company”), a specialty retailer of home goods, including

furniture, appliances, and consumer electronics, with a mission to

elevate home life to home love, today announced its financial

results for the quarter ended July 31, 2022.

“Challenging macroeconomic conditions continued

to pressure consumer spending during our second quarter, which

disproportionately affected year-over-year sales to our financial

access customer segment and sales of our discretionary product

categories. While we entered the second quarter with a cautious

outlook for the remainder of the fiscal year, the retail

environment has continued to deteriorate prompting us to accelerate

our efforts to reduce operating costs, and lower capital

expenditures as well continue to maintain conservative credit

underwriting. In July, we successfully completed our latest ABS

transaction and ended the second quarter with over $211.0 million

of available liquidity and cash. This provides us with the

financial flexibility to support the current needs of our business,

while investing in our long-term growth and transformation,” stated

Chandra Holt, Conn's Chief Executive Officer.

“During the second quarter, we completed the

first phase of our eCommerce platform migration, launched our

store-within-a-store pilot at Belk, Inc. ("Belk"), and expanded our

best-in-class payment options with the launch of a new layaway

program across our retail footprint. We continue to pursue new go

to market strategies and partnerships aimed at leveraging our

industry-leading next-day white glove delivery capabilities. We

believe we are taking the correct near-term actions to successfully

navigate a difficult retail environment, while continuing to pursue

long-term growth opportunities that we believe will drive value for

our shareholders and our customers,” concluded Ms. Holt.

Second Quarter Financial Highlights as

Compared to the Prior Fiscal Year Period (Unless Otherwise

Noted):

- Total

consolidated revenue declined 17.1% to $346.6 million, due to a

19.4% decline in total net sales, and a 6.3% reduction in finance

charges and other revenues;

- Same store sales

decreased 22.0%;

- eCommerce sales

increased 11.5% to a second quarter record of $19.3 million;

- Credit spread

was 960 basis points, and fiscal year-to-date the credit spread was

1,060 basis points;

- Net earnings

were $0.09 per diluted share, compared to net earnings of $1.22 per

diluted share for the same period last fiscal year;

- Adjusted

earnings were $0.04 per diluted share, compared to adjusted

earnings of $1.22 per diluted share for the same period last fiscal

year;

- Added two new

standalone stores bringing the total number of stores at July 31,

2022 to 163 and added four store-within-a store locations with

Belk; and

- The Company completed an ABS

transaction demonstrating the Company’s ability to access the

capital markets even during turbulent market conditions resulting

in the issuance and sale of $407.7 million aggregate principal

amount of Class A and Class B Notes, and issued and retained Class

C Notes in an aggregate principal amount of $63.1 million.

Strategic Update

In response to challenging macroeconomic

pressures, the Company has updated its near-term strategic

priorities which include:

- Reducing operating costs. The Company is

conducting an extensive review and prioritization of its cost

structure. The Company expects current initiatives, combined with

prior actions, to generate cost savings of approximately $12.0 -

$16.0 million in the back half of this fiscal year.

- Lowering capital

expenditures. The Company is delaying or eliminating

several planned capital investments, including adjusting planned

new store openings and distribution center expansions. As a result,

Conn’s expects to reduce investments in capital expenditures for

fiscal year 2023 by approximately $20.0 million compared to its

prior expectation.

- Maintaining conservative

credit underwriting. The Company is focused on maintaining

conservative credit underwriting and remaining disciplined in its

approach to credit collections. At July 31, 2022, the weighted

average credit score of outstanding balances was 611, 60+ days past

due balances as a percentage of the total customer portfolio

carrying value was 11.0%, and re-aged balances as a percentage of

the total customer portfolio carrying value was

16.1%.

Second Quarter Results

Net income for the three months ended

July 31, 2022 was $2.1 million, or $0.09 per diluted share,

compared to net income for the three months ended July 31,

2021 of $37.0 million, or $1.22 per diluted share. On a non-GAAP

basis, adjusted net income for the three months ended July 31,

2022 was $1.0 million, or $0.04 per diluted share. This compares to

adjusted net income for the three months ended July 31, 2021

of $37.0 million, or $1.22 per diluted share.

Retail Segment Second Quarter

Results

Retail revenues were $279.8 million for the

three months ended July 31, 2022 compared to $347.0 million

for the three months ended July 31, 2021, a decrease of $67.2

million or 19.4%. The decrease in retail revenue was primarily

driven by a decrease in same store sales of 22.0%. The decrease in

same store sales was primarily driven by a tightening of

underwriting standards by our lease-to-own partners, the effect the

benefits stimulus had on sales in the prior year period and lower

consumer demand in the current period. The decrease in same store

sales was partially offset by new store growth.

For the three months ended July 31, 2022,

retail segment operating income was $0.1 million compared to retail

segment operating income of $28.7 million for three months ended

July 31, 2021. On a non-GAAP basis, adjusted retail segment

operating loss for the three months ended July 31, 2022 was $1.4

million after excluding the gain on lease termination. On a

non-GAAP basis, the adjusted retail segment operating income for

the three months ended July 31, 2021 was $28.7 million. The

decrease in retail segment operating income for the three months

ended July 31, 2022 was primarily due to a decrease in revenue as

described above and a decline in the retail gross margin

percentage.

The decrease in retail gross margin was

primarily driven by increased product costs as a result of higher

freight, higher fuel costs and the deleveraging of fixed

distribution costs. These increases were partially offset by an

increase in RSA commissions and a more profitable product mix.

The SG&A decrease in the retail segment was

primarily due to a decline in variable costs and declines in

advertising and labor costs as a result of cost saving initiatives.

These decreases were partially offset by an increase in occupancy

costs due to higher utilities costs and new store growth.

The following table presents net sales and

changes in net sales by category:

| |

Three Months Ended July 31, |

|

|

|

|

|

Same Store |

| (dollars in thousands) |

|

2022 |

|

% of Total |

|

|

2021 |

|

% of Total |

|

Change |

|

% Change |

|

% Change |

|

Furniture and mattress |

$ |

86,320 |

|

30.9 |

% |

|

$ |

109,259 |

|

31.5 |

% |

|

$ |

(22,939 |

) |

|

(21.0 |

)% |

|

(24.6 |

)% |

| Home appliance |

|

120,748 |

|

43.2 |

|

|

|

135,444 |

|

39.1 |

|

|

|

(14,696 |

) |

|

(10.9 |

) |

|

(13.1 |

) |

| Consumer electronics |

|

31,860 |

|

11.4 |

|

|

|

48,413 |

|

14.0 |

|

|

|

(16,553 |

) |

|

(34.2 |

) |

|

(36.2 |

) |

| Home office |

|

8,857 |

|

3.2 |

|

|

|

17,986 |

|

5.2 |

|

|

|

(9,129 |

) |

|

(50.8 |

) |

|

(50.1 |

) |

| Other |

|

7,664 |

|

2.7 |

|

|

|

9,143 |

|

2.6 |

|

|

|

(1,479 |

) |

|

(16.2 |

) |

|

(16.9 |

) |

|

Product sales |

|

255,449 |

|

91.4 |

|

|

|

320,245 |

|

92.4 |

|

|

|

(64,796 |

) |

|

(20.2 |

) |

|

(22.7 |

) |

| Repair service agreement

commissions (1) |

|

21,615 |

|

7.7 |

|

|

|

23,700 |

|

6.8 |

|

|

|

(2,085 |

) |

|

(8.8 |

) |

|

(15.3 |

) |

| Service revenues |

|

2,448 |

|

0.9 |

|

|

|

2,840 |

|

0.8 |

|

|

|

(392 |

) |

|

(13.8 |

) |

|

|

|

Total net sales |

$ |

279,512 |

|

100.0 |

% |

|

$ |

346,785 |

|

100.0 |

% |

|

$ |

(67,273 |

) |

|

(19.4 |

)% |

|

(22.0 |

)% |

(1) The total change in sales of repair service

agreement commissions includes retrospective commissions, which are

not reflected in the change in same store sales.

Credit Segment Second Quarter

Results

Credit revenues were $66.8 million for the three

months ended July 31, 2022 compared to $71.4 million for the

three months ended July 31, 2021, a decrease of $4.6 million

or 6.4%. The decrease in credit revenue was primarily due to a 4.9%

decrease in the average outstanding balance of the customer

accounts receivable portfolio as well as a decline in insurance

commissions.

Provision for bad debts increased to $26.8

million for the three months ended July 31, 2022 from $10.1

million for the three months ended July 31, 2021, an overall

change of $16.7 million. The year-over-year increase was primarily

driven by a smaller decrease in the allowance for bad debts during

the three months ended July 31, 2022 compared to the three

months ended July 31, 2021 and a year-over-year increase in

net charge-offs of $4.9 million. The decrease in the allowance

for bad debts during the three months ended July 31, 2022 was

primarily driven by a decrease in the customer account receivable

portfolio balance and an improvement in historical loss rates.

During the three months ended July 31, 2021, the decrease was

primarily driven by a decrease in the rate of delinquencies and

re-ages, a decrease in the customer account receivable portfolio

and an improvement in the forecasted unemployment rate that drove a

$5.0 million decrease in the economic adjustment.

Credit segment operating income was $7.9 million

for the three months ended July 31, 2022, compared to

operating income of $25.5 million for the three months ended

July 31, 2021. The decrease was primarily due to the

increase in the provision for bad debts and the decrease in credit

revenue.

Additional information on the credit portfolio

and its performance may be found in the Customer Accounts

Receivable Portfolio Statistics table included within this press

release and in the Company’s Form 10-Q for the quarter ended

July 31, 2022, to be filed with the Securities and Exchange

Commission on August 30, 2022 (the “Second Quarter Form

10-Q”).

Store and Facilities Update

The Company opened two new standalone stores

during the second quarter of fiscal year 2023 bringing the

total store count to 163 in 15 states and opened four

store-within-a-store locations with Belk. During fiscal year 2023,

the Company plans to open a total of 10 to 12 standalone

locations and 15 to 20 store-within-a-store locations.

Liquidity and Capital

Resources

As of July 31, 2022, the Company had $186.8

million of immediately available borrowing capacity under its

$650.0 million revolving credit facility. The Company also had

$24.3 million of unrestricted cash available for use.

On July 21, 2022, the Company completed an ABS

transaction resulting in the issuance and sale of approximately

$407.7 million in aggregate principal amount of Class A and

Class B Notes secured by customer accounts receivables and

restricted cash held by a consolidated VIE, which resulted in

proceeds of approximately $402.8 million, net of debt issuance

costs. The Company retained Class C Notes in an aggregate principal

amount of $63.1 million.

Conference Call Information

The Company will host a conference call on

August 30, 2022, at 10 a.m. CT / 11 a.m. ET, to discuss its

three months ended July 31, 2022 financial results. Participants

can join the call by dialing 877-451-6152 or 201-389-0879. The

conference call will also be broadcast simultaneously via webcast

on a listen-only basis. A link to the earnings release, webcast and

second quarter fiscal year 2023 conference call presentation will

be available at ir.conns.com.

Replay of the telephonic call can be accessed

through September 6, 2022 by dialing 844-512-2921 or 412-317-6671

and Conference ID: 13729951.

About Conn’s, Inc.

Conn's HomePlus (NASDAQ: CONN) is a specialty

retailer of home goods, including furniture, appliances and

consumer electronics, with a mission to elevate home life to home

love. With over 160 stores across 15 states and online at

Conns.com, our over 3,500 employees strive to help all customers

create a home they love through access to high-quality products,

next-day delivery and personalized payment options, including our

flexible, in-house credit program. Additional information can be

found by visiting our investor relations website at

https://ir.conns.com and social channels (@connshomeplus on

Twitter, Instagram, Facebook and LinkedIn).

This press release contains forward-looking

statements within the meaning of the federal securities laws,

including but not limited to, the Private Securities Litigation

Reform Act of 1995, that involve risks and uncertainties. Such

forward-looking statements include information concerning our

future financial performance, business strategy, plans, goals and

objectives. Statements containing the words “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “should,” “predict,” “will,” “potential,” or the

negative of such terms or other similar expressions are generally

forward-looking in nature and not historical facts. Such

forward-looking statements are based on our current expectations.

We can give no assurance that such statements will prove to be

correct, and actual results may differ materially. A wide variety

of potential risks, uncertainties, and other factors could

materially affect our ability to achieve the results either

expressed or implied by our forward-looking statements, including,

but not limited to: general economic conditions impacting our

customers or potential customers; our ability to execute periodic

securitizations of future originated customer loans on favorable

terms; our ability to continue existing customer financing programs

or to offer new customer financing programs; changes in the

delinquency status of our credit portfolio; unfavorable

developments in ongoing litigation; increased regulatory oversight;

higher than anticipated net charge-offs in the credit portfolio;

the success of our planned opening of new stores; expansion of our

e-commerce business; technological and market developments and

sales trends for our major product offerings; our ability to manage

effectively the selection of our major product offerings; our

ability to protect against cyber-attacks or data security breaches

and to protect the integrity and security of individually

identifiable data of our customers and employees; our ability to

fund our operations, capital expenditures, debt repayment and

expansion from cash flows from operations, borrowings from our

Revolving Credit Facility, and proceeds from accessing debt or

equity markets; the effects of epidemics or pandemics, including

the COVID-19 pandemic; and other risks detailed in Part I, Item 1A,

Risk Factors, in our Annual Report on Form 10-K for the fiscal year

ended January 31, 2022 and other reports filed with the Securities

and Exchange Commission. If one or more of these or other risks or

uncertainties materialize (or the consequences of such a

development changes), or should our underlying assumptions prove

incorrect, actual outcomes may vary materially from those reflected

in our forward-looking statements. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. We disclaim any

intention or obligation to update publicly or revise such

statements, whether as a result of new information, future events

or otherwise, or to provide periodic updates or guidance. All

forward-looking statements attributable to us, or to persons acting

on our behalf, are expressly qualified in their entirety by these

cautionary statements.

CONN-G

S.M. Berger & Company

Andrew Berger (216) 464-6400

CONN’S, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)(dollars in thousands, except per

share amounts)

| |

Three Months EndedJuly 31, |

|

Six Months EndedJuly 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

|

|

Revenues: |

|

|

|

|

|

|

|

| Total net sales |

$ |

279,512 |

|

|

$ |

346,785 |

|

$ |

551,775 |

|

|

$ |

638,081 |

|

| Finance charges and other

revenues |

|

67,120 |

|

|

|

71,598 |

|

|

134,677 |

|

|

|

144,004 |

|

|

Total revenues |

|

346,632 |

|

|

|

418,383 |

|

|

686,452 |

|

|

|

782,085 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

| Cost of goods sold |

|

182,718 |

|

|

|

216,042 |

|

|

361,100 |

|

|

|

400,921 |

|

| Selling, general and

administrative expense |

|

130,142 |

|

|

|

137,870 |

|

|

262,925 |

|

|

|

263,919 |

|

| Provision (benefit) for bad

debts |

|

27,226 |

|

|

|

10,262 |

|

|

41,956 |

|

|

|

(6,874 |

) |

| Charges and credits |

|

(1,484 |

) |

|

|

— |

|

|

(1,484 |

) |

|

|

— |

|

|

Total costs and expenses |

|

338,602 |

|

|

|

364,174 |

|

|

664,497 |

|

|

|

657,966 |

|

|

Operating income |

|

8,030 |

|

|

|

54,209 |

|

|

21,955 |

|

|

|

124,119 |

|

| Interest expense |

|

6,808 |

|

|

|

6,088 |

|

|

12,329 |

|

|

|

15,292 |

|

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

— |

|

|

|

1,218 |

|

|

Income before income taxes |

|

1,222 |

|

|

|

48,121 |

|

|

9,626 |

|

|

|

107,609 |

|

| Provision (benefit) for income

taxes |

|

(907 |

) |

|

|

11,117 |

|

|

1,276 |

|

|

|

25,207 |

|

|

Net income |

$ |

2,129 |

|

|

$ |

37,004 |

|

$ |

8,350 |

|

|

$ |

82,402 |

|

| Income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.09 |

|

|

$ |

1.26 |

|

$ |

0.34 |

|

|

$ |

2.80 |

|

|

Diluted |

$ |

0.09 |

|

|

$ |

1.22 |

|

$ |

0.34 |

|

|

$ |

2.74 |

|

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

23,833,100 |

|

|

|

29,438,605 |

|

|

24,306,524 |

|

|

|

29,382,162 |

|

|

Diluted |

|

23,916,269 |

|

|

|

30,212,448 |

|

|

24,461,836 |

|

|

|

30,072,401 |

|

CONN’S, INC. AND SUBSIDIARIES

CONDENSED RETAIL SEGMENT FINANCIAL

INFORMATION(unaudited)(dollars in thousands)

| |

Three Months EndedJuly 31, |

|

Six Months EndedJuly 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenues: |

|

|

|

|

|

|

|

| Product sales |

$ |

255,449 |

|

|

$ |

320,245 |

|

|

$ |

505,422 |

|

|

$ |

589,456 |

|

| Repair service agreement

commissions |

|

21,615 |

|

|

|

23,700 |

|

|

|

41,452 |

|

|

|

42,831 |

|

| Service revenues |

|

2,448 |

|

|

|

2,840 |

|

|

|

4,901 |

|

|

|

5,794 |

|

|

Total net sales |

|

279,512 |

|

|

|

346,785 |

|

|

|

551,775 |

|

|

|

638,081 |

|

| Finance charges and other |

|

273 |

|

|

|

224 |

|

|

|

544 |

|

|

|

433 |

|

|

Total revenues |

|

279,785 |

|

|

|

347,009 |

|

|

|

552,319 |

|

|

|

638,514 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

| Cost of goods sold |

|

182,718 |

|

|

|

216,042 |

|

|

|

361,100 |

|

|

|

400,921 |

|

| Selling, general and

administrative expense |

|

98,035 |

|

|

|

102,157 |

|

|

|

194,065 |

|

|

|

193,050 |

|

| Provision for bad debts |

|

409 |

|

|

|

142 |

|

|

|

588 |

|

|

|

160 |

|

| Charges and credits |

|

(1,484 |

) |

|

|

— |

|

|

|

(1,484 |

) |

|

|

— |

|

|

Total costs and expenses |

|

279,678 |

|

|

|

318,341 |

|

|

|

554,269 |

|

|

|

594,131 |

|

|

Operating income (loss) |

$ |

107 |

|

|

$ |

28,668 |

|

|

$ |

(1,950 |

) |

|

$ |

44,383 |

|

| Retail gross margin |

|

34.6 |

% |

|

|

37.7 |

% |

|

|

34.6 |

% |

|

|

37.2 |

% |

| Selling, general and

administrative expense as percent of revenues |

|

35.0 |

% |

|

|

29.4 |

% |

|

|

35.1 |

% |

|

|

30.2 |

% |

| Operating margin |

|

0.0 |

% |

|

|

8.3 |

% |

|

|

(0.4 |

)% |

|

|

7.0 |

% |

| Store

count: |

|

|

|

|

|

|

|

| Beginning of period |

|

161 |

|

|

|

152 |

|

|

|

158 |

|

|

|

146 |

|

| Opened |

|

2 |

|

|

|

3 |

|

|

|

5 |

|

|

|

9 |

|

|

End of period (1) |

|

163 |

|

|

|

155 |

|

|

|

163 |

|

|

|

155 |

|

| |

|

|

|

|

|

|

|

(1) Does not include four

store-within-a-store locations with Belk opened during the three

and six months ended July 31, 2022.

CONN’S, INC. AND SUBSIDIARIES

CONDENSED CREDIT SEGMENT FINANCIAL

INFORMATION(unaudited)(dollars in thousands)

| |

Three Months EndedJuly 31, |

|

Six Months EndedJuly 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenues: |

|

|

|

|

|

|

|

| Finance charges and other

revenues |

$ |

66,847 |

|

|

$ |

71,374 |

|

|

$ |

134,133 |

|

|

$ |

143,571 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

| Selling, general and

administrative expense |

|

32,107 |

|

|

|

35,713 |

|

|

|

68,860 |

|

|

|

70,869 |

|

| Provision for bad debts |

|

26,817 |

|

|

|

10,120 |

|

|

|

41,368 |

|

|

|

(7,034 |

) |

|

Total costs and expenses |

|

58,924 |

|

|

|

45,833 |

|

|

|

110,228 |

|

|

|

63,835 |

|

|

Operating income |

|

7,923 |

|

|

|

25,541 |

|

|

|

23,905 |

|

|

|

79,736 |

|

| Interest expense |

|

6,808 |

|

|

|

6,088 |

|

|

|

12,329 |

|

|

|

15,292 |

|

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,218 |

|

|

Income before income taxes |

$ |

1,115 |

|

|

$ |

19,453 |

|

|

$ |

11,576 |

|

|

$ |

63,226 |

|

| Selling, general and

administrative expense as percent of revenues |

|

48.0 |

% |

|

|

50.0 |

% |

|

|

51.3 |

% |

|

|

49.4 |

% |

| Selling, general and

administrative expense as percent of average outstanding customer

accounts receivable balance (annualized) |

|

12.2 |

% |

|

|

12.9 |

% |

|

|

12.8 |

% |

|

|

12.4 |

% |

| Operating margin |

|

11.9 |

% |

|

|

35.8 |

% |

|

|

17.8 |

% |

|

|

55.5 |

% |

CONN’S, INC. AND SUBSIDIARIES

CUSTOMER ACCOUNTS RECEIVABLE PORTFOLIO

STATISTICS(unaudited)

| |

As of July 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| Weighted average credit score

of outstanding balances (1) |

|

611 |

|

|

|

608 |

|

| Average outstanding customer

balance |

$ |

2,508 |

|

|

$ |

2,414 |

|

| Balances 60+ days past due as

a percentage of total customer portfolio carrying value

(2)(3)(4) |

|

11.0 |

% |

|

|

7.2 |

% |

| Re-aged balance as a

percentage of total customer portfolio carrying value

(2)(3)(5) |

|

16.1 |

% |

|

|

20.4 |

% |

| Carrying value of account

balances re-aged more than six months (in thousands) (3) |

$ |

35,808 |

|

|

$ |

70,058 |

|

| Allowance for bad debts and

uncollectible interest as a percentage of total customer accounts

receivable portfolio balance |

|

17.2 |

% |

|

|

18.3 |

% |

| Percent of total customer

accounts receivable portfolio balance represented by no-interest

option receivables |

|

34.0 |

% |

|

|

29.8 |

% |

| |

Three Months EndedJuly 31, |

|

Six Months EndedJuly 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Total applications

processed |

|

257,381 |

|

|

|

336,438 |

|

|

|

525,085 |

|

|

|

634,344 |

|

| Weighted average origination

credit score of sales financed (1) |

|

620 |

|

|

|

614 |

|

|

|

620 |

|

|

|

615 |

|

| Percent of total applications

approved and utilized |

|

23.5 |

% |

|

|

22.5 |

% |

|

|

21.8 |

% |

|

|

22.2 |

% |

| Average income of credit

customer at origination |

$ |

50,800 |

|

|

$ |

47,700 |

|

|

$ |

50,500 |

|

|

$ |

48,100 |

|

| Percent of retail sales paid

for by: |

|

|

|

|

|

|

|

|

In-house financing, including down payments received |

|

52.1 |

% |

|

|

50.9 |

% |

|

|

51.0 |

% |

|

|

49.9 |

% |

|

Third-party financing |

|

18.9 |

% |

|

|

17.5 |

% |

|

|

18.4 |

% |

|

|

17.2 |

% |

|

Third-party lease-to-own option |

|

6.8 |

% |

|

|

11.5 |

% |

|

|

7.1 |

% |

|

|

11.9 |

% |

| |

|

77.8 |

% |

|

|

79.9 |

% |

|

|

76.5 |

% |

|

|

79.0 |

% |

(1) Credit scores exclude

non-scored accounts.

(2) Accounts that become

delinquent after being re-aged are included in both the delinquency

and re-aged amounts.

(3) Carrying value reflects the

total customer accounts receivable portfolio balance, net of

deferred fees and origination costs, the allowance for no-interest

option credit programs and the allowance for uncollectible

interest.

(4) Increase was primarily due

to a decrease in cash collections driven by the impact of stimulus

benefits in prior year.

(5) Decrease was primarily due

to the change in the unilateral re-age policy that occurred in the

second quarter of fiscal year 2021 and the tightening of

underwriting standards that occurred in fiscal year 2021 and fiscal

year 2022.

CONN’S, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS(in

thousands)

| |

July 31, 2022 |

|

January 31, 2022 |

|

Assets |

(unaudited) |

|

|

| Current

Assets: |

|

|

|

| Cash and cash equivalents |

$ |

24,256 |

|

$ |

7,707 |

| Restricted cash |

|

47,855 |

|

|

31,930 |

| Customer accounts receivable,

net of allowances |

|

434,824 |

|

|

455,787 |

| Other accounts receivable |

|

55,565 |

|

|

63,055 |

| Inventories |

|

262,952 |

|

|

246,826 |

| Income taxes receivable |

|

6,813 |

|

|

6,745 |

| Prepaid expenses and other

current assets |

|

10,101 |

|

|

8,756 |

|

Total current assets |

|

842,366 |

|

|

820,806 |

| Long-term portion of customer

accounts receivable, net of allowances |

|

398,127 |

|

|

432,431 |

| Property and equipment,

net |

|

210,814 |

|

|

192,763 |

| Operating lease right-of-use

assets |

|

252,653 |

|

|

256,267 |

| Other assets |

|

50,849 |

|

|

52,199 |

|

Total assets |

$ |

1,754,809 |

|

$ |

1,754,466 |

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current

liabilities: |

|

|

|

| Current finance lease

obligations |

$ |

909 |

|

$ |

889 |

| Accounts payable |

|

77,691 |

|

|

74,705 |

| Accrued expenses |

|

89,934 |

|

|

109,712 |

| Operating lease liability -

current |

|

57,940 |

|

|

54,534 |

| Other current liabilities |

|

15,517 |

|

|

18,576 |

|

Total current liabilities |

|

241,991 |

|

|

258,416 |

| Operating lease liability -

non current |

|

321,104 |

|

|

330,439 |

| Long-term debt and finance

lease obligations |

|

602,412 |

|

|

522,149 |

| Deferred tax liability |

|

— |

|

|

7,351 |

| Other long-term

liabilities |

|

29,425 |

|

|

21,292 |

|

Total liabilities |

|

1,194,932 |

|

|

1,139,647 |

| Stockholders’ equity |

|

559,877 |

|

|

614,819 |

|

Total liabilities and stockholders’ equity |

$ |

1,754,809 |

|

$ |

1,754,466 |

CONN’S, INC. AND SUBSIDIARIES

NON-GAAP RECONCILIATIONS(unaudited)(dollars in

thousands, except per share amounts)

Basis for presentation of non-GAAP

disclosures:

To supplement the Condensed Consolidated

Financial Statements, which are prepared and presented in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”), the Company also provides the

following non-GAAP financial measures: adjusted retail segment

operating income, adjusted net income, and adjusted net income per

diluted share and net debt. These non-GAAP financial measures are

not meant to be considered as a substitute for, or superior to,

comparable GAAP measures and should be considered in addition to

results presented in accordance with GAAP. They are intended to

provide additional insight into our operations and the factors and

trends affecting the business. Management believes these non-GAAP

financial measures are useful to financial statement readers

because (1) they allow for greater transparency with respect to key

metrics we use in our financial and operational decision making and

(2) they are used by some of our institutional investors and the

analyst community to help them analyze our operating results.

RETAIL SEGMENT ADJUSTED OPERATING INCOME

(LOSS)

| |

Three Months EndedJuly 31, |

|

Six Months EndedJuly 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

| Retail segment

operating income (loss), as reported |

$ |

107 |

|

|

$ |

28,668 |

|

$ |

(1,950 |

) |

|

$ |

44,383 |

| Adjustments: |

|

|

|

|

|

|

|

|

Lease termination (1) |

|

(1,484 |

) |

|

|

— |

|

|

(1,484 |

) |

|

|

— |

|

Retail segment operating income (loss), as

adjusted |

$ |

(1,377 |

) |

|

$ |

28,668 |

|

$ |

(3,434 |

) |

|

$ |

44,383 |

(1) Represents a gain on the

termination of a lease.

ADJUSTED NET INCOME AND ADJUSTED NET

INCOME PER DILUTED SHARE

| |

Three Months EndedJuly 31, |

|

Six Months EndedJuly 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

|

|

Net income, as reported |

$ |

2,129 |

|

|

$ |

37,004 |

|

$ |

8,350 |

|

|

$ |

82,402 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Lease termination (1) |

|

(1,484 |

) |

|

|

— |

|

|

(1,484 |

) |

|

|

— |

|

|

Loss on extinguishment of debt (2) |

|

— |

|

|

|

— |

|

|

— |

|

|

|

1,218 |

|

|

Tax impact of adjustments |

|

337 |

|

|

|

— |

|

|

337 |

|

|

|

(274 |

) |

|

Net income, as adjusted |

$ |

982 |

|

|

$ |

37,004 |

|

$ |

7,203 |

|

|

$ |

83,346 |

|

| Weighted average common shares

outstanding - Diluted |

|

23,916,269 |

|

|

|

30,212,448 |

|

|

24,461,836 |

|

|

|

30,072,401 |

|

| Earnings per

share: |

|

|

|

|

|

|

|

| As reported |

$ |

0.09 |

|

|

$ |

1.22 |

|

$ |

0.34 |

|

|

$ |

2.74 |

|

| As adjusted |

$ |

0.04 |

|

|

$ |

1.22 |

|

$ |

0.29 |

|

|

$ |

2.77 |

|

(1) Represents a gain on the

termination of a lease.

(2) Represents a loss of $1.0

million from retirement of $141.2 million aggregate principal

amount of our 7.25% senior notes due 2022 (“Senior Notes”) and a

loss of $0.2 million related to the amendment of our Fifth

Amended and Restated Loan and Security Agreement.

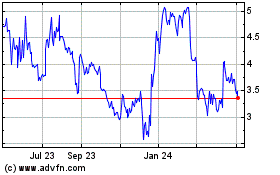

Conns (NASDAQ:CONN)

Historical Stock Chart

From Mar 2024 to Apr 2024

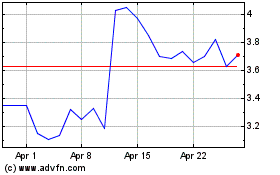

Conns (NASDAQ:CONN)

Historical Stock Chart

From Apr 2023 to Apr 2024