Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

August 19 2022 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of: August,

2022

Commission File Number:

001-39557

Siyata Mobile Inc.

(Translation

of registrant’s name into English)

1001 Lenoir St., Suite A-414

Montreal, QC H4C 2Z6

(Address

of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

☒

Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Restatement of Financial Information

for the Quarter Ended March 31, 2022

On August 15, 2022, the management and the audit committee of the board

of directors (the “Audit Committee”) of the Company determined that the Company’s condensed consolidated unaudited

interim financial statements for the three month period ended March 31, 2022, filed with the Securities and Exchange Commission (“SEC”)

on Form 6-K on May 17, 2022 (the “Prior Period Financial Statements”), should no longer be relied upon due to an error

in the accounting treatment for the classification of the Company’s warrants (the “Warrants”) as equity rather

than as a derivative liability. In addition, investors should no longer rely upon any communications relating to these condensed consolidated

unaudited interim financial statements.

As part of the Company’s normal quarterly reporting

process for the six months ended June 30, 2022, management and the Audit Committee of the Company concluded that a material error was

made related to the accounting for the Warrants entered into on January 11, 2022 and therefore were misstated in the Company’s March

31, 2022 Prior Period Financial Statements. There is no impact on any of the year end financial statements previously filed.

The Company determined that the Warrants should be accounted for as a derivative

liability in accordance with International Accounting Standards No. 32.6 and International Financial Reporting Standards No. 9 that deal

with the measurement of financial assets and financial liabilities. As a result of this change, the Warrants for 9,999,999 shares of common

stock have been classified as liabilities rather than equity, the fair value of the Warrants decreased by $2.9 million, transaction costs

increased by $0.96 million and the fair value loss increased by $0.96 million for the three months ended March 31, 2022. The Company has

restated certain financial information as at March 31, 2022 and for the period ended March 31, 2022 as follows:

| As at March 31, 2022 | |

Debits and Credits (Unaudited) | |

| | |

As Previously Reported | | |

As Restated | | |

Difference | |

| Warrant liability | |

| - | | |

$ | (4,535,840 | ) | |

| 4,535,840 | |

| Fair value loss (P&L) | |

| | | |

$ | 962,350 | | |

| (962,350 | ) |

| Change in FV of warrants | |

| - | | |

$ | (2,942,178 | ) | |

| 2,942,178 | |

| Transaction costs (P&L) | |

| | | |

$ | 965,247 | | |

| (965,247 | ) |

| Common shares | |

| (12,035,523 | ) | |

$ | (12,460,526 | ) | |

| 425,003 | |

| Warrants (equity) | |

| (6,282,614 | ) | |

$ | (307,189 | ) | |

| (5,975,425 | ) |

The information in this Form 6-K relating to the restatement of the Company’s

condensed consolidated unaudited interim financial statements for the three month period ended March 31, 2022 is being furnished to the

SEC on this Form 6-K and such information is not deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, or otherwise subject to the liabilities of that section. Moreover, unless otherwise stated in such filing, the information

in this Form 6-K relating to the restatement of the Company’s condensed consolidated unaudited interim financial statements for

the three month period ended March 31, 2022 shall not be deemed to be incorporated by reference into the filings of the registrant under

the Securities Act of 1933.

The Company has attached its restated condensed consolidated unaudited interim

financial statements for the three month period ended March 31, 2022 as Exhibit 99.1 and has attached its restated Management’s

Discussion and Analysis of Results of Operations and Financial Condition for the three months ended March 31, 2022 as Exhibit 99.2 to

this Form 6-K.

Forward-Looking Statements

This Current Report on Form 6-K contains forward-looking statements within

the meaning of the United States federal securities laws. These statements include, but are not limited to, statements regarding the nature

and extent of the accounting errors discussed above, and the expected impact of the restatement on the Company’s prior and future

financial statements, financial position and results of operation. These forward-looking statements are made as of the date hereof and

are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Forward-looking

statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s

control. The Company’s actual results could differ materially from those stated or implied in forward-looking statements due to

a number of factors, including, but not limited to, the risks related to additional information that may arise prior to the filing of

the restated Prior Period Financial Statements; and the Company’s evaluation of its internal controls over financial reporting.

These and other potential risks and uncertainties that could cause actual results to differ from the results predicted are more fully

detailed in the Company’s filings and reports with the SEC. The Company disclaims any obligation to update forward-looking statements.

EXHIBIT INDEX

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Date: August 18, 2022 |

SIYATA MOBILE INC. |

| |

|

|

| |

By: |

/s/ Marc Seelenfreund |

| |

Name: |

Marc Seelenfreund |

| |

Title: |

Chief Executive Officer |

4

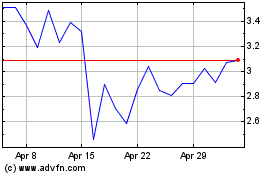

Siyata Mobile (NASDAQ:SYTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

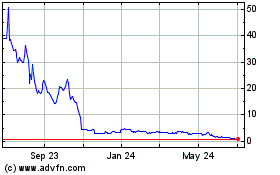

Siyata Mobile (NASDAQ:SYTA)

Historical Stock Chart

From Apr 2023 to Apr 2024