Global-e Online Ltd. (Nasdaq: GLBE) the global leader

ofDirect-To-Consumer cross border eCommerce enablement, today

reported financial results for the second quarter of 2022.

“The record results we are publishing today for the second

quarter of 2022, together with the updated guidance for the third

quarter and full year, illustrate the continued momentum of our

business, as evident from top-linegrowth, improved profitability

and the strong new bookings pipeline,” said Amir Schlachet, Founder

and CEO of Global-e. “We remain focused on executing across all

fronts,to tap the massiveglobal direct-to-consumer

opportunity.”

Q2

2022 Financial

Results

- GMV1 in the second quarter of 2022 was

$534 million, an increase of 64% year over year

- Revenue in the second quarter of 2022

was $87.3 million, an increase of 52% year over year, of which

service fees revenue was $39.3 million and fulfillment services

revenue was $48.0 million

- Non-GAAP gross profit2 in the second

quarter of 2022 was $36.5 million, an increase of 77% year over

year. GAAP gross profit in the second quarter of 2022 was $34.3

million

- Non-GAAP gross margin2 in the second

quarter of 2022 was 41.8%, an increase of 580 basis points from

36.0% in the second quarter of 2021. GAAP gross margin in the

second quarter of 2022 was 39.3%

- Adjusted EBITDA3 in the second quarter

of 2022 was $11.1 million compared to $7.6 million in the second

quarter of 2021

- Net loss in the second quarter of 2022

was $48.8 million

Recent Business Highlights

- Launched partnership withDisney,one of

the world’s most well-known brands, to support their

direct-to-consumer efforts, based on ourmulti-local offering

- Launched several markets in the APAC

region, as a first phase

- Continued launching withnumerous

exciting brands across geographies and verticals, with notable

examples being:

- Leading fashion brands Rag &

Bone and Zadig&Voltaire, as well as the official tennis

merchandize store of Wimbledon, and the luxury watches brand

Zenith, expanding our partnership with the LVMH group

- Several celebrity brands and other

fast-growing digitally native brands, such as Justin Bieber’s

fashion brand drew house, the highly successful training apparel

brand NOBULL, as well as SKKN, another brand by Kim Kardashian,

augmenting our successful partnership with SKIMS

- APAC expansion continues with the

launches of Triangl Swimwear out of Hong-Kong, and Ryderwear, our

first live Australian merchant, as well as the signing of our first

ever Japanese merchant

- Expanded activity with brands such as

adidas and Suunto, which added additional lanes to be operated by

Global-e

- Continued accelerated growth of the

US-outbound business, with revenues up 104% year-over-year

- Penetration efforts into new markets

are starting to show initial positive results

- While still relatively small in

share, APAC and the Middle East outbound revenues have grown 213%

year-over-year

- Strategic partnership with Shopify remains on track

- On the Global-e enterprise offering side, dozens of merchants

of different sizes are already live on our new native integration

into the Shopify platform

- Booked our first live orders as part of the alpha trials of the

new white-label Merchant of Record solution on Shopify, built upon

the Flow Commerce technology

- Post-merger integration processes are

on track with earlier than planned synergies realization in Flow

and the Borderfree process progressing

Q3 and Full

Year Outlook

Global-e is introducing third quarter guidance and raising

previously issued guidance for the fiscal year as follows:

|

|

|

Q3 2022 |

|

FY 2022 |

|

|

|

(in millions) |

|

GMV |

$600 - $614 |

|

$2,450 - $2,550 |

|

Revenue |

$99.5 - $102.5 |

|

$406 - $426 |

|

Adjusted EBITDA (1) |

$8.5 - $11.5 |

|

$41 - $46 |

Of this, Borderfree is expected to contribute:

- Q3 2022: GMV of $50-54 million, at a similar take rate to

Global-e’s

- FY 2022: GMV of $125-135 million, at a similar take rate to

Global-e’s

- A slightly negative adjusted EBITDA both in Q3 2022 and in FY

2022

Given the macro environment uncertainty, we will provide

investors with updated business trends as they evolve.

1 Gross Merchandise Value (GMV) is a non-GAAP operating metric.

See “Non-GAAP Financial Measures and Key Operating Metrics” for

additional information regarding this metric.

2 Non-GAAP Gross profit and Non-GAAP gross margin are non-GAAP

financial measures. See “Non-GAAP Financial Measures and Key

Operating Metrics” for additional information regarding this

metric.

3 Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP

Financial Measures” for additional information regarding this

metric, including the reconciliations to Operating Profit (Loss),

its most directly comparable GAAP financial measure. The Company is

unable to provide a reconciliation of Adjusted EBITDA to Operating

Profit (Loss), its most directly comparable GAAP financial measure,

on a forward-looking basis without unreasonable effort because

items that impact this GAAP financial measure are not within the

Company’s control and/or cannot be reasonably predicted. These

items may include, but are not limited to, share based compensation

expenses. Such information may have a significant, and potentially

unpredictable impact on the Company’s future financial results.

Conference Call Information:

Global-e will host a conference call at 8:00 a.m. ET on Tuesday,

August 16, 2022.The call will be available, live, to interested

parties by dialing:

| United

States/Canada Toll Free: |

1-877-704-4453 |

| International Toll: |

1-201-389-0920 |

A live webcast will also be available in the Investor Relations

section of Global-e’s website at:

https://investors.global-e.com/news-events/events-presentations

Approximately two hours after completion of the live call, an

archived version of the webcast will be available on the Investor

Relations section of the Company’s web site and will remain

available for approximately 30 calendar days.

Non-GAAP Financial Measures

To supplement Global-e’s financial information presented in

accordance with generally accepted accounting principles in the

United States of America, or GAAP, Global-e considers certain

financial measures and key performance metrics that are not

prepared in accordance with GAAP including:

- Non-GAAP gross profit, which Global-e defines as gross profit

excluding amortization of acquired intangibles. Non-GAAP gross

margin is calculated Non-GAAP gross profit divided by revenues

- Adjusted EBITDA, which Global-e defines as operating profit

(loss) adjusted for stock-based compensation expenses, depreciation

and amortization, commercial agreements amortization, amortization

of acquired intangibles, merger related contingent consideration

and acquisition related expenses. Adjusted EBITDA is frequently

used by analysts, investors and other interested parties to

evaluate companies in our industry. We believe that Adjusted EBITDA

is an appropriate measure of operating performance because it

eliminates the impact of expenses that do not relate directly to

the performance of the underlying business.

Global-e uses the Non-GAAP measures in conjunction with GAAP

measures as part of Global-e’s overall assessment of its

performance, including the preparation of Global-e’s annual

operating budget and quarterly forecasts, to evaluate the

effectiveness of Global-e’s business strategies, and to communicate

with Global-e’s board of directors concerning its financial

performance. The Non-GAAP measures are used by our management to

understand and evaluate our operating performance and trends.

Global-e’s definition of Non-GAAP measures may differ from the

definition used by other companies and therefore comparability may

be limited. In addition, other companies may not publish these

metrics or similar metrics. Furthermore, these metrics have certain

limitations in that they do not include the impact of certain

expenses that are reflected in our consolidated statement of

operations that are necessary to run our business. Thus, Non -GAAP

measures should be considered in addition to, not as substitutes

for, or in isolation from, measures prepared in accordance with

GAAP.

Global-e also uses Gross Merchandise Value (GMV) as a key

operating metric. Gross Merchandise Value or GMV is defined as the

combined amount we collect from the shopper and the merchant for

all components of a given transaction, including products, duties

and taxes and shipping.

For more information on the non-GAAP financial measures, please

see the reconciliation tables provided below. The accompanying

reconciliation tables have more details on the GAAP financial

measures that are most directly comparable to non-GAAP financial

measures and the related reconciliations between these financial

measures.

Cautionary Note Regarding Forward Looking

Statements

Certain statements in this press release may constitute

“forward-looking” statements and information, within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934, and the safe harbor provisions of

the U.S. Private Securities Litigation Reform Act of 1995,

including statements regarding Global-e’s operations, strategy and

Global-e’s projected revenue and other future financial and

operational results. These forward-looking statements generally are

identified by the words "believe," "project," "expect,"

"anticipate," "estimate," "intend," "strategy," "future,"

"opportunity," "plan," "may," "should," "will," "would," "will be,"

"will continue," "will likely result," and similar expressions.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

announcement, including but not limited to, the ability to retain

merchants or the GMV generated by such merchants; the ability to

attract new merchants; our expectations regarding our revenue,

expenses and operations; anticipated trends and challenges in our

business and the markets in which we operate; our ability to

compete in our industry; our ability to anticipate merchant needs

or develop or acquire new functionality or enhance our existing

platform to meet those needs; our ability to manage our growth and

manage expansion into additional markets; our ability to establish

and protect intellectual property rights; our ability to hire and

retain key personnel; our expectations regarding the use of

proceeds from our initial public offering; our ability to adapt to

emerging or evolving regulatory developments, technological

changes, and cybersecurity needs; our anticipated cash needs and

our estimates regarding our capital requirements and our needs for

additional financing; the impact of the COVID-19 pandemic,

including variants, and related vaccination roll out efforts; and

the other risks and uncertainties described in Global-e’s Annual

Report on Form 20-F for the year ended December 31, 2021, filed

with the SEC on March 28, 2022 and other documents filed with or

furnished by Global-e from time to time with the SEC. The foregoing

list of factors is not exhaustive. You should carefully consider

the foregoing factors. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. These statements reflect management’s

current expectations regarding future events and operating

performance and speak only as of the date of this press release.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

that future results, levels of activity, performance and events and

circumstances reflected in the forward-looking statements will be

achieved or will occur. Except as required by applicable law, we

undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

About Global-E Online Ltd.

Global-e (Nasdaq: GLBE) is the world's leading platform

enabling and accelerating global, direct-to-consumer cross-border

e-commerce. The chosen partner of hundreds of brands and retailers

across the United States, Europe and Asia,

Global-e makes selling internationally as simple as selling

domestically. The company enables merchants to increase the

conversion of international traffic into sales by offering online

shoppers in over 200 destinations worldwide a seamless, localized

shopping experience. Global-e's end-to-end e-commerce solutions

combine best-in-class localization capabilities, big-data

best-practice business intelligence models, streamlined

international logistics and vast cross-border experience, enabling

international shoppers to buy seamlessly online and retailers to

sell to, and from, anywhere in the world. Founded in 2013

by Amir Schlachet, Shahar Tamari and Nir

Debbi, Global-e operates from eight offices worldwide. For

more information, please visit: www.global-e.com

Investor Contact:Erica Mannion or Mike

FunariSapphire Investor Relations, LLCIR@global-e.com +1

617-542-6180

Press Contact:Headline MediaGarrett Krivicich

Globale@headline.media +1 786-233-7684

|

Global-E Online

Ltd. |

|

| CONSOLIDATED

BALANCE

SHEETS |

|

| (In

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period Ended |

|

|

|

|

December 31, |

|

|

June 30, |

|

|

|

|

2021 |

|

|

2022 |

|

|

|

|

(Audited) |

|

|

(Unaudited) |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

448,623 |

|

|

$ |

232,971 |

|

| Short-term

deposits |

|

|

41,985 |

|

|

|

35,079 |

|

| Accounts

receivable, net |

|

|

9,185 |

|

|

|

9,344 |

|

| Prepaid

expenses and other current assets |

|

|

46,568 |

|

|

|

52,598 |

|

| Marketable

securities |

|

|

18,464 |

|

|

|

16,492 |

|

| Funds

receivable, including cash in banks |

|

|

57,635 |

|

|

|

63,627 |

|

| Total

current assets |

|

|

622,460 |

|

|

|

410,111 |

|

| Property and

equipment, net |

|

|

3,269 |

|

|

|

9,431 |

|

| Operating

lease right-of-use assets |

|

|

20,108 |

|

|

|

20,565 |

|

| Long term

deposits |

|

|

2,219 |

|

|

|

2,288 |

|

| Deferred

contract acquisition costs, noncurrent |

|

|

1,314 |

|

|

|

1,638 |

|

| Other

assets, noncurrent |

|

|

213 |

|

|

|

190 |

|

| Commercial

agreement asset |

|

196,544 |

|

|

|

280,861 |

|

| Goodwill and

other intangible assets |

|

|

- |

|

|

|

366,221 |

|

| Total

long-term assets |

|

|

223,667 |

|

|

|

681,194 |

|

| Total

assets |

|

$ |

846,127 |

|

|

$ |

1,091,305 |

|

|

Liabilities, Convertible Preferred Shares and

Shareholders’ (Deficit)

Equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

24,064 |

|

|

$ |

30,089 |

|

| Accrued

expenses and other current liabilities |

|

|

47,358 |

|

|

|

51,681 |

|

| Funds

payable to Customers |

|

|

57,635 |

|

|

|

63,627 |

|

| Short term

operating lease liabilities |

|

|

2,517 |

|

|

|

3,316 |

|

| Total

current liabilities |

|

|

131,574 |

|

|

|

148,713 |

|

| Long-term

liabilities: |

|

|

|

|

|

|

|

|

| Long term

operating lease liabilities |

|

|

18,803 |

|

|

|

16,932 |

|

| Total

liabilities |

|

$ |

150,377 |

|

|

$ |

165,645 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ deficit: |

|

|

|

|

|

|

|

|

| Share

capital and additional paid-in capital |

|

|

823,550 |

|

|

|

1,157,398 |

|

| Accumulated

comprehensive income |

|

|

(159 |

) |

|

|

(1,714 |

) |

| Accumulated

deficit |

|

|

(127,641 |

) |

|

|

(230,024 |

) |

| Total

shareholders’ (deficit) equity |

|

|

695,750 |

|

|

|

925,660 |

|

| Total

liabilities, convertible preferred shares and shareholders’

(deficit) equity |

|

$ |

846,127 |

|

|

$ |

1,091,305 |

|

| |

|

|

|

|

|

|

|

|

| Global-E

Online Ltd. |

|

| CONSOLIDATED

STATEMENTS OF OPERATIONS |

|

| (In

thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

Six Months

Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Revenue |

|

$ |

57,287 |

|

|

$ |

87,305 |

|

|

$ |

103,438 |

|

|

$ |

163,628 |

|

| Cost of

revenue |

|

|

36,687 |

|

|

|

52,954 |

|

|

|

67,471 |

|

|

|

102,094 |

|

| Gross

profit |

|

|

20,600 |

|

|

|

34,351 |

|

|

|

35,967 |

|

|

|

61,534 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development |

|

|

5,739 |

|

|

|

17,597 |

|

|

|

11,182 |

|

|

|

35,284 |

|

| Sales and

marketing |

|

|

30,017 |

|

|

|

50,986 |

|

|

|

33,117 |

|

|

|

100,625 |

|

| General and

administrative |

|

|

4,337 |

|

|

|

15,071 |

|

|

|

7,051 |

|

|

|

26,611 |

|

| Total

operating expenses |

|

|

40,093 |

|

|

|

83,654 |

|

|

|

51,350 |

|

|

|

162,520 |

|

| Operating

profit (loss) |

|

|

(19,493 |

) |

|

|

(49,303 |

) |

|

|

(15,383 |

) |

|

|

(100,986 |

) |

| Financial

expenses, net |

|

|

2,420 |

|

|

|

(680 |

) |

|

|

8,129 |

|

|

|

986 |

|

| Loss before

income taxes |

|

|

(21,913 |

) |

|

|

(48,623 |

) |

|

|

(23,512 |

) |

|

|

(101,972 |

) |

| Income

taxes |

|

|

311 |

|

|

|

174 |

|

|

|

461 |

|

|

|

411 |

|

| Net loss

attributable to ordinary shareholders |

|

$ |

(22,224 |

) |

|

$ |

(48,797 |

) |

|

$ |

(23,973 |

) |

|

$ |

(102,383 |

) |

| Basic and

diluted net loss per share attributable to ordinary

shareholders |

|

$ |

(0.25 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.66 |

) |

| Basic and

diluted weighted average ordinary shares |

|

|

87,308,647 |

|

|

|

156,891,201 |

|

|

|

54,750,595 |

|

|

|

155,636,936 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global-E

Online

Ltd. |

|

| CONSOLIDATED

STATEMENTS OF CASH

FLOWS |

|

| (In

thousands) |

|

|

|

|

Three Months

Ended |

|

|

Six Months

Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit

(loss) |

|

$ |

(22,224 |

) |

|

$ |

(48,797 |

) |

|

$ |

(23,973 |

) |

|

$ |

(102,383 |

) |

| Adjustments

to reconcile net profit (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

69 |

|

|

|

330 |

|

|

|

131 |

|

|

|

594 |

|

|

Share-based compensation expense |

|

|

1,551 |

|

|

|

12,843 |

|

|

|

2,618 |

|

|

|

20,772 |

|

|

Commercial agreement asset |

|

|

25,486 |

|

|

|

37,433 |

|

|

|

25,486 |

|

|

|

74,182 |

|

|

Amortization of intangible assets |

|

|

- |

|

|

|

6,049 |

|

|

|

- |

|

|

|

12,665 |

|

|

Long term deposit revaluation |

|

|

- |

|

|

|

(38 |

) |

|

|

- |

|

|

|

6 |

|

|

Accounts receivable |

|

|

(1,530 |

) |

|

|

728 |

|

|

|

(573 |

) |

|

|

4,721 |

|

|

Prepaid expenses and other assets |

|

|

(7,561 |

) |

|

|

(1,334 |

) |

|

|

(5,432 |

) |

|

|

(4,725 |

) |

|

Funds receivable |

|

|

(7,452 |

) |

|

|

960 |

|

|

|

(9,520 |

) |

|

|

20,125 |

|

|

Long-term receivables |

|

|

957 |

|

|

|

- |

|

|

|

- |

|

|

- |

|

|

Funds payable to customers |

|

|

6,122 |

|

|

|

18,175 |

|

|

|

(3,500 |

) |

|

|

3,238 |

|

|

Operating lease ROU assets |

|

|

208 |

|

|

|

657 |

|

|

|

590 |

|

|

|

1,455 |

|

|

Deferred contract acquisition costs |

|

|

(184 |

) |

|

|

(230 |

) |

|

|

(374 |

) |

|

|

(475 |

) |

|

Accounts payable |

|

|

2,857 |

|

|

|

2,699 |

|

|

|

(6 |

) |

|

|

2,263 |

|

|

Accrued expenses and other liabilities |

|

|

7,163 |

|

|

|

4,501 |

|

|

|

(4,406 |

) |

|

|

(4,543 |

) |

|

Deferred tax liabilities |

|

|

8 |

|

|

|

- |

|

|

|

19 |

|

|

|

- |

|

|

Operating lease liabilities |

|

|

(163 |

) |

|

|

(2,128 |

) |

|

|

(628 |

) |

|

|

(2,985 |

) |

|

Impairment of marketable securities |

|

|

- |

|

|

|

48 |

|

|

|

- |

|

|

|

62 |

|

|

Warrants liabilities to preferred shares |

|

|

1,625 |

|

|

|

- |

|

|

|

5,872 |

|

|

|

- |

|

|

Net cash used in operating activities |

|

|

6,932 |

|

|

|

31,896 |

|

|

|

(13,696 |

) |

|

|

24,972 |

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment in marketable securities |

|

|

(508 |

) |

|

|

(357 |

) |

|

|

(2,154 |

) |

|

|

(7,555 |

) |

|

Proceeds from marketable securities |

|

257 |

|

|

|

752 |

|

|

257 |

|

|

|

7,910 |

|

|

Purchases of short-term investments |

|

|

(64,360 |

) |

|

|

(197 |

) |

|

|

(71,913 |

) |

|

|

(31,495 |

) |

|

Purchases of long-term investments |

|

|

(31 |

) |

|

|

- |

|

|

|

(49 |

) |

|

|

- |

|

|

Proceeds from short-term investments |

|

|

- |

|

|

|

35,000 |

|

|

|

- |

|

|

|

38,400 |

|

|

Purchases of property and equipment |

|

|

(149 |

) |

|

|

(1,900 |

) |

|

|

(263 |

) |

|

|

(6,584 |

) |

|

Payments for business combinations, net of cash acquired |

|

|

- |

|

|

|

(1,471 |

) |

|

|

- |

|

|

|

(217,083 |

) |

|

Net cash used in investing activities |

|

|

(64,791 |

) |

|

|

31,827 |

|

|

|

(74,122 |

) |

|

|

(216,407 |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise of Warrants to ordinary shares |

|

|

- |

|

|

15 |

|

|

|

- |

|

|

43 |

|

|

Proceeds from issuance of Ordinary shares in IPO, net of issuance

costs |

|

396,983 |

|

|

|

- |

|

|

396,983 |

|

|

|

- |

|

|

Proceeds from exercise of share options |

|

|

20 |

|

|

|

386 |

|

|

|

173 |

|

|

|

488 |

|

|

Net cash provided by financing activities |

|

|

397,003 |

|

|

|

401 |

|

|

|

397,156 |

|

|

|

531 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net decrease

in cash, cash equivalents, and restricted cash |

|

|

339,144 |

|

|

|

64,124 |

|

|

|

309,338 |

|

|

|

(190,904 |

) |

| Cash and

cash equivalents and restricted cash—beginning of period |

|

|

55,227 |

|

|

|

203,871 |

|

|

|

85,033 |

|

|

|

458,899 |

|

| Cash and

cash equivalents and restricted cash—end of period |

|

$ |

394,371 |

|

|

$ |

267,995 |

|

|

$ |

394,371 |

|

|

$ |

267,995 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global-E

Online

Ltd. |

| SELECTED

OTHER DATA |

| (In

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

Six Months

Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Key

performance metrics |

|

|

|

|

|

|

|

Gross Merchandise Value |

|

|

326,231 |

|

|

|

|

|

|

|

534,459 |

|

|

|

|

|

|

|

592,786 |

|

|

|

|

|

|

|

989,752 |

|

|

|

|

|

|

Adjusted EBITDA (a) |

|

|

7,613 |

|

|

|

|

|

|

|

11,128 |

|

|

|

|

|

|

|

12,852 |

|

|

|

|

|

|

|

14,410 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue by Category |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service fees |

|

|

21,106 |

|

|

|

37 |

% |

|

|

39,324 |

|

|

|

45 |

% |

|

|

38,202 |

|

|

|

37 |

% |

|

|

71,272 |

|

|

|

44 |

% |

|

Fulfillment services |

|

|

36,181 |

|

|

|

63 |

% |

|

|

47,981 |

|

|

|

55 |

% |

|

|

65,236 |

|

|

|

63 |

% |

|

|

92,356 |

|

|

|

56 |

% |

|

Total revenue |

|

$ |

57,287 |

|

|

|

100 |

% |

|

$ |

87,305 |

|

|

|

100 |

% |

|

$ |

103,438 |

|

|

|

100 |

% |

|

$ |

163,628 |

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue by merchant outbound region |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United Kingdom |

|

|

27,706 |

|

|

|

48 |

% |

|

|

33,963 |

|

|

|

39 |

% |

|

|

49,250 |

|

|

|

48 |

% |

|

|

62,244 |

|

|

|

38 |

% |

|

United States |

|

|

16,638 |

|

|

|

29 |

% |

|

|

33,944 |

|

|

|

39 |

% |

|

|

29,845 |

|

|

|

29 |

% |

|

|

61,865 |

|

|

|

38 |

% |

|

European Union |

|

|

12,433 |

|

|

|

22 |

% |

|

|

17,798 |

|

|

|

20 |

% |

|

|

23,581 |

|

|

|

23 |

% |

|

|

36,852 |

|

|

|

23 |

% |

|

Israel |

|

|

243 |

|

|

|

0 |

% |

|

|

263 |

|

|

|

0 |

% |

|

|

494 |

|

|

|

0 |

% |

|

|

628 |

|

|

|

0 |

% |

|

Other |

|

267 |

|

|

0 |

% |

|

|

1,337 |

|

|

|

2 |

% |

|

268 |

|

|

0 |

% |

|

|

2,039 |

|

|

|

1 |

% |

|

Total revenue |

|

$ |

57,287 |

|

|

|

100 |

% |

|

$ |

87,305 |

|

|

|

100 |

% |

|

$ |

103,438 |

|

|

|

100 |

% |

|

$ |

163,628 |

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) See reconciliation to adjusted

EBITDA table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global-E

Online

Ltd. |

|

|

|

RECONCILIATION TO Non-GAAP GROSS

PROFIT |

|

|

| (In

thousands) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

Six Months

Ended |

|

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

| |

|

|

|

|

|

|

(Unaudited) |

| Gross

Profit |

|

|

20,600 |

|

|

|

34,351 |

|

|

|

35,967 |

|

|

|

61,534 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization

of acquired intangibles included in cost of revenue |

|

|

- |

|

|

|

2,198 |

|

|

|

- |

|

|

|

4,874 |

|

|

| Non-GAAP

gross profit |

|

|

20,600 |

|

|

|

36,549 |

|

|

|

35,967 |

|

|

|

66,408 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global-E

Online

Ltd. |

|

|

|

RECONCILIATION TO ADJUSTED

EBITDA |

|

|

| (In

thousands) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

Six Months

Ended |

|

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

| Operating

profit (loss) |

|

|

(19,493 |

) |

|

|

(49,303 |

) |

|

|

(15,383 |

) |

|

|

(100,986 |

) |

|

|

(1) Stock-based compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

19 |

|

|

|

52 |

|

|

|

39 |

|

|

|

88 |

|

|

|

Research and development |

|

|

222 |

|

|

|

5,296 |

|

|

|

444 |

|

|

|

10,448 |

|

|

|

Selling and marketing |

|

|

223 |

|

|

|

1,706 |

|

|

|

444 |

|

|

|

2,465 |

|

|

|

General and administrative |

|

|

1,087 |

|

|

|

5,788 |

|

|

|

1,691 |

|

|

|

7,771 |

|

|

|

Total stock-based compensation |

|

|

1,551 |

|

|

|

12,842 |

|

|

|

2,618 |

|

|

|

20,772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Depreciation and amortization |

|

|

69 |

|

|

|

330 |

|

|

|

131 |

|

|

|

594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Commercial agreement asset amortization |

|

25,486 |

|

|

|

37,433 |

|

|

25,486 |

|

|

|

74,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) Amortization of acquired intangibles |

|

- |

|

|

|

6,049 |

|

|

- |

|

|

|

12,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) Merger related contingent consideration |

|

- |

|

|

|

3,026 |

|

|

- |

|

|

|

5,985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) Acquisition related costs |

|

- |

|

|

|

751 |

|

|

- |

|

|

|

1,198 |

|

|

| Adjusted

EBITDA |

|

|

7,613 |

|

|

|

11,128 |

|

|

|

12,852 |

|

|

|

14,410 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

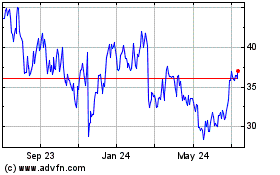

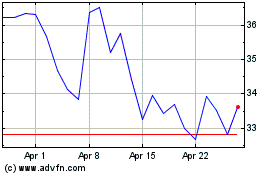

Global E Online (NASDAQ:GLBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global E Online (NASDAQ:GLBE)

Historical Stock Chart

From Apr 2023 to Apr 2024