Current Report Filing (8-k)

August 15 2022 - 8:49AM

Edgar (US Regulatory)

0001798562

false

TMC the metals Co Inc.

00-0000000

0001798562

2022-08-12

2022-08-12

0001798562

TMC:TMCCommonShareswithoutparvalueMember

2022-08-12

2022-08-12

0001798562

TMC:RedeemablewarrantseachwholewarrantexercisableforoneTMCCommonShareeachatanexercisepriceofdollar1150pershareMember

2022-08-12

2022-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 12, 2022

TMC THE METALS COMPANY INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada |

001-39281 |

Not Applicable |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

595 Howe Street, 10th Floor

Vancouver, British Columbia |

|

V6C 2T5 |

(Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (604) 631-3115

Not

applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| TMC Common Shares without par value |

|

TMC |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one TMC Common Share, each at an exercise price of $11.50 per share |

|

TMCWW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry into a Material Definitive Agreement. |

On August 12, 2022, TMC

the metals company Inc. (the “Company”) entered into three securities purchase agreements

for the private placement of an aggregate of 37,978,680 of the Company's common shares ("Common Shares") (the "Private Placement").

The Company entered into a securities purchase agreement (the “PIPE Purchase Agreement”) with the purchasers

named therein (the “PIPE Purchasers”) for the issuance and sale of an aggregate of 31,625,000 Common Shares at a

purchase price of $0.80 per share, a separate securities purchase agreement with Gerard Barron, the Company’s Chief Executive

Officer and Chairman, for the issuance and sale of 103,680 Common Shares at $0.9645 per share, the consolidated closing bid price

per Common Share on August 11, 2022 (the “Barron Purchase Agreement”), and a separate securities purchase agreement with

ERAS Capital LLC, the family fund of the Company's director, Andrei Karkar, for the issuance and sale of 6,250,000 common shares at

a purchase price of $0.80 per share (the “ERAS Purchase Agreement”, together with the PIPE Purchase Agreement and the

Barron Purchase Agreement, the “Purchase Agreements”). The Common Shares issuable in the Private Placement pursuant to

the Purchase Agreements are referred to herein as the “Shares” and the PIPE Purchasers, together with Mr. Barron and

ERAS Capital LLC are referred to herein as the “Purchasers.” The Company expects to receive aggregate gross proceeds of

approximately $30.4

million this quarter from the Private Placement and net proceeds of approximately $30 million, after deducting placement

agent fees and offering expenses.

The Company intends to use

the net proceeds from the Private Placement for working capital and general corporate purposes.

In addition, pursuant to

the Purchase Agreements, the Company also agreed to file a registration statement with the Securities and Exchange Commission (the “SEC”)

on or before September 16, 2022 (subject to certain exceptions) for purposes of registering the resale of the Shares, to use its commercially

reasonable efforts to have such registration statement declared effective within the time period set forth in the Purchase Agreements,

and to keep such registration statement effective for up to three years.

The Purchase Agreements contain

customary closing conditions, representations, warranties and agreements by the Company, indemnification obligations of the Company and

the Purchasers, including for liabilities under the Securities Act of 1933, as amended (the “Securities Act”), and other obligations

of the parties. The representations, warranties and covenants contained in the Purchase Agreements were made only for purposes of such

Purchase Agreements and are made as of specific dates; are solely for the benefit of the parties (except as specifically set forth therein);

may be subject to qualifications and limitations agreed upon by the parties in connection with negotiating the terms of the Purchase Agreements,

instead of establishing matters as facts; and may be subject to standards of materiality and knowledge applicable to the contracting parties

that differ from those applicable to the investors generally. Investors should not rely on the representations, warranties and covenants

or any description thereof as characterizations of the actual state of facts or condition of the Company.

The Private Placement is

exempt from the registration requirements of the Securities Act pursuant to the exemption for transactions by an issuer not involving

any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D of the Securities Act and in reliance on

similar exemptions under applicable state laws. The Purchasers represented that they were accredited investors within the meaning of Rule

501(a) of Regulation D, and were acquiring the securities for investment only and not with a view towards, or for resale in connection

with, the public sale or distribution thereof. The securities were offered without any general solicitation by the Company or its representatives.

The securities sold and issued in the Private Placement will not be registered under the Securities Act or any state securities laws

and may not be offered or sold in the United States absent registration with the SEC or an applicable exemption from the registration

requirements.

The foregoing

description of the Purchase Agreements does not purport to be complete and is qualified in its entirety by reference to the form of

the PIPE Purchase Agreement, the Barron Purchase Agreement and the ERAS Purchase Agreement, filed as Exhibits 10.1, 10.2 and 10.3,

respectively, to this Current Report on Form 8-K and incorporated herein by reference.

| Item 3.02. | Unregistered Sales of Equity Securities. |

The disclosures set forth

in Item 1.01 above are incorporated in this Item 3.02.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

Forward-Looking Statements

Statements in this report that are not

strictly historical in nature are forward-looking statements. These statements include but are not limited to statements regarding

the completion of the Private Placement and the receipt and anticipated use of proceeds therefrom, and related to the anticipated

filing of a registration statement to cover resales of the Shares. These statements are only predictions based on current

information and expectations and involve a number of risks and uncertainties. Actual events or results may differ materially from

those projected in any of such statements due to various factors, including risks and uncertainties associated with market

conditions and the satisfaction of customary closing conditions related to the Private Placement. For a discussion of these and

other factors, please refer to the Company’s annual report on Form 10-K for the year ended December 31, 2021 as well as the

Company’s subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TMC THE METALS COMPANY INC. |

| |

|

| |

|

| Date: August 15, 2022 |

By: |

/s/ Craig Shesky |

| |

Name: Craig Shesky |

| |

Title: Chief Financial Officer |

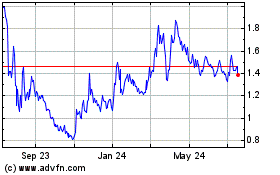

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Apr 2023 to Apr 2024