Regis Corporation Successfully Renegotiates Debt

August 15 2022 - 6:00AM

Business Wire

Announces Credit Agreement Amendment and

Extension

Regis Corporation (NYSE: RGS), a leader in the haircare

industry, announced today that it successfully amended its credit

facility and extended the maturity date from March 23, 2023 to

August 31, 2025. Under the amendment, the revolving credit facility

was converted to a $180 million term loan and $55 million revolving

credit facility with the minimum liquidity covenant reduced to $10

million from $75 million. The amended credit agreement includes

typical provisions and financial covenants, including minimum

EBITDA, leverage and fixed-charge coverage ratio covenants, the

latter two of which are not tested until December 31, 2023.

“We are pleased with the outcome of our debt refinancing

efforts. The terms of the amended credit agreement provide us with

adequate runway and liquidity to invest in the strategic priorities

that we believe will lead us to improved revenue and

profitability,” said Kersten Zupfer, Regis Corporation’s Executive

Vice President and Chief Financial Officer.

“As we have mentioned previously, refinancing our credit

facility was a top priority and I’m very pleased with the outcome.

To be able to extend our maturity and provide Regis with sufficient

liquidity at this time is a major step forward. This amendment,

combined with the sale of our salon management system to Zenoti,

clears the path for us to fully focus on our core business. This

also further demonstrates this leadership team not only

prioritizes, but also executes in a timely manner,” said Matt

Doctor, Regis President and Chief Executive Officer. “Now that we

have the credit agreement completed, I look forward to sharing more

detailed thoughts on our business strategy later this month during

our quarterly earnings call,” added Doctor.

Weil, Gotshal & Manges LLP served as legal counsel and

Jefferies LLC served as financial advisor to Regis Corporation.

About Regis Corporation

Regis Corporation (NYSE:RGS) is leader in the beauty salon

industry. As of March 31, 2022, the Company franchised, owned or

held ownership interests in 5,697 worldwide locations. Regis'

franchised and corporate locations operate under concepts such as

Supercuts®, SmartStyle®, Cost Cutters®, Roosters® and First Choice

Haircutters®. Regis maintains an ownership interest in Empire

Education Group in the U.S. For additional information about the

Company, please visit the Investor Information section of the

corporate website at www.regiscorp.com.

This press release contains or may contain “forward-looking

statements” within the meaning of the federal securities laws,

including statements concerning anticipated future events and

expectations that are not historical facts. These forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements in this document reflect management's

best judgment at the time they are made, but all such statements

are subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those expressed in or

implied by the statements herein. Such forward-looking statements

are often identified herein by use of words including, but not

limited to, “may,” “believe,” “project,” “forecast,” “expect,”

“estimate,” “anticipate,” “intend” and “plan.” In addition, the

following factors could affect the Company's actual results and

cause such results to differ materially from those expressed in

forward-looking statements. These factors include our ability to

regain compliance with the NYSE listing requirements, future

compliance with such requirements, potential future application of

suspension and delisting procedures and future quotation of our

common stock, and other potential factors that could affect future

financial and operating results as set forth under Item 1A of our

Form 10-K. We undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. However, your attention is

directed to any further disclosures made in our subsequent annual

and periodic reports filed or furnished with the SEC on Forms 10-K,

10-Q and 8-K and Proxy Statements on Schedule 14A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220815005168/en/

REGIS CORPORATION: Kersten Zupfer

investorrelations@regiscorp.com

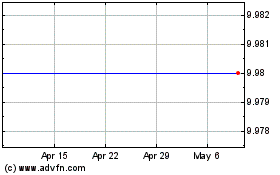

Regis (NYSE:RGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

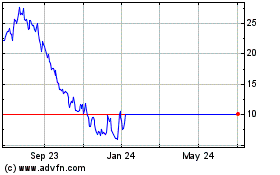

Regis (NYSE:RGS)

Historical Stock Chart

From Apr 2023 to Apr 2024