UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2022

Commission File Number: 001-39258

METEN HOLDING GROUP LTD.

(Translation of registrant’s name into English)

3rd Floor, Tower A

Tagen Knowledge & Innovation Center

2nd Shenyun West Road, Nanshan District

Shenzhen, Guangdong Province 518000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

Private Placement

On August 4, 2022, Meten

Holding Group Ltd. (the “Company”) entered into a Securities Purchase Agreement (the “PIPE Purchase Agreement”)

with two accredited investors for a private placement offering (“Private Placement”) of pre-funded warrants (the “PIPE

Pre-Funded Warrants”), with each PIPE Pre-Funded Warrant exercisable for one ordinary share of the Company, par value $0.003 per

share (the “ordinary shares”), and warrants exercisable for one ordinary share (the “Investor Warrants”). Pursuant

to the PIPE Purchase Agreement, the Company has agreed to issue and sell 1,470,475 PIPE Pre-Funded Warrants and 21,428,572 Investor Warrants.

Each PIPE Pre-Funded Warrant and accompanying Investor Warrants will be sold together at a combined offering price of $0.70.

The PIPE Pre-Funded Warrants

are immediately exercisable, at a nominal exercise price of $0.001, and may be exercised at any time until all of the PIPE Pre-Funded

Warrants are exercised in full. Under the terms of the PIPE Pre-Funded Warrants, the Company may not effect the exercise of any such warrant,

and a holder will not be entitled to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate

number of ordinary shares beneficially owned by the holder (together with its affiliates, any other persons acting as a group together

with the holder or any of the holder’s affiliates, and any other persons whose beneficial ownership of ordinary shares would or

could be aggregated with the holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended)

would exceed 4.99% of the number of ordinary shares outstanding immediately after giving effect to the exercise, as such percentage ownership

is determined in accordance with the terms of such warrant, which percentage may be increased or decreased at the holder’s election

upon 61 days’ notice to the Company subject to the terms of such warrants, provided that such percentage may in

no event exceed 9.99%.

The Investor Warrants

have an exercise price of $0.70 per share (subject to adjustment as set forth in the warrant), are exercisable on or after August 8, 2022

and will expire on August 9, 2027. The Investor Warrants contain standard adjustments to the exercise price including for share splits,

share dividends, rights offerings and pro rata distributions.

The Private Placement

closed on August 8, 2022. The gross proceeds to the Company from the Private Placement, before deducting placement agent fees and other

estimated offering expenses payable by the Company, were approximately $1 million. The Company intends to use the net proceeds from the

private placement for working capital and other general corporate purposes.

In connection with the

PIPE Purchase Agreement, the Company entered into a registration rights agreement (the “Registration Rights Agreement”) with

the investors. Pursuant to the Registration Rights Agreement, the Company will be required to file a resale registration statement (the

“Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) to register for resale

of the shares issuable upon exercise of the PIPE Pre-Funded Warrants and the Investor Warrant within thirty (30) days after the Closing

Date (the “Filing Date”). Pursuant to the Registration Rights Agreement, the Registration Statement shall be declared effective

within 30 days after the Filing Date or 60 days following the Filing Date if the Registration Statement is reviewed by the SEC. The Company

will be obligated to pay certain liquidated damages to the investors if the Company fails to file the resale registration statement when

required, fails to cause the Registration Statement to be declared effective by the SEC when required, of if the Company fails to maintain

the effectiveness of the Registration Statement.

Based in part upon the

representations of the purchaser in the PIPE Purchase Agreement, the offering and sale of the PIPE Pre-Funded Warrants and Investor Warrants

will be exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), Rule

506 of Regulation D promulgated under the Securities Act, and corresponding provisions of state securities or “blue sky” laws.

The sales of the PIPE Pre-Funded Warrants and Investor Warrants by the Company in the Private Placement have not been registered under

the Securities Act or any state securities laws and the PIPE Pre-Funded Warrants and Investor Warrants may not be offered or sold in the

United States absent registration with the SEC or an applicable exemption from the registration requirements. The sale of such securities

will not involve a public offering and will be made without general solicitation or general advertising. In the PIPE Purchase Agreement,

the purchaser represented that it is and on each date on which it exercises any PIPE Pre-Funded Warrant or Investor Warrant will be, either

(i) an accredited investor, as such term is defined in Rule 501(a) of Regulation D under the Securities Act or (ii) a “qualified

institutional buyer” as defined in Rule 144A(a) under the Securities Act, and it is acquiring the PIPE Pre-Funded Warrants and Investor

Warrants for investment purposes only and not with a view to any resale, distribution or other disposition of the PIPE Pre-Funded Warrants

and Investor Warrants in violation of the United States federal securities laws.

Each of the Company’s

executive officers, directors and 10% or more shareholders entered into a lock-up agreement (the “Lock-Up Agreement”) in favor

of the Company, pursuant to which they agreed not to sell or transfer any securities of the Company held by them for a period of 120 days

from August 4, 2022, subject to limited exceptions.

Registered Offering

On August 4, 2022, the

Company also entered into a Securities Purchase Agreement (the “Registered Purchase Agreement”) with the same accredited investors,

pursuant to which the Company agreed to issue and sell 1,260,000 ordinary shares and 7,983,811 pre-funded warrants (the “RD Pre-Funded

Warrants”) at a price per share of $0.70, with each RD Pre-Funded Warrant exercisable for one ordinary share of the Company (the

“Offering”). The price per RD Pre-Funded Warrant was equal to the price per ordinary share, less the nominal exercise price

of $0.001 per share. The Company received approximately $6.5 million in gross proceeds from the Offering, before deducting placement agency

fees and estimated offering expenses. The ordinary shares and RD Pre-Funded Warrants offered under the Registered Purchase Agreement were

offered and sold pursuant to the Company’s effective registration statement on Form F-3 (Registration No. 333-256087), which was

declared effective by the SEC on May 21, 2021, and the base prospectus included therein, as supplemented by the prospectus supplement

dated August 4, 2022.

The Offering closed on

August 8, 2022. The Company intends to use the net proceeds from the Offering for working capital and other general corporate purposes.

Aegis Capital Corp. (“Aegis”)

acted as the placement agent in connection with the Offering and the Private Placement. Pursuant to the placement agent agreement, Aegis

was paid a commission equal to 9.0% of the gross proceeds received by the Company in the Offering and the Private Placement. The Company

paid Aegis $100,000 for fees and expenses including attorneys’ fees.

The foregoing descriptions

of the PIPE Purchase Agreement, Registered Purchase Agreement, RD Pre-Funded Warrants, PIPE Pre-Funded Warrants, Investor Warrants, Registration

Rights Agreement, Lock-Up Agreement and the placement agent agreement described herein are subject to, and qualified in their entirety

by, such documents, which are incorporated herein by reference.

A copy of the opinion

and consent of Conyers Dill & Pearman, as special counsel in the Cayman Islands to the Company, regarding the legality of the issuance

and sale of the ordinary shares in the Offering is attached hereto as Exhibit 5.1 and Exhibit 23.1 to this report, which are incorporated

by reference into the Registration Statement.

On August 4, 2022, the

Company issued a press release announcing the concurrent Private Placement and the Offering. The full text of the press release is attached

as Exhibit 99.1 to this Report on Form 6-K and incorporated herein by reference.

On August 8, 2022, the

Company issued a press release announcing the concurrent closing of the Private Placement and the Offering. The full text of the press

release is attached as Exhibit 99.2 to this Report on Form 6-K and incorporated herein by reference.

Adjustment to Warrant

Exercise Price

On December 7, 2020,

we filed a tender offer statement on Schedule TO, as amended (File number: 005-91479) in relation to our offer to the holders of outstanding

warrants to purchase 12,705,000 ordinary shares, each with an exercise price of $11.50 per share, the opportunity to exercise the warrants

at a temporarily reduced price of $1.40 per ordinary share. The tender offer for warrants terminated on January 5, 2021. Effective January

6, 2021, we temporarily reduced the exercise price of all outstanding warrants to $2.50 per share, and added a “full-ratchet”

anti-dilution protection with respect to subsequent equity sales in which any person will be entitled to acquire ordinary shares at an

effective price per share that is lower than the then exercise price of the warrants, subject to customary exceptions (the “Temporary

Reduction Period”).

As a result of our offering

of 40,000,000 ordinary shares at a price of $1.0 per share, which was on May 25, 2021, the exercise price of the warrants was reduced

to $1.0 per warrant. On September 7, 2021, we closed our offering of $60 million of ordinary shares and pre-funded warrants, at a price

of $0.30 per share and $0.2999 per pre-funded warrant. As a result of that offering, the exercise price of the warrants was reduced to

$0.30 per warrant.

On May 4, 2022, we effected

a share consolidation of 30 ordinary shares with par value of US$0.0001 each in our issued and unissued share capital into one ordinary

share with par value of US$0.003 each (the “Share Consolidation”). Upon effectiveness of the Share Consolidation on May 4,

2022, each outstanding warrant of the Company was adjusted to become exercisable for 1/30 ordinary share of the Company, and the exercise

price of Company’s outstanding warrants was increased to US$9.00, adjusted from $0.30 prior to the Share Consolidation, representing

the updated temporary reduced price.

On August 8, 2022, we

closed our offering of $6.46 million of ordinary shares and pre-funded warrants, at a price of $0.70 per share and $0.699 per warrant.

As a result of this transaction, exercise price of the warrants was reduced to $0.70 per warrant. As of the date of this current report

on Form 6-K, the Temporary Reduction Period has not been terminated. The exercise price of our outstanding warrants will be reset to $345.00

per share on the date following which the closing price of our ordinary shares has been equal to or greater than $90.00 per share for

at least twenty (20) trading days during the preceding thirty (30) trading day period, and such exercise price will no longer be subject

to the “full-ratchet” anti-dilution protection.

| Item 9.01 |

Financial Statements and Exhibits |

(b) Exhibits. The following

exhibits are included in this report:

| No. |

|

Description |

| 5.1 |

|

Opinion of Conyers Dill & Pearman |

| 10.1 |

|

Placement Agency Agreement entered into by and between the Company and Aegis Capital Corp., dated August 4, 2022 |

| 10.2 |

|

Securities Purchase Agreement (PIPE), dated August 4, 2022, by and among the Company and the purchasers thereto |

| 10.3 |

|

Securities Purchase Agreement (Registered Offering), dated August 4, 2022, by and among the Company and the purchasers thereto |

| 10.4 |

|

Form of Investor Warrant (PIPE) |

| 10.5 |

|

Form of Pre-Funded Warrant (PIPE) |

| 10.6 |

|

Form of Pre-Funded Warrant (Registered Offering) |

| 10.7 |

|

Registration Rights Agreement, dated August 4, 2022, by and among the Company and the purchaser party thereto |

| 10.8 |

|

Form of Lockup Agreement |

| 23.1 |

|

Consent of Conyers (included in Exhibit 5.1) |

| 99.1 |

|

Press Release – Meten Holding Group Ltd. Announces $7.5 Million Registered Direct and Private Placement |

| 99.2 |

|

Press Release – Meten Holding Group Ltd. Announces Closing of $7.5 Million Registered Direct and Private Placement Offerings |

Cautionary Note Regarding Forward-Looking

Statements

Any statements in this

Report on Form 6-K about the Company’s future expectations, plans and prospects, as well as any other statements regarding matters

that are not historical facts, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are subject to risks and uncertainties and actual results may differ materially from those expressed

or implied by such forward-looking statements. Such statements include, but are not limited to, statements about the anticipated use of

proceeds from the Private Placement and the Offering, and other statements containing the words “believes,” “anticipates,”

“plans,” “expects,” and similar expressions. Risks that contribute to the uncertain nature of the forward-looking

statements include: uncertainties with respect to the Company’s ability to comply with its obligations under its loan facility and

fund future operations; uncertainties regarding the Company’s ability to maintain its listing on the Nasdaq Capital Market; uncertainties

regarding the scope, timing and severity of the COVID-19 pandemic; as well as other risks and uncertainties set forth in the Company’s

Annual Report on Form 20-F for the fiscal year ended December 31, 2021 filed with the SEC and in subsequent filings with the SEC. All

forward-looking statements contained in this Report on Form 6-K speak only as of the date hereof, and the Company specifically disclaims

any obligation to update any forward-looking statement, whether because of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: August 11, 2022

| |

Meten Holding Group Ltd. |

| |

|

|

| |

By: |

/s/ Siguang Peng |

| |

Name: |

Siguang Peng |

| |

Title: |

Chief Executive Officer |

5

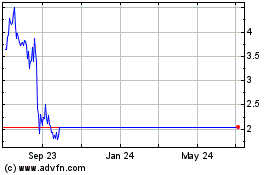

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Mar 2024 to Apr 2024

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Apr 2023 to Apr 2024