Current Report Filing (8-k)

August 05 2022 - 6:09AM

Edgar (US Regulatory)

0000888981

false

--12-31

0000888981

2022-08-01

2022-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 1, 2022

Commission File Number: 000-20333

| NOCOPI TECHNOLOGIES, INC. |

| (Exact name of registrant as specified in its charter) |

| maryland |

87-0406496 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

480 Shoemaker Road, Suite 104, King of Prussia,

PA 19406

(Address of principal executive offices)(Zip

Code)

(610) 834-9600

(Registrant's telephone number, including area

code)

Not Applicable

(Former name

or former address, if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into

a Material Definitive Agreement.

Stock

Purchase Agreement

On August

1, 2022, Nocopi Technologies, Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Purchase

Agreement”), among the Company and the purchasers described on Schedule A to the Purchase Agreement (each a “Purchaser”

and collectively the “Purchasers”). The Purchase Agreement provides for the issuance to the Purchasers of 2,500,000

shares of the Company’s common stock, par value $0.01 per share at a purchase price of $1.40 per share, as adjusted for the Company’s

contemplated one-for-ten (1:10) reverse stock split of the Company’s common stock, par value $0.01 per share (the “Reverse

Stock Split”). For additional information related to the Reverse Stock Split, see Item 5.03 of this Current Report on Form 8-K.

The closing

of the Purchase Agreement is expected to occur as soon as possible following the consummation of the Reverse Stock Split. If the Closing

has not occurred by September 15, 2022, any Purchaser may, at its sole discretion, terminate the Purchase Agreement by providing written

notice to the Company. If the closing occurs, the Company will receive proceeds of $3,500,000. The closing is subject to the occurrence

of the Reverse Stock Split and the Company’s satisfaction of certain additional conditions. There is no guarantee that the closing

of the Purchase Agreement will occur.

MSL 18

HOLDINGS LLC is a Purchaser under the Purchase Agreement. On March 29, 2022, the Company entered into a Nomination and Standstill Agreement

with MSL 18 HOLDINGS LLC, Michael S. Liebowitz and Matthew C. Winger (collectively, the “MSL18 Group”), pursuant to

which the MSL18 Group agreed to certain standstill provisions and the Company agreed to appoint and nominate (i) Mr. Matthew C. Winger

and (ii) on or before September 30, 2022, an additional qualified person to be named by the MSL18 Group, to the Company’s Board

of Directors. The Nomination and Standstill Agreement was amended on May 23, 2022 to increase the number of shares of common stock which

the MSL Group can hold to 35% from 25%. Based upon a Schedule 13D/A filed on June 7, 2022, without giving effect to the Reverse Stock

Split, MSL 18 HOLDINGS LLC beneficially owns 18,288,020 shares of the Company’s common stock,

representing 27.10% of outstanding shares, and Matthew C. Winger, a Company director, beneficially owns 620,000

shares of the Company’s common stock, representing 0.92% of outstanding shares. Michael S. Liebowitz, has sole voting and

dispositive control of MSL 18 HOLDINGS LLC.

Registration Rights Agreement

In connection

with the Purchase Agreement, on August 1, 2022, the Company entered into a Registration Rights Agreement with the Purchasers (the “Registration

Rights Agreement”). The Registration Rights Agreement provides that on or prior to the August 1, 2023, the Company must file

a registration statement to register the shares of common stock purchased pursuant to the Purchase Agreement.

A copy

of the Purchase Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference. A copy

of the Registration Rights Agreement is filed as Exhibit 4.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

The foregoing descriptions of the Purchase Agreement and the Registration Rights Agreement do not purport to be complete and are qualified

in their entirety by reference to the applicable exhibit.

Any

shares of the Company’s common stock that may be issued pursuant to the Purchase Agreement will be issued in reliance on the exemption

from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended, and by Rule 506 of Regulation D promulgated

thereunder as a transaction by an issuer not involving any public offering.

Item 3.02. Unregistered

Sales of Equity Securities.

The information

set forth in Item 1.01 is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

On August 2, 2022 the Company filed

Articles of Amendment to its Articles of Incorporation with the Secretary of State of the State of Maryland to effect one-for-ten (1:10)

reverse stock split of the Company’s common stock, par value $0.01 per share (the “Reverse Stock Split”). The

Articles of Amendment will become effective as of 12:01 a.m. Eastern Standard Time on August 26, 2022 (the “Effective Time”).

At the Effective Time, every ten shares of common stock of the Company that were issued and outstanding immediately prior to the Effective

Time shall be changed into one issued and outstanding share of common stock of the Company. The Company’s common stock will trade

with the new CUSIP number of 655213106 after the Effective Time. The foregoing actions have been approved

by the Company's Board of Directors pursuant to the Maryland General Corporation Law and no stockholder approval is required.

The

Reverse Stock Split will not affect any stockholder’s ownership percentage of the Company’s shares, except to the limited

extent that the Reverse Stock Split would result in any stockholder owning a fractional share. No

fractional shares will be issued in connection with the Reverse Stock Split. Each stockholder who would otherwise be entitled to receive

a fraction of a share of the Company’s common stock will instead receive one whole share of common stock. There will be no

change to the number of authorized shares or the par value per share.

The

Company’s transfer agent, American Stock Transfer & Trust Company, LLC, is acting as exchange agent for the Reverse Stock Split

and, as necessary, will send instructions to stockholders of record regarding the exchange of certificates for common stock.

A copy

of the Articles of Amendment is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item. 8.01. Other Events.

On August 5,

2022, the Company issued a press release announcing that it has entered into the Purchase Agreement and the Registration Rights Agreement,

and that it has filed the Articles of Amendment to its Articles of Incorporation to effect the Reverse Stock Split. A copy of the press

release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NOCOPI TECHNOLOGIES, INC. |

| |

|

|

| Dated: August 5, 2022 |

By: |

/s/

Rudolph A. Lutterschmidt |

| |

|

Rudolph

A. Lutterschmidt |

| |

|

Vice-President

and Chief Financial Officer |

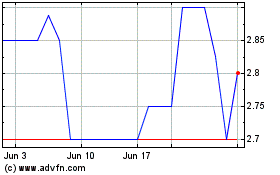

Nocopi Technologies Inc MD (PK) (USOTC:NNUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nocopi Technologies Inc MD (PK) (USOTC:NNUP)

Historical Stock Chart

From Apr 2023 to Apr 2024