SuRo Capital Corp. (“SuRo Capital”,

the “Company”, “we”, “us”, and “our”) (Nasdaq:

SSSS) today announced its financial results for

the quarter ended June 30, 2022. Net assets totaled approximately

$280.2 million, or $9.24 per share, at June 30, 2022 as compared to

$12.22 per share at March 31, 2022 and $16.56 per share at June 30,

2021.

“As we previously mentioned, equity market

performance in the first half of 2022 was the worst first half

performance in over 50 years. Private markets were no exception as

numerous late-stage unicorns experienced turbulent market

conditions. This turbulence has forced new financing rounds at

valuations below previous capital raises, secondary trades at

significant discounts, and lower internal valuations. These new

dynamics, while impactful on short-term valuations, have provided

us with compelling long-term investment opportunities. With greater

than 40% of our investable assets in cash, we are well-positioned

to take advantage of these attractive opportunities,” said Mark

Klein, Chairman and Chief Executive Officer of SuRo

Capital.

Klein continued, “To that end, during the second

quarter, we added two new companies to our investment portfolio:

Whoop, Inc. and EDGE Markets, Inc. (via SuRo Capital Sports, LLC).

We also made a follow-on investment in Shogun Enterprises, Inc.

(d/b/a Hearth). With over $150.0 million in cash at quarter-end, we

remain confident and opportunistic in seeking out compelling,

high-growth companies. Given current conditions, we

believe being judicious on price when assessing potential

investment opportunities is paramount to creating shareholder

value.”

“As we have consistently demonstrated, SuRo

Capital is committed to initiatives that enhance shareholder value,

and we believe the market is currently undervaluing our portfolio.

Accordingly, on August 1, 2022, our Board of Directors authorized a

modified Dutch Auction Tender Offer to purchase up to 2 million

shares of our common stock at a price per share between $6.00 and

$7.00. This modified Dutch Auction Tender Offer comes in addition

to the $15.0 million expansion of our Share Repurchase Program to

$55.0 million authorized by our Board of Directors in March.

Assuming 2 million shares tender, SuRo Capital will have

repurchased over 3 million shares, or approximately 10% of our

outstanding shares, since the expansion of the Share Repurchase

Program in mid-March. Given our stock is trading at a significant

discount to net asset value, coupled with the extreme market

volatility, we believe the modified Dutch Auction Tender offer to

be an efficient and accretive deployment of capital,” Klein

concluded.

Investment Portfolio as of June 30,

2022

At June 30, 2022, SuRo Capital held positions in

40 portfolio companies – 32 privately held and 8 publicly held,

some of which may be subject to certain lock-up provisions – with

an aggregate fair value of approximately $200.1

million. The Company’s top five portfolio company

investments accounted for approximately 58% of the total portfolio

at fair value as of June 30, 2022.

Top Five Investments as of June 30,

2022

|

Portfolio Company($ in millions) |

Cost Basis |

Fair Value |

% of Total Portfolio |

|

Course Hero, Inc. |

$ |

15.0 |

$ |

59.5 |

29.8 |

% |

|

Forge Global Holdings, Inc. |

|

2.5 |

|

21.3 |

10.6 |

|

|

Blink Health, Inc. |

|

15.0 |

|

11.7 |

5.8 |

|

|

Aspiration Partners, Inc. |

|

1.3 |

|

11.4 |

5.7 |

|

|

StormWind, LLC |

|

6.4 |

|

11.2 |

5.6 |

|

|

Total |

$ |

40.2 |

$ |

115.1 |

57.5 |

% |

__________________

Note: Total may not sum due to rounding.

Second Quarter 2022 Investment Portfolio

Activity

During the three months ended June 30, 2022,

SuRo Capital funded the following new and follow-on

investments:

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

| Shogun Enterprises, Inc.

(d/b/a Hearth) |

Convertible Note |

5/2/2022 |

$0.5 million |

| EDGE Markets, Inc.(1) |

Preferred Shares, Series Seed |

5/18/2022 |

$0.5 million |

| Whoop, Inc. |

Preferred Shares, Series C |

6/30/2022 |

$10.0 million |

__________________

(1) Investment made through

SuRo Capital Sports, LLC.During the three months ended June 30,

2022, SuRo Capital exited or received proceeds from the following

investments:

|

Portfolio Company |

Transaction Date |

Shares Sold |

Average Net Share Price(1) |

NetProceeds |

Realized Gain/(Loss) |

| NewLake Capital Partners,

Inc.(2) |

Various |

3,676 |

$21.02 |

$0.1 million |

<$0.1 million |

| Rent the Runway, Inc.(3) |

Various |

50,000 |

$3.62 |

$0.2 million |

($0.6 million) |

| Residential Homes For Rent,

LLC (d/b/a Second Avenue)(4) |

Various |

N/A |

N/A |

$0.3 million |

$- |

| Rover Group, Inc.(5) |

Various |

431,591 |

$5.52 |

$2.4 million |

$1.1 million |

| True Global Ventures 4 Plus

Pte Ltd |

5/31/22 |

N/A |

N/A |

$0.9 million |

$0.2 million |

__________________(1) The

average net share price is the net share price realized after

deducting all commissions and fees on the sale(s), if applicable.

(2) As of June 30, 2022, SuRo Capital held 247,443

remaining NewLake Capital Partners, Inc. common

shares.(3) As of June 30, 2022, SuRo Capital held

289,191 remaining Rent the Runway, Inc. common

shares.(4) During the three months ended June 30,

2022, approximately $0.3 million was received from Residential

Homes for Rent, LLC (d/b/a Second Avenue) related to the 15% term

loan due December 23, 2023. Of the proceeds received, $0.3 million

repaid a portion of the outstanding principal and the remaining was

attributed to interest.(5) As of June 30, 2022,

SuRo Capital held 364,046 remaining Rover Group, Inc. common

shares.Subsequent to quarter-end through August 3, 2022, SuRo

Capital exited or received proceeds from the following

investments:

|

Portfolio Company |

Transaction Date |

Shares Sold |

Average Net Share Price(1) |

NetProceeds |

Realized Gain/(Loss) |

| Enjoy Technology, Inc.(2) |

Various |

626,955 |

$0.38 |

$0.2 million |

($3.0 million) |

| Palantir Lending Trust SPV

I(3) |

7/14/22 |

N/A |

N/A |

$0.6 million |

$0.6 million |

| Rent the Runway, Inc.(4) |

Various |

15,000 |

$3.43 |

$0.1 million |

($0.2 million) |

| Residential Homes For Rent,

LLC (d/b/a Second Avenue)(5) |

7/22/22 |

N/A |

N/A |

$0.1 million |

$- |

| Rover Group, Inc.(6) |

Various |

110,000 |

$4.14 |

$0.5 million |

$0.1 million |

__________________(1) The average net share price is the net

share price realized after deducting all commissions and fees on

the sale(s), if applicable. (2) As of August 3, 2022, SuRo Capital

held 320,342 remaining Enjoy Technology, Inc. common shares. (3) On

July 14, 2022, a final payment was received for the remaining

512,290 Class A common shares of Palantir Technologies, Inc. that

comprised the beneficial equity interest in underlying shares. The

realized gain from SuRo Capital's investment in Palantir Lending

Trust SPV I is generated by the proceeds from the sale of shares

collateralizing the repaid promissory note to Palantir Lending

Trust SPV I and attributable to the Equity Participation in

Underlying Collateral. (4) As of August 3, 2022, SuRo Capital held

274,191 remaining Rent the Runway, Inc. common shares. (5)

Subsequent to June 30, 2022, $0.1 million was received from

Residential Homes for Rent, LLC (d/b/a Second Avenue) related to

the 15% term loan due December 23, 2023. Of the proceeds received,

$0.1 million repaid a portion of the outstanding principal and the

remaining was attributed to interest. (6) As of August 3, 2022,

SuRo Capital held 254,046 remaining Rover Group, Inc. common

shares.

Second Quarter 2022 Financial

Results

| |

Quarter EndedJune 30, 2022 |

Quarter EndedJune 30, 2021 |

|

|

$ in millions |

per share(1) |

$ in millions |

per share(1) |

|

|

|

|

|

|

| Net

investment loss |

$(3.8) |

|

$(0.12) |

|

$(2.0) |

|

$(0.07) |

|

| |

|

|

|

|

|

Net realized gain/(loss) on investments |

|

(2.0) |

|

|

(0.06) |

|

|

27.7 |

|

|

0.63 |

|

| |

|

|

|

|

| Net change in unrealized

appreciation/(depreciation) of investments |

|

(88.6) |

|

|

(2.89) |

|

|

7.7 |

|

|

0.32 |

|

| |

|

|

|

|

| Net increase/(decrease) in net

assets resulting from operations – basic(2) |

$(94.3) |

|

$(3.07) |

|

$33.4 |

|

$0.88 |

|

| |

|

|

|

|

| Dividends declared |

|

- |

|

|

- |

|

|

(60.5) |

|

|

(2.50) |

|

| |

|

|

|

|

| Issuance of common stock from

stock dividend |

|

- |

|

|

- |

|

|

30.5 |

|

|

0.16 |

|

| |

|

|

|

|

| Repurchase of common

stock(3) |

|

(6.9) |

|

|

0.07 |

|

|

- |

|

|

- |

|

| |

|

|

|

|

| Stock-based compensation |

|

0.7 |

|

|

0.02 |

|

|

0.3 |

|

|

0.01 |

|

| |

|

|

|

|

|

Increase/(decrease) in net asset value(2) |

$(100.5) |

|

$(2.98) |

|

$3.6 |

|

$(1.45) |

|

__________________

(1) Based on basic

weighted-average number of shares outstanding for the relevant

period.(2) Total may not sum due to

rounding.(3) During the quarters ended June 30,

2022 and June 30, 2021, the Company repurchased 855,159 and 0

shares of SuRo Capital common stock, respectively, for

approximately $6.9 million and $0, respectively, in cash under its

Share Repurchase Program. The use of cash in connection with the

repurchases decreased net asset value as of quarter-end; however,

the reduction in shares outstanding as of quarter-end resulted in

an increase in the net asset value per share. Weighted-average

common basic shares outstanding were approximately 30.6 million and

25.3 million for the quarters ended June 30, 2022, and 2021,

respectively. As of June 30, 2022, there were 30,325,187 shares of

the Company’s common stock outstanding.

SuRo Capital’s liquid assets were approximately

$169.4 million as of June 30, 2022, consisting of cash and

securities of publicly traded portfolio companies not subject to

lock-up restrictions at quarter-end.

Share Repurchase Program

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 5.8 million

shares of its common stock for an aggregate purchase price of

approximately $38.6 million.

On March 13, 2022, the Company’s Board of

Directors authorized a $15.0 million expansion of the Share

Repurchase Program to $55.0 million. During the three and six

months ended June 30, 2022, under the Share Repurchase Program, the

Company repurchased 855,159 and 1,008,676 shares, respectively, of

its common stock for approximately $6.9 million and $8.3 million,

respectively. The dollar value of shares that may yet be

purchased by the Company under the Share Repurchase Program is

approximately $16.4 million. The Share Repurchase Program is

authorized through October 31, 2022.

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market

provided it complies with the prohibitions under its insider

trading policies and procedures and the applicable provisions of

the Investment Company Act of 1940, as amended, and the Securities

Exchange Act of 1934, as amended.

Modified Dutch Auction Tender

Offer

On August 1, 2022, the Company’s Board of

Directors authorized a modified “Dutch Auction” tender offer (the

“Tender Offer”) to purchase up to 2,000,000 shares of its common

stock at a price per share not less than $6.00 and not greater than

$7.00 in $0.10 increments, using available cash. The Tender Offer

will commence on August 8, 2022 and will expire at 5:00 P.M.,

Eastern Time, on September 2, 2022, unless extended. If the Tender

Offer is fully subscribed, the Company will purchase 2,000,000

shares, or approximately 6.60%, of the Company’s outstanding shares

of its common stock. Any shares tendered may be withdrawn prior to

expiration of the Tender Offer. Stockholders that do not wish to

participate in the Tender Offer do not need to take any action.

Based on the number of shares tendered and the

prices specified by the tendering stockholders, the Company will

determine the lowest per-share price that will enable it to acquire

up to 2,000,000 shares of its common stock. All shares accepted in

the Tender Offer will be purchased at the same price even if

tendered at a lower price.

The Tender Offer is not contingent upon any

minimum number of shares being tendered. The Tender Offer is,

however, subject to other conditions, which will be disclosed in

the Tender Offer documents. In the future, the Board of Directors

may consider additional tender offer(s) or other measures to

enhance shareholder value based upon a variety of factors,

including the market price of the Company’s common stock and its

net asset value.

The Company’s Board of Directors is not making

any recommendation to stockholders as to whether to tender or

refrain from tendering their shares into the Tender Offer.

Stockholders must decide how many shares they will tender, if any,

and the price within the stated range at which they will offer

their shares for purchase.

The information agent for the Tender Offer is

D.F. King & Co. Inc., and the depositary is American Stock

Transfer & Trust Company, LLC. The offer to purchase (the

“Offer to Purchase”), a letter of transmittal and related documents

will be mailed to registered holders and certain of our beneficial

holders. Beneficial holders may alternatively receive the Offer to

Purchase and a communication to consult with their bank, broker or

custodian, if they wish to tender shares. For questions and

information, please contact the information agent at

suro@dfking.com. Banks and brokers may call the information agent

at (212) 269-5550, and all others may call the information agent

toll-free at (800) 769-4414.

Certain Information Regarding the Tender

Offer

The information in this press release describing

the Company’s Tender Offer is for informational purposes only and

does not constitute an offer to buy or the solicitation of an offer

to sell shares of the Company’s common stock in the Tender Offer.

The Tender Offer is being made only pursuant to the Offer to

Purchase and the related materials that the Company will file with

the Securities and Exchange Commission, and is distributing to its

stockholders, as they may be amended or supplemented. Stockholders

should read such Offer to Purchase and related materials carefully

and in their entirety because they contain important information,

including the various terms and conditions of the Tender Offer.

Stockholders of SuRo Capital Corp. may obtain a free copy of the

Tender Offer statement on Schedule TO, the Offer to Purchase and

other documents that the Company will be filing with the Securities

and Exchange Commission from the Securities and Exchange

Commission’s website at www.sec.gov. Stockholders may also obtain a

copy of these documents, without charge, from D.F. King & Co.

Inc., the information agent for the Tender Offer, by emailing

suro@dfking.com or calling toll-free at (800) 769-4414.

Stockholders are urged to carefully read all of these materials

prior to making any decision with respect to the Tender Offer.

Stockholders and investors who have questions or need assistance

may call D.F. King & Co. Inc. or email suro@dfking.com.

Conference Call and Webcast

Management will hold a conference call and

webcast for investors at 5:00 p.m. ET (2:00 p.m. PT) on August 3,

2022. The conference call access number for U.S. participants is

323-701-0160, and the conference call access number for

participants outside the U.S. is 800-289-0720. The conference ID

number for both access numbers is 7679361. Additionally, interested

parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An

archived replay of the webcast will also be available for 12 months

following the live presentation.

A replay of the conference call may be accessed

until 8:00 p.m. ET (5:00 p.m. PT) on August 10, 2022 by dialing

888-203-1112 (U.S.) or +1 719-457-0820 (International) and using

conference ID number 7679361.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking statements

involve a number of risks and uncertainties, including the impact

of the COVID-19 pandemic and any market volatility that may be

detrimental to our business, our portfolio companies, our industry,

and the global economy, that could cause actual results to differ

materially from the plans, intentions, and expectations reflected

in or suggested by the forward-looking statements. Risk factors,

cautionary statements, and other conditions which could cause SuRo

Capital's actual results to differ from management's current

expectations are contained in SuRo Capital's filings with the

Securities and Exchange Commission. SuRo Capital undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in New

York, NY and has offices in San Francisco, CA. Connect with the

company on Twitter, LinkedIn, and at www.surocap.com.

ContactSuRo Capital Corp.(212)

931-6331IR@surocap.com

Media ContactBill

DouglassGotham Communications, LLCCommunications@surocap.com

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

ASSETS AND LIABILITIES (UNAUDITED)

| |

June 30, 2022 |

|

December 31, 2021 |

| ASSETS |

|

|

|

| Investments at fair

value: |

|

|

|

|

Non-controlled/non-affiliate investments (cost of $153,356,838 and

$146,360,300, respectively) |

$ |

171,870,750 |

|

|

$ |

231,768,290 |

|

| Non-controlled/affiliate

investments (cost of $41,140,804 and $41,211,183,

respectively) |

|

14,177,090 |

|

|

|

14,609,089 |

|

| Controlled investments (cost

of $19,883,894 and $19,883,894, respectively) |

|

14,018,874 |

|

|

|

13,758,874 |

|

| Total Investments (cost of

$214,381,536 and $207,455,377, respectively) |

|

200,066,714 |

|

|

|

260,136,253 |

|

| Cash |

|

152,984,799 |

|

|

|

198,437,078 |

|

| Proceeds receivable |

|

55,943 |

|

|

|

52,493 |

|

| Escrow proceeds

receivable |

|

2,005,019 |

|

|

|

2,046,645 |

|

| Interest and dividends

receivable |

|

156,637 |

|

|

|

83,655 |

|

| Deferred financing costs |

|

589,781 |

|

|

|

621,719 |

|

| Prepaid expenses and other

assets(1) |

|

588,499 |

|

|

|

937,984 |

|

|

Total Assets |

|

356,447,392 |

|

|

|

462,315,827 |

|

|

LIABILITIES |

|

|

|

| Accounts payable and accrued

expenses(1) |

|

2,705,829 |

|

|

|

875,047 |

|

| Accrued interest payable |

|

12,500 |

|

|

|

175,000 |

|

| Dividends payable |

|

349,929 |

|

|

|

23,390,048 |

|

| 6.00% Notes due December 30,

2026(2) |

|

73,206,662 |

|

|

|

73,029,108 |

|

|

Total Liabilities |

|

76,274,920 |

|

|

|

97,469,203 |

|

| |

|

|

|

| Net

Assets |

$ |

280,172,472 |

|

|

$ |

364,846,624 |

|

| NET

ASSETS |

|

|

|

|

Common stock, par value $0.01 per share (100,000,000 authorized;

30,325,187 and 31,118,556 issued and outstanding,

respectively) |

$ |

303,252 |

|

|

$ |

311,185 |

|

| Paid-in capital in excess of

par |

|

342,738,247 |

|

|

|

350,079,409 |

|

| Accumulated net investment

loss |

|

(58,160,190 |

) |

|

|

(50,124,597 |

) |

| Accumulated net realized gain

on investments, net of distributions |

|

9,587,968 |

|

|

|

11,899,742 |

|

| Accumulated net unrealized

appreciation/(depreciation) of investments |

|

(14,296,805 |

) |

|

|

52,680,885 |

|

|

Net Assets |

$ |

280,172,472 |

|

|

$ |

364,846,624 |

|

|

Net Asset Value Per Share |

$ |

9.24 |

|

|

$ |

11.72 |

|

__________________________________________________

(1) This balance includes a right of use asset

and corresponding operating lease liability, respectively. (2) As

of June 30, 2022, the 6.00% Notes due December 30, 2026 (effective

interest rate of 6.53%) had a face value $75,000,000. As of

December 31, 2021, the 6.00% Notes due December 30, 2026 (effective

interest rate of 6.13%) had a face value $75,000,000.

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

| |

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| INVESTMENT

INCOME |

|

|

|

|

|

|

|

|

| Non-controlled/non-affiliate

investments: |

|

|

|

|

|

|

|

|

|

Interest income |

|

$ |

149,282 |

|

|

$ |

145,851 |

|

|

$ |

311,737 |

|

|

$ |

312,696 |

|

|

Dividend income |

|

|

191,349 |

|

|

|

128,969 |

|

|

|

321,994 |

|

|

|

150,844 |

|

| Non-controlled/affiliate

investments: |

|

|

|

|

|

|

|

|

|

Dividend income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

102,632 |

|

| Controlled investments: |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

550,000 |

|

|

|

— |

|

|

|

840,000 |

|

|

|

— |

|

|

Total Investment Income |

|

|

890,631 |

|

|

|

274,820 |

|

|

|

1,473,731 |

|

|

|

566,172 |

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

| Compensation expense |

|

|

1,759,261 |

|

|

|

1,345,892 |

|

|

|

3,619,963 |

|

|

|

2,639,202 |

|

| Directors’ fees(2) |

|

|

191,829 |

|

|

|

111,250 |

|

|

|

352,394 |

|

|

|

222,500 |

|

| Professional fees |

|

|

1,078,459 |

|

|

|

529,524 |

|

|

|

2,351,172 |

|

|

|

1,502,683 |

|

| Interest expense |

|

|

1,226,767 |

|

|

|

— |

|

|

|

2,427,553 |

|

|

|

504,793 |

|

| Income tax expense |

|

|

5,691 |

|

|

|

7,598 |

|

|

|

7,741 |

|

|

|

9,623 |

|

| Other expenses |

|

|

439,512 |

|

|

|

323,556 |

|

|

|

750,501 |

|

|

|

564,689 |

|

|

Total Operating Expenses |

|

|

4,701,519 |

|

|

|

2,317,820 |

|

|

|

9,509,324 |

|

|

|

5,443,490 |

|

|

Net Investment Loss |

|

|

(3,810,888 |

) |

|

|

(2,043,000 |

) |

|

|

(8,035,593 |

) |

|

|

(4,877,318 |

) |

| Realized Gain/(Loss)

on Investments: |

|

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

|

|

(1,895,846 |

) |

|

|

27,658,812 |

|

|

|

1,200,429 |

|

|

|

139,811,330 |

|

| Non-controlled/affiliate

investments |

|

|

(70,379 |

) |

|

|

— |

|

|

|

(70,379 |

) |

|

|

— |

|

|

Net Realized Gain/(Loss) on Investments |

|

|

(1,966,225 |

) |

|

|

27,658,812 |

|

|

|

1,130,050 |

|

|

|

139,811,330 |

|

| Change in Unrealized

Appreciation/(Depreciation) of Investments: |

|

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments |

|

|

(88,620,056 |

) |

|

|

(12,065,362 |

) |

|

|

(66,876,069 |

) |

|

|

(15,330,669 |

) |

| Non-controlled/affiliate

investments |

|

|

(72,519 |

) |

|

|

19,817,253 |

|

|

|

(361,621 |

) |

|

|

21,661,723 |

|

| Controlled investments |

|

|

130,000 |

|

|

|

(10,639 |

) |

|

|

260,000 |

|

|

|

94,361 |

|

|

Net Change in Unrealized Appreciation/(Depreciation) of

Investments |

|

|

(88,562,575 |

) |

|

|

7,741,252 |

|

|

|

(66,977,690 |

) |

|

|

6,425,415 |

|

|

Net Change in Net Assets Resulting from

Operations |

|

$ |

(94,339,688 |

) |

|

$ |

33,357,064 |

|

|

$ |

(73,883,233 |

) |

|

$ |

141,359,427 |

|

|

Net Change in Net Assets Resulting from Operations per

Common Share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(3.08 |

) |

|

$ |

1.32 |

|

|

$ |

(2.39 |

) |

|

$ |

6.17 |

|

|

Diluted(1) |

|

$ |

(3.08 |

) |

|

$ |

1.32 |

|

|

$ |

(2.39 |

) |

|

$ |

5.74 |

|

| Weighted-Average

Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

30,633,878 |

|

|

|

25,334,482 |

|

|

|

30,929,321 |

|

|

|

22,923,943 |

|

|

Diluted(1) |

|

|

30,633,878 |

|

|

|

25,334,482 |

|

|

|

30,929,321 |

|

|

|

24,732,256 |

|

__________________________________________________

(1) For the three and six

months ended June 30, 2022 and the three months ended June 30,

2021, there were no potentially dilutive securities

outstanding.

SURO CAPITAL CORP. AND

SUBSIDIARIESFINANCIAL HIGHLIGHTS

(UNAUDITED)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Per Basic Share

Data |

|

|

|

|

|

|

|

|

| Net asset value at beginning

of the year |

|

$ |

12.22 |

|

|

$ |

18.01 |

|

|

$ |

11.72 |

|

|

$ |

15.14 |

|

|

Net investment loss(1) |

|

|

(0.12 |

) |

|

|

(0.07 |

) |

|

|

(0.26 |

) |

|

|

(0.21 |

) |

|

Net realized gain/(loss) on investments(1) |

|

|

(0.06 |

) |

|

|

0.63 |

|

|

|

0.04 |

|

|

|

6.10 |

|

|

Net change in unrealized appreciation/(depreciation) of

investments(1) |

|

|

(2.89 |

) |

|

|

0.32 |

|

|

|

(2.17 |

) |

|

|

0.26 |

|

|

Dividends declared |

|

|

— |

|

|

|

(2.50 |

) |

|

|

(0.11 |

) |

|

|

(3.00 |

) |

|

Issuance of common stock from stock dividend |

|

|

— |

|

|

|

0.16 |

|

|

|

— |

|

|

|

0.16 |

|

|

Issuance of common stock from public offering(1) |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

Issuance of common stock from conversion of 4.75% Convertible Notes

due 2023(1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.91 |

) |

|

Repurchase of common stock(1) |

|

|

0.07 |

|

|

|

|

|

(0.01 |

) |

|

|

— |

|

|

Stock-based compensation(1) |

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.02 |

|

| Net asset value at end of

period |

|

$ |

9.24 |

|

|

$ |

16.56 |

|

|

$ |

9.24 |

|

|

$ |

16.56 |

|

| Per share market value at end

of period |

|

$ |

6.40 |

|

|

$ |

13.49 |

|

|

$ |

6.40 |

|

|

$ |

13.49 |

|

| Total return based on market

value(2) |

|

(25.84)% |

|

|

40.63 |

% |

|

(49.14)% |

|

|

55.57 |

% |

| Total return based on net

asset value(2) |

|

(24.39)% |

|

|

5.83 |

% |

|

(20.22)% |

|

|

29.19 |

% |

| Shares outstanding at end of

period |

|

|

30,325,187 |

|

|

|

26,540,743 |

|

|

|

30,325,187 |

|

|

|

26,540,743 |

|

| Ratios/Supplemental

Data: |

|

|

|

|

|

|

|

|

| Net assets at end of

period |

|

$ |

280,172,472 |

|

|

$ |

439,592,729 |

|

|

$ |

280,172,472 |

|

|

$ |

439,592,729 |

|

| Average net assets |

|

$ |

378,428,728 |

|

|

$ |

425,330,123 |

|

|

$ |

371,249,600 |

|

|

$ |

369,373,984 |

|

| Ratio of net operating

expenses to average net assets(3) |

|

|

4.24 |

% |

|

|

2.19 |

% |

|

|

4.80 |

% |

|

|

2.97 |

% |

| Ratio of net investment loss

to average net assets(3) |

|

(3.48)% |

|

(1.93)% |

|

(4.18)% |

|

(2.66)% |

| Portfolio Turnover Ratio |

|

|

1.20 |

% |

|

|

10.20 |

% |

|

|

1.69 |

% |

|

|

13.64 |

% |

__________________________________________________

(1) Based on weighted-average number of shares

outstanding for the relevant period.(2) Total return based on

market value is based upon the change in market price per share

between the opening and ending market values per share in the

period, adjusted for dividends and equity issuances. Total return

based on net asset value is based upon the change in net asset

value per share between the opening and ending net asset values per

share in the period, adjusted for dividends and equity issuances.

(3) Because the ratios are calculated for the Company’s common

stock taken as a whole, an individual investor’s ratios may vary

from these ratios.

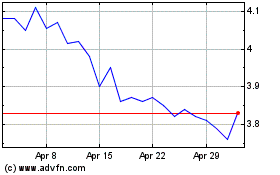

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Apr 2023 to Apr 2024