Current Report Filing (8-k)

August 02 2022 - 5:29PM

Edgar (US Regulatory)

0001605331

false

0001605331

2022-08-01

2022-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August

1, 2022

AB International

Group Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55979 |

37-1740351 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

48 Wall Street, Suite 1009,

New York, NY |

10005 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 918-4519

|

______________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry into a Material Definitive Agreement.

On August 1, 2022, we entered

into a Common Stock Purchase Agreement (the “Purchase Agreement”) with Alumni Capital LP, a Delaware limited partnership.

Pursuant to the Purchase Agreement, the Company has the right, but not the obligation to cause Alumni Capital to purchase up to $1 million

of our common stock at the Investment Amount (defined below) during the period beginning on the execution date of the Purchase Agreement

and ending on the earlier of (i) the date on which the Alumni Capital has purchased $1 million of our common stock shares pursuant to

the Purchase Agreement or (ii) December 31, 2022.

Pursuant to the Purchase

Agreement, the “Investment Amount” means seventy five percent (75%) of the lowest traded price of the Common Stock five Business

Days prior to the Closing of a Purchase Notice. No Purchase Notice will be made without an effective registration statement and no Purchase

Notice will be in an amount less than twenty-five thousand dollars ($25,000) or greater than five hundred thousand dollars ($500,000).

The

Purchase Agreement provides that the number of our common stock shares to be sold to Alumni Capital will not exceed the number of shares

that, when aggregated together with all other shares of our common stock which the investor is deemed to beneficially own, would result

in the investor owning more than 9.99% of our outstanding common stock.

In consideration for Alumni Capital’s execution and performance under

the Purchase Agreement, the Company issued to Alumni Capital a Common Stock Purchase Warrant dated August 1, 2022 to purchase 50,000,000

shares of Common Stock at an exercise price of $0.02 per share.

The Purchase Agreement contains certain representations, warranties, covenants

and events of default. The Closing occurred following the satisfaction of customary closing conditions.

The foregoing description

of the Purchase Agreement and Common Stock Purchase Warrant does not purport to be complete and is qualified in its entirety by the full

text of the Purchase Agreement and Common Stock Purchase Warrant, which are filed as Exhibits 10.1 and 4.1 hereto, respectively, and incorporated

by reference herein.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AB International Group Corp.

/s/ Chiyuan Deng

Chiyuan Deng

President

Date: August 2, 2022

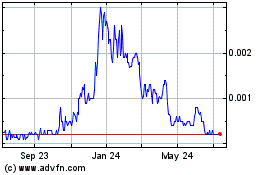

AB (PK) (USOTC:ABQQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

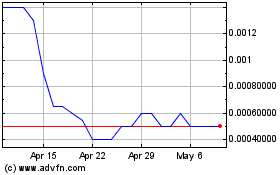

AB (PK) (USOTC:ABQQ)

Historical Stock Chart

From Apr 2023 to Apr 2024