Standard Chartered Earnings Beat, Downplays Risks from China Property - Update

July 29 2022 - 11:05AM

Dow Jones News

By Elaine Yu

HONG KONG-Standard Chartered PLC reported better-than-expected

profit for the second quarter while unveiling a new share buyback

plan aimed at boosting shareholder returns.

The London-headquartered lender on Friday reported an underlying

pretax profit of $1.3 billion, up 7% year-on-year and beating an

estimate of $1.06 billion compiled by the bank.

The results were helped by its Asia-focused position as the bank

benefited from both the Federal Reserve's interest rate increases

and its core markets being more insulated from volatile

macroeconomic conditions in the West. The bank generated 72.5% of

its underlying pretax profit from Asia in the three months-ended

June 30.

Buoyed by a rising interest rates environment, the bank's

net-interest income rose 8% to $3.64 billion for the first six

months of this year and net-interest margin is up 10 basis points

year-on-year during that period.

The bank also said on Friday it will buy back $500 million worth

of shares, on the back of a $750 million buyback program completed

earlier this year. It plans to return more than $5 billion to

shareholders over the next three years.

The results were partly offset by $267 million in credit

impairment over the last two quarters owing to the bank's exposure

to China's real-estate sector and the downgrade of Sri Lanka's

long-term foreign currency sovereign rating. By comparison, the

same period last year saw a net release of $47 million in credit

impairment.

China's property downturn has amplified the asset risks for Hong

Kong's banks that have exposure to the mainland's real-estate

sector, including Standard Chartered's subsidiary in Hong Kong,

Moody's Investors Service said in a report this month. Authorities

in China have moved to quash a revolt among homeowners who have

threatened to renege on mortgages on unfinished properties as the

country faces growing pressure to address its property crisis.

Benjamin Hung, Standard Chartered's Asia Chief Executive

Officer, said in a press conference on Friday the bank hadn't been

affected by the mortgage boycott because its main focus is on

China's large and comparatively wealthy first-tier and second-tier

cities. The bank's $3.7 billion net exposure to the country's

real-estate sector is only a small part of its $64 billion exposure

in China overall, Mr. Hung said.

He said the bank's strategy hinges on China's continued opening

up of its financial and capital markets, rather than its overall

economic growth. "That to me is the far more important driver of

our strategy," he said.

Write to Elaine Yu at elaine.yu@wsj.com

(END) Dow Jones Newswires

July 29, 2022 10:50 ET (14:50 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

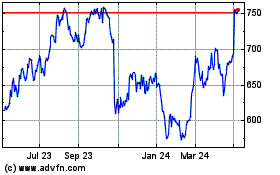

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

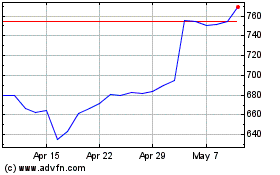

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024