UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

| |

☒ |

Preliminary Information Statement |

| |

☐ |

Confidential, for Use of Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

☐ |

Definitive Information Statement |

BIOVIE INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check all boxes that

apply):

| |

☒ |

No fee required. |

| |

☐ |

Fee paid previously with preliminary materials |

| |

☐ |

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

BIOVIE INC.

680 W Nye Lane Suite 201

Carson City, NV 89703

NOTICE

OF STOCKHOLDER ACTION BY WRITTEN CONSENT

To the Stockholders of BioVie Inc.:

This Notice and the accompanying Information

Statement are being furnished to the stockholders of record of the Class A common stock, par value $0.0001 per share (the “Common

Stock”), of BioVie Inc., a Nevada corporation (the “Company”), in connection with action taken by Acuitas Group Holdings,

LLC (the “Majority Stockholder”), the holder of a majority of the issued and outstanding voting securities of the Company,

approving in accordance with Nasdaq Listing Rule 5635(c) and 5635(d) (collectively, “Nasdaq Rule 5635”), by written consent

in lieu of a special meeting dated July 15, 2022, the issuance to the Majority Stockholder in a private placement by the Company of (i)

shares of Common Stock and (ii) a warrant to purchase shares of Common Stock (the “Warrant Shares”), (the “PIPE Financing”).

The approval of the PIPE Financing for purposes

of Nasdaq Rule 5635 was taken by written consent pursuant to Section 78.320(2) of the Nevada Revised Statutes and Article II, Section

7 of the Company’s Amended and Restated Bylaws (the “Bylaws”), which provides that any action that may be taken at any

annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if a consent or consents

in writing, setting forth the action so taken, shall be signed by the holders of outstanding Common Stock having not less than the minimum

number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were

present and voted. The Company has obtained the approval of stockholders holding a majority of the Company’s issued and outstanding

shares of Common Stock for such stock issuance as required by the Nasdaq Listing Rules.

This Information Statement is being mailed on or about ________ __, 2022, to stockholders

of record as of July 15, 2022, referred to as the record date. The information statement is being delivered only to inform you of the

corporate action described herein before it takes effect in accordance with Rule 14c-2 promulgated under the Exchange Act. The action

shall be effective on or about ________ __, 2022, or approximately 20 days after we mail this Information Statement.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY.

Your vote or consent is not requested or required

to approve the PIPE Financing. The accompanying Information Statement is provided solely for your information.

The Company is mailing this Notice and the accompanying Information Statement to stockholders on or

about ________ __, 2022. This Information Statement will serve as written notice to the stockholders of the Company pursuant to the Company’s

Bylaws.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

By Order of the Board of Directors,

Cuong V. Do

Chief Executive Officer

Dated: July __, 2022 |

INFORMATION STATEMENT

OF

BIOVIE INC.

TABLE OF CONTENTS

Exhibit A: Written Consent of The Majority Stockholder To Action Taken

Without A Meeting

PRELIMINARY

INFORMATION STATEMENT — SUBJECT TO COMPLETION

INFORMATION STATEMENT

OF

BIOVIE INC.

680 W Nye Lane Suite 201

Carson City, NV 89703

(775) 888-3162

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

July 15, 2022

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS

IS REQUIRED IN

CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

General

Information

BioVie Inc., a Nevada corporation (“BioVie,” the “Company,” “we,”

or “us”), is sending you this Information Statement solely for purposes of informing its stockholders of record as of July

15, 2022 (the “Record Date”), in the manner required by Regulation 14C of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and the Company’s amended and restated bylaws (the “Bylaws”), of the action taken

by written consent by Acuitas Group Holdings, LLC, an entity controlled by Terren Peizer, Company’s Chairman (the “Majority

Stockholder” or “Purchaser”), the holder of a majority of the issued and outstanding voting securities of the Company,

to approve, for purposes of Nasdaq Listing Rule 5635(c) and 5635(d) (collectively, “Nasdaq Rule 5635”), the issuance to the

Majority Stockholder in a private placement by the Company of (i) shares of the Company’s Class A common stock, par value $0.0001

per share (the “Common Stock”) and (ii) a warrant (the “Warrant”) to purchase shares of Common Stock (the “Warrant

Shares”), on the terms and subject to the conditions set forth in the Securities Purchase Agreement, dated July 15, 2022 (the “Purchase

Agreement”), between the Company and the Purchaser (the “PIPE Financing”).

The Company’s Common Stock is listed on the

Nasdaq Capital Market, and the Company is subject to Nasdaq’s rules and regulations, including Nasdaq Rule 5635. Nasdaq Rule 5635,

subsections (c) and (d), requires stockholder approval prior to certain issuances of securities, as follows:

(c) the

issuance of securities in a transaction (other than a public offering) to officers, directors, employees or consultants at a discount

to the market value (the consolidated closing bid price immediately preceding the time the company enters into a binding agreement to

issue the securities) (the “Current Market Price”); or

(d) the

issuance in a transaction (other than a public offering) of common stock (or securities convertible into or exercisable for common stock)

equal to 20% or more of the outstanding common stock or 20% or more of the voting power of a company for a purchase price that is lower

than (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of a binding agreement; or (ii)

the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding

the signing of the binding agreement (such lower amount, the “Minimum Price”).

Under Nevada law and our Bylaws, any action

that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a

vote, if a consent in writing, setting forth the action so taken, shall be signed by the holders of a majority of the outstanding

shares entitled to vote. On the Record Date, the Company was authorized to issue 800,000,000 shares of Common Stock and there were

24,893,083 shares of Common Stock issued and outstanding with the holders thereof being entitled to cast one vote per share.

On July 15, 2022, the board of directors of the Company (with the Majority

Stockholder abstaining) adopted resolutions approving the transactions in connection with the PIPE Financing. In connection with the adoption

of these resolutions, the board of directors had been informed that holders of a majority of our outstanding shares of Common Stock were

in favor of this proposal and would enter into a written consent approving the PIPE Financing. On July 15, 2022, the Majority Stockholder,

who holds a total of 19,529,846 shares of our Common Stock, representing 78.2% of our outstanding shares of Common Stock as of the Record

Date, consented in writing to the PIPE Financing (the “Stockholder Consent”). The full text of the Stockholder Consent is

attached hereto as Exhibit A. As described below, the Majority Stockholder is also the sole purchaser in the PIPE Financing.

Accordingly, all necessary corporate approvals

in connection with the PIPE Financing have been obtained and this Information Statement is furnished solely for the purpose of informing

the stockholders of the Company in the manner required under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The general effect of the PIPE Financing is described in “APPROVAL OF THE PIPE FINANCING FOR PURPOSES OF NASDAQ RULE 5635”.

The Company knows of no other matters other than

that described in this Information Statement which have been recently approved or considered by the holders of the Common Stock.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement contains

forward-looking statements within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”). Any statements contained in this Information Statement that are not statements of historical fact

may be forward-looking statements, including, without limitation, the timing of and the anticipated benefits of the PIPE Financing. When

we use the words “intends,” “estimates,” “predicts,” “potential,” “continues,”

“anticipates,” “plans,” “expects,” “believes,” “should,” “could,”

“may,” “will” or the negative of these terms or other comparable terminology, we are identifying forward-looking

statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could

cause actual events or results to differ from those expressed or implied by the forward-looking statements. Factors that might cause such

a difference include, but are not limited to, those discussed in our periodic reports filed with the SEC, including those discussed in

the “Risk Factors” section in Part I, Item 1A of our Annual Report on Form 10-K filed with the SEC on August 30, 2021 and

the following factors::

- the risk of substantial dilution

from future issuances of our equity securities;

- our limited operating

history and experience in developing and manufacturing drugs;

- that none of our products

are approved for commercial sale;

- our substantial capital

needs;

- product development risks;

- our lack of sales and

marketing personnel;

- regulatory, competitive

and contractual risks;

- no assurance that

our product candidates will obtain regulatory approval or that the results of clinical studies will be favorable;

- risks related to our intellectual

property rights;

- uncertainty of

successful development of biopharmaceuticals;

- the volatility of the

market price and trading volume of our common stock;

- the other risks set forth in the documents

incorporated by reference herein under the caption “Risk Factors.”

Except as may be required by applicable

law, the Company does not undertake or intend to update or revise any forward-looking statements, and the Company assumes no obligation

to update any forward-looking statements contained in this Information Statement as a result of new information or future events or developments.

Thus, you should not assume that the Company’s silence over time means that actual events are bearing out as expressed or implied

in such forward-looking statements.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Based solely upon information made available

to the Company, the following table sets forth information as of the Record Date regarding the beneficial ownership of the Company’s

Common Stock by:

| |

· |

each person known by the Company to be the beneficial owner of more than 5% of the Company’s outstanding shares of Common Stock; |

| |

· |

each of the Company’s named executive officers and directors; and |

| |

· |

all of the Company’s officers and directors as a group. |

The percentage ownership information shown

in the table is based upon 24,893,083 shares of Common Stock outstanding as of the Record Date.

Beneficial ownership is determined in accordance

with the rules of the SEC and includes voting or investment power with respect to the securities. Except as otherwise indicated, each

person or entity named in the table has sole voting and investment power with respect to all shares of the Company’s capital shown

as beneficially owned, subject to applicable community property laws.

In computing the number and percentage of shares

beneficially owned by a person as of a particular date, shares that may be acquired by such person (for example, upon the exercise of

options or warrants) within 60 days of such date are counted as outstanding, while these shares are not counted as outstanding for computing

the percentage ownership of any other person.

The address of each holder listed below, except

as otherwise indicated, is c/o BioVie Inc., 680 W Nye Lane Suite 201, Carson City, NV 89703.

| Name and Address of Beneficial Owner | |

Number of Common Shares Before PIPE Financing | |

Percentage Before PIPE Financing | |

Number of Common Shares After PIPE Financing | |

Percentage After PIPE Financing |

| | |

| |

| |

| |

|

| Terren Peizer (1) |

|

|

19,529,846 |

|

|

|

78.2 |

% |

|

|

30,438,938 |

|

|

84.8% |

| Cuong Do (2) | |

| 521,241 | | |

| 2.1 | % | |

| 521,241 | | |

1.8% |

| Joanne Wendy Kim (3) | |

| 49,100 | | |

| * | | |

| 49,100 | | |

* |

| Joe Palumbo (4) | |

| 24,883 | | |

| * | | |

| 24,883 | | |

* |

| Penny Markham (5) | |

| 58,593 | | |

| * | | |

| 58,593 | | |

* |

| Chris Reading (6) | |

| 44,700 | | |

| * | | |

| 44700 | | |

* |

| Clarence Ahlem (6) | |

| 44.700 | | |

| * | | |

| 44,700 | | |

* |

| Richard Berman (7) | |

| 85,913 | | |

| * | | |

| 85,913 | | |

* |

| Steve Gorlin (8) | |

| 128,713 | | |

| * | | |

| 128,713 | | |

* |

| Robert Hariri (9) | |

| 78,513 | | |

| * | | |

| 78,513 | | |

* |

| James Lang (10) | |

| 126,707 | | |

| * | | |

| 126,707 | | |

* |

| Sigmund Rogich (11) | |

| 79,500 | | |

| * | | |

| 79,500 | | |

* |

| Michael Sherman (12) | |

| 121,572 | | |

| * | | |

| 121,572 | | |

* |

| All directors and executive officers as a group | |

| 20,893,980 | | |

| 83.6 | % | |

| 31,803,072 | | |

89.5% |

_________________________________

*Less than 1%

| (1) |

|

Includes warrants to purchase 7,272,724 shares of Common Stock. All shares held of record by Acuitas Group Holdings, LLC, a limited liability company 100% owned by Terren Peizer, and as to which, Mr. Peizer may be deemed to beneficially own or control. Mr. Peizer disclaims beneficial ownership of any such securities. |

| (2) |

|

Includes warrants to purchase 70,667 shares of Common Stock and options to purchase 294,975 shares of Common Stock, which are exercisable within 60 days of July 15, 2022. All shares of Common Stock, warrants and options are held of record by Mr. Do or Do & Rickles Investments, LLC, a limited liability company 100% owned by Cuong Do and his wife, and as such, Mr. Do may be deemed to beneficially own or control. |

| (3) |

|

Includes options to purchase 47,100 shares of Common Stock exercisable within 60 days of July 15, 2022. |

| (4) |

|

Represents options to purchase 24,883 shares of Common Stock, all of which are exercisable within 60 days of July 15, 2022. |

| (5) |

|

Includes options to purchase 85,593 shares of Common Stock exercisable within 60 days of July 15, 2022. |

| (6) |

|

Includes options to purchase 44,700 shares of Common Stock exercisable within 60 days of July 15, 2022. |

| (7) |

|

Includes options to purchase 84,313 shares of Common Stock, which are exercisable within 60 days of July 15, 2022. |

| (8) |

|

Includes options to purchase 78,713 shares of Common Stock, all of which are exercisable within 60 days of July 15, 2022. Common Stock held by Steve Gorlin includes shares of Common Stock held by Mr. Gorlin’s wife. |

| (9) |

|

Includes options to purchase 78,513 shares of Common Stock, all of which are exercisable within 60 days July 15, 2022. |

| (10) |

|

Includes warrants to purchase 18,788 shares of Common Stock and options to purchase 83,875 shares of Common Stock, all of which are exercisable within 60 days of July 15, 2022. |

| (11) |

|

Includes options to purchase 79,500 shares of Common Stock, all of which are exercisable within 60 days of July 15, 2022. |

| (12) |

|

Includes warrants to purchase 13,606 shares of Common Stock and options to purchase 121,572 shares of Common Stock, all of which are exercisable within 60 days of July 15, 2022. Common Stock held by Michael Sherman includes 13,333 shares of the Common Stock held of record by Sherman Children’s Trust Brian Krisber, Trustee. All shares of Common Stock, warrants and options are deemed to be beneficially owned or controlled by Michael Sherman. |

APPROVAL OF THE PIPE FINANCING FOR PURPOSES

OF NASDAQ RULE 5635

Purpose of the PIPE Financing

Our Board of Directors believes it is in the

best interests of the Company to raise capital in the amount of $6.0 million in a private placement transaction to fund the working capital

needs of the Company.

Description of the PIPE Financing

On July 15, 2022, the Company entered into a securities purchase agreement

(the “Purchase Agreement”) with the Purchaser, pursuant to which the Company agreed to issue and sell to the Purchaser, and

the Purchaser agreed to purchase from the Company, in a private placement, (i) an aggregate of 3,636,364 shares (the “PIPE Shares”)

of the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”), at a price of $1.65 per share

and (ii) a warrant (the “Warrant”) to purchase up to a number of shares of Common Stock equal to 200% of the PIPE Shares (the

“Warrant Shares”) at an exercise price of $1.82, with a term of exercise of five years. The aggregate purchase price for the

PIPE Shares and the Warrant (collectively, the “Securities”) sold in the Private Placement was approximately $6.0 million.

The closing of the transactions contemplated by the Purchase Agreement is subject to customary closing conditions and is expected to occur

on or about ________ __, 2022, or approximately 20 days after the mailing of this Information Statement.

As required under Nasdaq Listing Rule 5630, the

independent directors with no interest in the PIPE Financing different from, or in addition to, the interests of the Company’s stockholders

generally negotiated the terms and conditions of the PIPE Financing and approved the PIPE Financing.

The foregoing description of the Purchase Agreement is qualified in its entirety by reference

to the full and complete terms of the Purchase Agreement, which is filed as Exhibit 10.1 to the Company’s Current Report on Form

8-K filed with the Securities and Exchange Commission on July 15, 2022, which is incorporated herein by reference.

Reason for Stockholder Approval

Pursuant to Nasdaq Stock Market Listing

Rule 5635(c), if a company intends to issue securities to an officer, director, employee or consultant of the company at a price less

than the Current Market Price, the issuer generally must obtain the prior approval of its stockholders. Terren Peizer, the Company’s

Chairman, is the direct beneficial owner of the Majority Stockholder, and as such, the PIPE Financing may be considered an issuance of

securities to a director of the Company. Moreover, the Current Market Price was $1.81 on July 14, 2022, therefore the purchase price

for the Securities is less than the Current Market Price. As a result, Nasdaq Rule 5635(c) requires that the Company obtain stockholder

approval prior to issuing the Securities to the Purchaser.

Pursuant to Nasdaq Stock Market Listing Rule

5635(d), if an issuer intends to issue securities in a transaction which could result in the issuance of 20% or more of the issued and

outstanding shares of the issuer’s common stock on a pre-transaction basis for less than the Minimum Price for such stock, the issuer

generally must obtain the prior approval of its stockholders. The Minimum Price was $1.81 on July 14, 2022, therefore the purchase price

for the Securities is less than Minimum Price. In addition, as of July 14, 2022, the Company had 24,893,083 shares of Common Stock issued

and outstanding (the “Outstanding Shares”). The maximum number of shares of Common Stock to be issued to the Purchaser in

the PIPE Financing, assuming exercise in full of the Warrants, would result in the issuance of 10,909,092 shares, which is equal to 43.8%

of the Outstanding Shares on a pre-transaction basis. As a result, Nasdaq Rule 5635(d) requires that the Company obtain stockholder approval

prior to issuing the Securities in the PIPE Financing.

To ensure compliance with Nasdaq Rule 5635, the

Purchase Agreement provides that the Company may not issue and the Purchaser may not purchase any Securities unless stockholder approval

is obtained for such issuance.

Effect of the PIPE Financing on Existing Stockholders

The issuance of Securities pursuant to the Purchase

Agreement will not affect the rights of the holders of outstanding Common Stock, but such issuances will have a dilutive effect on the

Company‘s existing stockholders, including the voting power and economic rights of the existing stockholders.

Subject to the satisfaction or waiver of the

conditions to the closing of the PIPE Financing, upon the closing of the

PIPE Financing, (i) 3,636,364 shares of Common Stock and (ii) warrants to purchase up to 7,272,728 shares of Common Stock will be issued

to the Majority Stockholder pursuant to the terms of the Purchase Agreement. Collectively, these issuances, assuming full exercise of

the Warrants, will represent approximately 43.8% of the issued and outstanding shares of Common Stock and will increase the beneficial

ownership of Mr. Peizer from approximately 78.2% to 84.8% of our issued and outstanding shares of Common Stock.

Approval of the PIPE Financing

The approval of the PIPE Financing, including

for purposes of Nasdaq Rule 5635, requires the approval of the holders of our outstanding Common Stock having not less than the minimum

number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were

present and voted.

The Majority Stockholder, the holder of 19,529,846 shares of Common Stock, or approximately 78.2% of the Outstanding

Shares entitled to vote on this corporate action, approved the PIPE Financing by a written consent in lieu of special meeting, the

form of which is attached hereto as Exhibit A. Accordingly, the limitations on issuances and sales of securities under Nasdaq Rule

5635 will not apply to the PIPE Financing. Pursuant to Rule 14c-2(b) promulgated under the Exchange Act, such action may not be effected

until at least 20 calendar days following the mailing of this Information Statement to our stockholders. This Information Statement is

first being mailed on or about ________ __, 2022 to the Company’s stockholders of record as of the Record Date.

DISSENTERS’ RIGHTS OF APPRAISAL

Under the General Corporation Law of the State

of Nevada, our stockholders are not entitled to appraisal rights with respect to the PIPE Financing.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING

AN ADDRESS

Unless the Company is otherwise advised by the

stockholders, we will only deliver one copy of this Information Statement to multiple stockholders sharing an address. This practice known

as “householding” is intended to reduce the Company’s printing and postage costs.

We will, upon request, promptly deliver a separate

copy of this Information Statement to a stockholder who shares an address with another stockholder. A stockholder, who wishes to receive

a separate copy of this Information Statement, may direct such request to the Company at 680 W Nye Lane Suite 201, Carson City, NV 89703,

or you can contact us via telephone at (775) 888-3162. Stockholders who receive multiple copies of the Information Statement at their

address and would like to request that only a single copy of communications be delivered to the shared address may do so by making either

a written or oral request to the Company contacts listed above.

WHERE

YOU CAN FIND MORE INFORMATION

The Company files annual, quarterly and current

reports and other documents with the SEC. These reports contain additional information about BioVie. The Company’s SEC filings are

made available electronically to the public at the SEC’s website located at www.sec.gov. Stockholders can also obtain free copies

of the Company’s SEC filings through the “Investors” section of the Company’s website at www.biovieinc.com. The

Company’s website address is being provided as an inactive textual reference only. The information provided on the Company’s

website, other than the copies of the documents listed or referenced below that have been or will be filed with the SEC, is not part of

this Information Statement, and therefore is not incorporated herein by reference.

The SEC allows the Company to “incorporate

by reference” information that it files with the SEC in other documents into this Information Statement. This means that the Company

may disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated

by reference is considered to be part of this Information Statement. This Information Statement and the information that the Company files

later with the SEC may update and supersede the information incorporated by reference. Such updated and superseded information will not,

except as so modified or superseded, constitute part of this Information Statement.

The Company is incorporating by reference the

filings listed below and any additional documents that the Company may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d)

of the Exchange Act on or after the date of the initial filing of this Information Statement and before the actions described in this

Information Statement become effective, except the Company is not incorporating by reference any information furnished (but not filed)

under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

| |

· |

The Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2021 filed with the SEC on August 30, 2021 (the “2021 10-K”); |

| |

· |

The Company’s definitive proxy statement on Schedule 14A filed with the SEC on September 14, 2021; |

| |

· |

The Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended September 30, 2021, December 31, 2021 and March 31, 2022 filed with the SEC on November 10, 2021, February 8, 2022 and May 11, 2022, respectively; |

| |

· |

The Company’s Current Reports on Form 8-K filed with the SEC on August 11, 2021, October

14, 2021, December 1, 2021, June 29, 2022, and July 15, 2022; and |

| |

· |

The description of the Company’s securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, filed as Ex. 4.4 of the 2021 10-K. |

The Company undertakes to provide without charge

to each person to whom a copy of this Information Statement has been delivered, upon request, by first class mail or other equally prompt

means, a copy of any or all of the documents incorporated by reference in this Information Statement, other than the exhibits to these

documents, unless the exhibits are specifically incorporated by reference into the information that this Information Statement incorporates.

You may obtain documents incorporated by reference by requesting them in writing at BioVie Inc., 680 W Nye Lane Suite 201, Carson City,

NV 89703 or by telephone at (775) 888-3162.

OTHER

MATTERS

The Company has not authorized anyone to provide

information on behalf of the Company that is different from that contained in this Information Statement. This Information Statement is

dated July 15, 2022. No assumption should be made that the information contained in this Information Statement is accurate as of any

date other than that date, and the mailing of this Information Statement will not create any implication to the contrary.

The Company will make arrangements with brokerage

firms and other custodians, nominees and fiduciaries who are record holders of the Company’s Common Stock for the forwarding of

this Information Statement to the beneficial owners of the Company’s Common Stock. The Company will reimburse these brokers, custodians,

nominees and fiduciaries for the reasonable out-of-pocket expenses they incur in connection with the forwarding of the Information Statement.

| |

By Order of the Board of Directors,

Cuong V. Do

Chief Executive Officer

Dated: July __, 2022 |

EXHIBIT A

WRITTEN CONSENT

IN LIEU OF A MEETING

OF

THE MAJORITY STOCKHOLDER OF

OF

BIOVIE INC.

Pursuant

to Section 78.320 of the Nevada Revised Statutes (the “NRS”) and Article II, Section 7 of the Amended and Restated

By-laws (the “Bylaws”) of BioVie Inc., a Nevada corporation (the “Company”), the undersigned stockholder

(the “Majority Stockholder”), which holds at least a majority of the issued and outstanding shares of the Company’s

Class A common stock, par value $0.0001 per share (the “Common Stock”), does hereby waive any and all notices that

may be required to be given with respect to a meeting of the stockholders and, in lieu of holding a special meeting of the stockholders,

hereby consents to the adoption of and hereby adopts by written consent the following resolution. Pursuant to Article II, Section 7 of

the Bylaws, prompt notice of the below action shall be given to those stockholders who have not consented in writing.

WHEREAS,

the board of directors of the Company (the “Board”) previously adopted and has determined that it is advisable, fair

to and in the best interests of the Company and its stockholders for the Company to enter into the Securities Purchase Agreement (the

“Purchase Agreement”), dated July 15, 2022, by and between the Company and Acuitas Group Holdings, LLC, a California

limited liability company, as purchaser (the “Purchaser”), in substantially the form attached hereto as Exhibit

A. For purposes of these resolutions, any capitalized terms used and not otherwise defined shall have the meaning ascribed to such

terms in the Purchase Agreement; and

WHEREAS,

on the terms and subject to the conditions set forth in the Purchase Agreement,

the Company will issue and sell to Purchaser (i) 3,636,364 shares of Common Stock (the “PIPE Shares”) and (ii) a warrant

(the “Warrant”) to purchase 7,272,728 shares of Common Stock (the “Warrant Shares”), as more fully

set forth in the Purchase Agreement; and

WHEREAS,

pursuant to Nasdaq Listing Rule 5635, stockholder approval is required for the issuance of the PIPE Shares, the Warrant and the Warrant

Shares.

NOW,

THEREFORE, BE IT RESOLVED, that the issuance of the PIPE Shares, the Warrant and the Warrant Shares, subject in each case to the terms

and conditions set forth in the Purchase Agreement, be and hereby is approved.

[Signature page follows]

IN WITNESS WHEREOF,

the undersigned has duly executed this written consent on the date set forth below.

| |

ACUITAS GROUP HOLDINGS, LLC |

Date: _____________ |

By: ___________________________

Name: Terren S. Peizer

Title: Chairman |

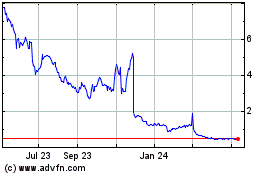

BioVie (NASDAQ:BIVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

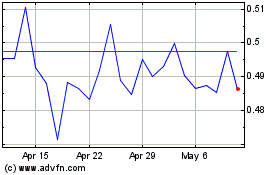

BioVie (NASDAQ:BIVI)

Historical Stock Chart

From Apr 2023 to Apr 2024