UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

SCHEDULE 14A

_____________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-12

United-Guardian, Inc.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1)

and 0-11

230

Marcus Boulevard • P. O. Box 18050 • Hauppauge, NY 11788 • (631) 273-0900

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 26, 2022

To the Stockholders of UNITED-GUARDIAN, INC.:

You are hereby notified that the 2022

annual meeting of stockholders (“Annual Meeting”) of UNITED-GUARDIAN, INC. (the “Company”), will be held

on Friday, August 26, 2022 at 1:00 P.M. Eastern Time. Due to the coronavirus pandemic, the Annual Meeting will be a virtual meeting

only, and will be held via a Zoom videoconference. Stockholders will not be able to physically attend the meeting. The virtual meeting

can be accessed by using either of the following links: https://us06web.zoom.us/j/88427136045?pwd=NXRRZDY0ZDBBai9aRUVKN3JqTjA1Zz09 or

bit.ly/3yywucl. Any stockholder who is unable to join the online meeting can participate by telephone by dialing (929) 205-6099, and using

the Zoom Meeting ID 884 2713 6045 and the Passcode 230MARCUS.

The meeting is being held for the following purposes:

| 1. | To elect five (5) directors to serve until the next annual meeting of the stockholders

and until their respective successors are elected and qualified; |

| 2. | To hold an advisory vote on the frequency of voting on the compensation paid to

the Company’s named executive officers; |

| 3. | To hold an advisory vote relating to the compensation of the Company’s named

executive officers; |

| 4. | To ratify the appointment by the Company of Baker Tilly US, LLP as its independent

registered public accounting firm for the fiscal year ending December 31, 2022; and |

| 5. | To transact such other matters as may properly come before the meeting or any adjournment

thereof. |

Only stockholders of record at the close of

business on July 7, 2022 are entitled to notice of and to vote at the meeting.

| |

By order of the Board of Directors |

|

| |

|

|

| Dated: July 22, 2022 |

/s/ Andrea Young |

|

| |

Andrea Young |

|

| |

Secretary |

|

|

RETURN OF PROXIES

It is important that your shares be represented and voted at the Annual

Meeting. To ensure your representation at the Annual Meeting, a proxy card and business reply envelopes are enclosed for your use. We

urge each stockholder to vote promptly by signing and returning his or her proxy card, regardless of the number of shares held.

(NOTE: Since this year’s meeting will be a virtual-only meeting,

there will not be any in-person voting).

|

Important notice regarding the availability

of proxy materials for the Annual Meeting of Stockholders to be held August 26, 2022: The Proxy Statement and Annual Report to Stockholders

are available on the Company’s website at https://u-g.com/view-annual-meeting/?meeting_year=2022.

230

Marcus Boulevard • P. O. Box 18050 • Hauppauge, NY 11788 • (631) 273-0900

Proxy Statement

The enclosed proxy is solicited by

the Board of Directors (“Board”) of UNITED-GUARDIAN, INC. (“Company”) for use at the 2022 Annual Meeting of Stockholders

(“Annual Meeting”) to be held be held on Friday, August 26, 2022 at 1:00 P.M. Eastern time and at any adjournments thereof.

Due to the ongoing coronavirus pandemic, the Annual Meeting will be a virtual meeting only, and will be held via a Zoom videoconference.

The virtual meeting can be accessed by using either of the following two links:

(1) https://us06web.zoom.us/j/88427136045?pwd=NXRRZDY0ZDBBai9aRUVKN3JqTjA1Zz09;

or

(2) bit.ly/3yywucl.

Any stockholder who is unable to join

the online meeting can participate by telephone by dialing (929) 205-6099, and using the Zoom Meeting ID 884 2713 6045 and the

Passcode 230MARCUS. Stockholders will not be able to physically attend the meeting.

A proxy granted hereunder is revocable

at any time before it is voted by (a) a duly executed proxy bearing a later date, or (b) written notice to the Secretary of the Company

received by the Company at any time before such proxy is voted at the Annual Meeting.

It is anticipated that the mailing

of this Proxy Statement and the accompanying Proxy to stockholders will commence on or about July 22, 2022.

SOLICITATION OF PROXIES

The persons named as proxies are Ken

Globus and Andrea Young.

All shares represented by properly

executed, unrevoked proxies received in proper form and in time for use at the Annual Meeting will be voted in accordance with the directions

specified thereon and otherwise in accordance with the judgment of the persons designated as proxies. Any proxy on which no direction

is specified will be voted in favor of the nominees to the Board listed in this Proxy Statement and for the approval of the proposals

to (i) have an advisory stockholder vote every (one year) on the compensation paid to the Company’s named executive officers; (ii) approve

the compensation of the Company’s named executive officers; and (iii) ratify the appointment of Baker Tilly US, LLP (“Baker”)

as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022, but will not be voted

in favor of stockholder proposals (if any) included in this Proxy Statement. If any other matters are properly presented at the Annual

Meeting for consideration, the persons named as proxies in a properly delivered proxy card will have the discretion to vote on those matters

for the stockholder delivering the proxy card. As of the date we filed this Proxy Statement with the Securities and Exchange Commission

(“SEC”), the Board was not aware of any other matters to be raised at the Annual Meeting.

The cost of preparing, assembling and

mailing the Notice of Annual Meeting, Proxy Statement, proxy card and any other materials enclosed, will be borne by the Company. In addition

to the solicitation of proxies by use of the mails, officers and employees of the Company may solicit proxies by telephone, facsimile,

or personal interview. They will not receive additional compensation for their effort. The Company will request brokerage houses and other

custodians, nominees and fiduciaries to forward soliciting materials to the beneficial owners of stock held of record by such persons,

and will reimburse such persons for their expenses in forwarding soliciting material. The Company does not anticipate paying any compensation

to any other party for the solicitation of proxies.

VOTING SECURITIES AND PRINCIPAL STOCKHOLDERS

Outstanding Shares and Voting Rights

Only holders of record of the Company’s

Common Stock, par value $.10 per share (“Common Stock”), at the close of business on July 7, 2022, will be entitled to notice

of and to vote at the Annual Meeting. As of July 7, 2022, there were 4,594,319 shares of Common Stock outstanding. The holders of a majority

of the shares of Common Stock issued and outstanding must be present or represented by proxy at the annual meeting to have a quorum. Each

outstanding share of Common Stock is entitled to one vote on all matters submitted to a vote at the Annual Meeting, which vote may be

given in person or by proxy. There are no cumulative voting rights.

Nominees for director are elected if the

votes cast for a nominee’s election exceed the votes cast against that nominee’s election.

The affirmative vote of the holders of

a majority of shares of Common Stock present, in person or by proxy, and eligible to vote at the Annual Meeting is necessary for the approval

of the proposals to (i) have an advisory stockholder vote every year on the compensation paid to

the Company’s named executive officers; (ii) approve the compensation of the Company’s named executive officers; and

(iii) ratify the appointment of Baker as the Company's independent registered public accounting firm for the fiscal year ending December

31, 2022.

Any broker holding shares in “street

name” on behalf of a stockholder is required to vote those shares in accordance with the stockholder’s instructions. If the

stockholder does not give instructions to the broker, the broker will be entitled to vote the shares with respect to “routine”

items, but will not be permitted to vote the shares with respect to non-routine items (resulting in a “broker non-vote”).

The ratification of the selection of Baker is a “routine” item. The election of directors, the

advisory vote on the frequency of voting on the compensation paid to the Company’s named executive officers, the advisory

vote relating to the compensation of the Company’s named executive officers, and stockholder proposals, if any, are non-routine

items.

Under Delaware law, shares as to which

a stockholder abstains or withholds authority to vote and broker non-votes will be treated as present at the Annual Meeting for the purposes

of determining a quorum. Proxies marked "Withhold Authority" with respect to the election of one or more directors will not

be counted in determining who the five persons are who received the greatest number of votes in the election of directors. Proxies marked

“Abstain” with respect to (a) the ratification of the appointment of Baker as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2022; (b) the advisory vote on the frequency

of voting on the compensation paid to the Company’s named executive officers; (c) the advisory vote relating to the compensation

of the Company’s named executive officers; or (d) stockholder proposals (if any) that are properly presented at the Annual Meeting,

will have the effect of a vote against approval or ratification with respect to such proposals.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth the shares

of the Company’s Common Stock, par value $.10 per share (the only class of stock issued and outstanding), owned beneficially by

each person who, as of July 1, 2022 is known by the Company to have owned beneficially more than 5% of the outstanding Common Stock. Regarding

the shares referenced in footnote (1) below, the beneficial owner has both sole voting power and sole investment power, except for those

shares held by his spouse as noted.

| Name and Address of Beneficial Owner |

Number of Shares Owned |

Percent of Class |

| |

|

|

|

Ken Globus

c/o United-Guardian, Inc.

230 Marcus Blvd., Hauppauge, NY 11788 |

1,318,053 (1) |

28.7% |

| |

|

|

|

Dr. Betsee Parker

P.O. Box 2198, Middleburg, VA 20118 |

354,133 (2) |

7.7% |

| |

|

|

|

Renaissance Technologies LLC

800 Third Avenue, New York, NY 10022 |

230,263 (3) |

5.0% |

| |

|

|

|

Mario J. Gabelli

One Corporate Center, Rye, NY 10580 |

256,811 (4) |

5.6% |

| (1) | 279,027 shares held directly in his own name, and another 1,039,026 shares held beneficially as follows:

760,000 shares as joint Trustee of the Alfred Globus Testamentary Trust, as to which he has sole voting rights and shared investment power,

and 279,026 shares held by his wife. |

| (2) | As of March 8, 2022, based on information provided to the Company by a representative of Dr. Betsee Parker. |

| (3) | Based on Schedule 13G/A filed by Renaissance Technologies LLC with the SEC on February 11, 2022 |

| (4) | As of March 3, 2022, based on information provided to the Company by Gabelli. Of this total, 38,000 shares

are owned by Gabelli Funds, LLC; 70,511 shares by Teton Advisors, Inc.; and 148,300 shares by GAMCO Asset Management Inc. and GAMCO Investors,

Inc. Some of the shares of Common Stock beneficially owned by Mr. Gabelli are also beneficially owned by certain of the other related

entities. However, none of such entities individually reported beneficial ownership of shares constituting more than 5% of the outstanding

shares of Common Stock of the Company. |

SECURITY OWNERSHIP OF MANAGEMENT

The following information is furnished with respect

to ownership of shares of Common Stock as of July 1, 2022, by each named executive officer, each director (which includes all nominees

for director) and by all directors and executive officers of the Company as a group (8 persons). Except as otherwise indicated, the beneficial

owner has sole voting and investment power.

| Name of Beneficial Owner |

Amount and Nature

of Beneficial

Ownership |

Percent of

Class |

| Ken Globus |

1,318,053(1) |

28.7% |

| Arthur M. Dresner |

12,175 |

(2) |

| Lawrence F. Maietta |

4,000 |

(2) |

| Peter A. Hiltunen |

320 |

(2) |

| Andrew A. Boccone |

0 |

(2) |

| S. Ari Papoulias |

0 |

(2) |

| Andrea Young |

0 |

(2) |

| Donna Vigilante |

0 |

(2) |

| All Officers and directors as a group (8 persons) |

1,334,548 |

29.1% |

| (1) | 279,027 shares held directly in his own name, and another 1,039,026 shares held beneficially as follows: 760,000 shares as joint Trustee

of the Alfred Globus Testamentary Trust, as to which he has sole voting rights and shared investment power, and 279,026 shares held by

his wife. |

| |

(2) |

Less than one

percent (1%). |

RELATED PARTY TRANSACTIONS

The Company has adopted a written policy

for the approval of “related party” transactions. Under the policy, related parties are defined to include executive officers

and directors of the Company and their immediate family members, a stockholder owning in excess of 5% of the Company, and entities

in which any of the foregoing have a substantial ownership interest or control. The policy applies to any transactions that exceed or

are expected to exceed $50,000 in a single calendar year.

The policy provides that the Audit Committee

will review transactions subject to the policy and decide whether or not to approve or ratify those transactions. In doing so, the Audit

Committee will make a determination as to whether the transaction is in the best interests of the Company and its stockholders, taking

into account (a) the benefits to the Company and its stockholders; (b) the extent of the related person’s interest in the transaction;

(c) whether the transaction is on terms generally available to an unaffiliated third-party under the same or similar circumstances; (d)

the impact or potential impact on a director’s independence in the event the related party is a director, an immediate family member

of a director, or an entity in which a director is a partner, shareholder or executive officer; and (e) the terms of each transaction.

The policy also provides that director and officer compensation that is approved by the Board or the Compensation Committee is exempt

from this approval process and will be considered to be pre-approved. The Related Party Transaction Policy can be found on the Company's

web site at www.u-g.com.

There were no related party transactions

during the fiscal year ended December 31, 2021.

PROPOSAL ONE

ELECTION OF DIRECTORS AND MANAGEMENT INFORMATION

Nominees for Election as Directors

Five (5) directors are to be elected at

the Annual Meeting to serve until the next annual meeting of stockholders and until their successors have been elected and qualified.

Set forth in the table below are the names of all persons nominated for election as directors (all of whom are currently directors) by

a majority of the Company’s independent directors, the principal occupation or employment of each nominee for at least the past

five years, his present positions with the Company, his qualifications to serve as a director, other board memberships of public companies,

and the year he was first elected a director.

| Name and Position with the Company |

Age |

Principal Occupation, Qualifications, and other Directorships |

Year First Elected as Director |

|

Ken Globus

President

Chief Executive Officer

General Counsel

Chairman of the Board

|

71 |

President and General Counsel of the Company since July 1988; Chief Financial

Officer of the Company from November 1997 to December 2006; and Chairman of the Board since September 2009. He has leadership experience,

legal experience from his prior years as an attorney in private practice, business experience, and knowledge of the Company’s operations

from over 38 years as General Counsel, Vice President, and then President of the Company. He holds a bachelor’s degree in Psychology

and English from the State University of New York at Albany, and a Juris Doctor degree from the George Washington University Law School.

|

1982 |

|

Lawrence F. Maietta

Director |

64 |

Partner in the accounting firm of PKF O’Connor Davies, LLP, New York,

NY since January 1, 2021; partner in the accounting firm of Bonamassa, Maietta & Cartelli, LLP, Brooklyn, NY, from 1991 through December

2020; and Controller of the Company from October 1991 to November 1997. He has financial experience, business experience, and an extensive

knowledge of the Company’s operations. He has been a CPA and consultant preparing financial reports and tax returns for the Company

and other clients for more than 35 years. He holds a bachelor’s degree in Business Administration from Niagara University, and an

MBA from Hofstra University. (2)

|

1994 |

|

Arthur M. Dresner

Director |

81 |

Counsel to the law firm of Duane Morris LLP, New York, NY since August

2007. He has leadership experience, legal experience, business experience, and a scientific education and background. From 1998 to 2007

he was partner and previously “Of Counsel” to the law firm of Reed Smith, LLP, New York, NY. For more than 20 years prior,

he was employed by GAF Corporation and its subsidiary, International Specialty Products, Inc., Wayne, NJ, including having been Vice President

of corporate development and general management for the last 8 of those years. He holds a bachelor’s degree in Engineering from

Stevens Institute of Technology, and a Juris Doctor degree from St. John’s University School of Law. (1)

(2)

|

1997 |

|

Andrew A. Boccone

Director |

76 |

Independent business consultant since 2001. He has leadership experience,

business experience, and a scientific education and background. For more than 25 years he was employed by Kline & Company, Inc., Parsippany,

NJ, an international business consulting and market research firm specializing in the chemicals industry, consumer products, life sciences,

and energy, including having been President from 1990 to 2001. He holds a bachelor’s degree in Chemistry from Hofstra University,

and an MBA from Seton Hall University. (1) (2)

|

2002 |

|

S. Ari Papoulias

Director |

68 |

Principal of ChemRise LLC, a business advisory firm providing technology, marketing, and financial advice to firms in the chemicals industry, since 2016; from 2006 to 2015 Global Marketing Director for Momentive Performance Materials (formerly GE Advanced materials); from 1987 to 2006 initially Business Manager of Advanced Materials, then Business Director of Industrial Markets, and then Global Marketing Director of Performance Chemicals for International Specialty Products, Inc., Wayne, NJ. He has leadership experience, business and financial experience, and a scientific background and education. He holds a B.Sc. in Chemical Engineering from the University of Massachusetts, an M.Sc. in Chemical Engineering from the University of Florida, a Ph.D. in Chemical Engineering from Carnegie Mellon University, and an MBA in Finance from New York University. (1) |

2016 |

(1) Member of Audit Committee

(2) Member of Compensation Committee

There are no family relationships between

any director and/or officer of the Company.

The Board recommends a vote “FOR” the

election of the five (5) nominees named for election as directors.

Board Diversity Matrix

The matrix below reflects our Board’s gender

and racial characteristics and LGBTQ+ status, based on the self-identification of our directors. Each of the categories below has the

meaning as it is used in Nasdaq Rule 5605(f).

| Board Diversity Matrix (as of July 20, 2022) |

| Total Number of Directors |

5 |

| Gender Identity: |

Male |

Female |

Non-Binary |

Gender Undisclosed |

| Directors |

5 |

0 |

0 |

0 |

| Number of Directors who Identify in any of the Categories Below: |

| African American or Black |

- |

- |

- |

- |

| Alaskan Native or Native American |

- |

- |

- |

- |

| Asian |

- |

- |

- |

- |

| Hispanic or Latinx |

- |

- |

- |

- |

| Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

| White |

5 |

- |

- |

- |

| Two or More Races or Ethnicities |

- |

- |

- |

- |

| LGBTQ+ |

- |

| Did Not Disclose Demographic Background |

- |

Legal Proceeding Involving Directors

There were no legal proceedings involving the nominees

to the Board in the past ten years.

Executive Officers and Significant Employees

| Name and Position with the Company |

Age |

Principal Occupation During the Past Five Years |

|

Ken Globus

President

Principal Executive Officer

General Counsel

Chairman of the Board |

71 |

President and General Counsel of the Company from July 1988 to date; Chairman of the Board and Principal Executive Officer since September 2009; Chief Financial Officer of the Company from November 1997 to December 2006. |

|

Peter A. Hiltunen

Senior Vice President

Production Manager |

63 |

Senior Vice President of the Company from April 2020 to date; Vice President of the Company from July 2002 to April 2020; Production Manager of the Company since 1982. |

|

Andrea Young

Principal Financial Officer

Controller; Treasurer

Secretary

|

53 |

Secretary of the Company from April 2020 to date; Treasurer and Principal Financial Officer of the Company from May 2018 to date; Controller of the Company from September 2016 to date; Human Resources Manager of the Company from May 2017 to date. |

|

Donna Vigilante

Vice President

R&D Manager |

42 |

Vice President of the Company since May 2020; Research and Development Manager of the Company since September 2017; Research and Development chemist from November 2015 until September 2017. |

Board Leadership Structure

The Company is led by Ken Globus, who

has served as President since 1988 and Chairman of the Board since September 2009. The Board is composed of Ken Globus and four independent

directors. The Board has two standing committees composed solely of independent directors: the Audit Committee and the Compensation Committee.

The Board also has a Stock Option Committee. Only the Audit Committee has a chairman.

The Board does not have a lead director

as all of the independent directors have a strong knowledge of Company operations and have held leadership positions in their respective

employment, both past and present. The independent directors meet in executive session at least twice per year in accordance with NASDAQ

guidelines. The Company has had this same basic leadership structure since it was founded in 1942, except that the committees were not

established until the 1990s. The Board believes that this leadership structure has been effective for the Company considering its size

and its resources, and similar leadership structures are commonly utilized by other small public companies in the United States.

Affirmative Determinations Regarding Director Independence

The Company’s Board has considered

the independence of the nominees for election at the Annual Meeting and has affirmatively determined that none of the four non-employee

nominees for director: Lawrence Maietta, Arthur Dresner, Andrew Boccone, and S. Ari Papoulias, has any material business, family or other

relationship with the Company other than as a director, and for that reason they all qualify as independent under the corporate governance

rules of NASDAQ. Lawrence Maietta does receive compensation as an outside accounting consultant in addition to the fees he receives as

a director, which disqualifies him from serving on the Audit Committee. However, the Board has determined that the additional compensation

is not material and falls well below the thresholds established by NASDAQ and the SEC for determining director independence for purposes

other than serving on the Audit Committee. Ken Globus is not independent due to his status as President of the Company, and not due to

any other transactions or relationships.

Role of the Board in Risk Oversight

The Board views risk management as a process

designed to identify, manage, and control risks that may adversely affect the Company, so that they are appropriate considering the Company's

size, operations and business objectives. The Company’s risk management policies enable the Company to manage risk within acceptable

limits and provide reasonable assurance of optimum corporate performance in the area of risk/return. The Board has ultimate responsibility

for oversight of the Company’s risk management processes, and discharges this responsibility through regular reports received from,

and discussions with, senior management on all areas of material risk exposure to the Company. These reports and discussions include,

among other things, operational, financial, legal and regulatory, and strategic risks. The full Board engages with the appropriate members

of senior management to enable its members to understand and provide input to, and oversight of, risk identification, risk management

and risk mitigation strategies. In addition, the Company’s Audit Committee is responsible for evaluating and monitoring financial

risks, and meets regularly in executive session without management present to, among other things, discuss the Company’s risk management

culture and processes. While the Board oversees the Company’s risk management, the Company’s senior management is responsible

for day-to-day risk management processes.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange

Act of 1934 (the “Exchange Act”) requires the Company’s officers, directors and persons who own more than 10% of a class

of the Company’s equity securities to file reports of beneficial ownership and changes in beneficial ownership with the SEC. Officers,

directors and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms

they file. Based on (i) a review of copies of Forms 3, 4, and 5 and any amendments thereto furnished to the Company during and with respect

to the fiscal year ended December 31, 2021 and (ii) any written representations signed by reporting persons that no Form 5 is required,

the Company believes that all persons subject to the reporting requirements pursuant to Section 16(a) filed the required reports

on a timely basis during and with respect to the fiscal year ended December 31, 2021.

Directors Meetings

During the fiscal year ended December

31, 2021, the Board held four regular meetings. All five directors participated in all four regular directors’ meetings, as well

as the Annual Meeting of Stockholders.

The Board has a separately-designated

standing Audit Committee, established in accordance with Section 3(a)(58)(A) of the Exchange Act, to oversee the accounting and financial

reporting processes of the Company and to meet and review with the Company’s independent auditors the plan, scope and results of

its audits. Members of the Audit Committee in 2021 were Messrs. Arthur M. Dresner, the Chairman, Andrew A. Boccone, and S. Ari Papoulias.

All of the Audit Committee members are independent as that term is defined in the listing standards of NASDAQ, the Company’s stock

exchange since March 16, 2009. Under NASDAQ rules, the Board is required to make certain findings about the independence and qualifications

of the members of the Audit Committee of the Board. In addition to assessing the independence of the members under NASDAQ rules, the Board

also considered the requirements of Section 10A(m)(3) and Rule 10a-3 under the Exchange Act. As a result of its review, the Board determined

that the Audit Committee does not have a financial expert. However, S. Ari Papoulias is considered “financially sophisticated”

as that term is defined by NASDAQ. Lawrence F. Maietta, a Certified Public Accountant and former member of the Audit Committee, acts as

an advisor to the Audit Committee. Mr. Maietta would not be deemed independent for purposes of membership on the Audit Committee. The

reason for the absence of a financial expert is that the Board determined that the expense involved did not justify recruiting one, considering

Mr. Maietta’s presence as an advisor, and the “financially sophisticated” status of Mr. Papoulias. There were four meetings

of the Audit Committee held during the fiscal year ended December 31, 2021. All members attended all four meetings. A copy of the Audit

Committee Charter is available on the Company’s website at www.u-g.com/corporate.

During the fiscal year ended December

31, 2021, the directors who were independent directors of the Company, Messrs. Lawrence F. Maietta, Arthur M. Dresner, Andrew A. Boccone,

and S. Ari Papoulias, held two meetings in executive session without the presence of non-independent directors and management in accordance

with NASDAQ rules. All of the independent directors were present at both of the meetings.

The Board has a Compensation Committee

which was formed in 1999 for the purpose of recommending to the Board the compensation of corporate officers and key employees for the

ensuing year. Members of the Compensation Committee are Messrs. Lawrence F. Maietta, Arthur M. Dresner, and Andrew A. Boccone. Ken Globus

acts as advisor to the Committee representing management. The Committee held one meeting in 2021. The Compensation Committee does not

have a charter. Neither management nor the Committee has engaged a consultant to provide advice on compensation.

Prior to 2021 the Compensation Committee

met in June of each year for the purpose of determining the amount, if any, to be paid in bonuses to the Company’s employees in

July of each year. In 2021 the meeting was moved to March and the bonuses paid in April. The bonuses are based on the Company’s

financial results for the previous fiscal year, and are determined either by (a) specifying a bonus pool that is allocated to non-manager

employees on a pay-to-pay formula, or (b) specifying a percentage increase or decrease to the previous year’s bonuses. Bonuses to

managers are determined on an individual basis, based on both individual performance as well as the prior year’s financial results.

In addition, the Committee determines the amount of any cost-of-living increase for all employees based upon U.S. Department of Labor

statistics for the prior year. The bonuses are paid as a single cash payment.

The Compensation Committee does not set

compensation of directors. Instead, the full Board acts on recommendations made by the independent directors. In its review of compensation

of directors, the Board considers various factors, such as compensation of directors in other public companies of a similar size, the

time spent by Board and Committee members in their service to the Company, and recent changes that may result in an increase or decrease

in the responsibilities or time commitment of a Board and Committee member.

The Board does not have a standing Nominating

Committee. The full Board fulfills the role of a nominating committee. Final selections are made by a majority of the independent directors.

It is the position of the Board that it is appropriate for the Company not to have a separate nominating committee because the size, composition

and collective independence of the Board enables it to adequately fulfill the functions of a standing committee. NASDAQ does not require

the Company to have a separate nominating committee but does require that Board nominees be selected by either a nominating committee

composed solely of independent directors or by a majority of the independent directors.

The Board identifies director candidates

through a combination of referrals, including by management, existing Board members, and stockholders. Once a candidate has been identified,

the Board reviews the individual’s experience and background, and may discuss the proposed nominee with the source of the recommendation.

If the independent directors believe it to be appropriate, such directors may meet with the proposed nominee before making a final determination

on whether to include the proposed nominee as a member of management’s slate of director nominees submitted to the stockholders

for election to the Board. The Board will evaluate stockholder-nominated candidates under the same criteria as director-nominated candidates.

Stockholders wishing to refer director candidates to the Board should do so in writing and they should be delivered to the Board c/o Corporate

Secretary, United-Guardian, Inc., P.O. Box 18050, Hauppauge, NY 11788. The Board has adopted a corporate resolution with regard to the

nominating process as discussed above. The Board has no charter for the nominating process.

AUDIT COMMITTEE REPORT

In 2021 the Audit Committee of the Board

comprised three directors: Arthur M. Dresner, Andrew A. Boccone, and S. Ari Papoulias. All of the Audit Committee members are “independent”

as that term is defined in the listing standards of NASDAQ.

The Audit Committee assists the Board

in fulfilling its oversight responsibilities by reviewing the Company’s consolidated financial reports, its internal financial and

accounting controls, and its auditing, accounting and financial reporting processes generally.

In discharging its oversight responsibilities

regarding the audit process, the Audit Committee reviewed and discussed the audited consolidated financial statements of the Company as

of and for the year ended December 31, 2021, with Company management and Baker Tilly US, LLP (“Baker”) the Company’s

independent registered public accounting firm auditors. The Audit Committee received the written disclosures and the letter from Baker

required by applicable requirements of the Public Company Accounting Oversight Board regarding Baker’s communications with the Audit

Committee concerning their independence, and discussed with Baker any relationships which might impair that firm’s independence

from management and the Company and satisfied itself as to the auditors’ independence. The Audit Committee reviewed and discussed

with Baker all communications required by generally accepted auditing standards, including Statement on Auditing Standards No. 61, as

amended (AICPA, Professional Standards, Vol. 1 AU section 380).

Based upon these reviews and discussions, the Audit

Committee recommended to the Board that the Company’s audited consolidated financial statements for the year ended December

31, 2021, be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for filing

with the SEC.

| /s/ Arthur M. Dresner |

/s/ Andrew A. Boccone |

/s/ S. Ari

Papoulias |

The foregoing Audit Committee Report does

not constitute soliciting material and shall not be deemed “filed” with the SEC, incorporated by reference into any other

Company filing under the Securities Act of 1933 or the Exchange Act (except to the extent the Company specifically incorporates this Report

by reference therein) or subject to the liabilities of Section 18 of the Exchange Act.

PROPOSAL TWO

ADVISORY VOTE ON THE FREQUENCY OF VOTING ON THE

COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS

Section 14A of the Exchange Act requires

the Company to include in its proxy statement an advisory vote on named executive officer compensation. Section 14A also requires

the Company to include in its proxy statement at least at least every six years an advisory vote regarding the frequency with which the

advisory vote on named executive officer compensation should be held. The Board has included in each of its Proxy Statements beginning

with the Proxy Statement for the 2013 Annual Meeting of Stockholders an advisory vote on named executive officer compensation and currently

plans to continue to seek an advisory vote on executive compensation every year. Stockholders will be able to specify one of four choices

for this proposal on the proxy card or voting instruction: one year, two years, three years or abstain.

We are asking you to vote to approve the

adoption of the following resolution:

RESOLVED: That the stockholders of the Company approve,

on a nonbinding, advisory basis, the holding of an advisory vote on compensation paid to the Company's named executive officers, every

year.

The Board believes this approach

would align more closely with the interests of stockholders by giving stockholders the opportunity to cast a vote regarding the compensation

decisions made by the Compensation Committee each year. The Board believes that an annual vote provides the most direct communication

and clarity and avoids delays.

The Board recommends that you vote for “ONE YEAR”

as the preferred frequency for the approval of the non-binding advisory resolution of the future compensation of the Company’s named

executive officers.

PROPOSAL THREE

ADVISORY VOTE ON THE

COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS

Pursuant

to Section 14A of the Exchange Act, we are including a proposal for our stockholders to vote to approve, on a nonbinding, advisory

basis, the compensation of those of our executive officers disclosed pursuant to Item 402 of Regulation S-K in this proxy statement.

Our executive compensation is designed

to reward executive performance that contributes to our success and increases stockholder value, while encouraging behavior that is in

our and our stockholders’ long-term best interests.

We are asking you to vote to approve the

adoption of the following resolution:

RESOLVED: That the stockholders

of the Company approve, on a nonbinding, advisory basis, the compensation paid to the Company’s named executive officers, as disclosed

pursuant to Item 402 of Regulation S-K.

The stockholder vote on the proposal to

approve the compensation paid to the Company’s named executive officers is advisory and nonbinding, and serves only as a recommendation

to our Board.

The

Board recommends that you vote “FOR” the proposal to approve the compensation paid to the Company’s named executive

officers.

COMPENSATION OF EXECUTIVE OFFICERS

AND DIRECTORS

Summary Compensation Table

Executive Officers

The following table sets forth for the

years ended December 31, 2021 and December 31, 2020 certain information concerning the compensation awarded to, earned by or paid to the

Company’s principal executive officer and the three most highly compensated executive officers other than the principal executive

officer:

| Name and position |

Year |

Salary

($) |

Bonus(1)

($) |

All other

compensation(2)

($) |

Total

($) |

|

Ken Globus

President

Chief Executive Officer

Chairman of the Board

|

2021 |

284,876 |

91,700 |

29,209 |

405,785 |

| 2020 |

280,498 |

131,100 |

29,155 |

440,753 |

|

Donna Vigilante

Vice President

R&D Manager;

Director of Technical Services

|

2021 |

122,733 |

30,000 |

15,383 |

168,116 |

|

Andrea Young

Chief Financial Officer

Controller, Treasurer, Secretary |

2020 |

109,817 |

25,000 |

13,749 |

148,566 |

|

Peter A. Hiltunen

Senior Vice President

Production Manager

|

2021 |

166,522 |

25,000 |

19,290 |

210,812 |

| 2020 |

163,987 |

34,800 |

18,922 |

217,709 |

(1) The payment of executive bonuses is at the discretion

of the Company’s Board of Directors. The amounts of such bonuses are determined by the Company’s Compensation Committee and

are based on the financial results of the previous fiscal year.

(2) In both 2021 and 2020 under the Company’s

401(k) plan for all its employees, the Company made a contribution of up to 4% of each employee’s salary, matching an employee’s

elective deferral of up to 4% of salary. In addition, in 2009 the Company began making a discretionary contribution to all employees’

401(k) accounts based on a formula that qualifies the 401(k) plan under Internal Revenue Service (“IRS”) Safe Harbor provisions.

These amounts represent the Company's contribution for each year. There are no other items included in these amounts.

Pension Plans

The Company sponsors a 401(k)-defined

contribution plan (“DC Plan”) that provides for a dollar-for-dollar employer matching contribution of up to 4% of each employee’s

pay that is deferred under the DC Plan. Employees become fully vested in employer matching contributions immediately. Company 401(k) matching

contributions were approximately $80,000 for the year ended December 31, 2021 and $83,000 for the year ended December 31, 2020. In 2021

and 2020 employees were able to defer up to $19,500 of their annual pay as a pre-tax investment in the 401(k) plan (plus an additional

$6,500 for employees over the age of 50), in accordance with limits set by the IRS.

The Company also makes discretionary contributions

to each employee’s account based on a “pay-to-pay” safe-harbor formula that qualifies the 401(k) plan under current

IRS regulations. The Company’s Board authorized discretionary contributions of $109,000 and $130,000 in November 2021 and November

2020, respectively, to be allocated among all eligible employees, for the 2021 and 2020 plan years, respectively. The Company’s

contribution for 2021 was paid into the DC plan in January 2022, and the contribution for 2020 was paid into the DC Plan in December 2020.

The allocated amounts for FY-2021 and FY-2020 were distributed into each employee’s account in January 2022 and January 2021, respectively.

Employees become vested in the discretionary contributions as follows: 20% after two years of employment, and 20% for each year of employment

thereafter until the employee becomes 100% vested after six years of employment.

All the persons named in the Summary Compensation

Table above participated in the DC Plan. All were fully vested as of December 31, 2021, with the exception of Andrea Young.

Outstanding Equity Awards at Fiscal Year-End

As of December 31, 2021, there were

no outstanding equity awards held by the persons named in the Summary Compensation Table above. The Company’s previous stock option

plan, which had been adopted in March 2004, expired in March 2014.

Director Compensation

Effective January 1, 2021, the annual

retainer paid to each non-employee director was increased to $14,500 from $13,900, paid quarterly, and non-employee director fees for

meetings of the full Board increased by $150 per director per meeting, with non-employee directors each receiving a fee of $2,300 for

each Board meeting attended. Ken Globus, as President of the Company, does not receive separate compensation for his service as a director.

Each Audit Committee member and Mr. Lawrence F. Maietta, as an adviser to the Committee, receives a retainer of $750 per quarter. Mr.

Arthur M. Dresner, the Committee Chairman, receives an additional $250 per quarter. In addition, each receives a fee of $1,500 for the

Annual Audit Committee Meeting and $1,000 for each quarterly meeting. The Audit Committee Chairman, Mr. Arthur M. Dresner, receives an

additional $1,250 for the Annual Audit Committee Meeting and an additional $750 for each quarterly meeting. The Committee Secretary, Mr.

Andrew A. Boccone, receives an additional $250 for each meeting. Compensation Committee members each receive a fee of $1,000 for each

meeting attended. No fees are paid for meetings of the independent directors.

The following table sets forth for the

fiscal year ended December 31, 2021 certain information concerning the compensation paid to directors of the Company who are not “named

executive officers” (as such term is defined in Item 402(m)(2) of Regulation S-K):

|

Name |

Fees earned or paid in

cash

($) |

All other

compensation

($) |

Total

($) |

| Lawrence F. Maietta |

47,200 |

19,500(1) |

66,700 |

| Arthur M. Dresner |

51,700 |

- |

51,700 |

| Andrew A. Boccone |

48,200 |

- |

48,200 |

| S. Ari Papoulias |

46,200 |

- |

46,200 |

| (1) | Consulting fee paid to of PKF O’Connor Davies, LLP, New York, NY, of which Lawrence F. Maietta is

a partner, for work performed by Mr. Maietta in connection with his review of the Company’s quarterly and annual financial statements

and corporate tax returns. |

PROPOSAL FOUR

RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The firm of Baker Tilly US, LLP (“Baker”),

headquartered in Melville, N.Y., has been appointed by the Audit Committee of the Board to be the independent registered public accounting

firm of the Company for the fiscal year ending December 31, 2022. The appointment of such firm is subject to ratification by the

stockholders at the Annual Meeting. Management believes that the firm is well qualified and recommends a vote in favor of the ratification.

Representatives of Baker are expected to be present at the Annual Meeting and will have an opportunity to make a statement, if they desire

to do so, and will be available to respond to appropriate questions.

Neither

the Company’s bylaws nor the governing documents or law require stockholder ratification of the selection of Baker as the Company’s

independent registered public accounting firm. However, this proposal is being submitted to the stockholders as a matter of good corporate

practice. If the stockholders do not ratify Baker, the appointment of another firm of independent certified public accountants may be

considered by the Audit Committee. Even if Baker is ratified, the Audit Committee may, in its discretion, direct the appointment of a

different independent registered public accounting firm at any time during the year if they determine that doing so is in the best interests

of the Company and its stockholders.

The Board recommends that you vote

“FOR” the ratification of the appointment of Baker to serve as the Company’s independent accountants for the fiscal

year ending December 31, 2022.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Baker Tilly US, LLP (formerly Baker Tilly

Virchow Krause, LLP) has been the Company’s independent accountant since March 25, 2019, and audited the Company’s financial

statements for the fiscal years ended December 31, 2020 and 2021. It had also been the Company’s independent accountant from 2009

until 2016, and had audited the Company’s financial statements for the fiscal years ended December 31, 2009 through 2015.

Audit Fees

The aggregate fees billed by Baker to

the Company for the review and audit of the Company’s financial statements for FY-2021 were approximately $90,500 for FY-2021 and

$89,500 for FY-2020. The Company anticipates that its fee for FY-2022 will be approximately $96,000.

Audit-Related Fees

During 2021 and 2020 there were no fees

paid to Baker in connection with the Company’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002.

No other fees were billed by Baker for

the last two years that were reasonably related to the performance of the audit or review of the Company’s financial statements

and not reported under “Audit Fees” above.

Tax Fees

There were no other fees billed by Baker

during the last two fiscal years for professional services rendered for tax compliance, tax advice, or tax planning. Accordingly, none

of such services were approved pursuant to pre-approval procedures or permitted waivers thereof.

All Other Fees

There were no non-audit-related fees

billed to the Company by Baker in 2021 or 2020.

Pre-approval Policies for Audit Services

Engagement of accounting services by the

Company is not made pursuant to any pre-approval policies or procedures. The Company believes that its accounting firm is independent

because all of its engagements by the Company are approved by the Company’s Audit Committee prior to any such engagement.

The Audit Committee of the Company’s

Board meets periodically to review and approve the scope of the services to be provided to the Company by its independent accountant,

as well as to review and discuss any issues that may arise during an engagement. The Audit Committee is responsible for the prior approval

of every engagement of the Company’s independent auditors to perform audit and permissible non-audit services for the Company (such

as quarterly reviews, tax matters, consultation on new accounting and disclosure standards and, in future years, reporting on management’s

internal controls assessment).

Before the auditors are engaged to provide

those services, the chief financial officer and the controller will make a recommendation to the Audit Committee regarding each of the

services to be performed, including the fees to be charged for such services. At the request of the Audit Committee the independent auditors

and/or management shall periodically report to the Audit Committee regarding the extent of services being provided by the independent

auditors, and the fees for the services performed to date.

ANNUAL REPORT TO STOCKHOLDERS

The Annual Report to Stockholders for

the fiscal year ended December 31, 2021 accompanies this Proxy Statement. The Annual Report contains financial and other information about

the Company, but is not incorporated into this Proxy Statement and is not deemed to be a part of the proxy soliciting material.

STOCKHOLDER PROPOSALS

Proposals of stockholders for possible consideration

at the 2023 Annual Meeting (expected to be held in May 2023) must be received by the Secretary of the Company at the Company’s principal

executive offices not later than December 9, 2022 and must satisfy the other conditions set forth in SEC regulations regarding the inclusion

of stockholder proposals in Company-sponsored proxy materials.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

The Board has adopted the following

procedure for stockholders to send communications to the Board other than stockholder proposals for consideration at the annual meeting

of stockholders which should be submitted to our Corporate Secretary. Stockholders who wish to send communications to directors should

refer to the Company’s website at: www.u-g.com and direct those communications to Mr. Arthur M. Dresner, Chairman of the Audit Committee,

whose email address is posted there. Periodically, all communications sent to Mr. Dresner, but addressed to other Board members will be

forwarded to that Board member by Mr. Dresner.

CODE OF ETHICS

The

Company has adopted a Code of Business Conduct and Ethics that applies to all officers, directors, and employees serving in any capacity

to the Company, including the Chief Executive Officer and/or President, Chief Financial Officer, and Principal Accounting Officer. A copy

of the Company's Code of Business Conduct and Ethics is available on the Company’s website at http://www.u-g.com/corporate.

HOUSEHOLDING OF PROXY MATERIALS

The Securities and Exchange Commission permits

companies and intermediaries such as brokers to satisfy the delivery requirements for proxy materials with respect to two or more stockholders

sharing the same address by delivering a single set of proxy materials addressed to those stockholders. This process, which is commonly

referred to as “householding”, potentially provides extra conveniences for stockholders and cost savings for companies.

Although we do not intend to household for

our stockholders of record, some brokers household our proxy materials, delivering a single set of proxy materials to multiple stockholders

sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from

your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until

you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate set

of proxy materials, or if you are receiving multiple sets of proxy materials and wish to receive only one, please notify your broker.

Stockholders who currently receive multiple sets of the proxy materials at their address and would like to request householding of their

communications should contact their broker.

OTHER BUSINESS

Management of the Company knows of

no business other than that referred to in the foregoing Notice of Annual Meeting and Proxy Statement that may come before the Annual

Meeting.

| |

By order of the Board of Directors |

|

| |

|

|

| |

/s/ Andrea Young |

|

| |

Andrea Young |

|

| |

Secretary |

|

Dated: July 22, 2022

|

THE COMPANY WILL FURNISH, WITHOUT CHARGE, A COPY OF ITS ANNUAL REPORT

ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021, INCLUDING FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES, BUT EXCLUDING

EXHIBITS, TO EACH STOCKHOLDER WHO REQUESTS THE 10-K IN WRITING ADDRESSED TO: ANDREA YOUNG, CORPORATE SECRETARY, UNITED-GUARDIAN, INC.,

P. O. BOX 18050, HAUPPAUGE, NEW YORK 11788. |

16

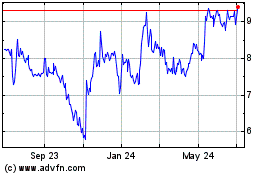

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Mar 2024 to Apr 2024

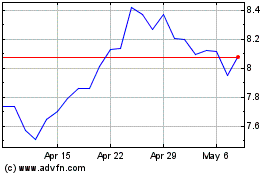

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Apr 2023 to Apr 2024