Filed Pursuant to Rule 424(b)(5)

Registration No. 333-252539

14,492,754 Shares of Class A Common Stock

And

Warrants to purchase up to 14,492,754 Shares of Class A Common Stock

ALPINE 4 HOLDINGS, INC.

Pursuant to this prospectus supplement and the accompanying prospectus, Alpine 4 Holdings, Inc. (the “Company,” “we,” “our,” or “us”) is offering to investors 14,492,754 shares of our Class A common stock (the “Shares”) and warrants to purchase up to 14,492,754 Shares of Class A Common Stock, at an exercise price of $0.69 per share (the “Warrants”).

The combined purchase price per Share and Warrant will be $0.69. The shares of Class A common stock issuable from time to time pursuant to the exercise of the Warrants are also being offered pursuant to this prospectus supplement and the accompanying prospectus.

We have retained A.G.P./Alliance Global Partners (“A.G.P.”) as placement agent (the “Placement Agent”) to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. We expect that the delivery of the securities being offered pursuant to this prospectus supplement and the accompanying prospectus will be made on or before July 13, 2022.

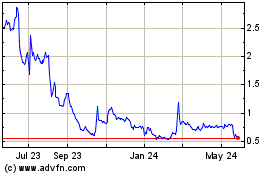

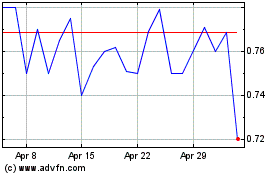

Our Class A common stock is listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “ALPP.” The last reported sale price of our Class A common stock on Nasdaq on July 8, 2022 was $0.69 per share. We recommend that you obtain current market quotations for our Class A common stock prior to making an investment decision. There is no established trading market for the Warrants and we do not intend to list the Warrants on any securities exchange or nationally recognized trading system.

| | | | | | | | | | | |

| | Per Share and Accompanying Warrant | | Total |

| Offering price | $ | 0.69 | | | $ | 10,000,000 | |

| Placement Agent commissions to be paid by us* | $ | 0.0483 | | | $ | 700,000 | |

| Proceeds, before expenses, to us | $ | 0.6417 | | | $ | 9,300,000 | |

| | | | | | | | |

| * | Does not include other additional compensation we have agreed to pay the Placement Agent, including reimbursement of legal fees and out of pocket expenses. See “Plan of Distribution.” |

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. BEFORE MAKING ANY INVESTMENT DECISION, YOU SHOULD CAREFULLY REVIEW AND CONSIDER ALL THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT, THE ACCOMPANYING PROSPECTUS AND THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN AND THEREIN, INCLUDING THE RISKS AND UNCERTAINTIES DESCRIBED UNDER “RISK FACTORS” BEGINNING ON PAGE S-4 OF THIS PROSPECTUS SUPPLEMENT AND THE RISK FACTORS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

A.G.P.

The date of this prospectus supplement is July 11, 2022

Table of Contents

Prospectus Supplement

| | | | | |

| iii |

| S-1 |

| S-3 |

| S-4 |

| S-18 |

| S-19 |

| S-19 |

| S-19 |

| S-20 |

| S-21 |

| S-23 |

| S-23 |

| S-23 |

| S-24 |

Prospectus

| | | | | |

| | Page |

| 4 |

| 4 |

| 9 |

| 6 |

| 9 |

| 9 |

| 10 |

| 20 |

| 22 |

| 23 |

| 24 |

| 25 |

| 27 |

| 29 |

| 29 |

| 8 |

| 8 |

We have not, and the Placement Agent has not, authorized any dealer, salesperson or other person to give any information or to make any representation other than those contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. You must not rely upon any information or representation not contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus as if we had authorized it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor does this prospectus supplement or the accompanying prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus, and the documents incorporated herein and therein by reference is correct on any date after their respective dates, even though this prospectus supplement or the accompanying prospectus is delivered or securities are sold on a later date. Our business, financial condition, results of operations and cash flows may have changed since those dates.

About This Prospectus Supplement

This prospectus supplement and the accompanying prospectus are part of a shelf registration statement that we filed with the Securities and Exchange Commission (the “SEC”). This prospectus supplement amends and supplements the information in the prospectus, dated February 10, 2021, filed as a part of our registration statement on Form S-3 (File No. 333-252539) (the “Registration Statement”). The Registration Statement was declared effective by the SEC as of February 10, 2021. This prospectus supplement should be read in conjunction with the accompanying prospectus, and is qualified by reference thereto, except to the extent that the information herein amends or supersedes the information contained in the accompanying prospectus. This prospectus supplement is not complete without, and may only be delivered or utilized in connection with, the accompanying prospectus.

Our Registration Statement allows us to offer from time to time a wide array of securities. In the accompanying prospectus, we provide you with a general description of the securities we may offer from time to time under our Registration Statement and other general information that may apply to this offering. Both this prospectus supplement and the accompanying prospectus include important information about us, our common stock, and other information that you should know before investing. You should carefully read both this prospectus supplement and the accompanying prospectus as well as additional information described under “Where You Can Find More Information” before investing in our securities.

This document is in two parts. The first part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus. The second part, the prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus supplement,” we are referring to both this prospectus supplement and the accompanying prospectus, as well as the documents incorporated by reference herein and therein. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. To the extent there is any other conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date (for example, a document incorporated by reference in the accompanying prospectus) the statement in the document having the later date modifies or supersedes the earlier statement. As noted, it is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents we have referred you to in the section entitled “Where You Can Find More Information” below in this prospectus supplement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless otherwise indicated, information contained in or incorporated by reference into this prospectus concerning our industry and the markets in which we operate, including market position and market opportunity, is based on information from our management’s estimates, as well as from industry publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. However, assumptions and estimates of our future performance, and the future performance of our industry are subject to numerous known and unknown risks and uncertainties, including those described under the heading “Risk Factors” beginning on page S-4 of this prospectus supplement. These and other important factors could result in our estimates and assumptions being materially different from future results. You should read the information contained in, or incorporated by reference into, this prospectus completely and with the understanding that future results may be materially different and worse from what we expect. See the information included under the heading “Cautionary Note Regarding Forward-Looking Statements.”

Unless expressly stated otherwise, all references in this prospectus to “we,” “us,” “our” or similar references mean Alpine 4 Holdings, Inc. and its subsidiaries on a consolidated basis.

Prospectus Supplement Summary

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus supplement and in the documents which we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before investing in our securities. To fully understand this offering and its consequences to you, you should read this entire prospectus supplement carefully, including the information referred to under the heading “Risk Factors” , and the financial statements and other information incorporated by reference in this prospectus supplement when making an investment decision.

Our Company

Company Background and History

We were incorporated under the laws of the State of Delaware on April 22, 2014. We are a publicly traded conglomerate that is acquiring businesses that fit into our disruptive DSF business model of Drivers, Stabilizers, and Facilitators. At Alpine 4, we understand the nature of how technology and innovation can accentuate a business. Our focus is on how the adaptation of new technologies even in brick and mortar businesses can drive innovation. We also believe that our holdings should benefit synergistically from each other and that the ability to have collaboration across varying industries can spawn new ideas and create fertile ground for competitive advantages. This unique perspective has culminated in the development of our Blockchain-enabled Enterprise Business Operating System called SPECTRUMebos.

As of the date of this prospectus supplement, the Company was a holding company that owned, directly or indirectly, fourteen operating subsidiaries:

- A4 Corporate Services, LLC;

- ALTIA, LLC;

- Quality Circuit Assembly, Inc.;

- Morris Sheet Metal, Corp;

- JTD Spiral, Inc.;

- Excel Construction Services, LLC;

- SPECTRUMebos, Inc.;

- Vayu (US), Inc.;

- Thermal Dynamics International, Inc.;

- Alternative Laboratories, LLC.;

- Identified Technologies Corporation;

- ElecJet Corp.;

- DTI Services Limited Liability Company (doing business as RCA Commercial Electronics); and

- Global Autonomous Corporation;

Starting in the first quarter of 2020, we also created additional subsidiaries to act as silo holding companies, organized by industries. These silo subsidiaries are A4 Construction Services, Inc. (“A4 Construction”), A4 Manufacturing, Inc. (“A4 Manufacturing”), and A4 Technologies, Inc. (“A4 Technologies”), A4 Aerospace Corporation (“A4 Aerospace”), and A4 Defense Services, Inc. (“A4 Defense Services”). All of these holding companies are Delaware corporations. The Company is the sole shareholder of each of these subsidiaries.

Alpine 4 maintains our corporate office at 2525 E. Arizona Biltmore Circle, Suite 237, Phoenix, Arizona 85016. ALTIA works out of the headquarters offices. QCA rents a location at 1709 Junction Court #380 San Jose, California 95112. Morris Sheet Metal and JTD Spiral are located at 6212 Highview Dr, Fort Wayne, Indiana 46818. Excel Construction Services’ office and fabrication space are located at 297 Wycoff Cir, Twin Falls, Idaho 83301. Vayu (US) has its headquarters at 3753 Plaza Drive, Ann Arbor, Michigan 48108. The headquarters for TDI are located at 14955 Technology Ct, Fort Myers, Florida 33912. Alt Labs has its headquarters at 4740 S. Cleveland Ave. Fort Myers, Florida 33907. The Identified Technologies Corporation headquarters are located at 6401 Penn Ave, Suite 211, Pittsburgh, Pennsylvania 15206. ElecJet has its headquarters at 2525 E Arizona Biltmore Cir, Suite 237, Phoenix, Arizona 85016. RCA Commercial Electronics has its headquarters at 5935 W 84th St, Indianapolis, Indiana 46278. Global Autonomous Corporation has its offices at 2525 E Arizona Biltmore Circle, Suite 237, Phoenix Arizona 85016.

What We Do:

Alexander Hamilton in his “Federalist paper #11”, said that our adventurous spirit distinguishes the commercial character of America. Hamilton knew that our freedom to be creative gave American businesses a competitive advantage over the rest of the world. We believe that Alpine 4 also exemplifies this spirit in our subsidiaries and that our greatest competitive advantage is our highly diverse business structure combined with a culture of collaboration.

It is our mandate to grow Alpine 4 into a leading, multi-faceted holding company with diverse subsidiary holdings with products and services that not only benefit from one another as a whole, but also have the benefit of independence. This type of corporate structure is about having our subsidiaries prosper through strong onsite leadership while working synergistically with other Alpine 4 holdings. The essence of our business model is based around acquiring B2B companies in a broad spectrum of industries via our acquisition strategy of DSF (Drivers, Stabilizer, Facilitator). Our DSF business model (which is discussed more below) offers our shareholders an opportunity to own small-cap businesses that hold defensible positions in their individual market space. Further, Alpine 4’s greatest opportunity for growth exists in the smaller to middle-market operating companies with revenues between $5 to $150 million annually. In this target-rich environment, we believe businesses generally sell at more reasonable multiples, presenting greater opportunities for operational and strategic improvements that have greater potential to enhance profit.

Driver, Stabilizer, Facilitator (DSF)

Driver: A Driver is a company that is in an emerging market or technology, that has enormous upside potential for revenue and profits, with a significant market opportunity to access. These types of acquisitions are typically small, brand new companies that need a structure to support their growth.

Stabilizer: Stabilizers are companies that have sticky customers, consistent revenue and provide solid net profit returns to Alpine 4.

Facilitators: Facilitators are our “secret sauce”. Facilitators are companies that provide a product or service that an Alpine 4 sister company can use as leverage to create a competitive advantage.

Risk Factors

We face numerous risks that could materially affect our business, results of operations or financial condition. The most significant of these risks include the following:

-The global supply chain is an issue for many companies in the global business environment, including for Alpine 4. These constraints affected the company in 2021 and may affect our ability to deliver our products on time in 2022.

-Alpine 4 is an “emerging growth company,” and the reduced disclosure requirements applicable to “emerging growth companies” could make our Class A common stock less attractive to investors

-Growth and development of operations will depend on the acceptance of Alpine 4’s proposed businesses. If Alpine 4’s products are not deemed desirable and suitable for purchase and it cannot establish a customer base, it may not be able to generate future revenues, which would result in a failure of the business and a loss of the value of your investment.

-If demand for the products Alpine 4 plans to offer slows, then its business would be materially affected, which could result in the loss of your entire investment.

-Our revenue growth rate depends primarily on our ability to satisfy relevant channels and end-customer demands, identify suppliers of our necessary ingredients and to coordinate those suppliers, all subject to many unpredictable factors.

-If securities or industry analysts do not publish or cease publishing research or reports or publish misleading, inaccurate or unfavorable research about us, our business or our market, our stock price and trading volume could decline.

-An active trading market for our Class A common stock may not be sustained.

-The ongoing COVID-19 pandemic has caused severe disruptions in the U.S. and global economies, which has impacted the business, activities, and operations of our customers, as well as our business and operations. Additionally, through 2021, the U.S. and other economies have been impacted by supply chain disruptions, labor shortages and high inflation, all of which may have a negative impact on our business and operations.

-Our existing debt levels may adversely affect our financial condition or operational flexibility and prevent us from fulfilling our obligations under our outstanding indebtedness.

-Growth and development of operations will depend on the growth in our acquisition model and from organic growth from our subsidiaries’ businesses. If we cannot find desirable acquisition candidates, we may not be able to generate growth with future revenues.

-Should we fail to satisfy or comply with the minimum listing standards applicable to issuers listed on The Nasdaq Capital Market, our common stock may be delisted from The Nasdaq Capital Market.

For further discussion of these and other risks, see “Risk Factors,” beginning on page S-4.

The Offering

| | | | | | | | |

| Issuer | | Alpine 4 Holdings, Inc. |

| | |

Securities offered | | 14,492,754 Shares of Class A common stock (the “Shares”) and warrants to purchase up to 14,492,754 shares of Class A common stock (the “Warrants”), at a purchase price of $0.69 per Share and accompanying Warrant. The Warrants have a term of five years and an exercise price of $0.69 per share. |

| | |

| Class A Common Stock outstanding immediately prior to this offering(1) | | 162,458,324 |

| | |

| Use of proceeds | | We intend to use the net proceeds from this offering for working capital and general corporate purposes, including specifically to build additional products and solutions to meet market demand, further advance the development of new products and solutions, engage in corporate development and merger and acquisition activities, for working capital needs, capital expenditures, and for other general corporate purposes. However, we will retain broad discretion over how the net proceeds are used. See “Use of Proceeds.” |

| | | |

| Risk factors | | Investing in our securities involves a high degree of risk. You should carefully consider all of the information in this prospectus and the documents incorporated by reference in this prospectus supplement. In particular, see “Risk Factors” beginning on page S-4 of this prospectus supplement. |

| | | |

| Nasdaq Market symbol | | “ALPP” |

(1) The number of shares of Class A common stock to be outstanding prior to and after this offering is based on the actual number of shares outstanding as of July 7, 2022, which was 162,458,324, and does not include, as of that date:

-14,492,754 shares of Class A Common Stock issuable upon the exercise of the Warrants;

-8,548,088 shares of Class A Common Stock issuable upon the conversion of outstanding shares of Class B Common Stock;

-12,500,200 shares of Class A Common Stock issuable upon the conversion of outstanding shares of Class C Common Stock;

-1,172,000 shares of Class A Common Stock issuable upon the exercise of outstanding options; and

-5,527,778 shares of Class A Common Stock issuable upon the exercise of outstanding warrants.

Unless otherwise stated, outstanding share information throughout this prospectus supplement excludes the above.

RISK FACTORS

Investing in our securities involves substantial risk. You should carefully consider the risk factors disclosed below as well as those contained in our most recent Annual Report on Form 10-K, which is incorporated by reference herein, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the other information contained in this prospectus supplement before acquiring any of our securities. Additionally, you should carefully consider and evaluate all of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus supplement. Our business, results of operations or financial condition could be adversely affected by any of these risks or by additional risks and uncertainties not currently known to us or that we currently consider immaterial. These risks could have a material adverse effect on our business, results of operations or financial condition and cause the value of our Class A common stock to decline. You could lose all or part of your investment.

Risks Associated with Our Business and Operations

Alpine 4 is an "emerging growth company," and the reduced disclosure requirements applicable to "emerging growth companies" could make our Class A common stock less attractive to investors.

Alpine 4 is an "emerging growth company," as defined in the JOBS Act. For as long as we are an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding advisory "say-on-pay" votes on executive compensation and shareholder advisory votes on golden parachute compensation. We will remain an "emerging growth company" until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; (ii) the last date of the fiscal year following the fifth anniversary of the date of the first sale of Class A common stock under the Company's first filed registration statement; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and (iv) the date on which we are deemed to be a "large accelerated filer" under the Exchange Act. We will be deemed a large accelerated filer on the first day of the fiscal year after the market value of our common equity held by non-affiliates exceeds $700 million, measured on October 31.

We cannot predict if investors will find our Class A common stock less attractive to the extent we rely on the exemptions available to emerging growth companies. If some investors find our Class A common stock less attractive as a result, there may be a less active trading market for our Class A common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

A Company that elects to be treated as an emerging growth company shall continue to be deemed an emerging growth company

until the earliest of (i) the last day of the fiscal year during which it had total annual gross revenues of $1,000,000,000 (as indexed for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock under the Company's first filed registration statement; (iii) the date on which it has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which is deemed to be a 'large accelerated filer' as defined by the SEC, which would generally occur upon it attaining a public float of at least $700 million.

However, we are choosing to "opt out" of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Significant time and management resources are required to ensure compliance with public company reporting and other obligations. Taking steps to comply with these requirements will increase our costs and require additional management resources and does not ensure that we will be able to satisfy them.

We are a publicly reporting company. As a public company, we are required to comply with applicable provisions of the Sarbanes-Oxley Act of 2002, as well as other federal securities laws, and rules and regulations promulgated by the SEC and the various exchanges and trading facilities where our Class A common stock may trade, which result in significant legal, accounting, administrative and other costs and expenses. These rules and requirements impose certain corporate governance requirements relating to director independence, distributing annual and interim reports, stockholder meetings, approvals and voting, soliciting proxies, conflicts of interest, and codes of conduct, depending on where our shares trade. Our management and other personnel will need to devote a substantial amount of time to ensure that we comply with all applicable requirements.

As we review our internal controls and procedures, we may determine that they are ineffective or have material weaknesses, which could impact the market's acceptance of our filings and financial statements.

In connection with the preparation of our Annual Report for the year ended December 31, 2021, we conducted a review of our internal control over financial reporting for the purpose of providing the management report required by these rules. During the course of our review and testing, we have identified deficiencies and have been unable to remediate them before we were required to provide the required reports. Furthermore, because we have material weaknesses in our internal control over financial reporting, we may not detect errors on a timely basis and our financial statements may be materially misstated. Even if we are able to remediate the material weaknesses, we may not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting, which could harm our operating results, cause investors to lose confidence in our reported financial information and cause the trading price of our stock to fall. In addition, as a public company we are required to file in a timely manner accurate quarterly and annual reports with the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”), as amended. Any failure to report our financial results on an accurate and timely basis could result in sanctions, lawsuits, delisting of our shares from the market or trading facility where our shares may trade, or other adverse consequences that would materially harm our business.

Alpine 4 is a growth-based company and has shown a net loss since inception. Ownership of Alpine 4 shares is highly risky and could result in a complete loss of the value of your investment if we are unsuccessful in our business plans.

As the Alpine 4’s “Driver” classified subsidiaries mature from a start-up phase to an operating phase, the Company expects to stop incurring operating losses at some point in the future. However new additional subsidiaries may incur significant expenses associated with the growth of those businesses. Further, there is no guarantee that the Company will be successful in realizing future revenues or in achieving or sustaining positive cash flow at any time in the future. Any such failure could result in the possible closure of one of its subsidiaries or force Alpine 4 to seek additional capital through loans or additional sales of its equity securities to continue business operations which would dilute the value of any shares you purchase in connection with this offering.

Growth and development of operations will depend on the growth in the Alpine 4 acquisition model and from organic growth from its subsidiaries’ businesses. If we cannot find desirable acquisition candidates, it may not be able to generate growth with future revenues.

We expect to continue our strategy of acquiring businesses, which management believes will result in significant growth in projected annualized revenue by the end of 2022. However, there is No guarantee that we will be successful in realizing future revenue growth from our acquisition model. As such, we are highly dependent on suitable candidates to acquire, which supply of such candidates cannot be guaranteed and is driven from the market for M&A. If we are unable to locate or identify suitable acquisition candidates, or to enter into transactions with such candidates, or if we are unable to integrate the acquired businesses, we may not be able to grow our revenues to the extent anticipated, or at all.

We may make acquisitions which could divert the attention of management and which may not be integrated successfully into our existing business.

We may pursue acquisitions to increase our market penetration, enter new geographic markets and expand the scope of services we provide. We cannot guarantee that we will identify suitable acquisition candidates, that acquisitions will be completed on acceptable terms or that we will be able to integrate successfully the operations of any acquired business into our existing business. The acquisitions could be of significant size and involve operations in multiple jurisdictions. The acquisition and integration of another business would divert management attention from other business activities. This diversion, together with other difficulties we may incur in integrating an acquired business, could have a material adverse effect on our business, financial condition and results of operations. In addition, we may borrow money or issue capital stock to finance acquisitions. Such borrowings might not be available on terms as favorable to us as our current borrowing terms and may increase our leverage, and the issuance of capital stock could dilute the interests of our stockholders.

As we acquire companies or technologies in the future, they could prove difficult to integrate, disrupt our business, dilute stockholder value and adversely affect our operating results and the value of your investment.

As part of our business strategy, we regularly evaluate investments in, or acquisitions of, complementary businesses, joint ventures, services and technologies, and we expect that periodically we will continue to make such investments and acquisitions in the future. Acquisitions and investments involve numerous risks, including:

| | | | | | | | |

| – | the potential failure to achieve the expected benefits of the combination or acquisition; |

| – | difficulties in and the cost of integrating operations, technologies, services and personnel; |

| – | diversion of financial and managerial resources from existing operations; |

| – | risk of entering new markets in which we have little or no experience; |

| – | potential write-offs of acquired assets or investments; |

| – | potential loss of key employees; |

| – | inability to generate sufficient revenue to offset acquisition or investment costs; |

| – | the inability to maintain relationships with customers and partners of the acquired business; |

| – | the difficulty of incorporating acquired technology and rights into our products and services and of maintaining quality standards consistent with our established brand; |

| – | potential unknown liabilities associated with the acquired businesses; |

| – | unanticipated expenses related to acquired technology and its integration into existing technology; |

| – | negative impact to our results of operations because of the depreciation and amortization of amounts related to acquired intangible assets, fixed assets and deferred compensation, and the loss of acquired deferred revenue; |

| – | the need to implement controls, procedures and policies appropriate for a public company at companies that prior to the acquisition lacked such controls, procedures and policies; and |

| – | challenges caused by distance, language and cultural differences. |

In addition, if we finance acquisitions by issuing additional convertible debt or equity securities, our existing stockholders may be diluted which could affect the market price of our stock. Further, if we fail to properly evaluate and execute acquisitions or investments, our business and prospects may be seriously harmed, and the value of your investment may decline.

Alpine 4 has limited management resources and will be dependent on key executives. The loss of the services of the current officers and directors could severely impact Alpine 4’s business operations and future development, which could result in a loss of revenues and adversely impact the business.

Alpine 4 is relying on a small number of key individuals, which the Company has increased during 2021, to implement its business and operations and, in particular, the professional expertise and services of Kent B. Wilson, our President, Chief Executive Officer, and Secretary, Jeff Hail, our Chief Operating Officer, Larry Zic, our Chief Financial Officer, and SaVonnah Osmanski, our VP/Corporate Controller. Mr. Wilson serves full time in his capacities with Alpine 4 to work to develop and grow the Company. Nevertheless, Alpine 4 may not have sufficient managerial resources to successfully manage the increased business activity envisioned by its business strategy. In addition, Alpine 4’s future success depends in large part on the continued service of Mr. Wilson and the executive team If Mr. Wilson or any member of the executive team chooses not to serve as an officer or if Mr. Wilson or any member of the executive team is unable to perform his or her duties, this could have an adverse effect on Company business operations, financial condition and operating results, especially if we are unable to replace Mr. Wilson or Mr. Hail with other individuals qualified to develop and market our business. The loss of their services could result in a loss of revenues, which could result in a reduction of the value of any ownership of Alpine 4.

Competition that we face is varied and strong.

Our subsidiaries’ products and industries as a whole are subject to competition. There is No guarantee that we can sustain our market position or expand our business.

We compete with a number of entities in providing products to our customers. Such competitor entities include a variety of large nationwide corporations, including but not limited to public entities and companies that have established loyal customer bases over several decades.

Many of our current and potential competitors are well established and have significantly greater financial and operational resources, and name recognition than we have. As a result, these competitors may have greater credibility with both existing and potential customers. They also may be able to offer more competitive products and services and more aggressively promote and sell their products. Our competitors may also be able to support more aggressive pricing than we will be able to, which could adversely affect sales, cause us to decrease our prices to remain competitive, or otherwise reduce the overall gross profit earned on our products.

Our success in business and operations will depend on general economic conditions.

The success of Alpine 4 and its subsidiaries depends, to a large extent, on certain economic factors that are beyond its control. Factors such as general economic conditions, levels of unemployment, interest rates, tax rates at all levels of government, competition and other factors beyond Alpine 4’s control may have an adverse effect on the ability of our subsidiaries to sell its products, to operate, and to collect sums due and owing to them.

Alpine 4 may not be able to successfully implement its business strategy, which could adversely affect its business, financial condition, results of operations and cash flows. If Alpine 4 cannot successfully implement its business strategy, it could result in the loss of the value of your investment.

Successful implementation of our business strategy depends on our being able to acquire additional businesses and grow our existing subsidiaries, as well as on factors specific to the industries in which our subsidiaries operate, and the state of the financial industry and numerous other factors that may be beyond our control. Adverse changes in the following factors could undermine our business strategy and have a material adverse effect on our business, our financial condition, and results of operations and cash flow:

| | | | | | | | |

| – | The competitive environment in the industries in which our subsidiaries operate that may force us to reduce prices below the optimal pricing level or increase promotional spending; |

| | |

| – | Our ability to anticipate changes in consumer preferences and to meet customers’ needs for our products in a timely cost-effective manner; and |

| | |

| – | Our ability to establish, maintain and eventually grow market share in these competitive environments. |

Our revenue growth rate depends primarily on our ability to satisfy relevant channels and end-customer demands, identify suppliers of our necessary ingredients and to coordinate those suppliers, all subject to many unpredictable factors.

We may not be able to identify and maintain the necessary relationships with suppliers of product and services as planned. Delays or failures in deliveries could materially and adversely affect our growth strategy and expected results. As we supply more customers, our rate of expansion relative to the size of such customer base will decline. In addition, one of our biggest challenges is securing an adequate supply of suitable product. Competition for product is intense, and commodities costs subject to price volatility.

Our ability to execute our business plan also depends on other factors, including:

| | | | | | | | |

| – | ability to keep satisfied vendor relationships |

| | |

| – | hiring and training qualified personnel in local markets; |

| | |

| – | managing marketing and development costs at affordable levels; |

| | |

| – | cost and availability of labor; |

| | |

| – | the availability of, and our ability to obtain, adequate supplies of ingredients that meet our quality standards; and |

| | |

| – | securing required governmental approvals in a timely manner when necessary. |

Our financial condition and results of operations for fiscal 2022 may continue to be adversely affected by the COVID-19 pandemic.

The impact of the worldwide COVID-19 pandemic has been and will likely continue to be extensive in many geographies and aspects of society. The pandemic has resulted in and will likely continue to result in disruptions to the global economy, as well as businesses, supply chains and capital markets around the world.

Impacts to our business have included temporary closures of many of our government and university customers and our suppliers, disruptions or restrictions on our employees’ and customers’ ability to travel, and delays in product installations or shipments to and from affected countries. In an effort to halt the outbreak of COVID-19, a number of countries, including the United States, implemented and some continue to implement significant restrictions on travel, shelter in place or stay at home orders, and business closures. While some of these restrictions were loosened in certain jurisdictions, some markets have returned to restrictions in the face of increases in new COVID-19 cases, particularly as more contagious strains of the virus emerge. Many of our employees in jurisdictions in which we have significant operations continue to work remotely. Much of the commercial activity in sales and marketing, and customer demonstrations and applications training, is still either being conducted remotely or postponed. Even where customers have re-opened their sites, some still operate at productivity levels that are below pre-pandemic levels in an effort to accommodate safety protocols and as a result of pandemic-related supply chain disruptions. Any resurgence of the virus or the emergence of new strains of the virus, particularly any new strains which are more easily transmitted or which are resistant to existing vaccines, may require us or our customers to close or partially close operations once again. These travel restrictions, business closures and operating reductions at Alpine 4, our customers, our distributors, and/or our suppliers have in the past adversely impacted and may continue to adversely impact our operations, including our ability to manufacture, sell or distribute our products, as well as cause temporary closures of our distributors, or the facilities of suppliers or customers. Further, global supply chains continue to be disrupted, causing shortages, which has impacted our ability to manufacture and supply our products. We could also experience increased compensation expenses associated with employee recruiting and employee retention to the extent employment opportunities continue to multiply post-pandemic, causing the search for and retention of talent to become more competitive. This disruption of our employees, distributors, suppliers and customers has historically impacted and may continue to impact our global sales and future operating results.

We are continuing to monitor and assess the ongoing effects of the COVID-19 pandemic on our commercial operations in 2022 and going forward. However, we cannot at this time accurately predict what effects these conditions will ultimately have on our operations due to uncertainties relating to the severity of the disease, including the impact of any resurgence of the virus, the continued emergence of new strains of the virus, the effectiveness and availability of vaccines, the willingness of individuals to receive vaccines, (including to protect against any new strains of the virus), and the length or severity of travel restrictions, business closures, and other safety and precautionary measures imposed by the governments of impacted countries. The pandemic has also adversely affected the economies and financial markets of many countries, which has affected and may continue to affect demand for our products and our operating results.

In addition, there is a risk that one or more of our current service providers, manufacturers and other partners may not survive such difficult economic times, which could directly affect our ability to attain our operating goals on schedule and on budget. Any of the foregoing could harm our business and we cannot anticipate all of the ways in which the current economic climate and financial market conditions could adversely impact our business. Furthermore, our stock price may decline due in part to the volatility of the stock market and any general economic downturn.

The preparation of the consolidated financial statements requires us to make estimates, judgments and assumptions that may affect the reported amounts of assets, liabilities, equity, revenues and expenses and related disclosure of contingent assets and liabilities. We evaluate estimates, judgments and methodologies on an ongoing basis. Changes in estimates are recorded in the period in which they become known. We base estimates on historical experience and on various other assumptions that we believe are reasonable, the results of which form the basis for making judgments about the carrying values of assets, liabilities and equity and the amount of revenues and expenses. The full extent to which the COVID-19 pandemic will directly or indirectly impact future business, results of operations and financial condition, including sales, expenses, reserves and allowances, manufacturing, research and development costs and employee-related amounts, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19, the continued emergence of new strains of the virus, the effectiveness and availability of vaccines, the willingness of individuals to receive vaccines (including to protect against any new strains of the virus), and the actions taken to contain or treat the virus, as well as the economic impact on local, regional, national and international customers and markets. We have made estimates of the impact of COVID-19 within the consolidated financial statements and there may be changes to those estimates in future periods. Actual results may differ from management’s estimates if these results differ from historical experience.

Our existing debt levels may adversely affect our financial condition or operational flexibility and prevent us from fulfilling our obligations under our outstanding indebtedness.

As of March 31, 2022, we had total debt of approximately $62 million. This level of debt or any increase in our debt level could have adverse consequences for our business, financial condition, operating results and operational flexibility, including the following: (i) the debt level may cause us to have difficulty borrowing money in the future for working capital, capital expenditures, acquisitions or other purposes; (ii) our debt level may limit operational flexibility and our ability to pursue business opportunities and implement certain business strategies; and (iii) we have a higher level of debt than some of our competitors or potential competitors, which may cause a competitive disadvantage and may reduce flexibility in responding to changing business and economic conditions, including increased competition and vulnerability to general adverse economic and industry conditions. If we fail to satisfy our obligations under our outstanding debt, an event of default could result that could cause some or all of our debt to become due and payable.

Cybersecurity risks and cyber incidents, including cyber-attacks, could adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential information and confidential information in our possession and damage to our business relationships, any of which could negatively impact our business, financial condition and operating results.

There has been an increase in the frequency and sophistication of the cyber and security threats we face, with attacks ranging from those common to businesses generally to those that are more advanced and persistent, which may target us due to our substantial reliance on information technology or otherwise. Cyber-attacks and other security threats could originate from a wide variety of sources, including cyber criminals, nation state hackers, hacktivists and other outside parties. As a result of the generally increasing frequency and sophistication of cyber-attacks, and our substantial reliance on technology, we may face a heightened risk of a security breach or disruption with respect to sensitive information resulting from an attack by computer hackers, foreign governments or cyber terrorists.

The operation of our business is dependent on computer hardware and software systems, as well as data processing systems and the secure processing, storage and transmission of information, which are vulnerable to security breaches and cyber incidents. A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity or availability of our information resources. These incidents may be an intentional attack or an unintentional event and could involve gaining unauthorized access to our information systems for purposes of misappropriating assets, stealing confidential information, corrupting data or causing operational disruption. In addition, we and our employees may be the target of fraudulent emails or other targeted attempts to gain unauthorized access to proprietary or other sensitive information. The result of these incidents may include disrupted operations, misstated or unreliable financial data, fraudulent transfers or requests for transfers of money, liability for stolen information, increased cybersecurity protection and insurance costs, litigation and damage to our business relationships, causing our business and results of operations to suffer. Our reliance on information technology is substantial, and accordingly the risks posed to our information systems, both internal and those provided by third-party service providers are critical. We have implemented processes, procedures and internal controls designed to mitigate cybersecurity risks and cyber intrusions and rely on industry accepted security measures and technology to securely maintain confidential and proprietary information maintained on our information systems; however, these measures, as well as our increased awareness of the nature and extent of a risk of a cyber-incident, do not guarantee that a cyber-incident will not occur and/or that our financial results, operations or confidential information will not be negatively impacted by such an incident, especially because the cyber-incident techniques change frequently or are not recognized until launched and because cyber-incidents can originate from a wide variety of sources.

Those risks are exacerbated by the rapidly increasing volume of highly sensitive data, including our and our customers’ proprietary business information and intellectual property, and personally identifiable information of our employees and customers, that we collect and store in our data centers and on our networks. The secure processing, maintenance and transmission of this information are critical to our operations. A significant actual or potential theft, loss, corruption, exposure, fraudulent use or misuse of employee, customer or other personally identifiable or our or our customers’ proprietary business data, whether by third parties or as a result of employee malfeasance (or the negligence or malfeasance of third party service providers that have access to such confidential information) or otherwise, non-compliance with our contractual or other legal obligations regarding such data or intellectual property or a violation of our privacy and security policies with respect to such data could result in significant remediation and other costs, fines, litigation or regulatory actions against us and significant reputational harm.

Failure to maintain the security of our information and technology networks or data security breaches could harm our reputation and have a material adverse effect on our results of operations, financial condition and cash flow.

We rely on the reasonably secure processing, storage and transmission of confidential and other sensitive information in our computer systems and networks, and those of our service providers and their vendors. We are subject to various risks and costs associated with the collection, handling, storage and transmission of personally identifiable information and other sensitive information, including those related to compliance with U.S. and foreign data collection and privacy laws and other contractual obligations, as well as those associated with the compromise of our systems processing such information. In the ordinary course of our business, we collect, store a range of data, including our proprietary business information and intellectual property, and personally identifiable information of our employees and other third parties, in our cloud applications and on our networks, as well as our services providers’ systems. The secure processing, maintenance and transmission of this information are critical to our operations. We, our service providers and their vendors face various security threats on a regular basis, including ongoing cybersecurity threats to and attacks on our and their information technology infrastructure that are intended to gain access to our proprietary information, destroy data or disable, degrade or sabotage our systems. Cyber-incident techniques change frequently, may not immediately be recognized and can originate from a wide variety of sources. There has been an increase in the frequency, sophistication and ingenuity of the data security threats we and our service providers face, with attacks ranging from those common to businesses generally to those that are more advanced and persistent. Although we and our services providers take protective measures and endeavor to modify them as circumstances warrant, our computer systems, software and networks may be vulnerable to unauthorized access, theft, misuse, computer viruses or other malicious code, including malware, and other events that could have a security impact. We may be the target of more advanced and persistent attacks because, as an alternative asset manager, we hold a significant amount of confidential and sensitive information about, among other things, portfolio companies and potential investments. We may also be exposed to a more significant risk if these acts are taken by state actors. Any of the above cybersecurity threats, fraudulent activities or security breaches suffered by our service providers and their vendors could also put our confidential and sensitive information at risk or cause the shutdown of a service provider on which we rely. We and our employees have been and expect to continue to be the target of fraudulent calls and emails, the subject of impersonations and fraudulent requests for money, including attempts to redirect material payment amounts in a transaction to a fraudulent bank account, and other forms of spam attacks, phishing or other social engineering, ransomware or other events. Cyber-criminals may attempt to redirect payments made at the closings of our investments to unauthorized accounts, which we or our services providers we retain, such as paying agents and escrow agents, may be unable to detect or protect against. The COVID-19 pandemic has exacerbated these risks due to heavier reliance on online communication and the remote working environment, which may be less secure, and there has been a significant increase in hacking attempts by cyber-criminals. The costs related to cyber or other security threats or disruptions may not be fully insured or indemnified by others, including by our service providers. If successful, such attacks and criminal activity could harm our reputation, disrupt our business, cause liability for stolen assets or information and have a material adverse effect on our results of operations, financial condition and cash flow.

We rely heavily on our back office informational technology infrastructure, including our data processing systems, communication lines, and networks. Although we have back-up systems and business-continuation plan in place, our back-up procedures and capabilities in the event of a failure or interruption may not be adequate. Any interruption or failure of our informational technology infrastructure could result in our inability to provide services to our clients, other disruptions of our business, corruption or modifications to our data and fraudulent transfers or requests for transfers of money. Further consequences could include liability for stolen assets or information, increased cybersecurity protection and insurance costs and litigation. We expect that we will need to continue to upgrade and expand our back-up and procedures and capabilities in the future to avoid disruption of, or constraints on, our operations. We may incur significant costs to further upgrade our data processing systems and other operating technology in the future.

Our technology, data and intellectual property and the technology, data and intellectual property of our subsidiaries are also subject to a heightened risk of theft or compromise to the extent that we and our subsidiaries engage in operations outside the United States, particularly in those jurisdictions that do not have comparable levels of protection of proprietary information and assets, such as intellectual property, trademarks, trade secrets, know-how and customer information and records. In addition, we and our subsidiaries may be required to forgo protections or rights to technology, data and intellectual property in order to operate in or access markets in a foreign jurisdiction. Any such direct or indirect loss of rights in these assets could negatively impact us and our subsidiaries.

A significant actual or potential theft, loss, corruption, exposure or fraudulent, unauthorized or accidental use or misuse of investor, employee or other personally identifiable or proprietary business data could occur, as a result of third-party actions, employee malfeasance or otherwise, non-compliance with our contractual or other legal obligations regarding such data or intellectual property or a violation of our privacy and security policies with respect to such data. If such a theft, loss, corruption, use or misuse of data were to occur, it could result in significant remediation and other costs, fines, litigation and regulatory actions against us by (i) the U.S. federal and state governments, (ii) the EU or other jurisdictions, (iii) various regulatory organizations or exchanges and (iv) affected individuals, as well as significant reputational harm.

Cybersecurity has become a top priority for regulators around the world. Many jurisdictions in which we operate have laws and regulations relating to data privacy, cybersecurity and protection of personal information and other sensitive information, including, without limitation the General Data Protection Regulation (Regulation (EU) 2016/679) (the “GDPR”) in the EU and the Data Protection Act 2018 in the U.K. (the “U.K. Data Protection Act”), comprehensive privacy laws enacted in California, Colorado and Virginia, the Hong Kong Personal Data (Privacy) Ordinance, the Korean Personal Information Protection Act and related legislation, regulations and orders and the Australian Privacy Act. China and other countries have also passed cybersecurity laws that may impose data sovereignty restrictions and require the localization of certain information. We believe that additional similar laws will be adopted in these and other jurisdictions in the future, further expanding the regulation of data privacy and cybersecurity. Such laws and regulations strengthen the rights of individuals (data subjects), mandate stricter controls over the processing of personal data by both controllers and processors of personal data and impose stricter sanctions with substantial administrative fines and potential claims for damages from data subjects for breach of their rights, among other requirements. Some jurisdictions, including each of the U.S. states as well as the EU through the GDPR and the U.K. through the U.K. Data Protection Act, have also enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data, which would require heightened escalation and notification processes with associated response plans. We expect to devote resources to comply with evolving cybersecurity and data privacy regulations and to continually monitor and enhance our information security and data privacy procedures and controls as necessary. We or our subsidiaries may incur substantial costs to comply with changes in such laws and regulations and may be unable to adapt to such changes in the necessary timeframe and/or at reasonable cost. Furthermore, if we experience a cybersecurity incident and fail to comply with the applicable laws and regulations, it could result in regulatory investigations and penalties, which could lead to negative publicity.

The materialization of one or more of these risks could impair the quality of our operations, harm our reputation, negatively impact our businesses and limit our ability to grow.

We rely significantly on the use of information technology, as well as those of our third-party service providers. Our failure or the failure of third-party service providers to protect our website, networks, and systems against cybersecurity incidents, or otherwise to protect our confidential information, could damage our reputation and brand and substantially harm our business, financial condition, and results of operations.

To the extent that our services are web-based, we collect, process, transmit and store large amounts of data about our customers, employees, vendors and others, including credit card information and personally identifiable information, as well as other confidential and proprietary information. We also employ third-party service providers for a variety of reasons, including storing, processing and transmitting proprietary, personal and confidential information on our behalf. While we rely on tokenization solutions licensed from third parties in an effort to securely transmit confidential and sensitive information, including credit card numbers, advances in computer capabilities, new technological discoveries or other developments may result in the whole or partial failure of this technology to protect this data from being breached or compromised. Similarly, our security measures, and those of our third-party service providers, may not detect or prevent all attempts to hack our systems or those of our third-party service providers. DDoS attacks, viruses, malicious software, break-ins, phishing attacks, social engineering, security breaches or other cybersecurity incidents and similar disruptions that may jeopardize the security of information stored in or transmitted by our website, networks and systems or that we or our third-party service providers otherwise maintain, including payment card systems, may subject us to fines or higher transaction fees or limit or terminate our access to certain payment methods. We and our service providers may not anticipate or prevent all types of attacks until after they have already been launched, and techniques used to obtain unauthorized access to or sabotage systems change frequently and may not be known until launched against us or our third-party service

providers, and we may be unable to implement adequate preventative measures. We may also experience security breaches that may remain undetected for an extended period. In addition, cybersecurity incidents can also occur as a result of non-technical issues, including intentional or inadvertent breaches by our employees or by persons with whom we have commercial relationships.

Breaches of our security measures or those of our third-party service providers or any cybersecurity incident could result in unauthorized access to our website, networks and systems; unauthorized access to and misappropriation of customer and/or employee information, including personally identifiable information, or other confidential or proprietary information of ourselves or third parties; viruses, worms, spyware or other malware being served from our website, networks or systems; deletion or modification of content or the display of unauthorized content on our website; interruption, disruption or malfunction of operations; costs relating to cybersecurity incident remediation, deployment of additional personnel and protection technologies, response to governmental investigations and media inquiries and coverage; engagement of third party experts and consultants; litigation, regulatory action and other potential liabilities. If any of these cybersecurity incidents occur, or there is a public perception that we, or our third-party service providers, have suffered such a breach, our reputation and brand could also be damaged and we could be required to expend significant capital and other resources to alleviate problems caused by such cybersecurity incidents. As a consequence, our business could be materially and adversely affected and we could also be exposed to litigation and regulatory action and possible liability. In addition, any party who is able to illicitly obtain a customer’s password could access the customer’s transaction data or personal information. Any compromise or breach of our security measures, or those of our third-party service providers, could violate applicable privacy, data security and other laws, and cause significant legal and financial exposure, adverse publicity and a loss of confidence in our security measures, which could have an material adverse effect on our business, financial condition, and results of operations. This risk is heightened as governmental authorities throughout the U.S. and around the world devote increasing attention to data privacy and security issues.

While we maintain privacy, data breach and network security liability insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all. Additionally, even though we continue to devote resources to monitor and update our systems and implement information security measures to protect our systems, there can be no assurance that any controls and procedures we have in place will be sufficient to protect us from future cybersecurity incidents. Failure by us or our vendors to comply with data security requirements, including (if applicable) the California Consumer Privacy Act’s (“CCPA”) new “reasonable security” requirement in light of the private right of action, or rectify a security issue may result in class action litigation, fines and the imposition of restrictions on our ability to accept payment cards, which could adversely affect our operations. As cyber threats are continually evolving, our controls and procedures may become inadequate and we may be required to devote additional resources to modify or enhance our systems in the future. As a result, we may face interruptions to our systems, reputational damage, claims under privacy and data protection laws and regulations, customer dissatisfaction, legal liability, enforcement actions or additional costs, any and all of which could adversely affect our business, financial condition, and results of operations. In addition, although we seek to detect and investigate data security incidents, security breaches and other incidents of unauthorized access to our information technology systems and data can be difficult to detect and any delay in identifying such breaches or incidents may lead to increased harm and legal exposure of the type described above.

Environmental, social and governance matters may impact our business and reputation.

Increasingly, in addition to the importance of their financial performance, companies are being judged by their performance on a variety of environmental, social and governance (“ESG”) matters, which are considered to contribute to the long-term sustainability of companies’ performance.

A variety of organizations measure the performance of companies on ESG topics, and the results of these assessments are widely publicized. In addition, investment in funds that specialize in companies that perform well in such assessments are increasingly popular, and major institutional investors have publicly emphasized the importance of ESG measures to their investment decisions. Topics taken into account in such assessments include, among others, companies’ efforts and impacts on climate change and human rights, ethics and compliance with law, diversity and the role of companies’ board of directors in supervising various sustainability issues.

ESG goals and values are embedded in our core mission and vision, and we actively take into consideration their expected impact on the sustainability of our business over time and the potential impact of our business on society and the environment, including offsetting or reducing carbon emissions and sound pollution from launches. However, in light of investors’ increased focus on ESG matters, there can be no certainty that we will manage such issues successfully, or that we will successfully meet society’s expectations as to our proper role. This could lead to risk of litigation or reputational damage relating to our ESG policies or performance.

Further, our emphasis on ESG issues may not maximize short-term financial results and may yield financial results that conflict with the market’s expectations. We have and may in the future make business decisions that may reduce our short-term financial results if we believe that the decisions are consistent with our ESG goals, which we believe will improve our financial results over the long-term. These decisions may not be consistent with the short-term expectations of our stockholders and may not produce the long-term benefits that we expect, in which case our business, financial condition, and operating results could be harmed.

Risks Related to Our Class A Common Stock and this Offering

We may, in the future, issue additional securities, which would reduce our stockholders’ percent of ownership and may dilute our share value.

Our Certificate of Incorporation, as amended to date, authorizes us to issue 295,000,000 shares of Class A common stock, 10,000,000 shares of Class B common stock, and 15,000,000 Class C stock. As of the date of this prospectus supplement, we had 162,458,324 shares of Class A common stock outstanding; 8,548,088 shares of Class B common stock issued and outstanding; and 12,500,200 shares of Class C common stock issued and outstanding.

The future issuance of additional shares of Class A common stock will result in additional dilution in the percentage of our Class A common stock held by our then existing stockholders. We may value any Class A common stock issued in the future on an arbitrary basis including for services or acquisitions or other corporate actions that may have the effect of diluting the value of the shares held by our stockholders, and might have an adverse effect on any trading market for our Class A common stock. Additionally, our board of directors may designate the rights terms and preferences of one or more series of preferred stock at its discretion including conversion and voting preferences without prior notice to our stockholders. Any of these events could have a dilutive effect on the ownership of our shareholders, and the value of shares owned.

Raising additional capital or purchasing businesses through the issuance of common stock will cause dilution to our existing stockholders.

We may seek additional capital through a combination of private and public equity offerings, debt financings, collaborations, and strategic and licensing arrangements, as well as issuing stock to make additional business or asset acquisitions. To the extent that we raise additional capital through the sale of common stock or securities convertible or exchangeable into common stock or through the issuance of equity for purchases of businesses or assets, your ownership interest in Alpine 4 will be diluted.

Raising additional capital may restrict our operations or require us to relinquish rights.

We may seek additional capital through a combination of private and public equity offerings, debt financings, collaborations, and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of common stock or securities convertible or exchangeable into common stock, the terms of any such securities may include liquidation or other preferences that materially adversely affect your rights as a stockholder. Debt financing, if available, would increase our fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration, strategic partnerships and licensing arrangements with third parties, we may have to relinquish valuable rights to our intellectual property, future revenue streams or grant licenses on terms that are not favorable to us.

Market volatility may affect our stock price and the value of your shares.

The market price for our Class A common stock is likely to be volatile, in part because of the volume of trades of our Class A common stock. In addition, the market price of our Class A common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including, among others:

| | | | | | | | |

| – | announcements of new products, brands, commercial relationships, acquisitions or other events by us or our competitors; |

| | |

| – | regulatory or legal developments in the United States and other countries; |

| | |

| – | fluctuations in stock market prices and trading volumes of similar companies; |

| | |

| – | general market conditions and overall fluctuations in U.S. equity markets; |

| | |

| – | social and economic impacts resulting from the global COVID-19 pandemic; |

| | |

| – | variations in our quarterly operating results; |

| | |

| – | changes in our financial guidance or securities analysts’ estimates of our financial performance; |

| | |

| – | changes in accounting principles; |

| | |

| – | our ability to raise additional capital and the terms on which we can raise it; |

| | |

| – | sales of large blocks of our common stock, including sales by our executive officers, directors and significant stockholders; |

| | |

| – | additions or departures of key personnel; |

| | |

| – | discussion of us or our stock price by the press and by online investor communities; and |

| | |

| – | other risks and uncertainties described in these risk factors. |

Future sales of our Class A common stock may cause our stock price to decline.

Sales of a substantial number of shares of our Class A common stock in the public market or the perception that these sales might occur could significantly reduce the market price of our Class A common stock and impair our ability to raise adequate capital through the sale of additional equity securities.

Alpine 4 may issue Preferred Stock with voting and conversion rights that could adversely affect the voting power of the holders of Class A Common Stock.

Pursuant to our Certificate of Incorporation, our Board of Directors may issue Preferred Stock with voting and conversion rights that could adversely affect the voting power of the holders of Class A Common Stock. In the fourth quarter of 2019, we issued shares of a newly designated Series B Preferred Stock to members of our Board of Directors. The outstanding shares of Series B Preferred Stock have voting rights in the aggregate equal to 200% of the total voting power of our other outstanding securities, giving our Board of Directors control over any matters submitted to the vote of the shareholders of Alpine 4. Any such provision may be deemed to have a potential anti-takeover effect, and the issuance of Preferred Stock in accordance with such provision may delay or prevent a change of control of Alpine 4. The Board of Directors also may declare a dividend on any outstanding shares of Preferred Stock.

If we are unable to meet the required listing standards of The Nasdaq Capital Market, our Class A common stock may be delisted from The Nasdaq Capital Market, which could negatively impact the price of our common stock and our ability to access the capital markets.

Our common stock is currently listed on The Nasdaq Capital Market. The listing standards of The Nasdaq Capital Market require that a company maintain stockholders’ equity of at least $2.5 million and a minimum bid price