Current Report Filing (8-k)

July 08 2022 - 7:51AM

Edgar (US Regulatory)

falseATHERSYS, INC / NEW000136814800013681482022-07-012022-07-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 1, 2022

Athersys, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33876 | | 20-4864095 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 3201 Carnegie Avenue, | Cleveland, | Ohio | | 44115-2634 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (216) 431-9900

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | ATHX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

Following ongoing discussions with Aspire Capital Fund, LLC, an Illinois limited liability company (“Aspire Capital”), on July 6, 2022, Aspire Capital delivered notice to Athersys, Inc., a Delaware corporation (the “Company”), terminating the Common Stock Purchase Agreement, dated May 12, 2022 (the “Purchase Agreement”), by and between the Company and Aspire Capital, effective immediately. Aspire Capital had the right to terminate the Purchase Agreement pursuant to the terms thereof at the time or any time after any of the Company’s then-current executive officers (as defined in Section 16 of the Securities Exchange Act of 1934) ceased to be an executive officer or full-time employee of the Company, which right was triggered in connection with the departures of William (B.J.) Lehmann, the Company’s former President, Chief Operating Officer and Secretary, John Harrington, the Company’s former Executive Vice President and Chief Scientific Officer, and Ivor Macleod, the Company’s former Chief Financial Officer. The Purchase Agreement provided that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital was committed to purchase up to an aggregate of $100.0 million of the Company’s common stock over the 24-month term of the Purchase Agreement at a price equal to the lower of (i) the lowest sale price for the Company’s common stock on the date of sale and (ii) the arithmetic average of the three lowest closing sale prices for the Company’s common stock during the ten consecutive business days ending on the business day immediately preceding the purchase date of those securities.

The Company had equity purchase agreements in place since 2011 with Aspire Capital that allowed the Company to sell shares of its common stock to Aspire Capital from time to time. From May 12, 2022 through the date of termination, the Company sold 6,870,000 shares of its common stock under the Purchase Agreement, generating proceeds of $1,867,971. Upon termination, the Company had no further obligations under the Purchase Agreement.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective July 1, 2022, the Company designated Daniel Camardo, age 54, as the Company’s principal financial officer and principal accounting officer while the Company searches for a new permanent Chief Financial Officer. Mr. Camardo is the Company’s current Chief Executive Officer. Ivor Macleod, the Company’s former Chief Financial Officer, ceased employment on June 30, 2022. Mr. Camardo will not receive any additional compensation or benefits in connection with this designation. There are no family relationships between Mr. Camardo and any director or executive officer of the Company, or any person nominated or chosen by the Company to become a director or executive officer. There are no arrangements or understandings between Mr. Camardo and any other persons pursuant to which he was designated as the Company’s principal financial officer and principal accounting officer. Information regarding Mr. Camardo’s business experience, positions with the Company and related transactions were previously disclosed in the Company’s proxy statement for its 2022 annual meeting of stockholders, as filed with the Securities and Exchange Commission on July 1, 2022, which is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 8, 2022

| | | | | | | | |

| ATHERSYS, INC. |

| | |

| By: | /s/ Daniel Camardo |

| | Name: Daniel Camardo Title: Chief Executive Officer |

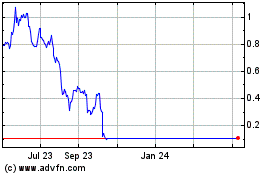

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Apr 2023 to Apr 2024