Micron Technology Shares Lower As Guidance Disappoints

July 01 2022 - 11:38AM

Dow Jones News

By Michael Dabaie

Micron Technology Inc. shares fell 5.8% to $52.08 in Friday

trading after guidance missed analyst views.

The memory and storage solutions company after the bell Thursday

guided for fourth-quarter revenue of $7.2 billion, plus or minus

$400 million, while the FactSet consensus had been for $9.15

billion.

"Recently, the industry demand environment has weakened, and we

are taking action to moderate our supply growth in fiscal 2023. We

are confident about the long-term secular demand for memory and

storage and are well positioned to deliver strong cross-cycle

financial performance," Chief Executive Sanjay Mehrotra said in the

company's earnings release.

Micron reported third quarter revenue of $8.64 billion, up from

$7.42 billion for the same period last year and in-line with

FactSet consensus. Adjusted per-share earnings were $2.59, ahead of

the FactSet consensus for $2.44.

Raymond James analysts Melissa Fairbanks and Liz Pate maintained

their Strong Buy rating on Micron following the May quarter

results, but lowered their price target to $72 a share.

"Notably, China-specific demand is coming in 30% below prior

expectations, resulting in a 10% cut to overall revenue; the

balance reflects headwinds related to broader macro concerns," the

analysts said.

Chief Business Officer Sumit Sadana said during the company's

earnings call that "the impact of China has been pretty

significant. The weakness in China is very pronounced."

"While the F4Q outlook reflects these near-term headwinds, we

believe the reset was generally expected given increasingly bearish

macro concerns. That said, we are encouraged by the company's

commitment to protect profitability, and while it may take time for

the overall market to respond to lower demand signals, MU's

decision to reduce bit output and cut capex for FY23 sets the

company up to better weather near-term turbulence," Raymond James

said in the research note.

Wedbush analyst Matt Bryson said focus should be squarely on

Micron's sharply reduced guidance for the fourth quarter. "Having

said this, we see Micron's guide as having taken much of the

forward risk out of numbers given management's conservative

bit/pricing guidance," the analyst said.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

July 01, 2022 11:23 ET (15:23 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

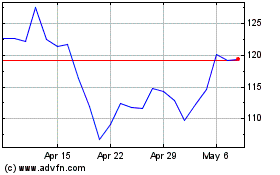

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024