Performance Shipping Inc. (NASDAQ: PSHG) (the “Company”), a global

shipping company specializing in the ownership of tanker vessels,

today reported a net loss from continuing and discontinued

operations of $2.1 million and net loss from continuing and

discontinued operations attributable to common stockholders of

$11.5 million for the first quarter of 2022, compared to a net loss

from continuing and discontinued operations and net loss from

continuing and discontinued operations attributable to common

stockholders of $2.9 million for the same period in 2021. Net loss

from continuing and discontinued operations attributable to common

stockholders for the three-month period ended March 31, 2022

included a one-time non-cash deemed dividend of $9.3 million,

stemming from the exchange of shares of certain holders of our

common stock for shares of Series B preferred stock at the closing

of the tender offer in January 2022.

Revenue from continuing and discontinued

operations was $8.6 million ($5.2 million net of voyage expenses)

for the first quarter of 2022, compared to $8.4 million ($3.5

million net of voyage expenses) for the same period in 2021. This

increase was attributable to the increased time-charter equivalent

rates (TCE rates) achieved during the quarter. Fleetwide, the

average time charter equivalent rate for the first quarter of 2022

was $12,352, compared with an average rate of $7,691 for the same

period in 2021. During the first quarter of 2022, net cash used in

operating activities of continuing and discontinued operations was

$3.9 million, compared with net cash used in operating activities

of continuing and discontinued operations of $1.4 million for the

first quarter of 2021.

As of March 31, 2022, the Company’s number of

common shares issued and outstanding was 2,592,421. As of the date

hereof, the number of common shares issued and outstanding is

10,395,030. During the first quarter of 2022 and up to the date

hereof, the Company sold in its previously announced at-the-market

offering an aggregate of 526,916 common shares at a weighted

average sales price of $2.94, for total proceeds of approximately

$1.5 million, net of commissions and other expenses. In addition,

in the second quarter of 2022, the Company sold in an underwritten

public offering 7,620,000 units at a price of $1.05 per unit, with

each unit consisting of one common share and one warrant to

purchase one common share, for total proceeds of approximately $7.4

million, net of underwriters’ fees and commissions.

On June 21, 2022, the Company announced its

agreement to acquire its sixth Aframax tanker with expected

delivery on or about July 5, 2022. The acquisition cost of

approximately $27.6 million will be financed with cash on hand and

the incurrence of debt through a new senior secured facility that

the Company anticipates it will enter into prior to delivery of the

vessel.

Commenting on the results of the first quarter

of 2022 and subsequent developments, Andreas Michalopoulos, the

Company’s Chief Executive Officer, stated:

“The first two months of 2022 saw a continuation

of the very soft charter rates that prevailed throughout 2021. In

March 2022, we saw a marked improvement in rates due to the

unfortunate Russian invasion of Ukraine, which resulted in higher

volumes of crude oil being transported over longer distances to

meet increasing global crude oil demand. We gradually took

advantage of the improved spot charter market as we undertook

positioning voyages, resulting in fleetwide average time charter

equivalent rates of $12,352 per day during the first quarter and in

a net loss of $2.1 million from our fleet operations. The one-time

non-cash deemed dividend from our exchange offer has no impact

on our results from operations or the cash position of the Company.

So far, during the second quarter of 2022, our fleetwide average

time charter rates are significantly above those of the first

quarter of 2022.

“We believe that the encouraging freight rate

developments experienced during the latter part of the first

quarter of 2022, and continuing into the current quarter, point

toward a sustainable charter rate recovery in the medium term that

we now expect to take advantage of with our expanded fleet of six

Aframax tankers. Positive crude oil demand prospects and the urgent

need for global crude oil inventory restocking are resulting in

increased crude oil production. We expect the rising demand for

seaborne transportation coupled with low expected fleet growth and

emission-related supply constraints to support higher charter rates

for our vessels.

“During the first quarter of 2022, we completed

the special survey and the installation of the ballast water

treatment system (BWTS) on the M/T Blue Moon, and we intend to

complete the same works on our M/T P. Kikuma during the fourth

quarter of this year. Based on this plan, having 100% of our

existing fleet BWTS fitted by the end of this year and no scheduled

special surveys for 2023 will allow full utilization of our

vessels.

“As a result of our financial results, and in

accordance with our dividend policy, we will not declare a dividend

for our Q1 2022 results from operations.”

Tanker Market Update for the first

quarter of 2022:

- Tanker fleet supply was 658.2

million dwt, up 0.9% from 652.3 million dwt from the previous

quarter and up 1.7% from Q1 2021 levels of 647.5 million dwt.

- Tanker demand in billion

tonne-miles is projected to increase by a firm 7.6% in 2022,

supported by the continued easing of OPEC crude oil production cuts

along with a shift in trading patterns to longer-haul distances

emerging due to the Russia-Ukraine war.

- Tanker fleet supply in deadweight

terms is estimated to grow by a moderate 2.4% in 2022.

- Crude oil tanker fleet utilization

was estimated at 78.0%, slightly down from 79.0% in the previous

quarter and at the same levels of 78.0% in Q1 2021.

- Newbuilding tanker contracting was

just 0.6 million dwt in the first quarter, resulting in a tanker

orderbook to fleet ratio of 6.1%, the lowest level seen since

1996.

- Daily spot charter rates for

Aframax tankers averaged $32,266, up 190.9% from the previous

quarter average of $11,093 and up 206.5% from the Q1 2021 average

of $10,527.

- The value of a 10-year-old Aframax

tanker at the end of the first quarter was $27.5 million, up 1.9%

from $27.0 million in the previous quarter, and up 17.0% from $23.5

million in Q1 2021.

- The number of tankers used for

floating storage (excluding dedicated storage) was 146 (21.3

million dwt), down 13.6% from 169 (25.6 million dwt) from the

previous quarter and down 12.6% from Q1 2021 levels of 167 (26.4

million dwt).

- Global oil consumption was 98.9

million bpd, down 1.6% from the previous quarter level of 100.4

million bpd, and up 4.9% from Q1 2021 levels of 94.2 million

bpd.

- Global oil production was 98.8

million bpd, up 0.6% from the previous quarter level of 98.3

million bpd and up 6.8% from Q1 2021 levels of 92.5 million

bpd.

- OECD commercial inventories were

2,623.8 million barrels, down 3.0% from the previous quarter level

of 2,704.2 million barrels, and down 11.5% from Q1 2021 levels of

2,965.9 million barrels.

- During the global gradual recovery

from COVID-19, we continue to take proactive measures to ensure the

health and wellness of our crew and onshore employees while

endeavoring to maintain effective business continuity and

uninterrupted service to our customers. While the situation is

improving, we continue to incur increased costs as a result of the

restrictions imposed in various jurisdictions creating delays and

additional complexities with respect to port calls and crew

rotations.

The above market outlook update is based on

information, data, and estimates derived from industry sources.

There can be no assurances that such trends will continue or that

anticipated developments in tanker demand, fleet supply or other

market indicators will materialize. While we believe the market and

industry information included in this release to be generally

reliable, we have not independently verified any third-party

information or verified that more recent information is not

available.

| Summary of

Selected Financial & Other Data (Continuing and Discontinued

Operations1 ) |

| |

|

For the three months ended March 31, |

|

|

|

2022 |

|

2021 |

| |

|

(unaudited) |

|

(unaudited) |

| STATEMENT

OF OPERATIONS DATA (in thousands of US Dollars): |

|

Revenue |

$ |

8,568 |

|

$ |

8,397 |

|

|

Voyage expenses |

|

3,380 |

|

|

4,936 |

|

|

Vessel operating expenses |

|

3,327 |

|

|

2,878 |

|

|

Net loss |

|

(2,080 |

) |

|

(2,853 |

) |

|

Net loss attributable to common stockholders |

|

(11,478 |

) |

|

(2,853 |

) |

|

Loss per common share, basic and diluted |

|

(3.43 |

) |

|

(0.57 |

) |

| FLEET

DATA |

|

Average number of vessels |

|

5.0 |

|

|

5.0 |

|

|

Number of vessels |

|

5.0 |

|

|

5.0 |

|

|

Ownership days |

|

450 |

|

|

450 |

|

|

Available days |

|

420 |

|

|

450 |

|

|

Operating days (2) |

|

400 |

|

|

373 |

|

|

Fleet utilization |

|

95.2 |

% |

|

82.9 |

% |

| AVERAGE

DAILY RESULTS |

|

Time charter equivalent (TCE) rate (3) |

$ |

12,352 |

|

$ |

7,691 |

|

|

Daily vessel operating expenses (4) |

$ |

7,393 |

|

$ |

6,396 |

|

| |

|

|

|

|

|

|

_______________

(1) Discontinued Operations refer to our

container vessels segment that we disposed of in 2020.

(2) Operating days are the number of available

days in a period less the aggregate number of days that our vessels

are off-hire. The specific calculation counts as on-hire the days

of the ballast leg of the spot voyages, as long as a charter party

is in place. The shipping industry uses operating days to measure

the aggregate number of days in a period during which vessels

actually generate revenues.

(3) Time charter equivalent rates, or TCE rates,

are defined as revenue (voyage, time charter and pool revenue),

less voyage expenses during a period divided by the number of our

available days during the period, which is consistent with industry

standards. Voyage expenses include port charges, bunker (fuel)

expenses, canal charges and commissions. TCE is a non-GAAP measure.

TCE rate is a standard shipping industry performance measure used

primarily to compare daily earnings generated by vessels despite

changes in the mix of charter types (i.e., voyage (spot) charters,

time charters and bareboat charters).

(4) Daily vessel operating expenses, which

include crew wages and related costs, the cost of insurance and

vessel registry, expenses relating to repairs and maintenance, the

costs of spares and consumable stores, lubricant costs, tonnage

taxes, regulatory fees, environmental costs, lay-up expenses and

other miscellaneous expenses, are calculated by dividing vessel

operating expenses by ownership days for the relevant period.

| Fleet

Employment Profile (As of June 29, 2022) |

| Performance Shipping

Inc.’s fleet is employed as follows: |

|

|

|

|

|

|

|

|

|

Vessel |

Year of Build |

Capacity |

Builder |

Charter Type |

|

|

Aframax Tanker Vessels |

|

1 |

BLUE

MOON |

2011 |

104,623

DWT |

Sumitomo Heavy Industries Marine & Engineering Co., LTD. |

Spot |

|

2 |

BRIOLETTE |

2011 |

104,588

DWT |

Sumitomo Heavy Industries Marine & Engineering Co., LTD. |

Pool |

|

3 |

P.

FOS |

2007 |

115,577

DWT |

Sasebo Heavy Industries Co. Ltd |

Pool |

|

4 |

P.

KIKUMA |

2007 |

115,915

DWT |

Samsung Heavy Industries Co Ltd. |

Spot |

|

5 |

P.

YANBU |

2011 |

105,391

DWT |

Sumitomo Heavy Industries Marine & Engineering Co., LTD. |

Pool |

|

|

|

|

|

|

|

About the Company

Performance Shipping Inc. is a global provider

of shipping transportation services through its ownership of

Aframax tankers. The Company's current fleet is employed on spot

voyages and through pool arrangements.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include, but are not limited to,

statements concerning plans, objectives, goals, strategies, future

events or performance, and underlying assumptions and other

statements, which are other than statements of historical facts,

including with respect to the delivery of the vessel we have agreed

to acquire.

The Company desires to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and is including this cautionary statement in

connection with this safe harbor legislation. The words "believe,"

"anticipate," "intends," "estimate," "forecast," "project," "plan,"

"potential," "may," "should," "expect," "pending," and similar

expressions, terms or phrases may identify forward-looking

statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, our management's examination of historical operating

trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we

cannot assure you that we will achieve or accomplish these

expectations, beliefs or projections.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include but are not limited to: the strength of world

economies, fluctuations in currencies and interest rates, general

market conditions, including fluctuations in charter rates and

vessel values, changes in demand in the tanker shipping industry,

changes in the supply of vessels, changes in worldwide oil

production and consumption and storage, changes in our operating

expenses, including bunker prices, crew costs, dry-docking and

insurance costs, our future operating or financial results,

availability of financing and refinancing including with respect to

the vessel we have agreed to acquire, changes in governmental rules

and regulations or actions taken by regulatory authorities,

potential liability from pending or future litigation, general

domestic and international political conditions, the length and

severity of epidemics and pandemics, including the ongoing outbreak

of the novel coronavirus (COVID-19) and its impact on the demand

for seaborne transportation of petroleum and other types of

products, changes in governmental rules and regulations or actions

taken by regulatory authorities, potential liability from pending

or future litigation, general domestic and international political

conditions or events, including “trade wars”, armed conflicts

including the war in Ukraine, the imposition of new international

sanctions, acts by terrorists or acts of piracy on ocean-going

vessels, potential disruption of shipping routes due to accidents,

labor disputes or political events, vessel breakdowns and instances

of off-hires and other important factors. Please see our filings

with the U.S. Securities and Exchange Commission for a more

complete discussion of these and other risks and uncertainties.

Disclaimer

This press release does not constitute an offer

to sell or the solicitation of an offer to buy securities and shall

not constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale is unlawful.

(See financial tables attached)

|

PERFORMANCE SHIPPING INC. |

|

FINANCIAL TABLES |

|

Expressed in thousands of U.S. Dollars, except for share and per

share data |

|

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

(CONTINUING AND DISCONTINUED OPERATIONS) |

| |

|

|

|

|

| |

|

For the three months ended March 31, |

| |

|

2022 |

|

2021 |

| REVENUE: |

|

|

|

|

|

Revenue |

$ |

8,568 |

|

$ |

8,397 |

|

| |

|

|

|

|

|

EXPENSES: |

|

|

|

|

|

Voyage expenses |

|

3,380 |

|

|

4,936 |

|

|

Vessel operating expenses |

|

3,327 |

|

|

2,878 |

|

|

Depreciation and amortization of deferred charges |

|

2,013 |

|

|

1,816 |

|

|

General and administrative expenses |

|

1,508 |

|

|

1,503 |

|

|

Provision for credit losses and write offs |

|

22 |

|

|

7 |

|

|

Foreign currency losses / (gains) |

|

(46 |

) |

|

51 |

|

|

Operating loss |

$ |

(1,636 |

) |

$ |

(2,794 |

) |

| |

|

|

|

|

| OTHER INCOME /

(EXPENSES): |

|

|

|

|

|

Interest and finance costs |

|

(445 |

) |

|

(467 |

) |

|

Interest income |

|

1 |

|

|

8 |

|

|

Other income |

|

- |

|

|

400 |

|

|

Total other expenses, net |

$ |

(444 |

) |

$ |

(59 |

) |

| |

|

|

|

|

| Net loss |

$ |

(2,080 |

) |

$ |

(2,853 |

) |

| Deemed dividend on Series B

preferred stock upon exchange of common stock |

|

(9,271 |

) |

|

- |

|

| Dividends on Series B

preferred stock |

|

(127 |

) |

|

- |

|

| |

|

|

|

|

| Net loss attributable

to common stockholders |

$ |

(11,478 |

) |

$ |

(2,853 |

) |

| |

|

|

|

|

| Loss per common share,

basic and diluted |

$ |

(3.43 |

) |

$ |

(0.57 |

) |

|

|

|

|

|

|

| Weighted average

number of common shares, basic and diluted |

|

3,345,664 |

|

|

5,007,493 |

|

| |

|

|

|

|

|

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE

LOSS (CONTINUING AND DISCONTINUED OPERATIONS) |

|

|

|

|

|

|

|

|

|

For the three months ended March 31, |

| |

|

2022 |

|

2021 |

| |

|

|

|

|

| Net loss |

$ |

(2,080 |

) |

$ |

(2,853 |

) |

| |

|

|

|

|

| Comprehensive

loss |

$ |

(2,080 |

) |

$ |

(2,853 |

) |

| |

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEET DATA |

|

|

|

| (Expressed in

thousands of US Dollars) |

|

|

|

|

|

|

March 31, 2022 |

|

December 31, 2021* |

|

ASSETS |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

8,186 |

|

$ |

9,574 |

|

|

Vessels, net |

|

122,408 |

|

|

123,036 |

|

|

Other fixed assets, net |

|

125 |

|

|

151 |

|

|

Other assets |

|

15,389 |

|

|

12,163 |

|

|

Total assets |

$ |

146,108 |

|

$ |

144,924 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term bank debt, net of unamortized deferred financing

costs |

$ |

47,953 |

|

$ |

49,898 |

|

|

Related party financing, net of unamortized deferred financing

costs |

|

4,813 |

|

|

- |

|

|

Other liabilities |

|

7,192 |

|

|

7,677 |

|

|

Total stockholders' equity |

|

86,150 |

|

|

87,349 |

|

|

Total liabilities and stockholders' equity |

$ |

146,108 |

|

$ |

144,924 |

|

|

|

|

|

|

|

|

|

* The balance sheet data as of December 31, 2021 has been

derived from the audited consolidated financial statements at that

date.

| OTHER

FINANCIAL DATA (CONTINUING AND DISCONTINUED

OPERATIONS) |

| |

|

|

|

|

|

|

|

For the three months ended March 31, |

|

|

|

2022 |

|

2021 |

| |

|

(unaudited) |

|

(unaudited) |

|

Net Cash used in Operating Activities |

$ |

(3,863 |

) |

$ |

(1,383 |

) |

|

Net Cash used in Investing Activities |

$ |

(1,161 |

) |

$ |

(253 |

) |

|

Net Cash provided by / (used in) Financing Activities |

$ |

3,636 |

|

$ |

(1,978 |

) |

|

|

|

|

|

|

|

|

Dividend Policy – Quarterly

Calculations

Our Board of Directors has adopted a variable

quarterly dividend policy with respect to our common stock,

pursuant to which we may declare and pay a variable quarterly cash

dividend on our common stock. If declared, the quarterly dividend

is expected to be paid each February, May, August and November and

will be equal to available cash from operations during the previous

quarter after cash payments for debt repayment and interest

expense, dividends to holders of our Series B Preferred Shares, if

any, and reserves for the replacement of our vessels, scheduled

drydockings, intermediate and special surveys and other purposes as

our Board of Directors may from time to time determine are

required, after taking into account contingent liabilities, the

terms of any credit facility, our growth strategy and other cash

needs as well as the requirements of Marshall Islands law. The

declaration and payment of dividends is, at all times, subject to

the discretion of our Board of Directors. Our Board of Directors

may review and amend our dividend policy from time to time, in

light of our plans for future growth and other factors.

In accordance with our dividend policy, and

taking into account the above-listed factors, we expect to pay

dividends only if during the preceding quarter Quarterly Cash Flow

is positive and Quarter-End Excess Cash is also positive. As a

general guideline, the amount of any such dividends is expected to

be based on a pay-out ratio of the lower of i) Quarterly Cash Flow;

and ii) Quarter-End Excess Cash. So long as our end of quarter

outstanding debt exceeds our equity market capitalization our

pay-out ratio is expected to be 50%. We will consider increasing

the pay-out ratio gradually up to a maximum level of 90% that we

may achieve when our end of quarter outstanding debt is less than

10% of our equity market capitalization. Quarter-End Excess Cash is

defined as actual end of quarter Cash and Cash Equivalents over our

Minimum Cash Threshold. Minimum Cash Threshold is defined as the

sum of minimum liquidity pursuant to our loan agreements and $1.5

million per vessel. Our bank facilities currently require us to

maintain minimum liquidity of $5.0 million.

Quarterly Cash Flow is equal to voyage and time

charter revenues less voyage expenses, less vessel operating

expenses, less general and administrative expenses, less - the

greater of i) net interest expense and repayment of long-term bank

debt or ii) fleet replacement reserves - and less maintenance

reserves for our fleet and less cash dividends to holders of our

Series B Preferred Shares, if any.

We believe the above approach will ensure the

sustainability of our Company and replacement of our fleet as

during quarters where either Excess Cash is negative or Quarterly

Cash Flow is negative, we will not pay dividends until Quarterly

Cash Flow is positive and Excess Cash is also positive. Below are

our calculations of Quarter-End Excess Cash and Quarterly Cash Flow

for the first quarter of 2022.

| DIVIDEND

CALCULATIONS |

| (Expressed in

thousands of U.S. Dollars) |

| |

|

For the three months ended March 31, 2022 |

|

Revenue |

$ |

8,568 |

|

|

Less, Voyage expenses |

$ |

(3,380 |

) |

|

Less, Vessel operating expenses |

$ |

(3,327 |

) |

|

Less, General and administrative expenses |

$ |

(1,441 |

) |

| |

|

|

|

Less, Greater of (I) or (II): |

|

|

|

Interest and finance costs |

$ |

(445 |

) |

|

Plus, Repayment of long-term bank debt |

$ |

(1,978 |

) |

|

Total (I) |

$ |

(2,423 |

) |

|

Or |

|

|

|

Replacement reserve (II) |

$ |

(1,714 |

) |

| |

|

|

|

Less, Maintenance reserve |

|

(438 |

) |

| Quarterly Cash Flow

(A) |

$ |

(2,441 |

) |

| |

|

|

|

Cash and cash equivalents |

$ |

8,186 |

|

|

Less, Minimum Cash Threshold |

$ |

12,500 |

|

| Quarter-End Excess

Cash (B) |

$ |

(4,314 |

) |

| |

|

|

| Quarterly Cash Flow Test (A)

>0, AND |

|

Not eligible for

dividend |

| Quarter-End Excess Cash Test

(B) >0 |

|

Not

eligible for dividend |

| Cash Available for

Dividend, lower (A) or (B) |

$ |

- |

|

|

Payout ratio |

|

50 |

% |

| Quarterly

Dividend |

$ |

- |

|

| |

|

|

_______________

(1) General and administrative expenses, for the

purpose of calculating dividends, exclude non-cash items.

(2) Replacement reserves reflect the aggregate

annual amount of cash that the Company retains to fund the

replacement of each of its vessels. In addition to the replacement

reserve retained and reinvested at a certain annual rate or

equivalent debt repayment, the Company estimates at the specific

expected replacement date to utilize funds from the proceeds of the

scrap value of the vessels and the assumption of a modest level of

debt to purchase the replacement vessel assuming such replacement

is for a ten-year-old vessel at the ten-year historical mid-cycle

value.

(3) Maintenance reserves are based on an

estimated cost for the drydock, intermediate and special surveys of

the vessels in our fleet over the recurring statutory five-year

survey period. They are used, instead of actual maintenance costs

when incurred, for purposes of calculating the quarterly dividend

to remove the additional cash flow variability during quarters that

drydocks occur.

Corporate Contact:

Andreas Michalopoulos

Chief Executive Officer, Director and Secretary

Telephone: + 30-216-600-2400

Email: amichalopoulos@pshipping.com

Website: www.pshipping.com

Investor and Media Relations:

Edward Nebb

Comm-Counsellors, LLC

Telephone: + 1-203-972-8350

Email: enebb@optonline.net

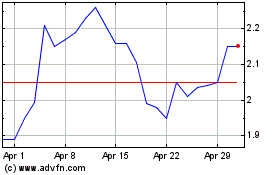

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Apr 2023 to Apr 2024