Current Report Filing (8-k)

June 28 2022 - 4:20PM

Edgar (US Regulatory)

0001278027

false

0001278027

2022-06-28

2022-06-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed with the

Securities and Exchange Commission on June 28, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

June 28, 2022

| |

B&G Foods, Inc. |

|

| (Exact name of Registrant as specified in its charter) |

| Delaware |

|

001-32316 |

|

13-3918742 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

| Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (973) 401-6500

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BGS |

New York Stock Exchange |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On June 28, 2022, we amended our amended and

restated credit agreement, dated as of October 2, 2015, and previously amended on March 30, 2017, November 20, 2017, October 10,

2019 and December 16, 2020, among B&G Foods, as borrower, the several banks and other financial institutions or entities from

time to time party thereto as lenders and Barclays Bank PLC, as administrative agent and collateral agent. In the remainder of this report,

we refer to the amended and restated credit agreement as so amended, as our credit agreement.

The amendment modifies the consolidated leverage

ratio financial maintenance covenant contained in Section 6.1(a) of our credit agreement so that the consolidated leverage ratio

as at the last day of any test period may not exceed the ratios indicated below:

Test Periods Ending on

or about | |

Consolidated Leverage

Ratio |

| June 30, 2022 | |

7.50 to 1.00 |

| September 30, 2022 | |

8.00 to 1.00 |

| December 31, 2022 | |

8.00 to 1.00 |

| March 31, 2023 | |

8.00 to 1.00 |

| June 30, 2023 | |

8.00 to 1.00 |

| September 30, 2023 | |

8.00 to 1.00 |

| December 31, 2023 | |

7.50 to 1.00 |

| March 31, 2024 and thereafter | |

7.00 to 1.00 |

A copy of the amendment to our credit agreement

is filed as Exhibit 10.1 to this report. A copy of the press release issued by B&G Foods to announce the completion of the amendment

is filed as Exhibit 99.1 to this report.

Item 8.01. Other Events.

On June 28, 2022, B&G Foods announced

that during the second quarter of 2022, we sold 2,739,568 shares of common stock under our previously announced “at the-market”

(ATM) equity offering program. B&G Foods generated $63.2 million in gross proceeds, or $23.08 per share, from the sales and paid commissions

to the sales agents of approximately $1.3 million and incurred other fees and expenses of approximately $0.1 million. In total since

launching the ATM equity offering program during the third quarter of 2021, B&G Foods has sold 6,547,627 shares of common stock and

has generated $179.0 million in gross proceeds, or $27.34 per share, from the sales and paid commissions to the sales agents of approximately

$3.6 million and incurred other fees and expenses of approximately $0.5 million.

B&G Foods has used the net proceeds from shares

sold under the ATM equity offering program to repay revolving credit loans, to pay offering fees and expenses, and for general corporate

purposes. B&G Foods intends to use the net proceeds from any future sales of its common stock under the ATM offering for general corporate

purposes, which could include, among other things, repayment, refinancing, redemption or repurchase of long-term debt or possible acquisitions.

A copy of the press release issued by B&G Foods

to announce the foregoing is filed as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| |

10.1 |

Fifth Amendment to Credit Agreement dated as of June 28, 2022, to the Amended and Restated Credit Agreement, dated as of October 2, 2015, as amended, among B&G Foods, Inc., as borrower, the subsidiaries of B&G Foods, Inc. from time to time party thereto as guarantors, the several banks and other financial institutions or entities from time to time party thereto as lenders and Barclays Bank PLC, as administrative agent for the lenders and as collateral agent for the secured parties |

| |

|

|

| |

99.1 |

Press Release dated June 28, 2022 |

| |

|

|

| |

104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

B&G FOODS, INC. |

| |

|

| Dated: June 28, 2022 |

By: |

/s/ Scott E. Lerner |

| |

|

Scott E. Lerner |

| |

|

Executive Vice President, |

| |

|

General Counsel and Secretary |

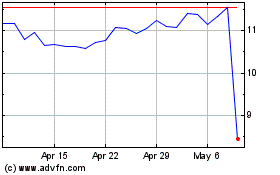

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

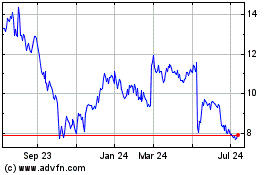

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024