Filed Pursuant to Rule 424(b)(3)

Registration No. 333-242322

Amendment No. 1 Dated June 28,

2022

(to Prospectus dated August 14, 2020)

Actinium Pharmaceuticals, Inc.

Up to $200,000,000

Common Stock

This Amendment No. 1 to Prospectus, or this amendment, amends

our sales agreement prospectus dated August 14, 2020, or the sales agreement prospectus and together with this amendment, the prospectus.

This amendment should be read in conjunction with the sales agreement prospectus, which is to be delivered with this amendment. This amendment

amends only those sections of the sales agreement prospectus listed in this amendment; all other sections of the sales agreement prospectus

remain as is.

We previously entered into a Capital on Demand™ Sales Agreement,

or the original sales agreement, with JonesTrading Institutional Services LLC, or JonesTrading, dated August 7, 2020, relating to the

sale of shares of our common stock, par value $0.001 per share, having an aggregate offering price of up to $200,000,000 from time to

time through or to JonesTrading, acting as agent or principal. On June 28, 2022, we amended and restated the original sales agreement,

or the sales agreement, to add B. Riley Securities, Inc., or B. Riley Securities, with JonesTrading, or the agents, to act as

agents or principals thereunder. To date, we have sold $76,193,552 of shares of common stock pursuant to the sales agreement prospectus.

As a result, $123,806,448 remain available to be sold pursuant to this prospectus.

Sales of our common stock, if any, under this prospectus, as amended,

will be made by any method permitted that is deemed an “at the market offering” as defined in Rule 415 under the Securities

Act of 1933, as amended, or the Securities Act. The agents will act as our sales agents using commercially reasonable efforts consistent

with their normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The agents will be entitled to compensation at a commission rate of

3.0% of the gross sales price per share sold under the sales agreement. See “Plan of Distribution” beginning on page 4

for additional information regarding the compensation to be paid to the agents. In connection with the sale of the shares of common stock

on our behalf, each agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation

of each agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution

to the agent with respect to certain liabilities, including liabilities under the Securities Act.

Investing in our securities involves a high degree of risk. These

risks are discussed under “Risk Factors” beginning on page 2 of this amendment, on page 4 of the sales agreement

prospectus and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this amendment or the accompanying

sales agreement prospectus. Any representation to the contrary is a criminal offense.

| JonesTrading |

B. Riley Securities |

The date of this Amendment No. 1 to Prospectus

is June 28, 2022.

TABLE OF CONTENTS

THE OFFERING

| Common stock offered by us |

Shares of our common stock having an aggregate offering price of up to $200,000,000. |

| Manner of offering |

“At the market offering” as defined in Rule 415(a)(4) under the Securities Act, that may be made from time to time, through or to the agents, each as agent or principal. See section titled “Plan of Distribution” on page 4 of this amendment. |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including the advancement of our drug candidates in clinical trials, regulatory submissions, potential commercial activity, preclinical research and development, capital expenditures, and to meet working capital needs. Please see “Use of Proceeds” on page 3. |

| Risk factors |

Investing in our securities involves a high degree of risk. You should read the sections titled “Risk Factors” beginning on page 2 of this amendment, on page 4 of the sales agreement prospectus and in the documents incorporated by reference into this prospectus, for a discussion of factors to consider before deciding to invest in our common stock. |

| NYSE American symbol |

ATNM. |

RISK FACTORS

An investment in our common stock involves a high degree of risk.

Before deciding whether to invest in our common stock, you should carefully consider the risks and uncertainties described below, together

with the information under the heading “Risk Factors” in our most recent Annual Report on Form 10-K for the fiscal year ended

December 31, 2021, all of which are incorporated herein by reference, as updated or superseded by the risks and uncertainties described

under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus,

as amended, together with all of the other information contained or incorporated by reference in this prospectus, as amended. The risks

and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that

we currently deem immaterial may also affect our operations. Past financial performance may not be a reliable indicator of future performance,

and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our

business, business prospects, financial condition or results of operations could be seriously harmed. This could cause the trading price

of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled

“Special Note Regarding Forward-Looking Statements.”

Additional Risks Related to this Offering

The actual number of shares we will issue under the sales agreement,

at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement and compliance

with applicable law, we have the discretion to deliver placement notices to either of the agents at any time throughout the term of the

sales agreement. The number of shares that are sold by an agent after delivering a placement notice will fluctuate based on the market

price of the common stock during the sales period and limits we set with said agent. Because the price per share of each share sold will

fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number

of shares that will be ultimately issued.

USE OF PROCEEDS

We may issue and sell shares of common stock having aggregate sales

proceeds of up to $200,000,000 from time to time, before deducting sales agent commissions and expenses. The amount of proceeds from this

offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance

that we will be able to sell any shares under or fully utilize the sales agreement with the agents.

We currently intend to use the net proceeds from the sale of securities

offered by this prospectus, as amended, for general corporate purposes, including the advancement of our drug candidates in clinical trials,

regulatory submissions, potential commercial activity, preclinical research and development, capital expenditures, and to meet working

capital needs.

Investors are cautioned, however, that expenditures may vary substantially

from these uses. Investors will be relying on the judgment of our management, who will have broad discretion regarding the application

of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including the amount

of cash generated by our operations, the amount of competition and other operational factors. We may find it necessary or advisable to

use portions of the proceeds from this offering for other purposes.

From time to time, we evaluate these and other factors and we anticipate

continuing to make such evaluations to determine if the existing allocation of resources, including the proceeds of this offering, is

being optimized. Circumstances that may give rise to a change in the use of proceeds include:

| |

● |

a change in development plan or strategy; |

| |

|

|

| |

● |

the addition of new products or applications; |

| |

|

|

| |

● |

technical delays; |

| |

|

|

| |

● |

delays or difficulties with our clinical trials; |

| |

|

|

| |

● |

negative results from our clinical trials; |

| |

|

|

| |

● |

difficulty obtaining U.S. Food and Drug Administration approval; and |

| |

|

|

| |

● |

the availability of other sources of cash including additional offerings, if any. |

Pending other uses, we intend to invest the proceeds to

us in investment-grade, interest-bearing securities such as money market funds, certificates of deposit, or direct or guaranteed obligations

of the U.S. government, or hold as cash. We cannot predict whether the proceeds invested will yield a favorable, or any, return.

PLAN OF DISTRIBUTION

On June 28, 2022, we entered into an Amended and Restated Capital

on Demand™ Sales Agreement, or the sales agreement, with JonesTrading and B. Riley Securities, pursuant to which we may, from

time to time, offer and sell shares of our common stock having an aggregate offering price of up to $200,000,000. Sales of our common

stock, if any, under this prospectus, as amended, may be made in sales deemed to be “at the market offerings” as defined in

Rule 415 promulgated under the Securities Act. To date, we have sold $76,193,552 of shares of common stock pursuant to the sales agreement

prospectus. As a result, $123,806,448 remain available to be sold pursuant to this prospectus.

Each time we wish to issue and sell common stock, we will notify either

agent of the number of shares to be issued, the dates on which such sales are anticipated to be made, any minimum price below which sales

may not be made and other sales parameters as we deem appropriate. Once we have so instructed an agent, unless that agent declines to

accept the terms of the notice, each agent has agreed, subject to the terms and conditions of the sales agreement, to use its commercially

reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms.

We may instruct an agent not to sell shares of common stock if the sales cannot be effected at or above the price designated by us in

any such instruction. We or either agent may suspend the offering of shares of common stock being made through the applicable agent under

the sales agreement upon proper notice to the other party.

We will pay each agent commissions for its services in acting as agent

in the sale of our common stock. Each agent will be entitled to compensation at a commission rate equal to 3.0% of the aggregate gross

sales price of the shares sold by that agent. Because there is no minimum offering amount required as a condition to close this offering,

the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed

to reimburse the agents for certain specified expenses, including the fees and disbursements of their legal counsel in an aggregate amount

not to exceed $75,000. We estimate that the total expenses for this offering, excluding compensation and reimbursements payable to the

agents under the terms of the sales agreement, will be approximately $275,000.

Settlement for sales of common stock will occur on the second business

day following the date on which any sales are made or such earlier day as is industry practice for regular-way trading, or on some other

date that is agreed upon by us and the applicable agent in connection with a particular transaction, in return for payment of the net

proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of the common stock on our behalf, each

agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of each agent will

be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the agents against

certain civil liabilities, including liabilities under the Securities Act.

The offering of shares of common stock pursuant to the sales agreement

will terminate upon the earliest of (i) the sale of all shares of common stock subject to the sales agreement and (ii) the termination

of the sales agreement according to its terms by either agent or us, with respect to the applicable agent.

Our common stock is listed on the NYSE American and trades under the

symbol “ATNM.” The transfer agent of our common stock is Action Stock Transfer Corporation.

JonesTrading, B. Riley Securities and/or their respective affiliates

have in the past and may in the future provide various investment banking and other financial services for us for which services they

may in the future receive customary fees.

LEGAL MATTERS

The validity of the securities offered by this prospectus, as amended,

will be passed upon by Haynes and Boone, LLP, New York, New York. Duane Morris LLP, New York, New York, is counsel for JonesTrading and

B. Riley Securities in connection with this offering.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Securities and Exchange Commission allows us to “incorporate

by reference” the information we have filed with it, which means that we can disclose important information to you by referring

you to those documents. The information we incorporate by reference is an important part of this prospectus, and later information that

we file with the Securities and Exchange Commission will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future documents (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we file

with the Securities and Exchange Commission pursuant to Sections l3(a), l3(c), 14 or l5(d) of the Securities Exchange Act of 1934, as

amended, subsequent to the date of this prospectus and prior to the termination of the offering:

| |

● |

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission on March 25, 2022; |

| |

|

|

| |

● |

Our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022, filed with the Securities and Exchange Commission on May 13, 2022; |

| |

● |

Our Current Report on Form 8-K filed with the Securities and Exchange Commission on April 13, 2022; and |

| |

● |

The description of the Company’s common stock and warrants contained in the Exhibit 4.15 to our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 31, 2021, including any amendments thereto or reports filed for the purposes of updating this description. |

All filings filed by us pursuant to the Securities Exchange Act of

1934, as amended, after the date of the initial filing of this registration statement and prior to the effectiveness of such registration

statement (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) shall also be deemed to be incorporated by

reference into this prospectus.

You should rely only on the information incorporated by reference or

provided in this prospectus. We have not authorized anyone else to provide you with different information. Any statement contained in

a document incorporated by reference into this prospectus will be deemed to be modified or superseded for the purposes of this prospectus

to the extent that a later statement contained in this prospectus or in any other document incorporated by reference into this prospectus

modifies or supersedes the earlier statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded,

to constitute a part of this prospectus. You should not assume that the information in this prospectus is accurate as of any date other

than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

We will provide without charge to each person to whom a copy of this

prospectus is delivered, upon written or oral request, a copy of any or all of the reports or documents that have been incorporated by

reference in this prospectus but not delivered with this prospectus (other than an exhibit to these filings, unless we have specifically

incorporated that exhibit by reference in this prospectus). Any such request should be addressed to us at:

Actinium Pharmaceuticals, Inc.

Attn: Steve O’Loughlin

275 Madison Avenue, 7th Floor

New York, New York 10016

(646) 677-3870

You may also access the documents incorporated by reference in this

prospectus through our website at www.actiniumpharma.com. Except for the specific incorporated documents listed above, no information

available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms

a part.

$200,000,000

COMMON STOCK

PROSPECTUS

| JonesTrading |

B. Riley Securities |

The date of this Amendment No. 1 to Prospectus

is June 28, 2022.

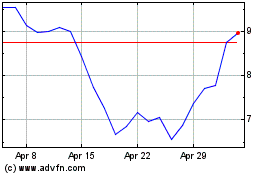

Actinium Pharmaceuticals (AMEX:ATNM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Actinium Pharmaceuticals (AMEX:ATNM)

Historical Stock Chart

From Apr 2023 to Apr 2024