WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

☐ Preliminary Information Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d) (1))

☒ Definitive Information Statement

| INTEGRATED CANNABIS SOLUTIONS, INC. |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check appropriate box):

| ☒ | No fee required. |

| |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: Not Applicable |

| (2) | Aggregate number of securities to which transaction applies: Not Applicable |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): Not Applicable |

| (4) | Proposed maximum aggregate value of transaction: Not Applicable |

| (5) | Total fee paid: Not Applicable |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Check box if any part of the fee is offset as provided by the Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing: |

| | |

| | Amount Previously Paid: Not Applicable Form, Schedule or Registration Statement No.: Not Applicable Filing Party: Not Applicable Date Filed: Not Applicable |

INTEGRATED CANNABIS SOLUTIONS, INC.

6810 N State Road 7, Suite 251

Coconut Creek, Florida 33073

June 27, 2022

Dear Stockholder:

This Information Statement is furnished to holders of shares of common stock, par value $0.0001 per share (the "Common Stock"), of Integrated Cannabis Solutions, Inc. (the "Company"). On June 14, 2022, the Board of Directors (the “Board”) approved and recommended the approval by our stockholders by majority consent vote, of the following corporate actions (“Corporate Actions”):

| 1. | To approve the amendment to the Articles of Incorporation of the Company wherein the name of the Company shall be changed to “Integrated Holding Solutions, Inc.” (the “Name Change”); and |

| | |

| 2. | To approve the increase in authorized share capital of common stock of the Company from 1,650,000,000 to 2,650,000,000 shares of common stock (“Common Stock”) (the “Common Stock Authorized Share Increase”) |

Certain of our stockholders, holding a majority of our voting power on June 14, 2022 (the “Record Date”), approved the Corporate Actions by written consent in lieu of a special meeting of stockholders.

As a matter of regulatory compliance, we are sending to you this Information Statement which describes the purpose and provisions of the contemplated Corporate Actions.

| | For the Board of Directors of |

| | INTERGATED CANNABIS SOLUTIONS, INC. |

| | |

| | By: | /s/ Matthew Dwyer |

| | | Matthew Dwyer |

| | | CEO and Director |

INTEGRATED CANNABIS SOLUTIONS, INC.

6810 N State Road 7, Suite 251

Coconut Creek, Florida 33073

June 27, 2022

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 14C-2 THEREUNDER

NO VOTE OR OTHER ACTION OF THE COMPANY'S STOCKHOLDERS IS

REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL

We are sending you this Information Statement to inform you of the June 14, 2022, consent, by a vote of stockholders holding a majority of the Company’s voting power in approval of the adoption of the Corporate Actions. The purpose of this Information Statement is to provide notice that the Company’s majority stockholders, representing 96.5% of the voting power of the Company as of the Record Date, executed a written consent authorizing and approving the following corporate actions (the “Corporate Actions”):

| 1. | To approve the amendment to the Articles of Incorporation of the Company wherein the name of the Company shall be changed to “Integrated Holding Solutions, Inc.” (the “Name Change”); and |

| | |

| 2. | To approve the increase in authorized share capital of common stock of the Company from 1,650,000,000 to 2,650,000,000 shares of common stock (“Common Stock”) (the “Common Stock Authorized Share Increase”) |

The foregoing Corporate Actions will be taken no sooner than 20 calendar days after the mailing of this Information Statement to our stockholders. The Board of Directors is not soliciting your proxy in connection with the adoption of these Corporate Actions and proxies are not being requested from stockholders.

The Company is distributing this Information Statement to its stockholders in full satisfaction of any notice requirements it may have under the Nevada Revised Statutes. No additional action will be undertaken by the Company with respect to the receipt of written consents, and no dissenters' rights with respect to the receipt of the written consents, and no dissenters' rights under the Nevada Revised Statutes are afforded to the Company's stockholders as a result of the adoption of this Corporate Actions.

Expenses in connection with the distribution of this Information Statement, will be paid by the Company.

This Information Statement is being mailed on or about June 27, 2022, to all Stockholders of record as of the Record Date.

VOTE REQUIRED, MANNER OF APPROVAL

Approval to amend the current Articles of Incorporation of the Company under the Nevada Revised Statutes ("NRS") requires the affirmative vote of the holders of a majority of the voting power of the Company.

Section 78.320 of the NRS provides, in substance, that, unless the Company's Articles of Incorporation provides otherwise, stockholders may take action without a meeting of stockholders and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by the holders of outstanding voting stock holding not less than the minimum number of votes that would be necessary to approve such action at a stockholders meeting. Under the applicable provisions of the NRS, this action is effective when written consents from holders of record of a majority of the outstanding voting power are executed and delivered to the Company.

In accordance with the NRS, the affirmative vote on the Corporate Actions of at least a majority of the outstanding voting power has been obtained. As a result, no vote or proxy is required by the stockholders to approve the Corporate Actions.

Under Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the "Act"), the Corporate Actions cannot take effect prior to the filing of a Certificate of Amendment with the Nevada Secretary of State approximately twenty (20) days after the Mailing Date, which is anticipated to be on or about June 27, 2022.

OTHER INFORMATION REGARDING THE COMPANY

As of the record date, there were 1,633,317,059 shares of our Common Stock issued and outstanding, 990,440 shares of Series A Preferred Stock issued and outstanding of which each share has voting rights equal to 50,000 votes, 0 shares of Series B Preferred Stock issued and outstanding which hold no voting rights, and 540,000 shares of Series C Preferred Stock which hold no voting rights. For the approval of the Corporate Actions, the Company received written consents from 1 stockholder of the Company holding 96.5% of the voting power of the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of the Company’s stock owned beneficially as of the Record Date by: (i) each person (including any group) known by the Company to own more than five percent (5%) of any class of its voting securities, (ii) each of the Company’s directors and each of its named executive officers, and (iii) officers and directors as a group. Unless otherwise indicated, the stockholders listed possess sole voting and investment power with respect to the shares shown.

For purposes of this table, a person is deemed to be the beneficial owner of any shares of Common Stock (i) over which the person has or shares, directly or indirectly, voting or investment power, or (ii) of which the person has a right to acquire beneficial ownership at any time within 60 days after the Record Date. "Voting power" is the power to vote or direct the voting of shares and "investment power" includes the power to dispose or direct the disposition of shares.

| Name | | Shares of Stock Beneficially Owned | | | Percent of Class | | | Voting Rights | | | Total Voting % | |

| Common Stock | | | | | | | | | | | | |

| Matthew Dwyer (1) | | | 0 | | | | — | | | | — | | | | — | |

| Manuel Losada (2) | | | 0 | | | | — | | | | — | | | | — | |

| Penni Gruenberg (3) | | | 80,642,100 | | | | 4.93 | % | | | 4.93 | % | | | 0.16 | % |

| Laurence Wilneff Living Trust (4) | | | 115,030,000 | | | | 7.04 | % | | | 7.04 | % | | | 0.22 | % |

| | | | | | | | | | | | | | | | | |

| All common stock beneficial owners as a group (4 persons) | | | 195,672,100 | | | | 11.97 | % | | | 11.97 | % | | | 0.38 | % |

| | | | | | | | | | | | | | | | | |

| Series A Preferred Stock (5) | | | | | | | | | | | | | | | | |

| Matthew Dwyer (1) | | | 987,440 | | | | 99.6 | % | | | 96.5 | % | | | 96.5 | % |

| | | | | | | | | | | | | | | | | |

| Total Voting Rights of Beneficial Owners | | | 196,659,540 | | | | -- | | | | -- | | | | 96.88 | % |

Notes

| | (1) | Since November 8, 2017, Matthew Dwyer has been our President/Director and since November 11, 2019, our Chief Executive Officer/Chief Financial Officer. Matthew Dwyer holds the 540,000 Preferred C Shares referenced above. |

| | | |

| | (2) | Manuel Losada was appointed as our Director on November 11, 2019 and owns no common stock or any of our securities. |

| | | |

| | (3) | Penni Gruenberg is not a member of management and has no influence over management. |

| | | |

| | (4) | Laurence Wilneff controls Laurence Wilneff Living Trust, and has dispositive power over the shares of the Trust, and has no influence over management. |

| | | |

| | (5) | Holders of Series A Preferred Stock are entitled to exactly 50,000 votes per each 1 share held |

PROPOSAL NUMBER ONE

APPROVAL OF AMENDMENT TO ARTICLES OF INCORPORATION TO CHANGE THE NAME OF THE COMPANY TO “INTEGRATED HOLDING SOLUTIONS, INC.”

The Board of Directors believes that the amendment to the Articles of Incorporation of the Company to change the name to “Integrated Holding Solutions, Inc” (the “Name Change”) would benefit the Company by being better aligned with the business of the Company. The Board of Directors has determined that it is therefore in the best interest of the Company to complete the Name Change.

AMENDED CERTIFICATE OF INCORPORATION

Upon the effectiveness and on a date that is no less than twenty (20) days following the mailing of this Information Statement, the Board of Directors shall have the Company’s Amendment to the Certificate of Incorporation filed with the State of Nevada in order to effectuate the Name Change. Filing of such Amendment to the Certificate of Incorporation shall take place upon approval of a corporate action as filed with FINRA, which approval shall not be granted on a date that is less than twenty (20) days following the mailing of this Information Statement.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PROPOSAL TWO

APPROVAL OF COMMON STOCK AUTHORIZED SHARE CAPITAL INCREASE

The Board of Directors believes that the Common Stock Authorized Share Capital Increase would aid the Company with future fund raising as well as ensure availability of Common Stock in the event that any holders of any Series of Preferred Stock of the Company with the option to convert such Preferred Stock into the Company’s common stock shares. An increase in authorized common shares from 1,650,000,000 to 2,650,000,000 will provide the Company with that flexibility as discussed above. The Board of Directors has determined that it is therefore in the best interest of the Company to increase the authorized number of common shares in order to meet the obligations of the Company to 2,650,000,000 shares of Common Stock.

PLANS, PROPOSALS OR ARRANGEMENTS TO ISSUE NEWLY AVAILABLE SHARES OF COMMON STOCK

Other than as stated in the above, at the present time, the Board has not made any specific plan with respect to the shares of Common Stock that will be available for issuance after the Common Stock Authorized Share Capital Increase.

AMENDED ARTICLES OF INCORPORATION

Upon the effectiveness of this Information Statement and on the date that is twenty (20) days following the mailing of this Information Statement, the Board of Directors shall file the Company’s Amendment to the Articles of Incorporation with the State of Nevada in order to effectuate the Common Stock Authorized Share Increase.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

CORPORATE ACTIONS AND EFFECTIVE TIME

Upon the effectiveness of this Information Statement and on the date that is twenty (20) days following the mailing of this Information Statement, the Board of Directors shall seek the approval of FINRA for the Name Change. Upon such approval from FINRA, which shall take place no sooner than twenty (20) days following the mailing of this Information Statement, the Company shall file an Amendment to the Articles of Incorporation wherein the name of the Company shall be changed. Upon effectiveness of this Information Statement and on a date that is twenty (20) days following the mailing of this Information Statement, the Company shall file an Amendment to the Articles of Incorporation with the Secretary of State for Nevada wherein they shall enact the Common Stock Authorized Share Increase.

INTEREST OF CERTAIN PERSONS IN OR IN OPPOSITION TO THE MATTERS TO BE ACTED UPON

No director, executive officer, associate of any officer or director or executive officer, or any other person has any interest, direct or indirect, by security holdings or otherwise, in the amendment to the Articles of Incorporation referenced herein which is not shared by the majority of the stockholders.

OTHER MATTERS

If you and others who share your mailing address own Common Stock in street name, meaning through bank or brokerage accounts, you may have received a notice that your household will receive only one annual report and proxy statement from each company whose stock is held in such accounts. This practice, known as "householding" is designed to reduce the volume of duplicate information and reduce printing and postage costs. Unless you responded that you did not want to participate in householding, you were deemed to have consented to it, and a single copy of this Information Statement has been sent to your address. Each stockholder will continue to receive a separate notice.

If you would like to receive an individual copy of this Information Statement, we will promptly send a copy to you upon request by mail to the Company at 6810 North State Road 7, Suite 251, Coconut Creek, Florida 33073, or by calling (954) 906-0098. This document is also available in digital form for download or review by visiting the website of the Securities and Exchange Commission at www.sec.gov.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance with the requirements thereof, file reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). Copies of these reports, proxy statements and other information can be obtained at the SEC's public reference facilities at Judiciary Plaza, Room 1024, 450 Fifth Street, N.W., Washington, D.C., 20549. Additionally, these filings may be viewed at the SEC's website at http://www.sec.gov.

The following documents as filed with the Commission by the Company are incorporated herein by reference:

| 1. | Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 |

| | |

| 2. | Annual Report on Form 10-K and Form 10-K/A for the year ended December 31, 2021 |

SIGNATURE

Pursuant to the requirements of the Exchange Act of 1934, as amended, the Registrant has duly caused this Information Statement to be signed on its behalf by the undersigned hereunto authorized.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | INTEGRATED CANNABIS SOLUTIONS, INC. |

| | | |

| | By: | /s/ Matthew Dwyer |

| | | Matthew Dwyer CEO and Director |

EXHIBIT A

Certificate of Amendment to Articles of Incorporation for Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390- After Issuance of Stock)

| 1. | Name of Corporation: Integrated Cannabis Solutions, Inc. |

| | |

| 2. | The Articles have been amended as follows: |

| | a. | The Articles of Incorporation of Integrated Cannabis Solutions, Inc., are amended as follows: |

ARTICLE I: The name of the Corporation shall hereinafter be “Integrated Holding Solutions, Inc.”

ARTICLE IV: The number of shares of Common Stock authorized by the Corporation shall be 2,650,000,000 common shares, par value $0.00001 per share.

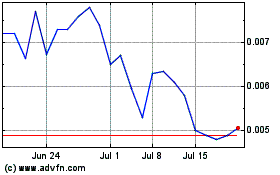

Intergrated Cannabis Sol... (PK) (USOTC:IGPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intergrated Cannabis Sol... (PK) (USOTC:IGPK)

Historical Stock Chart

From Apr 2023 to Apr 2024