Current Report Filing (8-k)

June 27 2022 - 8:01AM

Edgar (US Regulatory)

0001762239

false

0001762239

2022-06-24

2022-06-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report: June 24, 2022

Kaival

Brands Innovations Group, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

000-56016 |

83-3492907 |

| (State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification

No.) |

4460

Old Dixie Highway

Grant,

Florida 32949

(Address

of principal executive office, including zip code)

Telephone:

(833) 452-4825

(Registrant's

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

KAVL |

The

Nasdaq Stock Market, LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| ITEM 5.02. | DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS;

COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS |

Management Changes

On June 24, 2022, Nirajkumar Patel notified Kaival

Brands Innovations Group, Inc. (the “Company”), that he intends to resign as the Company’s Chief Executive Officer and

Treasurer effective immediately. Mr. Patel’s resignation is not due to any disagreement with the Company. In connection with Mr.

Patel’s resignation as the Company’s Chief Executive Officer and Treasurer, the Board of Directors (the “Board”)

appointed Mr. Patel to serve as the Company’s Chief Science and Regulatory Officer, a newly created position, effective immediately.

Mr. Patel will also continue to serve as a director.

On June 24, 2022, the Board appointed Eric Mosser,

the Company’s current Chief Operating Officer, as President, effective immediately. In connection with Mr. Mosser’s appointment

as President, the Board also appointed Mr. Mosser to serve as the Company’s principal executive officer for purposes of its filings

with the Securities and Exchange Commission. Mr. Mosser also will continue to serve as Chief Operating Officer, Secretary, and a director.

Mr. Mosser’s biographical information and business experience is set forth in the Company’s Definitive Proxy Statement on

Schedule 14A, filed with the Securities and Exchange Commission on May 4, 2022. There was no arrangement or understanding between Mr.

Mosser and any other person pursuant to which Mr. Mosser was selected for this position. Mr. Mosser is not a party to any transaction

with any related person required to be disclosed pursuant to Item 404(a) of Regulation S-K. In connection with Mr. Mosser’s appointment

as President, the Compensation Committee (the “Committee”) approved certain changes to Mr. Mosser’s cash and equity

compensation as set forth below.

Officer Compensation Changes

On June 24, 2022, the Committee approved an increase

in Mr. Mosser’s base salary to $300,000 in connection with his appointment as President. In addition, on June 24, 2022, the Committee

approved the grant of a non-qualified stock option exercisable for up to 250,000 shares of the Company’s common stock to Mr. Mosser,

with one-half of the shares vesting on the one-year anniversary of the grant date and the remaining one-half of the shares vesting on

the second-year anniversary of the grant date. The exercise price is $1.72 per share and the stock option has a ten-year term.

In addition, on June 24, 2022, the Committee approved

the grant of a non-qualified stock option exercisable for up to 250,000 shares of the Company’s common stock to Mr. Patel, with

one-half of the shares vesting on the one-year anniversary of the grant date and the remaining one-half of the shares vesting on the second-year

anniversary of the grant date. The exercise price is $1.72 per share and the stock option has a ten-year term.

ITEM 8.01. OTHER EVENTS

On June 24, 2022, Kaival Holdings, LLC (“KH”),

the Company’s controlling stockholder, and an entity owned and controlled by Mr. Patel and Mr. Mosser, exercised its right to convert

its 3,000,000 shares of Series A Preferred Stock into 25,000,000 shares of the Company’s common stock. The Certificate of Designation

of the Preferences, Rights, and Limitations of the Series A Preferred Stock (the “Certificate of Designation”) provides that

the Series A Preferred Stock is convertible (i) at the option of the holder on or after November 1, 2023 or (ii) prior to November 1,

2023, if there is a Change of Control (as defined in the Certificate of Designation) or the occurrence of any other event as determined

and agreed to by the Company and the holders holding a majority of the issued and outstanding shares of Series A Preferred Stock. KH had

previously agreed to return to the Company for cancellation a certain number of shares of Common Stock in exchange for shares of Series

A Preferred Stock convertible into shares of Common Stock equal to the number canceled, for the purpose of temporarily reducing the number

of issued and outstanding shares of Common Stock. The Board, after reviewing and discussing KH’s desire to convert the Series A

Preferred Stock prior to November 1, 2023, determined that there exists a justifiable reason for allowing the early conversion of the

Series A Preferred Stock, namely the occurrence of the entry into the international licensing agreement with an affiliate of Philip Morris

International, Inc. and approved the early conversion.

On June 27, 2022, the Company issued a press release

announcing the management changes referenced in Item 5.02, above.

ITEM 9.01 FINANCIAL STATEMENTS EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Kaival Brands Innovations Group, Inc. |

| |

|

| Dated: June 27, 2022 |

By: |

/s/ Eric Mosser |

| |

|

Eric Mosser, President and Chief Operating Officer |

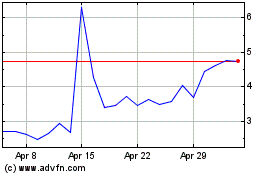

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

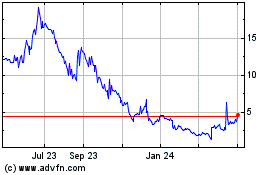

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024