UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

[ ü ] Annual Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

For the fiscal year ended December 31, 2021

or

[ ] Transition Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

For the transition period from _______ to _______

Commission File No. 001-35651

A. Full title of the plan and the address of the plan,

if different from that of the issuer named below:

THE BANK OF NEW YORK MELLON CORPORATION 401(k) SAVINGS PLAN

BNY Mellon Center

500 Grant Street

Pittsburgh, PA 15258-0001

B. Name of issuer of the securities held pursuant to the plan

and the address of its principal executive office:

THE BANK OF NEW YORK MELLON CORPORATION

240 Greenwich Street

New York, New York 10286

| | |

| The Bank of New York Mellon Corporation 401(k) Savings Plan |

|

Form 11-K

Table of Contents

| | | | | | | | |

| Page | |

| | |

| Report of Independent Registered Public Accounting Firm | | |

| | |

| Statements of Net Assets Available for Plan Benefits | | |

| | |

| Statements of Changes in Net Assets Available for Plan Benefits | | |

| | |

| Notes to Financial Statements | | |

| | |

| Supplemental Schedule: | | |

Schedule 1: Schedule H, Line 4i – Schedule of Assets (Held at End of Year) | | |

| | |

| Index to Exhibits | | |

| | |

| Signatures | | |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

The Bank of New York Mellon Corporation 401(k) Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of The Bank of New York Mellon Corporation 401(k) Savings Plan (the Plan) as of December 31, 2021 and 2020, the related statements of changes in net assets available for plan benefits for the years ended December 31, 2021 and 2020, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for plan benefits for the years ended December 31, 2021 and 2020, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying Schedule H, line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have not been able to determine the specific year that we began serving as the Plan’s auditor; however, we are aware that we have served as the Plan’s auditor since at least 1989.

Pittsburgh, Pennsylvania

June 22, 2022

/s/ KPMG LLP

The Bank of New York Mellon Corporation 401(k) Savings Plan

Statements of Net Assets Available for Plan Benefits

| | | | | | | | |

| December 31, |

| 2021 | 2020 |

| Assets: | | |

| Plan interest in the Master Trust | $ | 9,400,732,671 | | $ | 8,225,246,302 | |

| Other receivables | — | | 318,542 | |

| Total assets | 9,400,732,671 | | 8,225,564,844 | |

| | |

| Liabilities: | | |

| Total liabilities | — | | — | |

| | |

| Net assets available for plan benefits | $ | 9,400,732,671 | | $ | 8,225,564,844 | |

See accompanying Notes to Financial Statements.

The Bank of New York Mellon Corporation 401(k) Savings Plan

Statements of Changes in Net Assets Available for Plan Benefits

| | | | | | | | |

| Year ended December 31, |

| 2021 | 2020 |

| Investment income: | | |

| Change in the Plan interest in the Master Trust | $ | 1,344,051,968 | | $ | 897,560,825 | |

| Contributions | 473,635,277 | | 439,244,556 | |

| Total additions | 1,817,687,245 | | 1,336,805,381 | |

| | |

| Benefits paid to participants | 638,255,244 | | 565,055,864 | |

| Administrative expenses | 4,264,174 | | 3,243,436 | |

| Total deductions | 642,519,418 | | 568,299,300 | |

| Net increase in net assets available for plan benefits | 1,175,167,827 | | 768,506,081 | |

| | |

| Net assets available for plan benefits: | | |

| At beginning of year | 8,225,564,844 | | 7,457,058,763 | |

| At end of year | $ | 9,400,732,671 | | $ | 8,225,564,844 | |

See accompanying Notes to Financial Statements.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements December 31, 2021 and 2020 |

|

1. Description of the Plan

The following description of The Bank of New York Mellon Corporation 401(k) Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan document as amended and restated as of December 17, 2020 and the Plan’s Summary Plan Description and Prospectus for a more complete description of the Plan’s provisions.

General Information – The Plan is a defined contribution plan sponsored by The Bank of New York Mellon Corporation (the “Company”) and is intended to meet the requirements of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan provides employees with the opportunity to invest a portion of their annual compensation in the Plan, augmented by employer contributions, to meet retirement income goals.

Administration of the Plan – The Plan is administered by The Bank of New York Mellon Corporation Benefits Administration Committee (the “Plan Administrator”), a named fiduciary of the Plan. The Plan Administrator has full discretionary power and authority to construe, interpret and administer the Plan, including questions concerning eligibility and payment of benefits and may adopt rules and regulations for administering the Plan. The Bank of New York Mellon Corporation Benefits Investment Committee (the “Benefits Investment Committee”), also a named fiduciary of the Plan, is responsible for investment-related matters, including the establishment of an investment policy, the appointment of investment managers, and the monitoring of the performance of the Plan’s investment funds. There is no assurance that the stated objective of any of the funds can be achieved. The Plan’s trustee is The Bank of New York Mellon (the “Trustee”), a wholly-owned banking subsidiary of the Company. No administrative or custodial fees are paid to the Trustee from Plan assets.

The Benefits Investment Committee appointed Fiduciary Counselors Inc. to serve as the independent fiduciary (“Independent Fiduciary”) to (i) make all fiduciary decisions related to the continued prudence of offering the common stock of the Company or its affiliates as an investment option under the Plan, other than plan sponsor decisions, and (ii) select and monitor any actively or passively managed investments that are managed by the Company or its affiliates to be offered to participants as investment options under the Plan, excluding self-directed accounts (“SDAs”).

Eligibility – Employees are eligible to participate in the Plan if they are salaried U.S. employees of the Company or a subsidiary of the Company which has elected to have its U.S. employees covered by the Plan. U.S. hourly employees of the Company, or a participating subsidiary of the Company, are eligible to participate in the Plan after completing 1,000 hours of service during the 12-month period commencing on the employee’s hire date. U.S. hourly employees who do not complete 1,000 hours during the initial period will be eligible to participate in the Plan after completing 1,000 hours within any calendar year after the employee’s hire date.

Newly hired employees on or after January 1, 2021 meeting the eligibility requirements described above may begin participating in the Plan at the beginning of the next payroll period after completing the enrollment process. Those employees who do not take action to enroll in the Plan within a 30-day notification period are automatically enrolled with a pre-tax contribution rate equal to 7% of their eligible base pay (2% for newly hired employees prior to January 1, 2021). The money is invested in the LifePath Index Fund closest to the year that the participant will reach age 65.

Investment Funds – Participants in the Plan have the option of investing contributions in professionally managed funds offered under the Plan, which include lifecycle funds, passively managed index funds, actively managed funds, an SDA and common stock of the Company. The performance of the investment funds being offered in the Plan is evaluated regularly, and the funds offered under the Plan may change periodically. As described in Note 3, the Company directly pays, or indirectly reimburses participants’

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

accounts for, investment management fees related to investment management options that are managed by an affiliate.

The Benefits Investment Committee is authorized to place restrictions on trading in selected funds. Pursuant to this authority, an administrative restriction applies to account balance transfers in and out of investment funds that hold international securities, because these funds are particularly at risk for trading activity that might harm other participants or are inconsistent with the Plan’s retirement objectives. With this restriction, participants may not buy and then sell, or sell and then buy, shares in certain core funds in the Plan within a period of 15 to 60 calendar days. Trading restrictions imposed by the Company’s Personal Securities Trading Policy also apply to investments in the Company’s common stock (NYSE symbol: BK) under the Plan. With this restriction, participants may not buy and then sell, or sell and then buy, shares of the Company’s common stock within a period of less than 60 calendar days.

The maximum amount a participant can transfer into the SDA is 50% of their account balance. The Plan does not permit participants to invest in leveraged or inverse exchange-traded funds or exchange-traded notes through the SDA.

Contributions – Beginning in 2021, the Plan was designed as a traditional 401(k) plan under Internal Revenue Service (“IRS”) 401(k) plan regulations in which employee pre-tax, Roth 401(k) and employer matching contributions are subject to discrimination testing. Prior to 2021, the Plan utilized a “safe harbor” design under IRS regulations and was not subject to discrimination testing. Participants can contribute pre-tax, after-tax and/or Roth 401(k) contributions to the Plan, with an overall limit of 75% of the participant’s eligible base pay. Eligible base pay is defined as semi-monthly base pay excluding overtime, bonuses, commissions, deferrals to any non-qualified retirement program, or any other special payments, including payments after termination of employment. Federal law limited the total dollar amount participants were eligible to contribute on a pre-tax basis and/or Roth 401(k) basis (described below) to $19,500 in 2021 and 2020. The Plan limit for after-tax contributions was $16,000 in 2021 and 2020. After-tax contributions are not automatic. A participant must choose to make after-tax contributions to the Plan. Participants who were age 50 or older by December 31, 2021 or December 31, 2020, as applicable, and who reached the contribution limit for such year(s), were eligible to contribute an additional $6,500 in 2021 and 2020 in catch-up contributions to the Plan for such year(s).

Participants may elect to contribute through the Roth 401(k) contribution option. With the Roth 401(k) feature, participant contributions are made on an after-tax basis and growth in the Roth 401(k) portion of the account will be tax-free if certain holding periods applicable to Roth contributions are satisfied, as described below. The Roth 401(k) contributions qualify for matching contributions and are otherwise subject to the same combined dollar limits applicable to pre-tax contributions ($19,500 in 2021 and 2020, or $26,000 for participants over age 50 by December 31). In order for the Roth 401(k) investment earnings to be withdrawn tax-free, the distribution must be made at least five years after the first Roth 401(k) contribution and after the participant turns 59½, dies or becomes disabled.

The Plan contains an “auto-escalation” contribution feature. This feature automatically increases the rate at which participants, including newly eligible employees, contribute to the Plan by 1% each year, up to a maximum of 10%, on July 1. Prior to each July 1, participants will receive a notice indicating that their contribution rate is set to increase. Participant contributions will be invested in the investment options offered under the Plan as directed by the participant. If the participant does not have an investment election on record, the contributions will be invested in the LifePath Index Fund closest to the year that the participant will reach age 65. Participants can opt out of the contribution rate increases, change the rate of contribution or discontinue contributions at any time.

Participants may rollover into the Plan amounts representing distributions from other qualified retirement plans or Individual Retirement Accounts.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Matching Contribution – In 2021, the Company matched 100% of participant contributions up to 7% of eligible base pay with a monetary limit of $16,000 per participant. In 2020, the Company matched 100% of the first 4% of eligible base pay plus 50% of the next 2% of eligible base pay contributed by the participant for a maximum matching contribution of 5%. The Company’s matching contributions were paid in cash on a pre-tax basis and invested in the investment options offered under the Plan as directed by the participant.

Basic Company Contribution – In 2021, the Company made an annual basic company contribution of $750 to each participant with eligible base pay of less than $100,000 on January 1, 2021, and who were eligible to participate in the Plan, actively employed on December 31, 2021 and completed at least one year of service by December 31, 2021. Participants with eligible base pay of more than $100,000 on January 1, 2021 were not eligible for the annual basic company contribution of $750. In 2020, the Company made an annual basic contribution equal to 2% of eligible base pay to participants who were eligible to participate in the Plan and who were actively employed on December 31, 2020, employees who were terminated in 2020 after attaining age 55, employees who died during the plan year and employees on approved long-term disability. The basic company contributions were paid in cash on a pre-tax basis and invested in the investment options offered under the Plan as directed by the participant. If the participant does not have an investment election on record, the contributions will be invested in the LifePath Index Fund closest to the year that the participant will reach age 65. The basic company contribution was paid on March 28, 2022 for 2021 and March 24, 2021 for 2020.

Participant Accounts – Each participant’s account is credited with the participant’s pre-tax, after-tax and/or Roth 401(k) contributions, employer matching contributions and basic company contribution, if any. The account is also credited or charged with the proportionate share of changes in the net assets of the Plan arising from investment activities. Distributions with respect to a participant’s interest under the Plan are charged to the participant’s account. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting – Participants are immediately and fully vested in their pre-tax, Roth 401(k) and/or after-tax contributions, any rollover contributions and earnings or losses on these amounts. Matching contributions to the Plan for participants hired after December 31, 2020, plus any earnings or losses these amounts generate, will fully vest after three years of service. Matching contributions to the Plan for participants hired on or before December 31, 2020, plus any earnings or losses these amounts generate, are 100% vested at all times. Basic company contributions will fully vest after three years of service. If a participant attains age 65, dies or becomes disabled while employed by the Company, the participant’s account balance will be immediately vested.

Contributions made to eligible participants of the former PNC Global Investment Servicing, Inc. Retirement Savings Plan (“GIS Plan”), and the former Retirement Savings Plan of BNY Securities Group (the “Securities Group 401(k) Plan”) prior to the plan merger dates will continue to follow the vesting schedule outlined in the respective plan documents.

Forfeitures – If the participant is not fully vested in the matching or other employer contributions at the participant’s employment termination date, the nonvested portion of the account balance is forfeited on the earlier of distribution of the vested portion or five consecutive one-year breaks in service. Forfeitures are used to reduce future employer contributions. Forfeitures of $3,398,777 in 2021 and $2,487,060 in 2020, respectively, were used to reduce employer contributions. Unallocated forfeitures totaled $93,008 at December 31, 2021 and $123,910 at December 31, 2020.

Distributions and In-Service Withdrawals – The vested portion of a participant’s account will be payable upon severance of employment, including for reasons of retirement, death, or disability (within the meaning of the Company’s Long-Term Disability Plan). Participants are eligible to request withdrawals following the attainment of age 59½ or in the case of specified hardships. Amounts attributable to after-tax and rollover

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

contributions are available for in-service withdrawal at any time. The Plan also makes mandatory age 72 distributions pursuant to the minimum distribution regulations issued by the IRS. Beginning January 1, 2021, participants were permitted to convert a portion of traditional non-Roth 401(k) account balances into a Roth 401(k) contribution and withdraw up to $5,000 from the 401(k) account, penalty free, upon each birth or adoption of a child to cover related expenses. Amounts in the SDA are not eligible for withdrawals.

Notes Receivable from Participants – The Plan allows participants, either actively at work or on a paid leave of absence, to borrow from their account. The loan will be secured by a portion of the participant’s account balance and must be repaid to that account with interest. The interest payments will also be allocated to the participant’s account and will appear as earnings on that account. Loan guidelines, including interest rates, are set by the Plan in accordance with tax laws and regulations issued by the IRS and the Department of Labor.

For general purpose loans issued in plan years 2021 and 2020, the interest rate was fixed at one percentage point above the prime rate on the first business day of the month in which the loan was issued. For loans used for the purchase of a primary residence issued in 2021 and 2020, the interest rate was fixed at one percentage point above the prime rate on the first business day of the month in which the promissory note was issued to the participant.

Generally, new loans, when added to the amount of any existing loans, cannot exceed the lesser of (a) $50,000 minus the participant’s highest outstanding loan balance in the last 12 months, (b) one-half of the participant’s vested account, or (c) the participant’s account balance, excluding any investments in an SDA. General purpose loans are available for terms of 12 to 48 months. Loans for the purchase of a primary residence, however, may be for a term from 49 to 120 months. Loans are repaid in periodic installments through payroll deductions or recurring direct debit payments. Loan repayments, of both principal and interest, are invested by the Trustee among the available investment funds in the same proportions as the participant’s salary reduction contributions are invested.

The Plan provided for the following Coronavirus Aid, Relief and Economic Security (the “CARES Act”) features, among others, to permit “qualified participants” to: (i) withdraw up to $100,000 penalty free regardless if under age 59½; (ii) take up to the lesser of $100,000 or their account balance in a CARES Act loan (that is, more than the current limits of the lesser of $50,000 or ½ of the account balance) and (iii) defer all loan repayments up to one year. The provisions of the CARES Act ended December, 31, 2020.

Payment of Benefits – A participant (or their beneficiary) may elect to receive distributions in one lump sum or in a series of quarterly installments over a period not exceeding the lesser of (1) their life expectancy or the designated beneficiary’s joint life expectancy, or (2) ten years. Participants, except those who are on approved long-term disability, will automatically be paid in a lump sum if their account balance is $1,000 or less. If a portion of a participant’s balance is invested in the Company’s common stock or an SDA, the participant may elect to receive the distribution in-kind or in cash.

Voting Rights – Each participant is entitled to exercise voting rights attributable to the shares of the Company’s common stock allocated to his or her account and will be notified prior to the time that such rights are to be exercised. The Trustee will vote shares for which no directions have been timely received, and shares not credited to any participant’s account, in proportion to the vote cast by participants who have timely responded subject to review by the Independent Fiduciary.

Flexible Dividend – Dividends paid on the Company’s common stock held in a participant’s account are automatically reinvested in the Company’s common stock. A participant may elect to have the dividends on vested shares paid in cash as a distribution from the Plan.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Plan Termination or Plan Merger – Although the Company has no present intention to terminate the Plan, it expressly retains the right to amend, modify or terminate the Plan at any time. Such amendments or modifications may be retroactive, provided that no amendment or modification shall be made which permits Plan assets to be used or diverted for purposes other than the exclusive benefit of the participants or their beneficiaries. In the event of Plan termination, participants will become 100% vested in their accounts. Any unallocated assets of the Plan shall be allocated to participant accounts and distributed in such a manner as the Plan Administrator may determine.

In the event of any merger or consolidation of the Plan with, or transfer of assets of the Plan to, any other plan, each participant’s account, immediately after such event, would equal the market value of the account prior to such event.

2. Summary of Significant Accounting Policies

Basis of Financial Statements – The accompanying financial statements have been prepared on the accrual basis of accounting.

Use of Estimates – The preparation of the financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements, accompanying notes and supplemental schedule and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Valuation and Income Recognition – Investments held by the Plan are included in The Bank of New York Mellon Corporation Retirement Plans Master Trust (the “Master Trust”). All investments, except fully benefit-responsive investment contracts, are reported at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Investments in fully benefit-responsive investment contracts are required to be reported at contract value. Contract value is the amount participants will receive if they were to initiate permitted transactions.

Investment transactions are recorded on the trade date of the purchase or sale. Dividend income from investments in common stock is recorded on the ex-dividend date. Interest income is recorded as earned on an accrual basis. Net appreciation (depreciation) in fair value includes the gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants – Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest.

Administrative Expenses – The Company pays all administrative fees related to the Plan, except administrative costs related to certain retirement planning services, participant loans and certain investment management fees described in Note 3. Beginning September 30, 2020, the Company will no longer pay the $25 annual administrative fee for recordkeeping services for participants who are no longer actively employed by the Company. The fee is charged to such participants’ accounts in monthly increments.

Benefits Paid to Participants – Benefits paid to participants are recorded upon distribution.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Securities Lending – Securities lending transactions are accounted for as secured borrowings in accordance with the guidance in Financial Accounting Standards Board Accounting Standards Codification 860, Transfers and Servicing. As a result, the securities on loan are included in the net assets available for plan benefits. Collateral received, primarily cash, related to securities on loan is included as an asset at fair value with a corresponding payable included as a liability in the net assets available for plan benefits. See Note 4 for additional information.

3. Investment Options

The Trustee, under a declaration of trust, provides for the establishment, management, investment and reinvestment of the Plan’s assets. The Benefits Investment Committee established the Plan’s investment options by offering four investment tiers, which include a broad range of funds as core options. Core options are those funds in which employees can invest directly through payroll contributions. The investment tiers are described below.

LifePath Index Funds – The LifePath Index Funds consist of a series of funds which bear different risk profiles based on a targeted retirement date, ranging from 2025 to 2065. Each LifePath Index Fund is a collective trust fund composed predominantly of a combination of index funds covering the domestic fixed income, domestic equity, international equity and global real estate securities asset classes. The fund manager rebalances the investment mix periodically to gradually shift toward a more conservative profile as the fund’s maturity date approaches. There is also a separate fund for individuals near to or already in retirement, which intends to preserve account balances by maintaining a lower risk profile.

Passively Managed Index Funds – The passively managed index funds consists of four index funds covering the major asset classes (domestic investment grade bonds, domestic large cap equity, mid and small cap equity, and international equity). These funds are designed to track a specific investment index, such as the Standard and Poor’s 500 Index. The fund managers attempt to replicate the holdings and performance of the index, but do not seek to exceed the index’s returns, less fees and expenses.

Actively Managed Funds and Common Stock – The actively managed funds consist of fourteen funds (plus the Company’s common stock) covering the major asset classes. The investment managers of actively managed funds seek to exceed the returns of a given market index or benchmark. Because this approach often requires a great deal of research and trading activity, fees and expenses are generally higher than fees in passively managed index funds. The goal is to outperform the market enough to offset those higher expenses. Most of the funds have a multi-manager structure to reduce manager performance risk and to benefit from less than perfect correlation between different types of investment approaches within a sub-asset class.

Participants have the opportunity to own shares of the Company’s common stock. A common stock investment in a single company is subject to the fluctuations of the stock market, as well as the Company’s performance and its long-term financial prospects. As of September 28, 2020, future contributions and transfers into the Company’s stock fund are limited, generally, to 20% of a participant’s overall plan balance. New contributions or transfers into the Company’s common stock fund are not permitted if the contribution or transfer would cause the total allocation to exceed 20% of a participant’s overall plan balance. If a participant elects more than 20% of their overall plan balance to be invested in the Company’s stock fund, the amount exceeding 20% of that participant’s overall account balance will automatically be redirected to the LifePath Index fund closest to the year in which the participant will reach age 65.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Self-Directed Account – The SDA provides the opportunity for participants to build and manage their portfolio with access to various mutual funds and exchange-traded funds, subject to any limitations imposed by the Plan. A participant must have at least a $10,000 account balance to be eligible to invest in the SDA. The minimum initial investment in the SDA is $5,000, and subsequent transfers from any other fund into the SDA must be at least $1,000. The maximum amount that a participant may elect to invest in the SDA is 50% of their account balance, excluding any outstanding loans.

There is no assurance that the stated objective of any of the funds can be achieved.

The Company pays, or reimburses participants’ accounts for, the investment management fees for all passively managed index funds. For those actively managed funds which are wholly or partially managed by an affiliate, the Company directly pays, or reimburses participants’ accounts for, the portion of the investment management fees attributable to the related affiliate. Fees charged by the LifePath Index Funds, non-affiliated fund managers of actively managed funds and mutual funds and exchange-traded funds in the SDA are paid by the participant. In addition, the Company reimburses participants’ accounts for the administrative fees (or a portion thereof) charged by managers for those investment options that are managed (or partially managed) by an affiliate; however, the Company does not reimburse participants for any portion of the administrative fees charged by managers for those investment options that are managed by entities not affiliated with the Company.

Revenue-sharing and securities lending revenue generated by an investment fund is reallocated to the fund for the benefit of Plan participants investing in the fund.

4. Master Trust Financial Information

The Plan’s assets are held in the Master Trust. The assets of the Master Trust also include the assets of The Bank of New York Mellon Corporation Pension Plan and the Employee Stock Ownership Plan of The Bank of New York Company, Inc. The Master Trust assets are allocated among the participating plans by assigning to each plan those transactions (primarily contributions and benefit payments) that can be specifically identified. The Plan’s ownership in these investments and transactions does not represent an undivided interest.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

The following table presents the investments and other assets and liabilities of the Master Trust and the Plan’s interest in the Master Trust.

| | | | | | | | | | | | | | | | | |

| December 31, 2021 | | December 31, 2020 |

| | Plan’s interest in the Master Trust | | | Plan’s interest

in the Master Trust |

| Master Trust | | Master Trust |

| |

| Investments, at fair value: | | | | | |

| Common and preferred stock | $ | 2,113,668,150 | | $ | 552,748,522 | | | $ | 1,366,570,835 | | $ | 457,947,971 | |

| Self-directed accounts | 162,792,664 | | 162,792,664 | | | 148,296,891 | | 148,296,891 | |

| Mutual funds | — | | — | | | 875,330 | | — | |

| Collective trust funds | 7,098,636,202 | | 5,879,204,045 | | | 7,096,463,477 | | 5,081,077,699 | |

| U.S. Treasury | 402,392,520 | | — | | | 282,263,470 | | — | |

| U.S. government securities | 50,086,980 | | — | | | 57,635,200 | | — | |

| Corporate bonds | 2,872,621,297 | | — | | | 2,880,368,519 | | — | |

| Venture capital and partnership interests | 6,637,326 | | — | | | 14,580,789 | | — | |

| State and political subdivisions | 114,529,916 | | — | | | 50,254,646 | | — | |

| Sovereign debt/sovereign guaranteed | 51,754,876 | | — | | | 47,301,961 | | — | |

| Supranational | 11,893,071 | | — | | | — | | — | |

| Foreign covered bonds | 846,771 | | — | | | 867,808 | | — | |

| | | | | |

| Funds of funds | 2,312,290,010 | | 2,311,795,883 | | | 1,988,368,692 | | 1,987,889,151 | |

| Hedge fund of funds | 149,915,172 | | — | | | 139,105,725 | | — | |

| Interest-bearing cash | 3,365,022 | | — | | | 5,668,529 | | — | |

| Derivative instruments | (753,136) | | — | | | (529,601) | | — | |

| Investment contracts with insurance companies | 122,114,976 | | — | | | 133,864,752 | | — | |

| Total investments, at fair value | 15,472,791,817 | | 8,906,541,114 | | | 14,211,957,023 | | 7,675,211,712 | |

| Plus: | | | | | |

Fully benefit-responsive investment contracts, at contract value | 427,136,506 | | 426,987,857 | | | 427,926,294 | | 427,768,698 | |

| Notes receivable from participants | 64,900,920 | | 64,900,920 | | | 74,384,878 | | 74,384,878 | |

| Cash | 393,033 | | 393,033 | | | 633,008 | | 633,008 | |

| Pending investment sales and other receivables | 58,842,569 | | 17,029,323 | | | 103,656,288 | | 63,472,057 | |

| Assets held as collateral under securities lending | 604,038,040 | | 24,522,804 | | | 486,805,807 | | 54,178,406 | |

| Minus: | | | | | |

| Pending investment purchases and other liabilities | 33,131,335 | | 15,119,576 | | | 27,789,641 | | 16,224,051 | |

| Payable upon return of securities loaned | 604,038,040 | | 24,522,804 | | | 486,805,807 | | 54,178,406 | |

| Net assets available for plan benefits | $ | 15,990,933,510 | | $ | 9,400,732,671 | | | $ | 14,790,767,850 | | $ | 8,225,246,302 | |

The following table presents the net investment income of the Master Trust.

| | | | | | | | |

| Net investment income of the Master Trust | Year ended December 31, |

| 2021 | 2020 |

| Net investment income: | | |

| Net appreciation in fair value of investments | $ | 1,505,328,212 | | $ | 1,366,896,416 | |

| Dividends | 35,759,267 | | 36,623,003 | |

| Interest | 109,964,952 | | 91,545,560 | |

| Total net investment income | $ | 1,651,052,431 | | $ | 1,495,064,979 | |

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

The following is a reconciliation of net assets available for plan benefits of the Master Trust at December 31, 2021 and December 31, 2020, to the Master Trust’s Form 5500.

| | | | | | | | |

| Reconciliation of net assets available for plan benefits of the Master Trust | December 31, |

| 2021 | 2020 |

| Net assets available for plan benefits of the Master Trust | $ | 15,990,933,510 | | $ | 14,790,767,850 | |

Add: Adjustment from contract value to fair value for fully benefit-responsive investment contracts | 3,649,858 | | 15,031,051 | |

| Net assets available for plan benefits per the Master Trust’s Form 5500 | $ | 15,994,583,368 | | $ | 14,805,798,901 | |

The following is a reconciliation of the change in net assets available for plan benefits of the Master Trust for the years ended December 31, 2021 and December 31, 2020, to the Master Trust’s Form 5500.

| | | | | | | | |

| Reconciliation of change in net assets available for plan benefits of the Master Trust | Year ended December 31, |

| 2021 | 2020 |

Net change in net assets available for plan benefits of the Master Trust | $ | 1,200,165,660 | | $ | 1,104,979,906 | |

Less: Adjustment from contract value to fair value for fully benefit-responsive investment contracts - prior year | 15,031,051 | | 5,318,996 | |

Add: Adjustment from contract value to fair value for fully benefit-responsive investment contracts - current year | 3,649,858 | | 15,031,051 | |

| Net change in net assets available for plan benefits per the Master Trust’s Form 5500 | $ | 1,188,784,467 | | $ | 1,114,691,961 | |

Fully Benefit-Responsive Investment Contracts, at Contract Value

The Actively Managed Funds investment tier includes an option to invest in a stable value investment product. This product is managed as a separate account that holds a portfolio of investment contracts comprised of synthetic and traditional investment contracts. These contracts meet the fully benefit-responsive investment contract criteria and therefore are reported at contract value. Contract value is the relevant measurement for fully benefit-responsive investment contracts, as contract value is the amount participants will receive if they were to initiate permitted transactions. Contract value represents contributions and earnings, less benefits paid to participants and administrative expenses.

Certain events could limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (i) amendments to the Plan documents (including complete or partial Plan termination); (ii) changes to the Plan’s prohibition on competing investment options or deletion of equity wash provisions; (iii) bankruptcy of the Plan sponsor or other Plan sponsor events (e.g. divestitures or spin-offs of a subsidiary) which cause a significant withdrawal from the Plan; or (iv) the failure of the trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA. Such events that would limit the Plan’s ability to transact at contract value with participants are not probable of occurring.

The investment contracts held by the Master Trust generally consists of the following guaranteed investment contracts (“GICs”).

| | | | | | | | | | | |

| GICs at contract value | December 31, |

| 2021 | | 2020 |

| Synthetic GICs | $ | 378,071,997 | | | $ | 387,640,341 | |

| Traditional GICs | 49,064,509 | | | 40,285,953 | |

| Total GICs at contract value | $ | 427,136,506 | | | $ | 427,926,294 | |

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Synthetic GICs

Fixed maturity synthetic GICs consist of an asset or collection of assets and a benefit-responsive, book value wrap contract purchased for the portfolio. The wrap contract provides book value accounting for the asset and assures that benefit-responsive payments will be made for participant directed withdrawals. The crediting rate of the contract is set at the start of the contract and typically resets every quarter. Generally, fixed maturity synthetic GICs are held to maturity. The initial crediting rate is established based on the market interest rates at the time the initial asset is purchased and it will have an interest crediting rate not less than 0%.

Variable rate synthetic GICs consist of an asset or collection of assets that are held in a bankruptcy remote vehicle. The contract is benefit-responsive and provides next day liquidity at book value. The crediting rate on this product resets every quarter based on the then current market index rates and an investment spread. The investment spread is established at the time of issuance and is guaranteed by the issuer for the life of the investment.

Constant duration synthetic GICs consist of a portfolio of securities and a benefit-responsive, book value wrap contract purchased for the portfolio. The wrap contract amortizes gains and losses of the underlying securities over the portfolio duration and assures that benefit-responsive payments will be made at book value for participant directed withdrawals. The crediting rate on a constant duration synthetic GIC resets every quarter based on the book value of the contract, the market yield of the underlying assets, the market value of the underlying assets and the average duration of the underlying assets. The crediting rate aims at converging the book value of the contract and the market value of the underlying portfolio over the duration of the contract and therefore will be affected by movements in interest rates and/or changes in the market value of the underlying portfolio. The initial crediting rate is established based on the market interest rates at the time the underlying portfolio is funded and it will have an interest crediting rate of not less than 0%.

The interest crediting rate is determined quarterly and is primarily based on the current yield to maturity of the covered investment, plus or minus amortization of the difference between the market value and the contract value of the covered investments over the duration of the covered investments at the time of computation.

Traditional GICs

Traditional GICs are unsecured, general account obligations of insurance companies. The obligation is backed by the general account assets of the insurance company that writes the investment contract. The crediting rate on this product is typically fixed for the life of the investment.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Securities Lending

The Master Trust engages in securities lending whereby certain securities in its portfolio are loaned to other highly rated institutions generally on an open, overnight or term basis, under the terms of a prearranged contract, which normally matures in less than 90 days. By the end of the business day on which securities are delivered to the borrower, collateral with a minimum value of 102% of the market value of the loaned U.S. security, including any accrued interest, is obtained from the borrower. The market value of the securities on loan and the collateral held is monitored daily. If at any time the value of the collateral falls below 102%, the borrower may be required to deliver additional collateral necessary to restore the minimum 102% ratio, thus reducing credit risk. Market risk can also arise in securities lending transactions. These risks are managed through policies that determine what types of securities are eligible for lending at any time, and these policies are periodically reviewed. The Plan retains any income earned on the securities while on loan to the broker and a portion of any income earned on the collateral received from the broker. The carrying value approximates fair value for $604,038,040 and $486,805,807 of assets held as collateral under securities lending and payable upon return of securities loaned at December 31, 2021 and December 31, 2020, respectively.

5. Fair Value Measurement

Fair value is defined as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. A three-level hierarchy for fair value measurements is utilized based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date.

Valuation Hierarchy

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The three levels are described below.

Level 1: Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. Level 1 assets include common and preferred stock, self-directed accounts, mutual funds, U.S. Treasury securities, certain sovereign debt securities and derivative instruments.

Level 2: Observable inputs other than Level 1 prices, for example, are quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs that are observable or can be corroborated, either directly or indirectly, for substantially the full term of the financial instrument. Level 2 assets include items that are traded less frequently than exchange-traded securities and derivative instruments whose model inputs are observable in the market or can be corroborated by market-observable data. Examples in this category are collective trust funds, U.S. government securities, corporate bonds, state and political subdivisions, sovereign debt/sovereign guaranteed securities, supranational, foreign covered bonds, funds of funds, interest-bearing cash and derivative instruments.

Level 3: Inputs to the valuation methodology are unobservable and significant to the fair value measurement. These unobservable inputs reflect the Master Trust’s own assumptions about the market that participants would use to price an asset based on the best information available in the circumstances. Level 3 assets include investment contracts with insurance companies.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

Valuation Methodologies

Following is a description of the valuation methodologies used for instruments measured at fair value, as well as the general classification of such instruments pursuant to the valuation hierarchy.

Common and preferred stock, self-directed accounts and mutual funds: These types of securities are valued at the closing price reported in the active market in which the individual securities are traded, if available.

Collective trust funds and funds of funds: The fair value of collective trust funds and funds of funds are based on the securities in the portfolio, which typically are the amount that the fund might reasonably expect to receive for the securities upon a sale. These funds are valued using observable inputs on either a daily or monthly basis.

U.S. Treasury, U.S. government securities, corporate bonds, state and political subdivisions, sovereign debt/sovereign guaranteed, supranational and foreign covered bond investments: U.S. Treasury securities and certain sovereign debt securities that are actively traded in highly liquid over-the-counter markets are valued at the closing price reported in the active market and are included in Level 1 of the valuation hierarchy. U.S. government securities, corporate bonds, state and political subdivisions, sovereign debt/sovereign guaranteed, supranational and foreign covered bond investments included in Level 2 of the valuation hierarchy are valued using quoted prices for comparable securities with similar yields and credit ratings. When quoted prices are not available for identical or similar bonds, the security is valued using discounted cash flows that maximize observable inputs, such as current yields of similar instruments.

Interest-bearing cash: The fair value of interest-bearing cash is equal to the book value as a result of the short-term nature of these cash equivalents.

Derivative instruments: Exchange-traded derivative instruments are valued using quoted prices and are included in Level 1 of the valuation hierarchy. Over-the-counter derivative instruments are valued using internally developed models based on readily observable market parameters and are included in Level 2 of the valuation hierarchy. Derivative instruments include to-be-announced trades, foreign exchange contracts and interest rate contracts.

Investment contracts with insurance companies: There are no readily available market quotations for these investments. Certain investment contracts are valued at the present value of the contracted benefits payable using mortality and investment return assumptions. These contracts are valued on an annual basis.

Other assets measured at the net asset value (“NAV”), as a practical expedient: The following investments are valued at NAV as a practical expedient for measuring fair value. There are no readily available market quotations for these funds.

•Hedge fund of funds: The hedge fund of funds are valued at NAV, which is based on the fair value of the underlying investments held by the fund, less its liabilities. These funds are either valued on a daily or monthly basis.

•Venture capital and partnership interests: The fair value is based on the Master Trust’s ownership percentage of the fair value of the underlying investments as provided by the fund managers. These funds are typically valued on a quarterly basis.

The preceding methods described may produce a fair value calculation that may not be indicative of future fair values. Furthermore, although the Master Trust believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies and assumptions to determine the

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following tables present the fair value of the financial instruments of the Master Trust by level within the fair value hierarchy as of December 31, 2021 and December 31, 2020.

| | | | | | | | | | | | | | |

Master Trust investment assets measured at fair value on a recurring basis as of December 31, 2021 |

| Level 1 | Level 2 | Level 3 | Total

carrying value |

| Common and preferred stock | $ | 2,113,668,150 | | $ | — | | $ | — | | $ | 2,113,668,150 | |

| Self-directed accounts | 162,792,664 | | — | | — | | 162,792,664 | |

| | | | |

| Collective trust funds | — | | 7,098,636,202 | | — | | 7,098,636,202 | |

| U.S. Treasury | 402,392,520 | | — | | — | | 402,392,520 | |

| U.S. government securities | — | | 50,086,980 | | — | | 50,086,980 | |

| Corporate bonds | — | | 2,872,621,297 | | — | | 2,872,621,297 | |

| State and political subdivisions | — | | 114,529,916 | | — | | 114,529,916 | |

| Sovereign debt/sovereign guaranteed | 6,183,828 | | 45,571,048 | | — | | 51,754,876 | |

| Supranational | — | | 11,893,071 | | — | | 11,893,071 | |

| Foreign covered bonds | — | | 846,771 | | — | | 846,771 | |

| | | | |

Funds of funds (a) | — | | 2,312,290,010 | | — | | 2,312,290,010 | |

| Interest-bearing cash | — | | 3,365,022 | | — | | 3,365,022 | |

| Derivative instruments | (1,069,735) | | 316,599 | | — | | (753,136) | |

| Investment contracts with insurance companies | — | | — | | 122,114,976 | | 122,114,976 | |

Total Master Trust investments in the fair value hierarchy | $ | 2,683,967,427 | | $ | 12,510,156,916 | | $ | 122,114,976 | | $ | 15,316,239,319 | |

| Other assets measured at NAV: | | | | |

| Hedge fund of funds | | | | 149,915,172 | |

| Venture capital and partnership interests | | | | 6,637,326 | |

| Total Master Trust investments at fair value | | | | $ | 15,472,791,817 | |

(a) Underlying funds include investments in common and preferred stock, fixed income securities and mutual funds.

| | | | | | | | | | | | | | |

Master Trust investment assets measured at fair value on a recurring basis as of December 31, 2020 |

| Level 1 | Level 2 | Level 3 | Total

carrying value |

| Common and preferred stock | $ | 1,366,570,835 | | $ | — | | $ | — | | $ | 1,366,570,835 | |

| Self-directed accounts | 148,296,891 | | — | | — | | 148,296,891 | |

| Mutual funds | 875,330 | | — | | — | | 875,330 | |

| Collective trust funds | — | | 7,096,463,477 | | — | | 7,096,463,477 | |

| U.S. Treasury | 282,263,470 | | — | | — | | 282,263,470 | |

| U.S. government securities | — | | 57,635,200 | | — | | 57,635,200 | |

| Corporate bonds | — | | 2,880,368,519 | | — | | 2,880,368,519 | |

| State and political subdivisions | — | | 50,254,646 | | — | | 50,254,646 | |

| Sovereign debt/sovereign guaranteed | — | | 47,301,961 | | — | | 47,301,961 | |

| Foreign covered bonds | — | | 867,808 | | — | | 867,808 | |

| | | | |

Funds of funds (a) | — | | 1,988,368,692 | | — | | 1,988,368,692 | |

| Interest-bearing cash | — | | 5,668,529 | | — | | 5,668,529 | |

| Derivative instruments | (552,215) | | 22,614 | | — | | (529,601) | |

| Investment contracts with insurance companies | — | | — | | 133,864,752 | | 133,864,752 | |

Total Master Trust investments in the fair value hierarchy | $ | 1,797,454,311 | | $ | 12,126,951,446 | | $ | 133,864,752 | | $ | 14,058,270,509 | |

| Other assets measured at NAV: | | | | |

| Hedge fund of funds | | | | 139,105,725 | |

| Venture capital and partnership interests | | | | 14,580,789 | |

| Total Master Trust investments at fair value | | | | $ | 14,211,957,023 | |

(a) Underlying funds include investments in common and preferred stock, fixed income securities and mutual funds.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

The tables below present a roll forward of the Master Trust investments classified in Level 3 of the valuation hierarchy for the years ended December 31, 2021 and December 31, 2020.

| | | | | | | | |

Master Trust fair value measurements using significant unobservable inputs for the year ended December 31, 2021 |

| Investment contracts with insurance companies |

|

Fair value at December 31, 2020 | | $ | 133,864,752 | |

| Total losses included in changes in net assets | | (11,749,776) | |

Fair value at December 31, 2021 | | $ | 122,114,976 | |

| Change in unrealized loss for the period included in changes in net assets for assets held at the end of the reporting period | | $ | (11,749,776) | |

| | | | | | | | |

Master Trust fair value measurements using significant unobservable inputs for the year ended December 31, 2020 |

| Investment contracts with insurance companies |

|

Fair value at December 31, 2019 | | $ | 141,784,453 | |

| Total losses included in changes in net assets | | (7,919,701) | |

Fair value at December 31, 2020 | | $ | 133,864,752 | |

| Change in unrealized loss for the period included in changes in net assets for assets held at the end of the reporting period | | $ | (7,919,701) | |

The Master Trust has certain investments in which the fair value has been estimated using the NAV per share as a practical expedient. The Plan does not have any ownership interest in these investments. Our investment objective when investing in hedge fund of funds and venture capital and partnership interests is to maximize total returns while maintaining a broadly diversified portfolio. The tables below present information about the Master Trust’s investments valued at the funds’ NAV, as a practical expedient, which also have unfunded commitments and/or redemption provisions.

| | | | | | | | | | | | | | | | | | | | |

Master Trust investments valued using NAV as of December 31, 2021 |

| Fair value | Unfunded commitments | Redemption

frequency | Redemption

notice period |

| Hedge fund of funds | | $ | 149,915,172 | | | $ | — | | Monthly | 30-45 days |

Venture capital and partnership interests | | 6,637,326 | | | — | | N/A | N/A |

| Total | | $ | 156,552,498 | | | $ | — | | | |

N/A – Not applicable.

| | | | | | | | | | | | | | | | | | | | |

Master Trust investments valued using NAV as of December 31, 2020 |

| Fair value | Unfunded commitments | Redemption

frequency | Redemption

notice period |

| Hedge fund of funds | | $ | 139,105,725 | | | $ | — | | Monthly | 30-45 days |

Venture capital and partnership interests | | 14,580,789 | | | — | | N/A | N/A |

| Total | | $ | 153,686,514 | | | $ | — | | | |

N/A – Not applicable.

6. Estimated Fair Value of Financial Instruments

Note 5 presents investments measured at fair value by the three-level valuation hierarchy. The following is a summary of the practices used to estimate fair value of financial assets and liabilities not recorded at fair value. Pending investment sales and other receivables, pending investment purchases and other liabilities, assets held as collateral under securities lending and payable upon return of assets loaned approximate fair

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

value due to their short-term nature. The estimated fair value of the fully benefit-responsive investment contracts represents the sum of the fair values of the underlying assets.

The following tables present the estimated fair value and carrying value of financial instruments of the Master Trust not measured at fair value.

| | | | | | | | | | | | | | | | | |

| Summary of Master Trust financial instruments | December 31, 2021 |

| | | Estimated

fair value | Carrying

value |

| Level 1 | Level 2 | Level 3 |

| Assets: | | | | | |

| Cash | $ | 393,033 | | $ | — | | $ | — | | $ | 393,033 | | $ | 393,033 | |

Fully benefit-responsive investment contracts | — | | 430,786,364 | | — | | 430,786,364 | | 427,136,506 | |

Pending investment sales and other receivables | — | | 58,842,569 | | — | | 58,842,569 | | 58,842,569 | |

Assets held as collateral under securities lending | — | | 604,038,040 | | — | | 604,038,040 | | 604,038,040 | |

| Total | $ | 393,033 | | $ | 1,093,666,973 | | $ | — | | $ | 1,094,060,006 | | $ | 1,090,410,148 | |

| Liabilities: | | | | | |

Pending investment purchases and other liabilities | $ | — | | $ | 33,131,335 | | $ | — | | $ | 33,131,335 | | $ | 33,131,335 | |

| Payable upon return of securities loaned | — | | 604,038,040 | | — | | 604,038,040 | | 604,038,040 | |

| Total | $ | — | | $ | 637,169,375 | | $ | — | | $ | 637,169,375 | | $ | 637,169,375 | |

| | | | | | | | | | | | | | | | | |

| Summary of Master Trust financial instruments | December 31, 2020 |

| | | Estimated

fair value | Carrying

value |

| Level 1 | Level 2 | Level 3 |

| Assets: | | | | | |

Cash | $ | 633,008 | | $ | — | | $ | — | | $ | 633,008 | | $ | 633,008 | |

Fully benefit-responsive investment contracts | — | | 442,957,345 | | — | | 442,957,345 | | 427,926,294 | |

Pending investment sales and other receivables | — | | 103,656,288 | | — | | 103,656,288 | | 103,656,288 | |

Assets held as collateral under securities lending | — | | 486,805,807 | | — | | 486,805,807 | | 486,805,807 | |

| Total | $ | 633,008 | | $ | 1,033,419,440 | | $ | — | | $ | 1,034,052,448 | | $ | 1,019,021,397 | |

| Liabilities: | | | | | |

Pending investment purchases and other liabilities | $ | — | | $ | 27,789,641 | | $ | — | | $ | 27,789,641 | | $ | 27,789,641 | |

| Payable upon return of securities loaned | — | | 486,805,807 | | — | | 486,805,807 | | 486,805,807 | |

| Total | $ | — | | $ | 514,595,448 | | $ | — | | $ | 514,595,448 | | $ | 514,595,448 | |

7. Federal Income Taxes

The Plan received a favorable determination letter from the IRS dated July 9, 2015, which stated that the Plan and related trust, as amended and restated as of December 19, 2014, was designed in accordance with the applicable Sections of the Internal Revenue Code of 1986 (“IRC”). The Plan, which was the subject of the determination letter, has been amended and restated as of December 17, 2020, with the changes being effective January 1, 2021. The IRS no longer issues determination letters on amendments to existing plans. However, the Plan Administrator believes the Plan is designed and is currently being operated in compliance with the applicable provisions of the IRC. Accordingly, the accompanying financial statements do not include a provision for federal income taxes.

U.S. generally accepted accounting principles require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken any uncertain tax position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has concluded that as of December 31, 2021 and December 31, 2020, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes the Plan is no longer subject to federal income tax examinations for the years prior to 2018.

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

8. Party-in-Interest Transactions

The Bank of New York Mellon, a subsidiary of the Company, acts as Trustee of the Plan. The Bank of New York Mellon also acts as the lending agent for the securities lending activities of the Plan. The Plan paid no fees to The Bank of New York Mellon as the Trustee and lending agent for securities lending activity. Certain investments of the Master Trust are managed by subsidiaries of the Company. The Master Trust holds common stock of the Company. In addition, the Plan issues loans to participants, which are secured by the balances in the participants’ accounts. Therefore, these related transactions qualify as party-in-interest transactions. All other transactions which may be considered party-in-interest transactions relate to normal plan management and administrative services.

The Master Trust held 13,521,273 shares of the Company’s common stock at December 31, 2021, and 15,123,541 shares at December 31, 2020. The Plan held 9,517,020 shares of the Company’s common stock at December 31, 2021 and 10,790,480 shares at December 31, 2020.

9. Risks and Uncertainties

The Master Trust invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities could materially affect participants’ account balances and the amounts reported in the statements of net assets available for plan benefits. The value of the Company’s common stock is entirely dependent upon the performance of the Company and the market’s valuation of such performance.

The extent to which the COVID-19 pandemic may affect the results of the Plan’s operations will depend on future developments, including the duration of the outbreak and the effectiveness of vaccines and other actions taken to contain and treat the disease.

10. Reconciliation of The Bank of New York Mellon Corporation 401(k) Savings Plan Financial

Statements to Form 5500

Benefit claims payable recorded on Form 5500 have been processed and approved for payment prior to December 31, 2021, but not yet paid as of that date. Form 5500 requires fully benefit-responsive investment contracts to be reported at fair value. Therefore, the adjustment from contract value to fair value for fully benefit-responsive investment contracts represents a reconciling item.

The following is a reconciliation of net assets available for plan benefits per the financial statements at December 31, 2021 and December 31, 2020, to Form 5500.

| | | | | | | | |

| Reconciliation of net assets available for plan benefits | December 31, |

| 2021 | 2020 |

| Net assets available for plan benefits per the financial statements | $ | 9,400,732,671 | | $ | 8,225,564,844 | |

| Less: Benefit claims payable | 1,117,742 | | 1,891,309 | |

Add: Adjustment from contract value to fair value for fully benefit-responsive investment contracts | 3,648,763 | | 15,025,039 | |

| Net assets available for plan benefits per Form 5500 | $ | 9,403,263,692 | | $ | 8,238,698,574 | |

| | |

The Bank of New York Mellon Corporation 401(k) Savings Plan Notes to Financial Statements (continued) December 31, 2021 and 2020 |

|

The following is a reconciliation of benefits paid to participants per the financial statements for the years ended December 31, 2021 and December 31, 2020, to Form 5500.

| | | | | | | | |

| Reconciliation of benefits paid to participants | Year ended December 31, |

| 2021 | 2020 |

| Benefits paid to participants per the financial statements | $ | 638,255,244 | | $ | 565,055,864 | |

| Less: Benefit claims payable – prior year | 1,891,309 | | 2,288,231 | |

Add: Benefit claims payable – current year | 1,117,742 | | 1,891,309 | |

| Benefits paid to participants per Form 5500 | $ | 637,481,677 | | $ | 564,658,942 | |

11. Subsequent Events

The Plan was amended on November 29, 2021 to revise the eligibility requirements for U.S. hourly employees. U.S. hourly employees that have not met the eligibility requirements prior to January 1, 2022 will become eligible to participate in the Plan on January 1, 2022. U.S. hourly employees hired on or after January 1, 2022, will be eligible to participate in the Plan immediately upon hire.

The Plan has evaluated subsequent events through June 22, 2022, and determined that no additional events have occurred requiring adjustments to, or disclosure in, the financial statements.

Schedule 1

The Bank of New York Mellon Corporation

401(k) Savings Plan

EIN: 13-2614959

Plan Number: 004

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | |

| Identity of issue, borrower,

lessor, or similar party | | Description of investments and notes receivable | | Cost | | Current value |

| | | | | | | |

| * | Master Trust | | Common stock, self-directed accounts, collective trust funds and funds of funds | | N/A | | $ | 8,906,541,114 | |

| | | | | | | |

| * | Master Trust | | Fully benefit-responsive investment contracts, at contract value | | N/A | | 426,987,857 | |

| | | | | | | |

| * | Notes receivable from

participants | | Notes receivable from participants at interest rates ranging from 3.25% to 10.00% due from less than 1 year to 10 years | | - | | 64,900,920 | |

| | | | | | | |

| | | Total investments and notes receivable (held at end of year) | | | | $ | 9,398,429,891 | |

* Represents a party-in-interest as defined by ERISA.

N/A – This information is not required by ERISA or the Department of Labor to be reported for participant-directed investments.

See accompanying Report of Independent Registered Public Accounting Firm.

Index to Exhibits

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | Method of Filing |

| | | | |

| 23.1 | | Consent of Independent Registered Public Accounting Firm. | | Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the administrators of The Bank of New York Mellon Corporation 401(k) Savings Plan have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

THE BANK OF NEW YORK MELLON CORPORATION

401(k) SAVINGS PLAN

| | | | | | | | | | | |

| By: | /s/ Jolen Anderson | |

| | Jolen Anderson | |

| | Global Head of Human Resources | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| By: | /s/ Kurtis R. Kurimsky | |

| | Kurtis R. Kurimsky | |

| | Corporate Controller | |

| | | |

Date: June 22, 2022

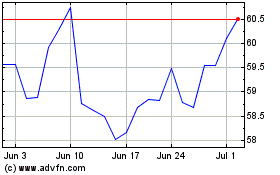

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024