Amended Statement of Beneficial Ownership (sc 13d/a)

June 21 2022 - 10:04AM

Edgar (US Regulatory)

UNITED STATES

Securities

and exchange commission

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Cogent Biosciences,

Inc.

(Name of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

19240Q201

(CUSIP Number)

Ms. Erin O’Connor

Fairmount Funds Management LLC

2001 Market Street

Suite 2500

Philadelphia, PA 19103

(267) 262-5300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 16, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(b)(3)

or (4), check the following box ¨.

CUSIP No. 19240Q201

| 1 |

NAME OF REPORTING PERSON

Fairmount Funds Management LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS

AF |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

15,230,473(1) |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

15,230,473(1) |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

15,230,473(1) |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.99%(2) |

|

| 14 |

TYPE OF REPORTING PERSON

IA |

|

| (1) | The securities include (a) 2,758,975 shares of common stock, $0.001 par value (“Common Stock”),

and (b) 12,471,498 shares of Common Stock issuable upon conversion of 49,885.992 shares of Series

A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), the conversion of which

is subject to a beneficial ownership limitation of 19.99% of the outstanding Common Stock. The securities exclude shares of Common Stock

issuable upon conversion of shares of Series A Preferred Stock in excess of the beneficial ownership limitation. |

| (2) | Based on 63,718,964 shares of Common Stock outstanding as of June 16, 2022 and the issuance of 12,471,498

additional shares upon the conversion of Series A Preferred Stock. |

CUSIP No. 19240Q201

| 1 |

NAME OF REPORTING PERSON

Fairmount Healthcare Fund GP LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS

AF |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

3,265,351(1) |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

3,265,351(1) |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,265,351(1) |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.90%(2) |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| (1) | The securities include (a) 286,851 shares of common stock, $0.001

par value (“Common Stock”), and (b) 2,978,500 shares of Common Stock issuable upon conversion of 11,914 shares of

Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred

Stock”), the conversion of which is subject to a beneficial ownership limitation of 19.99% of the outstanding Common Stock.

The securities exclude shares of Common Stock issuable upon conversion of shares of Series A Preferred Stock in excess of the beneficial

ownership limitation. |

| (2) | Based on 63,718,964 shares of Common Stock outstanding as of June 16, 2022 and the issuance of 2,978,500

additional shares upon the conversion of Series A Preferred Stock. |

CUSIP No. 19240Q201

| 1 |

NAME OF REPORTING PERSON

Fairmount Healthcare Fund II GP LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS

AF |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

14,943,622 (1) |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

14,943,622 (1) |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

14,943,622

(1) |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.61%(2) |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| (1) | The securities include (a) 2,472,124 shares of common stock,

$0.001 par value (“Common Stock”), and (b) 12,471,498 shares of Common Stock issuable upon conversion of 49,885.992

shares of Series A Convertible Preferred Stock, par value $0.001 per share (the “Series

A Preferred Stock”), the conversion of which is subject to a beneficial ownership limitation of 19.99% of the outstanding Common

Stock. The securities exclude shares of Common Stock issuable upon conversion of shares of Series A Preferred Stock in excess of the

beneficial ownership limitation. |

| (2) | Based on 63,718,964 shares of Common Stock outstanding as of

June 16, 2022 and the issuance of 12,471,498 additional shares upon the conversion of Series A Preferred Stock. |

CUSIP No. 19240Q201

|

Item 1. | Security and Issuer |

This

Amendment No. 1 amends and supplements the statement on Schedule 13D originally filed with the Securities and Exchange Commission on July

6, 2020 (the “Statement”) by the Reporting Persons with respect to the Common Stock, $0.001 par value (the “Common

Stock”), of Cogent Biosciences, Inc. (the “Company” or “Cogent”). Unless otherwise defined

herein, capitalized terms used in this Amendment No. 1 shall have the meanings ascribed to them in the Statement. Unless amended or supplemented

below, the information in the Statement remains unchanged. The address of the principal executive offices of the Company is 200

Cambridge Park Drive, Suite 2500, Cambridge, Massachusetts 02140.

| Item 2. | Identity and Background |

| (a) | This Schedule 13D is being filed jointly by (1) Fairmount Funds Management LLC, a Delaware limited liability

company and Securities and Exchange Commission registered investment adviser under the Investment Advisers Act of 1940 (“Fairmount

Funds Management”); (2) Fairmount Healthcare Fund GP LLC, a Delaware limited liability company (“Fairmount GP”);

and (3) Fairmount Healthcare Fund II GP LLC, a Delaware limited liability company (“Fairmount GP II”) (Fairmount Funds

Management, Fairmount GP, and Fairmount GP II, collectively, the “Reporting Persons”). |

| (b) | The principal business address of the Reporting Persons is 2001 Market Street, Suite 2500, Philadelphia,

PA 19103. |

| (c) | The principal business of Fairmount Funds Management is to provide discretionary investment management

services to qualified investors through its private pooled investment vehicles, Fairmount Healthcare Fund LP and Fairmount Healthcare

Fund II LP (collectively, the “Clients”). Fairmount GP serves as the general partner to Fairmount Healthcare Fund LP.

Fairmount GP II serves as the general partner to Fairmount Healthcare Fund II LP. Fairmount Funds Management has voting and dispositive

power over the Common Stock held by the Clients, which is deemed shared with Fairmount GP, and Fairmount GP II. The Clients do not have

the right to acquire voting or dispositive power over the Common Stock within sixty days. |

| (d)-(e) | During the last five years, none of the Reporting Persons (i) has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors) or (ii) has been a party to a civil proceeding of a judicial or administrative

body of competent jurisdiction and as a result of such proceedings was or is subject to a judgment, decree, or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect

at such laws. |

CUSIP No. 19240Q201

| Item 3. | Source and Amount of Funds or Other Consideration |

Item 3 of the Statement is hereby amended and supplemented

as follows:

On June 16, 2022, the Reporting Persons

purchased a total of 1,200,000 shares of Common Stock of the Company for an aggregate of $9,900,000. The shares were purchased with working

capital.

| Item 4. | Purpose of Transaction |

Item 4 is hereby

amended and supplemented as follows:

The Reporting Persons

acquired the Common Stock referred to in Item 3 for investment purposes and not with an intent, purpose or effect of changing control

of the Company.

| Item 5. | Interest in Securities of the Company |

Item 5 is hereby amended and supplemented as follows:

(a) and (b) See Items 7-11 of the cover

pages above and Item 2.

(c) The following table lists the Reporting

Persons’ transactions in Common Stock that were effected during the sixty day period prior to the filing of this Schedule 13D:

| Transaction | |

Purchaser | |

Date | |

Share Amount | | |

Price | |

| Purchase | |

Fairmount GP II | |

6/16/2022 | |

| 1,200,000 | | |

$ | 8.25 | |

(d) Not applicable.

(e) Not applicable.

| Item 7. | Material to be Filed as Exhibits |

| | |

| Exhibit No. | Description |

| 99.1 | Joint Filing Agreement by and among the Reporting Persons (incorporated by reference to Exhibit 99.1 to the Schedule 13D filed by

the Reporting Persons with the SEC on July 10, 2020, File No. 005-90431). |

CUSIP No. 19240Q201

SIGNATURES

After reasonable inquiry and

to the best of my knowledge and belief, we certify that the information set forth in this statement June 21, 2022.

| FAIRMOUNT FUNDS MANAGEMENT LLC | |

|

|

| | |

|

|

| By: |

/s/ Peter Harwin | |

/s/ Tomas Kiselak |

|

| |

Peter Harwin | |

Tomas Kiselak |

|

| |

Managing Member | |

Managing Member |

|

| | |

|

|

| | |

|

|

| FAIRMOUNT HEALTHCARE FUND GP LLC | |

|

|

| | |

|

|

| By: |

/s/ Peter Harwin | |

/s/ Tomas Kiselak |

|

| |

Peter Harwin | |

Tomas Kiselak |

|

| |

Managing Member | |

Managing Member |

|

| | |

|

|

| | |

|

|

| FAIRMOUNT HEALTHCARE FUND II GP LLC | |

|

|

| | |

|

|

| By: |

/s/ Peter Harwin | |

/s/ Tomas Kiselak |

|

| |

Peter Harwin | |

Tomas Kiselak |

|

| |

Managing Member | |

Managing Member |

|

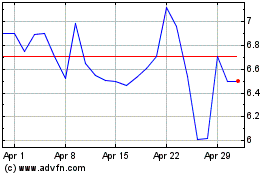

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Apr 2023 to Apr 2024