Newtek Business Services Corp., (NASDAQ: NEWT), an internally

managed business development company (“BDC”), provides forecasts

for certain financial metrics for the six months ending June 30,

2022. For the six months ending June 30, 2022, the Company is

forecasting net investment income (loss) (“NII”) in a range of

($0.01) per share to $0.00 per share and adjusted net investment

income (“ANII”)1 in a range of $1.40 per share to $1.50 per share.

Barry Sloane, Chairman, President and Chief Executive Officer

said, “As the end of the quarter approaches, we believe that we are

on track to deliver the previously forecasted results for the first

six months of 2022. We are continuing to work to deliver our

forecasted financial results and feel comfortable that we will be

able to achieve ANII for the first six months of 2022 that will be

equal to or exceed dividends that have been declared through the

first half of 2022 in the amount of $1.40 per share. As we

mentioned during our first quarter 2022 earnings conference call,

we anticipated some pricing pressure on government guaranteed loan

sale margins during the second quarter of 2022, and that is what we

have been seeing. However, in counterbalance to pricing pressure,

we are seeing high-quality borrower opportunities, as well as

strong portfolio performance as of May 31, 2022, that has placed

the Company in a comfortable position with respect to its portfolio

currency rate. In addition, we believe the combined performance of

Newtek Merchant Solutions and other portfolio companies will assist

us in achieving our NII and ANII forecasts for the first six months

of 2022.”

Mr. Sloane continued, “We were exceptionally pleased that 89% of

shareholders voting on the recent special proxy vote gave the board

the authorization to withdraw our election as a 1940s Act Company

which, subject to regulatory approvals, would allow us to operate

as a 1933 Act Company, which we believe can provide us with the

opportunity to raise more cost-effective capital. As a company that

has historically been able to grow its business, we believe that

converting to a bank holding company, subject to regulatory

approvals, could not be timelier despite having to overcome what we

believe has been a shareholder transition. Importantly, as a bank

holding company, we believe we will be eligible for inclusion in

the Russell 2000 Exchange Traded Funds, which are managed by

institutional money managers and, we believe can help mitigate the

friction that institutional money managers have experienced with

investing in BDCs due to the double counting of AFFE. Furthermore,

as a bank holding company, any dividends our loyal shareholders may

receive will be taxed at a more advantageous qualified rate rather

than the ordinary income rate.”

Mr. Sloane concluded, “We look forward to reporting second

quarter 2022 financial results in early August, and expect to

provide an update on the acquisition of the National Bank of New

York City.”

1 Use of Non-GAAP Financial Measures - In evaluating its

business, Newtek considers and uses ANII as a measure of its

operating performance. ANII includes short-term capital gains from

the sale of the guaranteed portions of SBA 7(a) loans and

conventional loans, and beginning in 2016, capital gain

distributions from controlled portfolio companies, which are

reoccurring events. The Company defines ANII as Net investment

income (loss) plus Net realized gains recognized from the sale of

guaranteed portions of SBA 7(a) loan investments, less realized

losses on non-affiliate investments, plus the net realized gains on

controlled investments, plus or minus the change in fair value of

contingent consideration liabilities, plus loss on extinguishment

of debt, plus or minus an adjustment for gains or losses on

derivative transactions. The term ANII is not defined under U.S.

generally accepted accounting principles, or U.S. GAAP, and is not

a measure of operating income, operating performance or liquidity

presented in accordance with U.S. GAAP. ANII has limitations as an

analytical tool and, when assessing the Company’s operating

performance, investors should not consider ANII in isolation, or as

a substitute for net investment income, or other consolidated

income statement data prepared in accordance with U.S. GAAP. Among

other things, ANII does not reflect the Company’s actual cash

expenditures. Other companies may calculate similar measures

differently than Newtek, limiting their usefulness as comparative

tools. The Company compensates for these limitations by relying

primarily on its GAAP results supplemented by ANII.

Newtek Business Services Corp., Your Business Solutions

Company®, is an internally managed BDC, which along with its

controlled portfolio companies, provides a wide range of business

and financial solutions under the Newtek® brand to the small- and

medium-sized business (“SMB”) market. Since 1999, Newtek has

provided state-of-the-art, cost-efficient products and services and

efficient business strategies to SMB relationships across all 50

states to help them grow their sales, control their expenses and

reduce their risk.

Newtek’s and its portfolio companies’ products and services

include: Business Lending, SBA Lending Solutions, Electronic

Payment Processing, Technology Solutions (Cloud Computing, Data

Backup, Storage and Retrieval, IT Consulting), eCommerce, Accounts

Receivable Financing & Inventory Financing, Insurance

Solutions, Web Services, and Payroll and Benefits Solutions.

Newtek® and Your Business Solutions Company® are registered

trademarks of Newtek Business Services Corp.

Note Regarding Forward Looking StatementsThis

press release contains certain forward-looking statements. Words

such as “believes,” “intends,” “expects,” “projects,”

“anticipates,” “forecasts,” “goal” and “future” or similar

expressions are intended to identify forward-looking statements.

All forward-looking statements involve a number of risks and

uncertainties that could cause actual results to differ materially

from the plans, intentions and expectations reflected in or

suggested by the forward-looking statements. Such risks and

uncertainties include, among others, include our ability to close

the pending acquisition of the National Bank of New York City (the

“Acquisition”), obtain required regulatory approvals for the

pending Acquisition, as well as projections concerning or

considering the pending Acquisition, our ability to originate new

investments, achieve certain margins and levels of profitability,

the availability of additional capital and the ability to maintain

certain debt to asset ratios, intensified competition, operating

problems and their impact on revenues and profit margins,

anticipated future business strategies and financial performance,

anticipated future number of customers, business prospects,

legislative developments and similar matters. Risk factors,

cautionary statements and other conditions, which could cause

Newtek’s actual results to differ from management’s current

expectations, are contained in Newtek’s filings with the Securities

and Exchange Commission and available through http://www.sec.gov/.

Newtek cautions you that forward-looking statements are not

guarantees of future performance and that actual results or

developments may differ materially from those projected or implied

in these statements..

SOURCE: Newtek Business Services Corp.

Investor Relations & Public

RelationsContact: Jayne Cavuoto Telephone: (212) 273-8179

/ jcavuoto@newtekone.com

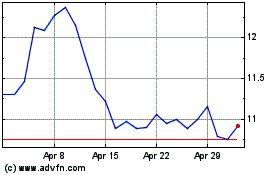

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

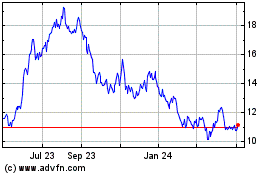

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024