Notification That a Class of Securities of Successor Issuer Is Demed to Be Registered Pursuant to Section 12(b) (8-k12b)

June 16 2022 - 8:16AM

Edgar (US Regulatory)

false

0001029125

0001029125

2022-06-15

2022-06-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K12B

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

June 15, 2022

|

|

Date of Report (Date of Earliest Event Reported)

|

|

Panbela Therapeutics, Inc

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

|

001-39468

|

|

88-2805017

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

712 Vista Blvd #305

Waconia, Minnesota

|

|

55387

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(952) 479-1196

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

Canary Merger Holdings, Inc.

|

|

(Former Name or Former Address, if Changed Since Last Report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

|

PBLA

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

On June 15, 2022 (the “Closing Date”), Panbela Therapeutics, Inc. (formerly known as Canary Merger Holdings, Inc.), a Delaware corporation (“Panbela”), completed the previously announced strategic business reorganization and acquisition of Cancer Prevention Pharmaceuticals, Inc. (“Cancer Prevention”) pursuant to the agreement and plan of merger, dated as of February 21, 2022 (the “Merger Agreement”), by and among Panbela, Cancer Prevention and Panbela Research, Inc. (formerly known as Panbela Therapeutics, Inc., “Panbela Research”), among others. Pursuant to the terms of the Merger Agreement, (i) Canary Merger Subsidiary I, Inc. (“Merger Sub I”), then a wholly-owned subsidiary of Panbela, which was itself a wholly-owned subsidiary of Panbela Research, merged with and into Panbela Research (the “First Merger”), with Panbela Research surviving the First Merger, and (ii) Canary Merger Subsidiary II, Inc., then a wholly-owned subsidiary of Panbela, merged with and into Cancer Prevention (the “Second Merger” and, together with the First Merger, the “Mergers”), with Cancer Prevention surviving the Second Merger. As a result of the Mergers, each of Panbela Research and Cancer Prevention became a wholly-owned subsidiary of Panbela. In addition, in connection with the consummation of the Mergers, “Panbela Therapeutics, Inc.” was renamed “Panbela Research, Inc.” and “Canary Merger Holdings, Inc.” was renamed “Panbela Therapeutics, Inc.”

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Cancer Prevention is party to a licensing agreement with One-Two Therapeutics Assets Limited (“One-Two”) dated as of July 16, 2021 (the “License Agreement”). Under the License Agreement, One-Two has licensed the North American development and commercialization rights for the Cancer Prevention’s familial adenomatous polyposis (FAP) product, CPP-IX/Sul or Flynpovi, a combination pharmaceutical product formulated for oral delivery for the FAP indication in adults containing both active ingredients, as described in Cancer Prevention’s new drug application. In addition to an upfront payment made to Cancer Prevention on the effective date, Cancer Prevention is entitled to a milestone payment of up to $70,000,000 upon regulatory approval of Flynpovi by the Food and Drug Administration (FDA) and royalties on net sales of Flynpovi in the licensed territory receive a milestone payment net of certain expenses upon regulatory approval of Flynpovi by the FDA and royalties on net sales in North America. One-Two is responsible for all costs of development and approval of Flynpovi in North America.

The information set forth in Item 2.03 of this current report is incorporated into this Item 1.01 by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

In accordance with the terms of the Merger Agreement and as a result of the First Merger, Panbela Research implemented a holding company reorganization pursuant to which each share of common stock, par value $0.001 per share, of Panbela Research issued and outstanding immediately prior to the effective time of the First Merger was automatically converted into and exchanged for one share of Panbela Common Stock. Each share of Panbela Common Stock held by Panbela Research was automatically cancelled and ceased to exist as of the effective time of the First Merger. Each share of common stock, par value $0.001 per share, of Merger Sub I held by Panbela was automatically converted into and exchanged for one share of common stock of Panbela Research, as the surviving entity. Also as a result of the First Merger, Panbela assumed all rights and obligations with respect to Panbela Research’s equity incentive plans and outstanding awards thereunder. Additionally, Panbela assumed all rights and obligations with respect to outstanding warrants to purchase shares of Panbela Common Stock. Accordingly, all of Panbela Research’s securityholders immediately prior to the consummation of the First Merger became securityholders of Panbela on identical terms.

In accordance with the terms of the Merger agreement and as a result of the Second Merger, each share of capital stock of Cancer Prevention issued and outstanding immediately prior to the effective time of the Second Merger was automatically converted into the applicable consideration consisting of shares of Panbela Common Stock and potential Post-Closing Contingent Payments as previously disclosed. Additionally, Panbela assumed all remaining in-the-money options outstanding under Cancer Prevention’s 2010 Equity Incentive Plan, the text of which is filed as Exhibit 10.1 to this current report, through the issuance of replacement options to purchase shares of Panbela Common Stock and issued replacement warrants to purchase shares of Panbela Common Stock.

Following the completion of the Mergers on June 15, 2022, there were an aggregate of 20,774,045 shares of Panbela Common Stock issued and outstanding. The shares of Panbela Common Stock are expected to commence trading on The Nasdaq Stock Market LLC under the existing ticker symbol “PBLA” on June 16, 2022.

The description of the Merger Agreement contained herein does not purport to be complete and is qualified by reference to the full text of the Merger Agreement, a copy of which is filed as Exhibit 2.1 hereto and incorporated herein by reference. This summary is not intended to modify or supplement any factual disclosures about Panbela, Panbela Research, or Cancer Prevention and should not be relied upon as disclosure about any such person without consideration of the periodic and current reports and statements that Panbela Research has filed and Panbela files with the Securities and Exchange Commission (the “Commission”). The terms of the Merger Agreement govern the contractual rights and relationships between, and allocate risks among, the parties thereto in relation to the transactions contemplated thereby. In particular, the representations and warranties made by the parties to each other in the Merger Agreement reflect negotiations between, and are solely for the benefit of, the parties thereto and may be limited or modified by a variety of factors, including subsequent events, information included in public filings, disclosures made during negotiations, correspondence between the parties and disclosure schedules to the Merger Agreement. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time and should not be relied upon as statements of fact.

The information set forth in the Explanatory Note to this current report is incorporated into this Item 2.01 by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

On June 15, 2022, Panbela entered into a guaranty (the “Guaranty”) pursuant to which it has agreed to guarantee the payment obligation of Cancer Prevention under a promissory note in favor of Sucampo GmbH dated as of September 6, 2017, as amended (the “Sucampo Note”). As the result of a capitalization of all principal and accrued but unpaid interest through the date of the Second Merger, the Sucampo Note had a principal balance of approximately $6.2 million and no accrued but unpaid interest as of the date of the Guaranty. Amounts outstanding under the Sucampo Note bear interest at a rate of 5.0% per annum. Cancer Prevention is required to make five payments of $1 million, plus accrued but unpaid interest, on January 31st of each of 2023, 2024, 2025, 2026, with the remaining balance due on January 31, 2027. All or a portion of the first payment due in January 2023 may become payable earlier if Cancer Prevention or Panbela completes a financing on or before January 31, 2023. Upon the occurrence of certain events of default, the Sucampo Note requires repayment of the entire balance. The conversion features of the Sucampo Note reflected in its original title were eliminated in a prior amendment.

The foregoing descriptions of the Sucampo Note and the Guaranty do not purport to be complete and are qualified by reference to, the text of each such document, which is filed as Exhibit 10.4 and Exhibit 10.5, respectively, to this current report and is incorporated herein by reference.

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

Prior to the completion of the Mergers, shares of common stock of Panbela Research were registered pursuant to Section 12(b) of the Exchange Act and listed on The Nasdaq Stock Market LLC. In connection with the completion of the Mergers, the shares of common stock of Panbela Research will be suspended from trading on The Nasdaq Stock Market LLC prior to the open of trading on June 16, 2022.

The information set forth in the Explanatory Note and Item 2.01 of this current report is incorporated into this Item 3.01 by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

In connection with the Mergers, Panbela sold and issued the following securities to the holders of Cancer Prevention securities pursuant to the Second Merger: (a) 6,587,576 shares of Panbela Common Stock, (b) 731,957 shares of Panbela Common Stock that remained subject to the Holdback Escrow (as defined in the Merger Agreement), (iv) replacement options to purchase up to 1,596,754 shares of Panbela Common Stock at a weighted average purchase price of $0.35 per share, and (v) replacement warrants to purchase up to 338,060 shares of Panbela Common Stock at a weighted average purchase price of $4.145 per share.

These securities were issued in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) of the Securities Act, and Regulation D promulgated thereunder. Accordingly, all such securities are restricted securities and may not be offered or sold by the holders of those shares, absent registration or an applicable exemption from registration requirements.

The information set forth in the Explanatory Note of this current report is incorporated into this Item 3.02 by reference.

|

Item 3.03

|

Material Modification to Rights of Security Holders.

|

In connection with the Mergers, the Panbela Common Stock was assigned a new CUSIP of 69833W107.

The information set forth in the Explanatory Note and in Items 1.01 and 5.03 relating to the Panbela Common Stock is incorporated by reference into this Item 3.03.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Board of Directors

In connection with, and effective immediately before the effective time of the First Merger, then current directors of Panbela Research, Suzanne Gagnon and Paul W. Schaffer, each resigned all positions with Panbela Research’s board of directors (the “Board”). There are no disagreements between either Dr. Gagnon or Mr. Schaffer and Panbela relating to its operations, policies or practices that resulted in their decisions to resign. All other directors of Panbela Research continue to serve as directors of Panbela. As a result of Mr. Schaffer’s departure, current director Arthur J. Fratamico was also named chair of the nominating and governance committee of the Board.

In accordance with the Merger Agreement and in connection with, and effective immediately after the Second Merger, each of Daniel J. Donovan and Jeffrey E. Jacob was appointed to Panbela’s Board, filling the two vacancies in Class I created by the departures of Dr. Gagnon and Mr. Schaffer. Each is expected to serve the remainder of the Class I term scheduled to expire as of Panbela’s annual meeting of stockholders to be held in 2023. Mr. Donovan has been appointed to serve on the audit and compensation committees of the Board.

Jeffrey E. Jacob, age 60, served as Chief Executive Officer of Cancer Prevention from 2009 until the consummation of the Second Merger in June 2022. He has served as principal at Tucson Pharma Ventures LLC, an Arizona-based biopharmaceutical consulting and investment firm, since 2004.

Daniel J. Donovan, age 58, served as a director and Chief Business Officer, a non-employee position, of Cancer Prevention from 2011 until the consummation of the Second Merger in June 2022. He has served as chief executive officer of rareLife Solutions, Inc., a private company, since he co-founded it in 2014.

No Change to Compensatory Arrangements

No change was made to the compensatory arrangements involving our executive officers other than Panbela’s assumption of the existing obligations of Panbela Research with respect to existing employment agreements and all other existing compensatory arrangements with our President and Chief Executive Officer, Jennifer K. Simpson, and our Vice President of Finance, Chief Financial Officer, Secretary and Treasurer, Susan Horvath.

Related Party Transaction with Incoming Director

Also on the Closing Date, Cancer Prevention entered into a Separation and Release Agreement (the “Separation Agreement”) with Mr. Jacob, now a director of Panbela, whereby he resigned as its Chief Executive Officer, employee, and all other capacities, immediately prior to the closing under the Merger Agreement. In consideration for Mr. Jacob’s acknowledgements, representations, warranties, covenants, releases and agreements set forth in the Separation Agreement, Cancer Prevention has agreed to pay to Mr. Jacob a total of $350,000, representing one times his base salary at the time of his resignation. Such payment will become due upon the earlier of (i) Cancer Prevention or its parent completing a material financing and (ii) the two-year anniversary of the Closing Date. As further consideration, Cancer Prevention has also agreed to reimburse Mr. Jacob for the employer’s portion of the premium payments for him to continue his current medical insurance coverage for 12 months through the Consolidated Omnibus Budget Reconciliation Act (COBRA).

The foregoing description of the Separation Agreement does not purport to be complete and is qualified by reference to, the text of the Separation Agreement, which is filed as Exhibit 10.6 to this current report and is incorporated herein by reference.

--12-31

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On June 15, 2022, in accordance with the terms of the Merger Agreement, Panbela amended and restated its certificate of incorporation and bylaws to reflect the changes set forth in the Merger Agreement and its exhibits as described in the

Proxy Statement. The resulting certificate of incorporation and bylaws are identical to those of Panbela Research immediately prior to the consummation of the First Merger.

The foregoing descriptions of the amended and restated certificate of incorporation of Panbela and the bylaws of Panbela do not purport to be complete and are qualified by reference to, the text of each such document, which is filed as Exhibit 3.1 and Exhibit 3.2, respectively, to this current report and is incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

On June 16, 2022, Panbela issued a press release announcing the completion of the Mergers, the text of which is furnished as Exhibit 99.1 to this current report and is incorporated herein by reference.

This Current Report on Form 8-K establishes Panbela as the successor issuer to Panbela Research pursuant to Rule 12g-3(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Pursuant to Rule 12g-3(d) under the Exchange Act, the shares of common stock, $0.001 par value per share, of Panbela (“Panbela Common Stock”) are deemed to be registered under Section 12(b) of the Exchange Act, and Panbela is subject to the informational requirements of the Exchange Act and the rules and regulations promulgated thereunder. Panbela hereby reports this succession in accordance with Rule 12g-3(f) under the Exchange Act. The description of the Panbela Common Stock set forth in Exhibit 4.1 to this current report is incorporated herein by reference.

|

Item 9.01

|

Financial Exhibits.

|

(a) Financial statements of business or funds acquired.

The financial information required by this Item 9.01(a) was previously reported in the

Proxy Statement and, pursuant to General Instruction B.3 of Form 8-K is not required to be reported herein.

(b) Pro forma financial information.

The unaudited pro forma condensed combined financial information of Panbela Therapeutics, Inc. as of and for the three months ended March 31, 2022 and the fiscal year ended December 31, 2021 and the related notes thereto are attached as Exhibit 99.3 to this current report and incorporated herein by reference.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

Method of Filing

|

|

2.1*

|

|

Agreement and Plan of Merger, dated February 21, 2022, by and among Panbela Therapeutics, Inc., Canary Merger Holdings, Inc., Canary Merger Subsidiary I, Inc., Canary Merger Subsidiary II, Inc., Cancer Prevention Pharmaceuticals, Inc., and Fortis Advisors LLC, as Stockholder Representative (incorporated by reference to Exhibit 2.1 to current report on Form 8-K filed February 22, 2022).

|

|

Incorporated by reference

|

|

3.1

|

|

|

|

Filed electronically

|

|

3.2

|

|

|

|

Filed electronically

|

|

4.1

|

|

|

|

Incorporated by reference

|

|

10.1

|

|

|

|

Filed electronically

|

|

10.2

|

|

|

|

Filed electronically

|

|

10.3

|

|

|

|

Filed electronically

|

|

10.4

|

|

|

|

Filed electronically

|

|

10.5

|

|

|

|

Filed electronically

|

|

10.6

|

|

|

|

Filed electronically

|

|

23.1

|

|

|

|

Filed electronically

|

|

99.1

|

|

|

|

Furnished electronically

|

|

99.2

|

|

|

|

Incorporated by reference

|

|

99.3

|

|

|

|

Filed electronically

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

*

|

Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule will be furnished to the SEC upon request; provided, however, that the parties may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any document so furnished.

|

The information contained in Item 7.01 of this current report and Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

PANBELA THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

Date: June 16, 2022

|

By:

|

/s/ Susan Horvath

|

|

|

|

|

Susan Horvath

|

|

|

|

|

Chief Financial Officer

|

|

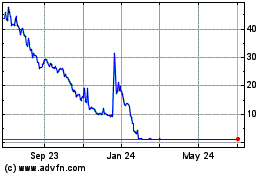

Panbela Therapeutics (NASDAQ:PBLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Panbela Therapeutics (NASDAQ:PBLA)

Historical Stock Chart

From Apr 2023 to Apr 2024