UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

| | | | | | | | | | | |

| | ☐ | Preliminary Information Statement | |

| | | | |

| | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) | |

| | | | |

| | ☒ | Definitive Information Statement | |

Earthstone Energy, Inc. |

(Name of Registrant as Specified in Its Charter) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| | ☒ | No fee required |

| | | |

| | ☐ | Fee paid previously with preliminary materials |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11. |

EARTHSTONE ENERGY, INC.

1400 Woodloch Forest Drive, Suite 300

The Woodlands, Texas 77380

NOTICE OF ACTION BY WRITTEN CONSENT OF THE STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

Dear Stockholder: June 15, 2022

This notice of action by written consent pursuant to Section 228(e) of the General Corporation Law of the State of Delaware (the “DGCL”) and the accompanying information statement (the “Information Statement”) are being furnished by the Board of Directors (the “Board”) of Earthstone Energy, Inc., a Delaware corporation (“Earthstone” and together with its consolidated subsidiaries, the “Company,” “we,” “us” or “our”), to the holders of record at the close of business on January 30, 2022 of the outstanding shares of Earthstone’s Class A common stock, par value $0.001 per share (“Class A Common Stock”), and Class B common stock, par value $0.001 per share (“Class B Common Stock” and collectively with the Class A Common Stock, the “Common Stock”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

On April 14, 2022, Earthstone issued 280,000 shares of its newly authorized Series A convertible preferred stock, par value $0.001 per share (the “Preferred Stock”), in a private placement pursuant to the terms of that certain Securities Purchase Agreement, dated as of January 30, 2022 (the “SPA”), by and among Earthstone, EnCap Energy Capital Fund XI, L.P. (“EnCap Fund XI”), an affiliate of EnCap Investments L.P. (“EnCap”), and Cypress Investments, LLC (“Cypress” and collectively with EnCap Fund XI, the “Investors”), a fund managed by Post Oak Energy Capital, LP (“Post Oak”), in exchange for gross proceeds of $280 million in cash. The Preferred Stock has the powers, preferences and rights, and the qualifications, limitations and restrictions thereof, as are set forth in the Certificate of Designations for the Preferred Stock filed with the Secretary of State of the State of Delaware (the “Certificate”), a copy of which is attached to the accompanying Information Statement as Annex A. The net proceeds of the private placement were used to fund a portion of the purchase price for oil and natural gas leases and related property in the Midland Basin, Texas, which the Company acquired from Bighorn Asset Company, LLC (“Bighorn”) on April 14, 2022 pursuant to that certain Purchase and Sale Agreement dated as of January 30, 2022 (the “Purchase Agreement”) by and among Earthstone, Earthstone Energy Holdings, LLC, a Delaware limited liability company and subsidiary of Earthstone (“EEH”), and Bighorn.

The purpose of the accompanying Information Statement is to provide formal notice to Earthstone’s stockholders that, on January 30, 2022, holders of approximately 61.6% of the voting power of all of the outstanding shares of Common Stock delivered to Earthstone an irrevocable written consent (the “Written Consent”) in lieu of a special meeting of stockholders approving the conversion feature of the Preferred Stock and the issuance of the Class A Common Stock upon conversion of the Preferred Stock.

The Class A Common Stock is listed on the New York Stock Exchange (the “NYSE”). Under Section 312.03 of the NYSE Listed Company Manual, stockholder approval is required prior to the issuance of shares of common stock, or of securities convertible into common stock, if:

• such common stock or securities have, or will have upon issuance, voting power equal to 20% or more of the voting power outstanding before the issuance of such stock or securities convertible into common stock;

• the number of shares of common stock to be issued is, or will be upon issuance, equal to 20% or more of the number of shares of common stock outstanding before the issuance of the common stock or securities convertible into common stock; or

• the number of shares of common stock to be issued is, or will be upon issuance, equal to more than one percent of the number of shares of common stock outstanding or voting power outstanding before the issuance and such issuance is to a Related Party (as defined in the NYSE Listed Company Manual) of Earthstone, or where such securities are issued as consideration in a transaction in which a Related Party has a five percent or greater interest, directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction and the present or potential issuance of common stock or

securities convertible into common stock could result in an issuance that exceeds either five percent of the number of shares of common stock or five percent of the voting power outstanding before the issuance.

Because the number of shares of Class A Common Stock issuable upon conversion of the shares of Preferred Stock issued pursuant to the SPA would represent greater than each of the foregoing thresholds, and because EnCap Fund XI who purchased shares of Preferred Stock pursuant to the SPA is a Related Party (as defined in the NYSE Listed Company Manual) of Earthstone, stockholder approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock was required under NYSE rules and regulations.

On January 30, 2022, certain entities controlled or affiliated with EnCap (collectively, the “EnCap Funds”) and certain entities controlled or affiliated with Warburg Pincus LLC (collectively, the “Warburg Funds”, and together with the EnCap Funds, the “Consenting Stockholders”) delivered to Earthstone the Written Consent approving the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock. As of January 30, 2022, the Consenting Stockholders held shares of Common Stock representing, in the aggregate, approximately 61.6% of the voting power of all of the outstanding shares of Common Stock. Accordingly, the Written Consent provided the requisite approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock by Earthstone’s stockholders in accordance with the NYSE rules and regulations. No further approval of the stockholders is required to approve the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock under the Third Amended and Restated Certificate of Incorporation of Earthstone, as amended (the “Certificate of Incorporation”), the Amended and Restated Bylaws of Earthstone, as amended (the “Bylaws”), the DGCL, the SPA or the NYSE rules and regulations. As a result, Earthstone is not soliciting your vote for the approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock and does not intend to call a meeting of stockholders for purposes of voting on the adoption and approval thereof.

Pursuant to the DGCL, the Written Consent was effective upon delivery to Earthstone. Pursuant to Rule 14c-2 of the Exchange Act, the actions contemplated by the Written Consent may not be taken until 20 calendar days following the date we first mail the accompanying Information Statement to our stockholders. Accordingly, we expect the conversion of the Preferred Stock into 25,225,225 shares of Class A Common Stock to occur on or about July 6, 2022 (the 21st calendar day following the date on which we expect to mail the accompanying Information Statement to our stockholders), after which time the Preferred Stock will no longer be outstanding and EnCap Fund XI and Cypress will own the shares of Class A Common Stock issuable upon conversion of the Preferred Stock.

The audit committee (the “Audit Committee”) of the Board, consisting of independent and disinterested members of the Board, carefully reviewed and considered the terms and conditions of the SPA, the Certificate, the Preferred Stock, the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock. The Audit Committee unanimously (i) determined that the SPA is fair to, and in the best interests of, Earthstone and its stockholders; (ii) approved and declared advisable the Certificate, the SPA and the ancillary agreements and documents appended thereto and each of the transactions contemplated therein, including the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock; and (iii) recommended that the Board approve the Certificate, the SPA, the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock, and that the approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock be submitted to Earthstone’s stockholders for approval in accordance with the terms of the SPA and the rules of the NYSE. The Board approved the Certificate, the SPA, the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock and recommended that the stockholders of Earthstone approve the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock and directed that the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock be submitted to the holders of the Common Stock for their approval.

This notice of action by written consent and the accompanying Information Statement constitutes notice to you from Earthstone pursuant to Section 228(e) of the DGCL that the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock have been approved by the holders of a majority of the voting power of all of the outstanding shares of Common Stock by Written Consent in lieu of a special meeting in accordance with Section 228 of the DGCL and the NYSE rules and regulations.

EARTHSTONE IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND EARTHSTONE A PROXY.

PLEASE NOTE THAT THE CONSENTING STOCKHOLDERS HAVE VOTED TO APPROVE THE CONVERSION FEATURE OF THE PREFERRED STOCK AND THE ISSUANCE OF THE SHARES OF CLASS A COMMON STOCK UPON THE CONVERSION OF THE PREFERRED STOCK. THE NUMBER OF VOTES HELD BY THE CONSENTING STOCKHOLDERS IS SUFFICIENT TO SATISFY THE STOCKHOLDER

VOTE REQUIREMENT UNDER SECTION 312 OF THE NYSE LISTED COMPANY MANUAL, THE DGCL, THE CERTIFICATE OF INCORPORATION, THE BYLAWS AND THE SPA FOR THESE ACTIONS AND CONSEQUENTLY, NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THE CONVERSION FEATURE OF THE PREFERRED STOCK AND THE ISSUANCE OF THE SHARES OF CLASS A COMMON STOCK UPON THE CONVERSION OF THE PREFERRED STOCK. THE CORPORATE ACTIONS DESCRIBED IN THE ACCOMPANYING INFORMATION STATEMENT REQUIRED STOCKHOLDER APPROVAL FROM THE HOLDERS OF OUR OUTSTANDING COMMON STOCK BECAUSE OUR COMMON STOCK IS TRADED ON THE NYSE AND BECAUSE THE SPA PROVIDED FOR IT.

The Information Statement accompanying this letter provides you with more specific information concerning the issuance of the Preferred Stock. We encourage you to carefully read the accompanying Information Statement and the annex attached thereto.

| | | | | | | | |

| | | By Order of the Board of Directors, |

|

| /s/ William A. Wiederkehr, Jr. |

| | WILLIAM A. WIEDERKEHR, JR. |

| | Corporate Secretary |

The accompanying Information Statement is dated June 15, 2022 and is first being mailed to our stockholders on or about June 15, 2022.

EARTHSTONE ENERGY, INC.

1400 Woodloch Forest Drive, Suite 300

The Woodlands, Texas 77380

INFORMATION STATEMENT

June 15, 2022

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This information statement (this “Information Statement”) is being furnished by the Board of Directors (the “Board”) of Earthstone Energy, Inc., a Delaware corporation (“Earthstone” and together with its consolidated subsidiaries, the “Company,” “we,” “us” or “our”), to the holders of record at the close of business on January 30, 2022 of the outstanding shares of Earthstone’s Class A common stock, par value $0.001 per share (“Class A Common Stock”), and Class B common stock, par value $0.001 per share (“Class B Common Stock” and collectively with the Class A Common Stock, the “Common Stock”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

On April 14, 2022, Earthstone issued 280,000 shares of its newly authorized Series A convertible preferred stock, par value $0.001 per share (the “Preferred Stock”), in a private placement pursuant to the terms of that certain Securities Purchase Agreement, dated as of January 30, 2022 (the “SPA”), by and among Earthstone, EnCap Energy Capital Fund XI, L.P. (“EnCap Fund XI”), an affiliate of EnCap Investments L.P. (“EnCap”), and Cypress Investments, LLC (“Cypress” and collectively with EnCap Fund XI, the “Investors”), a fund managed by Post Oak Energy Capital, LP (“Post Oak”), in exchange for gross proceeds of $280 million in cash. The Preferred Stock has the powers, preferences and rights, and the qualifications, limitations and restrictions thereof, as are set forth in the Certificate of Designations for the Preferred Stock filed with the Secretary of State of the State of Delaware (the “Certificate”), a copy of which is attached hereto as Annex A. The net proceeds of the private placement were used to fund a portion of the purchase price for oil and natural gas leases and related property in the Midland Basin, Texas, which the Company acquired from Bighorn Asset Company, LLC (“Bighorn”) on April 14, 2022 pursuant to that certain Purchase and Sale Agreement dated as of January 30, 2022 (the “Purchase Agreement”) by and among Earthstone, Earthstone Energy Holdings, LLC, a Delaware limited liability company and subsidiary of Earthstone (“EEH”), and Bighorn. This Information Statement is dated June 15, 2022 and is first being mailed to our stockholders on or about such date.

ABOUT THIS INFORMATION STATEMENT

What is the purpose of this Information Statement?

This Information Statement is being furnished to you pursuant to the requirements of the Exchange Act and the Delaware General Corporation Law (the “DGCL”) to notify you of a corporate action taken by holders of a majority of the voting power of all of the outstanding shares of Common Stock pursuant to an irrevocable written consent (the “Written Consent”) in lieu of a special meeting of stockholders approving the conversion feature of the Preferred Stock and the issuance of the Class A Common Stock upon conversion of the Preferred Stock. In order to eliminate the costs and management time involved in obtaining proxies and in order to effect this action as early as possible to accomplish the purposes described below, the Board elected to seek the written consent of the stockholders in lieu of a special meeting. Earthstone is making this Information Statement available to you on or about June 15, 2022. Earthstone is not soliciting your proxy or consent and you are not being asked to take any action in connection with this Information Statement.

Who is entitled to notice?

Each holder of record of outstanding shares of our Common Stock as of the close of business on January 30, 2022, the date the Written Consent was delivered to Earthstone, is entitled to notice of the action taken pursuant to the Written Consent. Each holder of record of outstanding shares of our Common Stock as of the close of business on May 2, 2022 will also receive notice of the action taken pursuant to the Written Consent.

Why did Earthstone seek stockholder approval?

On January 30, 2022, the Board (upon receiving the recommendation of the audit committee (the “Audit Committee”) of the Board) authorized the issuance and sale of $280 million of Preferred Stock, and approved the pricing and other terms of the issuance of the Preferred Stock. On that same date, Earthstone entered into the SPA to sell, in a private placement, 280,000 shares of Preferred Stock, each share of which will be convertible into 90.0900900900901 shares of Class A Common Stock, par value $0.001 per share (“Class A Common Stock”), for gross proceeds of $280 million in cash, or the equivalent of $11.10 per share of Class A Common Stock (the “Conversion Price”). If the Preferred Stock has not automatically converted into Class A Common Stock on or before October 1, 2022, then each holder of Preferred Stock will be entitled to receive dividends at an annual rate of 8% of the initial liquidation preference per share from the date of issuance. Each share of Preferred Stock has an initial liquidation preference of $1,000. If a cash dividend is not declared and paid on any dividend payment date, then the liquidation preference per share of Preferred Stock will be increased by the amount of the unpaid dividend. Earthstone will be required to redeem all of the outstanding shares of Preferred Stock if the Preferred Stock has not been converted into Class A Common Stock on or before November 22, 2025. The Conversion Price is subject to adjustment in certain circumstances, including stock splits, stock dividends, rights offerings or conversion of our Common Stock. The net proceeds from the sale of the Preferred Stock were used to partially fund the purchase price of certain assets of Bighorn, as described below under “Background and Reasons for the Preferred Stock Issuance and Stockholder Approval—Background and Reasons for the Preferred Stock Issuance.”

The Class A Common Stock is listed on the New York Stock Exchange (the “NYSE”). Under Section 312.03 of the NYSE Listed Company Manual, stockholder approval is required prior to the issuance of shares of common stock, or of securities convertible into common stock, if:

• such common stock or securities have, or will have upon issuance, voting power equal to 20% or more of the voting power outstanding before the issuance of such stock or securities convertible into common stock;

• the number of shares of common stock to be issued is, or will be upon issuance, equal to 20% or more of the number of shares of common stock outstanding before the issuance of the common stock or securities convertible into common stock; or

• the number of shares of common stock to be issued is, or will be upon issuance, equal to more than one percent of the number of shares of common stock outstanding or voting power outstanding before the issuance and such issuance is to a Related Party (as defined in the NYSE Listed Company Manual) of Earthstone, or where such securities are issued as consideration in a transaction in which a Related Party has a five percent or greater interest, directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction and the present or potential issuance of common stock or securities convertible into common stock could result in an issuance that exceeds either five percent of the number of shares of common stock or five percent of the voting power outstanding before the issuance.

Because the number of shares of Class A Common Stock issuable upon conversion of the shares of Preferred Stock issued pursuant to the SPA would represent greater than each of the foregoing thresholds, and because EnCap Fund XI who purchased shares of Preferred Stock pursuant to the SPA is a Related Party (as defined in the NYSE Listed Company Manual) of Earthstone, stockholder approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock is required under NYSE rules and regulations.

What actions were approved by the written consent of holders of a majority of the voting power of all of the outstanding shares of Common Stock?

Pursuant to the Written Consent, the following actions were authorized and approved by holders of a majority of the voting power of all of the outstanding shares of Common Stock:

• In accordance with Section 312.03 of the NYSE Listed Company Manual, the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock.

• Any actions and the making of all expenditures deemed by the officers of Earthstone to be necessary or desirable in carrying out and effectuating the conversion of the Preferred Stock and the issuance of shares of Class A Common Stock in connection therewith.

What vote was required to approve the actions?

Pursuant to Section 312.03 of the NYSE Listed Company Manual, the Third Amended and Restated Certificate of Incorporation of Earthstone, as amended (the “Certificate of Incorporation”), and the Amended and Restated Bylaws of Earthstone, as amended (the “Bylaws”), the approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock required the affirmative vote of a majority of the issued and outstanding shares of Common Stock. Under Section 228 of the DGCL, any action required or permitted to be taken at any annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote of stockholders, if a consent in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to take such action at a meeting at which all shares entitled to vote thereon were present and voted. As of the close of business on January 30, 2022, there were 87,814,265 shares of Common Stock issued and outstanding, each share of which entitled the holder thereof to one vote on each matter submitted to our stockholders, and the stockholders holding approximately 61.6% of our issued and outstanding shares of Common Stock executed and delivered the Written Consent to Earthstone on such date, providing the approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock required by the NYSE rules and regulations. Because the requisite stockholder approval for the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock has been received, all corporate approvals by or on behalf of Earthstone required for the matters referred to herein have been obtained and no further votes will be needed.

Do I have appraisal rights?

No. None of the DGCL, the Certificate of Incorporation or the Bylaws provides holders of the Common Stock or Preferred Stock with dissenters’ or appraisal rights in connection with the actions by Written Consent described in this Information Statement.

Will the automatic conversion of the Preferred Stock be dilutive (in terms of voting power) to existing holders of the Common Stock?

Yes, the conversion of the Preferred Stock will be dilutive to existing holders of the Common Stock. Based on the capitalization of Earthstone as of May 2, 2022 and the conversion rate of 90.0900900900901 shares of Class A Common Stock per share of Preferred Stock, the conversion of the Preferred Stock will result in the holders thereof owning approximately 18.2% of the outstanding Common Stock after giving effect to such conversion. This would amount to a dilution in voting power of approximately 18.2% to existing holders of the Common Stock. See the section “Security Ownership of Certain Beneficial Owners and Management” for more information.

BACKGROUND AND REASONS FOR THE PREFERRED STOCK ISSUANCE

AND STOCKHOLDER APPROVAL

Background and Reasons for the Preferred Stock Issuance

Earthstone is actively involved in the evaluation, acquisition and development of oil and natural gas properties in the Permian Basin (Midland and Delaware sub-basins in Texas and New Mexico) and the Eagle Ford trend in Texas.

Sable Permian Resources, LLC (“Sable”), the predecessor to Bighorn, filed for bankruptcy in 2020 and, in February 2021, Sable emerged from bankruptcy as Bighorn Asset Company, LLC (“Bighorn”). In late October 2021, RBC Richardson Barr Securities, Inc. (“RBC”), exclusive financial advisor to Bighorn, provided an executive summary to selected parties regarding a potential sale of Bighorn’s oil and natural gas assets located in the southern Midland Basin of Texas (the “Bighorn Assets”).

Management began evaluating the Bighorn Assets after executing a confidentiality agreement with Bighorn on October 30, 2021. Due to the expected size of the transaction of over $800 million, management began to consider options for financing the purchase of the Bighorn Assets including debt, equity, potential non-operating working interest partners and other alternatives.

In connection with reviewing and monitoring similar transactions in the industry, management has maintained relationships with private equity sponsors. Post Oak Energy Capital, LP, a private investment fund (referred to herein as “Post Oak”), was one such private equity sponsor with whom Earthstone management had discussed both potential capital investments and transactions over the past several years. In early November 2021, Robert J. Anderson, President and Chief Executive Officer of Earthstone, contacted Henry S. May III, Senior Vice President of Post Oak, to discuss the possible purchase of the Bighorn Assets and how Post Oak might provide equity capital to be used as part of the Bighorn Asset purchase price.

During the month of November, Messrs. Anderson and May held a number of telephonic discussions regarding the Bighorn Assets. On November 29, 2021, Earthstone management held a video conference with Post Oak’s management and principals to provide a technical evaluation of the Bighorn Assets and the potential impact on Earthstone’s business if Earthstone were to purchase the Bighorn Assets. The primary purpose of the meeting was to seek a basis for a possible bid on the Bighorn Assets and the interest, if any, of Post Oak. Post Oak management preliminarily indicated Post Oak would likely participate with Earthstone by providing an equity investment in Earthstone in the range of $75-$150 million. Also, at this time, Earthstone was also considering bringing in industry non-operating parties in order to reduce Earthstone’s share of the overall purchase price to management’s desired interest level of 75% to 85% of the total. The parties agreed further discussion was necessary regarding the nature and scope of the financing and that management would follow-up with Post Oak in the near future.

Mr. Anderson also discussed the potential purchase of the Bighorn Assets with the Board during a November 17, 2021 Earthstone board meeting. The discussion included purchase price and financing alternatives, one of which included Post Oak providing equity capital in the form of a private investment in public equity (“PIPE”) and other forms of industry non-operating partner participations.

Shortly thereafter, after consultation with the Board, Earthstone submitted a bid for the Bighorn Assets for $820 million, including $100 million of Class A Common Stock. RBC subsequently informed Mr. Anderson that Earthstone’s bid was unsuccessful. Mr. Anderson thereafter informed the Board and Post Oak that Bighorn had informed him that Bighorn was going in a different direction.

On December 22, 2021, Mr. Anderson received a call from RBC to discuss whether the Earthstone bid for Bighorn could still be considered active. RBC indicated to Mr. Anderson that Bighorn was willing to engage with Earthstone at the valuation for Bighorn previously offered if Earthstone could act quickly; however, exclusivity with Earthstone as the only potential purchaser of the Bighorn Assets would not be granted by Bighorn. Thereafter, Mr. Anderson spoke with Mr. May and confirmed that Post Oak was still interested in participating. Additionally, Mr. Anderson engaged in discussions with EnCap to determine whether it had any interest in participating in an equity investment on the same terms as Post Oak. In late December 2021, Earthstone management shared reserve and capitalization table summaries with Post Oak and EnCap. Separate discussions among Earthstone management, EnCap and Post Oak ensued near the end of December 2021 and early January 2022 in order to determine a possible deal structure that would be acceptable to all parties. At this point in time Earthstone’s bid was $820 million, consisting of $720 million in cash and $100 million in equity issuable to Bighorn and assuming a $10 stock price of the Class A Common Stock.

On December 30, 2021, Mr. Anderson provided an update to the Board regarding the possible purchase of the Bighorn Assets at the $820 million level. This included a hypothetical structure that assumed equity to Bighorn ranging from $70-$100 million and a PIPE with Post Oak and EnCap Fund XI of an aggregate of $250 million, with the remainder of the purchase price to be funded through the Company’s existing credit facility. Assuming $70-$100 million of equity to the seller, Earthstone determined that issuing at least $250 million of equity in the PIPE was necessary to keep the absolute debt and leverage ratios within Earthstone’s historical levels. Discussions were held between Earthstone and Post Oak and separately between Earthstone and EnCap in early January 2022 regarding the possible PIPE transaction.

During early January 2022, EnCap notified Mr. Anderson that it was interested in participating in a PIPE transaction. Mr. Anderson immediately notified Jay F. Joliat, the Chair of the Audit Committee, of EnCap’s potential participation in the PIPE transaction. After Mr. Anderson’s discussions with Mr. Joliat, it was determined that Mr. Anderson, on behalf of the Audit Committee, would negotiate directly with Post Oak, that EnCap would not participate in the negotiations, and that EnCap’s investment would need to be on the same terms as those agreed to by Earthstone with Post Oak. Mr. Anderson notified EnCap that its investment would be on the same terms and price as agreed to with Post Oak and EnCap agreed to such a framework. The Audit Committee discussed with Jones & Keller, P.C. (“J&K”), legal counsel to Earthstone, and Richards, Layton & Finger, P.A., legal counsel to the Audit Committee, the advantages of engaging a financial advisor to assist it in connection with the PIPE transaction. The Audit Committee consists of Mr. Joliat and two other directors, Zachary G. Urban and Phillip D. Kramer, each of whom, along with Mr. Joliat, is highly qualified and an independent director under NYSE and Securities and Exchange Commission (“SEC”) rules. After interviewing different financial firms that had experience with smaller market capitalized exploration and production (“E&P”) companies, in early January 2022, Mr. Joliat engaged Johnson Rice & Company L.L.C. (“Johnson Rice”), an independent investment banking firm, on behalf of the Audit Committee to provide financial advice to the Audit Committee in connection with the potential PIPE transaction.

On January 7, 2022, Mr. Anderson discussed with Post Oak and EnCap that certainty of financing at the execution of the Purchase Agreement was of paramount importance to Bighorn. In order to provide certainty of sufficient cash to close the transaction, the parties discussed the use of a privately placed, convertible preferred stock that would convert to Class A Common Stock upon approval of the holders of Common Stock at the 2022 annual meeting of stockholders of Earthstone. This would require the Board to approve the transaction and would include a voting agreement with both EnCap and another large stockholder, Warburg Pincus LLC (“Warburg”), who collectively owned a majority of the outstanding shares of Common Stock. Pursuant to such voting agreement, each of EnCap and Warburg would agree to vote all of their shares of Common Stock to approve the conversion feature of the Preferred Stock and the issuance of shares of Class A Common Stock upon conversion of the Preferred Stock, both required as a result of the NYSE rules and regulations. Thereafter, it was agreed that EnCap and Warburg would instead execute a written consent of stockholders rather than a voting agreement, and Earthstone would provide notice to the holders of Common Stock via an information statement that would be filed with the SEC and mailed to holders of Common Stock. All parties, including Bighorn, agreed that subject to legal review and appropriate agreements, that this would be an acceptable structure to provide certainty of financing at the execution of the Purchase Agreement and an expedited closing to Bighorn.

On January 17, 2022, the Audit Committee met with management and J&K to discuss the related-party nature of the PIPE with EnCap Fund XI participating. The Audit Committee considered and determined its role in the potential PIPE transaction as a result of the related party nature with the involvement of EnCap and its affiliates. Mr. Anderson had previously provided the Audit Committee with a spreadsheet of possible funding sources and post-transaction ownership. He had also previously sent the Audit Committee a model and technical information relating to the proposed acquisition of the Bighorn Assets based on recent strip prices of oil and natural gas. The Audit Committee discussed its role in reviewing materials related to the PIPE, noting that Johnson Rice was engaged as financial advisor to the Audit Committee to advise on pricing of the shares issuable in the PIPE as such information was deemed to be helpful and appropriate since the proposal to sell equity included a related party. With Johnson Rice engaged to provide information related to the pricing in small public company PIPEs and equity offerings, the Audit Committee would have access to meaningful guidelines. It was also discussed and agreed by the Audit Committee and management that Post Oak and Mr. Anderson would negotiate the equivalent Class A Common Stock price for which the PIPE transaction would be made. EnCap Fund XI would not participate in the negotiation of this price but would be kept advised as negotiations progressed.

The Audit Committee discussed possible PIPE pricing-related matters and the significant amount of funds needed to be raised in order to have reasonable certainty that Earthstone would be able to enter into and complete the acquisition of the Bighorn Assets under a very tight time frame, given the competitive nature of the transaction and lack of exclusivity provided by Bighorn. It was the consensus of the Audit Committee that a public offering would not be achievable in a sufficiently short time frame to complete the acquisition of the Bighorn Assets as Earthstone would have to assemble an underwriting syndicate, provide updated financial statements and a reserve report as of the recent year end, and provide pro forma financial statements, all of which would take a significant amount of time to prepare. In addition, from a market and economic perspective, in light of Earthstone’s market capitalization,

public float and trading volume, and the fact that Earthstone would need to conduct an offering of $250 million or more, it was highly likely that the public offering price would be a significant discount to the prevailing trading price of the Class A Common Stock.

Also, during the first three weeks of January 2022, the Company worked with its bank lending group in seeking to obtain an increase in the borrowing base and elected commitments under its senior secured revolving credit facility which would be necessary to provide a majority of the cash consideration for the purchase of the Bighorn Assets (in addition to the cash to be provided by the PIPE). On January 21, 2022, the Company’s bank lenders approved an amendment to the Company’s credit facility to increase Earthstone’s borrowing base from $825 million to $1,325 million, subject to the closing of the acquisition of the Bighorn Assets.

Messrs. Anderson and May had several discussions on the pricing of the PIPE investment beginning in mid-January 2022. Discussions centered around appropriate pricing metrics since the PIPE transaction was similar to a common stock offering because the Preferred Stock would automatically convert to Class A Common Stock 21 days after the SEC information statement was mailed to Earthstone stockholders.

In mid-January 2022, management suggested to Bighorn that it would be desirable to obtain exclusivity from Bighorn and, with increasing commodity prices, determined that the consideration offered could be increased to $770 million in cash with the seller taking approximately 6.8 million shares of Class A Common Stock. This was agreed to orally with the seller on January 24, 2022. Messrs. Anderson and May discussed the pricing of the PIPE after the consideration for the Bighorn Assets had been determined. Based on recent trading prices of the Class A Common Stock, on behalf of the Audit Committee, Mr. Anderson tentatively agreed to an $11 equivalent Class A Common Stock price for the PIPE shares. As the expectation for executing the SPA was in the near term, both Messrs. Anderson and May agreed to continue to review the proposed conversion price of the PIPE shares, with final determination of the conversion price to be immediately prior to the execution of definitive agreements relating to the acquisition of the Bighorn Assets.

On January 25, 2022, the Audit Committee held a meeting with representatives from Johnson Rice. Also present was Earthstone’s outside legal counsel and management. The purpose of the meeting was to review the preliminary analysis of Johnson Rice regarding PIPE pricing metrics and public equity offerings, as well as update the Audit Committee on the status of the Bighorn negotiations.

Mr. Joshua C. Cummings, the primary Johnson Rice representative, reviewed the Johnson Rice financing advisory presentation with the Audit Committee. The Audit Committee had engaged Johnson Rice as a financial advisor relating specifically to a contemplated $250 million PIPE private placement of shares of Preferred Stock convertible into shares of Class A Common Stock to Post Oak and EnCap Fund XI. Further, management (with final approval by the Audit Committee) and Post Oak would be negotiating the price and terms of the PIPE in which EnCap Fund XI also intended to participate. As part of its analysis, Johnson Rice considered the following:

•The accretive nature of the acquisition of the Bighorn Assets on a pro forma basis for the contemplated PIPE transaction;

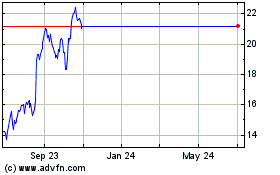

•Earthstone’s absolute and relative Class A Common Stock price performance and implied discounts of PIPE pricing;

•Public equity capital market conditions and comparable transactions deemed relevant by Johnson Rice; and

•Private equity and equity-linked capital market conditions and comparable transactions deemed relevant by Johnson Rice.

Johnson Rice noted that it had reviewed public company markets and comparable transactions as well as a myriad of transactions in the private equity and equity-linked capital markets. Johnson Rice had also reviewed information on Earthstone and public companies it deemed relevant. Mr. Cummings noted the materials reviewed included public information relating to financings deemed relevant, a transaction analysis and a management presentation relating to Earthstone and the proposed Bighorn acquisition, all as provided to Johnson Rice by Earthstone management. Further, Johnson Rice reviewed any conflicts it might have relating to its engagement and Mr. Cummings reported that he had cleared the conflicts through the Johnson Rice conflict committee. Johnson Rice would be paid $125,000 for its engagement on the project.

Johnson Rice next discussed an accretion/dilution analysis. Johnson Rice reviewed the contemplated Bighorn Accretion – Dilution Analysis of the transaction and pro forma financing against Johnson Rice’s published research model and the unpublished research pro forma model for Earthstone’s previously announced Chisholm transaction (which closed in February 2022). Johnson Rice concluded that the contemplated acquisition of the Bighorn Assets and associated financing appeared to be accretive to earnings per share, while maintaining Earthstone’s same or slightly better leverage profile. The key assumptions were that the PIPE transaction was $250 million at $10.47 per share, a 15% discount to the $12.32 closing price of the Class A Common Stock as of January 24, 2022, as well as completion of a $750 million high-yield bond offering with a 7.5% coupon within the general time period of the acquisition of the Bighorn Assets. This analysis covered Earthstone on a stand-alone basis. Johnson Rice discussed another analysis that included the Chisholm acquisition added to the proposed acquisition of the Bighorn Assets. The analyses covered 2022 estimated cash flow per share, 2022 estimated earnings per share, 2022 estimated enterprise value (as of December 31, 2021) and 2022 estimated EBITDA.

Johnson Rice reviewed the absolute and relative stock price of the Class A Common Stock versus an implied discount with a table covering discounts of 10%, 15%, and 20% to the Earthstone volume weighted average price (“VWAP”) of 90, 60, 30, 15 and one day(s), noting that since January 1, 2021 the Class A Common Stock has slightly underperformed relative to its peer group composite of REPX, LPI, OAS, CPE, ROCC, HPK, while it has outperformed the broader Energy ETF (XOP).

Mr. Cummings then discussed accessing the public equity capital markets as an alternative method of financing Earthstone’s need for capital in connection with the acquisition of the Bighorn Assets. Johnson Rice concluded that the public equity capital markets for E&P and traditional energy companies have been influenced recently by a myriad of relevant factors, and that a potential public offering of the size needed to fund the acquisition of the Bighorn Assets carried significant execution risk compared to the certainty of the contemplated PIPE transaction. In the view of Johnson Rice:

•The limited depth and breadth of institutional investors has created significant volatility in the energy space even as underlying commodity pricing has improved;

•Recent investment in the energy E&P sector has become almost exclusively “trade-oriented” based on commodity price perceptions and movements. There was no fundamental investment tenet in most investors’ minds;

• Environmental, social, and governance and climate initiative mandates have significantly reduced the number of institutional investors actively investing in the space, creating an uncertain outcome with respect to any public offering and a necessary “book-build” process in seeking to complete a public offering; and

•Exchange-traded funds and program traded funds represent an increasing percentage of ownership of E&P and traditional energy company equities. These equity owners typically do not provide demand for public offerings, which reduces the amount of participation that may be expected from institutional ownership.

Mr. Cummings noted that there is considerable uncertainty regarding the public energy capital markets for E&P companies. He indicated that the institutional investor universe had decreased significantly and noted that the market for equity is presently more receptive to public equity offerings than in previous months but was still volatile and difficult to navigate. Further, Mr. Cummings noted that there were, at the time, very few small cap E&P buyers in the market.

Mr. Cummings then addressed recent public equity capital markets activity of E&P companies and oilfield services companies, noting that the precedent transactions suggest discounts to the 1-day close and the 30-day VWAP were prevalent, with greater discounts associated with offerings that approach 15-20% of pre-deal market capitalization, as would occur in the contemplated PIPE transaction. Johnson Rice reviewed over 100 private transactions and precedents going back to 2010 and chose five transactions as most comparable where there were significant equity issuances. Based on its review Johnson Rice observed that:

•Few comparable PIPE transactions have been completed in the E&P and traditional energy space over the last decade;

•The larger the offering as a percentage of market capitalization, the greater the discount to the 1-day close and 30-day VWAP;

•Change of control transactions resulted in a different pricing paradigm than minority transactions; and

•Small-cap companies (such as Earthstone) faced steeper illiquidity discounts than larger capitalized companies.

The Audit Committee proceeded to discuss the proposed pricing of the Class A Common Stock in a PIPE offering and furthered the dialog with the Johnson Rice representatives regarding the lack of viable alternatives in the public equity capital markets. It was understood that there was virtually no available equity financing possibility in the public markets for Earthstone with undiscounted pricing to the public market price. Any public offering of the Class A Common Stock in the range of $250 million would be very difficult to achieve and the offering would take much longer to complete than a PIPE and, more importantly, a public offering of the Class A Common Stock would not meet the demands of Bighorn to close the transaction relatively quickly. Thus, the Audit Committee concluded upon the advice of Johnson Rice that equity financing in the public markets of the magnitude needed to complete the acquisition of the Bighorn Assets was highly unlikely and that equity financing would likely not be available in the public markets at better pricing than with the contemplated PIPE.

During the week of January 24th, management discussed increasing the PIPE amount from $250 million to $280 million based on the increased purchase price of the Bighorn Assets. Mr. Anderson discussed separately with Post Oak and EnCap whether they would consider increasing their investment amount. At the end of January, Post Oak and EnCap Fund XI reviewed the proposed PIPE investment with their relevant investment committees and advisory boards and received approvals for a PIPE investment. Post Oak provided an indication of interest to invest $60 million and EnCap Fund XI provided an indication of interest to invest $220 million.

A further meeting of the Audit Committee was held on January 27, 2022, at which Johnson Rice reiterated the information set forth above and highlighted some minor changes given that the PIPE offering was contemplated to be increased to $280 million in cash. The basic conclusions of Johnson Rice remained generally the same. Mr. Anderson noted that the purchase price had been increased to $850 million. The Audit Committee again discussed with Johnson Rice the overall nature of the prices of the Class A Common Stock during January 2022. Johnson Rice reiterated that in light of the need to raise $280 million, it would be even more difficult to access the public markets for the reasons discussed in the Audit Committee meeting on January 25, 2022.

The Audit Committee then considered and discussed other matters and relationships relevant to the overall Bighorn transaction. The Audit Committee, subject to Audit Committee approval of the final conversion price of the PIPE shares, (i) determined that it was advisable and in the best interest of Earthstone and its stockholders for Earthstone to enter into the SPA and (ii) approved and declared advisable the Certificate, the SPA and the ancillary agreements and documents appended thereto and each of the transactions contemplated therein, including the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock. Under the SPA, Earthstone would sell and issue 280,000 shares of Preferred Stock for aggregate gross proceeds of $280 million. The Audit Committee recommended to the Board, subject to the final conversion price of the PIPE shares, that the Board approve the SPA, the Certificate and the transactions contemplated thereby (including the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock), and recommend that the stockholders approve the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock.

On January 28, 2022, Messrs. Anderson and May discussed the recent movement in the trading price of the Class A Common Stock and Mr. Anderson proposed an increase in the conversion price of the Preferred Stock. Mr. May agreed to an increase from the prior conversion price of $11.00 per share to $11.10 per share.

On January 30, 2022, the Audit Committee approved the final conversion price of the Preferred Stock of $11.10 per share after receiving an updated presentation from Johnson Rice, dated January 28, 2022.

The Board unanimously approved the SPA, the Certificate and the transactions contemplated thereby, including the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon the conversion of the Preferred Stock effective January 30, 2022.

On January 30, 2022, Earthstone, EEH, as buyer, and Bighorn, as seller, entered into the Purchase Agreement. Pursuant to the Purchase Agreement, which closed on April 14, 2022, EEH acquired the interests in oil and gas leases and related property of Bighorn located in the Midland Basin, Texas for a purchase price of $638.9 million in cash, net of preliminary and customary purchase price adjustments and subject to final post-closing adjustments, and 5,650,977 shares of Class A Common Stock, net of preliminary and customary purchase price adjustments and subject to final post-closing adjustments, and of which 510,638 shares are held in escrow to satisfy any seller indemnification obligations. The SPA was executed by Earthstone, Cypress and EnCap Fund XI substantially simultaneously with the execution of the Purchase Agreement on January 30, 2022. The transactions contemplated by the SPA were consummated immediately prior to the consummation of the transactions contemplated by the Purchase Agreement on April 14, 2022.

The Board determined that it was in the best interest of Earthstone and its stockholders to fund a portion of the purchase price for the acquisition of the Bighorn Assets with proceeds from the sale of the Preferred Stock in the PIPE. Other funds used in this regard came from the closing of a $550 million high yield debt offering by EEH of its 8.000% unsecured senior notes on April 12, 2022. The timing of the acquisition of the Bighorn Assets, however, did not allow sufficient time for the Earthstone stockholders to approve the issuance of greater than 19.9% of its voting stock, or the issuance of greater than 1% of its voting stock to EnCap Fund XI, both as required by the NYSE Listing Company Manual, and for such approvals to become effective. To address this timing concern and the NYSE requirement, the Board authorized and approved the issuance of the Preferred Stock, which did not require stockholder approval for issuance. The shares of Preferred Stock will automatically convert into shares of Class A Common Stock on the 21st day after the mailing of this Information Statement to Earthstone stockholders.

Pursuant to the SPA, EnCap Fund XI and Post Oak collectively purchased 280,000 shares of Preferred Stock, each share of which is convertible into 90.0900900900901 shares of Class A Common Stock, for gross proceeds to Earthstone of $280 million, equivalent to a price of $11.10 per share of Class A Common Stock. The transactions contemplated by the SPA were contingent upon all closing conditions to the Purchase Agreement having been satisfied substantially concurrent therewith. Earthstone used the net proceeds from the sale of the Preferred Stock to partially fund the acquisition of the Bighorn Assets.

The Preferred Stock was offered and sold in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (“Securities Act”), pursuant to Section 4(a)(2) thereof, to “accredited investors” (as defined in Rule 501(a) under the Securities Act) and may not be re-offered or sold absent registration or an applicable exemption from registration under the Securities Act.

The aggregate liquidation preference of the Preferred Stock is $1,000 per share or approximately $280 million, plus accrued and unpaid dividends. No dividends will be paid on the Preferred Stock if it converts into Class A Common Stock on or before October 1, 2022. The Preferred Stock will convert automatically on the 21st calendar day after Earthstone mails this Information Statement to its stockholders. On January 30, 2022, Earthstone received the Written Consent approving the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock from stockholders representing more than 50% of the voting power of all of the outstanding shares of Common Stock. The Class A Common Stock issuable upon conversion of the Preferred Stock represents approximately 18.2% of the outstanding Common Stock as of May 2, 2022 after giving effect to the conversion.

Also on January 30, 2022, Cypress and EnCap Energy Capital Fund VII, L.P. (“EnCap Fund VII”), an affiliate of EnCap, entered into a securities purchase agreement (the “Cypress Agreement”) providing for the sale by EnCap Fund VII of 4,611,808 shares (the “Fund VII Shares”) of Class A Common Stock to Cypress at a price of $11.10 per share (the same price as the initial conversion price of the Preferred Stock). The closing of the transactions contemplated by the Cypress Agreement occurred immediately prior to the closing of the transactions contemplated by the SPA on April 14, 2022.

As of the date of the SPA, EnCap and its affiliates beneficially owned approximately 46.5% of the outstanding voting power of Earthstone. Two of Earthstone’s directors are affiliated with EnCap or its affiliates. One of Earthstone’s directors recently retired from EnCap in December 2020. As discussed above, the SPA and the PIPE were evaluated and approved by the Audit Committee. The terms and conversion price of the Preferred Stock were negotiated at arm’s length between the Audit Committee and Post Oak, with EnCap not participating in the negotiation of the conversion price. In connection with the closing of the transactions contemplated by the SPA, Earthstone entered into a customary registration rights agreement with EnCap Fund XI and Post Oak containing provisions by which Earthstone agreed, among other things, to file a registration statement on Form S-3 with the SEC providing for the registration of the shares of Class A Common Stock underlying the Preferred Stock (as well as any other shares of Class A Common Stock owned by Cypress and EnCap Fund XI, including the Fund VII Shares purchased by Cypress from EnCap Fund VII on April 14, 2022) and cooperate in certain underwritten offerings thereof. Cypress and EnCap Fund XI also have customary piggyback registration rights under the registration rights agreement. In connection with the closing of the transactions contemplated by the SPA, Earthstone, Cypress and affiliates of Warburg, and EnCap entered into a voting agreement containing provisions by which Cypress will have the right to designate a director to the Board.

For additional information about the terms of the shares of Preferred Stock and other outstanding capital stock, see “Description of Our Capital Stock” below. For additional information about the terms of the registration rights agreement applicable to the shares of Class A Common Stock issued upon conversion of the Preferred Stock, see “Registration Rights Agreement” below. For additional information about the voting agreement, see “Voting Agreement” below.

Stockholder Approval

The Class A Common Stock is listed on the NYSE. Under Section 312.03 of the NYSE Listed Company Manual, stockholder approval is required prior to the issuance of shares of common stock, or of securities convertible into common stock, if:

• such common stock or securities have, or will have upon issuance, voting power equal to 20% or more of the voting power outstanding before the issuance of such stock or securities convertible into common stock;

• the number of shares of common stock to be issued is, or will be upon issuance, equal to 20% or more of the number of shares of common stock outstanding before the issuance of the common stock or securities convertible into common stock; or

• the number of shares of common stock to be issued is, or will be upon issuance, equal to more than one percent of the number of shares of common stock outstanding or voting power outstanding before the issuance and such issuance is to a Related Party (as defined in the NYSE Listed Company Manual) of Earthstone, or where such securities are issued as consideration in a transaction in which a Related Party has a five percent or greater interest, directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction and the present or potential issuance of common stock or securities convertible into common stock could result in an issuance that exceeds either five percent of the number of shares of common stock or five percent of the voting power outstanding before the issuance.

Because the number of shares of Class A Common Stock issuable upon conversion of the shares of Preferred Stock issued pursuant to the SPA would represent greater than each of the foregoing thresholds, and because EnCap Fund XI who purchased shares of Preferred Stock pursuant to the SPA is a Related Party (as defined in the NYSE Listed Company Manual) of Earthstone, stockholder approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock is required under NYSE rules and regulations.

On January 30, 2022, certain entities controlled or affiliated with EnCap (collectively, the “EnCap Funds”) and certain entities controlled or affiliated with Warburg (collectively, the “Warburg Funds”, and together with the EnCap Funds, the “Consenting Stockholders”) delivered to Earthstone the Written Consent approving the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock. As of January 30, 2022, the Consenting Stockholders held shares of Common Stock representing, in the aggregate, approximately 61.6% of the voting power of all of the outstanding shares of Common Stock. Accordingly, the Written Consent provided the requisite approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock by Earthstone’s stockholders in accordance with the NYSE rules and regulations. No further approval of the stockholders is required to approve the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock under the DGCL, the Certificate of Incorporation, the Bylaws, the SPA or the NYSE rules and regulations. As a result, Earthstone is not soliciting your vote for the approval of the conversion feature of the Preferred Stock and the issuance of the shares of Class A Common Stock upon conversion of the Preferred Stock and does not intend to call a meeting of stockholders for purposes of voting on the adoption and approval thereof.

In accordance with the Certificate of Incorporation, the Board is expressly granted authority to issue shares of preferred stock, in one or more series, and to fix for each such series such voting powers, and such designations, preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof as shall be stated and expressed in the resolution or resolutions adopted by the Board providing for the issue of such series and as may be permitted by the DGCL. Accordingly, no approval by the holders of the Common Stock was required for the issuance of Preferred Stock under the DGCL. The consummation of the private placement of the Preferred Stock pursuant to the SPA occurred on April 14, 2022.

EFFECTS OF THE PROPOSED ISSUANCE OF CLASS A COMMON STOCK

The issuance of a significant number of shares of Class A Common Stock upon conversion of the Preferred Stock will be dilutive to the existing holders of Common Stock and may adversely affect the market price of the Class A Common Stock.

Earthstone has agreed to file a registration statement to permit the public resale of the shares of Class A Common Stock underlying the Preferred Stock. On April 14, 2022, Cypress purchased 4,611,808 shares of Class A Common Stock from EnCap Fund VII and Earthstone agreed that such shares would be included as registrable securities under the Registration Rights Agreement. The influx of such a substantial number of shares into the public market could have a significant negative effect on the trading price of the Class A Common Stock. As of May 2,

2022, 113,363,543 shares of Common Stock were issued and outstanding. An additional 25,225,225 shares of Class A Common Stock will be issued and outstanding upon the conversion of the outstanding Preferred Stock (assuming a liquidation preference of $1,000 and a conversion price of $11.10, each of which is subject to adjustment in certain circumstances as provided in the Certificate). The conversion of the Preferred Stock would result in the holders thereof owning approximately 18.2% of the outstanding Common Stock after giving effect to such conversion.

The registration rights we have granted may facilitate the resale of shares of the Class A Common Stock (including the Fund VII Shares and the shares issued upon conversion of the Preferred Stock) into the public market and, if the Investors sell their shares, increase the number of shares of the Class A Common Stock available for public trading. The potential for the Investors to sell shares of Class A Common Stock upon effectiveness of the registration statement could create a market overhang that may exert downward pressure on the trading price of the Class A Common Stock.

INTEREST OF CERTAIN PERSONS IN THE ACTIONS TAKEN

EnCap and its affiliated entities, which includes EnCap Fund XI, directly or indirectly held shares representing approximately 46.5% of the voting power of all of the issued and outstanding shares of Common Stock as of January 30, 2022, the date the Written Consent was delivered to Earthstone. On April 14, 2022, EnCap Fund XI, managed by affiliates of EnCap, purchased 220,000 shares of Preferred Stock from Earthstone for $220 million pursuant to the SPA, and EnCap Fund VII, managed by affiliates of EnCap, sold 4,611,808 shares of Class A Common Stock to Cypress at a purchase price of $11.10 per share pursuant to the Cypress Agreement. After giving effect to such transactions and assuming the conversion of the Preferred Stock, EnCap and its affiliates will directly or indirectly hold shares representing approximately 40.5% of the voting power of all of the issued and outstanding shares of Common Stock. Messrs. Thielemann and Zorich are directors of Earthstone and employed by EnCap. Mr. Snoots, a director of Earthstone, retired from EnCap in December 2020. On April 14, 2022, the size of the Board was increased to eleven members and the Board appointed Mr. Frost W. Cochran to the Board as a Class II director at the request of Cypress pursuant to the Voting Agreement.

No other director or officer of Earthstone, nor any associate of such person, has any substantial interest by security holding or otherwise in the issuance of the shares of Class A Common Stock underlying the outstanding shares of the Preferred Stock.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table includes all holdings of our Class A Common Stock and Class B Common Stock, as of May 2, 2022, of our directors and our named executive officers, our directors and named executive officers as a group, and all those known by us to be beneficial owners of more than five percent of our outstanding shares of Class A Common Stock or Class B Common Stock. Unless otherwise noted, the mailing address of each person or entity named below is 1400 Woodloch Forest Drive, Suite 300, The Woodlands, Texas 77380. The following table does not include the shares of Class A Common Stock issuable upon conversion of the Preferred Stock.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Shares Beneficially Owned by Certain Beneficial Owners and Management (1)(2) |

| | Class A Common Stock | | Class B Common Stock | | Combined Voting Power |

| Name | | Number | | Percent of Class (4) | | Number | | Percent of Class (5) | | Number | | Percent (3) |

| Named Executive Officers: | | | | | | | | | | | | |

Frank A. Lodzinski (6)(7) | | 623,349 | | | * | | — | | | — | | | 623,349 | | | * |

Robert J. Anderson (7) | | 485,397 | | | * | | — | | | — | | | 485,397 | | | * |

Steven C. Collins (7) | | 281,769 | | | * | | — | | | — | | | 281,769 | | | * |

Tony Oviedo (7) | | 118,425 | | | * | | — | | | — | | | 118,425 | | | * |

Mark Lumpkin, Jr. (7) | | 146,123 | | | * | | — | | | — | | | 146,123 | | | * |

Timothy D. Merrifield (7) | | 352,568 | | | * | | — | | | — | | | 352,568 | | | * |

| | | | | | | | | | | | |

| Non-Employee Directors: | | | | | | | | | | | | |

| Frost W. Cochran | | — | | | — | | | — | | | — | | | — | | | — | |

| David S. Habachy | | — | | | — | | | — | | | — | | | — | | | — | |

Jay F. Joliat (7) | | 199,951 | | | * | | — | | | — | | | 199,951 | | | * |

Phillip D. Kramer (7) | | 105,000 | | | * | | — | | | — | | | 105,000 | | | * |

Ray Singleton (7) | | 609,710 | | | * | | — | | | — | | | 609,710 | | | * |

| Wynne M. Snoots, Jr. | | — | | | — | | | — | | | — | | | — | | | — | |

| Brad A. Thielemann | | — | | | — | | | — | | | — | | | — | | | — | |

Zachary G. Urban (7) | | 67,965 | | | * | | — | | | — | | | 67,965 | | | * |

| Robert L. Zorich | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | |

Officers and Directors as a Group (15 persons): (7) | | 2,990,257 | | | 3.8 | % | | — | | | — | | | 2,990,257 | | | 2.6 | % |

| | | | | | | | | | | | |

| Beneficial Owners of More than Five Percent: | | | | | | | | | | | | |

EnCap Investments L.P. (8) | | 2,303,000 | | | 2.9 | % | | 33,956,524 | | | 99.1 | % | | 36,259,524 | | | 32.0 | % |

Warburg Pincus LLC (9) | | 26,389,956 | | | 33.4 | % | | — | | | — | | | 26,389,956 | | | 23.3 | % |

Bighorn Permian Resources, LLC (10) | | 5,650,977 | | | 7.1 | % | | — | | | — | | | 5,650,977 | | | 5.0 | % |

Cypress Investments, LLC (11) | | 4,611,808 | | | 5.8 | % | | — | | | — | | | 4,611,808 | | | 4.1 | % |

* Less than one percent.

(1) Subject to the terms of the Second Amended and Restated Limited Liability Company Agreement (the “EEH LLC Agreement”) of EEH, holders (“EEH Common Unit Holders”) of units of limited liability company interests of

EEH denominated as Common Units (the “EEH Common Units”) will have the right to exchange all or a portion of its EEH Common Units (together with a corresponding number of shares of Class B Common Stock) for Class A Common Stock (or the cash option) at an exchange ratio of one share of Class A Common Stock for each EEH Common Unit (and corresponding share of Class B Common Stock) exchanged. Pursuant to Rule 13d-3 under the Exchange Act, a person has beneficial ownership of a security as to which that person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares voting power and/or investment power of such security and as to which that person has the right to acquire beneficial ownership of such security within 60 days. Earthstone has the option to deliver cash in lieu of shares of Class A Common Stock upon exercise by EEH Common Unit Holders of their exchange right. As a result, beneficial ownership of Class B Common Stock and EEH Common Units is not reflected as beneficial ownership of shares of our Class A Common Stock for which such units and stock may be exchanged.

(2) This table lists beneficial ownership of voting securities as calculated under SEC rules. Otherwise, except to the extent noted below, each director, named executive officer or entity has sole voting and investment power over the shares reported. None of the shares are pledged as security by the named person.

(3) Represents the percentage of voting power of our Class A Common Stock and Class B Common Stock voting together as a single class. Each share of Class B Common Stock has no economic rights, but entitles the holder thereof to one vote for each EEH Common Unit held by such holder.

(4) The percentage is based upon 79,091,777 shares of Class A Common Stock issued and outstanding as of May 2, 2022.

(5) The percentage is based upon 34,271,766 shares of Class B Common Stock issued and outstanding as of May 2, 2022.

(6) 465,208 shares are held in the name of Azure Energy, LLC (“Azure”). Mr. Lodzinski disclaims beneficial ownership of the shares held by Azure, except to the extent of his pecuniary interests therein.

(7) Represents the following number of restricted stock units that will vest within 60 days of May 2, 2022 with each restricted stock unit representing the contingent right to receive one share of Class A Common Stock: Mr. Lodzinski – 5,950; Mr. Anderson – 20,257; Mr. Collins – 11,620; Mr. Oviedo – 11,620; Mr. Lumpkin – 11,620; Mr. Merrifield – 11,620; Mr. Joliat – 2,975; Mr. Kramer – 2,975; Mr. Singleton – 2,975; Mr. Urban – 2,975; and all directors and named executive officers as a group – 84,587.

(8) Attributable to shares owned directly or indirectly by three investment funds affiliated with EnCap (the “EnCap Funds”): (i) EnCap Energy Capital Fund VIII, L.P. (“EnCap Fund VIII”), which directly holds 2,303,000 shares of Class A Common Stock, (ii) EnCap Energy Capital Fund IX, L.P. (“EnCap Fund IX”), which beneficially owns 33,956,524 shares of Class B Common Stock and an equivalent number of EEH Common Units that are directly owned by its wholly owned subsidiary Bold Energy Holdings, LLC, and (iii) EnCap Fund XI, which directly holds 220,000 shares of Preferred Stock that will automatically convert into 19,819,820 shares of Class A Common Stock on the 21st day after the mailing of this Information Statement to Earthstone stockholders. EnCap Partners GP, LLC (“EnCap Partners GP”) is general partner of EnCap Partners, LP (“EnCap Partners”), which is the managing member of EnCap Investments Holdings, LLC (“EnCap Holdings”), which is sole member of EnCap Investments GP, L.L.C. (“EnCap Investments GP”), which is the general partner of EnCap Investments L.P. (“EnCap Investments LP”), which is the general partner of EnCap Equity Fund VIII GP, L.P. (“EnCap Fund VIII GP”) and EnCap Equity Fund IX GP, L.P. (“EnCap Fund IX GP”), which are the general partners of EnCap Fund VIII and EnCap Fund IX, respectively. EnCap Investments LP is also the sole member of EnCap Equity Fund XI GP, LLC (“EnCap Fund XI LLC”), which is the general partner of EnCap Equity Fund XI GP, L.P. (“Fund XI GP”), which is general partner of EnCap Fund XI. Therefore, each of EnCap Partners GP, EnCap Partners, EnCap Holdings, EnCap Investments GP, EnCap Investments LP, EnCap Fund VIII GP, EnCap Fund IX GP, EnCap Fund XI LLC and EnCap Fund XI GP may be deemed to beneficially own the reported securities that are held beneficially or of record by any EnCap Funds under its direct or indirect control. Each of EnCap Partners GP, EnCap Partners, EnCap Holdings, EnCap Investments GP, EnCap Investments LP, EnCap Fund VIII GP, EnCap Fund IX GP, EnCap Fund XI LLC and EnCap Fund XI GP disclaims beneficial ownership of such securities except to the extent of its pecuniary interest therein. The address for the EnCap entities listed above is 9651 Katy Freeway, Suite 600, Houston, Texas 77024.

(9) Based solely on a Schedule 13D/A filed with the SEC on February 23, 2022 by the Warburg Entities: the Warburg Pincus LLC shareholders (the “WP Shareholders”) are: (i) Warburg Pincus Private Equity (E&P) XI – A, L.P. (“WP E&P XI A”) which holds 2,123,393 shares of Class A Common Stock, (ii) Warburg Pincus XI (E&P) Partners – A, L.P. (“WP XI E&P Partners A”) which holds 163,270 shares of Class A Common Stock, (iii) WP IRH Holdings, L.P. (“WP IRH Holdings”) which holds 2,068,675 shares of Class A Common Stock, (iv) Warburg Pincus XI (E&P) Partners-B IRH, LLC (“WP XI E&P Partners B IRH”) which holds 57,365 shares of Class A Common