Current Report Filing (8-k)

June 13 2022 - 9:20AM

Edgar (US Regulatory)

0001805077

false

0001805077

2022-06-13

2022-06-13

0001805077

EOSE:CommonStockParValue0.0001PerShareMember

2022-06-13

2022-06-13

0001805077

EOSE:WarrantsEachExercisableForOneShareOfCommonStockMember

2022-06-13

2022-06-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 13, 2022

EOS ENERGY ENTERPRISES,

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39291 |

|

84-4290188 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

3920 Park Avenue

Edison,

New Jersey |

|

08820 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (732) 225-8400

N/A

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Trading Symbol |

|

Name

of Each Exchange

on which Registered |

| Common stock, par value $0.0001 per share |

|

EOSE |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock |

|

EOSEW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On June 13, 2022, Eos

Energy Enterprises, Inc. (the “Company”) and YA II PN, LTD (“Yorkville”) amended the Standby Equity Purchase Agreement

dated April 28, 2022 (the “Original SEPA”) pursuant to that certain Amendment No. 1 to the Standby Equity Purchase Agreement,

dated June 13, 2022 (the “SEPA Amendment” and, together with the Original SEPA, the “SEPA”), to revise the definition

of “Commitment Amount” to clarify that the Exchange Cap (as defined in the Original SEPA) will not apply if the average price

of all applicable sales of Common Shares under the SEPA (including the Commitment Fee Shares (as defined in the Original SEPA) in the

number of shares sold for these purposes) equals or exceeds $2.15 per share (which represents the lower of (i)

the Nasdaq Official Closing Price on the Trading Day (each as defined in the Original SEPA) immediately preceding the date of the Original

SEPA; or (ii) the average Nasdaq Official Closing Price for the five Trading Days immediately preceding the date of the Original SEPA).

The foregoing description

of the SEPA Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the SEPA Amendment,

a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1 hereto and is hereby incorporated by reference.

Supplemental Agreement to the SEPA and

Promissory Note Issuance

On June 13, 2022, the Company issued

and sold a convertible promissory note with an aggregate principal amount of $7.5 million (the “Promissory Note”) in

a private placement to Yorkville under a supplemental agreement dated as of June 13, 2022 (the “Supplemental Agreement”)

to the SEPA between the Company and Yorkville.

The Company will use the proceeds from the

sale of the Promissory Note for working capital and other general corporate purposes or, if different, in a manner consistent with the

application thereof described in the Company’s prospectus relating to the SEPA filed with the Securities and Exchange Commission

on April 25, 2022 and included as a part of the Company’s Registration Statement on Form S-3.

The Promissory Note has a maturity date of

September 15, 2022 (the “Maturity Date”). Interest shall not accrue on the outstanding principal balance of the Promissory

Note unless and until there is an event of default, upon the occurrence of which, interest shall accrue at a rate of 15% per year until

collected in full. The Promissory Note is convertible into shares of the Company’s Common Stock at a conversion price of $2.21 (the

“Conversion Price”) any time prior to the Maturity Date, subject to the terms and conditions of the Promissory Note. At any

time that there is an outstanding balance owed under the Promissory Note, Yorkville may, pursuant to the terms of the Supplemental Agreement,

require the Company to deliver an advance under the SEPA for the issuance and sale of Common Stock at the Conversion Price in order to

offset the amounts owed by the Company to Yorkville under the Promissory Note. In addition, while there is an outstanding balance owed

under the Promissory Note, the Company may use any advance requested by the Company pursuant to the SEPA to offset the amounts owed by

the Company to Yorkville under the Promissory Note.

The foregoing descriptions of the Supplemental

Agreement and the Promissory Note do not purport to be complete and are qualified in their entirety by reference to the full text of each

of the Supplemental Agreement and the Promissory Note, copies of which are filed with this Current Report on Form 8-K as Exhibit

4.1 and Exhibit 4.2 hereto respectively and are hereby incorporated herein by reference.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information

set forth in Item 1.01 of this Current Report on Form 8-K under the heading “Supplemental Agreement to the SEPA and Promissory

Note Issuance” is incorporated herein by reference.

Item 3.02

Unregistered Sales of Equity Securities.

The information

set forth under Item 1.01 of this Current Report on Form 8-K under the heading “Supplemental Agreement to the

SEPA and Promissory Note Issuance” is incorporated herein by reference.

On June 13, 2022, the Company issued and

sold the Promissory Note to Yorkville in a private placement pursuant to the exemption from the registration requirements of the Securities

Act of 1933, as amended (the “Securities Act”). The Company offered and sold the Promissory Note to Yorkville in reliance

on the exemption from registration provided by Section 4(a)(2) of the Securities Act without the involvement of any underwriter. The

Company relied on this exemption from registration based in part on representations made by Yorkville in the Supplemental Agreement and

the SEPA.

Item 9.01. Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| 4.1 |

|

Convertible Promissory Note dated as of June 13, 2022 between Eos Energy Enterprises, Inc. and YA II PN, LTD. |

| 10.1 |

|

Amendment No. 1 to the Standby Equity Purchase Agreement dated as of April 28, 2022 between Eos Energy Enterprises, Inc. and YA II PN, LTD. |

| 10.2 |

|

Supplemental Agreement dated as of June 13, 2022 to the Standby Equity Purchase Agreement dated as of April 28, 2022 between Eos Energy Enterprises, Inc. and YA II PN, LTD. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Date: June 13, 2022 |

EOS ENERGY ENTERPRISES, INC. |

| |

|

|

| |

By: |

/s/ Randall Gonzales |

| |

Name: |

Randall Gonzales |

| |

Title: |

Chief Financial Officer |

3

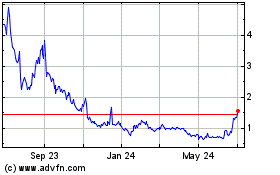

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

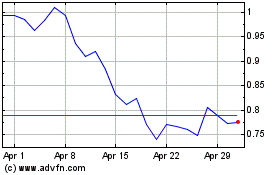

Eos Energy Enterprises (NASDAQ:EOSE)

Historical Stock Chart

From Apr 2023 to Apr 2024