UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2022

Commission File Number 001-38752

360 DigiTech, Inc.

(Translation of registrant’s name into English)

7/F Lujiazui Finance Plaza

No. 1217 Dongfang Road

Pudong New Area, Shanghai 200122

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

This

Form 6-K is furnished by 360 DigiTech, Inc., (the “Company”) in connection with the entry into a rights agreement

(the “Rights Agreement”) dated as of June 9, 2022,

between the Company and American Stock Transfer & Trust Company, LLC, as rights agent.

On June

9, 2022, the Board of Directors (the “Board”) of the Company authorized

the grant of one right (a “Right”) for each outstanding ordinary share, par value US$0.00001 per share, of the Company

(the “Ordinary Shares”), to shareholders as recorded in the register of members at the close of business on June 17,

2022 (the “Record Date”).

Initially, each Right entitles

the registered holder to acquire from the Company one class A ordinary share, par value $0.00001 per share, of the Company or any other

shares resulting from successive changes or reclassifications of the class A ordinary shares (the “Class A Ordinary Shares”)

at a Purchase Price (as defined in the Rights Agreement) per Class A Ordinary Share.

The

Board adopted the Rights Agreement to protect shareholders from coercive or otherwise unfair takeover tactics. In general terms,

it works by imposing a significant penalty upon any person or group that acquires 10% or more of the Ordinary Shares of the Company without

the approval of the Board. As a result, the overall effect of the Rights Agreement and the issuance of the Rights may be to render more

difficult or discourage a merger, tender or exchange offer or other business combination involving the Company that is not approved by

the Board. However, neither the Rights Agreement nor the Rights should interfere with any merger, tender or exchange offer or other business

combination approved by the Board.

The following description

is a summary of the terms of the Rights Agreement and does not purport to be complete and is qualified in its entirety by reference to

the Rights Agreement which is attached hereto as Exhibit 4.1 and is incorporated herein by reference.

Rights Certificates; Exercise Period.

Initially, the Rights will

be attached to all Ordinary Share certificates representing shares then outstanding, and no separate rights certificates ( “Rights

Certificates”) will be distributed. Subject to certain exceptions specified in the Rights Agreement, the Rights will separate

from the Ordinary Shares and a distribution date (“Distribution Date”) will occur upon the earlier of (i) ten

(10) business days following a public announcement that a person or group of affiliated or associated persons, or an Acquiring Person,

has acquired, or obtained the right to acquire, beneficial ownership of 10% or more of the outstanding Ordinary Shares (the “Share

Acquisition Date”), other than as a result of (x) repurchases of shares by the Company and (y) certain inadvertent actions

by institutional or certain other shareholders as described in the Rights Agreement, or (ii) ten (10) business days following

the commencement of a tender offer or exchange offer that would result in a person or group becoming an Acquiring Person.

Until the Distribution Date (or earlier exchange,

termination or expiration of the Rights), (i) the Rights will be evidenced by the Ordinary Share certificates (or, in the absence of

share certificates, by the notations in the register of members) and will be transferred with and only with such Ordinary Shares, (ii)

new Ordinary Share certificates issued after the Record Date will contain a notation incorporating the Rights Agreement by reference

and (iii) the surrender for transfer of any certificates for Ordinary Shares outstanding will also constitute the transfer of the Rights

associated with the Ordinary Shares represented by such certificates.

As soon as practicable after

the Distribution Date, Rights Certificates will be mailed to registered holders of the Ordinary Shares as of the close of business on

the Distribution Date and, thereafter, the separate Rights Certificates alone will represent the Rights. Except as otherwise determined

by the Board, only Ordinary Shares issued prior to the Distribution Date will be issued Rights.

Flip-in Trigger.

In the event that a person

or a group of affiliated or associated persons becomes an Acquiring Person, each holder of a Right, other than Rights that are or were

acquired or beneficially owned by the Acquiring Person (which Rights will thereafter be null and void), will thereafter have the right

to purchase, for the price of $36.00, subject to adjustment (the “Purchase Price”), a number of Class A Ordinary Shares

(or, in certain circumstances, cash, property or other securities of the Company) having a then-current market value of twice the Purchase

Price.

Flip-over Trigger.

In the event that, at any

time following the Share Acquisition Date, (i) the Company engages in a merger or other business combination transaction in which the

Company is not the surviving corporation, (ii) the Company engages in a merger or other business combination transaction in which the

Company is the surviving corporation and the Ordinary Shares of the Company are changed or exchanged, or (iii) 50% or more of the Company’s

assets, cash flow or earning power is sold or transferred, each holder of a Right (except Rights which have previously been voided) will

thereafter have the right to receive, upon exercise, ordinary shares (or capital stock, as applicable) of the acquiring company having

a value equal to two times the Purchase Price of the Right.

Termination of Rights.

At any time until ten (10)

business days following the Share Acquisition Date, the Company may terminate the Rights in whole, but not in part, for no consideration.

Immediately upon the action of the Board ordering termination of the Rights, the Rights will terminate.

Exchange.

At any time before an Acquiring

Person owns 50% or more of the outstanding Ordinary Shares, the Board may exchange the Rights (except for Rights that have previously

been voided), in whole or in part, for Ordinary Shares at an exchange ratio of one Class A Ordinary Share per Right or one-half ADS per

Right (subject to adjustment). In certain circumstances, the Company may elect to exchange the Rights for cash or other securities of

the Company having a value approximately equal to one Class A Ordinary Share.

Shareholder Rights.

Until a Right is exercised

or exchanged, the holder thereof, as such, will have no rights as a shareholder of the Company, including, without limitation, the right

to vote or to receive dividends.

Expiration.

The Rights are not exercisable

until the Distribution Date and will expire on the close of business on June 9, 2027 (the “Final Expiration Date”),

unless such date is extended or the Rights are earlier terminated as described above.

Amendments to Terms of the Rights.

The terms of the Rights

and the Rights Agreement may be amended in any respect without the consent of the holders of the Rights prior to the Distribution

Date. Thereafter, the terms of the Rights and the Rights Agreement may be amended without the consent of the holders of Rights, with

certain exceptions, in order to (i) cure any ambiguities; (ii) correct or supplement any provision contained in the Rights Agreement

that may be defective or inconsistent with any other provision therein; or (iii) make any other changes or provisions if the Company deems necessary or desirable; provided that such changes do not adversely affect

the interests of holders of the Rights (other than an Acquiring Person or an affiliate or associate of an Acquiring Person).

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

360 DigiTech, Inc. |

| |

|

| |

By: |

/s/ Alex Xu |

| |

Name: |

Alex Xu |

| |

Title: |

Director and Chief Financial Officer |

| |

|

| Date: June 13, 2022 |

|

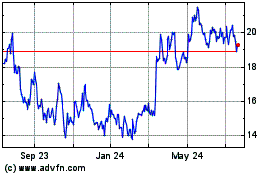

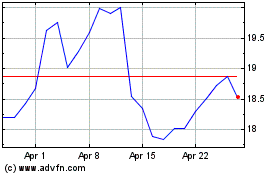

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024