Filed Pursuant to Rule 424(b)(3)

Registration No. 333-264515

PROSPECTUS

PLBY GROUP, INC.

30,534,974 Shares of Common Stock Offered by

Selling Stockholders

This prospectus relates to the resale from time

to time by the selling stockholders named in this prospectus or their permitted transferees (collectively, the “Selling Stockholders”)

of up to 30,534,974 shares of common stock, par value of $0.0001 per share (“Common Stock”), of PLBY Group, Inc. (f/k/a

Mountain Crest Acquisition Corp) (the “Company”). The 30,534,974 shares of our Common Stock consist of:

| • | 390,763 shares of Common Stock underlying the private units issued in connection with the Company’s

initial public offering; |

| • | 5,000,000 shares of Common Stock issued pursuant to the terms of the subscription agreements entered into

with the Company in connection with the Company’s Business Combination (as defined below); |

| • | 21,854,262 shares of Common Stock issued in connection with the consummation of the Company’s Business

Combination, consisting of (i) up to 20,916,812 shares of Common Stock issued to stockholders of Playboy (as defined below) upon

consummation of the Company’s Business Combination, (ii) up to 200,000 shares of Common Stock issued to Craig-Hallum Capital

Group LLC and Roth Capital Partners LLC upon consummation of the Company’s Business Combination, (iii) up to 731,450 shares

of Common Stock, which were originally issued by Mountain Crest Acquisition Corp (“MCAC”) to Sunlight Global Investment LLC

(the “Sponsor”) and were later distributed to Suying Liu and Dong Liu, who are members of the Sponsor, on October 2,

2020, and (iv) up to 6,000 shares of Common Stock issued to Nelson Haight, Todd Milbourn, and Wenhua Zhang for their serving as directors

of MCAC before consummation of the Company’s Business Combination; |

| • | 2,160,261 shares of Common Stock issued to the stockholders of Honey Birdette (Aust) Pty Limited (“Honey

Birdette”) upon the consummation of the Company’s acquisition of Honey Birdette; |

| • | 109,291 shares of Common Stock issued to a Selling Stockholder pursuant to the terms of a license agreement; |

| • | 592,738 shares of Common Stock issued to certain security holders of GlowUp Digital Inc. (“GlowUp”)

in connection with the consummation of the Company’s acquisition of GlowUp, and up to an additional 204,863 shares of Common Stock

that may be issued to those security holders in the future upon the occurrence of certain events under the terms of the acquisition agreement; |

| • | 46,365 shares of Common Stock issued to a Selling Stockholder pursuant to the terms of a license agreement

and up to an additional 72,861 shares of Common Stock that may be issued to that Selling Stockholder pursuant to the terms of that license

agreement; and |

| • | 103,570 shares of Common Stock issued to With Vibe, Inc. (“With Vibe”) upon the consummation

of the Company’s acquisition of substantially all of the assets of With Vibe. |

The Selling Stockholders may offer all or part

of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately

negotiated prices.

We will pay certain offering fees and expenses

and fees in connection with the registration of our Common Stock. We will not receive any of the proceeds from the resale of the shares

of Common Stock by the Selling Stockholders.

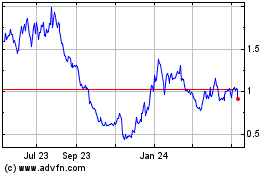

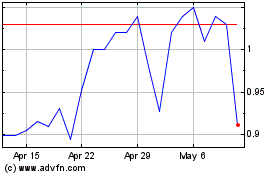

Our Common Stock is currently listed on the Nasdaq Global Market (“Nasdaq”) and

trades under the symbol “PLBY.” The last reported sale price of our Common Stock on the Nasdaq on June 10, 2022 was

$8.13 per share.

We may amend or supplement this prospectus from

time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements

carefully before you make your investment decision.

INVESTING IN OUR COMMON STOCK INVOLVES RISKS

THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 3 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 10,

2022.

TABLE OF CONTENTS

You should rely only on the information contained

in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus.

This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus

is accurate as of any date other than that date or as of any earlier date as of which information is given.

For investors outside the United States:

We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action

for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions

relating to this offering and the distribution of this prospectus.

ABOUT

THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration

process. Under this shelf registration process, the Selling Stockholders may, from time to time, sell the securities offered by them described

in this prospectus. We will not receive any proceeds from the sale by such Selling Stockholders of the securities offered by them described

in this prospectus.

Neither we nor the Selling Stockholders have authorized

anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable

prospectus supplement prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling

Stockholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or,

if appropriate, a post-effective amendment, to the registration statement to add information to, or update or change information contained

in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the

registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where

You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

On February 10, 2021, we consummated the

transactions contemplated by that certain Agreement and Plan of Merger, dated as of September 30, 2020 (the “Merger Agreement”),

by and among Mountain Crest Acquisition Corp (“MCAC”), MCAC Merger Sub Inc. (“Merger Sub”), and Playboy Enterprises, Inc.,

a Delaware corporation (“Playboy”), and Suying Liu (solely for purposes of Section 7.2 and Article XI of the Merger

Agreement). Pursuant to the terms of the Merger Agreement, Playboy merged with and into Merger Sub, with Playboy surviving the merger

as a wholly-owned subsidiary of MCAC (the “Business Combination”), and MCAC changed its name to “PLBY Group, Inc.”

upon consummation of the Business Combination.

Unless the context indicates otherwise, references

in this prospectus to the “Company,” “PLBY,” “we,” “us,” “our” and similar

terms refer to PLBY Group, Inc. and its consolidated subsidiaries, including Playboy.

References to “MCAC” refer to our

predecessor company prior to the consummation of the Business Combination. Upon consummation of the Business Combination, MCAC, who was

the legal acquirer, was treated as the “acquired” company for financial reporting purposes and Playboy was treated as the

accounting predecessor of MCAC for SEC purposes. All references to historical financial information of PLBY Group, Inc. in this prospectus

prior to the Business Combination refer to the historical financial information of Playboy unless the context otherwise requires.

In addition, in this prospectus “RT-ICON”

means RT-ICON Holdings LLC, a Delaware limited liability company, together with its affiliates and its and their successors and assigns

(other than the Company and its subsidiaries).

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that are forward-looking

and as such are not historical facts. These statements are based on the expectations and beliefs of the management of the Company in light

of historical results and trends, current conditions and potential future developments, and are subject to a number of factors and uncertainties

that could cause actual results to differ materially from forward-looking statements. These forward-looking statements include all statements

other than historical fact, including statements about our future performance and opportunities; benefits of acquisitions and corporate

transactions; statements of the plans, strategies and objectives of management for future operations; and statements regarding future

economic conditions or performance. When used in this prospectus, words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “strive,”

“would” and similar expressions may identify forward-looking statements, and include the assumptions that underlie such statements,

but the absence of these words does not mean that a statement is not forward-looking. When we discuss our strategies and/or plans, we

are making projections, forecasts or forward-looking statements. Such statements are based on the beliefs of, as well as assumptions made

by and information currently available to, our management.

The forward-looking statements contained in this

prospectus are based on current expectations and beliefs concerning future developments and their potential effects on the Company. There

can be no assurance that future developments affecting the Company will be those that the Company has anticipated. These forward-looking

statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in

the forward-looking statements. Factors that may cause such differences include, but are not limited to: (1) the impact of the COVID-19

pandemic on the Company’s business and acquisitions; (2) the inability to maintain the listing of the shares of our Common

Stock on Nasdaq; (3) the risk that the Company’s acquisitions or any proposed transactions disrupt the Company’s current

plans and/or operations, including the risk that the Company does not complete any such proposed transactions or achieve the expected

benefits from them; (4) the ability to recognize the anticipated benefits of acquisitions, commercial collaborations, commercialization

of digital assets and proposed transactions, which may be affected by, among other things, competition, the ability of the Company to

grow and manage growth profitably, and retain its key employees; (5) costs related to being a public company, acquisitions, commercial

collaborations and proposed transactions; (6) changes in applicable laws or regulations; (7) the possibility that the Company

may be adversely affected by global hostilities, supply chain disruptions or other economic, business, and/or competitive factors; (8) risks

relating to the uncertainty of the projected financial information of the Company; (9) risks related to the organic and inorganic

growth of the Company’s businesses, and the timing of expected business milestones; and (10) other risks and uncertainties

indicated in our Annual Report on Form 10-K, including those under “Item 1A. Risk Factors.” Should one or more

of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results may vary

in material respects from those projected in these forward-looking statements. The Company cautions that the foregoing list of factors

is not exclusive, and readers should not place undue reliance upon any forward-looking statements.

Forward-looking statements included in this prospectus

only as of the date of this prospectus or any earlier date specified for such statements. We do not undertake any obligation to update

or revise any forward-looking statements to reflect any change in our expectations or any change in events, conditions, or circumstances

on which any such statement is based, except as may be required under applicable law. All subsequent written or oral forward-looking statements

attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by this Cautionary Note Regarding

Forward-Looking Statements.

SUMMARY

OF THE PROSPECTUS

This summary highlights selected information

appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you.

To understand this offering fully, you should read this entire prospectus carefully, including the information set forth under the heading

“Risk Factors” and our financial statements and related notes included in this prospectus or incorporated by reference into

this prospectus, any applicable prospectus supplement and the documents to which we have referred to in the “Incorporation of Certain

Documents by Reference” section below.

Company Overview

We are a pleasure and leisure company. We provide

consumers around the world with products, content and experiences that help them lead happier, healthier and more fulfilling lives. Our

flagship consumer brand, Playboy, is one of the most recognizable brands in the world, driving billions of dollars annually in global

consumer spending with products and content available in approximately 180 countries.

Our mission — to create a culture where

all people can pursue pleasure — builds upon almost seven decades of creating groundbreaking media and hospitality experiences and

fighting for cultural progress rooted in the core values of equality, freedom of expression and the idea that pleasure is a fundamental

human right.

Driven by our cause of “Pleasure for All,”

our goal is to build the leading pleasure and leisure lifestyle platform for all people around the world.

Our Products

Our products and content connect consumers to

a lifestyle of pleasure and leisure. Our offerings help consumers around the world look good, feel good, and enjoy their lives.

Our four target consumer categories — Sexual

Wellness, Style and Apparel, Gaming and Lifestyle, and Beauty and Grooming — reflect the market segments where our nearly 70 years

of building consumer trust give us a unique position to lead in these categories. Each of these categories represent very large and growing

markets, providing us with significant opportunities for growth from the increased sales of our current products, as well as through the

introduction of new products within these categories.

Our Business Segments

We generate revenue through the sales of our products

to consumers around the world. We employ multiple business models, including brand licensing, direct-to-consumer and third-party retail

sales, and digital sales and subscriptions, to help maximize the value of our assets and promote long-term revenue and profitability growth.

We report on our business operations in three segments:

| • | Licensing, including licensing our brand to third parties for products, services, venues and events. |

| • | Direct-to-Consumer, including sales of third-party products through our owned-and-operated e-commerce

platforms; and sales of our proprietary products through our platforms and/or third-party retailers; and |

| • | Digital Subscription and Content, including revenues generated from the sales of creator offerings

to consumers on centerfold.com, our creator-led platform launched in December 2021, trademark licensing for online gaming products,

the sale of subscriptions to Playboy programming and the sales of tokenized digital art and collectibles. |

Our Strategy

We aim to build the leading pleasure and leisure

lifestyle platform for all people around the world. Our commercial strategy is to capture high consumer lifetime value while maintaining

low consumer acquisition costs. We do this by building direct relationships with our customers through our owned-and-operated digital

commerce and digital offerings and by utilizing our significant organic reach for marketing efficiency.

We are focused on three key growth pillars: first,

accelerating our direct-to-consumer commerce business, where we target an 18-34-year-old consumer base with Sexual Wellness and Apparel

offerings. Second, strategically expanding our licensing business in key categories and territories with a focus on China, India

and gaming. In addition, we use our licensing business as a marketing tool and brand builder for us, in particular through our high-end

designer collaborations and our large-scale partnerships with partners such as PacSun. Third, investing in new emerging growth opportunities,

with a focus on scalable digital products and services, that deliver recurring or long tail revenue and allow us to generate significant

returns over a three-to-five-year time horizon.

centerfold.com, our new creator-led platform dedicated

to creative freedom, artistic expression and sex positivity, is the cornerstone of our digital strategy in 2022. Creators can set up their

own subscription or membership services, directly message with their fans and interact with consumers in other ways. As we expand, we

plan to offer creators services that only Playboy can, including the ability to tap into our merchandise design, production and distribution

capabilities, artist collaborations, merchandise collaborations with Playboy and Honey Birdette, and access NFTs and blockchain tools.

Lastly, building on our acquisitions of Yandy

in December 2019, TLA Acquisition Corp., the owner of the Lovers brand, in March 2021, Honey Birdette (Aust) Pty Limited, owner

of the luxury lingerie brand Honey Birdette, in August 2021, and GlowUp Digital Inc., owner of the Dream web platform which has become

our centerfold.com content-creator platform, in October 2021, we will continue to identify and assess potentially advantageous

merger, acquisition and investment opportunities. Utilizing the flexibility of our operating cash flow, and management expertise, we may

pursue additional acquisitions or other strategic opportunities to complement and accelerate our organic growth.

Our Team

We seek to recruit, retain, and incentivize highly

talented existing and future employees. We believe that creating a respectful and inclusive environment where team members can be themselves

and be supported is critical to attracting, developing and retaining talent. A set of fundamental values guide our thinking and actions

both inside the company and as we pursue our mission through our interaction with our consumers and our partners around the world. We

created these values with the goal of holding ourselves accountable, of preserving what is special, and to inspire and guide ourselves

moving forward as we grow and take on new challenges. We believe staying true to these values will drive the long-term value we create

in consumers’ lives.

Intellectual Property

We own various trademarks, copyrights and software

comprising our intellectual property holdings including, without limitation, the “Playboy” name, the “RABBIT HEAD DESIGN”

logo, the “Yandy” name, the “Lovers” name, the “Honey Birdette” name and the “Centerfold”

name.

We currently have active trademark registrations

in more than 150 countries for our key trademarks, including variations of the PLAYBOY and the RABBIT HEAD DESIGN logo, which are typically

the core intellectual property we license pursuant to our licensing agreements and use on our branded consumer products. Trademark registrations

typically allow us to exclusively use or permit licensed use of the marks in the product categories in which they are registered. These

registrations are typically valid for 10 years from the original date of registration or the date of renewal. When these registrations

become due for renewal, we typically renew them unless the registrations have become redundant due to overlapping coverage from other

existing registered marks or they cover marks or categories that we no longer actively use or have plans to use in the future. Most jurisdictions

allow for an unlimited number of renewals provided that the criteria to apply for renewal are met in the applicable jurisdiction.

Corporate Information

Our principal executive office is located at 10960

Wilshire Blvd, Suite 2200, Los Angeles, California 90024 and our telephone number is (310) 424-1800. We maintain a website at www.plbygroup.com.

The information on any websites or web platforms of the Company is not incorporated by reference in this prospectus or any accompanying

prospectus supplement, and you should not consider it a part of this prospectus or any accompanying prospectus supplement.

RISK

FACTORS

Investing in our Common Stock involves risks.

You should carefully review the risk factors contained under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and any risk factors that we may describe in our Quarterly Reports on Form 10-Q

or Current Reports on Form 8-K filed subsequently to the Annual Report on Form 10 K, which risk factors are incorporated by

reference in this prospectus, the information contained under the heading “Cautionary Note Regarding Forward-Looking Statements”

in this prospectus or under any similar heading in any applicable prospectus supplement or in any document incorporated herein or therein

by reference, any specific risk factors discussed under the caption “Risk Factors” in any applicable prospectus supplement

or in any document incorporated herein or therein by reference and the other information contained in, or incorporated by reference in,

this prospectus or any applicable prospectus supplement before making an investment decision. The risks and uncertainties described in

our SEC filings are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see

as immaterial, may also harm our business. If any such risks and uncertainties actually occur, our business, financial condition, results

of operations, cash flows and prospects could be materially and adversely affected, the market price of our Common Stock could decline

and you could lose all or part of your investment. See “Incorporation of Certain Documents by Reference” and “Cautionary

Note Regarding Forward-Looking Statements.”

USE

OF PROCEEDS

All of the shares of Common Stock offered by the

Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for their respective accounts. We cannot currently

determine the price or prices at which shares of Common stock may be sold by the Selling Stockholders. We will not receive any of the

proceeds from these sales.

The Selling Stockholders will pay any underwriting

fees, discounts, selling commissions, stock transfer taxes and certain legal expenses incurred by such Selling Stockholders in disposing

of their shares of Common Stock, and we will bear all other costs, fees and expenses incurred in effecting the registration of such securities

covered by this prospectus, including, without limitation, all registration and filing fees, any Nasdaq fees and fees and expenses of

our counsel and our independent registered public accountants.

DESCRIPTION

OF COMMON STOCK

The following summary of the material terms

of our Common Stock is not intended to be a complete summary of the rights and preferences of such Common Stock and is qualified by reference

to our Second Amended and Restated Certificate of Incorporation (for purposes of this section, the “Certificate of Incorporation”),

our Amended and Restated Bylaws (for purposes of this section, the “Bylaws”) and each of the agreements containing registration

rights (the “Registration Rights Agreements”) which are exhibits to the registration statement of which this prospectus is

a part. We urge you to read each of the Certificate of Incorporation, the Bylaws, the Registration Rights Agreements in their entirety

for a complete description of the rights and preferences of our Common Stock.

Authorized Capital Stock

The Certificate of Incorporation authorized the

issuance of 155,000,000 shares, consisting of 150,000,000 shares of Common Stock, $0.0001 par value per share, and 5,000,000 shares of

preferred stock, $0.0001 par value (the “Preferred Stock”).

Common Stock

Ranking

The voting, dividend and liquidation rights of

the holders of our Common Stock are subject to and qualified by the rights of the holders of the Preferred Stock of any series as may

be designated by the board of directors of the Company (the “Board”) upon any issuance of the Preferred Stock of any series.

Voting

Except as otherwise required by law or the Second

Amended and Restated Certificate of Incorporation (as the same may be amended and/or restated from time to time, including the terms of

any Preferred Stock Designation (as defined below), the “Certificate of Incorporation”), each holder of record of Common Stock,

as such, shall have one vote for each share of Common Stock which is outstanding in his, her or its name on the books of the Company on

all matters on which stockholders are entitled to vote generally. Except as otherwise required by law or the Certificate of Incorporation

(including any Preferred Stock Designation), the holders of outstanding shares of Common Stock shall have the exclusive right to vote

for the election of directors and for all other purposes. Notwithstanding any other provision of the Certificate of Incorporation to the

contrary, the holders of Common Stock shall not be entitled to vote on any amendment to the Certificate of Incorporation (including any

Preferred Stock Designation) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such

affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon

pursuant to the Certificate of Incorporation (including any Preferred Stock Designation) or the Delaware General Corporation Law (the

“DGCL”).

Dividends

Subject to the rights of the holders of Preferred

Stock, holders of shares of Common Stock shall be entitled to receive such dividends and distributions and other distributions in cash,

stock or property of the Company when, as and if declared thereon by the Board from time to time out of assets or funds of the Company

legally available therefor.

Liquidation, Dissolution and Winding Up

Subject to the rights of the holders of Preferred

Stock, shares of Common Stock shall be entitled to receive the assets and funds of the Company available for distribution in the event

of any liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary. A liquidation, dissolution

or winding up of the affairs of the Company, as such terms are used in Section B(4) of the Certificate of Incorporation, shall

not be deemed to be occasioned by or to include any consolidation or merger of the Company with or into any other person or a sale, lease,

exchange or conveyance of all or a part of its assets.

No Preemptive, Conversion or Redemption Rights

The holders of shares of Common Stock have no

preemptive rights and no right to convert their Common Stock into other securities. There are no redemption or sinking fund provisions

applicable to our Common Stock under the Company’s existing Certificate of Incorporation or its Bylaws.

Preferred Stock

Issuance of Preferred Stock

Shares of Preferred Stock may be issued from time

to time in one or more series. The Board is hereby authorized to provide by resolution or resolutions from time to time for the issuance,

out of the unissued shares of Preferred Stock, of one or more series of Preferred Stock, without stockholder approval, by filing a certificate

pursuant to the applicable law of the State of Delaware (a “Preferred Stock Designation”), setting forth such resolution and,

with respect to each such series, establishing the number of shares to be included in such series, and fixing the voting powers, full

or limited, or no voting power of the shares of such series, and the designation, preferences and relative, participating, optional or

other special rights, if any, of the shares of each such series and any qualifications, limitations or restrictions thereof. The powers,

designation, preferences and relative, participating, optional and other special rights of each series of Preferred Stock, and the qualifications,

limitations and restrictions thereof, if any, may differ from those of any and all other series at any time outstanding. The authority

of the Board with respect to each series of Preferred Stock shall include, but not be limited to, the determination of the following:

| • | the designation of the series, which may be by distinguishing number, letter or title; |

| • | the number of shares of the series, which number the Board may thereafter (except where otherwise provided

in the Preferred Stock Designation) increase or decrease (but not below the number of shares thereof then outstanding); |

| • | the amounts or rates at which dividends will be payable on, and the preferences, if any, of, shares of

the series in respect of dividends, and whether such dividends, if any, shall be cumulative or noncumulative; |

| • | the dates on which dividends, if any, shall be payable; |

| • | the redemption rights and price or prices, if any, for shares of the series; |

| • | the terms and amount of any sinking fund, if any, provided for the purchase or redemption of shares of

the series; |

| • | the amounts payable on, and the preferences, if any, of, shares of the series in the event of any voluntary

or involuntary liquidation, dissolution or winding up of the affairs of the Company; |

| • | whether the shares of the series shall be convertible into or exchangeable for, shares of any other class

or series, or any other security, of the Company or any other corporation, and, if so, the specification of such other class or series

or such other security, the conversion or exchange price or prices or rate or rates, any adjustments thereof, the date or dates at which

such shares shall be convertible or exchangeable and all other terms and conditions upon which such conversion or exchange may be made; |

| • | restrictions on the issuance of shares of the same series or any other class or series; |

| • | the voting rights, if any, of the holders of shares of the series generally or upon specified events;

and |

| • | any other powers, preferences and relative, participating, optional or other special rights of each series

of Preferred Stock, and any qualifications, limitations or restrictions of such shares, all as may be determined from time to time by

the Board and stated in the Preferred Stock Designation for such Preferred Stock. |

Without limiting the generality of the foregoing,

the Preferred Stock Designation of any series of Preferred Stock may provide that such series shall be superior or rank equally or be

junior to any other series of Preferred Stock to the extent permitted by law.

On May 16, 2022, the Company issued 25,000

shares of a newly created series of the Company’s preferred stock, par value $0.0001 per share, designated as “Series A

Preferred Stock,” as described in the Company’s Current Report on Form 8-K, filed with the SEC on May 17, 2022,

and incorporated by reference into this prospectus.

Registration Rights

In addition to the registration rights pursuant

to which we filed the registration statement of which the prospectus is a part, certain of our stockholders or their permitted transferees

are entitled to additional registration rights with respect to the registration of certain shares of Common Stock held by them under the

Securities Act of 1933, as amended (the “Securities Act”). These rights are provided under the terms of the Amended and Restated

Registration Rights Agreement (the “A&R Registration Rights Agreement”), by and among (i) PLBY, (ii) Suying

Liu, Dong Liu, Nelson Haight, Todd Milbourn, and Wenhua Zhang, with respect to the 1,437,450 shares of Common Stock, 355,241 units sold

to Sunlight Global Investment LLC and Chardan Capital Markets, LLC and any securities issuable upon conversion of working capital loans

made to MCAC they owned at the closing of the Business Combination, and (iii) RT-ICON, and each of the other stockholders of Playboy

and include demand registration rights and piggyback registration rights. The A&R Registration Rights Agreement also provides that

we will pay certain expenses of these holders relating to such registrations and indemnify them against certain liabilities which may

arise under the Securities Act.

Anti-Takeover Effects of Delaware Law and the Certificate of Incorporation

and Bylaws

The Company has expressly opted out of Section 203

of the DGCL. However, the Certificate of Incorporation contains similar provisions providing that the Company may not engage in certain

“business combinations” with any “interested stockholder” for a three-year period following the time that the

stockholder became an interested stockholder, unless:

| • | prior to such time, the Board approved either the business combination or the transaction which resulted

in the stockholder becoming an interested stockholder; |

| • | upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the Company outstanding at the time the transaction commenced, excluding

for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those

shares owned by (a) persons who are directors and also officers and (b) employee stock plans in which employee participants

do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer;

or |

| • | at or subsequent to such time, the business combination is approved by the Board and authorized at an

annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding

voting stock of the Company which is not owned by the interested stockholder. |

Generally, a “business combination”

includes a merger, asset or stock sale or certain other transactions resulting in a financial benefit to the interested stockholder. Subject

to certain exceptions, an “interested stockholder” is a person who, together with that person’s affiliates, owns or

within the previous three years owned, 15% or more of the Company’s voting stock.

Under certain circumstances, this provision will

make it more difficult for a person who would be an “interested stockholder” to effect various business combinations with

a corporation for a three-year period. This provision may encourage companies interested in acquiring the Company to negotiate in advance

with the Company’s Board because the Company’s stockholder approval requirement would be avoided if the Company’s Board

approves either the business combination or the transaction which results in the stockholder becoming an interested stockholder. These

provisions also may have the effect of preventing changes in the Company’s Board and may make it more difficult to accomplish transactions

which stockholders may otherwise deem to be in their best interests.

The Certificate of Incorporation provides that

RT-ICON and its affiliates, any of its respective direct or indirect transferees of at least 15% of the outstanding shares of the Company’s

Common Stock, and any group as to which such persons are a part, do not constitute “interested stockholders” for purposes

of this provision.

In addition, the Certificate of Incorporation

does not provide for cumulative voting in the election of directors. The Company’s Board is empowered to elect a director to fill

a vacancy created by the expansion of the Board or the resignation, death or removal of a director in certain circumstances. Authorized

shares of Common Stock and Preferred Stock are available for future issuances without stockholder approval and could be utilized for a

variety of corporate purposes, including future offerings to raise additional capital, acquisitions and employee benefit plans. The existence

of authorized but unissued and unreserved Common Stock and Preferred Stock could render more difficult or discourage an attempt to obtain

control of the Company by means of proxy contest, tender offer, merger or otherwise.

Special Meeting, Action by Written Consent and Advance Notice Requirements

for Stockholder Proposals

Except as otherwise required by law, the Certificate

of Incorporation or the Bylaws, written or printed notice of the meeting of the stockholders stating the place, day and hour of the meeting

and, in case of a special meeting, stating the purpose or purposes for which the meeting is called, and in case of a meeting held by remote

communication stating such means, shall be delivered not less than 10 nor more than 60 days before the date of the meeting, either personally,

or by mail, or if prior consent has been received by a stockholder by electronic transmission, by or at the direction of the Chairman

or the President, the Secretary, or the persons calling the meeting, to each stockholder of record entitled to vote at such meeting. Without

limiting the manner by which notice otherwise may be given to stockholders, any notice shall be effective if given by a form of electronic

transmission consented to (in a manner consistent with the DGCL) by the stockholder to whom the notice is given. If notice is given by

mail, such notice shall be deemed given when deposited in the United States mail, postage prepaid, directed to the stockholder at such

stockholder’s address as it appears on the records of the Company. If notice is given by electronic transmission, such notice shall

be deemed given at the time specified in Section 232 of the DGCL.

The Bylaws also provide that unless otherwise

restricted by the Certificate of Incorporation or the Bylaws, any action required or permitted to be taken at any meeting of our Board

or of any committee thereof may be taken without a meeting, if all members of our Board or of such committee, as the case may be, consent

thereto in writing or by electronic transmission, and the writing or writings or electronic transmission or transmissions are filed with

the minutes of proceedings of our Board or committee.

In addition, the Bylaws require advance notice

procedures for stockholder proposals to be brought before an annual meeting of the stockholders, including the nomination of directors.

Stockholders at an annual meeting may only consider the proposals specified in the notice of meeting or brought before the meeting by

or at the direction of the Board, or by a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting

and who has delivered a timely written notice in proper form to our secretary, of the stockholder’s intention to bring such business

before the meeting.

These provisions could have the effect of delaying

until the next stockholder meeting any stockholder actions, even if they are favored by the holders of a majority of our outstanding voting

securities.

Amendment to the Certificate of Incorporation and Bylaws

Our Certificate of Incorporation provides that

so long as RT-ICON and its affiliates own, in the aggregate, at least 50% in voting power of our Common Stock, any amendment, alteration,

change, addition, or repeal of the Certificate of Incorporation requires an affirmative vote of a majority of the then- outstanding shares

of Common Stock entitled to vote thereon. At any time when RT-ICON and its affiliates beneficially own, in the aggregate, less than 50%

of our outstanding Common Stock, our Certificate of Incorporation requires the affirmative vote by the holders of at least 66 2/3% of

our outstanding Common Stock for any amendment, alteration, change, addition, or repeal of our Certificate of Incorporation; provided

that, irrespective of RT-ICON ownership, the affirmative vote of holders of at least 66 2/3% of our outstanding Common Stock is required

to amend certain provisions of our Certificate of Incorporation, including those provisions changing the size of the Board, the removal

of certain directors, the availability of action by majority written consent of the stockholders or the restriction on business combinations

with interest stockholders, among others.

The provisions of the DGCL, our Certificate of

Incorporation and Bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may

also inhibit temporary fluctuations in the market price of our Common Stock that often result from actual or rumored hostile takeover

attempts. These provisions may also have the effect of preventing changes in our management. It is possible that these provisions could

make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests.

Exclusive Forum

The Certificate of Incorporation provides that,

unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will, with certain

limited exceptions, be the sole and exclusive forum for any stockholder (including any beneficial owner) to bring (a) any derivative

action or proceeding brought on behalf of the Company, (b) any action asserting a claim of breach of a fiduciary duty owed by any

director, officer or other employee of the Corporation to the Company or the Company’s stockholders, (c) any action asserting

a claim against the Company, its directors, officers or employees arising pursuant to any provision of the DGCL or the charter or bylaws,

or (d) any action asserting a claim against the Company, its directors, officers or employees governed by the internal affairs doctrine.

Subject to the provisions in the preceding sentence, the federal district courts of the United States of America shall be the exclusive

forum for the resolution of any complaint, claim or proceeding asserting a cause of action arising under the Securities Exchange Act of

1934, as amended (the “Exchange Act”) or the Securities Act. Furthermore, Section 22 of the Securities Act creates concurrent

jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the

rules and regulations thereunder. Stockholders cannot waive compliance with the federal securities laws and the rules and regulations

thereunder. Any person or entity purchasing or otherwise acquiring or holding any interest in shares of our capital stock shall be deemed

to have notice of and consented to the forum provisions in the Certificate of Incorporation.

Limitations on Liability and Indemnification of Officers and Directors

The DGCL authorizes corporations to limit or eliminate

the personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary

duties, subject to certain exceptions. Our Certificate of Incorporation includes a provision that, to the fullest extent permitted by

the DGCL, eliminates the personal liability of directors to us or our stockholders for monetary damages for any breach of fiduciary duty

as a director. The effect of these provisions will be to eliminate the rights of us and our stockholders, through stockholders’

derivative suits on our behalf, to recover monetary damages from a director for breach of fiduciary duty as a director, including breaches

resulting from grossly negligent behavior. However, exculpation will not apply to any director if the director has acted in bad faith,

knowingly or intentionally violated the law, authorized illegal dividends or redemptions or derived an improper benefit from his or her

actions as a director.

Further, our Certificate of Incorporation and

our Bylaws provide that we must indemnify and advance expenses to our directors and officers to the fullest extent authorized by the DGCL.

We also are expressly authorized to carry directors’ and officers’ liability insurance providing indemnification for our directors,

officers and certain employees for some liabilities. We believe that these indemnification and advancement provisions and insurance are

useful to attract and retain qualified directors and officers.

The limitation of liability, indemnification and

advancement provisions in our Certificate of Incorporation and Bylaws may discourage stockholders from bringing a lawsuit against directors

for breach of their fiduciary duty. These provisions also may have the effect of reducing the likelihood of derivative litigation against

directors and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. In addition, your

investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant

to these indemnification provisions.

There is currently no pending material litigation

or proceeding involving any of our directors, officers or employees for which indemnification is sought.

Transfer Agent

The transfer agent for our Common Stock is Continental

Stock Transfer & Trust Company.

Rule 144

Pursuant to Rule 144, a person who has beneficially

owned restricted shares of our Common Stock for at least six months would be entitled to sell their securities provided that (i) such

person is not deemed to have been one of our affiliates at the time of, or at any time during the three months preceding, a sale and (ii) we

are subject to the Exchange Act periodic reporting requirements for at least three months before the sale and have filed all required

reports under Section 13 or 15(d) of the Exchange Act during the 12 months preceding the sale.

Persons who have beneficially owned restricted

shares of our Common Stock for at least six months but who are our affiliates at the time of, or at any time during the three months preceding,

a sale, would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only

a number of securities that does not exceed the greater of:

| • | 1% of the total number of shares of Common Stock then outstanding; or |

| • | the average weekly reported trading volume of our Common Stock during the four calendar weeks preceding

the filing of a notice on Form 144 with respect to the sale. |

Sales by our affiliates under Rule 144 are

also limited by manner of sale provisions and notice requirements and to the availability of current public information about us.

Restrictions on the Use of Rule 144 by Shell Companies or

Former Shell Companies

Rule 144 is not available for the resale

of securities initially issued by shell companies (other than business combination related shell companies) or issuers that have been

at any time previously a shell company, unless certain conditions are met. Now that we have ceased to be a shell company as a result of

the Business Combination and because at least one year has elapsed from the time that we filed current Form 10 type information with

the SEC reflecting our status as an entity that is not a shell company, Rule 144 is available if the following conditions continue

to be met:

| • | we are subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; and |

| • | we have filed all Exchange Act reports and material required to be filed, as applicable, during the preceding

12 months, other than Form 8-K reports. |

Listing of Common Stock

Our Common Stock is listed on The Nasdaq Global

Market under the symbol “PLBY.”

SELLING

STOCKHOLDERS

This prospectus relates to the resale by the Selling

Stockholders from time to time of up to 30,534,974 shares of our Common Stock pursuant to registration rights granted to those Selling

Stockholders. The Selling Stockholders may from time to time offer and sell any or all of our Common Stock set forth below pursuant to

this prospectus and any accompanying prospectus supplement. When we refer to the “Selling Stockholders” in this prospectus,

we mean the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors, designees and others who

later come to hold any of the Selling Stockholders’ interest in our Common Stock other than through a public sale.

The following table sets forth and the accompanying

footnotes are based primarily on information provided to us by the Selling Stockholders indicating our Common Stock they wished to be

covered by this registration statement and eligible for sale under this prospectus. A Selling Stockholder may have sold or transferred

some or all of the Common Stock indicated below with respect to such Selling Stockholder and may in the future sell or transfer some or

all of the Common Stock indicated below in transactions exempt from the registration requirements of the Securities Act rather than under

this prospectus. We cannot advise you as to whether the Selling Stockholder will in fact sell any or all of such Common Stock. For purposes

of this table, we have assumed that the Selling Stockholder will have sold all of our Common Stock covered by this prospectus upon the

completion of the offering. We have based percentage ownership on 45,596,879 shares of common stock outstanding as of June 1, 2022.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative

of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the

tables have sole voting and sole investment power with respect to all securities that they beneficially own, subject to community property

laws where applicable. Except as otherwise described below, based on the information provided to us by the Selling Stockholders, no Selling

Stockholder is a broker-dealer or an affiliate thereof.

Information for each additional Selling Stockholder,

if any, will be set forth by prospectus supplement to the extent required prior to the time of any offer or sale of such Selling Stockholder’s

shares pursuant to this prospectus. Any prospectus supplement may add, update, substitute, or change the information contained in this

prospectus, including the identity of each Selling Stockholder and the number of shares registered on its, his, her or their behalf. A

Selling Stockholder may sell or otherwise transfer all, some or none of such shares in this offering. See “Plan of Distribution.”

| | |

Number of Shares of

Beneficially Owned

Before Sale of All Shares

of Common Stock

Offered Hereby† | | |

Number of

Shares of

Common

Stock to be

Sold in the

Offering† (1) | | |

Number of Shares of

Beneficially Owned After

Sale of All Shares of

Common Stock Offered

Hereby(2) | |

| Name and Address of Beneficial Owner | |

Number | | |

% | | |

Number | | |

Number | | |

% | |

| Shares of Common Stock registered for resale: | |

| | |

| | |

| | |

| | |

| |

| 1992 Clemens Fam Tr UAD 8/27/92(3) | |

| 2,500 | | |

| * | | |

| 2,500 | | |

| — | | |

| — | |

| 2009 Sanders Children Trust UAD 10/21/09 FBO Chelsea Collmer(4) | |

| 3,000 | | |

| * | | |

| 3,000 | | |

| — | | |

| — | |

| 2009 Sanders Children Trust UAD 10/21/09 FBO Christopher Collmer(4) | |

| 3,000 | | |

| * | | |

| 3,000 | | |

| — | | |

| — | |

| Albert Sanders Keller U/T/D 02/11/97(5) | |

| 4,000 | | |

| * | | |

| 4,000 | | |

| — | | |

| — | |

| Andy Cracchiolo | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Ariana J Gale 2006 Trust DTD 3/26/2006(7) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| BBRC International Pte Ltd as trustee for The BB Family International Trust | |

| 1,335,046 | | |

| 2.9 | | |

| 1,335,046 | | |

| — | | |

| — | |

| Bircoll Kohn Family Trust(8) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Boxwood Row LP(9) | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Brad D. Sanders(7) | |

| 2,500 | | |

| * | | |

| 2,500 | | |

| — | | |

| — | |

| Bradley W. Baker | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| Brandy Fox Pty Ltd as trustee for the Eloise Monaghan Family Trust | |

| 324,038 | | |

| * | | |

| 324,038 | | |

| — | | |

| — | |

| | |

Number of Shares of

Beneficially Owned

Before Sale of All Shares

of Common Stock

Offered Hereby† | | |

Number of

Shares of

Common

Stock to be

Sold in the

Offering† (1) | | |

Number of Shares of

Beneficially Owned After

Sale of All Shares of

Common Stock Offered

Hereby(2) | |

| Name and Address of Beneficial Owner | |

Number | | |

% | | |

Number | | |

Number | | |

% | |

| Bret D. Sanders(4) | |

| 2,500 | | |

| * | | |

| 2,500 | | |

| — | | |

| — | |

| Calm Waters Partnership(10) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Candy Blundy | |

| 8,640 | | |

| * | | |

| 8,640 | | |

| — | | |

| — | |

| Chardan Capital Markets LLC(11) | |

| 31,623 | | |

| * | | |

| 31,623 | | |

| — | | |

| — | |

| Christine M. Patterson | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| Coloskye Pty Limited as trustee for The Allofus Trust | |

| 36,723 | | |

| * | | |

| 36,723 | | |

| — | | |

| — | |

| Connective Capital Emerging Energy QP LP(12) | |

| 24,182 | | |

| * | | |

| 24,182 | | |

| — | | |

| — | |

| Connective Capital I QP LP(12) | |

| 10,818 | | |

| * | | |

| 10,818 | | |

| — | | |

| — | |

| Cooper Creek Partners (Master) Ltd.(13) | |

| 300,000 | | |

| * | | |

| 300,000 | | |

| — | | |

| — | |

| Craig-Hallum Capital Group LLC(14) | |

| 6,000 | | |

| * | | |

| 6,000 | | |

| — | | |

| — | |

| Creative Artists Agency, LLC(15) | |

| 290,563 | | |

| * | | |

| 290,563 | | |

| — | | |

| — | |

| Cruiser Capital Master Fund LP(9) | |

| 70,000 | | |

| * | | |

| 70,000 | | |

| — | | |

| — | |

| Daniel Alpert Trust UAD 12/27/90(16) | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| Daniel J Clark | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| David R Chamberlin 11/07/2005 Revocable Trust(9) | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| Diego Fernandez Mallory Fernandez JT TEN | |

| 2,500 | | |

| * | | |

| 2,500 | | |

| — | | |

| — | |

| Dillco Inc.(17) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| District 2 Capital Fund LP(18) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Don A. Sanders(7) | |

| 30,000 | | |

| * | | |

| 30,000 | | |

| — | | |

| — | |

| Dong Liu | |

| 179,570 | | |

| * | | |

| 179,570 | | |

| — | | |

| — | |

| Drawbridge Special Opportunities Fund LP(19) | |

| 1,817,620 | | |

| 4.0 | | |

| 1,817,620 | | |

| — | | |

| — | |

| Dreamer Bunnies LLC(6) | |

| 43,800 | | |

| * | | |

| 43,800 | | |

| — | | |

| — | |

| Edward F Heil III PROP TR U/A Edward F Heil III TR Pursuant to 1983 DTD 12/1/1983(20) | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Eight Is Awesome, LLC(21) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Eleven Fund LLC(22) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| EZ Colony Partners, LLC(23) | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Fintax Trading International Limited(24) | |

| 300,000 | | |

| * | | |

| 300,000 | | |

| — | | |

| — | |

| Fivet Capital Holding AG(25) | |

| 100,000 | | |

| * | | |

| 100,000 | | |

| — | | |

| — | |

| Gary R. Petersen | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Glowup Digital Seed LLC(6) | |

| 13,875 | | |

| * | | |

| 13,875 | | |

| — | | |

| — | |

| Graham Growth Partners LP(27) | |

| 16,013 | | |

| * | | |

| 16,013 | | |

| — | | |

| — | |

| Graham Institutional Partners LP(27) | |

| 50,288 | | |

| * | | |

| 50,288 | | |

| — | | |

| — | |

| Graham Partners LP(27) | |

| 8,699 | | |

| * | | |

| 8,699 | | |

| — | | |

| — | |

| Granite Point Capital Master Fund, LP(28) | |

| 150,000 | | |

| * | | |

| 150,000 | | |

| — | | |

| — | |

| Harbour Holdings Ltd.(29) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Harry Sloan | |

| 200,000 | | |

| * | | |

| 200,000 | | |

| — | | |

| — | |

| Hillary Alpert | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Howard Silverman & Phyllis Silverman Ten Com | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Intracoastal Capital, LLC(30) | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| J. Moore & J. Moore Trust UAD 2/13/92(31) | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| | |

Number of Shares of

Beneficially Owned

Before Sale of All Shares

of Common Stock

Offered Hereby† | | |

Number of

Shares of

Common

Stock to be

Sold in the

Offering† (1) | | |

Number of Shares of

Beneficially Owned After

Sale of All Shares of

Common Stock Offered

Hereby(2) | |

| Name and Address of Beneficial Owner | |

Number | | |

% | | |

Number | | |

Number | | |

% | |

| Jackie S. Moore | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| James W. Christmas | |

| 30,000 | | |

| * | | |

| 30,000 | | |

| — | | |

| — | |

| James Zavoral | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| John Lipman | |

| 80,000 | | |

| * | | |

| 80,000 | | |

| — | | |

| — | |

| John Whitmire | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| JPMCB New York(32) | |

| 1,000,000 | | |

| 2.2 | | |

| 1,000,000 | | |

| — | | |

| — | |

| Karen Blanchard(33) | |

| 916 | | |

| * | | |

| 916 | | |

| — | | |

| — | |

| Katherine U. Sanders | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Keenan Limited Partnership Special(34) | |

| 12,500 | | |

| * | | |

| 12,500 | | |

| — | | |

| — | |

| Kevin Harris | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| Kirk L. Covington | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Kosberg Holdings LLC(35) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Laura K Sanders | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Luke J Drury Non-Exempt Trst(36) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Magnum Capital Advisors, LLC(37) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Mark Mays | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| MAZ Partners LP(38) | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| Mia Scarlet Batistick 2016 Trust Uad 12/23/16 Susan Ashley Batistick Ttee Fbo Mia Scarlet Batistick(39) | |

| 1,500 | | |

| * | | |

| 1,500 | | |

| — | | |

| — | |

| Michael Berman(6)(40) | |

| 241,635 | | |

| * | | |

| 241,635 | | |

| — | | |

| — | |

| Michael Dow(6)(41) | |

| 293,428 | | |

| * | | |

| 293,428 | | |

| — | | |

| — | |

| N. Anna Shaheen | |

| 2,500 | | |

| * | | |

| 2,500 | | |

| — | | |

| — | |

| Nelson Haight | |

| 2,000 | | |

| * | | |

| 2,000 | | |

| — | | |

| — | |

| Nolan Bradley Sanders 2005 Trust FBO Nolan Sanders U/A/D 06/16/03(7) | |

| 3,000 | | |

| * | | |

| 3,000 | | |

| — | | |

| — | |

| Patriot Strategy Partners LLC(42) | |

| 250,000 | | |

| * | | |

| 250,000 | | |

| — | | |

| — | |

| Polar Long/Short Master Fund(43) | |

| 586,628 | | |

| 1.3 | | |

| 586,628 | | |

| — | | |

| — | |

| Polar Multi-Strategy Master Fund(43) | |

| 413,372 | | |

| * | | |

| 413,372 | | |

| — | | |

| — | |

| Quincy Catalina Sanders 2009 TR Brad Sanders TTEE UAD 06/16/03(7) | |

| 3,000 | | |

| * | | |

| 3,000 | | |

| — | | |

| — | |

| RAJ Capital, LLC(44) | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Rayra Pty Limited as trustee for The Mountainview Trust | |

| 455,814 | | |

| * | | |

| 455,814 | | |

| — | | |

| — | |

| Rizvi Interests, Inc. (45) | |

| 51,434 | | |

| * | | |

| 51,434 | | |

| — | | |

| — | |

| Rizvi Master, LLC(46) | |

| 100,000 | | |

| * | | |

| 100,000 | | |

| — | | |

| — | |

| Rizvi Opportunistic Equity Fund (TI), L.P. (47) | |

| 164,637 | | |

| * | | |

| 164,637 | | |

| — | | |

| — | |

| Rizvi Opportunistic Equity Fund I-B (TI), L.P.(48) | |

| 379,634 | | |

| * | | |

| 379,364 | | |

| — | | |

| — | |

| Rizvi Opportunistic Equity Fund I-B, L.P.(49) | |

| 1,599,369 | | |

| 3.5 | | |

| 1,599,368 | | |

| — | | |

| — | |

| Rizvi Opportunistic Equity Fund II, L.P. (50) | |

| 7,069,064 | | |

| 15.5 | | |

| 7,069,064 | | |

| — | | |

| — | |

| Rizvi Opportunistic Equity Fund, L.P. (51) | |

| 819,428 | | |

| 1.8 | | |

| 819,428 | | |

| — | | |

| — | |

| Rizvi Traverse Partners II, LLC(52) | |

| 279,128 | | |

| * | | |

| 279,128 | | |

| — | | |

| — | |

| Rizvi Traverse Partners LLC(53) | |

| 377,021 | | |

| * | | |

| 377,021 | | |

| — | | |

| — | |

| Robert Alpert | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| | |

Number of Shares of

Beneficially Owned

Before Sale of All Shares

of Common Stock

Offered Hereby† | | |

Number of

Shares of

Common

Stock to be

Sold in the

Offering† (1) | | |

Number of Shares of

Beneficially Owned After

Sale of All Shares of

Common Stock Offered

Hereby(2) | |

| Name and Address of Beneficial Owner | |

Number | | |

% | | |

Number | | |

Number | | |

% | |

| Roman Alpert Trust DTD 12-27-1990 UAD 12/27/1990 Roman Alpert TTEE AMD 12/08/08(54) | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| Roth Capital Partners, LLC(21) | |

| 126,000 | | |

| * | | |

| 126,000 | | |

| — | | |

| — | |

| S A Designer Parfums Limited | |

| 109,290 | | |

| * | | |

| 109,290 | | |

| — | | |

| — | |

| Sela Rivas Sanders 2003 TRST FBO Sela Rivas Sanders U/A/D 06/16/03(7) | |

| 3,000 | | |

| * | | |

| 3,000 | | |

| — | | |

| — | |

| Skylands Special Investment II LLC(42) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Skylands Special Investment LLC(42) | |

| 30,000 | | |

| * | | |

| 30,000 | | |

| — | | |

| — | |

| Steve Harter | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Sunlight Global Investment LLC(26) | |

| 150,000 | | |

| * | | |

| 150,000 | | |

| — | | |

| — | |

| Susan Sanders | |

| 2,500 | | |

| * | | |

| 2,500 | | |

| — | | |

| — | |

| Suying Liu | |

| 179,570 | | |

| * | | |

| 179,570 | | |

| — | | |

| — | |

| Tanglewood Family Limited Partnership(55) | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| Tanya J. Drury | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| Tanya Jo Drury DTD 4/15/2000(56) | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Tilman J Fertitta & Paige Fertitta Ten in Common | |

| 5,000 | | |

| * | | |

| 5,000 | | |

| — | | |

| — | |

| Todd Milbourn | |

| 2,000 | | |

| * | | |

| 2,000 | | |

| — | | |

| — | |

| Traverse Capital Partners, LLC(57) | |

| 51,434 | | |

| * | | |

| 51,434 | | |

| — | | |

| — | |

| Trust No. 3 U/A/D 12/23/03 FBO William Hunter Heil(20) | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Washpoppin Ventures, LLC(58) | |

| 46,365 | | |

| * | | |

| 46,365 | | |

| — | | |

| — | |

| Wenhua Zhang | |

| 2,000 | | |

| * | | |

| 2,000 | | |

| — | | |

| — | |

| With Vibe, Inc. | |

| 103,570 | | |

| * | | |

| 103,570 | | |

| — | | |

| — | |

| William F. Hartfiel III | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| William Roger Clemens & Debbie Lynn Clemems JTWROS | |

| 17,500 | | |

| * | | |

| 17,500 | | |

| — | | |

| — | |

| Wolf Canyon Ltd– Special(34) | |

| 12,500 | | |

| * | | |

| 12,500 | | |

| — | | |

| — | |

| † | Common Stock offered and beneficially owned are based primarily on information initially provided to us by the Selling Stockholders

indicating the Common Stock they wished to be covered by this registration statement and eligible for sale under this prospectus and the

Prior Registration Statements. A Selling Stockholder may have sold or transferred some or all of the Common Stock set forth in the table

and accompanying footnotes, and consequently the Common Stock indicated to be offered may exceed the number of Common Stock to be sold

by the Selling Stockholders. |

| * | Represents beneficial ownership of less than 1%. |

| (1) | The amounts set forth in this column are the number of shares of our Common Stock that may be offered by each Selling Stockholder

using this prospectus. These amounts do not represent any other shares of our Common Stock that the Selling Stockholder may own beneficially

or otherwise. |

| (2) | Assumes all of the shares of Common Stock being offered are sold in the offering. |

| (3) | K. A. Clemens, who serves as the trustee, is the control person of 1992 Clemens Fam Tr UAD 8/27/92. |

| (4) | Bret D. Sanders, who serves as the trustee for both entities, is the control person of 2009 Sanders Children Trust UAD 10/21/09 FBO

Chelsea Collmer and 2009 Sanders Children Trust UAD 10/21/09 FBO Christopher Collmer. |

| (5) | Donald V Weir, who serves as the trustee, is the control person of Albert Sanders Keller U/T/D 02/11/97. |

| (6) | Does not include up to an additional 204,863 shares of Common Stock that may be issued to certain Selling Stockholders upon the release

of the portion thereof held back in respect of indemnification obligations pursuant to the terms of that certain Agreement and Plan of

Merger, dated as of October 15, 2021, by and among PLBY, Buyer, GlowUp and Michael Dow, solely in his capacity as representative

of the holders of the outstanding equity interests. |

| (7) | Don Sanders, who serves as the trustee, is the control person of Ariana J Gale 2006 Trust DTD 3/26/2006. Brad D. Sanders serves as

the trustee for the following entities — Quincy Catalina Sanders 2009 TR Brad Sanders TTEE UAD 06/16/03, Sela Rivas Sanders 2003

TRST FBO Sela Rivas Sanders U/A/D 06/16/03, and Nolan Bradley Sanders 2005 Trust FBO Nolan Sanders U/A/D 06/16/03. |

| (8) | Ben Kohn serves as trustee and controlling person of the Bircoll Kohn Family Trust. Mr. Kohn is the Company’s Chief Executive

Officer and a director of the Company. |

| (9) | Voting and investment power over the shares held by David R Chamberlin 11/07/2005 Revocable Trust, Cruiser Capital Master Fund LP,

and Boxwood Row LP resides with their investment advisor, Cruiser Capital Advisors, LLC. Keith Rosenbloom is the control person of Cruiser

Capital Advisors, LLC and may be deemed to be the beneficial owner of the shares held by such entities. |

| (10) | Richard S. Strong, who serves as the managing partner, is the control person of Calm Waters Partnership. |

| (11) | Represents private units issued to Chardan in a private placement consummated on June 4, 2020, in connection with the consummation

of the Company’s initial public offering. Steven Urbach, who serves as the CEO, is the control person of Chardan Capital Markets

LLC. Chardan Capital is a registered broker-dealer that acted as underwriter in the Company’s initial public offering. |

| (12) | Voting and investment power over the shares held by Connective Capital Emerging Energy QP LP and Connective Capital I QP LP resides

with their investment manager, CCM LLC. Robert Romero is the Managing Member of CCM LLC. and may be deemed to be the beneficial owner

of the shares held by such entities. |

| (13) | Robert Schwartz is the control person of Cooper Creek Partners (Master) Ltd. |

| (14) | Steve Dyer, who serves as the CEO, is the control person of Craig-Hallum Capital Group LLC. |

| (15) | Jim Burtson is the control person of Creative Artist Agency, LLC. |

| (16) | Linda Stanley, who serves as the trustee, is the control person of Daniel Alpert Trust UAD 12/27/90. |

| (17) | Max M. Dillard, who serves as the CEO, is the control person of Dillco Inc. |

| (18) | Eric J Schlanger, who serves as the partner, is the control person of District 2 Capital Fund LP. |

| (19) | Based on the Schedule 13D/A filed by Drawbridge Special Opportunities Fund LP, Drawbridge Special Opportunities Advisors LLC, a Delaware

limited liability company (“DBSO Advisors”), is the investment manager of Drawbridge Special Opportunities Fund, LP, a Delaware

limited partnership (“DBSO”), and DBSO’s general partner is Drawbridge Special Opportunities GP LLC, a Delaware limited

liability company (“DBSO GP”). FIG LLC, a Delaware limited liability company, is the holder of all of the issued and outstanding

interests of DBSO Advisors. Fortress Principal Investment Holdings IV LLC, a Delaware limited liability company (“FPI IV”),

is the managing member of DBSO GP. Fortress Operating Entity I LP, a Delaware limited partnership (“FOE I”), is the owner

of all of the outstanding membership interests in FPI IV and the Class A member of FIG LLC. FIG Corp., a Delaware Corporation (“FIG

Corp”), is the general partner of FOE I. Fortress Investment Group LLC, a Delaware limited liability company (“Fortress”),

is the holder of all of the issued and outstanding shares of FIG Corp. DBSO holds and beneficially owns these shares of common stock,

and on the basis of the relationships described in this footnote, each of the other forgoing persons may be deemed to beneficially own

the shares of common stock held by DBSO. As the Co-Chief Investment Officers of DBSO Advisors and DBSO GP, each of Peter L. Briger, Jr.,

Dean Dakolias, Drew McKnight and Joshua Pack participates in the voting and investment decisions with respect to the shares of common

stock held by DBSO, but each of them disclaims beneficial ownership thereof. |

| (20) | Marge C. Lutz, who serves as the trustee for both entities, is the control person of Edward F Heil III PROP TR U/A Edward F Heil III

TR Pursuant to 1983 DTD 12/1/1983 and Trust No. 3 U/A/D 12/23/03 FBO William Hunter Heil. |

| (21) | Byron Roth and Gordon Roth are control persons of Roth Capital Partners, LLC. Byron Roth is also the control person for the entity

Eight Is Awesome, LLC. |

| (22) | Hartley Wasko, who serves as the manager, is the control person of Eleven Fund LLC. |

| (23) | Byran Ezralow and Marc Ezralow are the control persons of EZ Colony Partners, LLC. |

| (24) | Man Yee Chan is the control person of Fintax Trading International Limited. |

| (25) | Johannes Minho Roth, who serves as a member of the board, is the control person of Fivet Capital Holding AG. |

| (26) | Dr. Suying Liu and Mr. Dong Liu, as members of Sunlight Global Investment LLC, are the control persons of Sunlight Global

Investment LLC. |

| (27) | Harold W. Berry III, who serves as the managing member for the following three entities, is the control person of Graham Partners

LP, Graham Growth Partners LP, and Graham Institutional Partners LP. |

| (28) | Warren B. Lammert III is the control person of Granite Point Capital Master Fund, LP. |

| (29) | Charles A. Paquelet is the control person of Harbour Holdings Ltd., Skylands Special Investment LLC, and Skylands Special Investment

II LLC. |