| | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549 |

|

FORM 11-K |

|

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 |

|

X ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended December 31, 2021 |

|

OR |

|

__ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from _______ to _______ |

|

COMMISSION FILE NUMBER 1-3619 |

|

A. Full title of the plan and the address of the plan, if different from that of the issuer named below: |

|

PFIZER SAVINGS PLAN

FOR EMPLOYEES RESIDENT IN PUERTO RICO |

|

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

|

PFIZER INC.

235 EAST 42ND STREET

NEW YORK, NEW YORK 10017 |

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

Table of Contents

| | | | | |

| Page |

| |

Report of Independent Registered Public Accounting Firm | |

| |

Financial Statements | |

| Statements of Net Assets Available for Plan Benefits as of December 31, 2021 and 2020 | |

| Statement of Changes in Net Assets Available for Plan Benefits for the year ended December 31, 2021 | |

| Notes to Financial Statements | |

| |

Supplemental Schedule* | |

Schedule H, Line 4i - Schedule of Assets (Held at End of Year) | |

| |

| Exhibit Index | |

| |

| Signature | |

*Note: Other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended, have been omitted because they are not applicable.

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Savings Plan Committee

Pfizer Savings Plan for Employees Resident in Puerto Rico

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of Pfizer Savings Plan for Employees Resident in Puerto Rico (the Plan) as of December 31, 2021 and 2020, the related statement of changes in net assets available for plan benefits for the year ended December 31, 2021, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for plan benefits for the year ended December 31, 2021, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The Schedule H, line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have served as the Plan’s auditor since 1990.

Memphis, Tennessee

June 9, 2022

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

STATEMENTS OF NET ASSETS AVAILABLE FOR PLAN BENEFITS

| | | | | | | | | | | | | | | | |

| | As of December 31, | |

(THOUSANDS OF DOLLARS) | | 2021 | | | 2020 | |

Assets | | | | | | |

Investments, at fair value | | | | | | |

Pfizer Inc. common stock | | $ | 114,896 | | | | $ | 80,214 | | |

Viatris Inc. common stock | | — | | | | 4,669 | | |

| | | | | | |

Common/collective trust funds | | 371,060 | | | | 330,543 | | |

Mutual funds | | 27,303 | | | | 28,790 | | |

Total investments, at fair value | | 513,259 | | | | 444,217 | | |

| | | | | | |

Receivables | | | | | | |

Participant contributions | | — | | | | 42 | | |

Company contributions | | 1,370 | | | | 7,265 | | |

Notes receivable from participants | | 2,736 | | | | 5,688 | | |

| | | | | | |

Interest and other | | 143 | | | | 184 | | |

Total receivables | | 4,248 | | | | 13,179 | | |

Total assets | | 517,508 | | | | 457,396 | | |

| | | | | | |

Liabilities | | | | | | |

Investment management fees payable | | 8 | | | | 7 | | |

Total liabilities | | 8 | | | | 7 | | |

Net assets available for plan benefits | | $ | 517,500 | | | | $ | 457,389 | | |

Amounts may not add due to rounding.

See accompanying Notes to Financial Statements.

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR PLAN BENEFITS

| | | | | | | | | |

(THOUSANDS OF DOLLARS) | | Year Ended December 31, 2021 | |

Additions/(reductions) to net assets attributed to: | | | |

Investment income | | | |

Net appreciation in investments | | $ | 87,750 | | |

Pfizer Inc. common stock dividends | | 3,264 | | |

| | | |

Interest and dividend income from other investments | | 3,588 | | |

Total investment income | | 94,602 | | |

Interest income from notes receivable from participants | | 226 | | |

Less: Investment management, redemption and loan fees | | (143) | | |

Net investment and interest income | | 94,686 | | |

| | | |

Contributions | | | |

Participant | | 1,731 | | |

Company | | 1,790 | | |

Rollovers into the Plan | | 7,086 | | |

Total contributions | | 10,608 | | |

Total additions | | 105,293 | | |

| | | |

Deductions from net assets attributed to: | | | |

Benefits paid to participants | | 45,182 | | |

| | | |

Net increase | | 60,111 | | |

| | | |

Net assets available for plan benefits | | | |

Beginning of year | | 457,389 | | |

End of year | | $ | 517,500 | | |

Amounts may not add due to rounding.

See accompanying Notes to Financial Statements.

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

NOTES TO FINANCIAL STATEMENTS

1. Description of the Plan and Recent Transactions and Events

The following description of the Pfizer Savings Plan for Employees Resident in Puerto Rico (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan. Participation in the Plan is open to any employee of PBG Puerto Rico LLC (the Company or Plan Sponsor) or any affiliate which meets the requirements for participation, as set forth in the Plan document. The Company is a wholly owned subsidiary of Pfizer Inc. (the Parent). Pfizer Pharmaceuticals LLC was the plan sponsor prior to October 15, 2020, at which time it transferred sponsorship to the Company in advance of the Upjohn spin-off and business combination. The Plan excludes any employees covered by another Company-sponsored defined contribution plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA), and the New Puerto Rico Internal Revenue Code, Act No. 1 of January 31, 2011, as amended (the Puerto Rico Code).

Recent Transactions and Events Impacting the Plan

Effective April 16, 2020, the Plan adopted certain provisions for special disaster relief withdrawals through December 31, 2020 as permitted by the Puerto Rico Treasury Department Internal Revenue Circular Letter (CC RI) Number 20-23 due to the COVID-19 global pandemic.

On November 16, 2020, the Parent completed a spin-off and the combination of the Upjohn Business, Pfizer’s former global, primarily off-patent branded generics business, with Mylan N.V. (Mylan) to form Viatris, Inc. (Viatris). As a result, the Plan was amended in December 2020 to reflect that certain employees transferred to Viatris and were no longer eligible for the Plan; however, such employees remained eligible to receive the quarterly Company matching contributions and the 2020 Retirement Savings Contribution (RSC), each as described in the Contributions section below, earned through the transaction date. Such employees also became 100% vested in their RSC account in the Plan. Additionally, the Plan was amended and the Viatris stock fund was established, for the existing Pfizer stock fund that received the special dividend paid to shareholders of Pfizer Inc. common stock in the form of Viatris common stock in connection with the spin-off. The Savings Plan Committee of the Parent (the Plan Administrator) appointed Gallagher Fiduciary Advisors, LLC (Gallagher) as an independent fiduciary and investment manager for the Viatris stock fund. The Viatris stock fund was frozen to new contributions and investment elections as of November 16, 2020 and ceased to be an investment fund offered to participants of the Plan on September 29, 2021. The Viatris stock fund was liquidated and proceeds were reinvested in other funds at that time.

Plan Administration

The Plan is administered by the Plan Administrator, the named fiduciary of the Plan. The Plan Administrator monitors and reports on (i) the selection and termination of the trustee, custodian, investment managers and other service providers to the Plan and (ii) the investment activity and performance of the Plan, with the exclusion of the Company stock funds, which are reviewed by an independent fiduciary appointed by the Plan Administrator.

Administrative Costs

Plan participants pay quarterly fees from their account balances. These fees include general plan administrative fees and expenses, such as recordkeeping, trustee and investment reporting fees. The quarterly fee deductions take place on the first business day following the end of each quarter (and are deducted from any full account distribution occurring during a quarter). In addition, certain transaction fees such as check fees, loan fees and qualified domestic relations order fees are paid by Plan participants.

Contributions

Participants may contribute (i) 1% to 20% of their eligible compensation on a before-tax basis, up to the maximum before-tax amount permitted by the Puerto Rico Code; and (ii) 1% to 10% of their eligible compensation on an after-tax basis. The maximum combined pre-tax and after-tax contribution is 20%. For all participants, contributions of up to 3% of eligible compensation are matched 100% by the Company and the next 3% are matched 50% by the Company. Participant contributions in excess of 6% are not matched.

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

NOTES TO FINANCIAL STATEMENTS

Company matching contributions are deposited into the Plan each quarter, rather than on each pay date. In addition, generally participants must be actively employed on the last day of the quarter to receive the match; however, if the participant separates from the Company prior to the last day of the quarter due to retirement (defined as at least age 55 with at least 10 years of service or age 65), death, or disability, such participant will receive the matching contribution. In January 2021, the Company funded the fourth quarter 2020 Company matching contributions in the amount of approximately $0.5 million. In January 2022, the Company funded the fourth quarter 2021 Company matching contributions in the amount of approximately $0.1 million. These contributions are reported in the Company contributions receivable in the accompanying statements of net assets available for plan benefits.

Total combined before-tax and after-tax contributions may not exceed 20% of a participant’s eligible compensation, but total after-tax contributions, including spillover from before-tax contributions, cannot exceed 10% of a participant’s eligible compensation. Contributions are subject to certain legal limits set forth by the Puerto Rico Department of the Treasury and the Puerto Rico Code.

The Plan includes an RSC, which is an additional annual Company-provided contribution based on age and years of service. With the exception of certain participants who are specifically excluded by the Plan terms, participants generally are eligible to receive the RSC. Effective January 1, 2018, the Parent froze its non-union U.S. and Puerto Rico defined benefit plans and began providing RSC eligibility for those active employees. The RSC contributions are deposited into the Plan annually following the close of the Plan year, usually in February. In general, participants must be actively employed on the last day of the year to receive the RSC; however, if the participant separates from the Company prior to the last day of the year due to retirement (defined as at least age 55 with at least 10 years of service or age 65), death, or disability, such participant will receive the RSC. In February 2021, the Company funded the RSC for Plan year 2020 in the amount of approximately $6.7 million. In February 2022, the Company funded the RSC for Plan year 2021 in the amount of approximately $1.2 million. These contributions are reported in the Company contributions receivable in the accompanying statements of net assets available for plan benefits.

Participant Accounts

Each participant’s account is credited with the participant’s contributions, the Company’s contributions and an allocation of Plan earnings/(losses). Allocations are based on participants’ account balances, as defined in the Plan document.

Vesting

Participants are immediately 100% vested in their contributions and all Company contributions with the exception of the RSC. For the RSC, participants are 100% vested after three years of credited service.

Forfeited Amounts

Forfeited amounts of terminated participants are generally used to reduce future Company contributions. At December 31, 2021 and 2020, the market value of the forfeiture account in the Plan totaled approximately $17,000 and $10,000, respectively. In 2021 and 2020, Company contributions were reduced by $23,000 and $375,000, respectively, from the forfeiture account.

Rollovers into the Plan

Participants may elect to roll over one or more account balances from Company-sponsored or other qualified plans (including defined benefit plans) into the Plan.

Investment Options

Each participant in the Plan elects to have his or her contributions and Company contributions invested in any one or a combination of investment funds in the Plan. Transfers between funds must be made in whole percentages or dollar amounts. Based on the investment option, certain short-term redemption fees or restrictions may apply. Any contributions for which the participant does not provide investment direction are invested in the participant’s Qualified Default Investment Alternative (QDIA), which is the Vanguard Target Retirement Fund based on the participant’s year of birth.

Eligibility

All employees of the Company who are employed within the Commonwealth of Puerto Rico are eligible to enroll in the Plan on their date of hire, except for certain employees who (i) are covered by a collective bargaining agreement and have not

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

NOTES TO FINANCIAL STATEMENTS

negotiated to participate in the Plan, (ii) are employed by an employee group not designated for participation in the Plan or (iii) are otherwise eligible for another Company-sponsored savings plan.

Notes Receivable from Participants

Participants may borrow from their account balances with the interest rate set at 1% above the prime rate. The minimum loan is $1,000 and the maximum amount is the lesser of (i) 50% of the vested account balance reduced by any current outstanding loan balance, or (ii) $50,000, reduced by the current outstanding loan balance. Loans must be repaid within five years, unless the funds are used to purchase a primary residence. Primary residence loans must be repaid within 15 years. Loans transferred to the Plan due to the merger of legacy plans into the Plan maintain the terms of the original loan. Interest rates on outstanding loans ranged from 3.25% to 9.50% at December 31, 2021 and 2020.

Interest paid by the participant is credited to the participant’s account. Interest income from notes receivable from participants is recorded by the trustee as earned in the investment funds in the same proportion as the original loan issuance. Repayments may not necessarily be made to the same fund from which the amounts were borrowed. Repayments are credited to the applicable funds based on the participant’s investment elections at the time of repayment.

In the event of termination, participants will have 90 days to repay the outstanding loan balance or set up recurring monthly payments before it is considered a distribution and subject to ordinary income tax in the year it is considered distributed. In addition, a 10% excise tax will generally apply if the participant is younger than age 59½ at the time the distribution occurs.

Payment of Benefits

Participants are entitled to receive distributions upon termination and may be able to take voluntary, in-service withdrawals, which include hardship withdrawals. Mandatory distributions are made in accordance with Plan provisions.

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting.

Some amounts in the financial statements, notes to financial statements and supplemental schedule of the Plan may not add due to rounding.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires Plan management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Common stock is valued at the closing market price on the last business day of the year. Mutual funds are recorded at fair value based on the closing market prices obtained from national exchanges of the underlying investments of the respective fund as of the last business day of the year. Common/collective trust funds (CCTs) are stated at redemption value as determined by the trustees of such funds based upon the underlying securities stated at fair value on the last business day of the year. The Plan generally has the ability to redeem its investments at the net asset value (NAV) at the valuation date. There are no significant restrictions, redemption terms or holding periods that would limit the ability of the Plan or the participants to transact at the NAV.

See Note 4 for additional information regarding the fair value of the Plan’s investments.

Purchases and sales of securities are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded as earned. The net appreciation/(depreciation) in the fair value of investments consists of the realized gains or losses on the sales of investments and the net unrealized appreciation/(depreciation) of investments.

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

NOTES TO FINANCIAL STATEMENTS

Notes Receivable from Participants

Notes receivable from participants, which are subject to various interest rates, are recorded at amortized cost.

Payment of Benefits

Benefits are recorded when paid.

3. Tax Status

The Puerto Rico Department of the Treasury has determined and informed the Plan Sponsor by letter dated February 17, 2017 that the Plan and related trust are designed in accordance with the applicable sections of the Puerto Rico Code. The Plan has been amended since receiving the determination letter. However, the Company’s counsel believes the Plan is currently designed and being operated in compliance with the applicable requirements of the Puerto Rico Code. Accordingly, no provision has been made for Puerto Rico income taxes in the accompanying financial statements.

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Puerto Rico Department of the Treasury. The Company’s counsel has confirmed there are no uncertain positions taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes the Plan is generally no longer subject to income tax examinations for years prior to 2018.

4. Fair Value Measurements

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. There are three levels of inputs to fair value measurements - Level 1 meaning the use of quoted prices for identical instruments in active markets; Level 2 meaning the use of quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active or are directly or indirectly observable; and Level 3 meaning the use of unobservable inputs.

See Note 2 for information regarding the methods used to determine the fair value of the Plan’s investments. These methods may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

| | | | | | | | | | | | | | | | | | | | | | |

| The following tables set forth by level, within the fair value hierarchy, the Plan’s investments at fair value: |

| | Fair Value as of December 31, 2021 |

(THOUSANDS OF DOLLARS) | | Level 1 | | Level 2 | | | | Total |

Pfizer Inc. common stock | | $ | 114,896 | | | $ | — | | | | | $ | 114,896 | |

| | | | | | | | |

| | | | | | | | |

Common/collective trust funds | | — | | | 371,060 | | | | | 371,060 | |

Mutual funds | | 27,303 | | | — | | | | | 27,303 | |

Total | | $ | 142,199 | | | $ | 371,060 | | | | | $ | 513,259 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value as of December 31, 2020 |

(THOUSANDS OF DOLLARS) | | Level 1 | | Level 2 | | | | Total |

Pfizer Inc. common stock | | $ | 80,214 | | | $ | — | | | | | $ | 80,214 | |

| Viatris Inc. common stock | | 4,669 | | | — | | | | | 4,669 | |

| | | | | | | | |

Common/collective trust funds | | — | | | 330,543 | | | | | 330,543 | |

Mutual funds | | 28,790 | | | — | | | | | 28,790 | |

Total | | $ | 113,674 | | | $ | 330,543 | | | | | $ | 444,217 | |

Amounts may not add due to rounding.5. Related Party Transactions and Party-In-Interest Transactions

Banco Popular de Puerto Rico, the trustee of the Plan, is deemed a party-in-interest and a related party. Northern Trust manages investments in its sponsored funds and, therefore, is deemed a party-in-interest and a related party. Fidelity, the

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO

NOTES TO FINANCIAL STATEMENTS

record keeper of the Plan, manages investments in its sponsored funds and, therefore, is deemed a party-in-interest and a related party. In December 2020, the Plan was amended in connection with the spin-off and the combination of Pfizer’s Upjohn Business with Mylan and the Viatris stock fund was established (see Note 1 for additional information). The Plan also invested in shares of the Parent and Viatris; therefore, these transactions qualify as party-in-interest transactions.

6. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of termination of the Plan, each participant shall be entitled to the full value of his or her account balance as though he or she had retired as of the date of such termination. No part of the invested assets established pursuant to the Plan will at any time revert to the Company, except as otherwise permitted under ERISA.

7. Risks and Uncertainties

Investment securities, including Pfizer Inc. common stock and through September 29, 2021, Viatris common stock, are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in their fair values will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for plan benefits.

8. Subsequent Events

Effective January 1, 2022, retirement as it relates to company matching and RSC contribution eligibility is defined as at least age 62 with at least 5 years of service.

The Plan Sponsor has evaluated subsequent events from the statement of net assets available for plan benefits date through June 9, 2022, the date at which the financial statements were issued, and no additional events were noted which warrant adjustments to, or disclosure in, the financial statements.

9. Reconciliation of Financial Statements to Form 5500

Amounts allocated to withdrawing participants are recorded as benefits paid on Form 5500 for benefit claims that have been processed and approved for payment prior to December 31st but not yet paid as of that date. Deemed distributions, representing withdrawing participants with outstanding loan balances for which no post-default payment activity has occurred, are not reported on Form 5500 in net assets available for plan benefits.

| | | | | | | | | | | | | | |

| The following is a reconciliation of net assets available for plan benefits per the financial statements to the Form 5500: |

| | Year Ended December 31, |

(THOUSANDS OF DOLLARS) | | 2021 | | 2020 |

Net assets available for plan benefits per the financial statements | | $ | 517,500 | | | $ | 457,389 | |

Amounts allocated to withdrawing participants | | (86) | | | (35) | |

Deemed distributions | | (538) | | | (574) | |

Net assets available for plan benefits per Form 5500 | | $ | 516,876 | | | $ | 456,780 | |

| | | | | | | | | |

| The following is a reconciliation of benefits paid to participants, including rollovers, per the financial statements to the Form 5500: | |

(THOUSANDS OF DOLLARS) | | Year Ended December 31, 2021 |

| Benefits paid to participants, including rollovers, per the financial statements | | $ | 45,182 | | |

Amounts allocated to withdrawing participants and deemed distributions at end of year | | 624 | | |

| Amounts allocated to withdrawing participants and deemed distributions at beginning of year | | (609) | | |

Benefits paid to participants, including rollovers, per Form 5500 | | $ | 45,197 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO |

| SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| As of December 31, 2020 |

(THOUSANDS OF DOLLARS) |

| Identity of Issuer, Borrower, Lessor or Similar Party | | Description of Investment | | Rate of Interest | | Maturity

Date | | Cost** | | Current Value |

| | | | | | | | | | | |

| * | Pfizer Inc. Common Stock | | Common stock | | | | | | | | $ | 114,896 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| * | NTGI - S&P 500 Index Fund | | Collective trust fund | | | | | | | | 74,070 | |

| * | NTGI - Russell 2000 Small Cap Index Fund | | Collective trust fund | | | | | | | | 12,191 | |

| * | NTGI - Collective Government Short-Term | | | | | | | | | | |

| Investment Fund | | Collective trust fund | | | | | | | | 1,330 | |

| BlackRock Mid Cap Equity Index Fund | | Collective trust fund | | | | | | | | 22,132 | |

| BlackRock International Index Fund | | Collective trust fund | | | | | | | | 2,165 | |

| * | Fidelity Large Cap Growth Fund | | Collective trust fund | | | | | | | | 68,563 | |

| Oppenheimer Developing Markets Fund | | Collective trust fund | | | | | | | | 4,478 | |

| Boston Partners Large Cap Value Fund | | Collective trust fund | | | | | | | | 7,273 | |

| T. Rowe Price Stable Value Common Trust Fund | | Collective trust fund | | | | | | | | 71,322 | |

| Wellington International Research Equity ex | | | | | | | | | | |

| Emerging Markets Fund | | Collective trust fund | | | | | | | | 13,613 | |

| Vanguard Institutional Target Retirement Income Fund | | Collective trust fund | | | | | | | | 5,876 | |

| Vanguard Institutional Target Retirement 2015 Fund | | Collective trust fund | | | | | | | | 1,365 | |

| Vanguard Institutional Target Retirement 2020 Fund | | Collective trust fund | | | | | | | | 15,300 | |

| Vanguard Institutional Target Retirement 2025 Fund | | Collective trust fund | | | | | | | | 15,511 | |

| Vanguard Institutional Target Retirement 2030 Fund | | Collective trust fund | | | | | | | | 23,700 | |

| Vanguard Institutional Target Retirement 2035 Fund | | Collective trust fund | | | | | | | | 12,237 | |

| Vanguard Institutional Target Retirement 2040 Fund | | Collective trust fund | | | | | | | | 12,160 | |

| Vanguard Institutional Target Retirement 2045 Fund | | Collective trust fund | | | | | | | | 4,324 | |

| Vanguard Institutional Target Retirement 2050 Fund | | Collective trust fund | | | | | | | | 1,740 | |

| Vanguard Institutional Target Retirement 2055 Fund | | Collective trust fund | | | | | | | | 1,298 | |

| Vanguard Institutional Target Retirement 2060 Fund | | Collective trust fund | | | | | | | | 412 | |

| Total common/collective trust funds | | | | | | | | | | 371,060 | |

| | | | | | | | | | | |

| T. Rowe Price Small Cap Stock Fund | | Mutual fund | | | | | | | | 7,500 | |

| | | | | | | | | | | |

| Diversified Bond Fund - Core | | Mutual fund | | | | | | | | 17,826 | |

| Diversified Bond Fund - High Yield | | Mutual fund | | | | | | | | 987 | |

| Diversified Bond Fund - Emerging Markets | | Mutual fund | | | | | | | | 989 | |

| Total mutual funds | | | | | | | | | | 27,303 | |

| | | | | | | | | | | |

| Total investments | | | | | | | | | | 513,259 | |

| | | | | | | | | | | |

| * | Notes receivable from participants | | Interest Rates: 3.25% - 9.50% | | | | | | | | 2,736 | |

| | | Maturity Dates: 2022- 2036 | | | | | | | | |

| Total | | | | | | | | | | $ | 515,995 | |

* Party-in-interest as defined by ERISA

** Cost information omitted as all investments are fully participant-directed. This information is not required by ERISA or the Department of Labor to be reported for participant-directed investments.

Amounts may not add due to rounding.

See accompanying Report of Independent Registered Public Accounting Firm.

| | | | | | | | | | | |

| Exhibit Index |

| | | |

| | - | Consent of Independent Registered Public Accounting Firm |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the members of the Savings Plan Committee have duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

| | |

PFIZER SAVINGS PLAN FOR EMPLOYEES RESIDENT IN PUERTO RICO |

|

By: /s/ Colum Lane |

|

|

Colum Lane |

Member, Savings Plan Committee |

Date: June 9, 2022

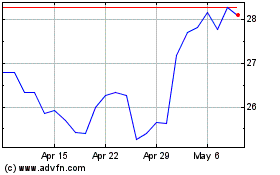

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024