Globus Maritime Limited (“Globus”, the “Company”, “we”, or “our”)

(NASDAQ: GLBS), a dry bulk shipping company, today reported its

unaudited consolidated operating and financial results for the

quarter ended March 31, 2022.

Financial Highlights

- In Q1 2022, Voyage revenues

increased by about 256% compared to Q1 2021.

- The Adjusted EBITDA for Q1

2022 increased by $12.5 million or 10.5 times compared to Q1 2021

and reached $13.8 million.

- The Total comprehensive

income for Q1 2022 reached $12.1 million in Q1 2022 compared to

$0.8 million Total comprehensive loss in Q1 2021.

- As at March 31, 2022, and

December 31, 2021, our cash and bank balances and bank deposits

(including restricted cash) were $59 and $50.4 million,

respectively, an increase of 17%.

| |

Three months ended March 31, |

|

|

(Expressed in thousands of U.S dollars except for daily rates and

per share data) |

2022 |

|

2021 |

|

| Voyage revenues |

18,351 |

|

5,167 |

|

| Total comprehensive

income/(loss) |

12,083 |

|

(766 |

) |

| Adjusted EBITDA (1) |

13,821 |

|

1,306 |

|

| Basic income/(loss) per share

(2) |

0.59 |

|

(0.11 |

) |

| Daily Time charter equivalent

rate (“TCE”) (3) |

23,643 |

|

9,857 |

|

| Average operating expenses per

vessel per day |

5,377 |

|

5,698 |

|

| Average number of vessels |

9.0 |

|

6.0 |

|

|

(1) |

Adjusted EBITDA is a measure not in accordance with generally

accepted accounting principles (“GAAP”). See a later section of

this press release for a reconciliation of Adjusted EBITDA to total

comprehensive income/(loss) and net cash generated from operating

activities, which are the most directly comparable financial

measures calculated and presented in accordance with the GAAP

measures. |

|

(2) |

The weighted average number of shares for the three-month period

ended March 31, 2022, was 20,582,301 compared to 7,209,657 shares

for the three-month period ended March 31, 2021. |

|

(3) |

Daily Time charter equivalent rate (“TCE”) is a measure not in

accordance with generally accepted accounting principles (“GAAP”).

See a later section of this press release for a reconciliation of

Daily TCE to Voyage revenues. |

Current Fleet ProfileAs of the

date of this press release, Globus’ subsidiaries own and operate

nine dry bulk carriers, consisting of four Supramax, one Panamax

and four Kamsarmax.

|

Vessel |

Year Built |

Yard |

Type |

Month/Year Delivered |

DWT |

Flag |

|

Moon Globe |

2005 |

Hudong-Zhonghua |

Panamax |

June 2011 |

74,432 |

Marshall Is. |

|

Sun Globe |

2007 |

Tsuneishi Cebu |

Supramax |

Sept 2011 |

58,790 |

Malta |

|

River Globe |

2007 |

Yangzhou Dayang |

Supramax |

Dec 2007 |

53,627 |

Marshall Is. |

|

Sky Globe |

2009 |

Taizhou Kouan |

Supramax |

May 2010 |

56,855 |

Marshall Is. |

|

Star Globe |

2010 |

Taizhou Kouan |

Supramax |

May 2010 |

56,867 |

Marshall Is. |

|

Galaxy Globe |

2015 |

Hudong-Zhonghua |

Kamsarmax |

October 2020 |

81,167 |

Marshall Is. |

|

Diamond Globe |

2018 |

Jiangsu New Yangzi Shipbuilding Co. |

Kamsarmax |

June 2021 |

82,027 |

Marshall Is. |

|

Power Globe |

2011 |

Universal Shipbuilding Corporation |

Kamsarmax |

July 2021 |

80,655 |

Marshall Is. |

|

Orion Globe |

2015 |

Tsuneishi Zosen |

Kamsarmax |

November 2021 |

81,837 |

Marshall Is. |

|

Weighted Average Age: 10.4 Years as at March 31, 2022 |

|

626,257 |

|

Current Fleet Deployment

All our vessels are currently operating on

short-term time charters (“on spot”).

Management Commentary

“We are proud to announce our Q1 2022 results.

This has been one of the best first quarters in the Company’s

recent history. During the last couple of years, the Company took

significant steps to improve its balance sheet and at the same time

expand and renew its fleet. During this time, we have also

refinanced our debt position at lower costs. We are pleased that

our efforts are now bearing fruits. The Company is well-positioned

to grow further while it takes full advantage and enjoys a strong

market.

As previously announced, we have recently

entered into three new agreements for the construction of three new

vessels; we view this as a pivotal next step for the Company going

forward well-aligned with our continuous effort to prepare for

future environmental regulations and compliance. We are excited in

our modern, fuel-efficient new building units which we hope will

add significant competitive advantages to our existing

operations.

As the market continues to be healthy, we look

for these prosperous days to remain, however, there are a lot of

threats and uncertainties in the world today; the effects of the

pandemic and the conflict in Ukraine have had significant impact in

our industry; we do still experience various disruptions in the

market such as delays at ports and crewing operations as well as a

shift of cargo flows. Therefore, we always need to be ready and

agile to adjust and cope with any such difficulties. We also find

ourselves operating in an uncertain world economic environment, the

galloping of inflation and the possible hike in interest rates are

major events that we are closely monitoring. We continue to be

vigilant on the financial, operational, and environmental

regulation front, and we hope that our strong balance sheet will

help us overcome any short-term volatility.

Last but not least, we are always looking for

ways to expand and upgrade our fleet and operations, with the

current market remaining healthy we continue to explore further

growth opportunities and ways to produce value for our

shareholders.”

Management Discussion and Analysis of the Results of

Operations

First Quarter of the Year 2022 compared

to the First Quarter of the Year 2021

Total comprehensive income for the three-month

period ended March 2022 amounted to $12.1 million or $0.59 basic

and diluted income per share based on 20,582,301 weighted average

number of shares, compared to total comprehensive loss of $0.8

million for the same period last year or $0.11 basic and diluted

loss per share based on 7,209,657 weighted average number of

shares.

The following table corresponds to the breakdown

of the factors that led to the increase in total comprehensive

income during the three-month period ended March 31, 2022, compared

to the three-month period ended March 31, 2021 (expressed in

$000’s):

1st

Quarter of 2022 vs 1st

Quarter of 2021

|

|

Net loss and total comprehensive loss for the

1st Quarter of

2021 |

(766 |

) |

|

| |

Increase in Voyage

revenues |

13,184 |

|

|

| |

Increase in Management &

consulting fee income |

90 |

|

|

| |

Increase in Voyage

expenses |

(271 |

) |

|

| |

Increase in Gain on sale of

bunkers, net |

1,149 |

|

|

| |

Increase in Vessels operating

expenses |

(1,278 |

) |

|

| |

Increase in Depreciation |

(693 |

) |

|

| |

Increase in Depreciation of

dry-docking costs |

(459 |

) |

|

| |

Increase in Total

administrative expenses |

(355 |

) |

|

| |

Decrease in Other income,

net |

(4 |

) |

|

| |

Increase in Interest

income |

4 |

|

|

| |

Decrease in Interest expense

and finance costs |

541 |

|

|

| |

Increase in Gain on derivative

financial instruments |

967 |

|

|

| |

Decrease in Foreign exchange

gains |

(26 |

) |

|

| |

Net income and total

comprehensive income for the 1st

Quarter of 2022 |

12,083 |

|

|

Voyage revenuesDuring the

three-month period ended March 31, 2022, and 2021, our Voyage

revenues reached $18.4 million and $5.2 million respectively. The

256% increase in Voyage revenues was mainly attributed to the

increase in the average time charter rates achieved by our vessels

during the three-month period ended March 31, 2022, compared to the

same period in 2021. Furthermore, the Company operated a fleet of

nine vessels during the 1st quarter of 2022 compared to six vessels

for the same period in 2021. Daily Time Charter Equivalent rate

(TCE) for the three-month period of 2022 was $23,643 per vessel per

day against $9,857 per vessel per day during the same period in

2021 corresponding to an increase of 140%, which is attributed to

the better conditions throughout the bulk market for the first

quarter of 2022.

Management & consulting fee

incomeOn July 15, 2021, the Company entered into a

consultancy agreement with Eolos Shipmanagement S.A., a related

party, for the purpose of providing consultancy services to Eolos

Shipmanagement S.A. For these services the Company receives a daily

fee of $1,000. The total income from these fees is classified in

the income statement component of the consolidated statement of

comprehensive income/(loss) under management & consulting fee

income.

Voyage expensesVoyage expenses

reached $0.3 million during the three-month period ended March 31,

2022, compared to $0.1 million during the same period last year.

Voyage expenses include commissions on revenues, port and other

voyage expenses and bunker expenses. Bunker expenses mainly refer

to the cost of bunkers consumed during periods that our vessels are

travelling seeking employment. Voyage expenses for the three-month

period ended March 31, 2022, and 2021, are analyzed as follows:

|

|

In $000’s |

2022 |

|

2021 |

|

|

| |

Commissions |

288 |

|

72 |

|

|

| |

Other voyage expenses |

61 |

|

6 |

|

|

| |

Total |

349 |

|

78 |

|

|

Gain on sale of bunkers,

netDuring the three-month period ended March 31, 2022, we

recognized a gain of approximately $1.1 million from bunkers. This

resulted mainly from the difference in the value of bunkers paid by

us when the vessel is redelivered from the charterer under the

vessel’s previous time charter agreement and the value of bunkers

sold when the vessel is delivered to a new charterer. For the

three-month period ended March 31, 2021, no gain from bunkers had

been recognized.

Vessel operating expensesVessel

operating expenses, which include crew costs, provisions, deck and

engine stores, lubricating oils, insurance, maintenance, and

repairs, reached $4.4 million during the three-month period ended

March 31, 2022, compared to $3.1 million during the same period

last year. This is mainly attributed to the fact that the fleet of

the Company has increased to nine vessels during the first quarter

of 2022 compared to six vessels for the same period in 2021. The

breakdown of our operating expenses for the three-month period

ended March 31, 2022, and 2021 was as follows:

|

|

|

2022 |

|

2021 |

|

|

| |

Crew expenses |

49 |

% |

52 |

% |

|

| |

Repairs and spares |

22 |

% |

24 |

% |

|

| |

Insurance |

8 |

% |

7 |

% |

|

| |

Stores |

13 |

% |

11 |

% |

|

| |

Lubricants |

5 |

% |

3 |

% |

|

| |

Other |

3 |

% |

3 |

% |

|

Average daily operating expenses during the

three-month periods ended March 31, 2022, and 2021 were $5,377 per

vessel per day and $5,698 per vessel per day respectively,

corresponding to a decrease of 6%.

DepreciationDepreciation charge

during the three-month period ended March 31, 2022, reached $1.4

million compared to $0.7 million during the same period in 2021.

This is mainly attributed to the increase of the fleet from 6

vessels during the three-month period ended March 31, 2021, to 9

vessels for the same period in 2022. Nonetheless, this increase has

been partly counterbalanced from the increase of scrap rate in our

books from $300/ton to $380/ton during the fourth quarter of 2021,

due to the increased scrap rates worldwide.

Total administrative

expensesTotal administrative expenses, including

administrative expenses to related parties and share bases

payments, increased to $1.1 million during the three-month period

ended March 31, 2022, compared to $0.7 million in the same period

of 2021. The increase is partly attributed to new personnel

hirings, as a result of the fleet expansion from 6 vessels, during

the first quarter of 2021, to 9 vessels for the same period in

2022.

Interest expense and finance

costsInterest expense and finance costs reached $0.4

million during the three-month period ended March 31, 2022,

compared to $0.9 million in the same period of 2021. Interest

expense and finance costs for the three-month periods ended March

31, 2022, and 2021, are analyzed as follows:

|

|

In $000’s |

2022 |

|

2021 |

|

|

| |

Interest payable on long-term

borrowings |

312 |

|

810 |

|

|

| |

Bank charges |

23 |

|

22 |

|

|

| |

Operating lease liability

interest |

16 |

|

10 |

|

|

| |

Amortization of debt

discount |

35 |

|

77 |

|

|

| |

Other finance expenses |

3 |

|

11 |

|

|

| |

Total |

389 |

|

930 |

|

|

As at March 31, 2022, and 2021 we and our

vessel-owning subsidiaries had outstanding borrowings under our

Loan agreements of an aggregate of $31 million, gross of

unamortized debt discount. The decrease in interest payable is

mainly attributed to the decrease of the weighted interest rate

from 8.76% during the three-month period ended March 31, 2021, to

4.02% for the same period in 2022, which is mainly attributed to

the refinance of the EnTrust loan facility with CIT loan facility

in May 2021. The EnTrust loan facility had a margin of 8.50% (plus

Libor) whereas the CIT loan facility has a margin of 3.75% (plus

Libor).

Gain on derivative financial

instrumentsFollowing the new loan facility with CIT Bank

N.A., the Company entered into an Interest Rate Swap agreement on

May 10, 2021. As at March 31, 2022, the Company recognized a gain

of approximately $967 thousand, net of interest for the period,

according to the Interest Rate Swap valuation and is included in

the condensed consolidated statement of comprehensive

income/(loss).

Liquidity and capital

resourcesAs at March 31, 2022, and December 31, 2021, our

cash and bank balances and bank deposits (including restricted

cash) were $59 and $50.4 million, respectively. As at March 31,

2022, the Company reported a working capital surplus of $50.1

million and was in compliance with the covenants included in the

loan agreement with CIT.

Net cash generated from operating

activities for the three-month period ended March 31,

2022, was $10.3 million compared to $0.4 million during

the respective period in 2021. The increase in our cash generated

from operating activities was mainly attributed to the increase in

our Voyage revenues from $5.2 million during the three-month period

ended March 31, 2021, to $18.4 million during the three-month

period under consideration.

Net cash used in investing activities

for the three-month period ended March 31, 2022, was $15

thousand compared to net cash used in investing activities of $4.3

million during the respective period in 2021. The decrease in our

cash used in investing activities was mainly attributed to the

advances for vessels purchase of m/v “Power Globe” and “Diamond

Globe”, amounting to $1.6 and $2.7 million, respectively during the

three-month period ended March 31, 2021.

Net cash used in financing activities

during the three-month period ended March 31, 2022, and

net cash generated from financing activities during the three-month

period ended March 31, 2021, were as follows:

| |

|

Three months ended March 31, |

|

|

|

|

In $000’s |

2022 |

|

2021 |

|

|

| |

|

(Unaudited) |

|

|

| |

Proceeds from issuance of

share capital |

- |

|

42,999 |

|

|

| |

Proceeds from issuance of

warrants |

- |

|

15 |

|

|

| |

Transaction costs on issue of

new common shares |

- |

|

(272 |

) |

|

| |

Repayment of long-term

debt |

(1,250 |

) |

(1,493 |

) |

|

| |

Prepayment of long-term

debt |

- |

|

(4,477 |

) |

|

| |

(Increase)/Decrease in

restricted cash |

(541 |

) |

360 |

|

|

| |

Repayment of lease

liability |

(75 |

) |

(80 |

) |

|

| |

Interest paid |

(382 |

) |

(813 |

) |

|

| |

Net cash (used

in)/generated from financing activities |

(2,248 |

) |

36,239 |

|

|

As at March 31, 2022, and 2021, we and our

vessel-owning subsidiaries had outstanding borrowings under our

Loan agreements of an aggregate of $31 million, gross of

unamortized debt discount.

Recent Developments

Contract for new building

vessels

On April 29, 2022, the Company has signed a

contract for the construction and purchase of one fuel efficient

bulk carrier of about 64,000 dwt. The vessel will be built at Nihon

Shipyard Co. in Japan and is scheduled to be delivered during the

first half of 2024. The total consideration for the construction of

the vessel is approximately $37.5 million, which the Company

intends to finance with a combination of debt and equity. In May

2022 the Company paid the 1st instalment of $7.4 million.

On May 13, 2022, the Company has signed two

contracts for the construction and purchase of two fuel-efficient

bulk carriers of about 64,000 dwt each. The sister vessels will be

built at Nantong COSCO KHI Ship Engineering Co. in China with the

first one scheduled to be delivered during the third quarter of

2024 and the second one during the fourth quarter of 2024. The

total consideration for the construction of both vessels is

approximately $70.3 million, which the Company intends to finance

with a combination of debt and equity. In May 2022 the Company paid

the 1st instalment of $13.8 million for both vessels under

construction.

LIBOR will be replaced as the reference

rate under debt obligations

The Company’s indebtedness accrues interest

based on LIBOR, which has been historically volatile and which will

no longer be published after June 30, 2023. The publication of U.S.

Dollar LIBOR for only the one-week and two-month U.S. Dollar LIBOR

tenors ceased on December 31, 2021, and the ICE Benchmark

Administration (“IBA”), the administrator of LIBOR, with the

support of the United States Federal Reserve and the United

Kingdom’s Financial Conduct Authority, announced the publication of

all other U.S. Dollar LIBOR tenors will cease on June 30, 2023. The

United States Federal Reserve concurrently issued a statement

prohibiting banks from issuing U.S. Dollar LIBOR instruments after

2021. As such, any new loan agreements The Company enters into will

not use LIBOR as an interest rate, and the Company will need to

transition its existing loan agreements from U.S. Dollar LIBOR to

an alternative reference rate prior to June 2023.

The Company’s financing agreement contain a

provision requiring or permitting it to enter into negotiations

with its lenders to agree to an alternative interest rate or an

alternative basis for determining the interest rate in anticipation

of the cessation of LIBOR. These clauses present significant

uncertainties as to how alternative reference rates or alternative

bases for determination of rates would be agreed upon, as well as

the potential for disputes or litigation with the Company’s lenders

regarding the appropriateness or comparability to LIBOR of any

substitute indices, such as SOFR, and any credit adjustment spread

between the two benchmarks. The discontinuation of LIBOR presents a

number of risks to the Company’s business, including volatility in

applicable interest rates among the Company’s financing agreements,

potential increased borrowing costs for future financing agreements

or unavailability of or difficulty in attaining financing, which

could in turn have an adverse effect on the Company’s

profitability, earnings and cash flow.

Impact of COVID-19 on the Company’s

Business

The spread of the COVID-19 virus, which has been

declared a pandemic by the World Health Organization in 2020 has

caused substantial disruptions in the global economy and the

shipping industry, as well as significant volatility in the

financial markets, the severity and duration of which remains

uncertain.

The impact of the COVID-19 pandemic continues to

unfold and may continue to have a negative effect on the Company’s

business, financial performance and the results of its operations.

As a result, many of the Company’s estimates and assumptions

required increased judgment and carry a higher degree of

variability and volatility. As events continue to evolve and

additional information becomes available, the Company’s estimates

may change in future periods. Besides reducing demand for cargo,

coronavirus may functionally limit the amount of cargo that the

Company and its competitors are able to move because countries

worldwide have imposed quarantine checks on arriving vessels, which

have caused delays in loading and delivery of cargoes.

The Company has evaluated the impact of current economic

situation on the recoverability of the carrying amount of its

vessels. For the first quarter of 2022 and 2021 the Company

evaluated the carrying amount of its vessels and concluded that no

impairment of its vessels should be recorded, or previously

recognized impairment should be reversed.

Conflicts

The conflict between Russia and Ukraine, which

commenced in February 2022, has disrupted supply chains and caused

instability and significant volatility in the global economy. Much

uncertainty remains regarding the global impact of the conflict in

Ukraine, and it is possible that such instability, uncertainty and

resulting volatility could significantly increase the costs of the

Company and adversely affect its business, including the ability to

secure charters and financing on attractive terms, and as a result,

adversely affect the Company’s business, financial condition,

results of operation and cash flows. Currently there is no direct

effect on the Company’s operations.

Selected Consolidated Financial &

Operating Data

|

|

Three months ended March 31, |

|

|

Consolidated Statements of Comprehensive Income/(Loss)

Data |

2022 |

|

2021 |

|

|

(in thousands of U.S. dollars, except per share data) |

(unaudited) |

|

|

|

|

|

|

|

Voyage revenues |

18,351 |

|

5,167 |

|

|

Management & consulting fee income |

90 |

|

- |

|

|

Total Revenues |

18,441 |

|

5,167 |

|

|

|

|

|

|

Voyage expenses |

(349 |

) |

(78 |

) |

|

Gain on sale of bunkers, net |

1,149 |

|

- |

|

|

Vessel operating expenses |

(4,355 |

) |

(3,077 |

) |

|

Depreciation |

(1,404 |

) |

(711 |

) |

|

Depreciation of dry-docking costs |

(951 |

) |

(492 |

) |

|

Administrative expenses |

(716 |

) |

(556 |

) |

|

Administrative expenses payable to related parties |

(359 |

) |

(154 |

) |

|

Share-based payments |

- |

|

(10 |

) |

|

Other income, net |

10 |

|

14 |

|

|

Operating income/(loss) |

11,466 |

|

103 |

|

|

Interest income |

5 |

|

1 |

|

|

Interest expense and finance costs |

(389 |

) |

(930 |

) |

|

Gain on derivative financial instruments, net |

967 |

|

- |

|

|

Foreign exchange gains, net |

34 |

|

60 |

|

|

Total finance gains/(costs), net |

617 |

|

(869 |

) |

|

Total comprehensive income/(loss) for the

period |

12,083 |

|

(766 |

) |

|

|

|

|

|

Basic & diluted income/(loss) per share for the period (1) |

0.59 |

|

(0.11 |

) |

|

Adjusted EBITDA (2) |

13,821 |

|

1,306 |

|

(1) The weighted average number of shares for

the three-month period ended March 31, 2022, was 20,582,301

compared to 7,209,657 shares for the three-month period ended March

31, 2021.

(2) Adjusted EBITDA represents net

earnings/(losses) before interest and finance costs net, gains or

losses from the change in fair value of derivative financial

instruments, foreign exchange gains or losses, income taxes,

depreciation, depreciation of dry-docking costs, amortization of

fair value of time charter acquired, impairment and gains or losses

on sale of vessels. Adjusted EBITDA does not represent and should

not be considered as an alternative to total comprehensive

income/(loss) or cash generated from operations, as determined by

IFRS, and our calculation of Adjusted EBITDA may not be comparable

to that reported by other companies. Adjusted EBITDA is not a

recognized measurement under IFRS.

Adjusted EBITDA is included herein because it is

a basis upon which we assess our financial performance and because

we believe that it presents useful information to investors

regarding a company’s ability to service and/or incur indebtedness

and it is frequently used by securities analysts, investors and

other interested parties in the evaluation of companies in our

industry.

Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation, or as a

substitute for analysis of our results as reported under IFRS. Some

of these limitations are:

- Adjusted EBITDA

does not reflect our cash expenditures or future requirements for

capital expenditures or contractual commitments;

- Adjusted EBITDA

does not reflect the interest expense or the cash requirements

necessary to service interest or principal payments on our

debt;

- Adjusted EBITDA

does not reflect changes in or cash requirements for our working

capital needs; and

- Other companies in

our industry may calculate Adjusted EBITDA differently than we do,

limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA

should not be considered a measure of discretionary cash available

to us to invest in the growth of our business.

The following table sets forth a

reconciliation of Adjusted EBITDA to total comprehensive

income/(loss) and net cash generated from operating activities for

the periods presented:

|

|

Three months ended March 31, |

|

|

(Expressed in thousands of U.S. dollars) |

2022 |

|

2021 |

|

|

|

(Unaudited) |

|

|

|

|

| Total comprehensive

income/(loss) for the period |

12,083 |

|

(766 |

) |

| Interest and finance costs,

net |

389 |

|

930 |

|

| Interest income |

(5 |

) |

(1 |

) |

| Foreign exchange gains,

net |

(34 |

) |

(60 |

) |

| Depreciation |

1,404 |

|

711 |

|

| Depreciation of dry-docking

costs |

951 |

|

492 |

|

| Gain on derivative financial

instruments |

(967 |

) |

- |

|

| Adjusted EBITDA |

13,821 |

|

1,306 |

|

| Share-based payments |

- |

|

10 |

|

| Payment of deferred

dry-docking costs |

(891 |

) |

(731 |

) |

| Net (increase)/decrease in

operating assets |

(2,562 |

) |

625 |

|

| Net decrease in operating

liabilities |

(42 |

) |

(773 |

) |

| Provision for staff retirement

indemnities |

(2 |

) |

1 |

|

| Foreign exchange

gains/(losses) net, not attributed to cash and cash

equivalents |

3 |

|

(2 |

) |

| Net cash generated

from operating activities |

10,327 |

|

436 |

|

|

|

Three months ended March 31, |

|

|

(Expressed in thousands of U.S. dollars) |

2022 |

|

2021 |

|

| |

(Unaudited) |

| Statement of cash flow

data: |

|

| Net cash generated from

operating activities |

10,327 |

|

436 |

|

| Net cash used in investing

activities |

(15 |

) |

(4,326 |

) |

| Net cash (used in)/generated

from financing activities |

(2,248 |

) |

36,239 |

|

|

|

As at March 31, |

|

As at December 31, |

|

|

(Expressed in thousands of U.S. Dollars) |

2022 |

|

2021 |

|

|

|

(Unaudited) |

|

|

|

|

Consolidated condensed statement of financial

position: |

|

|

|

|

|

Vessels, net |

128,610 |

|

130,724 |

|

|

Other non-current assets |

5,571 |

|

4,988 |

|

|

Total non-current assets |

134,181 |

|

135,712 |

|

|

Cash and bank balances and bank deposits (including restricted

cash) |

55,499 |

|

46,861 |

|

|

Other current assets |

5,850 |

|

3,079 |

|

|

Total current assets |

61,349 |

|

49,940 |

|

|

Total assets |

195,530 |

|

185,652 |

|

|

Total equity |

158,501 |

|

146,418 |

|

|

Total debt net of unamortized debt discount |

30,088 |

|

31,303 |

|

|

Other liabilities |

6,941 |

|

7,931 |

|

|

Total liabilities |

37,029 |

|

39,234 |

|

|

Total equity and liabilities |

195,530 |

|

185,652 |

|

|

Consolidated statement of changes in equity: |

|

|

|

|

|

|

|

|

|

(Expressed in thousands of U.S. Dollars) |

Issued share |

|

Share |

|

(Accumulated |

|

Total |

|

|

|

Capital |

|

Premium |

|

Deficit) |

|

Equity |

|

|

As at December 31, 2021 |

82 |

|

284,406 |

|

(138,070 |

) |

146,418 |

|

|

Total comprehensive income for the period |

- |

|

- |

|

12,083 |

|

12,083 |

|

|

As at March 31, 2022 |

82 |

|

284,406 |

|

(125,987 |

) |

158,501 |

|

|

|

|

Three months ended March 31, |

|

|

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

Ownership days (1) |

810 |

|

540 |

|

|

|

|

Available days (2) |

810 |

|

516 |

|

|

|

|

Operating days (3) |

798 |

|

512 |

|

|

|

|

Fleet utilization (4) |

98.5 |

% |

99.2 |

% |

|

|

|

Average number of vessels (5) |

9.0 |

|

6.0 |

|

|

|

|

Daily time charter equivalent (“TCE”) rate (6) |

23,643 |

|

9,857 |

|

|

|

|

Daily operating expenses (7) |

5,377 |

|

5,698 |

|

|

|

Notes: |

|

|

|

|

(1) |

Ownership days are the aggregate number of days in a period during

which each vessel in our fleet has been owned by us. |

|

(2) |

Available days are the number of ownership days less the aggregate

number of days that our vessels are off-hire due to scheduled

repairs or repairs under guarantee, vessel upgrades or special

surveys. |

|

(3) |

Operating days are the number of available days less the aggregate

number of days that the vessels are off-hire due to any reason,

including unforeseen circumstances but excluding days during which

vessels are seeking employment. |

|

(4) |

We calculate fleet utilization by dividing the number of operating

days during a period by the number of available days during the

period. |

|

(5) |

Average number of vessels is measured by the sum of the number of

days each vessel was part of our fleet during a relevant period

divided by the number of calendar days in such period. |

|

(6) |

TCE rates are our voyage revenues plus any potential gain on sale

of bunkers less voyage expenses during a period divided by the

number of our available days during the period which is consistent

with industry standards. TCE is a measure not in accordance with

GAAP. |

|

(7) |

We calculate daily vessel operating expenses by dividing vessel

operating expenses by ownership days for the relevant time

period. |

Voyage Revenues to Daily Time Charter

Equivalent (“TCE”) Reconciliation

|

|

|

Three months ended March 31, |

|

|

|

|

|

2022 |

|

2021 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

Voyage revenues |

18,351 |

|

5,167 |

|

|

|

|

Plus: Gain on sale of bunkers,

net |

1,149 |

|

- |

|

|

|

|

Less: Voyage expenses |

349 |

|

78 |

|

|

|

|

Net revenues |

19,151 |

|

5,089 |

|

|

|

|

Available days |

810 |

|

516 |

|

|

|

|

Daily TCE rate (1) |

23,643 |

|

9,857 |

|

|

(1) Subject to rounding.

About Globus Maritime

Limited

Globus is an integrated dry bulk shipping

company that provides marine transportation services worldwide and

presently owns, operates and manages a fleet of nine dry bulk

vessels that transport iron ore, coal, grain, steel products,

cement, alumina and other dry bulk cargoes internationally. Globus’

subsidiaries own and operate nine vessels with a total carrying

capacity of 626,257 Dwt and a weighted average age of 10.4 years as

at March 31, 2022.

Safe Harbor Statement

This communication contains “forward-looking

statements” as defined under U.S. federal securities laws.

Forward-looking statements provide the Company’s current

expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts or that are not present

facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “intend,” “may,”

“ongoing,” “plan,” “potential,” “predict,” “project,” “will” or

similar words or phrases, or the negatives of those words or

phrases, may identify forward-looking statements, but the absence

of these words does not necessarily mean that a statement is not

forward-looking. Forward-looking statements are subject to known

and unknown risks and uncertainties and are based on potentially

inaccurate assumptions that could cause actual results to differ

materially from those expected or implied by the forward-looking

statements. The Company’s actual results could differ materially

from those anticipated in forward-looking statements for many

reasons specifically as described in the Company’s filings with the

Securities and Exchange Commission. Accordingly, you should not

unduly rely on these forward-looking statements, which speak only

as of the date of this communication. Globus undertakes no

obligation to publicly revise any forward-looking statement to

reflect circumstances or events after the date of this

communication or to reflect the occurrence of unanticipated events.

You should, however, review the factors and risks Globus describes

in the reports it will file from time to time with the Securities

and Exchange Commission after the date of this communication.

|

For further information please contact: |

|

|

Globus Maritime Limited |

+30 210 960 8300 |

|

Athanasios Feidakis, CEO |

a.g.feidakis@globusmaritime.gr |

|

|

|

|

Capital Link – New York |

+1 212 661 7566 |

|

Nicolas Bornozis |

globus@capitallink.com |

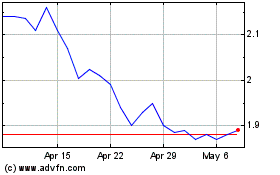

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024