As filed with the Securities and Exchange Commission on June 3, 2022

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| UNITED HEALTH PRODUCTS, INC. |

| (exact name of Registrant as specified in its charter) |

| Nevada | | 84-1517723 |

| (State or other jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

10624 S. Eastern Ave., STE A209

Henderson, NV 89052

(Address of Principal Executive Offices including Zip Code)

Employment Agreement dated as of January 1, 2020, between Company and John Gerhardt, as amended

Employment Agreement dated as of December 14, 2020, between Company and John Phillips, as amended

Restricted Stock Unit Agreement dated as of March 25, 2019, between Company and Douglas Beplate, as amended

(Full title of the plan)

Brian Thom

Chief Executive Officer

10624 S Eastern Ave, STE A209

Henderson, NV 89052

(877) 358-3444

(Name and address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Gavin Grusd, Esq.

Dominick Ragno, Esq.

Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza, East Tower, 15th Floor

Uniondale, New York 11556

(516) 663-6514

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

United Health Products, Inc. (the “Company”) has prepared this Registration Statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register an aggregate of 1,475,000 shares of common stock, par value $.001 per share (“Common Stock”) for resale on behalf of certain individuals who have provided the Company with services, either in the capacity as an independent contractor or as a former officer and director, who acquired the resale shares pursuant to: (i) the Employment Agreement dated as of January 1, 2020, between Company and John Gerhardt, as amended (the “Gerhardt Employment Agreement”); (ii) the Employment Agreement dated as of December 14, 2020, between Company and John Phillips, as amended (the “Phillips Employment Agreement”); and (iii) the Restricted Stock Unit Agreement dated as of March 25, 2019, between Company and Douglas Beplate, as amended (the “Beplate RSU Agreement” and together with the Gerhardt Employment Agreement and Philips Employment Agreement, collectively, the “Plans”). This Registration Statement includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction C and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for reoffers and resales of “restricted securities” (as such term is defined in Section C of the General Instructions to Form S-8) by the selling stockholders. The selling stockholders named in the reoffer prospectus acquired these resale shares pursuant to (i) the election of a right to receive the resale shares in payment of earned and accrued and unpaid compensation for services rendered to the Company in lieu of cash compensation, pursuant to the Gerhardt Employment Agreement and Philips Employment Agreement; or (ii) the settlement upon vesting of Restricted Stock Units granted, pursuant to the Beplate RSU Agreement. This reoffer prospectus is to be used for reoffers and resales of the resale shares, on a continuous or delayed basis in the future, by the selling stockholders. The registration of the shares of our Common Stock covered by the reoffer prospectus does not necessarily mean that any shares of our Common Stock will be sold by the selling stockholders. The second part of this Registration Statement contains information required in the Registration Statement pursuant to Part II of Form S-8.

REOFFER PROSPECTUS

1,475,000 Shares of Common Stock

This reoffer prospectus relates to the offer and sale from time to time by the selling stockholders named in this reoffer prospectus (the “Selling Stockholders”) of an aggregate of up to 1,475,000 shares of common stock, par value $.001 per share, of United Health Products, Inc. that were issued to each Selling Stockholder pursuant to their respective agreement with the Company (the “Plans”).

Our common stock is quoted on the OTCPK marketplace under the symbol “UEEC.” On May 31, 2022 the closing price of our common stock on OTCPK marketplace was $0.61 per share.

We are not offering any of the shares of common stock and we will not receive any proceeds from the sale of shares pursuant to this reoffer prospectus.

The shares of common stock may be offered by the Selling Stockholders in negotiated transactions, at either prevailing market prices or negotiated prices. Each Selling Stockholder in its discretion may also offer the shares of common stock from time to time in ordinary brokerage transactions in the OTCPK marketplace or otherwise.

These Selling Stockholders may sell or offer all, a portion, or none of the shares of common stock to which this reoffer prospectus relates from time to time. See our discussion in the “Plan of Distribution” section of this reoffer prospectus.

The names of persons selling shares under this reoffer prospectus and the amount of such shares are set forth below under the caption “Selling Stockholders”. Any securities covered by this reoffer prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this reoffer prospectus. See “Selling Stockholders” beginning on page 5.

The Securities and Exchange Commission may take the view that, under certain circumstances, the Selling Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the distribution of the resale shares may be deemed to be “underwriters” within the meaning of the Securities Act. Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act. See the section titled “Plan of Distribution.”

These are speculative securities. See “Risk Factors” beginning on page 2 for the factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this reoffer prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this reoffer prospectus June 3, 2022.

TABLE OF CONTENTS

This reoffer prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits. The reoffer prospectus may also add, update or change information contained or incorporated by reference in this reoffer prospectus. This reoffer prospectus and the documents incorporated by reference into this reoffer prospectus, includes all material information relating to the offering of securities under this prospectus. You should carefully read this reoffer prospectus, the applicable prospectus supplement, the information and documents incorporated herein by reference and the additional information under the headings “Where You Can Find More Information” and “Incorporation of Documents by Reference” before making an investment decision.

You should rely only on the information we have provided or incorporated by reference in this reoffer prospectus. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this reoffer prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained or incorporated by reference in this reoffer prospectus. You must not rely on any unauthorized information or representation. You should assume that the information in this reoffer prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this reoffer prospectus or any sale of a security.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this reoffer prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context indicates otherwise in this reoffer prospectus, the terms “UHP,” the “Company,” the “Registrant,” “we,” “our” or “us” in this reoffer prospectus refer to United Health Products, Inc. unless otherwise specified.

RISK FACTORS

Before making an investment decision in our securities, you should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC on April 1, 2022, which is incorporated by reference herein, and in our updates to those Risk Factors in our Quarterly Reports on Form 10-Q and our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act filed after that annual report, together with all of the other information appearing in this reoffer prospectus or incorporated by reference into this reoffer prospectus, applicable prospectus supplements or any applicable pricing supplement, in light of your particular investment objectives and financial circumstances. In addition to those risk factors, there may be additional risks and uncertainties of which management is not aware or focused on or that management deems immaterial. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this resale prospectus and the documents incorporated into it by reference that are considered “forward-looking statements” which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, numerous assumptions, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements are typically identified by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “projects”, “intends” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements are only predictions. Actual events or results may differ materially. Moreover, neither we nor any other person assumes responsibility.

We have based these forward-looking statements on our current expectations and projections about future events. We believe that the assumptions and expectations reflected in such forward-looking statements are reasonable, based on information available to us on the date of this prospectus, but we cannot assure you that these assumptions and expectations will prove to have been correct or that we will take any action that we may presently be planning. These forward-looking statements are inherently subject to known and unknown risks and uncertainties. We have included important cautionary statements in this prospectus, in the documents incorporated by reference in this prospectus, and in the sections in our periodic reports, including our most recent Annual Report on Form 10-K, entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” as supplemented by our subsequent Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K, discussing some of the factors that we believe could cause actual results or events to differ materially from the forward-looking statements that we are making including, among others: research and product development uncertainties; regulatory policies and FDA approval requirements and uncertainties; competition from other similar businesses; market acceptance of our products; reliance solely on our hemostatic gauze product; dependence on other parties to market or products; raw material supply chain uncertainties; and market and general economic factors.

In light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus or the date of the document incorporated by reference in this prospectus. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

USE OF PROCEEDS

The shares of common stock to be offered and sold pursuant to this reoffer prospectus will be reoffered and resold by the Selling Stockholders or their transferees. We will not receive any proceeds from the resale of the shares of common stock by the Selling Stockholders.

SELLING STOCKHOLDERS

This reoffer prospectus relates to the registration of up to 1,475,000 shares of our common stock that are being registered for reoffer and resale by the Selling Stockholders who have received or acquired the shares pursuant to the Plans. The Selling Stockholders may resell all, a portion, or none of the shares of common stock from time to time. We are registering the shares in order to permit the Selling Stockholders to offer the shares for resale from time to time.

The Company issued common stock to John Phillips and John Gerhardt, each a contractor of the Company, in payment of accrued and unpaid compensation for services rendered to the Company, at their respective elections in lieu of cash pursuant to the terms of their respective Employment Agreements with the Company. Messrs. Phillips and Gerhardt were each entitled to and were issued 200,000 shares of common stock as payment in lieu of $60,000 in accrued cash compensation for those services, respectively.

The Company issued common stock to Douglas Beplate, the former Chairman of the Board and Chief Executive Officer of the Company, in settlement of the vesting of Restricted Stock Units granted to him in consideration of services rendered to the Company, pursuant to the Beplate RSU Agreement. Mr. Beplate is entitled to and was issued an aggregate of 30,730,000 shares of common stock in settlement of vested Restricted Stock Units under the Beplate RSU Agreement.

The table below lists the Selling Stockholders and other information regarding the “beneficial ownership” of the shares of common stock by each Selling Stockholder. In accordance with Rule 13d-3 of the Exchange Act, “beneficial ownership” includes any shares of our common stock as to which the Selling Stockholders have sole or shared voting power or investment power and any shares of our common stock the Selling Stockholders have the right to acquire within 60 days.

Each Selling Stockholder may be deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

The first column lists the name of each Selling Stockholder, including their currently held position at the Company.

The second column indicates the number of shares of common stock beneficially owned by the Selling Stockholders, based on each stockholder’s ownership as of May 31, 2022.

The third column indicates the maximum number of shares of common stock that each Selling Stockholder may offer for sale from time to time pursuant to this reoffer prospectus, whether or not the Selling Stockholder has any present intention to do so and whether or not such shares have previously been issued to the Selling Stockholders or may be issued in the future if at all.

The fourth column indicates the maximum amount of shares of common stock that would be beneficially owned by each Selling Stockholder assuming the sale of all shares offered hereby.

The fifth column indicates the percentage of shares of common stock that would be beneficially owned by each Selling Stockholders assuming the sale of all shares offered hereby.

This prospectus covers the resale of any securities issued or then issuable upon any full anti-dilution protection, stock split, dividend or other distribution, recapitalization or similar event with respect to the shares of common stock.

Because the issuance price of the common stock may be adjusted, the number of shares of common stock that will actually be issued upon issuance of the common stock may be more or less than the number of shares of common stock being offered by this reoffer prospectus. Each Selling Stockholder can offer all, some or none of its shares of common stock, thus the number of shares of common stock it will hold after this offering is indeterminate. However, the fourth and fifth columns assume that the Selling Stockholders will sell all shares of common stock covered by this reoffer prospectus. See “Plan of Distribution.”

| Selling Security Holder | | Number of Shares Beneficially Owned Before Offering | | | Number of Shares Being Offered | | | Maximum Number of Shares Beneficially Owned After Offering | | | Percentage of Shares Beneficially Owned After Offering (%) | |

| John Phillips | | | 200,000 | (1) | | | 200,000 | | | | 0 | | | | 0 | |

| John Gerhardt | | | 450,000 | (2) | | | 200,000 | | | | 250,000 | | | | 0.1 | |

| Douglas Beplate | | | 14,447,190 | (3) | | | 1,075,000 | | | | 13,372,190 | | | | 5.81 | |

| (1) | Includes 200,000 shares of common stock to be sold by John Phillips, which were issued to Mr. Phillips in lieu of cash compensation for services rendered to the Company pursuant to the terms of the Philips Employment Agreement. |

| | |

| (2) | Includes 200,000 shares of common stock to be sold by John Gerhardt, which were issued to Mr. Gerhardt in lieu of cash compensation for services rendered to the Company pursuant to the terms of the Gerhardt Employment Agreement. |

| | |

| (3) | Includes 1,075,000 shares of common stock to be sold by Douglas Beplate, which were issued to Mr. Beplate in settlement of vested Restricted Stock Units, granted to Mr. Beplate under the Beplate RSU Agreement. |

PLAN OF DISTRIBUTION

The shares of common stock covered by this reoffer prospectus are being registered by the Company for the account of the Selling Stockholders.

We will pay the expenses incident to this registration, on behalf of the Selling Stockholders. The shares of common stock offered may be sold from time to time directly by or on behalf of each Selling Stockholder in one or more transactions on the OTCPK marketplace or any other stock exchange on which the common stock may be listed at the time of sale, in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices.

In connection with their sales, a Selling Stockholders and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions they receive and the proceeds of any sale of shares may be deemed to be underwriting discounts and commissions under the Securities Act.

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

In addition to any shares sold hereunder, Selling Stockholders may sell shares of common stock in compliance with Rule 144. There is no assurance that the Selling Stockholders will sell all or a portion of the common stock offered pursuant to this reoffer prospectus.

The Selling Stockholders may agree to indemnify any broker, dealer or agent that participates in transactions involving sales of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act.

We have notified the Selling Stockholders of the need to deliver a copy of this reoffer prospectus in connection with any sale of the shares.

DESCRIPTION OF COMMON STOCK

We are authorized to issue 300,000,000 shares of common stock, par value $0.001 per share. As of May 31, 2022 we had 230,127,509 shares of common stock issued and outstanding and approximately 410 common stockholders of record. The following summary of certain provisions of our common stock does not purport to be complete. You should refer to our certificate of incorporation and our bylaws, copies of which are on file with the SEC as exhibits to previous SEC filings. Please refer to “Where You Can Find More Information” below for directions on obtaining these documents. The summary below is also qualified by provisions of applicable law.

General

Holders of common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our board of directors, out of funds that we may legally use to pay dividends, subject to any preferential dividend rights of any outstanding series of preferred stock or series of preferred stock that we may designate and issue in the future. All shares of common stock outstanding as of the date of this prospectus and, upon issuance and sale, all shares of common stock that we may offer pursuant to this prospectus, will be fully paid and nonassessable.

In the event of our liquidation or dissolution, the holders of common stock are entitled to receive proportionately our net assets available for distribution to stockholders after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock. Holders of common stock have no preemptive, subscription, redemption or conversion rights. There are no redemption or sinking fund provisions applicable to the common stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Pacific Stock Transfer Co. Its address is 6725 Via Austi Pkwy, Suite 300, Las Vegas, NV 89119, United States; Telephone: (800) 785-7782.

Market for Securities

Our Common Stock trades on the OTCPK marketplace under the symbol “UEEC.”

CERTAIN PROVISIONS OF NEVADA LAW AND OF THE COMPANY’S CERTIFICATE OF INCORPORATION AND BYLAWS

United Health Products, Inc. is incorporated under the laws of the State of Nevada and is generally governed by the Nevada Private Corporations Code, Title 78 of the Nevada Revised Statutes, or NRS.

Section 78.138 of the NRS provides that, unless the corporation’s articles of incorporation provide otherwise, a director or officer will not be individually liable unless it is proven that (a) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties, and (b) such breach involved intentional misconduct, fraud, or a knowing violation of the law. Our articles of incorporation adopt the statutory standard for exculpation of our officers and directors from individual liability for their acts or omissions as an officer or director.

Section 78.7502 of the NRS permits a company to indemnify its directors and officers against expenses, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending, or completed action, suit, or proceeding, if the officer or director (a) is not liable pursuant to NRS 78.138, or (b) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful. Generally, indemnification under Section 78.7502 is discretionary and may be made by the corporation only as authorized in each specific case upon a determination that the indemnification is proper under the circumstances. Section 78.7502 of the NRS precludes indemnification by the corporation if the officer or director has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses.

Section 78.751 of the NRS requires a Nevada company to indemnify its officers and directors to the extent such person is successful on the merits or otherwise in defense of (a) any threatened, pending, or contemplated action, suit, or proceeding, whether civil, criminal, administrative, or investigative, including any action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise, or (b) any claim, issue or matter therein, against expenses incurred by them in defending the action, including attorney’s fees. Unless restricted by the articles of incorporation, the bylaws, or agreement, the corporation may pay the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of the final disposition of the action, suit, or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. The Articles of Incorporation, the Bylaws, or agreement may require the corporation to pay such expenses upon receipt of such an undertaking.

Indemnification pursuant to NRS 78.7502 and advancement of expenses authorized in or ordered by a court pursuant to NRS 78.751 (a) does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or any bylaw, agreement, vote of stockholders, or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, and (b) continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person. The foregoing notwithstanding, indemnification, unless ordered by a court pursuant to NRS 78.7502 or for the advancement of expenses upon undertaking as provided in 78.751(2), may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud, or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

A right to indemnification or to advancement of expenses arising under a provision of the Articles of Incorporation or any Bylaw is not eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification is provided.

Section 78.752 of the NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee, or agent of the company, or is or was serving at the request of the company as a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Our Articles of Incorporation and Bylaws implement the indemnification provisions permitted by Chapter 78 of the NRS by providing that we shall indemnify our directors and officers to the fullest extent permitted by the NRS against expense, liability, and loss reasonably incurred or suffered by them in connection with their service as an officer or director. Our articles of incorporation and bylaws also provide that we may purchase and maintain liability insurance, or make other arrangements for such obligations or otherwise, to the extent permitted by the NRS.

LEGAL MATTERS

The validity of the shares being offered for resale under this reoffer prospectus by us will be passed upon for us by Ruskin Moscou Faltischek, P.C., Uniondale, New York.

EXPERTS

The financial statements of United Health Products, Inc. appearing it its Annual Report on Form 10-K for the year ended December 31, 2021, have been audited by MAC Accounting Group, LLP, independent registered public accounting firm, as set forth in their report thereon, including therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. SEC filings are available at the SEC’s website at http://www.sec.gov.

This reoffer prospectus is only part of a registration statement on Form S-8 that we have filed with the SEC under the Securities Act and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded from this reoffer prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document.

The registration statement and the documents referred to below under “Incorporation of Certain Information by Reference” are also available on our website at www.unitedhealthproductsinc.com. We have not incorporated by reference into this reoffer prospectus the information on our website, and you should not consider it to be a part of this reoffer prospectus.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this reoffer prospectus, and information that we file later with the SEC will automatically update and supersede this information. We filed a registration statement on Form S-8 under the Securities Act with the SEC with respect to the securities we may offer pursuant to this reoffer prospectus. This reoffer prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits, for further information about us and the securities we may offer pursuant to this reoffer prospectus. Statements in this reoffer prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, are available at the SEC’s website at http://www.sec.gov. The documents we are incorporating by reference are:

| | · | Our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Commission on April 1, 2022; |

| | | |

| | · | Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022, filed with the Commission on May 16, 2022; |

| | | |

| | · | Our Current Report on Form 8-K, filed with the Commission on April 29, 2022; and |

| | | |

| | · | All reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to filing a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities offered hereby then remaining unsold, shall be deemed to be incorporated by reference herein and shall be deemed to be a part hereof from the date of the filing of such documents. |

The SEC file number for each of the documents listed above is 000-27781.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this reoffer prospectus will be deemed to be modified or superseded for purposes of this reoffer prospectus to the extent that a statement contained in this reoffer prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this reoffer prospectus.

We will provide, upon written or oral request, without charge to each person, including any beneficial owner, to whom a copy of this reoffer prospectus is delivered, a copy of any or all of the information incorporated herein by reference (exclusive of exhibits to such documents unless such exhibits are specifically incorporated by reference herein). You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: United Health Products, Inc., 10624 South Eastern Avenue, Suite A209, Henderson, Nevada 89052; telephone number (877) 358-3444.

You should rely only on information contained in, or incorporated by reference into, this reoffer prospectus and any supplement hereto. We have not authorized anyone to provide you with information different from that contained in this reoffer prospectus or incorporated by reference in this reoffer prospectus. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents previously filed with the Commission by United Health Products, Inc. (“we,” “us,” “our”, “Company”, “Registrant”, or “UHP”) are hereby incorporated by reference in this Registration Statement:

| | (a) | The Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Commission on April 1, 2022; |

| | | |

| | (b) | The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022, filed with the Commission on May 16, 2022; |

| | | |

| | (c) | The Company’s Current Report on Form 8-K, filed with the Commission on April 29, 2022 (Commission File No. 000-27781 and in only as to the information “filed” with the Commission thereunder for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and not as to information “furnished” thereunder); and |

| | | |

| | (d) | The description of the Company’s Common Stock contained in its Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Commission of April 1, 2022, including any amendment or report filed for the purpose of updating such description. |

All documents filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or subsequent to the effective date hereof and prior to the filing of a post-effective amendment hereto that indicates that all securities offered hereby have been sold or that deregisters all such securities then remaining unsold, shall be deemed to be incorporated herein by reference and to be a part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the Commission shall not be incorporated by reference into this Registration Statement. Any statement contained herein or in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed to constitute a part of this Registration Statement, except as so modified or superseded.

Item 4. Description of Securities

Not Applicable.

Item 5. Interests of Named Experts and Counsel

Not Applicable.

Item 6. Indemnification of Directors and Officers

United Health Products, Inc. is incorporated under the laws of the State of Nevada and is generally governed by the Nevada Private Corporations Code, Title 78 of the Nevada Revised Statutes, or NRS.

Section 78.138 of the NRS provides that, unless the corporation’s articles of incorporation provide otherwise, a director or officer will not be individually liable unless it is proven that (a) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties, and (b) such breach involved intentional misconduct, fraud, or a knowing violation of the law. Our articles of incorporation adopt the statutory standard for exculpation of our officers and directors from individual liability for their acts or omissions as an officer or director.

Section 78.7502 of the NRS permits a company to indemnify its directors and officers against expenses, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending, or completed action, suit, or proceeding, if the officer or director (a) is not liable pursuant to NRS 78.138, or (b) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful. Generally, indemnification under Section 78.7502 is discretionary and may be made by the corporation only as authorized in each specific case upon a determination that the indemnification is proper under the circumstances. Section 78.7502 of the NRS precludes indemnification by the corporation if the officer or director has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses.

Section 78.751 of the NRS requires a Nevada company to indemnify its officers and directors to the extent such person is successful on the merits or otherwise in defense of (a) any threatened, pending, or contemplated action, suit, or proceeding, whether civil, criminal, administrative, or investigative, including any action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise, or (b) any claim, issue or matter therein, against expenses incurred by them in defending the action, including attorney’s fees. Unless restricted by the articles of incorporation, the bylaws, or agreement, the corporation may pay the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of the final disposition of the action, suit, or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. The Articles of Incorporation, the Bylaws, or agreement may require the corporation to pay such expenses upon receipt of such an undertaking.

Indemnification pursuant to NRS 78.7502 and advancement of expenses authorized in or ordered by a court pursuant to NRS 78.751 (a) does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or any bylaw, agreement, vote of stockholders, or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, and (b) continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person. The foregoing notwithstanding, indemnification, unless ordered by a court pursuant to NRS 78.7502 or for the advancement of expenses upon undertaking as provided in 78.751(2), may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud, or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

A right to indemnification or to advancement of expenses arising under a provision of the Articles of Incorporation or any Bylaw is not eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification is provided.

Section 78.752 of the NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee, or agent of the company, or is or was serving at the request of the company as a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Our Articles of Incorporation and Bylaws implement the indemnification provisions permitted by Chapter 78 of the NRS by providing that we shall indemnify our directors and officers to the fullest extent permitted by the NRS against expense, liability, and loss reasonably incurred or suffered by them in connection with their service as an officer or director. Our articles of incorporation and bylaws also provide that we may purchase and maintain liability insurance, or make other arrangements for such obligations or otherwise, to the extent permitted by the NRS.

Item 7. Exemption from Registration Claimed

Not Applicable.

Item 8. Exhibits

* Filed herewith

Item 9. Undertakings

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification is against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Henderson, Nevada on the 3rd day of June, 2022.

| | UNITED HEALTH PRODUCTS, INC. | |

| | | | |

| By: | /s/ Brian Thom | |

| | | Brian Thom | |

| | | Chief Executive Officer | |

| | | (Principal Executive Officer) | |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each of the undersigned officers and directors of United Health Products, Inc., a Nevada corporation, does hereby constitute and appoint Brian Thom and Kristofer Heaton, as their true and lawful attorneys-in-fact and agents with full power and authority to do any and all acts and things and to execute any and all instruments which said attorneys and agents, and any one of them, determine may be necessary or advisable or required to enable said corporation to comply with the Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority, the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated below to this Registration Statement, to any and all amendments, both pre-effective and post-effective, and supplements to this Registration Statement, and to any and all instruments or documents filed as part of or in conjunction with this Registration Statement or amendments or supplements thereof, and each of the undersigned hereby ratifies and confirms that all said attorneys and agents, or any one of them, shall do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

In accordance with the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed on its behalf by the undersigned, thereunto duly authorized, in Henderson, Nevada on the 3rd day of June, 2022.

| Signature: | | Title: | | Date: |

| | | | | |

| /s/ Brian Thom | | Chief Executive Officer and Director (Principal Executive Officer) | | June 3, 2022 |

| Brian Thom | | | | |

| | | | | |

| /s/ Kristofer Heaton | | Vice President, Finance (Principal Finance and Accounting Officer) | | June 3, 2022 |

| Kristofer Heaton | | | | |

| | | | | |

| /s/ Robert Denser | | Director | | June 3, 2022 |

| Robert Denser | | | | |

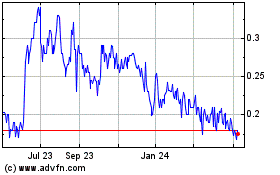

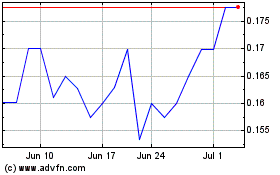

United Health Products (PK) (USOTC:UEEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Health Products (PK) (USOTC:UEEC)

Historical Stock Chart

From Apr 2023 to Apr 2024