Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

June 02 2022 - 5:12PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258348

Prospectus Supplement No. 2

(to prospectus dated April 28, 2022)

Up to 44,350,000 Shares of Class A Common

Stock

and

Up to 1,195,006,622 Shares of Class A Common Stock

Up to 44,350,000 Warrants to Purchase Class A Common Stock

Offered by the Selling Securityholders

This prospectus supplement

is being filed to update and supplement the information contained in the prospectus dated April 28, 2022 (the “Prospectus”),

which forms part of our registration statement on Form S-1 (No. 333-258348), as amended, with the information contained in our Current

Report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on June 2, 2022 (the “Current

Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus

supplement relate to: (1) the issuance by us of an aggregate of up to 44,350,000 shares of our common stock, par value $0.0001 per share

(“Class A common stock”), consisting of (a) 42,850,000 shares of Class A common stock issuable upon exercise of the

Private Placement Warrants and (b) 1,500,000 shares of Class A common stock issuable upon exercise of the Working Capital Warrants, and

(2) the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”),

or their permitted transferees, of (a) up to 1,195,006,622 shares of Class A common stock, consisting of (i) 1,118,905,164 issued and

outstanding shares of Class A common stock, (ii) 31,751,458 shares of Class A common stock subject to vesting and/or exercise of the assumed

Lucid Equity Awards and (iii) 44,350,000 shares of Class A common stock issuable upon exercise of the Private Placement Warrants and the

Working Capital Warrants, and (b) 44,350,000 warrants representing the Private Placement Warrants and the Working Capital Warrants.

This prospectus supplement

updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in

combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction

with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should

rely on the information in this prospectus supplement. Terms used in this prospectus supplement but not defined herein shall have the

meanings given to such terms in the Prospectus.

We are a “controlled

company” within the meaning of Nasdaq rules and, as a result, qualify for exemptions from certain corporate governance requirements.

Ayar, our majority stockholder, also currently has the ability to nominate five of the nine directors to our Board.

You should read the Prospectus,

this prospectus supplement and any additional prospectus supplement or amendment carefully before you invest in our securities. Our Class

A common stock is listed on The Nasdaq Stock Market LLC under the symbol “LCID”. On June 1, 2022, the closing price of our

Class A common stock was $19.50 per share.

Investing in our Class A

common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page 7 of the Prospectus

and in our other documents subsequently filed with the SEC.

Neither the SEC nor any

other state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of the Prospectus

or this prospectus supplement. Any representation to the contrary is a criminal offense.

June 2, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 26, 2022

Lucid Group, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

001-39408 |

85-0891392 |

(State or other

jurisdiction of

incorporation) |

(Commission File

Number) |

(I.R.S.

Employer

Identification No.) |

7373 Gateway Blvd

Newark, CA

(Address of principal executive offices) |

94560

(Zip Code) |

| Registrant’s telephone number, including area code: (510) 648-3553 |

| |

| |

| (Former name or former address, if changed since last report) |

| |

|

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading

Symbol(s) | |

Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | |

LCID | |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers. |

On

May 26, 2022, the Compensation Committee of the Board of Directors of Lucid Group, Inc. approved an increase to the annual

base salaries of the following named executive officers of the Company effective as of June 6, 2022.

| Name | |

Title | |

New Annual Base Salary | |

| Sherry House | |

Chief Financial Officer | |

$ | 535,000 | |

| | |

| |

| | |

| Eric Bach | |

Senior Vice President, Product and Chief Engineer | |

$ | 525,000 | |

| | |

| |

| | |

| Michael Bell | |

Senior Vice President, Digital | |

$ | 525,000 | |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned

hereunto duly authorized.

| Dated: June 2, 2022 |

|

LUCID GROUP, INC. |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Sherry House |

| |

|

|

|

Name: Sherry House

Title: Chief Financial Officer |

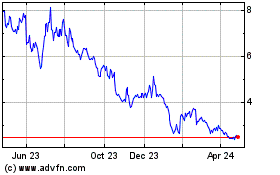

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Mar 2024 to Apr 2024

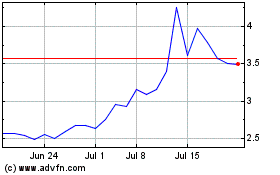

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Apr 2023 to Apr 2024