Current Report Filing (8-k)

June 01 2022 - 4:16PM

Edgar (US Regulatory)

0001448705

false

0001448705

2022-05-26

2022-05-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June

1, 2022 (May 26, 2022)

Basanite, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-53574 |

20-4959207 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S Employer

Identification No.) |

2041 NW 15th Avenue, Pompano Beach, Florida 33069

(Address of principal executive offices) (Zip

Code)

954-532-4653

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On May 26, 2022, Basanite, Inc.

(the “Company”) entered into a consulting agreement (the “Agreement”) with Technicon Consulting Group, Inc. (the

“Consultant”) and Key Honey Contracting, LLC (“Key Honey”, and, with the Company, each individually a “Party”,

and collectively the “Parties”). The effective date of the Agreement is February 21, 2022 (the “Effective Date”).

The Consultant is an affiliate of Frederick H. Tingberg, Jr. (“Mr. Tingberg”), an employee of Consultant and current member

of the Company’s Board of Directors.

Pursuant to the Agreement, the Company

has retained the Consultant as an independent contractor to provide technical, marketing and sales services to the Company (as described

further below and referenced hereafter as the “Services”), and the Parties agreed that the Consultant began to perform the

Services as of the Effective Date. The Services will be performed for Consultant by Mr. Tingberg, who serve in the capacity of Chief Technical

Officer of the Company. Specifically, Mr. Tingberg will use his good faith best efforts to market and drive sales of the Company’s

products by: (i) making introductions to federal, state and local governments, including municipalities, as well as construction companies

and other businesses likely to purchase the Company’s products; (ii) working with the Company’s personnel to close such sales;

and (iii) developing and implementing marketing and sales strategies for the Company. Mr. Tingberg shall also provide technical expertise

regarding the Company’s product development and manufacturing capabilities.

The Agreement contains a Confidentiality,

Non-Solicitation and Assignment of Inventions Agreement (in the form annexed as Appendix A to the Agreement, the “Confidentiality

Agreement”) which, as a condition to the Agreement, was executed by the Consultant and Mr. Tingberg effective as of the Effective

Date. As an independent contractor, the Parties agreed that Consultant is free to work for other parties during the term of the Agreement

and does not exclusively work for the Company or for Key Honey.

Consultant’s sole compensation

for the Services shall be a monthly fee of $25,000 (Twenty-Five Thousand Dollars) (the “Fee”) which will be paid solely by

Key Honey (an unaffiliated third party for whom the Consultant provides separate services). The Agreement has an initial term ending on

the first anniversary of the Effective Date, and such initial term shall be automatically extended for successive twelve (12) month terms

unless the Consultant or the Company provide the other with no less than fifteen (15) days prior written notice of its intention not to

renew the term. At any time, Consultant or Key Honey (on the one hand) or the Company (on the other hand) may terminate the Agreement

at will on fifteen (15) days’ written notice. In addition, Consultant or Key Honey (on the one hand) or the Company (on the other

hand) may terminate this Agreement on seven (7) days’ written notice of material breach of the Agreement.

In consideration of Key Honey’s

payment of Consultant’s Fee and expenses, the Company granted Key Honey a warrant (the “Warrant”) to purchase 2,000,000

shares of the Company’s common stock, par value $0.001 per share (the “Warrant Shares”) at an exercise price per share

of $0.33. Key Honey’s right to acquire Warrant Shares hereunder shall vest as follows: (i) the right to acquire 333,333 Warrant

Shares vested upon execution of the Agreement; and (ii) thereafter the right to acquire the remaining Warrant Shares vests in equal monthly

installments of 166,667 Warrant Shares on the 23rd day of each of the remaining initial ten (10) months of the Agreement, subject

to continuing effectiveness of the Agreement. The Warrant contains a customary “cashless” exercise provision as well as customary

stock-based, but not price-based, anti-dilution provisions.

The

foregoing descriptions of the Agreement and the Warrant do not purport to be complete and is subject to, and is qualified in its entirety

by reference to, the full text of the Agreement and the Warrant attached as Exhibits 10.1 and 4.1, respectively, to this Current Report

on Form 8-K, which text is incorporated herein by reference.

Item 8.01 Other Information.

On June 1, 2022, the

Company issued a press release regarding the matters described in this Current Report, which press release is filed as Exhibit 99.1

hereto and incorporated herein by reference.

Cautionary Statement Regarding

Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements. Forward-looking statements include, but are not limited to, statements

that express the Company’s intentions, beliefs, expectations, strategies, predictions or any other statements related to the Company’s

future activities, or future events or conditions. These statements are based on current expectations, estimates and projections about

the Company’s business based, in part, on assumptions made by its management. These statements are not guarantees of future performances

and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially

from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those risks discussed in documents

that the Company files from time to time with the SEC. Any forward-looking statements speak only as of the date on which they are made,

and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of

this Current Report on Form 8-K, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: June 1, 2022 |

BASANITE, INC. |

| |

|

|

| |

By: |

/s/ Simon R. Kay |

| |

|

Name: Simon R. Kay |

| |

|

Title: Chief Executive Officer & President and Acting Interim Chief Financial

Officer |

| |

|

|

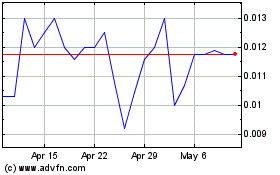

Basanite (QB) (USOTC:BASA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Basanite (QB) (USOTC:BASA)

Historical Stock Chart

From Apr 2023 to Apr 2024