Orgenesis Achieves Revenue of $7.2 Million for the First Quarter of 2022

May 24 2022 - 7:00AM

Orgenesis Inc. (NASDAQ: ORGS)

(“Orgenesis” or the “Company”), a global biotech company working to

unlock the full potential of cell and gene therapies, today

provided a business update for first quarter ended March 31, 2022.

Recent

highlights:

- Expanded POCare

with Johns Hopkins University through creation of the Maryland

Center for Cell Therapy Manufacturing

- Reached

milestone in collaboration with Hospital Infantil Universitario

Niño Jesús in Madrid

- Awarded €4M

European Innovation Council Pathfinder Grant

Vered Caplan, CEO of Orgenesis, said, “We are

completing the first phase of the rollout of our POCare Platform,

as we have now built a robust network of POCare centers across

Europe, Asia and the Middle East, and are focusing on

implementation of our POCare supply strategy in the US. Each of our

POCare centers serve as hubs for their respective territories. We

have cost effectively executed this model through partnerships with

leading hospitals and centers of excellence in the field of cell

and gene therapies, which provide us an immediate revenue stream

related to process development, technology transfer, setup, and

validation of both our POCare systems and Orgenesis Mobile

Processing Units and Labs (OMPULs). In turn, we have built out

significant capacity to support our anticipated growth.”

“We are now entering the second phase of our

rollout. Specifically, we are conducting work related to

validation, process development, and supply for clinical trials of

advanced therapies utilizing our POCare platform and OMPULs. As

these activities ramp up, we expect to benefit from recurring

revenue streams, based on long term contracts for the next two to

three years. Moreover, if any one of these therapies is granted

regulatory approval, we believe that the revenue potential is

significant since our POCare strategy positions us as a long term

industrial partner. We are currently working to expand our capacity

to supply products for over 10 distinct clinical programs. We

believe our approach is highly scalable and provides us

diversification across multiple revenue generating contracts. As

our customers’ needs grow, our goal is to be well prepared to add

new capacity utilizing our OMPUL-based approach, within 3-6 months

versus the 18-24 months typical for building out additional

cleanroom-based manufacturing capacity.”

“Overall, we are witnessing dramatic capacity

constraints across the industry. We believe our model is uniquely

positioned to address the challenges of current centralized

production through a highly innovative decentralized model, which

lowers costs, streamlines logistics, and expands capacity. We are

overcoming the growing pains and challenges arising from our rapid

transformation and believe that our model is essential and

sustainable. This is best evidenced by our existing contract

pipeline—which has total potential revenue in excess of $75 million

for the next two years, as well as our capacity to continually

expand our revenue generating relationships with additional biotech

companies, therapy developers and other providers such as hospitals

and academic centers.”

The complete financial results for the first

quarter of 2022 are available on the Company’s website in its Form

10-Q, which has been filed with the Securities and Exchange

Commission.

About OrgenesisOrgenesis is a

global biotech company working to unlock the full potential of cell

and gene therapies (CGTs) in an affordable and accessible format at

the point of care. The Orgenesis POCare Platform is comprised of

three enabling components: a pipeline of licensed POCare

Therapeutics that are processed and produced in closed, automated

POCare Technology systems across a collaborative POCare Network.

Orgenesis identifies promising new therapies and leverages its

POCare Platform to provide a rapid, globally harmonized pathway for

these therapies to reach and treat large numbers of patients at

lowered costs through efficient, scalable, and decentralized

production. The POCare Network brings together patients, doctors,

industry partners, research institutes and hospitals worldwide to

achieve harmonized, regulated clinical development and production

of the therapies. www.orgenesis.com.

Notice Regarding Forward-Looking

Statements This press release contains forward-looking

statements which are made pursuant to the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. These

forward-looking statements involve substantial uncertainties and

risks and are based upon our current expectations, estimates and

projections and reflect our beliefs and assumptions based upon

information available to us at the date of this release. We caution

readers that forward-looking statements are predictions based on

our current expectations about future events. These forward-looking

statements are not guarantees of future performance and are subject

to risks, uncertainties and assumptions that are difficult to

predict. Our actual results, performance or achievements could

differ materially from those expressed or implied by the

forward-looking statements as a result of a number of factors,

including, but not limited to, our reliance on, and our ability to

grow, our point-of-care cell therapy platform and OMPUL business,

our ability to achieve and maintain overall profitability, our

ability to manage our research and development programs that are

based on novel technologies, our ability to control key elements

relating to the development and commercialization of therapeutic

product candidates with third parties, the timing of completion of

clinical trials and studies, the availability of additional data,

outcomes of clinical trials of our product candidates, the

potential uses and benefits of our product candidates, our ability

to manage potential disruptions as a result of the COVID-19

pandemic, the sufficiency of working capital to realize our

business plans and our ability to raise additional capital, the

development of our POCare strategy, our trans differentiation

technology as therapeutic treatment for diabetes, the technology

behind our in-licensed ATMPs not functioning as expected, our

ability to further our CGT development projects, either directly or

through our JV partner agreements, and to fulfill our obligations

under such agreements, our license agreements with other

institutions, our ability to retain key employees, our competitors

developing better or cheaper alternatives to our products, risks

relating to legal proceedings against us and the risks and

uncertainties discussed under the heading "RISK FACTORS" in Item 1A

of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2021, and in our other filings with the Securities and

Exchange Commission. We undertake no obligation to revise or update

any forward-looking statement for any reason.

IR contact for Orgenesis:Crescendo

Communications, LLCTel: 212-671-1021Orgs@crescendo-ir.com

Communications contact for

OrgenesisImage Box CommunicationsNeil Hunter / Michelle

BoxallTel +44 (0)20 8943

4685neil@ibcomms.agency / michelle@ibcomms.agency

ORGENESIS INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(U.S. Dollars, in

thousands, except share and per share

amounts)(Unaudited)

|

|

|

As of

|

|

|

|

March 31,2022

|

|

|

|

December 31,2021

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

1,123

|

|

|

$

|

5,473

|

|

|

Restricted cash

|

|

490

|

|

|

|

501

|

|

|

Accounts receivable, net

|

|

17,075

|

|

|

|

15,245

|

|

|

Prepaid expenses and other receivables

|

|

1,438

|

|

|

|

1,188

|

|

|

Convertible Loan receivables-related parties

|

|

2,969

|

|

|

|

3,064

|

|

|

Loans receivable

|

|

802

|

|

|

|

-

|

|

|

Grants receivable

|

|

-

|

|

|

|

169

|

|

|

Inventory

|

|

113

|

|

|

|

118

|

|

|

Total current assets

|

|

24,010

|

|

|

|

25,758

|

|

| |

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

Deposits

|

$

|

358

|

|

|

$

|

363

|

|

|

Investments in and loans to associated entities

|

|

1,574

|

|

|

|

584

|

|

|

Loans receivable

|

|

-

|

|

|

|

821

|

|

|

Property, plant and equipment, net

|

|

11,104

|

|

|

|

10,271

|

|

|

Intangible assets, net

|

|

11,539

|

|

|

|

11,821

|

|

|

Operating lease right-of-use assets

|

|

886

|

|

|

|

1,015

|

|

|

Goodwill

|

|

8,329

|

|

|

|

8,403

|

|

|

Other assets

|

|

738

|

|

|

|

805

|

|

|

Total non-current assets

|

|

34,528

|

|

|

|

34,083

|

|

|

TOTAL ASSETS

|

$

|

58,538

|

|

|

$

|

59,841

|

|

ORGENESIS INC.CONDENSED

CONSOLIDATED BALANCE SHEETS (Cont’d)(U.S. Dollars,

in thousands, except share and per share

amounts)(Unaudited)

|

|

|

As of

|

|

|

|

March 31,2022

|

|

|

December 31,2021

|

|

Liabilities and Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

Accounts payable

|

$

|

6,933

|

|

|

$

|

5,238

|

|

|

Accrued expenses and other payables

|

|

1,076

|

|

|

|

485

|

|

|

Income tax payable

|

|

91

|

|

|

|

54

|

|

|

Employees and related payables

|

|

2,041

|

|

|

|

1,907

|

|

|

Advance payments on account of grant

|

|

1,216

|

|

|

|

1,238

|

|

|

Contract liabilities

|

|

70

|

|

|

|

59

|

|

|

Current maturities of finance leases

|

|

18

|

|

|

|

18

|

|

|

Current maturities of operating leases

|

|

451

|

|

|

|

481

|

|

|

Current maturities of convertible loans

|

|

3,357

|

|

|

|

5,885

|

|

|

Total current liabilities

|

|

15,253

|

|

|

|

15,365

|

|

| |

|

|

|

|

|

|

LONG-TERM LIABILITIES:

|

|

|

|

|

|

|

Non-current operating leases

|

$

|

461

|

|

|

$

|

561

|

|

|

Convertible loans

|

|

7,544

|

|

|

|

4,854

|

|

|

Retirement benefits obligation

|

|

105

|

|

|

|

101

|

|

|

Non-current finance leases

|

|

36

|

|

|

|

41

|

|

|

Other long-term liabilities

|

|

282

|

|

|

|

288

|

|

|

Total long-term liabilities

|

|

8,428

|

|

|

|

5,845

|

|

|

TOTAL LIABILITIES

|

|

23,681

|

|

|

|

21,210

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY:Common stock of $0.0001 par value:

Authorized at March 31, 2022 and December 31, 2021: 145,833,334

shares; Issued at March 31, 2022 and December 31, 2021: 25,107,323

and 24,567,366 shares, respectively; Outstanding at March 31, 2022

and December 31, 2021: 24,820,756 and 24,280,799 shares,

respectively.

|

|

3

|

|

|

|

3

|

|

|

Additional paid-in capital

|

|

146,290

|

|

|

|

145,916

|

|

|

Accumulated other comprehensive income

|

|

56

|

|

|

|

207

|

|

|

Treasury stock, 286,567 shares as of March 31, 2022 and December

31, 2021

|

|

(1,266

|

)

|

|

|

(1,266

|

)

|

|

Accumulated deficit

|

|

(110,381

|

)

|

|

|

(106,372

|

)

|

|

Equity attributable to Orgenesis Inc.

|

|

34,702

|

|

|

|

38,488

|

|

|

Non-controlling interest

|

|

155

|

|

|

|

143

|

|

|

Total equity

|

|

34,857

|

|

|

|

38,631

|

|

|

TOTAL LIABILITIES AND EQUITY

|

$

|

58,538

|

|

|

$

|

59,841

|

|

ORGENESIS INC.CONDENSED

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE

LOSS(U.S. Dollars in Thousands, Except Share

and Loss Per Share

Amounts)(Unaudited)

| |

Three Months Ended

|

|

|

|

March 31,

|

|

|

|

March 31,

|

|

2022

|

|

2021

|

|

|

POC development services

|

$

|

5,689

|

|

|

$

|

7,987

|

|

|

POC development services from related party

|

|

635

|

|

|

|

1,157

|

|

|

Cell process development services and hospital services

|

|

888

|

|

|

|

245

|

|

|

Total revenues

|

|

7,212

|

|

|

|

9,389

|

|

|

Cost of revenues cell process development services and hospital

services

|

|

714

|

|

|

|

770

|

|

|

Cost of development services and research and development

expenses

|

|

6,651

|

|

|

|

5,357

|

|

|

Amortization of intangible assets

|

|

232

|

|

|

|

238

|

|

|

Selling, general and administrative expenses

|

|

2,851

|

|

|

|

2,968

|

|

|

Operating loss (income)

|

|

3,236

|

|

|

|

(56

|

)

|

|

Other income, net

|

|

-

|

|

|

|

(25

|

)

|

|

Financial expenses, net

|

|

213

|

|

|

|

233

|

|

|

Share in net loss of associated companies

|

|

547

|

|

|

|

15

|

|

|

Loss before income taxes

|

|

3,996

|

|

|

|

167

|

|

|

Tax (income) expense

|

|

1

|

|

|

|

(2

|

)

|

|

Net loss

|

|

3,997

|

|

|

|

165

|

|

|

Net loss attributable to non-controlling interests

|

|

12

|

|

|

|

54

|

|

|

Net loss attributable to Orgenesis Inc.

|

|

4,009

|

|

|

|

219

|

|

| |

|

|

|

|

|

|

|

Loss per share:

|

|

|

|

|

|

|

|

Basic and diluted

|

$

|

0.16

|

|

|

$

|

0.01

|

|

| |

|

|

|

|

|

|

|

Weighted average number of shares used in computation of

Basic and Diluted loss per share:

|

|

|

|

|

|

|

|

Basic and diluted

|

|

24,600,954

|

|

|

|

24,192,951

|

|

| |

|

|

|

|

|

|

|

Comprehensive loss:

|

|

|

|

|

|

|

|

Net loss

|

$

|

3,997

|

|

|

$

|

165

|

|

|

Other Comprehensive loss – Translation adjustment

|

|

151

|

|

|

|

277

|

|

|

Comprehensive loss

|

|

4,148

|

|

|

|

442

|

|

|

Comprehensive loss attributed to non-controlling interests

|

|

12

|

|

|

|

54

|

|

|

Comprehensive loss attributed to Orgenesis Inc.

|

$

|

4,160

|

|

|

$

|

496

|

|

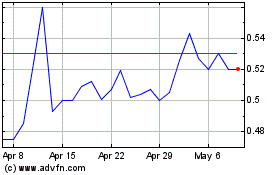

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Apr 2023 to Apr 2024