Additional Proxy Soliciting Materials (definitive) (defa14a)

May 20 2022 - 11:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant þ

Filed by a party other than the registrant ¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential, for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

þ Definitive Additional

Materials

¨ Soliciting Material Pursuant to §240.14a-12

Exact Sciences Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No

fee required.

¨ Fee paid previously with preliminary materials

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange

Act Rules 14a6(i)(1) and 0-11

EXACT SCIENCES CORPORATION

5505 Endeavor Lane

Madison, Wisconsin 53719

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT

DATED APRIL 29, 2022

FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 9, 2022

This proxy statement supplement, dated May 20,

2022 (the “Supplement”), supplements the definitive proxy statement (the “Proxy Statement”) of Exact Sciences

Corporation, which we filed with the Securities and Exchange Commission on April 29, 2022, relating to our annual meeting of shareholders

to be held on June 9, 2022.

We are providing this Supplement solely to correct

typographical errors resulting in overstatements of the amounts disclosed for Messrs. Elliott, Coward, Lidgard and Orville in the Stock Awards column of the Summary

Compensation Table for 2021 on page 49 of the Proxy Statement. The Summary Compensation Table for 2021 is amended and restated on the

following page solely to correct these typographical errors.

We have made no other changes to the Proxy Statement

nor have we changed or added to the matters to be considered by our shareholders at the annual meeting.

If you have already voted, you do not need to

vote again unless you would like to change your prior vote on any proposal. If you would like to change your prior vote on any proposal,

please refer to the Proxy Statement for instructions on how to do so. This Supplement should be read in conjunction with the Proxy Statement.

From and after the date of this Supplement, any references to the “proxy statement” are to the Proxy Statement as supplemented

hereby.

Summary Compensation Table for 2021

The following table represents summary information regarding the compensation

of each of our NEOs for the three years ended December 31, 2021.

| NAME

AND PRINCIPAL POSITION | |

YEAR | | |

SALARY

($) | | |

BONUS

($) | | |

STOCK

AWARDS ($)(1) | | |

OPTION

AWARDS ($)(2) | | |

ALL

OTHER

COMPENSATION ($) | | |

TOTAL

($) | |

| Kevin Conroy | |

| 2021 | | |

| 962,668 | | |

| 1,266,871 | (3) | |

| 12,266,752 | (4) | |

| — | | |

| 135,949 | (5) | |

| 14,632,240 | |

| Chairman, President and | |

| 2020 | | |

| 498,976 | | |

| 1,374,450 | | |

| 12,226,355 | | |

| 5,975,741 | | |

| 45,731 | (6) | |

| 20,121,254 | |

| Chief Executive

Officer | |

| 2019 | | |

| 792,169 | | |

| 1,000,250 | (7) | |

| 14,949,979 | | |

| 1,948,193 | | |

| 25,952 | (8) | |

| 18,716,543 | |

| Jeffrey Elliott | |

| 2021 | | |

| 574,391 | | |

| 323,956 | | |

| 2,555,635 | (4) | |

| — | | |

| 6,319 | (9) | |

| 3,460,301 | |

| Executive Vice President, | |

| 2020 | | |

| 503,932 | | |

| 337,302 | | |

| 1,559,884 | | |

| 762,393 | | |

| 6,145 | (9) | |

| 3,169,656 | |

| Chief Financial Officer and | |

| 2019 | | |

| 455,385 | | |

| 230,000 | | |

| 3,772,876 | | |

| 648,884 | | |

| 16,385 | (9) | |

| 5,123,530 | |

| Chief Operating

Officer | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| D. Scott Coward | |

| 2021 | | |

| 530,262 | | |

| 299,068 | | |

| 1,865,658 | (4) | |

| — | | |

| 17,950 | (9) | |

| 2,712,937 | |

| Executive Vice President, | |

| 2020 | | |

| 485,051 | | |

| 324,450 | | |

| 1,559,884 | | |

| 762,393 | | |

| 17,100 | (9) | |

| 3,148,878 | |

| Chief Legal Officer | |

| 2019 | | |

| 483,016 | | |

| 242,050 | | |

| 3,708,412 | | |

| 616,042 | | |

| 16,800 | (9) | |

| 5,066,320 | |

| and Secretary | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Graham Lidgard | |

| 2021 | | |

| 574,336 | | |

| 323,925 | (10) | |

| 2,555,635 | (4) | |

| — | | |

| 38,778 | (11) | |

| 3,492,674 | |

| Chief Science Officer | |

| 2020 | | |

| 500,702 | (12) | |

| 335,034 | (10) | |

| 1,559,884 | | |

| 762,393 | | |

| 17,100 | (9) | |

| 3,175,113 | |

| | |

| 2019 | | |

| 477,447 | | |

| 238,750 | | |

| 3,708,412 | | |

| 616,042 | | |

| 16,800 | (9) | |

| 5,057,451 | |

| Jacob Orville(12) | |

| 2021 | | |

| 477,831 | | |

| 224,581 | | |

| 1,865,658 | (4) | |

| — | | |

| 18,035 | (9) | |

| 2,586,104 | |

| General Manager, Pipeline | |

| 2020 | | |

| 407,212 | | |

| 227,120 | | |

| 797,320 | | |

| 389,694 | | |

| 17,100 | (9) | |

| 1,838,445 | |

| | |

| 2019 | | |

| 331,731 | (13) | |

| 370,137 | (14) | |

| 3,291,960 | | |

| — | | |

| 341,800 | (15) | |

| 4,335,628 | |

| Everett Cunningham(16) | |

| 2021 | | |

| 137,500 | | |

| 540,475 | (17) | |

| 8,864,293 | (4) | |

| — | | |

| 330,285 | (18) | |

| 9,872,553 | |

| Chief Commercial

Officer | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) |

The amounts shown in this column indicate the grant date fair

value of stock awards computed in accordance with FASB ASC Topic 718. Generally, the grant date fair value is the amount that we would

expense in our financial statements over the award’s vesting schedule. For additional information regarding the assumptions made

in calculating these amounts, see the Notes to our audited, consolidated financial statements included in our Annual Report on Form 10-K

for 2021. These amounts reflect our accounting expense for these awards and do not correspond to the actual value that may be recognized

by our NEOs. |

| |

| (2) |

The amounts shown in this column indicate the grant date fair

value of option awards computed in accordance with FASB ASC Topic 718. Generally, the grant date fair value is the amount that we would

expense in our financial statements over the award’s vesting schedule. For additional information regarding the assumptions made

in calculating these amounts, see the Notes to our audited, consolidated financial statements included in our Annual Report on Form 10-K

for 2021. These amounts reflect our accounting expense for these awards and do not correspond to the actual value that may be recognized

by our NEOs. |

| |

| (3) |

Mr. Conroy elected to defer payment of 50% of this amount

pursuant to the Company’s Executive Deferred Compensation Plan. |

| |

| (4) |

The PSUs granted in 2021 are valued at target as a result of

which this amount includes PSU amounts for Mr. Conroy, Mr. Elliott, Mr. Coward, Mr. Lidgard, Mr. Orville and Mr. Cunningham of $6,133,376,

$715,548, $536,698, $715,548, $536,698 and $452,392, respectively. Assuming maximum performance, this amount would include PSU amounts

for Mr. Conroy, Mr. Elliott, Mr. Coward, Mr. Lidgard, Mr. Orville and Mr. Cunningham of $12,266,753, $1,431,096, $1,073,396, $1,431,096,

$1,073,396 and $904,783, respectively. |

| |

| (5) |

Represents (i) a matching contribution to our 401(k) plan

paid in shares of our common stock and reimbursement for annual credit card fee and (ii) $117,943 of personal travel expenses paid by the Company on behalf of Mr. Conroy pursuant to the Chartered Aircraft Policy. |

|

| |

| (6)

|

Represents (i) a matching contribution to our 401(k) plan

paid in shares of our common stock and reimbursement for annual credit card fee and (ii) $28,631 of personal travel expenses paid

by the Company on behalf of Mr. Conroy pursuant to the Chartered Aircraft Policy. |

| |

| (7)

|

Mr. Conroy elected to defer payment of 100% of this amount

pursuant to the Company’s Executive Deferred Compensation Plan. |

| |

| (8)

|

Represents (i) a matching contribution to our 401(k) plan

paid in shares of our common stock and reimbursement for annual credit card fee and (ii) $9,152 paid by the Company to Mr. Conroy

for travel, lodging and other expenses incurred in respect of Mr. Conroy’s spouse’s attendance at a Company sales conference. |

| |

| (9)

|

Represents a matching contribution to our 401(k) plan paid

in shares of our common stock and reimbursement for annual credit card fee. |

| |

| (10) |

Mr. Lidgard elected to defer payment of 75% of this amount

pursuant to the Company’s Executive Deferred Compensation Plan. |

| |

| (11)

|

Represents (i) a matching contribution to our 401(k) plan paid

in shares of our common stock and (ii) a retirement gift valued at $21,378. |

| |

| (12) |

Mr. Lidgard elected to defer payment of 35% of this amount

pursuant to the Company’s Executive Deferred Compensation Plan. |

| |

| (13) |

Mr. Orville was hired in February 2019. |

| |

| (14) |

Represents (i) $170,137 in incentive compensation bonus

and (ii) a one-time payment of $200,000 in respect of a signing bonus owed to Mr. Orville in connection with his appointment

as Senior Vice President, Pipeline in February 2019. |

| |

| (15) |

Represents (i) a matching contribution to our 401(k) plan

paid in shares of our common stock and (ii) $325,000 paid in respect of certain relocation and travel stipends paid to Mr. Orville

in connection with his appointment as Senior Vice President, Pipeline in February 2019. |

| |

| (16) |

Mr. Cunningham was hired in October 2021. |

| |

| (17) |

Represents (i) $90,475 in incentive compensation bonus

and (ii) a one-time payment of $450,000 in respect of a signing bonus owed to Mr. Cunningham in connection with his appointment

as Chief Commercial Officer in October 2021. |

| |

| (18) |

Represents (i) $270,080 paid in respect of certain relocation

and travel stipends and (ii) $60,180 paid in respect to a home security system to Mr. Cunningham in connection with his appointment

as Chief Commercial Officer in October 2021. |

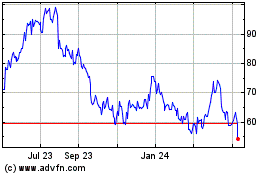

EXACT Sciences (NASDAQ:EXAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

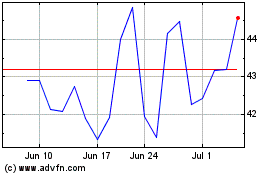

EXACT Sciences (NASDAQ:EXAS)

Historical Stock Chart

From Apr 2023 to Apr 2024