Current Report Filing (8-k)

May 19 2022 - 4:26PM

Edgar (US Regulatory)

0001386570FALSE00013865702022-05-192022-05-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 19, 2022

CHROMADEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37752 | | 26-2940963 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

10900 Wilshire Blvd. Suite 600, Los Angeles, California 90024

(Address of principal executive offices, including zip code)

(310) 388-6706

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | CDXC | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 19, 2022, ChromaDex Corporation (the “Company”) entered into an agreement (the “Agreement”) for the formation of a joint venture (the “JV”) among Crystal Lake Developments Limited (“Crystal Lake”), Pioneer Idea Holdings Limited (“Pioneer Idea”), and Hong Kong Taikuk (China) Group Ltd (“Taikuk”). The purpose of the JV will be to commercialize Tru Niagen® and other products containing nicotinamide riboside to be developed by the Company in the ordinary course (the “Products”) in Mainland China and its territories, excluding Hong Kong, Macau and Taiwan (the “Territory”). At the closing of the formation of the JV (the “Closing”) the Company will license to the JV certain inventions and trademarks relating to the Products and will exclusively own any invention developed by the JV that incorporates such intellectual property. The Agreement will have an initial term of 20 years, unless earlier terminated. The Closing is subject to certain customary closing conditions and is expected by the end of the third quarter of 2022.

Crystal Lake, Pioneer Idea and Taikuk have each agreed to contribute $1.8 million, $1.2 million and $1.0 million, respectively into the JV. In addition, the Company has agreed to pay $1.0 million to Taikuk and Taikuk will receive an additional 5% non-voting equity interest in the JV for introducing the parties. Following the closing, each of the parties will hold the following interest in the JV: the Company (71%), Crystal Lake (10.8%), Pioneer Idea (7.2%) and Taikuk (a 11% non-voting interest). The Company will have the right to elect three of the five directors in the JV, and Pioneer Idea, has the right to elect the other two directors, with each director having one vote with the exception of certain material corporate actions which will require unanimous approval of the board of the JV. Crystal Lake is indirectly wholly-owned by Li Ka Shing, and Pioneer Idea is indirectly owned by Solina Chau, and each of Mr. Li and Ms. Chau own through affiliated entities more than 5% of the Company’s common stock. The transaction has been approved by the Audit Committee of the Company in accordance with the Company’s Related Person Transaction Policy and ChromaDex engaged third party advisors to provide certain financial advisory services related to the transaction.

Prior to being able to commercialize the Products in the Territory, the JV will have to obtain all applicable regulatory approvals, including “Blue Hat” or health food registration with the PRC State Administration for Market Regulation for Products in the name of the Company or its designee (collectively, the “Blue Hat Registration”). If the Blue Hat Registration is not obtained within 24 months of closing (which may be extended by an additional 12 months upon consent of the parties), the JV may repurchase the 11% non-voting interest given to Taikuk for $2.

In addition, at the Closing the Company will enter into a distribution agreement with China National Pharmaceutical Group Co., Ltd. (“Sinopharm”) relating to the commercialization of the Products in the Territory on Sinopharm’s cross-border platform (the “Cross Border Agreement”) and the JV will enter into a distribution agreement with Sinopharm relating to the commercialization of the Products in the Territory (the “Sinopharm Distribution Agreement”). Upon Blue Hat Registration being obtained, the business of the JV will be to market, sell and distribute the Products in the Territory. Upon completion of the Blue Hat Registration, the parties intend that the Cross Border Agreement will be assigned to the JV. Taikuk would be entitled to certain royalty payments equal to a low single digit percentage based on the Company’s and the JV’s net revenue for sales of the Products in the Territory under the Cross-Border Agreement and Sinopharm Distribution Agreement, respectively.

The foregoing description of the Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of which is attached as Exhibit 10.1 hereto.

Item 7.01 Regulation FD.

On May 19, 2022, the Company issued a press release announcing the entry into the Agreement. A copy of that press release is attached as Exhibit 99.1 this Current Report on Form 8-K.

The information in this Item 7.01 and exhibit 99.1 hereto are being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without limitation, statements with respect to the formation of the JV and the commercialization of the Products in the Territory, the entry into the agreements contemplated by the JV, including the Cross Border Agreement and the Sinopharm Distribution Agreement and, the timing of the Closing. These forward-looking statements are based upon the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with the satisfaction of customary closing conditions related to the Agreement and obtaining the Blue Hat Registration. Additional risks and uncertainties relating to the Company and its business can be found under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, as filed with the Securities and Exchange Commission and other filings submitted by the Company. Forward-looking statements speak only as of the date of this Current Report, and the Company undertakes no duty or obligation to update any forward-looking statements contained in this Current Report as a result of new information, future events or changes in its expectations after the date of this Current Report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

** Certain portions of this exhibit (indicated by asterisks) have been excluded pursuant to Item 601(b)(10) of Regulation S-K because they are both not material and are the type that the Registrant treats as private or confidential.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CHROMADEX CORPORATION |

| | |

Dated: May 19, 2022 | By: | /s/ Kevin M. Farr |

| | Name: Kevin M. Farr |

| | Chief Financial Officer (Principal Financial and Accounting Officer) |

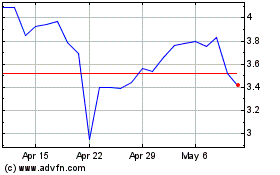

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

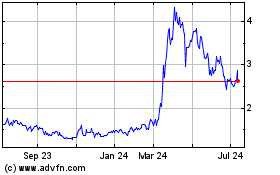

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Apr 2023 to Apr 2024