As filed with the Securities and Exchange Commission on May 19, 2022

Registration No. [•]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

| COSMOS GROUP HOLDINGS INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | | 90-1177460 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

37/F, Singapore Land Tower

50 Raffles Place

Singapore 048623

+ 65 6829 7017

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

COINLLECTIBLES INC. 2022 STOCK INCENTIVE PLAN

(Full title of the plan)

Man Chung CHAN

Chief Executive Officer

Cosmos Group Holdings Inc.

+ 65 6829 7017

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jenny Chen-Drake, Esq.

CHEN-DRAKE LAW

55 Sukhumvit 26

Khlongton, Khlong Toei, Bangkok Thailand 10110

(310) 358-0104

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Securities To Be Registered | | Amount To Be Registered (1) | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| Common Stock, $0.001 par value per share | | | 26,921,356 | (2) | | $ | 5.00 | (3) | | $ | 134,606,780 | | | $ | 12,478.05 | |

| (1) | Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement (“Registration Statement”) shall also cover any additional shares of the Registrant’s common stock, par value $0.001 per share (“Common Stock”), that become issuable in respect of the securities identified in the table above as a result of any stock dividend, stock split, recapitalization, or other similar transaction effected without the receipt of consideration that results in an increase to the number of outstanding shares of the Registrant’s Common Stock. In addition, this Registration Statement registers the resale of shares of the Registrant’s Common Stock by certain selling securityholders identified in the reoffer prospectus included in and filed with this Registration Statement, for which no additional registration fee is required pursuant to Rule 457(h)(3) under the Securities Act. |

| | |

| (2) | Represents shares of Common Stock issued pursuant to the Coinllectibles Inc. 2022 Stock Incentive Plan. |

| | |

| (3) | Pursuant to Rule 457(c) and 457(h) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price per share is $5.00, which is the average of the bid and ask prices of shares of the Registrant’s Common Stock on the over-the-counter market (“OTC”) on May 18, 2022. |

PART I

Explanatory Note

This Registration Statement on Form S-8 (this “Registration Statement”) includes a reoffer prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction C to Form S-8 and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for reoffers and resales of shares of Common Stock, par value $0.001 per share (“Common Stock”), of Cosmos Group Holdings Inc. (the “Registrant”), on a continuous or delayed basis that may be deemed to be “restricted securities” or “control securities” under the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder, that have been acquired by or are issuable to certain stockholders that are current and former employees, directors, officers, consultants, and/or advisors of the Registrant or its subsidiaries identified in the Reoffer Prospectus (the “Selling Securityholders”). The number of shares of Common Stock included in the Reoffer Prospectus are issuable to the Selling Securityholders pursuant to equity awards granted under the Coinllectibles Inc. 2022 Stock Incentive Plan (as described in the Reoffer Prospectus), and does not necessarily represent a present intention to sell any or all such shares of Common Stock. As specified in General Instruction C of Form S-8, the amount of securities to be reoffered or resold by means of the Reoffer Prospectus by each Selling Securityholder, and any other person with whom he or she is acting in concert for the purpose of selling the Registrant’s securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

REOFFER PROSPECTUS

26,921,356 Shares of Common Stock

This reoffer prospectus (“Reoffer Prospectus”) relates to the offer and sale from time to time by the selling stockholders named in this Reoffer Prospectus (the “Selling Securityholders”), or their permitted transferees, of up to 26,921,356 shares (the “Shares”) of common stock, par value $0.001 per share (“Common Stock”), of Cosmos Group Holdings Inc. (the “Company”). This Reoffer Prospectus covers the Shares issuable to the Selling Securityholders pursuant to awards granted to the Selling Securityholders under the Coinllectibles Inc. 2022 Stock Incentive Plan, as amended (“Plan”). We are not offering any of the Shares and will not receive any proceeds from the sale of the Shares offered by this Reoffer Prospectus.

Upon vesting of the shares of Common Stock offered by this Reoffer Prospectus pursuant to the terms of the relevant option agreements, and subject to the expiration of the lock-up restrictions described in this Reoffer Prospectus, the Selling Securityholders may from time to time sell, transfer or otherwise dispose of any or all of the Shares described in this Reoffer Prospectus in a number of different ways and at varying prices, including through underwriters or dealers which the Selling Securityholders may select, directly to purchasers (or a single purchaser), or through broker-dealers or agents. If underwriters or dealers are used to sell the Shares, we will name them and describe their compensation in a prospectus supplement. The Shares may be sold in one or more transactions at fixed prices, prevailing market prices at the time of a sale, prices related to the prevailing market prices over a period of time, or at negotiated prices. The Selling Securityholders may sell any, all, or none of the Shares and we do not know when or in what amount the Selling Securityholders may sell their Shares under this Reoffer Prospectus. The price at which any of the Shares may be sold, and the commissions, if any, paid in connection with any such sale, are unknown and may vary from transaction to transaction. We provide more information about how the Selling Securityholders may sell their Shares in the section titled “Plan of Distribution.” The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Securityholders will be borne by us.

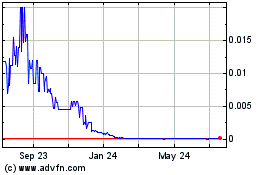

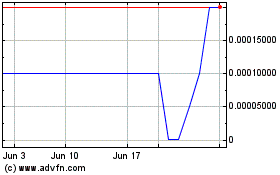

Our Common Stock is listed on The Over-The-Counter Pink (“OTC Pink”) under the symbol “COSG.” On May 18, 2022, the last quoted sale price for our Common Stock as reported on the OTC Pink was $5.00 per share.

The amount of the Shares to be offered or resold under this Reoffer Prospectus by each Selling Securityholder, and any other person with whom he or she is acting in concert for the purpose of selling our securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act of 1933, as amended (the “Securities Act”).

We are a “smaller reporting company” as defined under the U.S. federal securities laws, and, as such, we have elected to comply with certain reduced public company reporting requirements for this Reoffer Prospectus and may elect to do so in future filings.

The Securities and Exchange Commission may take the view that, under certain circumstances, the Selling Securityholders and any broker-dealers or agents that participate with the Selling Securityholders in the distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act. Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act. See the section titled “Plan of Distribution.”

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in the section titled “Risk Factors“ beginning on page 6 of this Reoffer Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Reoffer Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Reoffer Prospectus is May 19, 2022.

TABLE OF CONTENTS

REOFFER PROSPECTUS

ABOUT THIS REOFFER PROSPECTUS

This Reoffer Prospectus is part of a registration statement that we filed with the SEC. Before you invest, you should carefully read this Reoffer Prospectus, all information incorporated by reference herein and the additional information described under “Where You Can Find More Information” and “Information Incorporated By Reference.” These documents contain information you should consider when making your investment decision. To the extent that any statement that we make in this Reoffer Prospectus is inconsistent with statements made in any documents incorporated by reference, the statements made in this Reoffer Prospectus will be deemed to modify or supersede those made in such documents incorporated by reference; however, if any statement in one of these documents is inconsistent with a statement in another document having a later date and that is incorporated by reference herein, the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement or to any document that is incorporated by reference in this Reoffer Prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained or incorporated by reference in this Reoffer Prospectus and the documents incorporated by reference herein. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this Reoffer Prospectus, the documents incorporated by reference herein and any free writing prospectus we provide you is accurate only as of the date on those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this Reoffer Prospectus, including the documents incorporated by reference herein, when making your investment decision. You should also read and consider the information in the documents we have referred you to in the sections of this Reoffer Prospectus entitled “Where You Can Find More Information” and “Information Incorporated By Reference.” The distribution of this Reoffer Prospectus and the offering of the Common Stock in certain jurisdictions may be restricted by law. Persons outside the United States (the “U.S.”) who come into possession of this Reoffer Prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Common Stock and the distribution of this Reoffer Prospectus outside the U.S. This Reoffer Prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this Reoffer Prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless otherwise indicated, information contained in this Reoffer Prospectus or the documents incorporated by reference herein concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this Reoffer Prospectus and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the SEC, on April 15, 2022 (the “Annual Report”), which is incorporated by reference into this Reoffer Prospectus. These and other important factors could cause our future performance to differ materially from our assumptions and estimates. See the section of this Reoffer Prospectus entitled “Special Note Regarding Forward-Looking Statements.”

Our trademarks include, without limitation, our name and corporate logo. This Reoffer Prospectus, any applicable prospectus supplement, or any documents incorporated by reference may contain references to the Company’s trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Reoffer Prospectus, any applicable prospectus supplement, or any documents incorporated by reference, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate in any way that the Company will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensor to these trademarks and trade names. The Company does not intend the use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of the Company by, any other entity.

REOFFER PROSPECTUS SUMMARY

This summary highlights certain information about us and selected information contained elsewhere in or incorporated by reference into this Reoffer Prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our Common Stock. For a more complete understanding of our company, we encourage you to read and consider carefully the more detailed information in this Reoffer Prospectus, including the information incorporated by reference into this Reoffer Prospectus and the information referred to under the heading “Risk Factors” in this Reoffer Prospectus on page 8 and in the documents incorporated by reference into this Reoffer Prospectus.

Unless the context indicates otherwise, as used in this Reoffer Prospectus, the terms “COSG,” “the Company,” “we,” “us” and “our” refer to Cosmos Group Holdings Inc., a Nevada corporation, and its subsidiaries on a consolidated basis. Where reference to a specific entity is required, the name of such specific entity will be referenced.

About Cosmos Group Holdings Inc.

Cosmos Group Holdings Inc. is a Nevada holding company with no operations of its own. Its operations are conducted through subsidiaries based in Singapore and Hong Kong. Cosmos Group Holdings Inc., through its subsidiaries, is engaged in two business segments: (i) the physical arts and collectibles business, and (ii) the financing/money lending business.

Through our physical arts and collectibles business, we provide authentication, valuation and certification (“AVC”) service, sale and purchase, hire purchase, financing, custody, security and exhibition (“CSE”) services to art and collectibles buyers through traditional methods as well as through leveraging blockchain technology through the creation of Digital Ownership Tokens (“DOTs”). We initially intend to focus on customers located in Hong Kong and expand throughout Asia and the rest of the world.

We conduct our DOT operations from Singapore. In Singapore, cryptocurrencies and the custodianship of such cryptocurrencies are not specifically regulated. Cryptocurrency exchanges and trading of cryptocurrencies are legal, but not considered legal tender. To the extent that cryptocurrencies or tokens are considered “capital market products” such as securities, spot foreign exchange contracts, derivatives and the like, they will be subject to the jurisdiction of the Monetary Authority of Singapore (“MAS”), Securities and Futures Act, anti-money laundering and combating the financing of terrorism laws and requirements. To the extent that tokens are deemed “digital payment tokens,” they will be subject to the Payment Services Act of 2019 which, among other things, require compliance with anti-money laundering and combating the financing of terrorism laws and requirements. According to the Payment Services Act of 2019, “digital payment token” means any digital representation of value (other than an excluded digital representation of value) that (a) is expressed as a unit; (b) is not denominated in any currency, and is not pegged by its issuer to any currency; (c) is, or is intended to be, a medium of exchange accepted by the public, or a section of the public, as payment for goods or services or for the discharge of a debt; (d) can be transferred, stored or traded electronically; and (e) satisfies such other characteristics as the Authority may prescribe. Our DOTs, therefore, are not securities or digital payment tokens subject to these acts.

We receive fiat and cryptocurrency from the sale of art and collectibles and collection of transaction fees derived from the secondary and subsequent sales of the collectibles. In order to minimize the risk of price fluctuation in cryptocurrency, after we receive the cryptocurrencies we will recognize the value by immediately exchanging them into US dollar or stable currencies that are pegged with US dollar.

We conduct our financing/money lending business through our Hong Kong subsidiaries which are licensed under Hong Kong’s Money Lenders Ordinance. We primarily provide unsecured personal loan financings to private individuals. We also have a small portfolio of mortgage loans. Revenue is generated from interest received from the provision of loans to private individual customers.

Cosmos Group Holdings Inc. and our Hong Kong subsidiaries are not required to obtain permission from the Chinese authorities including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to operate or to issue securities to foreign investors. However, in light of the recent statements and regulatory actions by the People’s Republic of China (“the PRC”) government, such as those related to Hong Kong’s national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, we may be subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that such approvals are not required, or that applicable laws, regulations or interpretations change such that we are required to obtain approvals in the future.

There are significant legal and operational risks associated with our operations being in Hong Kong. We are subject to risks arising from the legal system in China where the Chinese government can change the rules and regulations in China and Hong Kong, including the enforcement and interpretation thereof, at any time with little to no advance notice including without limitation, the risk that that the PRC government could disallow our holding company structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. We are subject to operational risks including the risk of future actions by the Chinese government where the Chinese government can intervene in our operations at any time with little to no advance notice, and adversely affect our ability to carry on our current business. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the Chinese Securities Regulatory Commission, if we fail to comply with such rules and regulations, which would likely adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board, which would likely cause the value of our securities to significantly decline or become worthless.

For a detailed description of the risks facing the Company and associated with our operations in Hong Kong, please refer to “Risk Factors – Risk Factors Relating to Doing Business in Hong Kong.” set forth in the Annual Report.

Corporate History

We were incorporated in the state of Nevada on August 14, 1987, under the name Shur De Cor, Inc. and engaged in developing certain mining claims. In April 1999, Shur De Cor merged with Interactive Marketing Technology, a New Jersey corporation that was engaged in the business of developing and direct marketing of consumer products. As the surviving company, Shur De Cor changed its name to Interactive Marketing Technology, Inc. Shur De Cor’s then management resigned and the management of Interactive New Jersey became the Company’s management. The prior management of Shur De Cor retained Shur De Cor’s business and assets. After that acquisition, the Company, through a wholly owned subsidiary, IMT’s Plumber, Inc., produced, marketed, and sold a licensed product called the Plumber’s Secret, which was discontinued in fiscal 2001. In May 2002, the Company ceased to actively pursue its product development and marketing business and actively sought to either acquire a third party, merge with a third party or pursue a joint venture with a third party in order to re-enter its former business of development and direct marketing of proprietary consumer products in the United States and worldwide.

On November 17, 2004, the Company acquired MPL, a company organized under the laws of the British Virgin Islands, and its subsidiaries in accordance with the terms of a Share Exchange Agreement executed by the parties (the “2004 Agreement”). In connection with the acquisition, the Company issued an aggregate of 109,623,006 shares of its common stock to Imperial International Limited, a company incorporated under the laws of the British Virgin Islands (“Imperial”), the sole shareholder of MPL, in exchange for 100% of the issued and outstanding shares of MPL capital stock (the “2004 Share Exchange”). Upon completion of the share exchange, MPL became the Company’s wholly owned subsidiary and the Company’s former owner transferred control of the Company to Imperial. The Company relied on Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Act”), in regard to the shares that we issued pursuant to the 2004 Share Exchange. The Company treated this transaction as a qualified “business combination” as defined by Rule 501(d). The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D promulgated under, the Act in issuing the Company’s securities.

In connection with the 2004 Share Exchange, the Company: (i) changed its name from Interactive Marketing Technology, Inc. to China Artists Agency, Inc.; (ii) obtained a new stock symbol, “CAAY”, and CUSIP Number, effective on December 21, 2004; (iii) increased its authorized common stock to 200,000,000 shares; (iv) effectuated a 1 for 1.69 reverse stock split; and (v) spun off the Company’s existing business into a separate public company, All Star Marketing, Inc., a Nevada corporation (“All Star”). All Star was formed as a wholly owned subsidiary of the Company. The Spin-off was satisfied by means of a pro-rata share dividend to the Company’s shareholders of record as of December 10, 2004. The purpose of the Spin-Off was to allow the subsidiary to operate as a separate public company and raise working capital through the sale of its own equity. This allowed the Company’s management to focus on its business, while at the same time, allowing the spun-off company to have greater exposure by trading as an independent public company. Additionally, the shareholders and the market would then more easily identify the results and performance of the Company as a separate entity from that of All Star. In August 2005, the Company changed its name to China Entertainment Group, Inc. and effective August 9, 2005, obtained a new stock symbol “CGRP”, and CUSIP Number.

Effective July 22, 2010, the Company merged with Safe and Secure TV Channel, LLC, a Delaware limited liability company (the “Merger”). In connection with the Merger, the management of the Company resigned and was replaced by the management and principals of Safe and Secure TV Channel, LLC. The holders of interests in Safe and Secure TV Channel, LLC exchanged their interests for approximately 50.2% of the issued and outstanding stock of the Company. In September 2010, the Company effectuated a 9.85 for one stock split to shareholders of record as of August 23, 2010. After the Merger, the Company became a television network and multimedia information and distribution company focused on serving the homeland security and emergency preparedness industry.

On February 15, 2016, the Company sold to Asia Cosmos Group Limited, a private limited liability company incorporated under the laws of British Virgin Islands (“ACOSG”), 10,000,000 shares of its common stock at a per share price of $0.027. ACOSG’s sole shareholder is Miky Wan. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG. In connection with the private placement to ACOSG, a change of control occurred and Bryan Glass resigned from his position as President, Secretary, Treasurer and Chairman of the Company.

Miky Wan was appointed to serve as Chief Executive Officer, Chief Operating Officer, President and Director, effective February 19, 2016.

Effective February 26, 2016, the Company changed its name to Cosmos Group Holdings Inc. and filed a Certificate of Amendment to such effect with the Nevada Secretary of State. The name change and the related stock symbol change to “COSG” were approved by the Financial Industry Regulatory Authority on March 31, 2016. The Company also increased the number of its authorized common stock, par value $0.001, from 90,000,0000 shares to 500,000,000 and its preferred stock, par value $0.001, from 10,000,000 to 30,000,000 shares.

On January 13, 2017, the Company sold 200,000,000 shares of its common stock to ACOSG at a per share price of $0.001 per share for aggregate consideration of US $200,000. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG.

Acquisition of Lee Tat, Our Logistics Business

On May 12, 2017, the Company acquired all of the issued and outstanding shares of Lee Tat from Mr. Koon Wing Cheung, Lee Tat’s sole shareholder, in exchange for 219,222,938 shares of its issued and outstanding common stock. In connection with the Lee Tat acquisition, Miky Wan resigned from her positions as Chief Executive Officer and Chief Operating Officer and Koon Wing Cheung and Yongwei Hu were appointed to serve as our Chief Executive Officer and Chief Operating Officer, respectively, and also as directors of the Company. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to the shareholders of Lee Tat.

Acquisition and Rescission of Acquisition of HKHL

On July 19, 2019, the Company acquired 5,100 Ordinary Shares of Hong Kong Healthtech Limited, a limited company organized under the laws of Hong Kong (“HKHL”), from Wing Lok Jonathan So pursuant to the terms of a Share Exchange Agreement (the “Share Exchange Agreement”). Such securities represented approximately 51% of the issued and outstanding securities of HKHL. As consideration, the Company issued 6,232,951 shares of its common stock, at a per share price of US$8.99. As a result of such acquisition, the Company entered into the AI Education business of developing and delivering educational content.

On December 27, 2019, the parties mutually terminated the Share Exchange Agreement and IP License Agreement. As a result, 5,100 Ordinary Shares of HKHL were returned to Wing Lok Jonathan So and the 6,232,951 shares of our common stock issued in exchange therefor were returned to us for cancellation. In connection with the termination, on December 30, 2019, Kai Chi Wong resigned from his position as Chief Operating Officer of the Company. Koon Wing Cheung transferred to Kai Chi Wong 215,369 shares of Common Stock of the Company as a token of appreciation of Mr. Wong’s contribution to the Company.

The Company ultimately exited from the AI Education business in the first quarter of 2020. As a result,

| | · | The Employment Agreement, dated July 19, 2019, by and between Cosmos Group Holdings Inc. and Wing Lok Jonathan So was terminated by the parties thereto effective on March 31, 2020, and Mr. Tze Wai Albert Yip resigned from his position as the Chief Financial Officer, effective on 30 April 2020. |

| | | |

| | · | Syndicate Capital (Asia) Limited returned 1,503,185 shares of the Company’s common stock (of the 2,149,293, shares previously transferred to Syndicate Capital (Asia) Limited from Koon Wing Cheung), with the balance of the 646,108 shares retained by Syndicate Capital (Asia) Limited as consideration for Mr. Tze Wai Albert Yip’s contributions to the Company. |

Change in Control

On June 14, 2021, Asia Cosmos Group Limited, an entity controlled by our former Chief Executive Officer, and Koon Wing Cheung agreed to sell 6,230,618 and 8,149,670 shares, respectively, of our common stock to Chan Man Chung for a total purchase price of four hundred twenty thousand dollars (US$420,000). The common stock being sold constitutes sixty-six and seventy-seven hundredth percent (66.77%) of the issued and outstanding shares of our common stock. The sellers relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to Dr. Chan. The funds came from the personal funds of Dr. Chan, and was not the result of a loan. The closing occurred June 28, 2021.

In connection with such sale, Miky Wan, our former CEO, President and CFO resigned from her positions as a director and sole executive officer of the Company. Concurrently therewith, Messrs. Chan Man Chung, Lee Ying Chiu Herbert and Tan Tee Soo were appointed to the Company’s Board of Directors and Chan Man Chung was appointed to serve as the CEO, CFO and Secretary of the Company.

Acquisition of Massive Treasure Limited and Entities

On June 17, 2021, the Company entered into a Share Acquisition Agreement (the “Share Acquisition Agreement”), by and among the Company, Massive Treasure Limited (“Massive Treasure”), a British Virgin Islands corporation, and the holders of ordinary shares of Massive Treasure. Under the terms and conditions of the Share Acquisition Agreement, the Company offered to issue 1,078,269,470 shares of common stock of the Company, in consideration for all the issued and outstanding shares in Massive Treasure. Lee Ying Chiu Herbert, our director, is the beneficial holder of 47,500 common shares, or 95%, of the issued and outstanding shares of Massive Treasure. The Company will also issue 55,641,014 shares to complete the acquisitions of 12 business entities with Massive Treasure has signed.

These acquisitions consummated on September 17, 2021, with 800,000,000 shares of common stock pending to be issued to Lee Ying Chiu Herbert.

Acquisition of Art Collectibles

Recent Purchases of Collectibles and Acquisition of subsidiaries

On July 23, 2021, the Company and Lee Ying Chiu Herbert, our director, entered into a Sale and Purchase Agreement pursuant to which the Company agreed to purchase Fifty-Five (55) sets of art collectibles for HK$10,344,000, payable through the issuance of 180,855 shares of common stock of the Company (the “Shares”). The sale consummated on August 13, 2021. It is our understanding that Dr. Lee is not a U.S. Person within the meaning of Regulations S. Accordingly, the Shares were sold pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Regulation S promulgated thereunder.

On October 15, 2021, Massive Treasure, a subsidiary of Cosmos Group Holdings Inc., the Company, NFT Limited (“NFT”), a British Virgin Island limited liability company, and the shareholders of NFT (collectively, the “NFT Shareholders”) agreed to entered into a Share Exchange Agreement Version 2021001 (the “Agreement”) which is available on the web site of http://www.coinllectibles.art, pursuant to which Massive Treasure agreed to acquire 51% of NFT through the issuance of 2,350,229 shares of common stock of the Company (the “Shares”). The specifics of such share exchange are further set forth in that certain Confirmation dated October 15, 2021, by and among the Shareholders, NFT, the Company and Massive Treasure (the “Confirmation”). The consummation of the Agreement occurred upon the issuance of the Shares to the NFT Shareholders on October 22, 2021. NFT beneficially owns Talk+, a messaging and cryptocurrency-focused mobile application which seeks to simplify the crypto usage experience by allowing users to send crypto through instant messages to other individuals. We hope that the inclusion of Talk+ will enable us to attract more non-crypto native users and broaden our community reach.

On October 25, 2021, Coinllectibles Private Limited (“Coinllectibles”), a subsidiary of Cosmos Group Holdings Inc., and the Company entered into two Sale and Purchase Agreements (the “Agreements”) with two artists, pursuant to which Coinllectibles agreed to purchase collectible art items for £260,000 and US$100,000, payable through the issuance of 43,633 and 12,500 shares of common stock of the Company respectively, at a per share price of $4.00, and £130,000 and US$50,000 in cash payable after the respective collectible art item has been sold by Coinllectibles. The consummation of the Agreements occurs upon the issuance of the Shares to the respective artists on October 29, 2021.

On January 14, 2022, the Company filed an amendment to its Articles of Incorporation to: (i) Change the Company’s name to Coinllectibles Inc.; (ii) Increase the Company’s authorized capital from 530,000,000 to 5,030,000,000 shares, consisting of 5,000,000,000 shares of common stock, par value $0.001, and 30,000,000 shares of preferred stock, par value $0.001; and (iii) Elect NOT to be governed by Sections NRS 78.378 to 78.3792 inclusive of the Nevada Revised Statutes. The foregoing corporate actions will become effective once the Company has received FINRA approval of such actions.

On February 10, 2022, we consummated the acquisition of 80% of the issued and outstanding securities of Grand Gallery Limited, a Hong Kong limited liability company engaged in the business of selling traditional art and collectible pieces, through the issuance of 153,060 shares of our common stock, at a valuation of $4.00 per share. We believe that this acquisition will strengthen our DOT business by expanding our access to buyers of arts and collectibles.

We entered into an Equity Purchase Agreement with Williamsburg Venture Holdings, LLC, a Nevada limited liability company (“Investor”), pursuant to which the Investor agreed to invest up to Thirty Million Dollars ($30,000,000) over a 36-month period in accordance with the terms and conditions of that certain Equity Purchase Agreement, dated as of December 31, 2021, by and between us and the Investor (the “Equity Purchase Agreement”). During the term, the Company shall be entitled to put to the Investor, and the Investor shall be obligated to purchase, such number of shares of the Company’s common stock and at such price as are determined in accordance with the Equity Purchase Agreement. The per share purchase price for the Williamsburg Put Shares will be equal to 88% the lowest traded price of the Common Stock on the principal market during the five (5) consecutive trading days immediately preceding the date which Williamsburg received the Williamsburg Put Shares as DWAC Shares in its brokerage account (as reported by Bloomberg Finance L.P., Quotestream, or other reputable source).

In connection with the Equity Purchase Agreement, the parties also entered into a Registration Rights Agreement (the “Registration Rights Agreement”) pursuant to which the Company agreed to register with the SEC the common stock issuable under the Equity Purchase Agreement, among other securities.

The foregoing descriptions of the Equity Purchase Agreement and the Registration Rights Agreement are qualified in their entirety by reference to the Investment Agreement and the Registration Rights Agreement, which are filed as Exhibits 10.1 and 10.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on January 6, 2022.

Our principal executive offices are located at 37/F, Singapore Land Tower, 50 Raffles Place, Singapore 048623, and its telephone number is + 65 6829 7017. Our website address is www.coinllectibles.art. The information on, or that can be accessed through, our website is not part of this Reoffer Prospectus, and you should not consider information contained on our website in deciding whether to purchase shares of our Common Stock. We have included our website address in this prospectus solely as an inactive textual reference.

Smaller Reporting Company

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, or (ii) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our Common Stock held by non-affiliates exceeds $700 million as of the prior June 30.

THE OFFERING

The following is a brief summary of certain terms of this offering.

| Common Stock offered by the Selling Securityholders | | 26,921,356 |

| Securities being offered by the Company | | None |

| Use of proceeds | | We will not receive any proceeds from the sale or other disposition of the shares of Common Stock offered by this Reoffer Prospectus. All of the proceeds from the sale or other disposition of the shares of Common Stock offered by this Reoffer Prospectus will be received by the Selling Securityholders selling such shares. Upon exercise of the options, we will receive proceeds from the exercise of such options. |

| Risk factors | | Investing in our Common Stock involves a high degree of risk. Please read the information contained in and incorporated by reference under the heading “Risk Factors” on page 5 of this Reoffer Prospectus and under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus. |

| OTC Pink symbol | | Our Common Stock is quoted on the OTC Pink under the symbol “COSG.” |

RISK FACTORS

Investing in our Common Stock involves risk. Before deciding whether to invest in our Common Stock, you should consider carefully the risks and uncertainties described below. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K, which is on file with the SEC and is incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. If any of these risks actually occurs, our business, business prospects, financial condition or results of operations could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to This Offering and Our Common Stock

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock, or securities convertible or exchangeable into Common Stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

We do not intend to pay dividends on our Common Stock, so any returns will be limited to the value of our Common Stock.

We currently anticipate that we will retain any future earnings to finance the continued development, operation and expansion of our business. As a result, we do not anticipate declaring or paying any cash dividends or other distributions in the foreseeable future. Further, if we were to enter into a credit facility or issue debt securities or preferred stock in the future, we may become contractually restricted from paying dividends. If we do not pay dividends, our Common Stock may be less valuable because stockholders must rely on sales of their Common Stock after price appreciation, which may never occur, to realize any gains on their investment.

The sale of our Common Stock in any future sales of our Common Stock may depress our stock price and our ability to raise funds in new stock offerings.

Sales of our Common Stock in the public market could lower the market price of our Common Stock. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that our management deems acceptable, or at all.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Reoffer Prospectus and the documents incorporated by reference into this Reoffer Prospectus may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements are statements other than historical facts and relate to future events or circumstances or our future performance, and they are based on our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. These forward-looking statements include statements about, among other things, our future financial and operating performance, our future cash flows and liquidity and our growth strategies, as well as anticipated trends in our business and industry.

We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “may,” “plan,” “predict,” “believe,” “possible,” “should” and similar words or expressions are intended to identify forward-looking statements although not all forward-looking statements contain these identifying words. These forward-looking statements include statements about, among other things:

| | · | developments, projections and trends relating to us, our competitors and our industry; |

| | · | our strategic plans for our business; |

| | · | our expectations regarding the impact of the COVID-19 pandemic on our business; |

| | · | our operating performance, including our ability to achieve equal or higher levels of revenue and achieve or grow profitability; |

| | · | our ability to strengthen our existing base of customers by maintaining or increasing demand from these customers; |

| | · | our use of technology and ability to prevent security breaches, loss of data and other disruptions; |

| | · | our ability to effectively manage any growth we may experience, including expanding our infrastructure, developing increased efficiencies in our operations and hiring additional skilled personnel in order to support any such growth; |

| | · | our ability to attract, retain and motivate key scientific and management personnel; |

| | · | our expectations regarding our ability to obtain and maintain protection of our trade secrets and other intellectual property rights and not infringe the rights of others; |

| | · | our expectations regarding our future expense levels and our ability to appropriately forecast and plan our expenses; |

| | · | our expectations regarding our future capital requirements and our ability to obtain additional capital if and when needed; and |

| | · | the impact of the above factors and other future events on the market price of our Common Stock. |

All forward-looking statements reflect management’s present assumptions, expectations and beliefs regarding future events and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed in or implied by any forward-looking statements. These risks and uncertainties include those described under the heading “Risk Factors” contained in this Reoffer Prospectus, any related free writing prospectus, and in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC. In light of these risks and uncertainties, these forward-looking events and circumstances may not occur, and actual results could differ materially and adversely from those described in or implied by any forward-looking statements we make. Although we have based our forward-looking statements on assumptions and expectations we believe are reasonable, we cannot guarantee future results, levels of activity, performance or achievements or other future events. Moreover, we operate in a competitive and rapidly evolving industry and new risks emerge from time to time. It is not possible for us to predict all of the risks we may face, nor can we assess the impact of all factors on our business or the extent to which any factor or combination of factors could cause actual results to differ from our expectations. As a result, forward-looking statements should not be relied on or viewed as predictions of future events, and such forward-looking statements should be read with the understanding that actual future results, levels of activity, performance and achievements may be materially different than our current expectations. Given these risks, uncertainties and other important factors, you should not place undue reliance on these forward-looking statements. You should carefully read this Reoffer Prospectus and any related free writing prospectus, together with the information incorporated herein and therein by reference as described under the headings “Where You Can Find More Information” and ”Incorporation of Certain Information By Reference,” completely and with the understanding that our actual future results may be materially different from what we expect.

These forward-looking statements represent our estimates and assumptions only as of the date made. Any such forward-looking statements are not guarantees of future performance and actual results, developments and business decisions may differ from those contemplated by such forward-looking statements. We undertake no duty to update these forward-looking statements after the date of this Reoffer Prospectus, except as required by law, even though our situation may change in the future. You should carefully consider other information set forth in reports or other documents that we file with the SEC. We qualify all of our forward-looking statements by these cautionary statements.

USE OF PROCEEDS

The Selling Securityholders will receive all of the proceeds from the sale or other disposition of the shares of our Common Stock covered by this Reoffer Prospectus. We are not selling any securities under this Reoffer Prospectus and will not receive any proceeds from the sale or other disposition of the shares of our Common Stock covered by this Reoffer Prospectus. Upon exercise of the options, we will receive proceeds from the exercise of such options.

SELLING SECURITYHOLDERS

This Reoffer Prospectus covers the reoffer and resale by the Selling Securityholders or their transferees, pledgees, assignees, distributees, donees or other successors-in-interest, of an aggregate of up to 26,921,356 shares of our Common Stock that were previously acquired by the grant of restricted stock units or the exercise of outstanding stock options under the Coinllectibles Inc. 2022 Incentive Stock Plan (the “Plan”).

The following table sets forth, as of the date of this Reoffer Prospectus, certain information regarding certain of the Selling Securityholders, the shares of our Common Stock that may be reoffered and resold by them pursuant to this Reoffer Prospectus, and other shares of our Common Stock beneficially owned by them. Each of the Selling Securityholders has voting and investment control power over his or her shares. Although a person’s name is included in the table below, neither that person nor we are making an admission that the named person is our “affiliate.”

The Selling Securityholders may offer shares of our Common Stock under this Reoffer Prospectus on a continuous or delayed basis, and may elect to sell none, some or all of the shares set forth below. This Reoffer Prospectus does not constitute a commitment by the Selling Securityholders to sell all or any of the stated number of their shares, and the actual number of shares offered and sold will be determined from time to time by each Selling Securityholder at his or her sole discretion. However, for the purposes of the table below, we have assumed that, after the completion of this offering, all shares offered by this Reoffer Prospectus have been sold and are no longer held by the Selling Securityholders. In addition, a Selling Securityholder may have sold, transferred or otherwise disposed of all or a portion of such Selling Securityholder’s shares since the date of the information in the following table.

The amount of the Shares to be offered or resold under this Reoffer Prospectus by each Selling Securityholder, and any other person with whom he or she is acting in concert for the purpose of selling our securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

Information concerning the Selling Securityholders may change from time to time and changed information will be presented in a supplement to this Reoffer Prospectus if and when required. If, subsequent to the date of this Reoffer Prospectus, we grant additional shares to the Selling Securityholders or to other affiliates under the Plan, we may supplement this Reoffer Prospectus to reflect such additional shares to the Selling Securityholders and/or the names of such affiliates and the amounts of shares to be reoffered by them.

The percentages appearing in the column entitled “Shares of Common Stock to be Beneficially Owned Upon Completion of the Offering” are based on 385,241,897 shares of Common Stock issuable and outstanding as of May 18, 2022. Shares of Common Stock that may be acquired by the Selling Securityholders pursuant to previous grants under any stock or equity incentive plans of the Company, whether vested or unvested are deemed to be outstanding and to be beneficially owned by the Selling Securityholder holding such securities for the purpose of computing the percentage ownership of such Selling Securityholder but are not treated as outstanding for the purpose of computing the percentage ownership of each of the other Selling Securityholders. The actual number of shares beneficially owned prior to and after the offering is subject to adjustment and could be materially less or more than the estimated amount indicated depending upon factors, which we cannot predict at this time.

The Selling Securityholders are not required to sell any shares of our Common Stock and there is no assurance that any of the Selling Securityholders will sell any or all of the shares of our Common Stock covered by this Reoffer Prospectus. We are not aware of any agreements, arrangements or understandings with respect to the sale or other disposition of any of the shares covered hereby.

| | | Shares of Common Stock Beneficially Owned Before this Offering (2) | | | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus (3) | | | Shares of Common Stock to be Beneficially Owned Upon Completion of this Offering (4) | |

| Selling Securityholders (1) | | Number | | | Percentage | | | Number | | | Number | | | Percentage | |

| Chai Kok Young | | | 2,196,078 | | | * | | | | 2,196,078 | | | | 0 | | | | 0 | |

| Chan Chi Keung | | | 6,000,000 | | | | 1.56 | % | | | 6,000,000 | | | | 0 | | | | 0 | |

| Chan Kwan Lin | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Chan Ming Kei | | | 200,000 | | | * | | | | 200,000 | | | | 0 | | | | 0 | |

| Chung Wai Keung | | | 200,000 | | | * | | | | 200,000 | | | | 0 | | | | 0 | |

| Fu Wah | | | 8,000,000 | | | | 2.08 | % | | | 8,000,000 | | | | 0 | | | | 0 | |

| Gerald Gn Wen Chong | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Goh Te-Win, Getty | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Hui Kam Ying James | | | 7,243 | | | * | | | | 7,243 | | | | 0 | | | | 0 | |

| Julian So Han Meng | | | 588,235 | | | * | | | | 588,235 | | | | 0 | | | | 0 | |

| Kwok Ho Luen Jerry | | | 277,478 | | | * | | | | 277,478 | | | | 0 | | | | 0 | |

| Lim Hui Ming | | | 117,647 | | | * | | | | 117,647 | | | | 0 | | | | 0 | |

| Lung Yuen | | | 6,000,000 | | | | 1.56 | % | | | 6,000,000 | | | | 0 | | | | 0 | |

| Mak Pak Fai Ray | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Phang Liang Xiong | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Pwee Yek Kwan Benjamin | | | 117,647 | | | * | | | | 117,647 | | | | 0 | | | | 0 | |

| So Man Wa | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Tan Tee Soo | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Timothy Mark Toby O’Connor | | | 352,941 | | | * | | | | 352,941 | | | | 0 | | | | 0 | |

| Wong Chun Wing | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Wong Sze Man | | | 235,294 | | | * | | | | 235,294 | | | | 0 | | | | 0 | |

| Woo Peter Ping | | | 176,470 | | | * | | | | 176,470 | | | | 0 | | | | 0 | |

| Yau Chi Nap | | | 200,000 | | | * | | | | 200,000 | | | | 0 | | | | 0 | |

| Young Chi Kin Eric | | | 369,971 | | | * | | | | 369,971 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | | 26,921,356 | | | | | | | | 26,921,356 | | | | | | | | | |

| *Represents beneficial ownership of less than 1%. |

| (1) | Unless otherwise noted, the business address of each of these shareholders is c/o 37/F, Singapore Land Tower, 50 Raffles Place, Singapore 048623. |

| (2) | In computing the number of shares of Common Stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of Common Stock subject to stock options, restricted stock units or other derivative securities held by that person that are exercisable, vested or convertible as of May 18, 2022 or that will become exercisable, vested or convertible within 60 days after May 18, 2022, but we did not deem these shares outstanding for the purpose of computing the percentage ownership of any other person. |

| (3) | The numbers of shares of Common Stock reflect all shares of Common Stock acquired or issuable to a person pursuant to applicable grants previously made under the Plan irrespective of whether such grants are exercisable, vested or convertible as of May 18, 2022 or will become exercisable, vested or convertible within 60 days after May 18, 2022. |

| (4) | In computing the number of shares of Common Stock beneficially owned by a person and the percentage ownership of that person following the offering, we deemed to be outstanding all shares of Common Stock then subject to stock options, restricted stock units or other derivative securities held by that person that are vested, exercisable or convertible as of May 18, 2022 or that would become vested, exercisable or convertible within 60 days after May 18, 2022, but we did not deem these shares of Common Stock outstanding for the purpose of computing the percentage ownership of any other person. We further presumed that the person sold all shares of Common Stock eligible to be resold in this offering irrespective any applicable vesting, exercisability or conversion limitations, but retained ownership of all other shares of Common Stock beneficially owned as of May 18, 2022. |

Other Material Relationships with the Selling Securityholders

Compensation Arrangements

Each of the Selling Securityholders are parties to a Consultancy Agreement containing each Selling Securityholder’s specific terms of compensation, services to be provided and other normal and customary terms including provisions relating to confidentiality. The foregoing description of the form of Consultancy Agreement is qualified in its entirety by reference to the form of Consultancy Agreement which is filed as Exhibit 10.1 to this registration statement and incorporated herein by reference.

For more information on the compensation arrangements of our executive officers and director, see the section titled “Executive Compensation” starting on page 46 of the Annual Report filed with the SEC on April 15, 2022, which section is incorporated herein by reference.

PLAN OF DISTRIBUTION

We are registering the Shares covered by this Reoffer Prospectus to permit the Selling Securityholders to conduct public secondary trading of the Shares from time to time after the date of this Reoffer Prospectus. As used herein, references to “Selling Securityholders” includes donees, pledgees, transferees, distributees or other successors-in-interest selling shares of Common Stock received after the date of this Reoffer Prospectus from a Selling Securityholder as a gift, pledge, partnership distribution, or other transfer.

We will not receive any of the proceeds from the sale of the Shares offered by this Reoffer Prospectus. The aggregate proceeds to the Selling Securityholders from the sale of the Shares will be the purchase price of the Shares less any discounts and commissions. We will not pay any brokers’ or underwriters’ discounts and commissions in connection with the registration and sale of the Shares covered by this Reoffer Prospectus. The Selling Securityholders will pay any underwriting discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred by them in disposing of the Shares. We will bear the costs, fees and expenses incurred in effecting the registration of the Shares covered by this Reoffer Prospectus, including all registration and filing fees and fees and expenses of our counsel and our independent registered public accounting firm. The Selling Securityholders reserve the right to accept and, together with their respective agents, to reject, any proposed purchases of the Shares to be made directly or through agents.

The Shares offered by this Reoffer Prospectus may be sold from time to time to purchasers:

| | · | directly by the Selling Securityholders; |

| | | |

| | · | through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions from the Selling Securityholders or the purchasers of the Shares; or |

| | | |

| | · | through a combination of any of these methods of sale. |

Any underwriters, broker-dealers or agents who participate in the sale or distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act. As a result, any discounts, commissions or concessions received by any such broker-dealer or agents who are deemed to be underwriters will be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters are subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities under the Securities Act and the Exchange Act. The Selling Securityholders may agree to indemnify any broker, dealer, or agent that participates in transactions involving sales of the Shares against certain liabilities in connection with the offering of the Shares arising under the Securities Act. We will make copies of this Reoffer Prospectus available to the Selling Securityholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. To our knowledge, there are currently no plans, arrangements or understandings between the Selling Securityholders and any underwriter, broker-dealer or agent regarding the sale of the Shares by the Selling Securityholders.

The Shares may be sold in one or more transactions at:

| | · | fixed prices; |

| | | |

| | · | prevailing market prices at the time of sale; |

| | | |

| | · | prices related to such prevailing market prices; |

| | | |

| | · | varying prices determined at the time of sale; or |

| | | |

| | · | negotiated prices. |

These sales may be effected in one or more transactions:

| | · | through one or more underwritten offerings on a firm commitment or best efforts basis; |

| | | |

| | · | settlement of short sales entered into after the date of this prospectus; |

| | | |

| | · | agreements with broker-dealers to sell a specified number of the securities at a stipulated price per share; |

| | | |

| | · | in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| | | |

| | · | on any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale; |

| | | |

| | · | in the over-the-counter market; |

| | | |

| | · | in privately negotiated transactions; |

| | | |

| | · | in transactions otherwise than on such exchanges or services or in the over-the-counter market; |

| | | |

| | · | in options or other hedging transactions, whether through an options exchange or otherwise; |

| | | |

| | · | in distributions to members, limited partners or stockholders of Selling Securityholders; |

| | | |

| | · | through trading plans entered into by the Selling Securityholder pursuant to Rule 10b5-1 under the Exchange Act that are in place at the time of an offering pursuant to this Reoffer Prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans; |

| | | |

| | · | any other method permitted by applicable law; or |

| | | |

| | · | through any combination of the foregoing. |

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade.

At the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth the name of the Selling Securityholders, the aggregate amount of Shares being offered and the terms of the offering, including, to the extent required, (1) the name or names of any underwriters, broker-dealers or agents, (2) any discounts, commissions and other terms constituting compensation from the Selling Securityholders and (3) any discounts, commissions or concessions allowed or reallowed to be paid to broker-dealers.

The Selling Securityholders also may transfer the securities in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this Reoffer Prospectus. Upon being notified by a Selling Securityholder that a donee, pledgee, transferee, other successor-in-interest intends to sell our Shares, we will, to the extent required, promptly file a supplement to this prospectus to name specifically such person as a Selling Securityholder.

The Selling Securityholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale or other transfer. There can be no assurance that the Selling Securityholders will sell any or all the Shares under this Reoffer Prospectus. Further, we cannot assure you that the Selling Securityholders will not transfer, distribute, devise or gift the Shares by other means not described in this Reoffer Prospectus. In addition, any Shares covered by this Reoffer Prospectus that qualify for sale under Rule 144 of the Securities Act may be sold under Rule 144 rather than under this Reoffer Prospectus. The Shares may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The Selling Securityholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling Securityholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities with respect to the particular securities being distributed. This may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

Once sold under the registration statement of which this Reoffer Prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

For additional information regarding expenses of registration, see the section titled “Use of Proceeds” appearing elsewhere in this Reoffer Prospectus.

LEGAL MATTERS

The validity of the Shares offered hereby has been passed upon for us by Chen-Drake Law.

EXPERTS

The consolidated financial statements of Cosmos group Holdings Inc. and subsidiaries at December 31, 2021 and 2010, have been audited by J&S Associate, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information into this Reoffer Prospectus, which means that we can disclose important information about us by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this Reoffer Prospectus, and information that we file later with the SEC will automatically update and supersede the previously filed information. We incorporate by reference into this Reoffer Prospectus the following documents previously filed with the SEC:

| | (1) | Our Annual Report on Form 10-K (File No. 000-55793) for the fiscal year ended December 31, 2021 filed with the SEC on April 15, 2022, pursuant to Section 13(a) under the Exchange Act; |

| | | |

| | (2) | All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the period covered by the document referred to in (1) above. |

| | | |

| | (3) | The description of our Common Stock contained in our Registration Statement on Form 10-12G/A (File No. 000-55793) filed with the SEC on July 31, 2017, pursuant to Section 12(g) of the Exchange Act, as amended by the Annual Report and including any other amendments or reports filed for the purpose of updating such description. |

All documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the termination of the offering of the Shares under this Reoffer Prospectus shall be deemed to be incorporated by reference in this Reoffer Prospectus and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the SEC (including, without limitation, information furnished under Item 2.02 or Item 7.01 of Current Reports on Form 8-K and the exhibits related to such items furnished under Item 9.01) shall not be deemed incorporated by reference into this Reoffer Prospectus.

Any statement contained in this Reoffer Prospectus, or in a document incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this Reoffer Prospectus to the extent that a statement contained herein or in any subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Reoffer Prospectus.

We will provide without charge to each person, including any beneficial owner, to whom a copy of this Reoffer Prospectus is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated by reference in this Reoffer Prospectus but not delivered with the Reoffer Prospectus other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information that this Reoffer Prospectus incorporates. Requests for documents should be directed to Cosmos Group Holdings Inc., Attn: Chief Financial Officer, 37/F, Singapore Land Tower, 50 Raffles Place, Singapore 048623.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are subject to the informational reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC under the Exchange Act. Our SEC filings are available over the Internet at the SEC’s website at http://www.sec.gov. Our website address is www.coinllectibles.art. The information on, or that can be accessed through, our website is not part of this prospectus. We make available, free of charge, on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports as soon as reasonably practicable after electronically filing or furnishing those reports to the SEC. Information contained on, or that can be accessed through, our website is not a part of or incorporated by reference into this Reoffer Prospectus and the inclusion of our website address in this Reoffer Prospectus is an inactive textual reference only.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the employee benefit plans covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act. Such documents are not required to be, and are not, filed with the SEC, either as part of this Registration Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act.

Item 1. Plan Information.

Item 2. Registrant Information and Employee Plan Annual Information.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Registrant hereby incorporates by reference into this Registration Statement the following documents previously filed with the Securities and Exchange Commission (the “SEC”):

| | (1) | Our Annual Report on Form 10-K (File No. 000-55793) for the fiscal year ended December 31, 2021 filed with the SEC on April 15, 2022, pursuant to Section 13(a) under the Exchange Act; |

| | | |

| | (2) | All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the period covered by the document referred to in (1) above. |

| | | |

| | (3) | The description of our Common Stock contained in our Registration Statement on Form 10-12G/A (File No. 000-55793) filed with the SEC on July 31, 2017, pursuant to Section 12(g) of the Exchange Act, as amended by the Annual Report and including any other amendments or reports filed for the purpose of updating such description. |

All documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the termination of the offering of the Shares under this Reoffer Prospectus shall be deemed to be incorporated by reference in this Reoffer Prospectus and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the SEC (including, without limitation, information furnished under Item 2.02 or Item 7.01 of Current Reports on Form 8-K and the exhibits related to such items furnished under Item 9.01) shall not be deemed incorporated by reference into this Reoffer Prospectus.

Any statement contained in this Reoffer Prospectus, or in a document incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this Reoffer Prospectus to the extent that a statement contained herein or in any subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Reoffer Prospectus.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Chen-Drake Law has passed on the validity of the Shares offered pursuant to this Registration Statement.

Item 6. Indemnification of Officers and Directors