0001417664

true

2021

FY

--12-31

0001417664

2021-01-01

2021-12-31

0001417664

2021-12-31

0001417664

2022-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment Number One

(Mark One)

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2021

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to

_____________

Commission File No. 000-53537

VALUE EXCHANGE INTERNATIONAL, INC.

(Exact name of registrant as specified in its

charter)

| Nevada |

20-2819367 |

|

(State or other jurisdiction of incorporation

or organization) |

(I.R.S. Employer Identification No.) |

Unit 602, 6 Floor, Block B

Shatin Industrial Centre, 5-7 Yuen Shun Circuit

Shatin,N.T.,

Hong Kong SAR

(Address of Principal Executive Offices; Zip

Code)

(852) 2950 4288

(Registrant’s telephone number, including

area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading

Symbol |

Exchange

on which registered |

| NONE |

---- |

---- |

Securities registered pursuant to Section 12(g) of the Exchange

Act: Common Stock, $0.00001 par value

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨

No x

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨

No x

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes x No ¨

| Auditor PCAOB ID: 957 |

Auditor Name: Zhen

Hui Certified Public Accountants |

Auditor Location: Hong

Kong |

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or “emerging growth company”.

See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ☐ |

| Non-accelerated filer

¨ |

Smaller reporting company ☒ |

| Emerging Growth Company ☐ |

|

|

| |

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether registrant is a

shell company (as defined in Rule 12b-2 of the Act). Yes ¨

No x

As of December 31, 2021, (the last business day

of the registrant’s most recently completed fiscal year), the aggregate market value of the shares of the registrant’s common

stock held by non-affiliates was approximately $712,803. Shares of the registrant’s common stock held by each executive officer

and director and by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such

persons may be deemed to be “affiliates” of the registrant. This determination of affiliate status is not necessarily a conclusive

determination for other purposes.

As of March 31, 2022, there were 36,156,130 shares

of common stock issued and outstanding. The trading symbol of the common stock is VEII.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

Explanatory Note:

This Annual Report on Form 10-K/A Amendment

Number One (“Amendment”) is filed by Value Exchange International, Inc., a Nevada corporation, (“Company”) to:

(1) amend Item 1A. Risk Factors of the Annual Report on Form 10-K filed by the Company with the U.S. Securities and Exchange Commission

or “SEC” on April 15, 2022 (“Form 10-K”) in order to disclose additional risk factors pertaining to the Company

and its Common Stock, $0.00001 par value, (“Common Stock”) as a result of the Holding Foreign Companies Accountable Act or

“HFCAA” and related regulations adopted by the U.S. Securities and Exchange Commission or “SEC” under or in furtherance

of the HFCAA; (2) to correct a typographical error in the first paragraph of Item 9C of the Form 10-K, which correction is to insert

the missing word “not” in the last sentence of the first paragraph of Item 9C of the Form 10-K and delete an errant, orphaned

clause at the end of the last sentence of first paragraph of Item 9C; and (3) add disclosure about delinquent filers under pursuant to

Item 405 of Regulation S-K on cover page of Form 10-K. The Risk Factors stated in this Amendment describe certain related risks that

may affect companies based in or subject to laws and regulations of People’s Republic of China (“China”) or Hong Kong

SAR.

The Company is based in Hong Kong SAR and

is a U.S. holding corporation of operating subsidiaries located outside the U.S. The Company is not structured to be a primary beneficiary

of a variable interest entity or “VIE”, which is a complex structure designed to avoid Chinese restrictions on foreign investments

in certain industries.

Note: Unless the context requires otherwise,

all references to “we,” “our,” and “us” the Company and its consolidated subsidiaries. References

to “China,” and “Chinese” refers to People’s Republic of China or “PRC.” References to “Chinese

government” refers to PRC government and “Chinese laws” refers to PRC laws. Hong Kong SAR is a special administrative

region of PRC. “Exchange Act” means the Securities Exchange Act of 1934, as amended. “SEC” refers to the U.S.

Securities and Exchange Commission.

Except as otherwise expressly noted, this

Amendment does not modify or update in any way (1) the consolidated financial position, the results of operations or cash flows of the

Company, or (2) the Form 10-K; nor does it reflect events occurring after the filing of the Form 10-K, except as expressly stated below.

Among other things, forward-looking statements made in the Form 10-K have not been revised to reflect events that occurred or facts that

became known to us after the filing of the Form 10-K, and such forward-looking statements should be read in their historical context.

Furthermore, this Amendment should be read in conjunction with the Form 10-K and any subsequent filings with the SEC.

Special Note Regarding Forward Looking Statements

As used below, “you” refers to

any person reading our Form 10-K, as amended, which contains forward-looking statements that are contained principally in the sections

entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our

actual results, performance or achievements to be materially different from any future results, performances or achievements expressed

or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in

the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,”

“believes,” “hopes,” “could,” “estimates,” “expects,” “intends,”

“may,” “hopes,” “plans,” “potential,” “predicts,” “projects,”

“should,” “would” and similar expressions and variants thereof that are intended to identify forward-looking

statements. Forward-looking statements reflect Company’s current views with respect to future events and are based on assumptions

and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

These forward-looking statements include, among other things, statements relating to:

| · | our

expectations regarding growth in the information technologies industries in China, Hong Kong

SAR and Philippines or any other markets in which Company participates; |

| · | our

expectation regarding increasing demand for our products and services in China, Hong Kong

SAR, Philippines and any new markets; |

| · | any

belief that we will be able to effectively compete with our competitors and increase our

market share in the face of possible technological advances or superior resources and market

share of competitors, or aggressive pricing by our competitors; |

| · | our

expectations with respect to increased revenue growth and our ability to achieve and sustain

profitability resulting from any increases in our productivity; |

| · | our

ability to fund operations and business and product growth and the availability of sufficient,

affordable funding when required; |

| · | whether

we can expand or operate successfully in a market outside of our traditional market of China

and Hong Kong SAR; |

| · | our

ability to determine appropriate new products or services and then expand and fund our offerings

of products and services to new geographical markets and operate profitably in such new markets; |

| · | the

success and cost of new product or service initiatives in existing or new markets; |

| · | the

disruption or failure of our or those of our customers’ computer systems, networks,

information systems or technologies that we install, service or maintain as a result of computer

hacking, computer viruses, malware, “cyber-attacks,” misappropriation of data,

outages, natural disasters and other material events; |

| · | Impact

of changing laws and regulations in U.S. and China on our business and financial condition;

|

| · | continuation

of key strategic relationships, which can be essential for a small reporting company like

us; and |

| · | our

future business development, results of operations and financial condition. |

Also, forward-looking statements represent

our estimates and assumptions only as of the date of the Form 10-K, as amended. Except as required by law, we assume no obligation to

update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated

in any forward-looking statements, even if new information becomes available in the future.

Item 1A: Risk Factors.

Risks Relating to our Common Stock

Background: On December 18,

2020, the Holding Foreign Companies Accountable Act ("HFCAA") (Public Law No. 116-222, 134 Stat. 1063 (Dec. 18, 2020)) became

law. Among other things, the HFCAA requires the SEC to identify public companies that have retained a registered public accounting firm

to issue an audit report where that firm has a branch or office that: (1) is located in a foreign jurisdiction, and (2) the Public Company

Accounting Oversight Board (“PCAOB”) has determined that it is unable to inspect or investigate completely because of a position

taken by an authority in the foreign jurisdiction. PCAOB has identified several public accounting firms in China and Hong Kong SAR that

PCAOB cannot inspect or investigate completely because of a position taken by that foreign government. The PCAOB has oversight authority

over public accounting firms that audit financial results of companies subject to the Exchange Act. The PCAOB publishes a list of those

public accounting firms located outside the U.S. and that PCAOB is unable to inspect or investigate completely because of a position

taken by an authority in the foreign jurisdiction (each a “Listed Auditor”). Our auditor, Zhen Hui CPA, (“our Auditor”)

for our 2021 fiscal year audit and currently our public auditor is a Listed Auditor. Our Auditor is located in Hong Kong SAR.

The HFCAA states if the SEC determines that

we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection for the PCAOB for three

consecutive years beginning in 2021, being a Listed Auditor, the SEC shall prohibit our shares from being traded on a national securities

exchange or in the over-the counter trading market in the U.S. Accordingly, under the current law this could happen in 2024. On December

2, 2021, the SEC adopted final amendments to its rules implementing the HFCAA (the “Final Amendments”). The Final Amendments

include requirements to disclose information, including the auditor name and location, the percentage of shares of the issuer owned by

governmental entities, whether governmental entities in the applicable foreign jurisdiction with respect to the auditor has a controlling

financial interest with respect to the issuer, the name of each official of the Chinese Communist Party who is a member of the board

of the issuer, and whether the articles of incorporation of the issuer contains any charter of the Chinese Communist Party, including

the text of any such charter. See Item 9C of the Form 10-K (as revised by Item 9C below) for our disclosures under the HFCAA and Final

Amendments.

The SEC publishes a list of Exchange Act reporting

companies that retained a Listed Auditor that has issued an audit report for a fiscal year (each company listed is a “Commission

Identified Issuer” for purposes of HFCAA). If a Commission Identified Issuer has a Listed Auditor issue audit reports for three

consecutive fiscal years, being 2021, 2022 and 2023 for companies with a December fiscal year end, then the SEC will impose an initial

trading ban on the publicly traded securities of the Commission Identified Issuer in early 2024, which trading ban can be lifted if Commission

Identified Issuer retains a public auditor that is not a Listed Auditor and that public auditor issues an audit report for a fiscal year

for the Commission Identified Issuer. The SEC’s role at this stage of the process is solely to identify issuers that have used

Listed Auditors to audit their financial statements.

Our Auditor is the independent registered

public accounting firm that issues the audit report included elsewhere in our Form 10-K and conducts the audit of our annual financial

results. As an auditor of a company that has its stock traded publicly in the United States, our Auditor is registered with and supervised

by the PCAOB and is subject to laws in the United States. Under those laws, the PCAOB conducts regular inspections or audits to assess

public accounting firms acting as auditors, including our Auditor, compliance with the applicable PCAOB rules and professional standards.

Since our Auditor is located in Hong Kong SAR, a jurisdiction where the PCAOB has been unable to conduct audits and inspections completely

without the approval of the Hong Kong SAR authorities, our Auditor is not currently audited or inspected completely by the PCAOB and

is consequently a Listed Auditor.

On December 16, 2021, the PCAOB issued

the HFCAA Determination Report, according to which our Auditor is subject to the determinations that the PCAOB is unable to inspect or

investigate completely the Auditor due to a foreign authority and is located in a foreign jurisdiction (referred to as a “Listed

Auditor”). Since our Auditor has been identified by the PCAOB as a Listed Auditor, the Company has been provisionally identified

as a Commission Identified Issuer as of March 2022 and the Company anticipates that it will be identified conclusively as a Commission

Identified Issuer by the SEC after May 12, 2022. While the Company intends to engage a public auditor that is not a Listed Auditor prior

to the 2023 fiscal year annual audit, if there is no change in current status of our Auditor or changes in applicable laws, our Auditor

is currently our public auditor and is a Listed Auditor. The inability of the PCAOB to audit and investigate completely our Auditor deprives

the investors with the benefits of that audit and investigation.

The inability of the PCAOB to conduct unfettered

inspections of public accounting firms in China and Hong Kong SAR, including our Auditor, prevents the PCAOB from fully evaluating audits

and quality control procedures of our Auditor. This lack of full audit and inspection effectively deprives investors in our Common Stock

of the benefits of PCAOB oversight and inspections. The inability of the PCAOB to conduct inspections of auditors in China and Hong Kong

SAR makes it more difficult to evaluate the effectiveness of our Auditor’s audit procedures or quality control procedures as compared

to auditors outside of China and Hong Kong SAR that are subject to complete audit and investigation by the PCAOB. This limitation on

PCAOB audit and inspection could cause investors and potential investors in our Common Stock to lose confidence in our audit procedures

and reported financial information and the quality of our financial statements. This lack or loss of confidence could also not only cause

investors to avoid trading our Common Stock or sell positions in our Common Stock, but could also undermine efforts of the Company to

secure equity or debt financing, hinder any efforts to up-list the Common Stock to a national securities exchange, adversely influence

the decision of third parties to conduct business with our company, or have other adverse business or financial consequences.

Under the current version of HFCAA,

an SEC ban on trading shares of Common Stock in the U.S. could take place in early 2024 if we have a Listed Auditor (a public auditor

that cannot be completely audited and investigated by the PCAOB for three consecutive fiscal years (being 2021, 2022 and 2023)). If this

happens, there is no certainty that we will be able to list or otherwise trade our shares on a non-U.S. exchange or that a market for

our shares of Common Stock will develop outside of the U.S. The ban on trading of our shares in, or the threat of their being banned

from trading in, the U.S. may materially and adversely affect the value of our Shareholders’ investment.

If the Company is subject to a trading ban

in the United States, it may be unable to list its Common Stock on a non-U.S. public stock market, or even if listed on a non-U.S. public

stock market, that the Common Stock would enjoy any liquidity or investor support. The Company’s Common Stock is only quoted and

traded on the QB Venture Market. The Company is a “penny stock” under SEC rules and has no primary market maker or extensive

institutional investor support for its Common Stock in the QB Venture Market. As such, the Common Stock may be difficult to establish

or be unable to be established on a foreign public stock market or quotation system. The absence of a public market for the Common Stock

could render the shares of Common Stock an illiquid, potentially worthless investment.

The HFCAA or other efforts to increase U.S.

regulatory access to audit information could cause investor uncertainty for affected issuers, like our company, and the market price

of the shares could be adversely affected. Additionally, whether the PCAOB will be able to conduct inspections of our Auditor before

the issuance of our financial statements to be included in our Form 10-K for the year ending December 31, 2023, which is due by March

31, 2024, or at all, is subject to substantial uncertainty and depends on factors out of our control and our Auditor’s control.

If our Auditor is unable to be inspected in time, and we do not engage a public auditor who is not a Listed Auditor prior to the 2023

annual audit, we could be delisted from the QB Venture Market in 2024 and not eligible for trading on other tiers of the over the counter

markets. A ban on trading of our Common Stock would substantially impair your ability to sell or purchase our shares when you wish to

do so, and the risk and uncertainty associated with the ban would have a negative impact on the price of our shares of Common Stock.

The ban on trading would also significantly affect our ability to raise capital on terms acceptable to us, or at all, which would have

a material adverse impact on our business, financial condition, and prospects. If our shares are prohibited from trading in the U.S.,

there is no certainty that we will be able to list on a non-U.S. exchange or that a market for our shares will develop outside of the

U.S.

While the Company intends to engage an auditor

who is audited and investigated completely by the PCAOB in prior to fiscal year 2023, the Company has not engaged such an auditor as

of the date of this Amendment. The Company, as a smaller reporting company, may experience delays or difficulties in engaging a public

auditor who can be audited and investigated completely by the PCAOB and also audit our operations, which operations are located in China,

Hong Kong SAR and Manila, Philippines. We are investigating our options in respect of locating a suitable auditor in order to avoid suffering

an SEC ban on trading of the shares of the Common Stock in 2024.

Efforts to increase U.S. Regulatory

access to information about companies in China or Hong Kong SAR in order to enhance transparency for investors in U.S. corporations traded

on U.S. stock markets but with substantial operations in China or Hong Kong SAR, like the Company, and Chinese opposition and reaction

to those U.S. efforts could foster additional measures to restrict access to U.S. capital markets by such corporations or expedite delisting

of securities of such corporations from U.S. stock markets and quotation systems. The potential enactment of the Accelerating Holding

Foreign Companies Accountable Act, if it is enacted into law in the U.S., would decrease the number of non-inspection years from three

to two years under HFCAA, thus reducing the time period before our shares of Common Stock may be banned from being traded in the U.S.

If this bill were enacted as proposed, and we have a Listed Auditor for fiscal years 2021 and 2022, our shares may be banned from trading

in the U.S. in early 2023, not early 2024.

On June 22, 2021, the U.S. Senate passed a

bill known as the Accelerating Holding Foreign Companies Accountable Act, to amend Section 104(i) of the Sarbanes-Oxley Act of 2002 (15

U.S.C. 7214(i)) (“Proposed Law”) to prohibit securities of any registrant from being listed on any of the U.S. securities

exchanges or traded over-the-counter if the auditor of the registrant’s financial statements is not subject to PCAOB investigation

and inspection completely for two consecutive years, instead of three consecutive years as currently provided in the HFCAA.

On February 4, 2022, the U.S. House of Representatives

passed the America Competes Act of 2022 which includes the same amendments as the bill passed by the Senate. The America Competes Act,

however, includes a broader range of legislation not related to the HFCAA in response to the U.S. Innovation and Competition Act passed

by the Senate in 2021. The U.S. House of Representatives and U.S. Senate will need to agree on amendments to these respective bills to

align the legislation and pass their amended bills before the President can sign into law. It is unclear when the U.S. Senate and U.S.

House of Representatives will resolve the differences in the U.S. Innovation and Competition Act and the America Competes Act of 2022

bills currently passed, or when the U.S. President will sign the bill to make the amendment into law, if at all. In the case that the

bill becomes the law, it may reduce the time period before our shares could be prohibited from trading in the U.S. from 2024 to 2023.

Company is not certain as of the date of this Amendment of when and if the Proposed Law will become law and applicable to public companies

like our company.

If the Company becomes directly subject

to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese/Hong Kong SAR companies, we may have to expend

significant resources to investigate and resolve the matters. Any unfavorable results from the investigations could harm our business

operations and our reputation.

In 2021 and onwards, U.S. public companies

with operations based in China have been subjects of intense scrutiny, criticism and negative publicity by investors, financial commentators

and regulatory agencies, such as the SEC and certain members of Congress. Much of the scrutiny, criticism and negative publicity has

centered on alleged financial and accounting irregularities, lack of effective internal control over financial reporting, inadequate

corporate governance and ineffective implementation thereof and, in many cases, allegations of fraud. As a result of enhanced scrutiny,

criticism and negative publicity, the publicly traded stocks of many U.S.-listed Chinese companies have decreased in value and, in some

cases, have become virtually worthless or illiquid. Shareholder lawsuits and SEC investigations and enforcement actions can be fostered

by intense, negative public focus on Chinese or Hong Kong SAR based companies. The Company does not believe that it is subject to any

of these allegations, investigations or enforcement actions as of the date of this Form 10-K or Amendment. If the Company becomes a subject

of any unfavorable allegations, whether such allegations are proven to be true or untrue, the Company will have to expend significant

resources to investigate such allegations and defend the Company. If such allegations were not proven to be baseless, the Company would

be severely hampered and the price of the stock of the Company could decline substantially. If such allegations were proven to be groundless,

the investigation might have significantly distracted the attention of the Company’s management. The mere commencement of an investigation

by a regulator, like the SEC, even without evidence of any misconduct or violation of laws, can undermine investor confidence in the

Company as an investment and do so even if the investigation finds no misconduct or violations of laws or regulations. Regulator investigations

can take months or longer to resolve and can require considerable resources of a company to adequately respond to such. investigations.

The recent government regulation of

business activities of U.S.-listed Chinese companies may negatively impact our operations. Chinese regulatory authorities issued

Opinions on Strictly Cracking Down on Illegal Securities Activities, which were available to the public on July 6, 2021, which further

emphasized their goal to strengthen the cross-border regulatory collaboration, to improve relevant laws and regulations on data security,

cross-border data transmission, and confidential information management, and provided that efforts will be made to revise the regulations

on strengthening the confidentiality and file management relating to the offering and listing of securities overseas, to implement the

responsibility on information security of overseas listed companies, and to strengthen the standardized management of cross-border information

provision mechanisms and procedures. These opinions are issued in mid-2021, and there were no known further explanations or detailed

rules or regulations with respect to such opinions, and there are still uncertainties regarding the interpretation and implementation

of these opinions. China intends to improve regulation of cross-border data flows and security, crack down on illegal activity in the

securities market and punish fraudulent securities issuance, market manipulation and insider trading. China will also check sources of

funding for securities investment and control leverage ratios. If the Chinese government’s regulatory involvement expands and we

become subject to that expanded involvement, our operations may be negatively impacted, although, as of the date of this Form 10-K and

Amendment, there is no known regulatory involvement of the nature described in this paragraph and there is no discernible immediate impact

on our company under the recent regulatory developments described in this paragraph.

We face various risks and uncertainties relating

to doing business in China and Hong Kong SAR. Our business operations are primarily conducted in China and Hong Kong SAR, and we are

subject to complex and evolving Chinese and Hong Kong SAR laws and regulations. For example, we face risks associated with regulatory

approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the lack

of inspection on our Auditor by the PCAOB, which may impact our ability to conduct certain businesses, accept foreign investments, or

list and conduct offerings on a United States or other foreign exchange. These risks could result in a material adverse change in our

operations and the value of our shares of Common Stock, significantly limit or completely hinder our ability to continue to offer securities

to investors, or cause the value of our Common Stock to decline.

(Revised) Item 9C: The first paragraph

of our disclosure under Item 9C of the Form 10-K is amended to read in its entirety as follows: The public auditor for the Company for

this Form 10-K and in respect of audit report for the financial statements included in this Form 10-K has been identified by the Public

Company Accounting Oversight Board or “PCAOB” as being a PCAOB registered public accounting located in a foreign jurisdiction

and that the PCAOB has determined that it is unable to inspect or investigate completely because of a position taken by an authority

in a foreign jurisdiction. This identification was made in the PCAOB’s “Board Determinations under the Holding Foreign Companies

Accountable Act (“HFCAA”) (15 U.S.C. §§7214(i), 7214a) (“PCAOB Report”).

The Company believes that it is not a “foreign private issuer” under Rule 3b-4(c) of the Exchange Act.

PART IV

Item 15. Exhibits and Financial Statement Schedules

3. Exhibits. The exhibits listed below are filed as part of this

Annual Report on Form 10-K/A Amendment Number One or are incorporated herein by reference, in each case as indicated below.

EXHIBIT INDEX

*The certifications attached as Exhibit 32.1.1

that accompany this Annual Report on Form 10-K/A Amendment Number One are deemed furnished and not filed with the Securities and Exchange

Commission and are not to be incorporated by reference into any filing of Value Exchange International, Inc. under the Securities Act

of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date of this Annual Report

on Form 10-K/A Amendment Number One, irrespective of any general incorporation language contained in such filing.

SIGNATURES

Pursuant to the requirements of Section 13

or 15(d) of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Annual Report on Form 10-K/A to be signed

on its behalf by the undersigned, thereunto duly authorized.

VALUE EXCHANGE INTERNATIONAL,

INC.

Dated: May 13, 2022

By: /s/ Tan Seng Wee

Name: Tan Seng Wee (“Kenneth Tan”)

Its: President, Chief Executive Officer

(Principal executive officer)

Pursuant to the requirements of the Securities Exchange Act of

1934, as amended, this Annual Report on Form 10-K/A Amendment Number One has been signed below by the following persons on behalf of

the Registrant in the capacities and on the dates indicated.

By: /s/ Tan Seng Wee

Name: Tan Seng Wee (“Kenneth Tan”)

Its: President, Chief Executive Officer and Director

(Principal executive officer)

Date: May 13, 2022

By: /s/ Au Cheuk Lun

Name: Au Cheuk Lun (“Channing Au”)

Its: Chief Financial Officer

(Principal financial and accounting officer)

Date: May 13, 2022

By: /s/ Johan Pehrson

Name: Johan Pehrson

Its: Director

Date: May 13, 2022

By: /s/ Tsang Po Yee

Name Tsang Po Yee (“Bella Tsang”)

Its: Director

Date: May 13, 2022

By: /s/ Lee Yuen Fong

Name: Lee Yuen Fong (“Calinda Lee”)

Its: Director

Date: May 13, 2022

By: /s/ Lum Kan Fai

Name: Lum Kan Fai (“Vincent Lum”)

Its: Director

Date: May 13, 2022

10

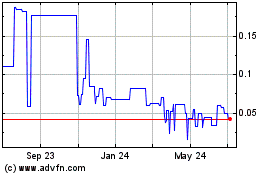

Value Exchange (QB) (USOTC:VEII)

Historical Stock Chart

From Mar 2024 to Apr 2024

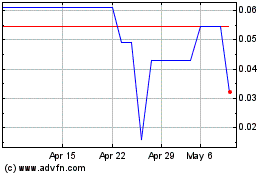

Value Exchange (QB) (USOTC:VEII)

Historical Stock Chart

From Apr 2023 to Apr 2024