iPower Inc. (Nasdaq:IPW) (“iPower” or the “Company”), a leading

online hydroponic equipment suppliers and retailers, today

announced financial results for its fiscal third quarter ended

March 31, 2022.

Fiscal Q3 2022 Results vs. Year-Ago

Quarter

- Total revenue increased 74% to $22.8 million.

- Gross profit increased 59% to $9.2 million.

- As a percentage of revenue, gross margin was 40.3% as compared

to 43.9%.

- Net income increased significantly to $1.2 million or $0.04 per

share as compared to $(0.01) per share for Q3 2021.

Management Commentary

“During our fiscal third quarter 2022 we experienced another

period of significant growth with record revenue and gross profit,”

said Lawrence Tan, CEO of iPower. “We continued to emphasize

in-house product sales, which made up approximately 82% of revenue

for the quarter, while driving additional sales velocity through

our largest online channel partner. Our continued strong growth and

in-house product mix speaks to our superior product research,

design and merchandising expertise.

“We began multiple new strategic initiatives this past quarter,

including the launch of our business in Europe as well as the

launch of two new joint ventures targeting the eCommerce, logistics

and social media markets. In addition, we closed our first ever

M&A transaction by acquiring our largest global co-engineering

partner, serving to expand our production capacity and deepen our

R&D capabilities.”

iPower CFO Kevin Vassily added, “Although we experienced record

high freight costs in the supply chain, we managed to maintain

gross margin above 40% by leveraging our diversified supplier

network. We also expanded operating margins despite adding new

warehouse capacity during the quarter that is still ramping up to

support higher volumes. We expect to close out the year on a strong

note as we deliver on our business and operational objectives in

fiscal 2022.”

Fiscal Third Quarter 2022 Financial

Results

Total revenue in the fiscal third quarter of 2022 increased 74%

to $22.8 million compared to $13.1 million for the same period in

fiscal 2021. The increase was driven by greater product sales to

the Company’s largest channel partner as well as strong demand for

iPower’s ventilation products, commercial fans and shelving

products.

Gross profit in the fiscal third quarter of 2022 increased 59%

to $9.2 million compared to $5.8 million for the same quarter in

fiscal 2021. As a percentage of revenue, gross margin was 40.3%

compared to 43.9% in the year-ago quarter. The decrease was driven

by product mix as well as higher freight costs.

Total operating expenses in the fiscal third quarter were $7.8

million compared to $5.0 million for the same period in fiscal

2021. As a percentage of revenue, operating expense improved 360

basis points to 34.3% compared to 37.9% in the year-ago quarter.

The increase in operating expenses were primarily driven by

additional warehouse, selling and fulfillment costs.

Net income in the fiscal third quarter of 2022 increased to $1.2

million or $0.04 per share, compared to net loss of $(0.2) million

or $(0.01) per share for the same period in fiscal 2021.

Cash and cash equivalents were $2.6 million at March 31, 2022,

compared to $6.7 million at June 30, 2021. The decrease was

attributed to the timing of accounts receivables and is not an

indication of any other business or operating trend. Long term debt

as of March 31, 2022 was $13.4 million compared to $0.5 million as

of June 30, 2021. This increase was also a function of timing as

the Company utilizes its revolving credit facility to manage

working capital.

Conference Call

The Company will conduct a conference call at 4:30 p.m. Eastern

time on Monday, May 16, 2022, to discuss the results for its fiscal

third quarter ended March 31, 2022.

iPower management will host the conference call, followed by a

question-and-answer period. The conference call details are as

follows:

Date: Monday, May 16, 2022Time: 4:30 p.m. Eastern timeToll-free

dial-in number: (888) 705-0179International dial-in number: (833)

730-3981Conference ID: 6364931Webcast: iPower FQ3 Earnings Call

Please call the conference call dial-in 5-10 minutes prior to

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Elevate IR at (720) 330-2829.

The conference call will also be broadcast live and available

for replay in the Events & Presentations section of the

Company’s website at www.meetipower.com.

About iPower Inc.

iPower Inc. is one of the leading online retailers and suppliers

of hydroponics equipment and accessories. iPower offers thousands

of stock keeping units from its in-house brands as well as hundreds

of other brands through its website, www.zenhydro.com, and its

online platform partners. iPower has a diverse customer base that

includes both commercial businesses and individuals. For more

information, please visit iPower's website at

https://ir.meetipower.com/.

Forward-Looking Statements

All statements other than statements of historical fact in this

announcement are forward-looking statements. These forward-looking

statements involve known and unknown risks and uncertainties and

are based on current expectations and projections about future

events and financial trends that iPower believes may affect its

financial condition, results of operations, business strategy and

financial needs. Investors can identify these forward-looking

statements by words or phrases such as "may," "will," "expect,"

"anticipate," "aim," "estimate," "intend," "plan," "believe,"

"potential," "continue," "is/are likely to" or other similar

expressions. iPower undertakes no obligation to update

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although iPower believes that the expectations

expressed in these forward-looking statements are reasonable, it

cannot assure you that such expectations will turn out to be

correct, and iPower cautions investors that actual results may

differ materially from the anticipated results and encourages

investors to review other factors that may affect its future

results in iPower's registration statement and in its other filings

with the SEC.

Investor Relations Contact:

Sean Mansouri, CFAElevate IR(720)

330-2829IPW@elevate-ir.com

iPower Inc. and

SubsidiariesUnaudited Condensed Consolidated

Balance SheetsAs of March 31, 2022 and June 30,

2021

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

June 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalent |

|

$ |

2,641,584 |

|

|

$ |

6,651,705 |

|

|

Accounts receivable, net |

|

|

19,083,554 |

|

|

|

7,896,347 |

|

|

Inventories, net |

|

|

22,410,936 |

|

|

|

13,065,741 |

|

|

Other receivables – related party |

|

|

20,746 |

|

|

|

– |

|

|

Prepayments and other current assets |

|

|

7,813,772 |

|

|

|

4,693,000 |

|

|

Total current assets |

|

|

51,970,592 |

|

|

|

32,306,793 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

Right of use - non current |

|

|

9,095,158 |

|

|

|

1,819,421 |

|

|

Property and equipment, net |

|

|

165,071 |

|

|

|

55,659 |

|

|

Non-current prepayments |

|

|

1,033,541 |

|

|

|

1,357,292 |

|

|

Goodwill |

|

|

6,094,144 |

|

|

|

– |

|

|

Investment in joint venture |

|

|

37,711 |

|

|

|

– |

|

|

Intangible assets, net |

|

|

5,091,785 |

|

|

|

– |

|

|

Other non-current assets |

|

|

300,346 |

|

|

|

99,645 |

|

|

Total non-current assets |

|

|

21,817,756 |

|

|

|

3,332,017 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

73,788,348 |

|

|

$ |

35,638,810 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

6,342,835 |

|

|

|

3,940,963 |

|

|

Credit cards payable |

|

|

745,585 |

|

|

|

584,311 |

|

|

Customer deposit |

|

|

204,490 |

|

|

|

297,407 |

|

|

Other payables and accrued liabilities |

|

|

4,895,528 |

|

|

|

2,487,441 |

|

|

Advance from shareholders |

|

|

97,476 |

|

|

|

– |

|

|

Short-term loans payable |

|

|

– |

|

|

|

162,769 |

|

|

Investment payable |

|

|

1,500,000 |

|

|

|

– |

|

|

Lease liability - current |

|

|

1,790,688 |

|

|

|

731,944 |

|

|

Long-term loan payable - current portion |

|

|

29,244 |

|

|

|

29,244 |

|

|

Long-term promissory note payable - current portion |

|

|

1,826,564 |

|

|

|

– |

|

|

Income taxes payable |

|

|

864,109 |

|

|

|

790,823 |

|

|

Total current liabilities |

|

|

18,296,519 |

|

|

|

9,024,902 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

Long-term loan payable |

|

|

434,201 |

|

|

|

458,571 |

|

|

Long-term revolving loan payable, net |

|

|

11,166,577 |

|

|

|

– |

|

|

Long-term promissory note payable, net |

|

|

1,800,315 |

|

|

|

– |

|

|

Deferred tax liabilities |

|

|

836,330 |

|

|

|

– |

|

|

Lease liability - non-current |

|

|

7,573,610 |

|

|

|

1,169,552 |

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities |

|

|

21,811,033 |

|

|

|

1,628,123 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

40,107,552 |

|

|

|

10,653,025 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and

contingency |

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 20,000,000 shares authorized; 0

shares issued and outstanding at March 31, 2022 and June 30,

2021 |

|

|

– |

|

|

|

– |

|

|

Common stock, $0.001 par value; 180,000,000 shares authorized;

29,572,382 and 26,448,663 shares issued and outstanding at March

31, 2022 and June 30, 2021 |

|

|

29,573 |

|

|

|

26,449 |

|

|

Additional paid in capital |

|

|

29,046,300 |

|

|

|

23,214,263 |

|

|

Retained earnings |

|

|

4,612,219 |

|

|

|

1,745,073 |

|

|

Non-controlling interest |

|

|

(4,070 |

) |

|

|

– |

|

|

Accumulated other comprehensive income (loss) |

|

|

(3,226 |

) |

|

|

– |

|

|

Total equity |

|

|

33,680,796 |

|

|

|

24,985,785 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

73,788,348 |

|

|

$ |

35,638,810 |

|

iPower Inc. and

SubsidiariesUnaudited Condensed Consolidated

Statements of Operations and Comprehensive

IncomeFor the Three and Nine Months Ended March

31, 2022 and 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

For the Nine Months Ended March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUES |

|

$ |

22,808,214 |

|

|

$ |

13,133,902 |

|

|

$ |

57,300,642 |

|

|

$ |

39,348,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL REVENUES |

|

|

22,808,214 |

|

|

|

13,133,902 |

|

|

|

57,300,642 |

|

|

|

39,348,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUES |

|

|

13,598,563 |

|

|

|

7,369,127 |

|

|

|

33,219,677 |

|

|

|

23,073,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

9,209,651 |

|

|

|

5,764,775 |

|

|

|

24,080,965 |

|

|

|

16,275,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and fulfillment |

|

|

5,030,267 |

|

|

|

3,071,897 |

|

|

|

12,338,027 |

|

|

|

9,070,320 |

|

|

General and administrative |

|

|

2,802,395 |

|

|

|

1,904,144 |

|

|

|

7,940,349 |

|

|

|

4,486,621 |

|

|

Total operating expenses |

|

|

7,832,662 |

|

|

|

4,976,041 |

|

|

|

20,278,376 |

|

|

|

13,556,941 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME FROM OPERATIONS |

|

|

1,376,989 |

|

|

|

788,734 |

|

|

|

3,802,589 |

|

|

|

2,718,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expenses) |

|

|

(152,030 |

) |

|

|

(60,118 |

) |

|

|

(227,142 |

) |

|

|

(109,656 |

) |

|

Other financing expenses |

|

|

(71,010 |

) |

|

|

(60,692 |

) |

|

|

(80,010 |

) |

|

|

(98,139 |

) |

|

PPP loan forgiveness |

|

|

– |

|

|

|

175,500 |

|

|

|

– |

|

|

|

175,500 |

|

|

Gain (Loss) on equity method investment |

|

|

(12,289 |

) |

|

|

– |

|

|

|

(12,289 |

) |

|

|

– |

|

|

Other non-operating income (expense) |

|

|

75,882 |

|

|

|

(812,434 |

) |

|

|

85,473 |

|

|

|

(794,582 |

) |

|

Total other (expenses), net |

|

|

(159,447 |

) |

|

|

(757,744 |

) |

|

|

(233,968 |

) |

|

|

(826,877 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

|

1,217,542 |

|

|

|

30,990 |

|

|

|

3,568,621 |

|

|

|

1,891,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROVISION FOR INCOME

TAXES |

|

|

39,855 |

|

|

|

237,813 |

|

|

|

705,545 |

|

|

|

760,687 |

|

| NET INCOME (LOSS) |

|

|

1,177,687 |

|

|

|

(206,823 |

) |

|

|

2,863,076 |

|

|

|

1,130,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

|

(4,070 |

) |

|

|

– |

|

|

|

(4,070 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) ATTRIBUTABLE TO IPOWER INC. |

|

$ |

1,181,757 |

|

|

$ |

(206,823 |

) |

|

$ |

2,867,146 |

|

|

$ |

1,130,649 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(3,226 |

) |

|

|

– |

|

|

|

(3,226 |

) |

|

|

– |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO IPOWER INC. |

|

$ |

1,178,531 |

|

|

$ |

(206,823 |

) |

|

$ |

2,863,920 |

|

|

$ |

1,130,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF COMMON STOCK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

28,045,130 |

|

|

|

20,204,496 |

|

|

|

26,999,342 |

|

|

|

20,204,496 |

|

|

Diluted |

|

|

28,045,130 |

|

|

|

20,204,496 |

|

|

|

26,999,342 |

|

|

|

20,204,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSSES) PER

SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.042 |

|

|

$ |

(0.010 |

) |

|

$ |

0.106 |

|

|

$ |

0.056 |

|

|

Diluted |

|

$ |

0.042 |

|

|

$ |

(0.010 |

) |

|

$ |

0.106 |

|

|

$ |

0.056 |

|

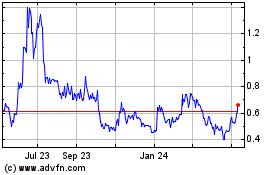

iPower (NASDAQ:IPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

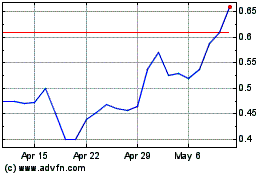

iPower (NASDAQ:IPW)

Historical Stock Chart

From Apr 2023 to Apr 2024