Datasea Reports Third Quarter Fiscal Year 2022 Earnings and Provides Business Updates

May 16 2022 - 8:30AM

Datasea Inc. (NASDAQ: DTSS) (“Datasea” or the “Company”),

incorporated in Nevada in September 2014, and a digital technology

corporation engaged in three converging and innovative business

segments: 5G messaging, acoustic intelligence and smart city in

China, today announced financial results for the quarter ended

March 31, 2022 and provided an update on its key strategic and

operational initiatives.

“Datasea delivered record third quarter results with

year-over-year growth, mainly driven by accelerating demand for our

5G messaging solutions. This quarter marked a significant

inflection point to scale and transform Datasea, underscoring our

continued diversification and competitiveness building across 5G

messaging, acoustic intelligence, and smart city businesses,” said

Zhixin Liu, CEO of Datasea. “Moving forward, underpinned

by momentum from increased customer wins,

leadership expansion, great synergy effects among the business

lines, and strong business resilience, Datasea is well-positioned

for future growth.”

Third Quarter 2022 Financial Highlights

- Revenue was $6,643,538 for the three months ended March 31,

2022 compared to 17,686 for the quarter ended March 31, 2021

representing an increase of $6,625,852, or 37463%.

- Gross profit was $588,404 for the three months ended March 31,

2022 compared to $7,774 for the three months ended March 31, 2021,

representing an increase of $580,630 or 7469%. The increase in

gross profit was mainly due to the delivery of services related to

the 5G SMS service platform in 2022.

- R&D expenses were $248,832 for the three months ended March

31, 2022 compared to $207,774 for the three months ended March 31,

2021, representing an increase of $41,058, or 19.76%.

- More than $17.05 million worth of 5G messaging business

contracts have been signed.

Third Quarter 2022 Business Highlights

5G Messaging

- Client expansion. The number of enterprises

that engaged with Datasea’s 5G message authorization development

increased from about 100 to nearly 200 which directly resulted in

the Company becoming a leading service provider in China.

- Marketing and sales expansion. The Company

adopted an integrated sales strategy to boost sales to better

promote business development and meet with the demand of customers,

which includes 1) an expansion of the sales team for direct sales;

2) partner and broker mode; 3) joint marketing mode; 4) the

enterprise key customer project cooperation mode.

- Industry recognition. Shuhai Zhangxun, a

company indirectly contractually controlled by Datasea focusing on

the 5G messaging business, was named the "Top 10 Enterprises of 5G

Messaging in 2021" by New 5G Messaging (New Media) and 5G New

Business Center. In January 2022, Shuhai Zhangxun took the lead in

drafting the overall technical requirements for 5G messaging

applications in the express delivery industry.

Acoustic Intelligence

In this quarter, the Company demonstrated the commercial

potential of acoustic intelligence, through direct sales of

acoustic intelligence powered disinfection equipment and agreements

with different businesses to apply acoustic intelligence in the

areas such as automotive systems and smart home appliances.

- Client expansion. The Company entered into a

three-year collaboration agreement with Guangdong Canbo Electrical

Co., Ltd to apply Datasea’s innovative acoustic

intelligence-enabled sterilization technology to the disinfection

cabinets. The Company worked with Shanghai Zhuifeng Automotive

System Co., Ltd to promote the acoustic intelligent module products

in vehicle application scenarios. Datasea added Jiangsu Xinrong

Network Technology Research Institute Co., Ltd. as a new customer

of acoustic intelligence powered disinfection equipment and the

total value of the engagement would be RMB 20 million

(approximately USD 3.14 million) over the course of the two-year

agreement.

- Marketing and sales expansion. Datasea worked

with Unicorner LLC to expand acoustic intelligence products

distribution in the US market.

- Industry recognition. In January, Datasea

released China’s inaugural white paper with co-authors to uncover

detailed facts and compelling analyses of the acoustic-intelligence

technology, commercial applications, and the industry outlook.

Smart City

- Client expansion. The Company was engaged by

Jiangsu Xinrong Network Technology Research Institution Co., Ltd to

provide 5G messaging smart city solutions, and the value of this

engagement would be RMB 500,000 (approximately USD 78,800) per

residential community over the course of the two-year

agreement.

- Product update. The Company recently laid out

a series of upgrades, including IoT cloud platform 2.0 and Campus

Security Cloud System to meet with the client needs in different

scenarios and enhance the system’s analysis efficiency and

integration capability.

Webcast and Conference Call Information

The Company will host a conference call and webcast to discuss

its financial results at 9 a.m. ET (9 p.m. Beijing and Hong Kong

Time) on Monday, May 16, 2022.

Dial-in details for the earnings conference call are as

follows:Toll

Free: 1-877-451-6152Toll/International: 1-201-389-0879

Participants should dial-in at least 5 minutes before the

scheduled start time. Additionally, a live and archived webcast of

the conference call will be available at:

https://viavid.webcasts.com/starthere.jsp?ei=1550068&tp_key=f65ec48b63

A replay of the conference call will be accessible approximately

soon after the conclusion of the live webcast, by dialing the

following telephone numbers:

| Toll

Free: 1-844-512-2921Toll/International: 1-412-317-6671Replay

Pin Number: 13730116Replay Start: Monday May 16, 2022,

12:00 PM ETReplay Expiry: Monday May 23, 2022, 11:59 PM

ET |

About Datasea Inc. Datasea Inc., through its

variable interest entity, Shuhai Information Technology Co., Ltd.,

a digital technology company in China, engages in three converging

and innovative industries: smart city, acoustic intelligence and 5G

messaging. Datasea leverages facial recognition technology and

other visual intelligence algorithms, combined with cutting-edge

acoustic and non-visual intelligence algorithms, to provide smart

city solutions that meet the security needs of residential

communities, schools and commercial enterprises. Most recently, in

response to the growing utilization of 5G technologies and the

overall initiative to utilize Datasea’s technology capabilities to

expand business coverage and revenue resources, Datasea has also

strategically expanded business coverage to 5G messaging and smart

payment solutions. Datasea has been certified as one of the

High-Tech Enterprises (jointly issued by the Beijing Science and

Technology Commission, Beijing Finance Bureau, Beijing State

Taxation Bureau and Beijing Local Taxation Bureau) and one of the

Zhongguancun High Tech Enterprises (issued by the Zhongguancun

Science Park Administrative Committee) in recognition of the

company’s achievement in high technology products. For additional

company information, please visit: www.dataseainc.com. Datasea

routinely posts important information on its website.

Cautionary Note Regarding Forward-Looking

Statements This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934 and as defined in the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

be identified by terminology such as "will", "expects",

"anticipates", "future", "intends", "plans", "believes",

"estimates", "target", "going forward", "outlook," “objective” and

similar terms. Such statements are based upon management's current

expectations and current market and operating conditions, and

relate to events that involve known or unknown risks, uncertainties

and other factors, all of which are difficult to predict and which

are beyond Datasea's control, which may cause Datasea's actual

results, performance or achievements (including the RMB/USD value

of its anticipated benefit to Datasea as described herein) to

differ materially and in an adverse manner from anticipated results

contained or implied in the forward-looking statements. Further

information regarding these and other risks, uncertainties or

factors is included in Datasea's filings with the U.S. Securities

and Exchange Commission, which are available at www.sec.gov.

Datasea does not undertake any obligation to update any

forward-looking statement as a result of new information, future

events or otherwise, except as required under law.

Datasea investor and media

Contact:International Elite Capital Inc. Annabelle

ZhangTelephone: +1(646) 866-7989 Email:

datasea@iecapitalusa.com

DATASEA INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(UNAUDITED)

|

|

|

NINE MONTHSENDEDMARCH 31, |

|

|

THREE MONTHSENDEDMARCH 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

16,294,147 |

|

|

$ |

152,925 |

|

|

$ |

6,643,538 |

|

|

$ |

17,686 |

|

|

Cost of goods sold |

|

|

15,395,849 |

|

|

|

66,925 |

|

|

|

6,055,134 |

|

|

|

9,912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

898,298 |

|

|

|

86,000 |

|

|

|

588,404 |

|

|

|

7,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

|

612,253 |

|

|

|

295,252 |

|

|

|

225,262 |

|

|

|

121,216 |

|

|

General and administrative |

|

|

3,990,789 |

|

|

|

2,377,257 |

|

|

|

1,372,509 |

|

|

|

945,285 |

|

|

Research and development |

|

|

968,403 |

|

|

|

537,009 |

|

|

|

248,832 |

|

|

|

207,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

5,571,445 |

|

|

|

3,209,518 |

|

|

|

1,846,603 |

|

|

|

1,274,275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(4,673,147 |

) |

|

|

(3,123,518 |

) |

|

|

(1,258,199 |

) |

|

|

(1,266,501 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses) |

|

|

12,917 |

|

|

|

(22,160 |

) |

|

|

7,670 |

|

|

|

(9,958 |

) |

|

Interest income |

|

|

37,730 |

|

|

|

1,916 |

|

|

|

4,837 |

|

|

|

112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-operating income (expenses), net |

|

|

50,647 |

|

|

|

(20,244 |

) |

|

|

12,507 |

|

|

|

(9,846 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax |

|

|

(4,622,500 |

) |

|

|

(3,143,762 |

) |

|

|

(1,245,692 |

) |

|

|

(1,276,347 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before noncontrolling interest |

|

|

(4,622,500 |

) |

|

|

(3,143,762 |

) |

|

|

(1,245,692 |

) |

|

|

(1,276,347 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: (loss) income attributable to noncontrolling interest |

|

|

(226,561 |

) |

|

|

(93,902 |

) |

|

|

31,720 |

|

|

|

(57,347 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss to the Company |

|

|

(4,395,939 |

) |

|

|

(3,049,860 |

) |

|

|

(1,277,412 |

) |

|

|

(1,219,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive item |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) attributable to the

Company |

|

|

89,911 |

|

|

|

105,471 |

|

|

|

19,919 |

|

|

|

(7,072 |

) |

|

Foreign currency translation gain (loss) attributable to

noncontrolling interest |

|

|

2,076 |

|

|

|

(1,582 |

) |

|

|

(218 |

) |

|

|

(192 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss attributable to the Company |

|

$ |

(4,306,028 |

) |

|

$ |

(2,944,389 |

) |

|

$ |

(1,257,493 |

) |

|

$ |

(1,226,072 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss (income) attributable to noncontrolling

interest |

|

$ |

(224,485 |

) |

|

$ |

(95,484 |

) |

|

$ |

31,502 |

|

|

$ |

(57,539 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

$ |

(0.18 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used for computing basic and diluted loss

per share |

|

$ |

23,837,047 |

|

|

$ |

21,214,197 |

|

|

|

24,244,130 |

|

|

|

21,470,487 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATASEA INC.CONSOLIDATED

BALANCE SHEETS

|

|

|

MARCH 31,2022 |

|

|

JUNE 30,2021 |

|

|

|

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

1,628,750 |

|

|

$ |

49,676 |

|

|

Accounts receivable |

|

|

5,521,461 |

|

|

|

1,856 |

|

|

Inventory |

|

|

247,378 |

|

|

|

194,264 |

|

|

Value-added tax prepayment |

|

|

66,295 |

|

|

|

171,574 |

|

|

Prepaid expenses and other current assets |

|

|

381,658 |

|

|

|

468,615 |

|

|

Total current assets |

|

|

7,845,542 |

|

|

|

885,985 |

|

| |

|

|

|

|

|

|

|

|

| NONCURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Security deposit for rents |

|

|

281,040 |

|

|

|

256,987 |

|

|

Long term investment |

|

|

63,010 |

|

|

|

- |

|

|

Property and equipment, net |

|

|

217,100 |

|

|

|

309,408 |

|

|

Intangible assets, net |

|

|

1,263,219 |

|

|

|

1,092,147 |

|

|

Right-of-use assets, net |

|

|

760,957 |

|

|

|

1,350,590 |

|

|

Total noncurrent assets |

|

|

2,585,326 |

|

|

|

3,009,132 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

10,430,868 |

|

|

$ |

3,895,117 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,874,633 |

|

|

$ |

174,718 |

|

|

Unearned revenue |

|

|

255,280 |

|

|

|

189,527 |

|

|

Deferred revenue |

|

|

72,682 |

|

|

|

46,439 |

|

|

Accrued expenses and other payables |

|

|

494,185 |

|

|

|

561,674 |

|

|

Due to related party |

|

|

29,063 |

|

|

|

69,305 |

|

|

Loans payable |

|

|

- |

|

|

|

1,486,819 |

|

|

Operating lease liabilities |

|

|

506,699 |

|

|

|

730,185 |

|

|

Total current liabilities |

|

|

6,232,542 |

|

|

|

3,258,667 |

|

| |

|

|

|

|

|

|

|

|

| NONCURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

132,257 |

|

|

|

558,739 |

|

|

Total noncurrent liabilities |

|

|

132,257 |

|

|

|

558,739 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

6,364,799 |

|

|

|

3,817,406 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 375,000,000 shares authorized,

24,244,130 and 21,474,138 shares issued and outstanding,

respectively |

|

|

24,244 |

|

|

|

21,474 |

|

|

Additional paid-in capital |

|

|

20,602,889 |

|

|

|

12,086,788 |

|

|

Accumulated comprehensive income |

|

|

363,161 |

|

|

|

273,250 |

|

|

Accumulated deficit |

|

|

(16,457,797 |

) |

|

|

(12,061,858 |

) |

|

TOTAL COMPANY STOCKHOLDERS’ EQUITY |

|

|

4,532,497 |

|

|

|

319,654 |

|

| |

|

|

|

|

|

|

|

|

|

Noncontrolling interest |

|

|

(466,428 |

) |

|

|

(241,943 |

) |

| |

|

|

|

|

|

|

|

|

|

TOTAL EQUITY |

|

|

4,066,069 |

|

|

|

77,711 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

EQUITY |

|

$ |

10,430,868 |

|

|

$ |

3,895,117 |

|

| |

|

|

|

|

|

|

|

|

DATASEA INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(UNAUDITED)

|

|

|

NINE MONTHSENDEDMARCH 31 |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Loss including noncontrolling interest |

|

$ |

(4,622,500 |

) |

|

$ |

(3,143,762 |

) |

|

Adjustments to reconcile loss including noncontrolling interest to

net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Loss on disposal on fixed assets |

|

|

679 |

|

|

|

9,619 |

|

|

Depreciation and amortization |

|

|

412,771 |

|

|

|

112,350 |

|

|

Bad debt expense |

|

|

287,214 |

|

|

|

- |

|

|

Operating lease expense |

|

|

654,029 |

|

|

|

588,924 |

|

|

Stock compensation expense |

|

|

515,250 |

|

|

|

12,000 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(5,469,460 |

) |

|

|

(12,380 |

) |

|

Inventory |

|

|

(49,239 |

) |

|

|

(19,278 |

) |

|

Value-added tax prepayment |

|

|

107,320 |

|

|

|

(75,765 |

) |

|

Prepaid expenses and other current assets |

|

|

(262,428 |

) |

|

|

(130,638 |

) |

|

Accounts payable |

|

|

4,655,575 |

|

|

|

81,903 |

|

|

Advance from customers |

|

|

87,041 |

|

|

|

41,823 |

|

|

Accrued expenses and other payables |

|

|

179,998 |

|

|

|

91,615 |

|

|

Payment on operating lease liabilities |

|

|

(712,738 |

) |

|

|

(618,366 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

|

(4,216,488 |

) |

|

|

(3,061,955 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment |

|

|

(32,188 |

) |

|

|

(103,054 |

) |

|

Acquisition of intangible assets |

|

|

(402,118 |

) |

|

|

(25,934 |

) |

|

Long-term investment |

|

|

(62,438 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

|

(496,744 |

) |

|

|

(128,988 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Due to related parties |

|

|

(40,760 |

) |

|

|

- |

|

|

Payment of loan payable |

|

|

(1,499,291 |

) |

|

|

728,824 |

|

|

Proceeds from capital contribution from a major shareholder |

|

|

62,438 |

|

|

|

- |

|

|

Net proceeds from issuance of common stock |

|

|

7,681,796 |

|

|

|

931,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

6,204,183 |

|

|

|

1,659,824 |

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

|

88,123 |

|

|

|

36,360 |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash |

|

|

1,579,074 |

|

|

|

(1,494,759 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash, beginning of period |

|

|

49,676 |

|

|

|

1,665,936 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash, end of period |

|

$ |

1,628,750 |

|

|

$ |

171,177 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow

information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

- |

|

|

$ |

- |

|

|

Cash paid for income tax |

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of non-cash investing and

financing activities: |

|

|

|

|

|

|

|

|

|

Transfer of prepaid software development expenditure to intangible

assets |

|

$ |

50,000 |

|

|

$ |

1,000,000 |

|

|

Right-of-use assets obtained in exchange for new operating lease

liabilities |

|

$ |

- |

|

|

$ |

1,294,315 |

|

|

Shares issued for accrued bonus to officers |

|

$ |

259,023 |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT NOTICE TO USERS (summary only, please refer to

the Form 10-Q for full text of notice); All information is

unaudited unless otherwise noted or accompanied by an audit opinion

and is subject to the more comprehensive information contained in

our SEC reports and filings. We do not endorse third-party

information. All information speaks as of the last fiscal quarter

or year for which we have filed a Form 10-K or 10-Q, or for

historical information the date or period expressly indicated in or

with such information. We undertake no duty to update the

information. Forward-looking statements are subject to risks and

uncertainties described in our Forms 10-Q and 10-K.

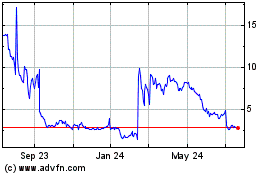

Datasea (NASDAQ:DTSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

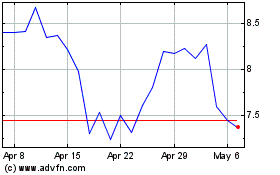

Datasea (NASDAQ:DTSS)

Historical Stock Chart

From Apr 2023 to Apr 2024