InMed Pharmaceuticals Inc. (“InMed” or the

“Company”) (Nasdaq: INM), a leader in the research, development,

manufacturing and commercialization of rare cannabinoids, today

announced financial results for the third quarter of the fiscal

year 2022 which ended March 31, 2022.

“The third quarter of fiscal 2022 saw noticeable

advancements across all of our programs, including commencing sales

of the rare cannabinoids CBDV and CBT as raw ingredients for the

health and wellness industry,” says Eric A. Adams, InMed President

& CEO. “For the remainder of fiscal 2022, we will remain

focused on driving our commercial operations by expanding our

product portfolio, increasing sales of our existing and new rare

cannabinoids, exploring new distribution channels and optimizing

our product development and supply chain strategy. We continue to

grow revenues and have established a solid platform upon which to

build as we commercialize additional high value products. We

continue to focus on enhancing our sales and marketing efforts to

support increasing demand.”

Business Update

Commercial ActivitiesIn January

2022, InMed announced that it launched B2B sales of

cannabicitran (“CBT”) to wholesalers, suppliers and

end-product manufacturers in the health and wellness sector via its

wholly-owned subsidiary, BayMedica LLC. Subsequent to the quarter

end, the Company also commenced sales of the rare cannabinoid

cannabidivarin (“CBDV”) in April, marking the third product in the

Company’s rare cannabinoid commercial portfolio, which also

includes cannabichromene (“CBC”). BayMedica has also begun

commercial scale production of its delta-9 dominant

tetrahydrocannabivarin (“THCV”) in anticipation of commencing B2B

sales. CBDV and THCV are highly anticipated, non-intoxicating rare

cannabinoids for which is there is growing interest.

Continuing to build out a robust product

portfolio is a strategic priority and the Company currently has

several additional high-value rare cannabinoids in various stages

of development and commercial manufacturing scale-up.

By establishing a reliable supply of these rare

cannabinoids at commercial scale, innovative product manufacturers

and consumer brands now have the ability to deliver improved and

differentiated products via product line extensions and

formulations designed to increase the performance of their

products.

In addition to sales of rare cannabinoids as raw

ingredients, the Company is also evaluating potential partners and

co-development collaborations for novel product development.

Formulated cannabinoid products in different delivery forms can

help to expand product development options for manufacturers of

health and wellness products.

Also following the quarter’s end, BayMedica

announced they will be supplying the rare cannabinoid THCV for

incorporation into Trokie’s proprietary product formulation. This

will then be evaluated in Radicle Science’s “Radicle Energy” study

on energy, focus/attention, appetite and weight/body mass index

(“BMI”). The study is being conducted to provide valuable third

party validation to the use case of THCV. Advancing the scientific

research and education of rare cannabinoids is a key part of

InMed’s commitment to building the framework that supports the

Company’s long-term commercial strategy.

To support our commercial efforts, in February

the Company appointed seasoned business executive, Jerry P.

Griffin, as VP of Sales and Marketing. Mr. Griffin has a wealth of

experience across various markets and with numerous cannabinoid

products, and a proven track record as a seasoned sales executive.

He has held several senior positions at both privately and publicly

held companies including Fortune 500 companies as a strong

strategic leader and has the requisite experience to oversee the

commercial ramp-up of B2B sales of rare cannabinoids products to

the consumer health and wellness market.

Pharmaceutical Development

Programs

INM-755 for the treatment of

Epidermolysis Bullosa (“EB”)Enrollment and patient

treatment of the Company’s Phase 2 clinical trial, 755-201-EB, of

INM-755 (cannabinol) cream in the treatment of EB, commenced in

December of 2021 and is expected to complete during the calendar

year 2022. An update on the progress of the EB program is expected

in the coming weeks.

The 755-201-EB study is designed to enroll up to

20 patients. InMed is evaluating the safety of INM-755 (cannabinol)

cream and its preliminary efficacy in treating symptoms and wound

healing over a 28-day treatment period. This study marks the first

time cannabinol (“CBN”) has advanced to a Phase 2 clinical trial to

be investigated as a therapeutic option to treat a disease.

INM-088 for the treatment of

glaucomaThe Company recently completed a

pre-Investigational New Drug (“pIND”) application discussion with

the U.S. Food and Drug Administration (“FDA”) regarding

manufacturing, preclinical studies and early clinical development

plans for INM-088, a cannabinol (“CBN”) formulation in development

for glaucoma. The Company has gained alignment with FDA on the

design of the initial Phase 1-2 clinical trial to gather

preliminary data on the safety and efficacy of INM-088 treatment.

The FDA has provided guidance for the development program based on

a summary of the available preclinical data, clinical safety data

for CBN from the INM-755 program, study designs for additional

IND-enabling preclinical studies, and Chemistry Manufacturing and

Controls (“CMC”) information. Management expects to file regulatory

applications in the first half of the calendar year 2023, to

initiate a human clinical trial.

The Company continues to advance its

pre-clinical research on CBN as a treatment for glaucoma. As

referenced in a recent international journal, InMed’s research

demonstrates that CBN was effective at providing neuroprotection to

the retinal ganglion cells and reducing intraocular pressure in

glaucoma models and outperforming several other naturally occurring

cannabinoids.

New Cannabinoid AnalogsIn April

2022, the Company announced the publication of a patent application

in North America for several cannabinoid analogs. This patent

application has broad claims directed to their molecular structure,

uses and methods of manufacturing. The patent application covers

technology that allows for the creation of libraries of new

chemical entities (“NCEs”), which the Company will screen in

several in vitro and in vivo models to select therapeutic

candidates for advancement. Unlike natural cannabinoids isolated

from the plant which are not patentable, these cannabinoid analogs

are patentable and may create potential value for the

Company.

In addition, the Company also initiated a

research collaboration agreement with the Department of

Biotechnological and Applied Clinical Sciences, University of

L’Aquila (Italy) in the laboratory of Dr. Mauro Maccarrone. Dr.

Maccarrone’s lab will be screening the Company’s novel cannabinoid

analogs to investigate pharmacological properties and potential

therapeutic uses.

Corporate

Today the Company would like to announce that

Mr. Bryan Baldasare has joined the Board of Directors effective

immediately.

Mr. Baldasare is a well-rounded biotech

executive with wealth of experience in finance and accounting,

financial planning and analysis, treasury management, commercial

operations and mergers and acquisitions. Mr. Baldasare spent over

20 years at Meridian Bioscience, most recently as Chief Financial

Officer where during his tenure, grew its revenues by over 500%,

developed and launched dozens of new products, expanded into a

diversified global business with 15 sites in 10 countries. Mr.

Baldasare is currently the CFO at Hilltop Companies, a leading

supplier to the construction industry. Prior to Meridian, Mr.

Baldasare spent over 10 years in public accounting at Arthur

Andersen LLP. Mr. Baldasare has a Bachelor’s degree in Business

Administration from the University of Cincinnati.

As noted earlier, in February, the Company also

appointed Jerry Griffin as VP of Sales and Marketing.

Financial and Operational

Highlights:

For the 9 months ended March 31, 2022, the

Company recorded a net loss of $10.7 million, or $0.81 per share,

compared with a net loss of $6.9 million, or $1.11 per share, for

the nine months ended March 31, 2021.

Research and development and patents expenses

increased by $2.2 million for the nine months ended March 31, 2022

compared to the nine months ended March 31, 2021. The increase in

research and development and patents expenses was primarily due to

increased activities related to the INM-755 clinical trial and the

addition of $0.9 million in our BayMedica segment following the

acquisition date.

The Company incurred general and administrative

expenses of $5.1 million for the nine months ended March 31, 2022

compared with $2.9 million for the nine months ended March 31,

2021. The increase results primarily from the inclusion of

BayMedica operating results following the acquisition date and

combination of changes including legal fees and investor relation

expenses, personnel expenses, substantially higher insurance fees

resulting from our listing on the Nasdaq Capital Market. In

addition, acquisition-related expenses, which were comprised of

regulatory, financial advisory and legal fees, totaled $0.2 million

for the nine months ended March 31, 2022 and were included in

general and administrative expenses in our InMed segment.

At March 31, 2022, the Company’s cash, cash

equivalents and short-term investments were $5.9 million, which

compares to $7.4 million at June 30, 2021. The change in cash, cash

equivalents and short-term investments during the nine months to

March 31, 2022, was primarily the result of the July 2, 2021

private placement partially offset by cash outflows from operating

activities.

At March 31, 2022, the Company's total

issued and outstanding shares were 14,283,848. During the three and

nine months ending March 31, 2022, the weighted average number

of common shares was 14,151,544 and 13,326,754, which is used for

the calculation of loss per share for the respective interim

periods.

BayMedica RevenueResults

subsequent the acquisition of BayMedica in October 2021, are net

sales of $0.6 million for the six months ended March 31, 2022 for

cannabinoid ingredient sales to wholesalers and product

manufacturers in the health and wellness sector. As the nine months

ended March 31, 2021 pre-dated the acquisition of BayMedica there

are no comparable revenues in the 2021 period. Accordingly, we

realized cost of goods sold of $0.3 million for the nine months

ended March 31, 2022, with no comparable expenses in 2021,

resulting in a gross profit of $0.3 million for the period.

Reported sales were impacted this quarter by a

delay in the product launches of two new rare cannabinoids, CBDV

and THCV. CBDV was launched subsequent to quarter end and the

commercial launch of THCV is planned shortly. With the

commercialization of these products and additional launches being

planned, the Company anticipates revenue growth in the coming

quarters.

Table 1: Condensed Consolidated Interim

Balance Sheets (unaudited):

|

InMed Pharmaceuticals Inc. |

|

|

|

|

CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS

(unaudited) |

|

|

|

As at March 31, 2022 and June 30, 2021 |

|

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

|

March 31, |

|

June 30, |

|

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

ASSETS |

$ |

|

$ |

|

|

|

Current |

|

|

|

|

Cash and cash

equivalents |

5,898,313 |

|

7,363,126 |

|

|

|

Short-term

investments |

46,098 |

|

46,462 |

|

|

|

Accounts receivable |

70,554 |

|

11,919 |

|

|

|

Inventories |

1,420,382 |

|

- |

|

|

|

Prepaids and other

assets |

1,311,539 |

|

956,762 |

|

|

|

Total current assets |

8,746,886 |

|

8,378,269 |

|

|

|

|

|

|

|

|

Non-Current |

|

|

|

|

Property and equipment,

net |

1,002,846 |

|

326,595 |

|

|

|

Intangible assets,

net |

2,355,401 |

|

1,061,697 |

|

|

|

In-process research and

development |

1,249,000 |

|

- |

|

|

|

Goodwill |

2,023,039 |

|

- |

|

|

|

Other assets |

108,625 |

|

14,655 |

|

|

|

Total Assets |

15,485,797 |

|

9,781,216 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

|

|

Current |

|

|

|

|

Accounts payable and accrued

liabilities |

2,866,927 |

|

2,134,878 |

|

|

|

Short-term debt |

29,312 |

|

- |

|

|

|

Current portion of lease

obligations |

399,904 |

|

80,483 |

|

|

|

Deferred revenue |

8,902 |

|

- |

|

|

|

Acquisition consideration

payable |

800,457 |

|

- |

|

|

|

Total current liabilities |

4,105,502 |

|

2,215,361 |

|

|

|

|

|

|

|

|

Non-current |

|

|

|

|

Lease obligations |

493,562 |

|

189,288 |

|

|

|

Total Liabilities |

4,599,064 |

|

2,404,649 |

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

Common shares, no par value, unlimited

authorized shares: |

|

|

|

|

14,283,848 (June 30, 2021 - 8,050,707)

issued and outstanding |

69,825,331 |

|

60,587,417 |

|

|

|

Additional paid-in capital |

26,515,397 |

|

21,513,051 |

|

|

|

Accumulated deficit |

(85,582,564 |

) |

(74,852,470 |

) |

|

|

Accumulated other comprehensive

income |

128,569 |

|

128,569 |

|

|

|

Total Shareholders' Equity |

10,886,733 |

|

7,376,567 |

|

|

|

Total Liabilities and Shareholders'

Equity |

15,485,797 |

|

9,781,216 |

|

|

| |

|

|

|

Table 2: Condensed Consolidated Interim

Statements of Operations and Comprehensive Loss

(unaudited):

|

InMed Pharmaceuticals Inc. |

|

|

|

|

|

|

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS (unaudited) |

|

|

|

For the three and nine months ended March 31, 2022 and

2021 |

|

|

|

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

|

| |

March 31 |

March 31 |

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

Sales |

309,585 |

|

- |

|

574,677 |

|

- |

|

|

|

Cost of sales |

127,308 |

|

- |

|

280,845 |

|

- |

|

|

|

Gross profit |

182,277 |

|

- |

|

293,832 |

|

- |

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

Research and development and

patents |

1,753,545 |

|

1,772,593 |

|

5,781,867 |

|

3,621,697 |

|

|

|

General and

administrative |

1,915,017 |

|

1,333,725 |

|

5,124,670 |

|

2,918,067 |

|

|

|

Amortization and

depreciation |

53,340 |

|

27,421 |

|

131,669 |

|

92,218 |

|

|

|

Total operating expenses |

3,721,902 |

|

3,133,739 |

|

11,038,206 |

|

6,631,982 |

|

|

|

|

|

|

|

|

|

|

Other Income (Expense) |

|

|

|

|

|

|

Interest and other

income |

30,964 |

|

3,797 |

|

62,389 |

|

11,192 |

|

|

|

Finance expense |

- |

|

- |

|

- |

|

(360,350 |

) |

|

|

Unrealized gain on derivative

warrants liability |

- |

|

- |

|

- |

|

242,628 |

|

|

|

Foreign exchange gain

(loss) |

32,996 |

|

28,467 |

|

(48,109 |

) |

(205,824 |

) |

|

|

Net loss for the period |

(3,475,665 |

) |

(3,101,475 |

) |

(10,730,094 |

) |

(6,944,336 |

) |

|

|

|

|

|

|

|

|

|

Other Comprehensive Loss |

|

|

|

|

|

|

Foreign currency translation

gain |

- |

|

- |

|

- |

|

430,443 |

|

|

|

Total comprehensive loss for the

period |

(3,475,665 |

) |

(3,101,475 |

) |

(10,730,094 |

) |

(6,513,893 |

) |

|

|

|

|

|

|

|

|

|

Net loss per share for the

period |

|

|

|

|

|

|

Basic and

diluted |

(0.25 |

) |

(0.41 |

) |

(0.81 |

) |

(1.11 |

) |

|

|

Weighted average outstanding common

shares |

|

|

|

|

|

|

Basic and

diluted |

14,151,544 |

|

7,549,040 |

|

13,326,754 |

|

6,277,824 |

|

|

|

|

|

|

|

|

|

Table 3: Condensed Consolidated Interim

Statements of Cash Flows (unaudited):

|

InMed Pharmaceuticals Inc. |

|

|

|

|

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(unaudited) |

|

|

For the nine months ended March 31, 2022 and

2021 |

|

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

Cash provided by (used in): |

$ |

|

$ |

|

|

|

|

|

|

|

|

Operating Activities |

|

|

|

|

Net loss for the period |

(10,730,094 |

) |

(6,944,336 |

) |

|

|

Items not requiring cash: |

|

|

|

|

Amortization and

depreciation |

131,669 |

|

92,218 |

|

|

|

Share-based

compensation |

521,006 |

|

389,343 |

|

|

|

Amortization of right-of-use

assets |

226,061 |

|

88,620 |

|

|

|

Loss on disposal of

assets |

11,355 |

|

- |

|

|

|

Interest income received on

short-term investments |

46 |

|

159 |

|

|

|

Unrealized gain on derivative

warrants liability |

- |

|

(242,628 |

) |

|

|

Unrealized foreign exchange

loss |

312 |

|

(571 |

) |

|

|

Payments on lease obligations |

(232,633 |

) |

(66,537 |

) |

|

|

Finance expense |

- |

|

360,350 |

|

|

|

Changes in non-cash working capital: |

|

|

|

|

Inventories |

(933,260 |

) |

- |

|

|

|

Prepaids and other

assets |

(323,653 |

) |

(1,192,936 |

) |

|

|

Other non-current

assets |

6,580 |

|

(14,161 |

) |

|

|

Accounts receivable |

(22,535 |

) |

(18,183 |

) |

|

|

Accounts payable and accrued

liabilities |

(195,125 |

) |

(235,892 |

) |

|

|

Deferred revenue |

3,760 |

|

- |

|

|

|

Total cash used in operating

activities |

(11,536,511 |

) |

(7,784,554 |

) |

|

|

|

|

|

|

|

Investing Activities |

|

|

|

|

Cash acquired from acqusition of

BayMedica |

91,566 |

|

- |

|

|

|

Purchase of property and

equipment |

(39,108 |

) |

- |

|

|

|

Total cash provided by investing

activities |

52,458 |

|

- |

|

|

|

|

|

|

|

|

Financing Activities |

|

|

|

|

Shares issued for

cash |

12,000,001 |

|

12,472,500 |

|

|

|

Share issuance costs |

(1,294,247 |

) |

(1,534,602 |

) |

|

|

Repayment of debt |

(261,514 |

) |

- |

|

|

|

Settlement of debt upon acquisition

of subsidiary |

(425,000 |

) |

- |

|

|

|

Total cash provided by financing

activities |

10,019,240 |

|

10,937,898 |

|

|

|

Effects of foreign exchange on cash and cash

equivalents |

- |

|

494,960 |

|

|

|

Increase (decrease) in cash during the

period |

(1,464,813 |

) |

3,648,304 |

|

|

|

Cash and cash equivalents beginning of the

period |

7,363,126 |

|

5,805,809 |

|

|

|

Cash and cash equivalents end of the

period |

5,898,313 |

|

9,454,113 |

|

|

|

|

|

|

|

About InMed: InMed

Pharmaceuticals is a global leader in the research, development,

manufacturing and commercialization of rare cannabinoids. Together

with its subsidiary BayMedica, LLC, the Company has unparalleled

cannabinoid manufacturing capabilities to serve a spectrum of

consumer markets, including pharmaceutical and health and wellness.

InMed is also a clinical-stage company developing a pipeline of

rare cannabinoid therapeutics and dedicated to delivering new

treatment alternatives to patients that may benefit from

cannabinoid-based pharmaceutical drugs. For more information,

visit www.inmedpharma.com and www.baymedica.com.

Investor Contact: Colin ClancySenior Director,

Investor RelationsT: +1.604.416.0999E: cclancy@inmedpharma.com

Cautionary Note Regarding Forward-Looking

Information:

This news release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking information") within the meaning of applicable

securities laws. Forward-looking information is based on

management's current expectations and beliefs and is subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Forward-looking information in this news release

includes statements about: expanding rare cannabinoid portfolio;

strengthening IP with publication of a patent application for novel

cannabinoid analogs; commencing sales of the rare cannabinoids CBDV

and CBT as raw ingredients for the health and wellness industry;

commercial scale production of delta-9 dominant

tetrahydrocannabivarin (“THCV”) in anticipation of commencing B2B

sales; CBDV and THCV being highly anticipated; several additional

high-value rare cannabinoids in various stages of development and

commercial manufacturing scale-up; establishing a reliable supply

of rare cannabinoids at commercial scale for manufacturers and

consumer brands to deliver improved and differentiated products;

evaluating potential partners and co-development collaborations for

novel product development; supplying the rare cannabinoid THCV for

incorporation into Trokie’s proprietary product formulation that

will then be evaluated in Radicle Science’s “Radicle Energy” study

on energy, focus/attention, appetite and weight/body mass index

(“BMI”); enrollment and patient treatment of the Company’s Phase 2

clinical trial, 755-201-EB, of INM-755 (cannabinol) cream in the

treatment of EB; the 755-201-EB study including 13 sites across 8

countries with enrollment and patient treatment being completed

during the calendar year 2022; the 755-201-EB study enrolling up to

20 patients to study the safety and preliminary efficacy of INM-755

(cannabinol) cream; having Company recently completed a

pre-Investigational New Drug (“pIND”) application discussion with

the U.S. Food and Drug Administration (“FDA”) regarding

manufacturing, preclinical studies and early clinical development

plans for INM-088, a cannabinol (“CBN”) formulation in development

for glaucoma; gaining alignment with FDA on the design of the

initial Phase 1-2 clinical trial to gather preliminary data on the

safety and efficacy of INM-088 treatment; the FDA providing

guidance for the development program based on a summary of the

available preclinical data, clinical safety data for CBN from the

INM-755 program, study designs for additional IND-enabling

preclinical studies, and Chemistry Manufacturing and Controls

(“CMC”) information; expecting to file regulatory applications in

the first half of the calendar year 2023, to initiate a human

clinical trial; the publication of a patent application in North

America for several cannabinoid analogs covering broad claims

directed to their molecular structure, uses and methods of

manufacturing; technology that allows for the creation of libraries

of new chemical entities (“NCEs”), which the Company will screen in

several in vitro and in vivo models to select therapeutic

candidates for advancement; the initiation of a research

collaboration agreement with the Department of Biotechnological and

Applied Clinical Sciences, University of L’Aquila (Italy) in the

laboratory of Dr. Mauro Maccarrone to screen the Company’s novel

cannabinoid analogs to investigate pharmacological properties and

potential therapeutic uses; the Company anticipates revenue growth

in the coming quarters with the commercialization of CBDV and THCV

as well as additional planned launches; being a global leader in

the research, development, manufacturing and development of rare

cannabinoids; and delivering new treatment alternatives to patients

that may benefit from cannabinoid-based pharmaceutical drugs.

With respect to the forward-looking information

contained in this news release, InMed has made numerous

assumptions. While InMed considers these assumptions to be

reasonable, these assumptions are inherently subject to significant

business, economic, competitive, market and social uncertainties

and contingencies.

Additionally, there are known and unknown risk

factors which could cause InMed's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. A complete discussion

of the risks and uncertainties facing InMed’s stand-alone business

is disclosed in InMed’s Annual Report on Form 10-K and other

filings with the Securities and Exchange Commission on

www.sec.gov.

All forward-looking information herein is

qualified in its entirety by this cautionary statement, and InMed

disclaims any obligation to revise or update any such

forward-looking information or to publicly announce the result of

any revisions to any of the forward-looking information contained

herein to reflect future results, events or developments, except as

required by law.

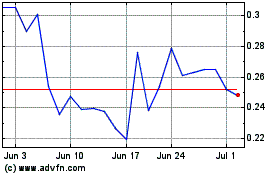

InMed Pharmaceuticals (NASDAQ:INM)

Historical Stock Chart

From Mar 2024 to Apr 2024

InMed Pharmaceuticals (NASDAQ:INM)

Historical Stock Chart

From Apr 2023 to Apr 2024