Filed Pursuant to Rule 424(b)(3)

Registration No. 333-256448

PROSPECTUS

ONCOTELIC

THERAPEUTICS, INC.

33,863,445

SHARES OF COMMON STOCK

This

prospectus relates to the resale of shares of our Common stock, par value $0.01 per share (the “Common Stock”), of an aggregate

of 33,863,445 Common Stock Shares pursuant to our May 3, 2021 Equity Purchase Agreement which may be offered by Peak One Opportunity

Fund, LP (“Peak One”) and Peak One Investments (“Peak One Investments) (the “EPA”), as follows: (a) up

to 29,878,445 Common Stock Shares to be issued to Peak One pursuant to put notices under the May 3, 2021 Equity Purchase Agreement with

Peak One; (b) 3,735,000 shares sold as of the date of this filing under the Equity Purchase Agreement with Peak One (c) 125,000 Commitment

Fee Shares issued to Peak One and Peak One Investments for an aggregate of 250,000 Commitment Fee Shares (Peak One Investments is the

General Partner of Peak One, both of which are Delaware corporations) and which Peak One and Peak One Investment have sold as of the

date of this filing; and (c) pursuant to Rule 416 under the Securities Act, an indeterminate number of shares of common stock that are

issuable upon stock splits, stock dividends, recapitalizations or other similar transactions affecting the shares of the selling stockholder.

The remaining amount of shares of Common Stock which

may be sold pursuant to this Prospectus would constitute 7.4% of the Company’s issued and outstanding Common Stock as of

April 22, 2022 (29,878,445 divided by current outstanding of 378,630,104 plus 29,878,445 for a total of 408,508,549, which includes

the 250,000 Commitment Fee Shares, and assuming that we sell all the remaining 29,878,445 shares to the selling security holders

(the “Selling Stockholders”).

Peak One and Peak One Investments are the Selling

Stockholders and are deemed to be each an “underwriter” within the meaning of the Securities Act of 1933, as amended (the

“Act”) and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents

and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or equivalent expenses and expenses

of legal counsel applicable to the sale of the shares.

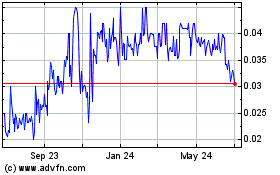

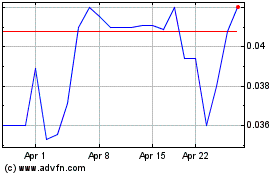

Our Common Stock is subject to quotation the OTCQB

Market under the symbol “OTLC”. On April 22, 2022, the last reported sales price for our Common Stock was $0.21

per share. We urge prospective purchasers of our Common Stock to obtain current information about the market prices of our Common

Stock. We will not receive proceeds from the sale of shares of our Common Stock in the open market or negotiated prices by the Selling

Stockholders. However, we will receive cash proceeds from Peak One pursuant to Purchase Notices they issue to us. The Selling Stockholders

may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market

prices or at privately negotiated prices. We provide more information about how the Selling Stockholders may sell its shares of common

stock in the section titled “Plan of Distribution” on page 34. We will pay for all expenses of this Offering, except that

the Selling Stockholders will pay fifty percent (50%) of any broker discounts or commissions or equivalent expenses and all expenses

of legal counsel applicable to the sale of the shares.

The prices at which the Selling Stockholders may sell

the shares of Common Stock in this Offering will be determined by the prevailing market prices for the shares of Common Stock or in negotiated

transactions.

Our independent registered public accounting firm

has expressed substantial doubt as to our ability to continue as going concern.

An investment in our common stock involves a high

degree of risk. You should purchase our common stock only if you can afford a complete loss of your purchase.

We urge you to read carefully the “Risk Factors”

section beginning on page 10 where we describe specific risks associated with an investment in these securities before you make your investment

decision.

Prior to this Offering, there has been a limited market

for our securities. While our common stock is quoted on OTC Markets, there has been limited trading volume of our stock. There is no guarantee

that an active trading market will develop in our securities.

This Offering is highly speculative, and these

securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire investment.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is May 11, 2022.

Table

of Contents

The

following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the

entire prospectus.

Please

read this Prospectus carefully and in its entirety. This Prospectus contains disclosure regarding our business, our financial condition

and results of operations and risk factors related to our business and our Common Stock, among other material disclosure items. We have

prepared this Prospectus so that you will have the information necessary to make an informed investment decision.

You

should rely only on information contained in this Prospectus. We have not authorized any other person to provide you with different information.

This Prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is

not permitted. The Selling Stockholder may not sell the securities listed in this Prospectus until the Registration Statement filed with

the Securities and Exchange Commission is effective. The information in this Prospectus is complete and accurate as of the date on the

front cover, but the information may have changed since that date.

The

Registration Statement containing this Prospectus, including the exhibits to the Registration Statement, provides additional information

about us and our Common Stock offered under this Prospectus. The Registration Statement, including the exhibits and the documents incorporated

herein by reference, can be read on the Securities and Exchange Commission website or at the Securities and Exchange Commission offices

mentioned under the heading “Where You Can Find More Information.”

PROSPECTUS

SUMMARY

You

should carefully read all information in the prospectus, including the financial statements and their explanatory notes under the Financial

Statements prior to making an investment decision.

This

summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be

important information about us, you should carefully read this entire prospectus before investing in our Common Stock, especially the

risks and other information we discuss under the headings “Risk Factors”, our “Management’s Discussion and Analysis

of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page

F-1. Our fiscal year end is December 31 and our audited financial statements for fiscal years ended December 31, 2021 and 2020 are included

in this prospectus. Some of the statements made in this prospectus discuss future events and developments, including our future strategy

and our ability to generate revenue. These forward-looking statements involve risks and uncertainties which could cause actual results

to differ materially from those contemplated in these forward-looking statements. See “Special Note Regarding Forward-Looking Statements”

at page 10 of this Prospectus.

Except

as otherwise required by the context, references in this prospectus to “we,” “our,” “us” refer to

Oncotelic Therapeutics, Inc. Peak One Opportunity Fund, LP is referred to herein as “Peak One” or “Investor”

and Peak One Investments is referred to herein a “Peak One Investments”.

This

summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information that you

should consider before investing. You should read the entire prospectus carefully, including the risk factors and our financial statements

and the related notes to those statements included in this prospectus.

We

have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or representation.

We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. This document may only

be used where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only

as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our common stock.

Our business, financial condition and results of operations may have changed since the date on the front of this prospectus. We urge

you to carefully read this prospectus before deciding whether to invest in any of the common stock being offered.

Overview

We

are a clinical-stage biopharmaceutical company developing drugs for the treatment of orphan oncology indications, developing antisense

and small molecule injectable drugs for the treatment of cancer. After the acquisition of Mateon Therapeutics, Inc through a reverse

merger in 2019, we realigned the company pipeline to focus on rare pediatric cancers. The United States Food and Drug Administration

(“FDA”) has granted us Rare Pediatric Designations (“RPD”) for pediatric Diffuse Intrinsic Pontine

Glioma (“DIPG”) for OT-101, pediatric melanoma for CAP4 and acute myeloid leukemia (“AML”) for

Oxi4503. This strategy aims to capitalize on a voucher program in the United States (“US”). By focusing on RPD we

anticipate: 1) reducing the cost of clinical development by way of a smaller and faster clinical trial, 2) acceleration of the approval

process and final approval, 3) obtaining regulatory/ marketing exclusivity for up to 12 years as a biologic, and 4) obtaining vouchers

worth a significantly large value on regulatory approval, which can be upwards of several million dollars. Approval in US would allow

for approval in the rest of the world (“ROW”) using the US dossier. Phase 3 clinical trials for approval in adult

indications will be conducted following the positive interim read of the pediatric trials. This approach maximize return on investment

for the shareholders.

Concurrently

we also explore opportunity to create values for shareholders by forming strategic alliances and/or licensing our product portfolio.

As of August 2021, we have been working on the formation of a joint venture (“JV”) with Golden Mountain Partners (“GMP”)

to transfer the developmental cost of our product(s) onto the JV, while still participating in potential upside through ownership of

the JV. The Company entered into a JV with Dragon Overseas Capital Limited (“Dragon Overseas”) and GMP Biotechnology Limited

(“GMP Bio”), affiliates of GMP on March 31, 2022. GMP Bio and the Company are also looking to take the JV into an initial

public offering (“IPO”) of the JV and which is anticipated to be a liquidity event for Company, especially if the

IPO is successful. While we believe that the JV and the IPO can be completed and be successful, we cannot provide assurance for either

of the events to occur; or if they occur, then they would be successful.

As

a result of the reverse merger of Oncotelic and Oncotelic Inc.in April 2019 and the acquisition of PointR in November 2019, respectively,

we believe we are well positioned as a biotech company with: (1) Oncotelic Inc.’s antisense platform with our drug candidate OT-101-

targeting high value TGF-β2 target for various cancers and COVID-19, (2) PointR artificial intelligence (“AI”)

for clinical trials, research and development, (3) Edgepoint for developing technologies for manufacturing and for developing technologies

for supporting our COVID-19 programs, (4) Artemisinin for COVID-19, (5) the Company’s vascular disruptor proven safe in more than

500 patients capable of causing massive antigen release which would stimulate immune response against the cancerous tumor and (6) apomorphine,

which we in-licensed in 2021, for developing against Parkinson’s Disease (“PD”), erectile disfunction (“ED”)

and female sexual disfunction (“FSD”). Since the JV is formed with GMP Bio, we will now plan to accelerate the development

of apomorphine as our flagship drug candidate.

We

are also developing OT-101, an antisense against TGF-β2 – for the treatment of various viruses, including the severe acute

respiratory syndrome (“SARS”) and the current coronavirus (“COVID-19”), on its own and in conjunction

with other compounds. Viral replication cannot occur without TGF-β; and TGF-β surge and a cytokine storm cannot occur without

TGF-β. A Phase 2 trial was completed for OT-101 in South America. Based on the final results of the trial, the trial can expand

into a Phase 3 trial if the data supports the safety of the drug. This was a randomized, double-blind, placebo-controlled Phase 2 study

is intended to evaluate the safety and efficacy of OT-101 in adult patients hospitalized with positive COVID-19 and pneumonia.

In

addition, during 2020 and 2021, the Company was developing Artemisinin as a potential therapy for the virus causing COVID-19 (“SARS-CoV-2”).

Artemisinin, purified from a plant Artemisia annua. It can inhibit TGF-β activity and is able to neutralize COVID-19. The

Company initially conducted a study and the test results during an in vitro study at Utah State University showed Artemisinin having

an EC50 of 0.45 ug/ml, and a Safety Index of 140. Artemisinin can target multiple viral threats, including COVID-19, by suppressing both

viral replication and clinical symptoms that arise from viral infection. Viral replication cannot occur without TGF-β. In a clinical

study undertaken in India called ARTI-19, clinical consequences related to the TGF-β surge, including ARDS and cytokine storm, were

suppressed by targeting TGF-β with Artemisinin. The ARTI-19 trials were conducted in India by Windlas Biotech Limited (“Windlas”),

the Company’s business partner in India. Windlas had applied for regulatory approval for it’s Artemisinin based product,

ArtiShieldTM, but has not been able to obtain regulatory approval for use of ArtiShieldTM as a COVID-19 therapy

and as such, no significant revenues have been reported by Windlas nor have we accrued any royalties on Artemisinin due from Windlas.

We intend to focus future development on Artemisinin against other respiratory viruses with unmet needs.

In

September 2021, Oncotelic entered into an exclusive License Agreement (the “Agreement”) with Autotelic, Inc. (“Autotelic”),

pursuant to which Autotelic granted Oncotelic, among other things: (i) the exclusive right and license to certain Autotelic Patents (as

defined in the Agreement) and Autotelic Know-How (as defined in the Agreement); and (ii) a right of first refusal to acquire at least

a majority of the outstanding capital stock of Autotelic prior to Autotelic entering into any transaction that is a financing collaboration,

distribution revenues, earn-outs, sales, out-licensing, purchases, debt, royalties, merger acquisition, change of control, transfer of

cash or non-cash assets, disposition of capital stock by way of tender or exchange offer, partnership or any other joint or collaborative

venture, research collaboration, material transfer, sponsored research or similar transaction or agreements. In exchange for the rights

granted to Oncotelic, Autotelic will be entitled to earn the milestone payments. This transaction brings in AL-101 - an intranasal apomorphine

asset with clear 505(b)2 pathway to approval for PD as well unique mechanism of action for treatment of ED and FSD.

We

currently have eight primary drug and AI technology programs we are seeking to advance:

| |

● |

Intranasal

drug and delivery system for intra-nasal Apomorphine for the treatment of PD, ED and FSD. |

| |

|

|

| |

● |

OT-101

- an antisense against TGF-β2 – for the treatment of solid tumors with focus on brain cancer in adult and DIPG in children.

A RPD for pediatric DIPG has been granted by US FDA. |

| |

|

|

| |

● |

OT-101

- an antisense against TGF-β2 –for the treatment of various viruses, including the SARS and the current COVID-19, on its

own and in conjunction with other compounds. |

| |

|

|

| |

● |

Artemisinin

– a natural derivative from an Asian herb Artemisia Annua - Artemisinin has shown to be highly potent at inhibiting the ability

of the COVID-19 causing virus to multiply while also having an excellent safety index as well as against hepatitis B and C viruses,

human herpes viruses, HIV-1, influenza virus A, and bovine viral diarrhea virus in the low micromolar range. |

| |

|

|

| |

● |

CA4P-

a vascular disrupting agent (“VDA”) - in combination with Ipilimumab for the treatment of solid tumors with focus on

melanoma in adult and pediatric melanoma. A RPD has been granted to the Company by the FDA for pediatric melanoma. |

| |

|

|

| |

● |

Oxi4503-

a second generation VDA - for the treatment of liquid tumors with focus on childhood leukemia. A RPD has been granted to the Company

by the FDA for AML. |

| |

|

|

| |

● |

Backoffice

support using PointR fabric cluster computing grids for blockchain/AI for pharmaceutical manufacturing and clinical trials and monitoring;

and PointR AI for drug development through various stages of development. |

| |

|

|

| |

● |

Developing

AI based technologies to enhance the development and commercialization of our Artemisinin based products and support technologies. |

Corporate

History

Oncotelic

Therapeutics, Inc. (f/k/a Mateon Therapeutics, Inc.) (“Oncotelic”), was formed in the State of New York in 1988 as

OXiGENE, Inc., was reincorporated in the State of Delaware in 1992, and changed its name to Mateon Therapeutics, Inc. in 2016, and Oncotelic

Therapeutics, Inc. in November 2020. Oncotelic conducts business activities through Oncotelic and its wholly-owned subsidiaries, Oncotelic,

Inc., a Delaware corporation, PointR Data, Inc. (“PointR”), a Delaware corporation, and EdgePoint AI, Inc. (“Edgepoint”),

a Delaware Corporation for which there are non-controlling interests, (Oncotelic, Oncotelic Inc., PointR and Edgepoint are collectively

called the “Company” or “We”). The Company is currently developing OT-101 for various cancers and

COVID-19, Artemisinin for COVID-19 and AI technologies for clinical development and manufacturing. The Company has acquired apomorphine

for Parkinson’s Disease, erectile dysfunction and female sexual dysfunction. In addition, the Company is evaluating the further

development of its product candidates OXi4503 as a treatment for acute myeloid leukemia and myelodysplastic syndromes and CA4P in combination

with a checkpoint inhibitor for the treatment of advanced metastatic melanoma. Our principal corporate office is in the United States

at 29397 Agoura Road, Suite 107, Agoura Hills, CA 91301 (telephone: 650-635-7000). Our internet address is www.oncotelic.com.

Amendments

to Certificate of Incorporation

In

November 2020 the Company filed an amendment to its Certificate of Incorporation with the Secretary of State for the State of Delaware

changing its name from “Mateon Therapeutics, Inc.” to “Oncotelic Therapeutics, Inc.” A notice of corporate action

had been filed with the Financial Industry Regulatory Authority (“FINRA”), requesting confirmation to change its name

and approval for a new ticker symbol. On March 29, 2021, the Company received approval from FINRA on its notice of corporate action,

and effective March 30, 2021, the Company’s ticker symbol has changed from “MATN” to “OTLC”.

In

January 2021, the Company filed an additional amendment to its Certificate of Incorporation, as amended (the “Charter Amendment”),

with the Secretary of State for the State of Delaware, which Charter Amendment went effective immediately upon acceptance by the Secretary

of State for the State of Delaware. As approved by the Company’s stockholders by written consent on August 10, 2020, the Charter

Amendment increased the number of authorized shares of Common Stock from 150,000,000 shares to 750,000,000 shares.

In

addition, the Company registered an additional total of 20,000,000 shares of its Common Stock, which may be issued pursuant to the Company’s

Amended and Restated 2015 Equity Incentive Plan (the “Plan”). Such additional shares were approved by the shareholders

of the Company on August 10, 2020 and as reported to the Securities and Exchange Commission (the “SEC”) vide a Current

Report on Form 8-K on August 14, 2020. As such, the total number of shares of the Company’s Common Stock available for issuance

under the 2015 plan is 27,250,000.

Summary

of Risk Factors

This

Offering, which provides for the registration of Shares by Peak One and Peak One Investments as the Selling Stockholders and the subsequent

public resale of such shares, involves substantial risk. Our ability to execute our business strategy is also subject to certain risks.

The risks described under the heading “Risk Factors” included elsewhere in this Prospectus may cause us not to realize the

full benefits of our business plan and strategy or may cause us to be unable to successfully execute all or part of our strategy. Some

of the most significant challenges and risks are:

| |

● |

We

may encounter difficulties in expanding our operations successfully, if and when we evolve from a company that is primarily involved

in clinical development to a company that is also involved in commercialization. |

| |

● |

We

will need substantial additional funding to continue our operations, which could result in dilution to our stockholders. |

| |

● |

If

physicians and patients do not accept our future products or if the market for indications for which any product candidate is approved

is smaller than expected, we may be unable to generate significant revenue, if any. |

| |

● |

The

Equity Purchase Agreement with Peak One may cause material dilution to our existing stockholders |

| |

● |

Our

stock price may decline because Peak One will pay less than the then-prevailing market price of our common stock. |

| |

● |

An

investment in our shares is highly speculative. |

| |

● |

We

may not have access to the full $10,000,000 amount of the Equity Purchase Agreement. |

Before

you invest in our Common Stock, you should carefully consider all the information in this Prospectus, including matters set forth under

the heading “Risk Factors.”

Where

You Can Find Us

Our

principal executive office and mailing address and phone number are 29397 Agoura Road, Suite 107, Agoura Hills, CA 91301, (650) 635-7000.

Our

Filing Status as a “Smaller Reporting Company”

We

are a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned

subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues

of less than $50 million during the most recently completed fiscal year. As a “smaller reporting company,” the disclosure

we will be required to provide in our Securities and Exchange Commission (“SEC”) filings are less than it would be if we

were not considered a “smaller reporting company.” Specifically, “smaller reporting companies” are able to provide

simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley

Act of 2002 requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal

control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after

January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being

permitted to provide two years of audited financial statements in annual reports rather than three years. Decreased disclosures in our

SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze our results of

operations and financial prospects.

For

more details regarding this exemption, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations

- Critical Accounting Policies and Significant Judgments and Estimates.”

SUMMARY

OF FINANCIAL INFORMATION

The

following summary consolidated statements of operations data for the fiscal year ended December 31, 2021 and December 31, 2020 have been

derived from our audited consolidated financial statements and notes included elsewhere in this prospectus. The historical financial

data presented below is not necessarily indicative of our financial results in future periods, and the results for the full fiscal year

ended December 31, 2021 is not necessarily indicative of our operating results to be expected for the full fiscal year ending December

31, 2022 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements

and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles,

or U.S. GAAP. Our consolidated financial statements have been prepared on a basis consistent with our audited financial statements for

the year ended December 31, 2021 and December 31, 2020 and include all adjustments, consisting of normal and recurring adjustments that

we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

ONCOTELIC

THERAPEUTICS, INC. AND SUBSIDIARIES

(Formerly

Mateon Therapeutics, Inc.)

CONSOLIDATED

BALANCE SHEETS

| | |

December 31, | | |

December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 568,769 | | |

$ | 474,019 | |

| Restricted cash | |

| 20,000 | | |

| 20,000 | |

| Accounts receivable | |

| 19,748 | | |

| 19,748 | |

| Prepaid & other current assets | |

| 18,778 | | |

| 101,869 | |

| | |

| | | |

| | |

| Total current assets | |

| 627,295 | | |

| 615,636 | |

| | |

| | | |

| | |

| Development equipment, net of accumulated depreciation of $111,958 and $101,810 | |

| - | | |

| 10,148 | |

| Intangibles, net of accumulated amortization of $188,339 and $136,974 | |

| 821,841 | | |

| 873,206 | |

| In process R&D | |

| 1,101,760 | | |

| 1,101,760 | |

| Goodwill | |

| 21,062,455 | | |

| 21,062,455 | |

| Total assets | |

$ | 23,613,351 | | |

$ | 23,663,205 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 3,092,723 | | |

$ | 2,735,805 | |

| Accounts payable to related party | |

| 403,423 | | |

| 391,631 | |

| Contingent consideration | |

| 2,625,000 | | |

| 2,625,000 | |

| Derivative liability | |

| 340,290 | | |

| 777,024 | |

| Convertible debt for clinical trial and JV | |

| 4,069,781 | | |

| 2,000,000 | |

| Convertible debt, net of costs | |

| 1,666,594 | | |

| 1,091,612 | |

| Convertible debt, related party, net of costs | |

| 717,816 | | |

| 297,989 | |

| Convertible debt 2021, net of costs | |

| 76,994 | | |

| - | |

| Private Placement convertible notes, net of costs | |

| 2,353,253 | | |

| 943,586 | |

| Private Placement convertible notes, related party, net of costs | |

| 109,046 | | |

| 67,992 | |

| Payroll Protection Plan loan | |

| - | | |

| 251,733 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 15,454,920 | | |

| 11,182,372 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 13) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Convertible Preferred stock, $0.01 par value, 15,000,000 shares authorized; 0 and 278,188 shares issued and outstanding | |

| - | | |

| 2,782 | |

| Common stock, $.01 par value; 750,000,000 and 150,000,000 shares authorized; 375,288,146 and 90,601,912 issued and outstanding, respectively | |

| 3,752,881 | | |

| 906,019 | |

| Additional paid-in capital | |

| 35,223,842 | | |

| 32,493,086 | |

| Accumulated deficit | |

| (31,021,050 | ) | |

| (21,630,008 | ) |

| | |

| | | |

| | |

| Total Oncotelic Therapeutics, Inc. stockholders’ equity | |

| 7,955,673 | | |

| 11,771,879 | |

| Non-controlling interests | |

| 202,758 | | |

| 708,954 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 8,158,431 | | |

| 12,480,833 | |

| Total liabilities and stockholders’ equity | |

$ | 23,613,351 | | |

$ | 23,663,205 | |

ONCOTELIC

THERAPEUTICS, INC. AND SUBSIDIARIES

(Formerly

Mateon Therapeutics, Inc.)

CONSOLIDATED

STATEMENTS OF OPERATIONS

| | |

For the Year Ended December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Service Revenue | |

$ | - | | |

$ | 1,740,855 | |

| Total Revenue | |

| - | | |

| 1,740,855 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

$ | 3,658,617 | | |

$ | 4,302,447 | |

| General and administrative | |

| 5,467,266 | | |

| 5,023,142 | |

| Total operating expenses | |

| 9,125,883 | | |

| 9,325,589 | |

| | |

| | | |

| | |

| Loss from operations | |

| (9,125,883 | ) | |

| (7,584,734 | ) |

| Other income (expense): | |

| | | |

| | |

| Interest expense, net | |

| (2,002,813 | ) | |

| (1,998,321 | ) |

| PPP loan forgiveness | |

| 346,761 | | |

| - | |

| Change in fair value of derivative | |

| 292,149 | | |

| (45,051 | ) |

| Loss on debt conversion | |

| (27,504 | ) | |

| (343,700 | ) |

| Total other expense | |

| (1,391,407 | ) | |

| (2,387,072 | ) |

| Net loss before non-controlling interests | |

| (10,517,290 | ) | |

| (9,971,806 | ) |

| Net loss attributable to non-controlling interests | |

| (1,126,248 | ) | |

| (469,204 | ) |

| Net income (loss) attributable to Oncotelic Therapeutics, Inc. | |

$ | (9,391,042 | ) | |

$ | (9,502,602 | ) |

| | |

| | | |

| | |

| Basic net loss per share attributable to common stock | |

$ | (0.03 | ) | |

$ | (0.11 | ) |

| Basic weighted average common stock outstanding | |

| 303,078,548 | | |

| 88,099,787 | |

Special

Note Regarding Forward-Looking Statements

The

information contained in this Prospectus, including in the documents incorporated by reference into this Prospectus contains forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934 (the “Exchange

Act”) that involve substantial risks and uncertainties. We generally identify forward-looking statements by terminology such

as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,”

“would,” “intend,” “target,” “aim,” “project,” “believe,” “estimate,”

“predict,” “potential,” “seek,” “indicate,” or “continue” or the negative

of these terms or other similar words, although not all forward-looking statements contain these words. Forward-looking statements include,

but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding

the future, such as our estimates regarding anticipated operating income or losses, future performance, future revenues and projected

expense, including that to fund our clinical and other development programs; our liquidity and our expectations regarding our needs for

and ability to raise additional capital; our ability to continue as a going concern; our ability to select and capitalize on commercially

desirable product opportunities as a result of limited financial resources; our ability to manage our expenses effectively and raise

the funds needed to continue our business; our ability to retain the services of our current or future executive officers, directors

and principal consultants; the competitive nature of our industry and the possibility that our products or product candidates may become

obsolete or may not generate revenues as expected or at all; our ability to obtain and maintain regulatory approval of our existing products

and any future products we may develop; the development of and the process of commercializing AI/Blockchain and other technologies for

supporting the development of OT-101 and Artemisinin for COVID-19, OT-101, including development of OT-101, Artemisinin, OXi4503, CA4P

and our 2021 in-licensing of apomorphine; the initiation, timing, progress and results of our preclinical and clinical trials, research

and development programs; regulatory and legislative developments in the United States and foreign countries; the timing, costs and other

limitations involved in obtaining regulatory approval for any product; the further preclinical or clinical development and commercialization

of our product candidates; the entering into any corporate transactions to develop our products through partnerships, joint ventures

or other corporate transactions; our ability to make a proposed initial public offering between us and our potential joint-venture partners

for the proposed joint venture: our ability to obtain and maintain orphan drug exclusivity for some of our product candidates; the potential

benefits of our product candidates over other therapies; our ability to enter into and maintain any collaboration with respect to product

candidates; our ability to continue to develop or commercialize our products or product candidates in the event any license agreements

in place with third parties expire or are terminated; the performance and conduct of third parties, including our third-party manufacturers

and third party service providers used in our clinical trials; our ability to obtain and maintain intellectual property protection for

our products and operate our business without infringing upon the intellectual property rights of others; the potential liability exposure

related to our products and our insurance coverage for such exposure; our ability to form alliances with other third parties to develop

the products in our pipeline through partnerships, joint ventures, mergers or acquisitions; the successful development of our sales and

marketing capabilities; the size and growth of the potential markets for our products and our ability to serve those markets; the rate

and degree of market acceptance of any future products; the volatility of the price of our common stock; the ability to achieve secondary

trading of our stock in certain states; the dilutive effects of potential future equity issuances; our expectation that no dividends

will be declared on our common stock in the foreseeable future; our ability to maintain an effective system of internal controls; the

payment and reimbursement methods used by private or governmental third-party payers; our ability to retain adequate staffing levels;

unfavorable global economic conditions; unfavorable global epidemic and pandemic conditions; a failure of our internal computer systems

or those of our contractors and consultants; potential misconduct or other improper activities by our employees, contractors or consultants;

the ability of our business continuity and disaster recovery plans to protect us in the event of a natural disaster; and other factors

discussed elsewhere in this document or any document incorporated by reference herein or therein.

The

forward-looking statements contained in this document are based on our current expectations and beliefs concerning future developments

and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated.

These forward-looking statements involve several risks, uncertainties (many of which are beyond our control) or other assumptions that

may cause actual results or performance to be materially different from those expressed or implied by these “forward-looking statements.”

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may

vary from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward- looking statements,

whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. The sections

captioned “Risk Factors” as well as other sections in this document or incorporated by reference into this document discuss

some of the factors that could contribute to these differences.

The

forward-looking statements made in this document relate only to events as of the date on which the statements are made. We undertake

no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made

or to reflect the occurrence of unanticipated events.

RISK

FACTORS

The

shares of our Common Stock being offered for resale by the Selling Shareholders are highly speculative in nature, involve a high degree

of risk and should be purchased only by persons who can afford to lose their entire amount invested in the Common Stock. Accordingly,

prospective investors should carefully consider, along with other matters referred to herein, the following risk factors in evaluating

our business before purchasing any shares of Common Stocks. If any of the following risks actually occurs, our business, financial condition

or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. In addition to

the risk factors described below, and some of which are part of our 2021 Annual Report on Form 10-K filed with the SEC on April 15, 2022,

you should carefully consider the risks and the other information in this Prospectus before investing in our Common Stock.

Risks

Related to Our Business

If

we are unable to obtain additional funding, we may be forced to cease operations.

We

have experienced net losses every year since inception. In April 2019, the Company entered into an Agreement and Plan of Merger with

Oncotelic Inc. for developing investigational drugs for the treatment of orphan oncology indications. The Company completed the Merger

and Oncotelic Inc. became a wholly-owned subsidiary of the Company. The Merger was treated as a recapitalization and reverse acquisition

for financial accounting purposes. Oncotelic was considered the acquirer for accounting purposes, and the Company’s historical

financial statements before the Merger were been replaced with the historical financial statements of Oncotelic Inc. prior to the Merger

in the financial statements and filings with the Securities and Exchange Commission.

Even

though Oncotelic Inc. is considered as the acquirer for accounting purposes, the Company, as of December 31, 2021, had an accumulated

deficit of approximately $31.0 million, including a net loss of approximately $10.5 million in 2021. We have no source of product revenue

and do not expect to receive any product revenue in the near future, except if we generate product revenues from Artemisinin in countries

around the globe other than India and which at the current time is not anticipated. We may generate revenues from services rendered in

the future, but we cannot expect that to be a regular and of recurring nature. If we remain in business, we expect to incur additional

operating losses over the next several years, principally as a result of our plans to continue clinical trials for our investigational

drugs. As of December 31, 2021, we had approximately $0.6 million in cash and current liabilities of approximately $15.5 million, of

which $1.3 million pertains to Oncotelic’s liabilities prior to the Merger and $2.6 million of contingent liabilities, incurred

upon our merger with PointR Data, Inc. in November 2019, that would be issuable in shares of common stock of the Company to the PointR

shareholders upon satisfaction of certain conditions. Based on our planned operations, we expect our cash to only support our operations

for a short period of time. Therefore, we will need to secure near-term funding, or we would be forced to curtail or terminate operations.

Because we do not currently have a guaranteed source of capital that will sustain operations for at least the next twelve months, Management

has determined that there is substantial doubt about our ability to continue as a going concern.

The

principal source of our working capital to date has been the proceeds from the sale of equity and debt, a substantial portion of which

has been provided by officers and certain insiders. If we are unable to access additional funds in the near term, whether through the

sale of additional equity, debt or another means, we may not be able to continue in business. We also may not be able to continue the

development of our investigational drugs. Any additional equity or debt financing, if available to us, may not be available on favorable

terms and would most likely be dilutive to stockholders. Any debt financing, if available, may involve restrictive covenants and also

be dilutive to current stockholders. If we obtain funds through collaborative or licensing arrangements, we may be required to relinquish

rights to some of our technologies or product candidates on terms that are not favorable to us. Our ability to access capital when needed

is not assured.

In

their audit report with regard to our financial statements as of December 31, 2021, we as well as our independent registered public accountants

have expressed an opinion that substantial doubt exists as to whether we can continue as a going concern. Because we have limited cash

resources, we believe that it will be necessary for us to either raise additional capital in the near term or to enter into a license

or other agreement with a larger pharmaceutical company. If we do not succeed in doing so, we may be required to suspend or cease our

business, which would likely materially harm the value of our common stock.

Due

in part to our limited financial resources, we may fail to select or capitalize on the most scientifically, clinically or commercially

promising or profitable indications or therapeutic areas for our product candidates, and we may be unable to pursue and complete the

clinical trials that we would like to pursue and complete.

We

have limited financial and technical resources to determine the indications on which we should focus the development efforts for our

product candidates. Due to our limited available financial resources, we have curtailed clinical development programs and activities

that might otherwise have led to more rapid progress of our product candidates through the regulatory and development processes. We currently

have insufficient financial resources to complete any additional drug development work.

If

we are able to raise funds and continue developing investigational drugs for cancer, we may make incorrect determinations with regard

to the indications and clinical trials on which to focus the available resources that we do have. Furthermore, we cannot assure you that

we will be able to retain adequate staffing levels to run our operations and/or to accomplish all of the objectives that we otherwise

would seek to accomplish. The decisions to allocate our research, management and financial resources toward particular indications or

therapeutic areas for our product candidates may not lead to the development of viable commercial products and may divert resources from

better opportunities. Similarly, our decisions to delay or terminate drug development programs may also cause us to miss valuable opportunities.

In addition, from time to time, we may in-license or otherwise acquire product candidates to supplement our internal development activities.

Those activities may use resources that otherwise would have been devoted to our internal programs, and with research and development

programs there is no way to assure that the outcome of any trials or other activities will be positive, whether the program was internally

generated or in-licensed.

We

may encounter difficulties in expanding our operations successfully if and when we evolve from a company that is primarily involved in

clinical development to a company that is also involved in commercialization.

As

we advance our product candidates through later stages of clinical trials, we will need to expand our development, regulatory, manufacturing,

marketing and sales capabilities or contract with third parties to provide these capabilities for us. As our operations expand, we expect

that we will need to manage additional relationships with such third parties, as well as additional collaborators, distributors, marketers

and suppliers.

Maintaining

third party relationships for these purposes will impose significant added responsibilities on members of our management and other personnel.

We must be able to manage our development efforts effectively, manage our participation in the clinical trials in which our product candidates

are involved effectively, and improve our managerial, development, operational and finance systems, all of which may impose a strain

on our administrative and operational infrastructure.

If,

following any approval of our product candidates, we enter into arrangements with third parties to perform sales, marketing or distribution

services, any product revenues that we receive, or the profitability of these product revenues to us, are likely to be lower than if

we were to market and sell any products that we develop ourselves. In addition, we may not be successful in entering into arrangements

with third parties to sell and market our products or in doing so on terms that are favorable to us. We likely will have little control

over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively.

If we do not establish sales and marketing capabilities successfully, either on our own or in collaboration with third parties, we will

not be successful in commercializing our products.

If

we were to submit an NDA for our drug candidates in the United States or a marketing application in the EU, we would need to undertake

commercial scale manufacturing activities at significant expense to us in order to proceed with the application for approval for commercialization.

We or our external vendors may encounter technical difficulties that preclude us from successfully manufacturing the required registration

and validation batches of active pharmaceutical ingredient, or API, and/or drug product and we may be unable to recover any financial

losses associated with the manufacturing activities. Further, our research or product development efforts may not be successfully completed,

any compounds currently under development by us may not be successfully developed into drugs, any potential products may not receive

regulatory approval on a timely basis, if at all, and competitors may develop and bring to market products or technologies that render

our potential products obsolete. If any of these problems occur, our business would be materially and adversely affected.

We

may not be able to partner with other pharmaceutical companies or even form any types of alliances with third parties.

As

we plan to advance our product candidates through later stages of clinical trials but with lack of adequate capital resources, we will

need to form alliances or enter into partnerships with other pharmaceutical companies or even other third parties. We cannot assure you

that we would be able to do so at terms beneficial to the Company or at all.

We

may not be able to successfully set up an IPO with third parties.

As

we plan to advance our product candidates through later stages of clinical trials but with lack of adequate capital resources, we will

need to form alliances or enter into partnerships with other pharmaceutical companies or even other third parties and create shareholder

value, including through IPOs. We cannot assure you that we would be able to do so at terms beneficial to the Company or at all. While

the Company has formed a joint venture with Dragon Overseas and GMP Bio, and taking that through an IPO, there can be no assurances that

such IPO will be made or will be successful.

We

have no manufacturing capacity and have relied on, and expect to continue to rely on, third-party manufacturers to produce our product

candidates.

We

do not own or operate manufacturing facilities for the production of clinical or commercial quantities of our product candidates or any

of the compounds that we are testing in our preclinical programs, and we lack the resources and the capabilities to do so. As a result,

we currently rely, and we expect to rely for the foreseeable future, on third-party manufacturers to supply our product candidates. Reliance

on third-party manufacturers entails risks to which we would not be subject if we manufactured our product candidates or products ourselves,

including:

| |

● |

reliance

on third-parties for manufacturing process development, regulatory compliance and quality assurance; |

| |

● |

limitations

on supply availability resulting from capacity and scheduling constraints of third-parties; |

| |

● |

the

possible breach of manufacturing agreements by third-parties because of factors beyond our control; and |

| |

● |

the

possible termination or non-renewal of the manufacturing agreements by the third-party, at a time that is costly or inconvenient

to us. |

If

we do not maintain our developed important manufacturing relationships, we may fail to find replacement manufacturers or develop our

own manufacturing capabilities, which could delay or impair our ability to obtain regulatory approval for our products and substantially

increase our costs or deplete profit margins, if any. If we do find replacement manufacturers, we may not be able to enter into agreements

with them on terms and conditions favorable to us, and there could be a substantial delay before new facilities could be qualified and

registered with the FDA, EMA and other foreign regulatory authorities.

The

FDA, EMA and other foreign regulatory authorities require manufacturers to register manufacturing facilities. The FDA and corresponding

foreign regulators also inspect these facilities to confirm compliance with current good manufacturing practices, or cGMPs. Contract

manufacturers may face manufacturing or quality control problems causing drug substance production and shipment delays or a situation

where the contractor may not be able to maintain compliance with the applicable cGMP requirements. Any failure to comply with cGMP requirements

or other FDA, EMA and comparable foreign regulatory requirements could adversely affect our clinical research activities and our ability

to develop our product candidates and market our products after approval.

Our

current and anticipated future dependence upon others for the manufacture of our product candidates may adversely affect our ability

to develop our product candidates, our ability to commercialize any products that receive regulatory approval and our potential future

profit margins on these products.

Our

product candidates have not completed clinical trials, and may never demonstrate sufficient safety and efficacy in order to do so.

Our

product candidates are in the clinical stage of development. In order to achieve profitable operations, we alone or in collaboration

with others, must successfully develop, manufacture, introduce and market our products. The time frame necessary to achieve market success

for any individual product is long and uncertain. The products currently under development by us may require significant additional research

and development and additional preclinical and clinical testing prior to application for commercial use. A number of companies in the

biotechnology and pharmaceutical industries have suffered significant setbacks in clinical trials, even after showing promising results

in early or later-stage studies or clinical trials. Although we have obtained some favorable results to date in preclinical studies and

clinical trials of certain of our potential products, such results may not be indicative of results that will ultimately be obtained

in or throughout such clinical trials, and clinical trials may not show any of our products to be safe or capable of producing a desired

result. Additionally, we may encounter problems in our clinical trials that may cause us to delay, suspend or terminate those clinical

trials.

Adverse

events observed to date and associated with CA4P and OXi4503 have generally been found to be manageable for drugs treating the indications

for which we are developing our product candidates. However, we will be required to continue to test and evaluate the safety of our product

candidates in additional clinical trials, and to demonstrate their safety to the satisfaction of appropriate regulatory agencies, as

a condition to receipt of any regulatory approvals. In clinical trials to date, transient hypertension believed to be associated with

CA4P and OXi4503 has been effectively managed through pre-treatment with anti-hypertensive medication. We cannot assure you, however,

that we will be able to make the necessary demonstrations of safety to allow us to receive regulatory approval for our product candidates

in any indication.

We

only have a limited number of employees to manage and operate our business.

As of April 22, 2022, we had sixteen full-time

employees. We rely on consultants and professionals to augment our staffing needs. Our limited financial resources require us to manage

and operate our business in a highly efficient manner. We cannot assure you that we will be able to retain adequate staffing levels to

run our operations and/or to accomplish all of the objectives that we otherwise would seek to accomplish.

We depend on our executive officers and principal

consultants and the loss of their services could materially harm our business.

We believe that our success depends, and will likely

continue to depend, upon our ability to retain the services of our current executive officers, particularly our Chief Executive Officer,

Chief Technology Officer, Chief Business Officer and Chief Financial Officer, our principal consultants and others. This increases

the risk that we may not be able to retain their services. The loss of the services of any of these individuals could have a material

adverse effect on our business. In addition to these key service providers, we have established relationships with universities, hospitals

and research institutions, which have historically provided, and continue to provide, us with access to research laboratories, clinical

trials, facilities and patients. Additionally, we believe that we may, at any time and from time to time, materially depend on the services

of consultants and other unaffiliated third parties. We cannot assure you that consultants and other unaffiliated third parties will

provide the level of service to us that we require in order to achieve our business objectives.

Our

industry is highly competitive, and our product candidates may become obsolete.

We

are engaged in a rapidly evolving field. Competition from other pharmaceutical companies, biotechnology companies and research and academic

institutions is intense and likely to increase. Many of those companies and institutions have substantially greater financial, technical

and human resources than we do. Many of those companies and institutions also have substantially greater experience in developing products,

conducting clinical trials, obtaining regulatory approval and in manufacturing and marketing pharmaceutical products. Our competitors

may succeed in obtaining regulatory approval for their products more rapidly than we do. Competitors have developed or are in the process

of developing technologies that are, or in the future may be, the basis for competitive products. Some of these competitive products

may have an entirely different approach or means of accomplishing the desired therapeutic effect than products being developed by us.

Our competitors may succeed in developing products that are more effective and/or cost competitive than those we are developing, or that

would render our product candidates less competitive or even obsolete. In addition, one or more of our competitors may achieve product

commercialization or patent protection earlier than we do, which could materially adversely affect us.

If

clinical trials or regulatory approval processes for our product candidates are prolonged, delayed or suspended, we may be unable to

out-license or commercialize our product candidates on a timely basis, which would require us to incur additional costs and delay or

prevent our receipt of any proceeds from potential license agreements or product sales.

We

cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials that will cause us or

any regulatory authority to delay or suspend those clinical trials or delay or invalidate the analysis of data derived from them. A number

of events, including any of the following, could delay the completion of our other ongoing and planned clinical trials and negatively

impact our ability to obtain regulatory approval for, and to market and sell, a particular product candidate:

| |

● |

conditions

imposed on us by the FDA, EMA or another foreign regulatory authority regarding the scope or design of our clinical trials; |

| |

● |

delays

in obtaining, or our inability to obtain, required approvals from institutional review boards or other reviewing entities at clinical

sites selected for participation in our clinical trials; |

| |

|

|

| |

● |

insufficient

supply of our product candidates or other materials necessary to conduct and complete our clinical trials; |

| |

|

|

| |

● |

slow

enrollment and retention rate of subjects in clinical trials; |

| |

|

|

| |

● |

any

compliance audits and pre-approval inspections by the FDA, EMA or other regulatory authorities; |

| |

|

|

| |

● |

negative

or inconclusive results from clinical trials, or results that are inconsistent with earlier results; |

| |

|

|

| |

● |

serious

and unexpected drug-related side effects; and |

| |

|

|

| |

● |

failure

of our third-party contractors to comply with regulatory requirements or otherwise meet their contractual obligations to us. |

Commercialization

or licensure of our product candidates may be delayed or prevented by the imposition of additional conditions on our clinical trials

by the FDA, EMA or another foreign regulatory authority or the requirement of additional supportive clinical trials by the FDA, EMA or

another foreign regulatory authority. In addition, clinical trials require sufficient patient enrollment, which is a function of many

factors, including the size of the patient population, the nature of the trial protocol, the proximity of patients to clinical sites,

the availability of effective treatments for the relevant disease, the conduct of other clinical trials that compete for the same patients

as our clinical trials, and the eligibility criteria for our clinical trials. Our failure to enroll patients in our clinical trials could

delay the completion of the clinical trial beyond our expectations, or it could prevent us from being able to complete the clinical trial.

In addition, the FDA and EMA could require us to conduct clinical trials with a larger number of subjects than we have projected for

any of our product candidates. We may not be able to enroll a sufficient number of patients in a timely or cost-effective manner. Furthermore,

enrolled patients may drop out of our clinical trials, which could impair the validity or statistical significance of the clinical trials.

We

do not know whether our clinical trials will begin as planned, will need to be restructured, or will be completed on schedule, if at

all. Delays in our clinical trials will result in increased development costs for our product candidates, and our financial resources

may be insufficient to fund any incremental costs. In addition, if our clinical trials are delayed, our competitors may be able to bring

products to market before we do and the commercial viability of our product candidates could be limited.

If

physicians and patients do not accept our future products or if the market for indications for which any product candidate is approved

is smaller than expected, we may be unable to generate significant revenue, if any.

Even

if any of our product candidates obtain regulatory approval, they may not gain market acceptance among physicians, patients, and third-party

payers. Physicians may decide not to prescribe our drugs for a variety of reasons including:

| |

● |

timing

of market introduction of competitive products; |

| |

|

|

| |

● |

demonstration

of clinical safety and efficacy compared to other products; |

| |

|

|

| |

● |

cost-effectiveness; |

| |

|

|

| |

● |

limited

or no coverage by third-party payers; |

| |

|

|

| |

● |

convenience

and ease of administration; |

| |

|

|

| |

● |

prevalence

and severity of adverse side effects; |

| |

|

|

| |

● |

restrictions

in the label of the drug; |

| |

● |

other

potential advantages of alternative treatment methods; and |

| |

|

|

| |

● |

ineffective

marketing and distribution support of our products. |

If

any of our product candidates is approved, but fails to achieve market acceptance, we may not be able to generate significant revenue

and our business would suffer.

The

uncertainty associated with pharmaceutical reimbursement and related matters may adversely affect our business.

Market

acceptance and sales of any one or more of our product candidates that we develop will depend on reimbursement policies and may be affected

by future healthcare reform measures in the United States and in foreign jurisdictions. Government authorities and third-party payers,

such as private health insurers and health maintenance organizations, decide which drugs they will cover and establish payment levels.

We cannot be certain that reimbursement will be available for any product candidates that we develop. Also, we cannot be certain that

reimbursement policies will not reduce the demand for, or the price paid for, our products. If reimbursement is not available or is available

on a limited basis, we may not be able to successfully commercialize any product candidates that we develop.

In

the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, also called the Medicare Modernization

Act, or MMA, changed the way Medicare covers and pays for pharmaceutical products. The legislation established Medicare Part D, which

expanded Medicare coverage for outpatient prescription drug purchases by the elderly but provided authority for limiting the number of

drugs that will be covered in any therapeutic class. The MMA also introduced a new reimbursement methodology based on average sales prices

for physician-administered drugs.

The

United States and several foreign jurisdictions are considering, or have already enacted, a number of legislative and regulatory proposals

to change the healthcare system in ways that could affect our ability to sell our products profitably. Among policy makers and payers

in the United States and elsewhere, there is significant interest in promoting changes in healthcare systems with the stated goals of

containing healthcare costs, improving quality and/or expanding access to healthcare. In the United States, the pharmaceutical industry

has been a particular focus of these efforts and has been significantly affected by major legislative initiatives. We expect to experience

pricing pressures in connection with the sale of any products that we develop due to the trend toward managed healthcare, the increasing

influence of health maintenance organizations and additional legislative proposals.

In

March 2010, the Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act, or collectively, ACA,

became law in the U.S. The goal of ACA is to reduce the cost of health care and substantially change the way health care is financed

by both government and private insurers. While we cannot predict what impact on federal reimbursement policies this legislation will

have in general or on our business specifically, the ACA may result in downward pressure on pharmaceutical reimbursement, which could

negatively affect market acceptance of, and the price we may charge for, any products we develop that receive regulatory approval.

More

recently, the current U.S. presidential administration has made statements suggesting plans to seek repeal of all or portions of the

ACA. There is uncertainty regarding the impact that the President’s administration may have on matters currently governed by the

ACA, if any, and any regulatory or legislative changes will likely take time to unfold. These changes could have an impact on coverage

and reimbursement for healthcare items and services covered by plans that were authorized by the ACA. However, we cannot predict the

ultimate content, timing or effect of any healthcare reform legislation or the impact of potential legislation on us. Any reduction in

reimbursement from Medicare or other government programs may result in a similar reduction in payments from private payors. The implementation

of cost containment measures or other healthcare reforms may prevent us from being able to generate revenue, attain profitability, or

commercialize our products.

Our

business and operations could suffer in the event of system failures.

Despite

the implementation of security measures, our internal computer systems and those of our third-party CROs and other contractors and consultants

are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical

failures. Furthermore, we have little or no control over the security measures and computer systems of our third-party CROs and other

contractors and consultants. While we have not experienced any material system failure, accident, or security breach to date, if such

an event were to occur and cause interruptions in our operations, it could result in a material disruption of our programs. For example,

the loss of clinical trial data for our product candidates could result in delays in our marketing approval efforts and significantly

increase our costs to recover or reproduce the data. To the extent that any disruption or security breach results in a loss of or damage

to our data or applications or other data or applications relating to our technology or product candidates, or inappropriate disclosure

of confidential or proprietary information, we could incur liabilities and the further development of our product candidates could be

delayed.

REGULATORY AND LEGAL RISK FACTORS

If we are unable to obtain required regulatory

approvals, we will be unable to market and sell our product candidates.

Our product candidates are

subject to extensive governmental regulations relating to development, clinical trials, manufacturing, oversight of clinical investigators,

recordkeeping and commercialization. Rigorous preclinical testing and clinical trials and an extensive regulatory review and approval

process are required to be successfully completed in the United States, in the European Union and in many other foreign jurisdictions

before a new drug can be sold. Satisfaction of these and other regulatory requirements is costly, time consuming, uncertain, and subject

to unanticipated delays. The time required to obtain approval by the FDA or the European Medicines Agency, or EMA, is unpredictable and

often takes many years following the commencement of clinical trials.

In connection with the clinical

development of our product candidates, we face risks that:

| |

● |

our

product candidates may not prove to be safe and efficacious; |

| |

|

|

| |

● |

patients

may die or suffer serious adverse effects for reasons that may or may not be related to the product candidate being tested; |

| |

|

|

| |

● |

we

fail to maintain adequate records of observations and data from our clinical trials, to establish and maintain sufficient procedures

to oversee, collect data from, and manage clinical trials, or to monitor clinical trial sites and investigators to the satisfaction

of the FDA, EMA or other regulatory agencies; |

| |

|

|

| |

● |

we

may not have sufficient financial resources to complete the clinical trials that would be necessary to obtain regulatory approvals; |

| |

|

|

| |

● |

the

results of later-phase clinical trials may not confirm the results of earlier clinical trials; and |

| |

|

|

| |

● |

the

results from clinical trials may not meet the level of statistical significance or clinical benefit-to-risk ratio required by the

FDA, EMA or other regulatory agencies for marketing approval. |

Only a small percentage of

product candidates for which clinical trials are initiated are the subject of NDAs and even fewer receive approval for commercialization.

Furthermore, even if we do receive regulatory approval to market a product candidate, any such approval may be subject to limitations

such as those on the indicated uses for which we may market the product.

If we or the third parties on which we rely

for the conduct of our clinical trials and results do not perform our clinical trial activities in accordance with good clinical practices

and related regulatory requirements, we may not be able to obtain regulatory approval for or commercialize our product candidates.

We currently use independent

clinical investigators in all of our clinical trials and, in many cases, also utilize contract research organizations, or CROs, and other

third-party service providers to conduct and/or oversee the clinical trials of our product candidates and expect to continue to do so

for the foreseeable future. We rely heavily on these parties for successful execution of our clinical trials. Nonetheless, we are responsible

for confirming that each of our clinical trials is conducted in accordance with the FDA’s requirements and our general investigational

plan and protocol. Currently, we have clinical trial activities involving CA4P and OXi4503 being conducted by clinical investigators

who are independent of us, but with whom we have agreements for them to provide the results of their clinical trials to us. In order

for us to rely on data from these ongoing clinical trials in support of a New Drug Application, or NDA, for approval of any of our product

candidates by the FDA or similar types of marketing applications that are required by other regulatory authorities, the independent investigators

are required to comply with applicable good clinical practice requirements.

The FDA and corresponding

foreign regulatory authorities require us and our clinical investigators to comply with regulations and standards, commonly referred

to as good clinical practices, or GCPs, for conducting and recording and reporting the results of clinical trials to assure that data

and reported results are credible and accurate and that the trial participants are adequately protected. Our reliance on third parties

that we do not control does not relieve us of these responsibilities and requirements. Third parties may not complete activities on schedule

or may not conduct our clinical trials in accordance with regulatory requirements or the respective trial plans and protocols. The failure

of these third parties to carry out their obligations could delay or prevent the development, approval and commercialization of our product

candidates or result in enforcement action against us.

We have taken and continue

to take steps to strengthen our procedures and practices, but we cannot assure you that the FDA will be satisfied with our procedures

or that the FDA will not issue warning letters or take other enforcement action against us in the future. The steps we take to strengthen

our procedures and conduct future clinical trials necessary for approval will be time-consuming and expensive.

The use of our products may result in product

liability exposure, and it is uncertain whether our insurance coverage will be sufficient to cover all claims.

The use of our product candidates

in clinical trials may expose us to liability claims in the event such product candidates cause death, injury or disease, or result in

adverse effects. We may be exposed to liability claims even if our product did not cause death, injury or diseases, but is merely presumed

or alleged to have caused any of these. If our product candidates are ever commercially approved, the commercial use of these products