Current Report Filing (8-k)

May 10 2022 - 4:19PM

Edgar (US Regulatory)

0001654595

false

0001654595

2022-05-04

2022-05-04

0001654595

us-gaap:CommonStockMember

2022-05-04

2022-05-04

0001654595

MDRR:SeriesACumulativeRedeemablePreferredStock8.0PercentMember

2022-05-04

2022-05-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): May 4, 2022

Medalist Diversified REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | |

001-38719 | |

47-5201540 |

(State or other jurisdiction of incorporation

or organization) | |

(Commission File Number) | |

(I.R.S. Employer

Identification No.) |

1051 E. Cary Street Suite 601

James Center Three

Richmond, VA, 23219

(Address

of principal executive offices)

(804) 344-4435

(Registrant’s telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

Growth Company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

|

Name of each Exchange

on Which

Registered |

|

Trading

Symbol(s) |

| Common Stock, $0.01 par value |

|

Nasdaq Capital Market |

|

MDRR |

| 8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value |

|

Nasdaq Capital Market |

|

MDRRP |

| ITEM 1.01 | ENTRY INTO MATERIAL DEFINITIVE AGREEMENT. |

On May 4, 2022, wholly owned

subsidiaries of the Company (the “Best Western Sellers”) entered into an Agreement of Sale (the “Agreement”),

a copy of which is filed hereto as Exhibit 10.1, with an unaffiliated purchaser (the “Purchaser”) whereby the Best Western

Sellers agreed to sell the Best Western Plus University Inn & Conference Center located in Clemson, SC (the “Clemson Best Western”)

for a sale price of $10,150,000, subject to customary prorations and adjustments. The Purchaser has made a $100,000 earnest money

deposit to the Best Western Sellers, which shall become non-refundable forty-five (45) days following the execution of the Agreement (the

“Due Diligence Period”). The Purchaser shall make an additional non-refundable earnest money deposit of $100,000 upon the

expiration of the Due Diligence Period. The closing of the sale of the Clemson Best Western is expected to occur within thirty (30) days

of the expiration of the Due Diligence Period, subject to the Purchaser’s right to extend such closing for thirty (30) additional

days in their sole discretion and upon payment of an additional non-refundable earnest money deposit of $100,000.

The Agreement contains provisions,

representations, warranties, covenants and indemnities that are customary and standard for the real estate industry and the sale of a

hotel property. Several conditions to closing on the sale remain to be satisfied, and there can be no assurance that we will complete

the transaction on the general terms described above or at all.

Certain statements included

in this Current Report on Form 8-K are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements above include, but are not limited

to, matters identified as expectations and matters with respect to the future sale of the Clemson Best Western. The Company undertakes

no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

For more information regarding risks and uncertainties that may affect the Company’s future results, review the Company’s

filings with the Securities and Exchange Commission.

The foregoing description of the Agreement is qualified

in its entirety by reference to the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated

by reference in this Item 1.01.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

MEDALIST DIVERSIFIED REIT, INC. |

| |

|

|

| Dated: May 10, 2022 |

By: |

/s/ Thomas E. Messier |

| |

|

Thomas E. Messier |

| |

|

Chief Executive Officer, Chairman of the Board, Treasurer and Secretary |

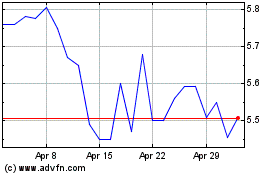

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Apr 2023 to Apr 2024